Global Copper Sulphate Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

2.27 Billion

2025

2033

USD

1.65 Billion

USD

2.27 Billion

2025

2033

| 2026 –2033 | |

| USD 1.65 Billion | |

| USD 2.27 Billion | |

|

|

|

|

What is the Global Copper Sulphate Market Size and Growth Rate?

- The global copper sulphate market size was valued at USD 1.65 billion in 2025 and is expected to reach USD 2.27 billion by 2033, at a CAGR of4.05% during the forecast period

- Rise in the presence of the many agricultural and animal husbandries is the vital factor escalating the market growth, also rise in the research and development activities and rise in the R&D for effective fungicide and herbicides to protect farm yield are the major factors among others driving the copper sulphate market

What are the Major Takeaways of Copper Sulphate Market?

- Increase in the technological advancements and modernization in the production techniques and rise in the demand from emerging economies will further create new opportunities for the copper sulphate market

- However, copper sulphate is moderately toxic when exposed for a longer period of time which acts as the major factor among others acting as a restraint, and will further challenge the growth of copper sulphate market

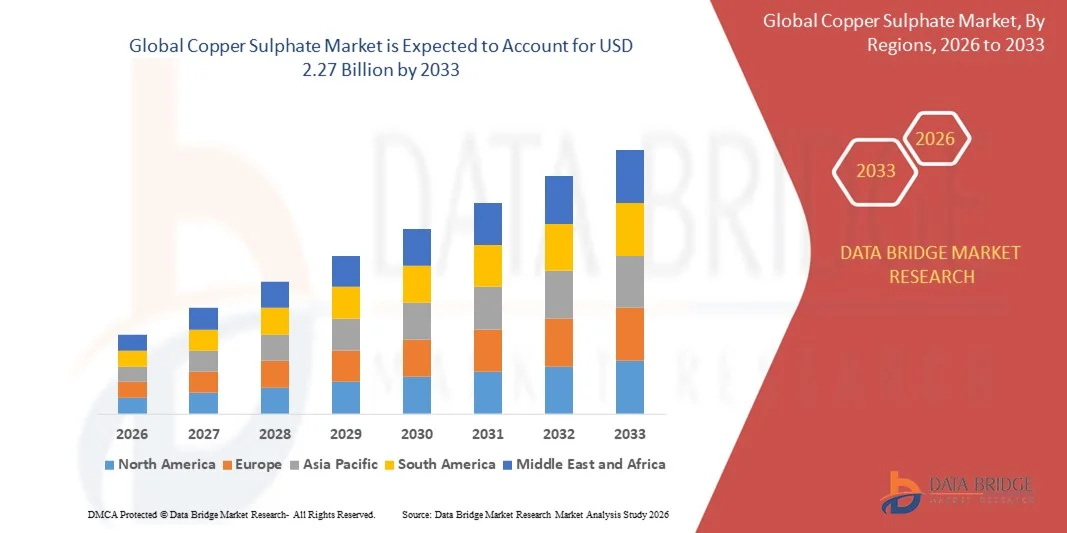

- Asia-Pacific dominated the copper sulphate market with a 42.05% revenue share in 2025, driven by rapid expansion in agriculture, industrial chemicals, mining, and water treatment applications across China, India, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 8.34% from 2026 to 2033, driven by increasing industrial chemical usage, agricultural applications, and mining activities in the U.S. and Canada

- The Fertilizer Grade segment dominated the market with a 43.2% share in 2025, driven by its extensive use as a micronutrient in soil treatment, crop protection, and foliar application. Rising demand for high-quality agricultural outputs, sustainable farming practices, and soil health management further reinforce its dominance

Report Scope and Copper Sulphate Market Segmentation

|

Attributes |

Copper Sulphate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Copper Sulphate Market?

Increasing Shift Toward High-Purity, Environmentally Safe, and Multi-Purpose Copper Sulphates

- The copper sulphate market is witnessing strong adoption of high-purity and finely processed copper sulphate for applications across agriculture, water treatment, and industrial processes

- Manufacturers are increasingly introducing eco-friendly and low-impurity formulations, ensuring compliance with environmental standards and safe usage in food, fertilizer, and aquaculture applications

- Growing demand for versatile, multi-purpose copper sulphate is driving usage in crop protection, soil correction, animal feed additives, and electroplating processes

- For instance, companies such as BASF, Sumitomo Chemicals, Shandong Luba, Dupont, and IQA Chemicals have expanded their copper sulphate portfolios with high-grade, water-soluble, and organically certified products

- Rising need for sustainable, high-efficiency solutions in agriculture, wastewater treatment, and chemical industries is accelerating the adoption of advanced copper sulphate variants

- As regulatory frameworks tighten and applications diversify, Copper Sulphates will remain essential for improving crop yield, industrial efficiency, and environmental safety

What are the Key Drivers of Copper Sulphate Market?

- Rising demand for high-quality copper sulphate in agriculture, aquaculture, and industrial sectors, supporting pest control, growth enhancement, and chemical manufacturing

- For instance, in 2024–2025, leading companies such as BASF, Sumitomo Chemicals, and Dupont expanded product lines to provide higher purity, water-solubility, and eco-friendly formulations

- Increasing adoption of sustainable farming practices and water treatment solutions is driving demand across the U.S., Europe, and Asia-Pacific

- Advancements in processing technology, solubility enhancement, and environmentally compliant formulations have strengthened performance, safety, and application versatility

- Rising need for soil correction, algae control, and industrial chemical processes is generating demand for multi-functional copper sulphate products

- Supported by ongoing investment in agriculture, water management, and chemical manufacturing, the Copper Sulphate market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Copper Sulphate Market?

- High production costs associated with refined, high-purity, and eco-certified copper sulphate restrict adoption among small-scale farmers and local industrial users

- For instance, during 2024–2025, fluctuations in raw material prices, energy costs, and supply chain constraints increased production expenses for global vendors

- Strict regulatory compliance, environmental standards, and safe handling requirements increase operational complexity and cost

- Limited awareness in emerging markets regarding proper application, environmental benefits, and quality differences slows adoption

- Competition from lower-cost, locally manufactured copper sulphate and alternative chemicals creates pricing pressure and reduces differentiation

- To address these challenges, companies are focusing on cost-efficient production, sustainable formulations, educational campaigns, and value-added services to expand global adoption of copper sulphates

How is the Copper Sulphate Market Segmented?

The market is segmented on the basis of product and end-use.

- By Product

On the basis of product, the copper sulphate market is segmented into Feed Grade, Electroplating Grade, Technical Grade, and Fertilizer Grade. The Fertilizer Grade segment dominated the market with a 43.2% share in 2025, driven by its extensive use as a micronutrient in soil treatment, crop protection, and foliar application. Rising demand for high-quality agricultural outputs, sustainable farming practices, and soil health management further reinforce its dominance. Fertilizer-grade copper sulphate is valued for its high solubility, purity, and compatibility with other agrochemicals, making it a preferred choice among farmers and agrochemical producers.

The Electroplating Grade segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing industrialization, expansion of electronics and automotive manufacturing, and rising adoption in metal finishing, coating, and corrosion prevention. Strict quality standards and demand for high-purity copper sulphate for plating processes continue to drive segment growth globally.

- By End-Use

On the basis of end-use, the copper sulphate market is segmented into Agriculture, Mining and Metallurgy, Chemicals, Construction, and Healthcare. The Agriculture segment dominated the market with a 46.5% share in 2025, fueled by strong global demand for micronutrient fertilizers, crop protection products, and sustainable farming solutions. High adoption of copper sulphate in horticulture, cereals, and commercial crops continues to drive segment growth, supported by government initiatives promoting food security and soil health.

The Mining and Metallurgy segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increased global demand for copper extraction, metal refining, and industrial chemical applications. Rising production of electrical equipment, renewable energy infrastructure, and high-performance alloys is boosting the use of copper sulphate in flotation, leaching, and metal recovery processes, contributing to rapid expansion in this end-use segment.

Which Region Holds the Largest Share of the Copper Sulphate Market?

- Asia-Pacific dominated the copper sulphate market with a 42.05% revenue share in 2025, driven by rapid expansion in agriculture, industrial chemicals, mining, and water treatment applications across China, India, Japan, South Korea, and Southeast Asia. High adoption of high-purity, multi-purpose copper sulphates and growing investments in industrial and agricultural infrastructure continues to fuel demand across manufacturing plants, processing facilities, and research centers

- Leading companies in Asia-Pacific are introducing high-quality, eco-friendly, and water-soluble copper sulphates, strengthening the region’s production capabilities. Continuous investments in industrial automation, sustainable agriculture, and chemical manufacturing drive long-term market expansion

- Strong industrial ecosystems, government-backed agricultural programs, and large-scale production capabilities further reinforce regional market leadership

China Copper Sulphate Market Insight

China is the largest contributor to Asia-Pacific due to massive agricultural and industrial chemical investments, advanced mining operations, and strong government support. Rising demand for high-purity copper sulphate in fertilizers, electroplating, and chemical applications drives adoption. Local manufacturing capabilities and cost-competitive products further boost domestic and export market growth.

India Copper Sulphate Market Insight

India is emerging as a major growth hub, driven by expanding agrochemical production, mining, and industrial chemical sectors. Rising adoption of fertilizers, feed-grade copper sulphates, and industrial applications fuels demand. Government initiatives, growing manufacturing capacity, and rising exports accelerate market penetration.

Japan Copper Sulphate Market Insight

Japan shows steady growth supported by precision chemical manufacturing, sustainable agriculture, and advanced industrial processes. Strong focus on product quality and environmentally safe formulations drives premium copper sulphate adoption. Continuous modernization of industrial and agricultural processes reinforces long-term market expansion.

South Korea Copper Sulphate Market Insight

South Korea contributes significantly due to high demand in industrial, chemical, and electronics manufacturing applications. Rapid development in mining, water treatment, and chemical industries drives adoption of multi-purpose copper sulphates. Technological innovation, strong production capacity, and growing export-oriented industries support sustained market growth.

North America Copper Sulphate Market

North America is projected to register the fastest CAGR of 8.34% from 2026 to 2033, driven by increasing industrial chemical usage, agricultural applications, and mining activities in the U.S. and Canada. Rising demand for high-purity, water-soluble copper sulphates, combined with advanced manufacturing infrastructure and R&D investments, fuels rapid adoption across industrial and agricultural sectors.

Which are the Top Companies in Copper Sulphate Market?

The copper sulphate industry is primarily led by well-established companies, including:

- Wego Chemical Group (China)

- Allan Chemical Corporation (U.S.)

- Atotech (Germany)

- Noah Technologies Corporation (U.S.)

- Modcon Industries Private Limited (India)

- Uma Chemicals (India)

- Siddhi Vinayak Industries (India)

- Shalibhadra Dyechem Private Limited (India)

- Triveni Chemicals (India)

What are the Recent Developments in Global Copper Sulphate Market?

- In April 2024, ProChem Inc. expanded its Rockford, IL facility, increasing manufacturing space and production capabilities as part of its five-year growth strategy. This expansion is aligned with rising demand for onshore production of critical raw materials, supported by the U.S. computer chip manufacturing surge and the CHIPS Act, further strengthening ProChem’s market presence

- In August 2023, True North Copper Limited (TNC) signed an agreement with Kanins International, commencing copper sulfate production at its Cloncurry Project in Queensland, Australia. The initial capacity of 12 kilotons per year addresses growing demand from agriculture, mining, water treatment, and chemical manufacturing industries, reinforcing TNC’s strategic role in global supply

- In February 2023, the European Commission approved a new copper sulfate-based fungicide for vineyard applications, creating additional demand for copper sulfate across the European Union. This regulatory approval is expected to enhance agricultural productivity and expand market opportunities for fungicide producers

- In January 2023, the Chinese government announced plans to increase copper sulfate usage in agriculture, aiming to boost crop yields and strengthen the nation’s position as the world’s largest consumer of copper sulfate. This initiative is expected to significantly elevate domestic demand and drive long-term market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Copper Sulphate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Copper Sulphate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Copper Sulphate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.