Global Cooling System For Edge Computing Market

Market Size in USD Billion

CAGR :

%

USD

1.77 Billion

USD

4.15 Billion

2025

2033

USD

1.77 Billion

USD

4.15 Billion

2025

2033

| 2026 –2033 | |

| USD 1.77 Billion | |

| USD 4.15 Billion | |

|

|

|

|

Cooling System for Edge Computing Market Size

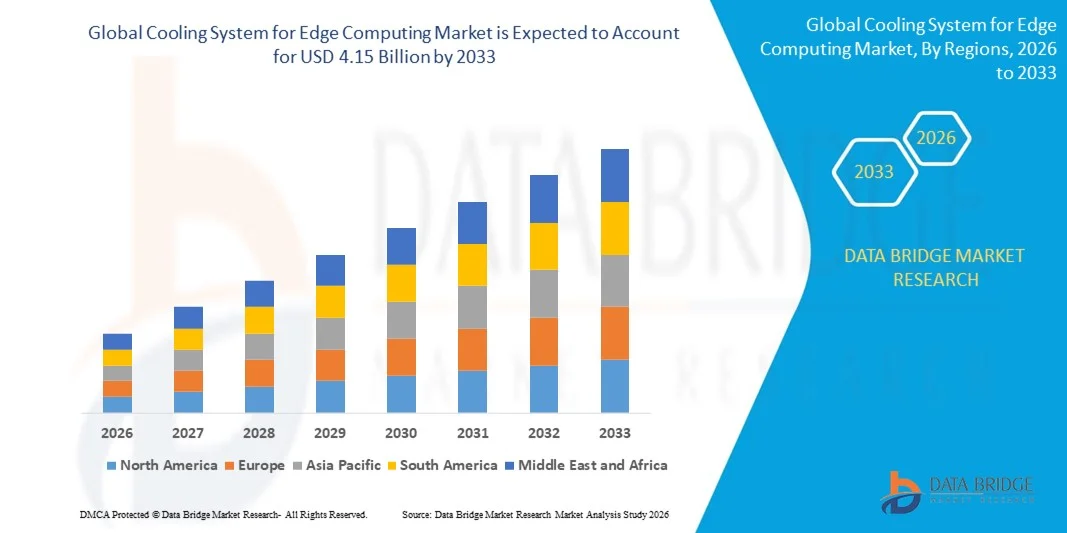

- The global cooling system for edge computing market size was valued at USD 1.77 billion in 2025 and is expected to reach USD 4.15 billion by 2033, at a CAGR of 11.2% during the forecast period

- The market growth is largely fueled by the increasing deployment of edge data centers and high-density computing infrastructure, driven by the rising adoption of AI, IoT, and 5G applications that demand efficient and reliable thermal management

- Furthermore, growing organizational focus on energy efficiency, sustainability, and operational cost reduction is establishing advanced cooling systems as essential solutions for maintaining performance and reliability in edge computing environments. These converging factors are accelerating the adoption of liquid-based, hybrid, and immersion cooling technologies, thereby significantly boosting the market’s growth

Cooling System for Edge Computing Market Analysis

- Advanced cooling solutions, including liquid cooling, hybrid cooling, and direct-to-chip (D2C) systems, are becoming increasingly vital components of modern edge data centers due to their ability to manage high-density workloads, reduce energy consumption, and ensure consistent server performance across both commercial and industrial deployments

- The escalating demand for edge cooling systems is primarily fueled by the rapid expansion of edge computing infrastructure, growing data traffic, and the need for low-latency, high-performance processing. Organizations are increasingly prioritizing efficient, scalable, and reliable thermal management solutions to support digital transformation initiatives and next-generation applications

- North America dominated the cooling system for edge computing market with a share of 38.5% in 2025, due to increasing deployment of edge data centers, growing demand for high-performance computing, and awareness of energy-efficient cooling solutions

- Asia-Pacific is expected to be the fastest growing region in the cooling system for edge computing market during the forecast period due to rapid urbanization, expanding IT & telecom infrastructure, and rising adoption of cloud and edge computing services

- Air-based segment dominated the market with a market share of 45.8% in 2025, due to its widespread adoption in small and medium edge computing facilities due to ease of installation, low maintenance, and proven reliability. Air-based systems are favored for their ability to maintain consistent temperatures across server racks without the need for complex infrastructure upgrades. Their compatibility with existing edge data centers and modular setups makes them a practical choice for businesses seeking cost-effective cooling solutions. In addition, advancements in fan design, airflow optimization, and energy-efficient components further support their adoption

Report Scope and Cooling System for Edge Computing Market Segmentation

|

Attributes |

Cooling System for Edge Computing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Cooling System for Edge Computing Market Trends

Growth of Liquid and Immersion Cooling in Edge Data Centers

- The global cooling system for edge computing market is witnessing rapid growth due to the rising deployment of edge data centers and high-density computing infrastructure, which generate significant heat and require efficient thermal management solutions to ensure reliable operations and energy optimization

- For instance, Vertiv launched an immersion cooling module specifically designed for edge AI data centers, offering compact, scalable solutions that support high-density GPU workloads and enable operators to achieve energy-efficient and high-performance operations in latency-sensitive applications

- The increasing adoption of liquid and hybrid cooling technologies is transforming edge computing infrastructure by providing more effective heat dissipation, reducing energy consumption, and improving system reliability compared to conventional air-based cooling solutions

- Growing organizational emphasis on sustainability, operational efficiency, and reduced carbon footprint is encouraging the deployment of advanced cooling systems that optimize energy usage, enhance server longevity, and contribute to environmentally responsible edge operations

- Modular and scalable cooling solutions are becoming more popular as they allow edge data centers to quickly adapt to fluctuating IT loads, expand capacity as required, and maintain consistent high-performance computing environments, supporting the rapid growth of distributed edge infrastructure

- The demand for innovative and reliable cooling technologies, including immersion and direct-to-chip liquid cooling systems, continues to grow as organizations prioritize energy efficiency, high-density processing, and seamless integration with advanced edge computing architectures, reinforcing the expansion of the market

Cooling System for Edge Computing Market Dynamics

Driver

Rising High-Density Edge and AI Workloads

- The growing adoption of high-density edge computing and AI workloads is a significant driver for the market, as these applications generate considerable heat and require advanced cooling technologies to maintain optimal performance, prevent downtime, and ensure energy-efficient operation

- For instance, Schneider Electric introduced liquid cooling solutions specifically for AI data centers, enabling operators to enhance server performance while reducing energy consumption and supporting sustainability initiatives in both commercial and industrial edge environments

- The rapid deployment of 5G networks and proliferation of IoT devices are increasing the need for edge computing infrastructure, which in turn accelerates demand for effective and reliable cooling solutions capable of managing distributed, high-density workloads

- Organizations are focusing on operational efficiency, energy cost reduction, and environmental sustainability, prompting them to adopt advanced cooling systems that ensure continuous performance while minimizing electricity usage and maintenance requirements

- The expansion of smart cities, digital transformation projects, and industrial IoT deployments is further driving the demand for advanced edge cooling technologies that can support low-latency applications and high-performance computing, establishing these solutions as critical components of modern edge infrastructures

Restraint/Challenge

High Cost and Integration Complexity

- The high initial investment and installation cost associated with advanced cooling systems such as immersion and direct-to-chip liquid cooling remain a major challenge for market adoption, especially for small and medium-sized edge facilities with limited budgets

- For instance, deploying immersion cooling solutions often requires specialized infrastructure, skilled personnel, and integration with existing IT and edge architectures, which can delay implementation and limit adoption among enterprises with constrained resources

- The complexity of maintenance and requirement for trained technicians to operate advanced cooling solutions can hinder adoption, particularly in regions where technical expertise in liquid-based or hybrid systems is limited

- Lack of standardization in edge cooling architectures and variability in deployment environments create integration challenges, affecting scalability and operational consistency across multiple edge sites

- Addressing high cost, operational complexity, and integration barriers through technological innovation, training programs, and modular deployment strategies will be essential to enable broader adoption and sustained growth of cooling systems for edge computing

Cooling System for Edge Computing Market Scope

The market is segmented on the basis of type of cooling systems, cooling capacity, deployment type, cooling management system, cooling method, and vertical.

- By Type of Cooling Systems

On the basis of type of cooling systems, the market is segmented into air-based, liquid-based, and hybrid cooling systems. The air-based cooling systems segment dominated the market with the largest revenue share of 45.8% in 2025, driven by its widespread adoption in small and medium edge computing facilities due to ease of installation, low maintenance, and proven reliability. Air-based systems are favored for their ability to maintain consistent temperatures across server racks without the need for complex infrastructure upgrades. Their compatibility with existing edge data centers and modular setups makes them a practical choice for businesses seeking cost-effective cooling solutions. In addition, advancements in fan design, airflow optimization, and energy-efficient components further support their adoption.

The liquid-based segment is anticipated to witness the fastest growth rate of 22.4% from 2026 to 2033, fueled by rising deployment in high-density edge computing environments that require more efficient heat dissipation. Liquid-based systems provide superior thermal management and reduced energy consumption per unit of computing power, making them attractive for facilities handling intensive workloads. Their scalability and ability to integrate with advanced monitoring solutions further drive market demand.

- By Cooling Capacity

On the basis of cooling capacity, the market is segmented into small-scale, medium-scale, and large-scale cooling systems (above 200KW). The medium-scale cooling systems segment held the largest market revenue share of 42.1% in 2025, as it balances performance and energy efficiency for mid-sized edge data centers and micro-edge deployments. Medium-scale systems are increasingly preferred for their adaptability to varying workloads and their compatibility with modular infrastructure setups, allowing operators to expand cooling capacity as needed. Their ability to support both air-based and liquid-based technologies provides additional flexibility for facility managers.

The large-scale cooling systems segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the deployment of edge computing hubs in enterprise and hyperscale environments. These systems offer advanced thermal management capabilities, supporting high-density racks and critical IT infrastructure, which ensures uninterrupted operations. Their integration with intelligent control systems enhances efficiency and reduces operational costs, further boosting adoption.

- By Deployment Type

On the basis of deployment type, the market is segmented into room-based cooling units, in-rack cooling units, outdoor cooling units, direct-to-chip liquid cooling units, portable cooling units, and immersion cooling units. Room-based cooling units dominated the market with a revenue share of 38.7% in 2025, due to their versatility and ease of integration within conventional edge computing setups. These units provide uniform cooling across server rooms and are compatible with a variety of IT equipment layouts, making them the preferred choice for small and medium edge data centers. For instance, companies such as Schneider Electric offer scalable room-based solutions that can be quickly deployed and maintained.

In-rack and direct-to-chip liquid cooling units are anticipated to witness the fastest growth, with a CAGR of 23.1% from 2026 to 2033, driven by increasing demand in high-performance and high-density edge computing facilities. These units allow precise cooling at the component level, improving server efficiency and reducing energy consumption, which is critical for mission-critical applications and hyperscale deployments.

- By Cooling Management System

On the basis of cooling management system, the market is segmented into integrated cooling management systems and standalone cooling management systems. The integrated cooling management system segment dominated the market with the largest revenue share of 44.3% in 2025, due to its ability to provide centralized monitoring, intelligent control, and predictive maintenance functionalities. Integrated systems optimize energy consumption and ensure precise temperature regulation, which minimizes the risk of equipment overheating and downtime. For instance, Vertiv’s integrated cooling solutions offer real-time analytics and automated adjustments, helping enterprises maintain operational efficiency.

The standalone cooling management system segment is expected to witness the fastest growth rate of 20.9% from 2026 to 2033, driven by growing adoption in modular and remote edge computing installations where fully integrated solutions may not be feasible. These systems offer flexibility, rapid deployment, and cost-effectiveness while still providing reliable cooling management for localized environments.

- By Cooling Method

On the basis of cooling method, the market is segmented into chilled water cooling, direct expansion (DX) cooling, liquid cooling, and others. The chilled water cooling segment held the largest market revenue share of 41.5% in 2025, owing to its high energy efficiency, proven reliability, and suitability for medium to large edge data centers. Chilled water systems allow precise temperature control, lower operational costs, and compatibility with modular cooling infrastructure. For instance, companies such as Airedale International provide scalable chilled water cooling solutions that support a variety of edge computing configurations.

The liquid cooling segment is expected to witness the fastest CAGR of 24.2% from 2026 to 2033, driven by rising adoption in high-density and performance-intensive edge computing setups. Liquid cooling enables rapid heat removal from critical components, reduces the footprint of cooling equipment, and improves overall energy efficiency, making it ideal for next-generation edge deployments.

- By Vertical

On the basis of vertical, the market is segmented into IT & telecom, manufacturing, government & public sectors, healthcare, transportation & logistics, retail & consumer goods, and others. The IT & telecom vertical dominated the market with the largest revenue share in 2025, due to the growing deployment of edge computing nodes to support data processing, low-latency applications, and network optimization. Telecom operators and IT service providers are increasingly investing in advanced cooling systems to ensure uninterrupted operations and enhance infrastructure reliability. For instance, companies such as Cisco and HPE implement state-of-the-art cooling technologies in their edge computing facilities to support 5G networks and cloud services.

The healthcare vertical is anticipated to witness the fastest CAGR from 2026 to 2033, driven by rising demand for real-time patient monitoring, telemedicine, and AI-powered diagnostics at the edge. Cooling solutions in healthcare facilities ensure reliable performance of sensitive computing equipment while maintaining energy efficiency and operational sustainability.

Cooling System for Edge Computing Market Regional Analysis

- North America dominated the cooling system for edge computing market with the largest revenue share of 38.5% in 2025, driven by increasing deployment of edge data centers, growing demand for high-performance computing, and awareness of energy-efficient cooling solutions

- Organizations in the region prioritize reliable, low-latency edge infrastructure, and cooling systems are essential to maintain performance, prevent hardware overheating, and optimize energy consumption

- This widespread adoption is further supported by the presence of major cloud and telecom providers, high technological adoption, and increasing investments in digital transformation initiatives, establishing advanced cooling systems as a critical component of edge computing infrastructure

U.S. Cooling System for Edge Computing Market Insight

The U.S. market captured the largest revenue share in 2025 within North America, fueled by rapid expansion of edge computing networks and hyperscale data centers. Organizations are increasingly prioritizing high-efficiency cooling solutions, such as liquid-based systems and integrated cooling management systems, to support high-density edge workloads and reduce operational costs. The growing adoption of air-based and hybrid cooling solutions enables flexible deployment across multiple edge sites. For instance, companies such as Vertiv and Schneider Electric are deploying scalable, energy-efficient cooling systems to maintain uninterrupted operations. Government initiatives promoting smart cities and 5G networks, along with rising emphasis on sustainability, further propel the deployment of advanced cooling systems. The market continues to benefit from increasing demand for low-maintenance, high-performance cooling technologies across enterprise and commercial facilities.

Europe Cooling System for Edge Computing Market Insight

Europe is projected to expand at a substantial CAGR, primarily driven by stringent energy efficiency regulations and rising demand for sustainable, reliable edge computing infrastructure. Countries such as Germany, France, and the U.K. are investing in edge computing hubs to support industrial IoT, smart manufacturing, and digital services. Organizations are adopting air-based, liquid-based, and hybrid cooling systems to optimize server performance while reducing energy consumption. For instance, companies such as Rittal and Schneider Electric provide integrated cooling management solutions aligned with European energy standards. The region is witnessing significant growth across IT & telecom, manufacturing, and government sectors, driving the adoption of advanced cooling solutions. Modernization of legacy data centers with modular, scalable cooling infrastructure further supports market expansion across Europe.

U.K. Cooling System for Edge Computing Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing edge computing deployments in IT, healthcare, and financial services. Organizations are implementing advanced cooling solutions such as in-rack liquid cooling and hybrid systems to improve energy efficiency, reduce latency, and maintain server performance. For instance, companies such as Vertiv and Schneider Electric are providing scalable, energy-efficient cooling systems for U.K.-based edge facilities. The U.K.’s robust digital infrastructure and focus on sustainability support the integration of efficient cooling technologies into edge data centers. Growing adoption of distributed computing architectures and cloud services further fuels market growth. The increasing reliance on high-performance, low-latency edge networks ensures continued demand for advanced cooling systems in both commercial and enterprise environments.

Germany Cooling System for Edge Computing Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by industrial IoT adoption, advanced manufacturing, and high-tech edge computing infrastructure. Organizations are deploying air-based, liquid-based, and hybrid cooling systems to manage high-density server workloads and ensure operational reliability. For instance, companies such as Rittal and Airedale International are implementing liquid cooling and integrated cooling management solutions in edge facilities. Government emphasis on sustainability and eco-conscious operations drives the adoption of energy-efficient cooling systems. High demand from smart factories, research centers, and enterprise IT networks further stimulates market growth. Integration with digital monitoring and predictive maintenance solutions allows real-time optimization of cooling operations, enhancing efficiency and reliability.

Asia-Pacific Cooling System for Edge Computing Market Insight

Asia-Pacific is poised to grow at the fastest CAGR during 2026–2033, driven by rapid urbanization, expanding IT & telecom infrastructure, and rising adoption of cloud and edge computing services. Countries such as China, Japan, and India are investing heavily in edge data centers to reduce latency and support AI, IoT, and 5G applications. For instance, companies such as Huawei and Inspur are deploying scalable, energy-efficient cooling solutions across APAC edge sites. Government initiatives promoting smart cities and digital infrastructure expansion, along with operational efficiency requirements, are boosting adoption. Increasing manufacturing of edge computing components in APAC facilitates broader accessibility of advanced air-based, liquid-based, and hybrid cooling systems. The market is also supported by growing demand for high-performance, energy-efficient cooling solutions across residential, commercial, and industrial edge deployments.

Japan Cooling System for Edge Computing Market Insight

The Japan market is gaining momentum due to high adoption of smart technologies, edge computing growth, and focus on energy-efficient operations. Organizations emphasize compact, reliable cooling solutions such as in-rack liquid cooling and hybrid systems to support dense edge servers. For instance, companies such as Fujitsu and Hitachi provide energy-efficient integrated cooling management solutions for edge data centers. Japan’s aging population and increasing automation in manufacturing and healthcare drive demand for low-maintenance, reliable cooling. Integration with AI and IoT-enabled monitoring enhances performance and energy efficiency. Expansion of smart buildings and connected infrastructure further supports market growth across residential and commercial edge deployments.

China Cooling System for Edge Computing Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding middle-class demand for digital services, and widespread edge computing adoption. The country is investing heavily in edge data centers to support 5G, AI, and industrial IoT applications. For instance, companies such as Huawei and Inspur are deploying advanced liquid-based and hybrid cooling systems to maintain high-density edge server performance. Cost-effective domestic manufacturing and availability of advanced solutions are accelerating adoption across multiple sectors. Government initiatives promoting smart cities and digital infrastructure expansion further enhance demand for high-performance cooling systems. Technological advancement and private sector investment are establishing China as the largest edge computing cooling market in APAC.

Cooling System for Edge Computing Market Share

The cooling system for edge computing industry is primarily led by well-established companies, including:

- VERTIV (U.S.)

- Schneider electric (France)

- STULZ GMBH (Germany)

- RITTAL (Germany)

- Mitsubishi Electric Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Fujitsu (Japan)

- Eaton (U.S.)

- HUAWEI (China)

- Trane (U.S.)

- Coolcentric (U.S.)

- Siemens (Germany)

- LG Electronics (South Korea)

- Danfoss A/S (Poland)

- Delta electronics (Taiwan)

- IBM (U.S.)

- Johnson Controls Inc. (U.S.)

- 2CRSI group (France)

- Airedale International (U.K.)

- Minekels B.V. (Netherland)

- Coolit systems (Canada)

- Iceotope (U.K.)

- Krellian Ltd. (U.K.)

- Green Revolution Cooling Inc. (U.S.)

Latest Developments in Global Cooling System for Edge Computing Market

- In October 2025, GRC (Green Revolution Cooling) introduced a next-generation immersion-cooled data center solution in partnership with Dell Technologies and DCV Industries for the Middle East & Africa region, combining its efficient dielectric fluid cooling with modular data center designs. This initiative enhances the global adoption of immersion cooling in edge and hyperscale environments by providing reliable, energy-efficient thermal management solutions for high-density computing workloads in emerging markets

- In June 2025, Vertiv announced a new immersion cooling module specifically designed for edge AI data centers, expanding its product portfolio to include compact, scalable solutions that support high-density GPU deployments. This development strengthens Vertiv’s position in the edge computing cooling market by providing tailored infrastructure for latency-sensitive, compute-intensive applications, enabling operators to deploy more energy-efficient, high-performance edge sites

- In June 2024, Schneider Electric released a new white paper on liquid cooling for AI data centers, offering guidance on selecting optimal cooling architectures to improve energy efficiency, server performance, and sustainability. This strengthens Schneider Electric’s leadership in advanced cooling solutions, enabling edge computing and AI data centers to deploy effective, sustainable technologies that reduce operational costs and carbon footprint

- In February 2024, STULZ GmbH partnered with Asperitas to develop a modular data center solution featuring immersion cooling, with STULZ handling infrastructure and cooling while Asperitas contributed immersion technology. The compact solution supports up to 200 kW IT loads and offers efficient cooling for high-demand applications, providing high reliability, rapid scalability, and global support, thereby promoting the adoption of immersion cooling in edge computing deployments across EMEA

- In February 2024, Nokia published a feasibility study on using direct-to-chip liquid cooling for Open Edge Servers, demonstrating that modifying server sleds and chassis to support D2C liquid cooling at the edge is practical and highly beneficial. This initiative helps standardize advanced cooling on edge infrastructure and enables broader deployment of efficient, liquid-cooled edge nodes, supporting high-density computing and energy-efficient operations in distributed environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cooling System For Edge Computing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cooling System For Edge Computing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cooling System For Edge Computing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.