Global Cookies Market

Market Size in USD Billion

CAGR :

%

USD

26.90 Billion

USD

43.49 Billion

2024

2032

USD

26.90 Billion

USD

43.49 Billion

2024

2032

| 2025 –2032 | |

| USD 26.90 Billion | |

| USD 43.49 Billion | |

|

|

|

|

Cookies Market Size

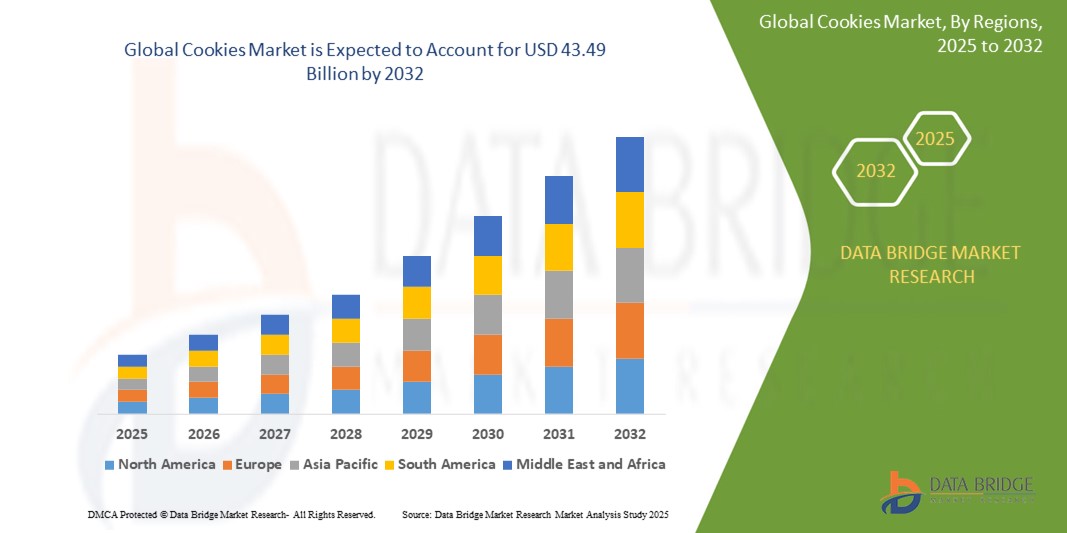

- The global cookies market size was valued at USD 26.90 billion in 2024 and is expected to reach USD 43.49 billion by 2032, at a CAGR of 6.19% during the forecast period

- The cookies market growth is largely fueled by rising consumer preference for convenient, ready-to-eat snacks that cater to busy lifestyles and on-the-go consumption across all age groups

- Furthermore, increasing demand for innovative flavors, healthier ingredient options, and premium products is driving product development and expanding consumer appeal, thereby significantly boosting market growth

Cookies Market Analysis

- Cookies, offering a wide variety of flavors and types, are increasingly vital components of modern snacking habits across residential and commercial settings due to their convenience, taste appeal, and ability to cater to diverse consumer preferences and dietary needs

- The escalating demand for cookies is primarily fueled by shifting consumer lifestyles towards on-the-go eating, growing awareness of premium and health-conscious ingredients, and the expanding presence of cookies in modern retail outlets and e-commerce platforms, which together drive broader market penetration and growth

- North America dominated the cookies market with a share of 34.2% in 2024, due to high consumer demand for premium and specialty cookies, widespread retail penetration, and growing health-consciousness encouraging diversified product offerings

- Asia-Pacific is expected to be the fastest growing region in the cookies market during the forecast period due to rising urbanization, increasing disposable incomes, and changing lifestyles in countries such as China, India, Japan, and South Korea

- Bar cookies segment dominated the market with a market share of 34% in 2024 due to their dense, rich texture and the convenience of cutting them into uniform portions, making them ideal for both retail packaging and foodservice distribution

Report Scope and Cookies Market Segmentation

|

Attributes |

Cookies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cookies Market Trends

“Rising Popularity of Gluten-Free and Vegan Cookies”

- A significant and accelerating trend in the global cookies market is the rising popularity of gluten-free and vegan cookies, driven by growing consumer awareness of dietary restrictions, health-conscious eating, and ethical consumption habits

- For instance, leading brands such as Lenny & Larry’s and Enjoy Life have expanded their product lines to include cookies that are both gluten-free and vegan, catering to a diverse set of consumers including those with celiac disease, lactose intolerance, or those following plant-based diets

- Manufacturers are investing in innovative formulations using alternative flours such as almond, oat, or chickpea, along with plant-based sweeteners and dairy substitutes, to ensure taste and texture that rival traditional cookies. These advancements have helped gluten-free and vegan options shed their reputation as inferior substitutes, making them attractive to mainstream consumers

- Retailers and e-commerce platforms are also dedicating more shelf space and digital categories to “free-from” and plant-based cookie options, highlighting their increasing appeal across developed and emerging markets alike

- This trend is reshaping the competitive landscape of the cookies market, encouraging both legacy brands and new entrants to diversify offerings and promote transparency in labeling and sourcing. Brands that align with clean-label, allergen-free, and sustainable values are seeing higher consumer loyalty

- The demand for gluten-free and vegan cookies is growing rapidly across multiple consumer segments, particularly millennials and Gen Z, who are more inclined toward conscious consumption and health-oriented snacking preferences

Cookies Market Dynamics

Driver

“Growing Demand for Convenient Snacks”

- The rising need for quick, easy-to-consume food options amid fast-paced lifestyles is a significant driver for the growing demand for convenient snacks such as cookies

- For instance, in 2024, leading snack manufacturers such as Mondelez International expanded their portfolio to include single-serve, on-the-go cookie packs designed for busy consumers seeking portability and minimal preparation

- As consumers increasingly prioritize time-saving and ready-to-eat food items, cookies provide an ideal snack choice due to their long shelf life, variety of flavors, and easy packaging formats. Furthermore, the surge in remote work and travel has boosted the consumption of convenient snacks that require no refrigeration and can be consumed anywhere, fueling cookie sales across diverse markets

- The availability of portion-controlled packs, multi-packs, and resealable packaging enhances the convenience factor, making cookies popular among all age groups including children, working professionals, and students

- Manufacturers are also innovating with healthier formulations and functional ingredients to cater to evolving consumer preferences, further driving the cookie market growth across retail, online, and convenience store channels

Restraint/Challenge

“Shelf Life and Freshness Issues”

- Persistent challenges related to maintaining shelf life and freshness significantly impact the cookies market, limiting broader consumer satisfaction and repeat purchases

- For instance, cookies are prone to staleness and moisture absorption, which can degrade texture and flavor, causing consumers to be cautious about product quality, especially in warmer or humid climates

- Addressing these freshness concerns requires advanced packaging solutions such as moisture barriers, resealable packs, and modified atmosphere packaging to extend shelf life while preserving taste and crispness; companies such as Mondelez and Campbell’s emphasize such innovations to maintain product quality and consumer trust

- In addition, supply chain inefficiencies and improper storage during transportation and retail display can further compromise cookie freshness, posing challenges particularly in regions with less developed cold chain infrastructure

- Overcoming shelf life and freshness issues through continuous innovation in packaging, better cold chain management, and consumer education about storage practices will be essential for sustaining growth and brand loyalty in the cookies market

Cookies Market Scope

The market is segmented on the basis of ingredient, product type, packaging type, and sales channel.

- By Ingredient

On the basis of ingredient, the cookies market is segmented into chocolate, chocolate chip, oatmeal, butter, cream, ginger, coconut, honey, and others. The chocolate segment dominated the largest market revenue share in 2024, driven by its mass appeal across various demographics and its rich, indulgent flavor. Chocolate cookies are a staple in both mainstream and premium product categories and enjoy high demand throughout the year, particularly during festive seasons and celebrations. Their versatility also allows for a wide range of formulations including double chocolate, chocolate-mint, and chocolate-nut variants.

The oatmeal segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for health-oriented snacks. Oatmeal cookies are perceived as a healthier alternative due to their high fiber content, whole grain base, and compatibility with organic and clean-label claims. This makes them highly attractive to health-conscious consumers seeking guilt-free indulgence without compromising on flavor or texture.

- By Product Type

On the basis of product type, the cookies market is segmented into drop cookies, bar cookies, moulded cookies, fried cookies, no-bake cookies, refrigerated cookies, ice box cookies, rolled cookies, sandwich cookies, and others. The bar cookies segment held the largest market revenue share of 34% in 2024, driven by their dense, rich texture and the convenience of cutting them into uniform portions, making them ideal for both retail packaging and foodservice distribution. Their versatility allows for a wide variety of ingredients such as nuts, fruits, chocolate, and layered fillings, appealing to diverse consumer tastes. Bar cookies also enjoy popularity due to their extended shelf life, ease of production in bulk, and suitability for on-the-go snacking, making them a preferred choice among manufacturers and consumers alike.

The sandwich cookies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their growing popularity among children, teens, and emerging markets. The creamy filling between two crisp biscuits provides a satisfying texture contrast, and manufacturers are leveraging this format to launch innovative flavors, branding collaborations, and festive packaging, making it a dynamic and fast-evolving segment.

- By Packaging Type

On the basis of packaging type, the cookies market is segmented into rigid, flexible, and others. The flexible packaging segment accounted for the largest market revenue share in 2024, driven by its cost-effectiveness, ease of handling, and suitability for varied portion sizes. Flexible packs also offer resealable options and barrier protection, making them ideal for maintaining product freshness and meeting the needs of on-the-go consumers.

The rigid packaging segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for premium and gift-oriented cookie offerings. Rigid formats such as tin boxes and cartons are favored for their durability and upscale visual appeal, particularly in festive seasons and e-commerce sales. Their ability to preserve shape and prevent breakage during transportation also supports premium positioning and higher price realization.

- By Sales Channel

On the basis of sales channel, the cookies market is segmented into modern trade, direct sales, specialist retailers, traditional grocery stores, supermarkets, hypermarkets, convenience stores, online channel, and others. The supermarkets segment held the largest market revenue share in 2024, driven by their broad product assortments, frequent promotions, and consumer preference for one-stop retail experiences. Supermarkets are instrumental in promoting both branded and private-label cookies through attractive shelf placements and in-store sampling.

The online channel is expected to witness the fastest CAGR from 2025 to 2032, driven by growing internet penetration, smartphone usage, and demand for doorstep delivery. Online platforms offer consumers a wide range of domestic and international cookie brands, subscription services, and personalized recommendations. The ability to shop anytime and access exclusive flavors or health-centric products is contributing to rapid digital channel expansion.

Cookies Market Regional Analysis

- North America dominates the cookies market with the largest revenue share of 34.2% in 2024, driven by high consumer demand for premium and specialty cookies, widespread retail penetration, and growing health-consciousness encouraging diversified product offerings

- Consumers in the region prioritize taste, quality, and convenience, fueling demand for innovative flavors and formats that cater to busy lifestyles and dietary preferences

- This robust market growth is further supported by strong distribution networks, rising disposable incomes, and increasing adoption of online grocery shopping, making cookies a staple in both household and on-the-go consumption

U.S. Cookies Market Insight

U.S. cookies market captured the largest revenue share in 2024 within North America, fueled by the popularity of indulgent treats such as chocolate chip and sandwich cookies. The demand for healthier options, such as oatmeal and gluten-free variants, is also rising, reflecting changing consumer preferences. The well-established bakery industry, coupled with extensive retail channels and promotional activities, further supports market expansion. Growth in online sales and e-commerce platforms enhances accessibility and consumer reach across urban and suburban areas.

Europe Cookies Market Insight

Europe cookies market is projected to expand steadily during the forecast period, driven by rising demand for premium, organic, and artisanal cookie varieties. Stringent food safety regulations and consumer preference for natural ingredients influence product innovation. Increased urbanization and busy lifestyles contribute to growing consumption of convenient, ready-to-eat snacks, including cookies. Countries such as Germany, France, and the U.K. lead the market, with a notable increase in demand for healthier and functional cookies.

U.K. Cookies Market Insight

U.K. cookies market is anticipated to grow at a healthy CAGR, supported by consumers’ growing interest in unique flavors and premium products. The popularity of sandwich cookies and specialty ingredients such as honey and ginger is on the rise. In addition, strong retail infrastructure and increasing online grocery shopping contribute to market growth. Consumer focus on indulgence balanced with health awareness drives manufacturers to innovate with reduced sugar and clean-label offerings.

Germany Cookies Market Insight

Germany cookies market is expected to grow steadily, driven by a mature bakery sector and consumer preference for traditional as well as innovative cookie types. There is growing interest in oatmeal and butter cookies due to their perceived health benefits and taste. Sustainability and eco-friendly packaging are increasingly influencing purchasing decisions. The rise of modern retail chains and specialty stores supports wider product availability and variety.

Asia-Pacific Cookies Market Insight

Asia-Pacific cookies market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rising urbanization, increasing disposable incomes, and changing lifestyles in countries such as China, India, Japan, and South Korea. Expanding retail networks and rising internet penetration promote online sales growth. Consumers in the region are increasingly seeking both traditional flavors and Western-style cookies, creating diverse opportunities for manufacturers. Government initiatives promoting food safety and quality standards further support market development.

Japan Cookies Market Insight

Japan cookies market is gaining momentum due to consumers’ preference for high-quality ingredients and unique flavor combinations. Traditional flavors such as matcha and red bean are being combined with Western cookie types, increasing appeal. The aging population and demand for convenient snack options are driving innovation in portion sizes and packaging. Integration of cookies into gifting culture also boosts sales in the country.

China Cookies Market Insight

China cookies market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing middle-class population, and increased consumption of packaged snacks. The rising popularity of both local and international cookie brands is evident, supported by strong domestic manufacturing and distribution. Expansion of e-commerce platforms and modern retail chains enhances market accessibility. Innovations focusing on health, flavor, and convenience are key factors propelling the market forward.

Cookies Market Share

The cookies industry is primarily led by well-established companies, including:

- Britannia Industries (India)

- Kellogg Co. (U.S.)

- Campbell Soup Company (U.S.)

- Ferrero (Italy)

- Nestlé (Switzerland)

- PepsiCo (U.S.)

- M. Dias Branco (Brazil)

- Barilla G. e R. Fratelli S.p.A (Italy)

- Arcor (Argentina)

- General Mills, Inc. (U.S.)

- Mondelez International (U.S.)

- Lotus Bakeries (Belgium)

- Adam Foods (Spain)

- THOMAS TUNNOCK LIMITED (U.K.)

- Burton's Biscuits Co. (U.K.)

- Parle Products Pvt. Limited (India)

- ITC Limited (India)

- Grupo Bimbo (Mexico)

- Bahlsen GmbH & Co. KG (Germany)

Latest Developments in Global Cookies Market

- In May 2024, Grupo Bimbo announced a strategic partnership with Oobli, a prominent brand known for its sweet proteins, to enhance its baked goods offerings. This collaboration aims to address the rising demand from health-conscious consumers seeking healthier bakery options. By incorporating sweet proteins into their products, Grupo Bimbo hopes to innovate its product line while catering to the growing market for nutritious and guilt-free indulgence

- In October 2023, Kellogg's undertook a significant transformation by splitting its business into two distinct entities: W K Kellogg Co and Kellanova. This strategic decision is designed to enable Kellanova to streamline its operations, focus on core competencies, and allocate resources more efficiently. The separation aims to enhance profitability and foster innovation, allowing both companies to pursue growth opportunities more effectively in their respective markets

- In August 2022, Mondelez International made a notable move by launching eight new products that are free from high in fat, sugar, and salt (HFSS) in August 2022. These offerings, spanning biscuits, desserts, and chocolate drinks, feature well-known brands such as BelVita, Cadbury Drinking Chocolate, Maynards Bassetts, and the Natural Confectionery Company. This launch aligns with the growing consumer demand for healthier snacking options while maintaining indulgent flavors

- In July 2022, Britannia Good Day, a well-known cookie brand in India, responded to increasing competition by launching the innovative Good Day Harmony biscuit in July 2022. These cookies are available in four delectable variants: Hazelnut, Cashew, Pista, and Almond. The introduction of these new flavors is aimed at attracting health-conscious consumers while preserving the brand's reputation for quality and taste in the competitive baked goods market

- In August 2022, General Mills introduced a new flavor of Pillsbury mini soft-baked cookies targeted specifically for convenience stores. These cookies are crafted with a unique blend of soft butter and shortening, enhancing their texture and flavor. Available in four homemade-inspired flavors—chocolate chip, confetti, sugar with drizzled icing, and peanut butter with chocolatey drizzle—this launch reflects General Mills’ commitment to meeting consumer preferences for quick, delicious snacks

- In January 2020, Nestlé launched its Edible Funfetti cookie dough brownie batter, offering consumers a nostalgic taste experience. This innovative product combines familiar flavors that appeal to both children and adults, making it a fun addition to any baking activity. The introduction of Edible Funfetti emphasizes Nestlé's strategy to tap into the growing demand for versatile and easy-to-use baking solutions that enhance family bonding moments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cookies Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cookies Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cookies Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.