Global Cordless Garden Equipment Market

Market Size in USD Billion

CAGR :

%

USD

12.55 Billion

USD

16.79 Billion

2024

2032

USD

12.55 Billion

USD

16.79 Billion

2024

2032

| 2025 –2032 | |

| USD 12.55 Billion | |

| USD 16.79 Billion | |

|

|

|

|

What is the Global Cordless Garden Equipment Market Size and Growth Rate?

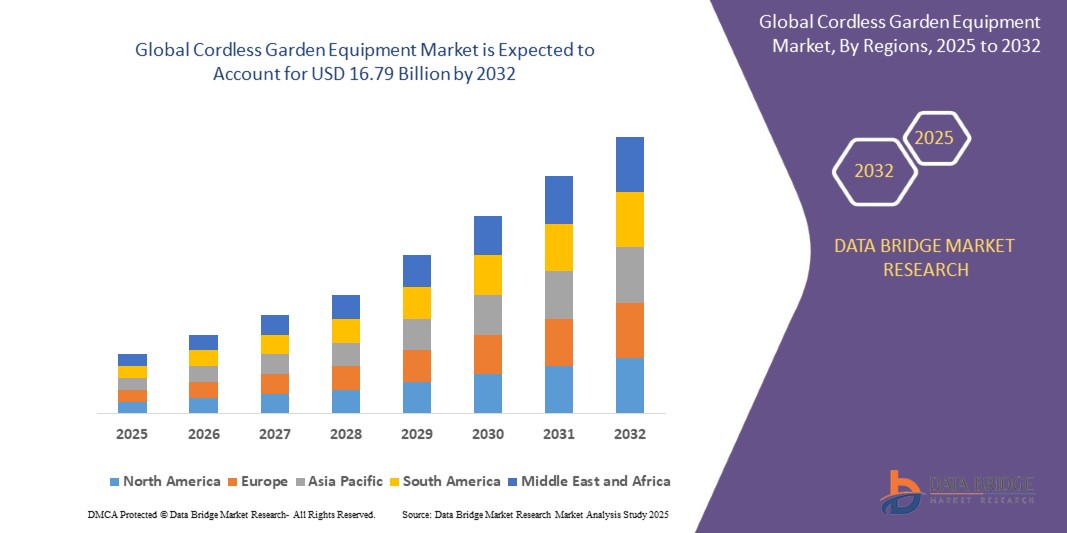

- The global cordless garden equipment market size was valued at USD 12.55 billion in 2024 and is expected to reach USD 16.79 billion by 2032, at a CAGR of 3.70% during the forecast period

- The cordless garden equipment market has experienced significant growth in recent years, driven by increasing consumer preference for convenient, eco-friendly gardening solutions

- Key factors contributing to this market expansion include advancements in battery technology, which have improved the power and runtime of cordless tools, reducing reliance on traditional corded or gas-powered alternatives. This shift towards cordless equipment is also bolstered by growing awareness of environmental sustainability and noise reduction benefits associated with battery-operated tools

- Major players in the market are investing in research and development to enhance product performance and durability, catering to a diverse range of gardening needs from residential to professional landscaping

What are the Major Takeaways of Cordless Garden Equipment Market?

- Increasing environmental awareness globally has significantly influenced consumer preferences towards eco-friendly gardening practices. Cordless garden equipment, by virtue of its electric or battery-powered operation, aligns with these preferences by reducing emissions and noise pollution compared to traditional gas-powered tools

- This growing consciousness among consumers about reducing their carbon footprint and contributing to a cleaner environment drives the demand for cordless tool

- North America dominated the cordless garden equipment market with the largest revenue share of 33.68% in 2024, driven by increased emphasis on outdoor aesthetics, rising disposable incomes, and a strong shift toward environmentally friendly landscaping tools

- Asia-Pacific cordless garden equipment market is projected to grow at the fastest CAGR of 12.56% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and growing awareness of green landscaping practices

- The Lawnmower segment dominated the cordless garden equipment market with the largest revenue share of 38.4% in 2024, attributed to its essential use in both residential and commercial lawn maintenance

Report Scope and Cordless Garden Equipment Market Segmentation

|

Attributes |

Cordless Garden Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cordless Garden Equipment Market?

“Smart Automation and Battery Advancements Fueling Product Innovation”

- A key emerging trend in the global cordless garden equipment market is the growing adoption of smart automation and advanced battery technologies to deliver enhanced performance, convenience, and sustainability. Manufacturers are integrating intelligent sensors and IoT connectivity into cordless tools, enabling users to automate tasks, monitor tool usage, and optimize energy consumption

- For instance, in March 2024, Husqvarna unveiled its latest AI-powered robotic lawn mowers capable of GPS-assisted navigation, auto-scheduling, and adaptive cutting based on grass height and density. These tools also integrate with smartphone apps for remote control and scheduling

- Moreover, battery innovations—such as the adoption of lithium-ion cells, fast-charging modules, and swappable battery packs—are improving runtime and durability, making cordless tools increasingly competitive with gas-powered alternatives. Tools such as Makita’s XGT line and DeWalt’s FlexVolt series offer high power output suitable for heavy-duty landscaping applications

- Another trend is the convergence with smart home platforms, where tools can be synced with digital ecosystems such as Google Home or Apple HomeKit for real-time updates or predictive maintenance reminders

- This shift toward intelligent, eco-friendly, and user-centric gardening tools is driving consumer expectations higher, prompting leading brands to focus on ergonomic designs, noise reduction, and wireless interconnectivity

- As a result, cordless garden equipment is transforming from simple outdoor tools into smart, sustainable landscaping solutions, appealing to both homeowners and professional landscapers looking for cleaner, quieter, and smarter equipment

What are the Key Drivers of Cordless Garden Equipment Market?

- The growing environmental awareness, combined with regulatory restrictions on gas-powered tools due to emissions and noise pollution, is significantly driving the demand for cordless garden equipment worldwide

- For instance, in September 2023, the California Air Resources Board (CARB) enforced new rules phasing out gas-powered garden tools, leading to a surge in sales of battery-powered mowers and blowers in the U.S

- Consumers are increasingly opting for low-maintenance, emission-free tools that provide the same performance without the need for fuel or oil. Cordless tools also offer instant start-up, lower noise levels, and ease of storage, making them ideal for residential use

- In addition, rising urbanization and shrinking outdoor spaces are influencing the demand for compact, lightweight, and versatile garden tools, such as string trimmers, pruners, and hedge cutters designed for small yards and gardens

- The surge in DIY gardening especially post-COVID-19 has further popularized cordless solutions among homeowners who prefer easy-to-use, plug-and-play tools for personal landscaping projects

- Increasing battery efficiency, coupled with competitive pricing, brand collaborations, and online retail growth, is expanding accessibility and accelerating global market adoption across both residential and professional segments

Which Factor is challenging the Growth of the Cordless Garden Equipment Market?

- A major barrier to widespread adoption remains the performance limitations and cost premium associated with some cordless garden tools when compared to traditional gas or corded counterparts especially in heavy-duty applications

- For instance, professional landscapers often find that runtime constraints and lower torque in budget cordless models can hinder productivity, particularly in large or dense vegetation areas

- Although battery prices have decreased significantly, high-performance models with extended battery life and fast-charging capabilities often come at a steep cost. This can deter small businesses and cost-sensitive consumers from transitioning entirely to cordless options

- Furthermore, battery compatibility and replacement concerns also affect user perception. Many brands use proprietary battery platforms, which can limit interchangeability across tools and drive up long-term ownership costs

- In addition, recycling and disposal of lithium-ion batteries pose environmental and logistical challenges, especially in countries lacking proper e-waste infrastructure

- To overcome these hurdles, companies need to focus on universal battery platforms, eco-friendly battery disposal programs, and product innovation that closes the power gap between cordless and gas tools. Expanding consumer awareness about total cost of ownership and environmental impact will also be crucial for broader adoption

How is the Cordless Garden Equipment Market Segmented?

The market is segmented on the basis of product type, application type, and distribution channel.

• By Product Type

On the basis of product type, the cordless garden equipment market is segmented into Lawnmower, Trimmer and Edger, Brushcutter, Chainsaw, Leaf Blower, and Others. The Lawnmower segment dominated the cordless garden equipment market with the largest revenue share of 38.4% in 2024, attributed to its essential use in both residential and commercial lawn maintenance. Lawnmowers offer versatility in grass trimming, especially with advancements in battery technology that now support extended runtime and efficient cutting. The growing popularity of robotic and self-propelled cordless lawnmowers further strengthens the segment's leadership.

The Chainsaw segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the increasing adoption of cordless chainsaws for landscaping, tree trimming, and firewood preparation. Their lightweight build, quiet operation, and reduced vibration appeal to DIY homeowners and arborists seeking maneuverability without sacrificing power.

• By Application Type

On the basis of application type, the cordless garden equipment market is segmented into Commercial and Residential. The Residential segment held the largest market share of 66.9% in 2024, driven by rising urbanization, increased interest in home gardening, and the availability of easy-to-use battery-powered tools. Homeowners are increasingly investing in cordless tools for lawn care and seasonal cleanup, especially with improved affordability and safety features.

The Commercial segment is expected to register the fastest growth rate during the forecast period, supported by landscaping companies, municipalities, and golf courses adopting cordless solutions to meet sustainability targets and reduce noise pollution. Government bans on gas-powered tools in certain cities are also accelerating this shift.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment dominated the market in 2024 with a market share of 57.6%, owing to the customer preference for physically inspecting tools before purchase and the value-added services offered by brick-and-mortar retailers such as installation, demo, and repair support.

The Online segment is forecasted to grow at the fastest CAGR from 2025 to 2032, driven by the expanding availability of cordless garden tools on e-commerce platforms, ease of product comparison, doorstep delivery, and digital discounts. The rise in DIY gardening during and post-pandemic has further fueled this trend.

Which Region Holds the Largest Share of the Cordless Garden Equipment Market?

- North America dominated the cordless garden equipment market with the largest revenue share of 33.68% in 2024, driven by increased emphasis on outdoor aesthetics, rising disposable incomes, and a strong shift toward environmentally friendly landscaping tools

- The region is characterized by a well-established culture of gardening and lawn care, particularly in suburban areas. The growing adoption of battery-powered tools over gas-powered alternatives due to environmental regulations and noise ordinances further supports market growth

- In addition, consumers in North America are embracing smart garden solutions, including robotic mowers and app-connected tools, offering real-time monitoring, automation, and performance tracking

U.S. Cordless Garden Equipment Market Insight

The U.S. cordless garden equipment market captured the largest revenue share in 2024 within North America, supported by increasing consumer preference for convenient, low-maintenance, and eco-conscious garden tools. Demand is particularly high for cordless mowers, hedge trimmers, and leaf blowers. The presence of major players such as Deere & Company, Toro, and Greenworks, combined with advanced battery innovations, is driving sustained product innovation. The rise of DIY gardening and the popularity of smart home integrations are further fueling the adoption of cordless tools among American homeowners and landscaping professionals.

Europe Cordless Garden Equipment Market Insight

The Europe cordless garden equipment market is expected to witness steady growth through 2032, fueled by stringent environmental regulations, a strong push for sustainability, and increasing popularity of low-emission electric tools. Countries such as Germany, France, and the U.K. are leading the transition from fuel-powered tools to battery-operated alternatives in residential and public spaces. Government support for green initiatives, along with rising demand for robotic lawn mowers and autonomous tools, is accelerating the adoption of cordless solutions in urban and rural settings.

U.K. Cordless Garden Equipment Market Insight

The U.K. market is anticipated to grow at a healthy CAGR during the forecast period, driven by increasing consumer awareness of carbon emissions, evolving gardening trends, and rising demand for lightweight, easy-to-use garden equipment. The popularity of small gardens and patio landscaping has sparked interest in cordless trimmers, pruners, and mini mowers. Moreover, favorable climate conditions and a strong DIY culture are influencing the uptake of smart cordless tools in both residential and commercial sectors.

Germany Cordless Garden Equipment Market Insight

The Germany cordless garden equipment market is projected to expand significantly, supported by the country’s commitment to sustainability and energy efficiency. Germany’s consumers demand quiet, low-vibration, and emission-free tools suitable for residential neighborhoods and public parks. The rise of smart gardening and a high emphasis on technological innovation are encouraging the integration of app-controlled and robotic tools, especially in premium landscaping services and modern homes.

Which Region is the Fastest Growing Region in the Cordless Garden Equipment Market?

Asia-Pacific cordless garden equipment market is projected to grow at the fastest CAGR of 12.56% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and growing awareness of green landscaping practices. Government initiatives promoting eco-friendly technologies, the surge in residential housing developments, and increasing participation in home gardening are driving demand in key countries such as China, Japan, and India. The region is also becoming a major manufacturing hub for cordless equipment, making these tools more affordable and accessible, especially to first-time users and small-scale landscaping businesses.

Japan Cordless Garden Equipment Market Insight

The Japan market is expanding rapidly, supported by the country’s affinity for precision gardening, compact tool design, and technology integration. Cordless tools are gaining popularity among urban gardeners and senior citizens seeking lightweight, ergonomic options. Integration with IoT platforms, quiet operation, and environmental benefits are key drivers influencing Japanese consumer preferences.

China Cordless Garden Equipment Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, driven by strong domestic production, increasing urban landscaping projects, and a booming smart home and garden tech ecosystem. Rising middle-class income, the growing trend of balcony gardening, and the availability of competitively priced cordless tools from local brands are accelerating market expansion. China's focus on urban green infrastructure and eco-conscious initiatives supports strong future growth.

Which are the Top Companies in Cordless Garden Equipment Market?

The cordless garden equipment industry is primarily led by well-established companies, including:

- ANDREAS STIHL AG & Co. KG (Germany)

- Oregon Tool, Inc. (U.S.)

- Deere & Company (U.S.)

- Emak S.p.A. (Italy)

- Honda Motor Co., Ltd. (Japan)

- Husqvarna Group (Sweden)

- MTD (U.S.)

- Robert Bosch GmbH (Germany)

- The Toro Company (U.S.)

- ECHO INCORPORATED (Japan)

- Koki Holdings Co., Ltd. (Japan)

- Makita U.S.A., Inc. (U.S.)

- Greenworks Tools (China)

- American Honda Motor Co., Inc. (U.S.)

- KUBOTA Corporation (Japan)

- Husqvarna AB (Sweden)

What are the Recent Developments in Global Cordless Garden Equipment Market?

- In August 2023, SnapFresh reinforced its position as a leader in the electric power tools segment for gardening enthusiasts, consistently pushing the envelope in innovation and revolutionizing the outdoor gardening experience through sustainability, high-quality standards, and user-friendly designs. This milestone has helped the brand earn a devoted customer base that values eco-conscious and performance-driven solutions in gardening

- In June 2023, Makita expanded its acclaimed 18V LXT cordless garden equipment series by launching new tools, including a powerful blower, multiple hedge trimmers, and a 350mm rear-handle chainsaw. These additions strengthen Makita’s product portfolio, offering greater versatility and efficiency for users seeking cordless convenience in outdoor maintenance

- In April 2023, Stanley BLACK+DECKER, Inc., through its CRAFTSMAN brand, introduced a comprehensive range of new battery-powered outdoor tools, featuring electric lawn mowers, riding mowers, string trimmers, and additional cordless garden equipment. This launch marked a significant step toward catering to the growing demand for eco-friendly and efficient lawn care solutions

- In February 2023, Husqvarna AB unveiled its Max Battery Series—a collection of battery-powered outdoor products including the Weed Eater, Leaf Blaster, Lawn Xpert, Hedge Master, and Power Axe—demonstrating a strong commitment to battery innovation for lawn and garden care. This new series enhances user performance while aligning with the shift toward cleaner, battery-operated garden tools

- In February 2023, Segway launched its advanced Navimow series of robotic lawn mowers in the U.K., featuring cutting-edge capabilities such as vision-fence sensors, enhanced GPS location accuracy, and an intelligent fusion locating system. This launch underlines Segway's growing influence in smart landscaping solutions and its continued dedication to precision-based autonomous mowing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.