Global Cookie Mixes Market

Market Size in USD Million

CAGR :

%

USD

128.46 Million

USD

194.18 Million

2025

2033

USD

128.46 Million

USD

194.18 Million

2025

2033

| 2026 –2033 | |

| USD 128.46 Million | |

| USD 194.18 Million | |

|

|

|

|

Cookie Mixes Market Size

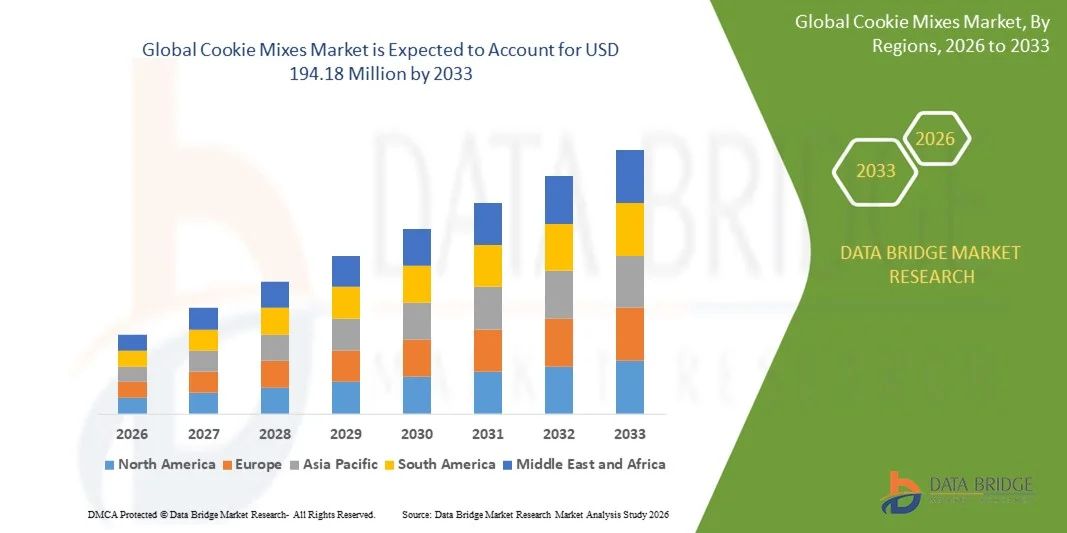

- The global cookie mixes market size was valued at USD 128.46 million in 2025 and is expected to reach USD 194.18 million by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely fueled by the increasing consumer preference for convenient, ready-to-bake solutions that save time while delivering consistent taste and quality, driving higher adoption across households and food service providers

- Furthermore, rising demand for healthier and specialty options, such as gluten-free and reduced-sugar mixes, is encouraging innovation and product diversification, expanding the appeal of cookie mixes to a broader consumer base and accelerating market growth

Cookie Mixes Market Analysis

- Cookie mixes, providing pre-measured ingredients for quick and easy baking at home or in commercial kitchens, are becoming essential for both households and food service providers due to their convenience, consistency, and versatility in flavor and type

- The escalating demand for cookie mixes is primarily fueled by busy lifestyles, growing interest in home baking experiences, seasonal and festive consumption trends, and the rising popularity of premium and specialty baking products that cater to health-conscious and novelty-seeking consumers

- Europe dominated the cookie mixes market with a share of over 40% in 2025, due to high consumer preference for convenience baking products, strong retail penetration, and growing demand for premium and specialty cookie mixes

- Asia-Pacific is expected to be the fastest growing region in the cookie mixes market during the forecast period due to rapid urbanization, rising disposable incomes, and growing exposure to Western-style baking

- Conventional segment dominated the market with a market share of 68.9% in 2025, due to widespread consumer familiarity and established recipes offering consistent taste and texture. Conventional cookie mixes often appeal to households seeking quick and convenient baking solutions without compromising on flavor, making them a staple in retail shelves. The availability of diverse flavors and packaging formats enhances their popularity, encouraging repeat purchases. Manufacturers are continuously innovating in formulations to maintain freshness and improve shelf life, further consolidating the segment’s dominance

Report Scope and Cookie Mixes Market Segmentation

|

Attributes |

Cookie Mixes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cookie Mixes Market Trends

Growing Popularity of Ready-to-Bake and Specialty Cookie Mixes

- A significant trend in the cookie mixes market is the increasing popularity of ready‑to‑bake and specialty cookie mixes, driven by busy lifestyles, rising interest in home baking experiences, and demand for convenient baking solutions that deliver consistent quality with minimal effort. This trend is elevating the role of cookie mixes as essential pantry staples for households and hobby bakers seeking quick, reliable dessert options

- For instance, My Better Batch has expanded its product offerings and retail presence with seasonal and specialty cookie mixes at major retailers, which is enhancing consumer awareness and uptake of premium baking mixes. Such products strengthen the appeal of cookie mixes for both everyday use and festive occasions where convenience and variety are key purchase drivers

- Home baking shows and social media platforms continue to spotlight unique and artisanal cookie mix recipes, encouraging trial of diverse flavors and mix types that cater to evolving taste preferences. This broader engagement positions cookie mixes as not just convenience items but enjoyable lifestyle products

- Retailers are dedicating more shelf space to branded and specialty cookie mixes, making them more visible and accessible within store aisles and online catalogs. Increased visibility supports market penetration and reinforces the perception of cookie mixes as mainstream baking solutions

- The trend towards premiumization is also growing, with brands offering gourmet and novel flavor profiles that appeal to adventurous consumers. This trend is driving product innovation and attracting new customer segments, thereby expanding the overall market footprint

Cookie Mixes Market Dynamics

Driver

Rising Consumer Demand for Convenient Home Baking Solutions

- The rising consumer demand for convenient home baking solutions is a key driver of the cookie mixes market as busy consumers seek time‑saving, easy‑to‑use products that eliminate the need for extensive ingredient sourcing and measurement

- For instance, King Arthur Baking Company has reported strong sales growth in its baking mix portfolio, including cookie mixes, as more consumers opt for products that simplify at‑home baking without sacrificing quality. These mixes appeal to both novice and experienced bakers looking to achieve consistent results with minimal preparation time

- The surge in home baking during holidays and family events further reinforces demand for ready‑to‑use cookie mixes that meet both traditional and contemporary flavor preferences. This increased usage sustains steady year‑round consumption

- Retailers are responding to this demand by expanding in‑store offerings and promoting cookie mixes through targeted displays and bundle promotions. This enhances visibility and incentivizes repeat purchases

- Overall, the convenience factor continues to shape buying behavior, strengthening the position of cookie mixes as preferred baking options for modern households

Restraint/Challenge

High Competition from Packaged and Fresh Bakery Products

- The cookie mixes market faces challenges due to intense competition from packaged and fresh bakery products, which often provide ready‑to‑eat alternatives that require no preparation time, reducing the need for baking mixes among convenience‑oriented consumers

- For instance, large packaged cookie brands such as Keebler (Kellogg’s) and Pepperidge Farm (Campbell Soup Company) have strong market presence and loyalty, which can divert consumer spending away from baking mixes toward their ready‑to‑eat cookie assortments. These established brands benefit from broad distribution and strong promotional support

- Fresh bakery offerings from supermarkets and specialty bakeries also compete by providing artisanal and customizable cookies without the effort of baking, appealing to consumers with limited time or baking interest

- The challenge is further compounded by consumers increasingly valuing immediate gratification and low‑effort snacking options that bypass preparation entirely. This preference creates a competitive headwind for cookie mixes that require baking time and kitchen involvement

- Brands in the cookie mix segment must continue to differentiate through product innovation, marketing, and convenience enhancements to maintain relevance in a landscape crowded with alternative sweet snack options

Cookie Mixes Market Scope

The market is segmented on the basis of category, end-use, and distribution channel.

- By Category

On the basis of category, the cookie mixes market is segmented into conventional and gluten-free. The conventional segment dominated the market with the largest revenue share of 68.9% in 2025, driven by widespread consumer familiarity and established recipes offering consistent taste and texture. Conventional cookie mixes often appeal to households seeking quick and convenient baking solutions without compromising on flavor, making them a staple in retail shelves. The availability of diverse flavors and packaging formats enhances their popularity, encouraging repeat purchases. Manufacturers are continuously innovating in formulations to maintain freshness and improve shelf life, further consolidating the segment’s dominance.

The gluten-free segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising health awareness and increasing prevalence of gluten intolerance and celiac disease. For instance, companies such as General Mills have launched specialized gluten-free cookie mixes catering to health-conscious consumers seeking nutritious alternatives without compromising taste. Growing adoption among millennials and urban populations, along with promotional campaigns highlighting clean-label ingredients, contributes to the accelerating demand. In addition, the segment benefits from expanding availability in both retail and online channels, making it more accessible to a wider audience.

- By End-Use

On the basis of end-use, the cookie mixes market is segmented into retail consumers and food service. The retail consumer segment dominated the market in 2025, driven by increasing home baking trends and growing preference for convenient, ready-to-bake solutions. Households prioritize cookie mixes for their ease of preparation, consistent results, and the ability to customize flavors and add-ins. Retail consumers are also influenced by seasonal promotions, festive packaging, and brand loyalty, which sustain strong market performance. The segment benefits from extensive distribution across supermarkets, hypermarkets, and e-commerce platforms, enhancing accessibility and consumer engagement.

The food service segment is expected to witness the fastest CAGR from 2026 to 2033, supported by rising demand from bakeries, cafes, and restaurants for ready-to-use mixes to streamline operations and reduce preparation time. For instance, Nestlé’s cookie mixes are increasingly adopted by food service providers aiming to maintain consistent product quality while optimizing labor efficiency. Growing café culture, coupled with the expansion of quick-service restaurants and dessert chains, drives large-scale bulk procurement. In addition, the segment benefits from product innovation tailored for professional kitchens, including mixes designed for uniform baking, shelf stability, and diverse flavor profiles.

- By Distribution Channel

On the basis of distribution channel, the cookie mixes market is segmented into store-based and non-store-based channels. The store-based segment dominated the market in 2025, driven by the strong presence of supermarket chains, hypermarkets, and specialty food stores offering extensive product varieties. Consumers often prefer in-store purchases for the ability to compare brands, check product information, and access promotional deals. The segment also benefits from strategic in-store placements, seasonal displays, and brand-led marketing activities that influence purchase decisions. Established retail networks ensure consistent product availability and reinforce brand recognition among consumers, sustaining segment dominance.

The non-store-based segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the expansion of e-commerce platforms and online grocery delivery services. For instance, Amazon and Walmart’s online platforms have enabled cookie mix brands to reach wider audiences with convenience and personalized recommendations. Growing digital adoption, urban lifestyle changes, and demand for doorstep delivery enhance the attractiveness of online channels. In addition, the segment benefits from targeted marketing campaigns, subscription-based offerings, and direct-to-consumer promotions, driving rapid adoption across diverse consumer groups.

Cookie Mixes Market Regional Analysis

- Europe dominated the cookie mixes market with the largest revenue share of over 40% in 2025, driven by high consumer preference for convenience baking products, strong retail penetration, and growing demand for premium and specialty cookie mixes

- Consumers across the region increasingly favor ready-to-bake solutions to save time and maintain consistent quality, fueling demand for established and innovative brands

- This dominance is further supported by mature retail networks, widespread supermarket and hypermarket presence, and strong brand loyalty, positioning Europe as a stable and innovation-driven market

Germany Cookie Mixes Market Insight

The Germany cookie mixes market accounted for the largest share within Europe in 2025, supported by the country’s robust retail infrastructure and rising consumer inclination toward home baking. German consumers emphasize product quality, variety, and health-conscious options, driving demand for both conventional and specialty cookie mixes. Seasonal promotions, festive packaging, and innovative flavors further enhance market expansion.

U.K. Cookie Mixes Market Insight

The U.K. cookie mixes market is projected to grow at a steady CAGR during the forecast period, driven by increasing home baking trends and demand for convenient, ready-to-bake products. Growth in e-commerce and online grocery platforms encourages broader access to cookie mix brands. Consumer interest in premium, gluten-free, and artisanal mixes also supports market growth.

North America Cookie Mixes Market Insight

The North America cookie mixes market holds a substantial market share, supported by high adoption of home baking, organized retail presence, and preference for convenient, time-saving solutions. Consumers increasingly opt for both conventional and specialty cookie mixes for quality and consistency. Strong marketing campaigns, product innovation, and expansion of online retail channels further strengthen market growth.

Asia-Pacific Cookie Mixes Market Insight

The Asia-Pacific cookie mixes market is expected to witness the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing exposure to Western-style baking. Consumers across emerging economies are increasingly experimenting with home baking, boosting demand for ready-to-bake mixes. Expanding modern retail, rising e-commerce penetration, and rising interest in premium and gluten-free variants accelerate regional growth.

China Cookie Mixes Market Insight

China dominated the Asia-Pacific cookie mixes market in 2025, supported by its large urban population, growing retail infrastructure, and increasing adoption of convenient baking products. Rising consumer interest in health-oriented and ready-to-bake solutions drives strong demand for cookie mixes. Market expansion is further supported by digital sales platforms, promotional campaigns, and a shift toward premium and international baking products.

Cookie Mixes Market Share

The cookie mixes industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Associated British Foods plc (U.K.)

- British Bakels (U.K.)

- Cargill, Incorporated (U.S.)

- Dawn Food Products, Inc (U.S.)

- Kerry Group PLC (Ireland)

- Muntons Plc (U.K.)

- DSM (Netherlands)

- Taura Natural Ingredients Ltd (U.K.)

- Barry Callebaut (Switzerland)

- Mitsui Sugar Co., Ltd (Japan)

- Nexira (France)

- Corbion (Netherlands)

- Roquette Frères (France)

- Royal Cosun (Netherlands)

- SAMYANG HOLDINGS CORPORATION (South Korea)

- Sensus America LLC (U.S.)

- Wuxi Cima Science Co., Ltd (China)

Latest Developments in Global Cookie Mixes Market

- In December 2025, My Better Batch expanded its retail footprint by securing distribution in Costco across the Midwest, significantly increasing accessibility to a large base of value-focused consumers. This move strengthens the brand’s presence during peak holiday baking seasons, driving higher seasonal sales and enhancing overall market visibility. The expansion also intensifies competition within the cookie mixes segment by offering premium, convenient baking solutions to a broader audience, encouraging other players to innovate and expand distribution

- In November 2025, My Better Batch launched its exclusive Holiday Cookie Collection at Target stores nationwide, featuring limited-edition flavors such as Chocolate Peppermint and Holiday Cheer. This seasonal offering captures festive consumer demand and positions the brand as a leader in convenience and novelty baking solutions. The launch stimulates trial among new customers, drives repeat purchases during peak periods, and sets a benchmark for seasonal innovation in the cookie mixes market

- In October 2025, Dawn Foods UK & Ireland introduced reduced-sugar cookie mixes in plain and chocolate variants, responding to increasing consumer interest in healthier indulgences. This product expansion allows retailers and bakers to cater to the growing “better-for-you” segment while maintaining taste and convenience. By addressing health-conscious preferences, the move broadens market reach, reinforces brand relevance, and drives growth in the premium cookie mix category

- In August 2025, My Better Batch signed a national distribution agreement with Target, bringing its cookie mixes to a major U.S. retail chain. This strategic partnership enhances brand visibility, provides greater convenience for consumers, and facilitates access to a wider demographic. It strengthens competitive positioning in the cookie mixes market, supports scale-up of production and marketing efforts, and encourages other brands to pursue strategic retail collaborations to capture market share

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cookie Mixes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cookie Mixes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cookie Mixes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.