Global Corneal Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.41 Billion

USD

5.04 Billion

2025

2033

USD

3.41 Billion

USD

5.04 Billion

2025

2033

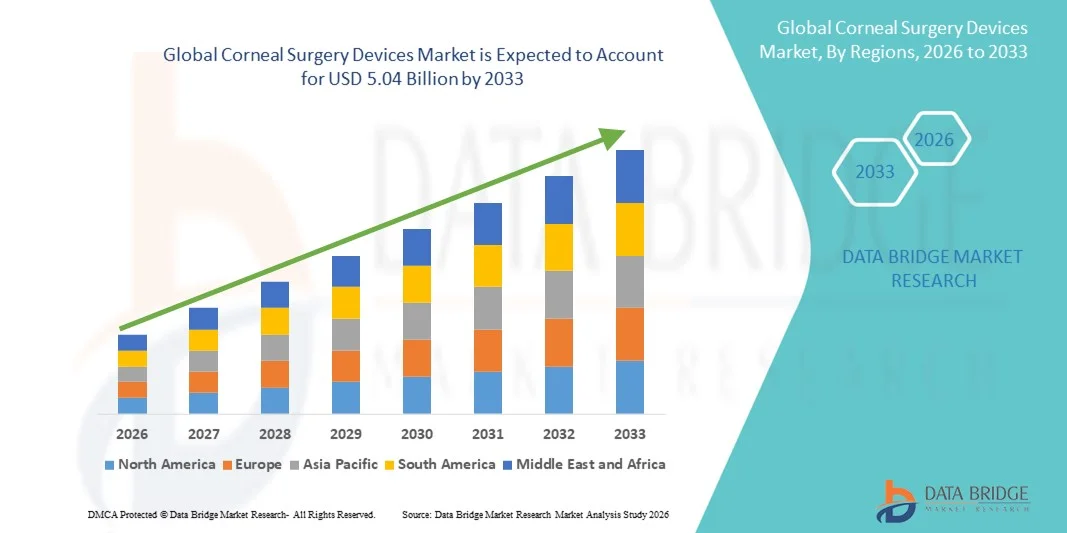

| 2026 –2033 | |

| USD 3.41 Billion | |

| USD 5.04 Billion | |

|

|

|

|

Corneal Surgery Devices Market Size

- The global corneal surgery devices market size was valued at USD 3.41 billion in 2025 and is expected to reach USD 5.04 billion by 2033, at a CAGR of 5.01% during the forecast period

- The market growth is primarily driven by the rising prevalence of corneal disorders, increasing incidence of refractive errors, and the growing volume of corneal transplant and corrective surgical procedures worldwide

- Furthermore, continuous technological advancements in surgical instruments, imaging systems, and minimally invasive techniques, along with increasing demand for precise, safe, and outcome-oriented ophthalmic procedures, are positioning corneal surgery devices as essential tools in modern eye care, thereby significantly supporting the market’s overall growth

Corneal Surgery Devices Market Analysis

- Corneal surgery devices, including diagnostic and surgical systems as well as vision care solutions, play a vital role in modern ophthalmology by enabling accurate diagnosis, pre-operative planning, and effective surgical correction of corneal disorders across hospitals and ophthalmic clinics

- The demand for corneal surgery devices is largely driven by the increasing prevalence of corneal diseases, rising cases of vision impairment, growing awareness regarding early eye examinations, and continuous technological advancements that enhance surgical precision and patient outcomes

- North America dominated the global corneal surgery devices market with the largest revenue share of 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative diagnostic and surgical technologies, and a strong presence of established ophthalmic device manufacturers, with the U.S. contributing significantly due to a high volume of corneal procedures and routine pre-operative examinations

- Asia-Pacific is anticipated to be the fastest growing region during the forecast period, driven by a large and underserved patient population, increasing access to ophthalmic care, expanding ophthalmic clinics, and rising healthcare expenditure in countries such as China, India, and Japan

- The penetrating keratoplasty segment dominated the corneal surgery devices market with a market share of 41.2% in 2025, owing to its widespread clinical adoption for treating advanced corneal disorders and the continued reliance on this well-established surgical technique supported by specialized diagnostic and surgical devices

Report Scope and Corneal Surgery Devices Market Segmentation

|

Attributes |

Corneal Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Corneal Surgery Devices Market Trends

Technological Advancements in Minimally Invasive and Precision-Based Corneal Procedures

- A significant and accelerating trend in the global corneal surgery devices market is the increasing adoption of technologically advanced, minimally invasive surgical devices that enhance precision, safety, and post-operative outcomes in corneal procedures

- For instance, femtosecond laser–assisted systems are increasingly being used in lamellar keratoplasty and corneal incision procedures, enabling highly accurate cuts, reduced tissue trauma, and improved surgical consistency compared to conventional manual techniques

- The integration of advanced imaging and diagnostic technologies into corneal surgery workflows is further improving surgical planning and intraoperative decision-making. For instance, high-resolution corneal topography and tomography systems allow surgeons to better assess corneal thickness, curvature, and pathology prior to surgery, thereby reducing complication rates

- The growing use of combined diagnostic and surgical platforms facilitates seamless transitions from pre-operative examination to surgical intervention. Through a unified system, ophthalmologists can enhance workflow efficiency while ensuring greater procedural accuracy and reproducibility

- This shift toward precision-driven and technology-enabled corneal surgery solutions is reshaping clinical standards in ophthalmology. Consequently, companies are increasingly focusing on developing next-generation corneal surgery devices that integrate diagnostics, imaging, and surgical capabilities into a single platform

- The demand for advanced, minimally invasive corneal surgery devices is steadily increasing across hospitals and ophthalmic clinics, as healthcare providers prioritize improved patient outcomes, shorter recovery times, and higher procedural success rates

Corneal Surgery Devices Market Dynamics

Driver

Rising Prevalence of Corneal Disorders and Increasing Surgical Volumes

- The growing incidence of corneal diseases, vision impairment, and refractive errors worldwide, coupled with increasing surgical intervention rates, is a key driver supporting the demand for corneal surgery devices

- For instance, the rising number of corneal transplant and keratoplasty procedures performed globally has led healthcare facilities to invest in advanced surgical and diagnostic devices to meet growing patient demand

- As awareness regarding early diagnosis and treatment of corneal conditions increases, patients are seeking timely surgical solutions, thereby driving the utilization of corneal surgery devices across both developed and emerging markets

- Furthermore, expanding access to specialized ophthalmic care, along with improvements in healthcare infrastructure, is making advanced corneal procedures more widely available in hospitals and ophthalmic clinics

- The increasing preference for procedures that offer improved visual outcomes, reduced complication risks, and faster recovery is encouraging surgeons to adopt technologically advanced corneal surgery devices

- Collectively, these factors are accelerating the adoption of corneal surgery devices and supporting sustained market growth over the forecast period

Restraint/Challenge

High Cost of Advanced Devices and Limited Donor Cornea Availability

- The high cost associated with advanced corneal surgery devices and integrated diagnostic systems poses a significant challenge to market growth, particularly in cost-sensitive and developing regions

- For instance, femtosecond laser platforms and high-end diagnostic imaging systems require substantial capital investment, limiting their adoption among smaller ophthalmic clinics and healthcare facilities with constrained budgets

- In addition, the limited availability of donor corneas in many regions restricts the volume of corneal transplant procedures, indirectly impacting the demand for certain corneal surgery devices

- Regulatory requirements, stringent quality standards, and lengthy approval processes for ophthalmic surgical devices further add to development timelines and overall costs for manufacturers

- While technological advancements continue to improve surgical outcomes, affordability and access remain critical concerns for widespread adoption, particularly in emerging markets

- Addressing these challenges through cost-effective device innovation, expansion of eye banking infrastructure, and supportive regulatory frameworks will be essential for long-term market expansion

- Shortage of skilled ophthalmic surgeons trained in advanced corneal procedures limits optimal utilization of sophisticated surgical devices, particularly in low- and middle-income regions

- Post-operative complications and variability in surgical outcomes across patient populations can create hesitancy among providers to rapidly adopt newer corneal surgery technologies, thereby slowing market penetration

Corneal Surgery Devices Market Scope

The market is segmented on the basis of device type, transplantation, procedures, and end users.

- By Device Type

On the basis of device type, the corneal surgery devices market is segmented into diagnostic and corneal surgery devices, and vision care devices. The diagnostic and corneal surgery devices segment dominated the market with the largest revenue share of 45.3% in 2025, owing to its essential role in pre-operative assessment, surgical precision, and post-operative evaluation. Surgeons and ophthalmic clinics rely heavily on advanced diagnostic tools such as corneal topographers, pachymeters, and femtosecond laser-assisted surgery systems to ensure accurate and safe procedures. The segment’s dominance is further supported by increasing prevalence of corneal disorders, growing surgical volumes, and rising adoption of minimally invasive surgical techniques. Continuous innovations in imaging and surgical device integration also reinforce its market leadership. In addition, the growing number of hospitals and specialized ophthalmic clinics with access to advanced surgical infrastructure strengthens the demand for these devices.

The vision care devices segment is anticipated to witness the fastest CAGR of 18.5% from 2026 to 2033, driven by rising demand for corrective lenses, contact lenses, and specialty vision care solutions that complement corneal surgeries. These devices support post-operative recovery and visual rehabilitation, improving overall patient outcomes. Increasing awareness regarding pre- and post-operative vision management is expanding adoption of these solutions. Technological advancements in smart vision care tools, such as adjustable-focus lenses and therapeutic contact lenses, are contributing to rapid market growth. Rising patient preference for non-invasive vision care solutions also fuels demand. Furthermore, emerging ophthalmic clinics in developing regions are increasingly investing in vision care devices due to cost-effectiveness and ease of integration.

- By Transplantation

On the basis of transplantation type, the market is segmented into deep anterior lamellar keratoplasty (DALK), penetrating keratoplasty (PK), and synthetic corneas. The penetrating keratoplasty (PK) segment dominated the market with a share of 41.2% in 2025, due to its widespread clinical adoption for treating severe corneal disorders such as keratoconus, corneal scarring, and endothelial dysfunction. PK remains the standard procedure in many regions because of its proven efficacy and extensive clinical experience. The increasing number of corneal transplants performed globally, supported by robust eye banking infrastructure, reinforces its market leadership. Surgeons’ familiarity with the procedure and ongoing technological improvements in surgical instruments also enhance adoption. The segment benefits from high reimbursement rates in developed countries, making PK procedures more accessible.

The synthetic cornea segment is expected to witness the fastest growth rate of 22.3% from 2026 to 2033, driven by innovations in keratoprosthesis and bioengineered corneal implants. Synthetic corneas address donor tissue shortages and provide treatment options for patients with repeated graft failure or high-risk corneal conditions. Rising research in biocompatible materials and improved post-operative outcomes is boosting adoption. Increasing awareness among ophthalmologists about the benefits of synthetic corneas also fuels growth. Emerging markets with limited donor availability represent key opportunities. In addition, regulatory approvals for new-generation synthetic corneas are accelerating commercial adoption globally.

- By Procedures

On the basis of procedures, the corneal surgery devices market is segmented into pre-operative examination, penetrating keratoplasty, and lamellar keratoplasty. The pre-operative examination segment dominated the market with a share of 43.1% in 2025, driven by the critical role of diagnostic assessments such as corneal mapping, thickness measurement, and curvature analysis in planning successful surgical outcomes. Accurate pre-operative evaluation reduces surgical risks and improves patient satisfaction. Hospitals and clinics rely on advanced imaging systems for precise surgical planning. Growing awareness of early detection of corneal abnormalities strengthens this segment’s dominance. Integration of diagnostics with surgical platforms further enhances workflow efficiency and outcomes.

The lamellar keratoplasty segment is anticipated to witness the fastest CAGR of 20.1% from 2026 to 2033, fueled by increasing adoption of minimally invasive partial-thickness corneal surgeries. Lamellar procedures offer faster recovery, reduced rejection rates, and better visual outcomes compared to full-thickness transplants. Technological advancements such as femtosecond laser-assisted lamellar keratoplasty are accelerating adoption. The procedure’s popularity is increasing in developed countries with high volumes of elective corneal surgeries. Growing awareness of less invasive alternatives among patients also supports segment growth. Specialized ophthalmic clinics are increasingly offering lamellar procedures, driving regional adoption.

- By End Users

On the basis of end users, the market is segmented into ophthalmic clinics, hospitals, and others. The hospitals segment dominated the market with a revenue share of 50.2% in 2025, attributed to their ability to perform high-volume surgical procedures, invest in advanced surgical devices, and provide integrated post-operative care. Hospitals benefit from established ophthalmology departments and trained specialists, supporting large-scale adoption of corneal surgery devices. The segment’s dominance is reinforced by growing demand for complex corneal surgeries, increasing healthcare spending, and the presence of advanced infrastructure in developed markets. Hospitals also lead adoption of integrated diagnostic-surgical platforms. High patient inflow for corneal procedures further strengthens this segment.

The ophthalmic clinics segment is expected to witness the fastest CAGR of 19.4% from 2026 to 2033, driven by the expansion of specialized eye care centers and ambulatory surgical facilities. Clinics are increasingly investing in diagnostic and minimally invasive surgical devices to offer high-quality corneal procedures closer to patients. Rising patient preference for personalized care supports this segment. Improvements in clinic infrastructure and accessibility are accelerating adoption. Ophthalmic clinics in emerging economies represent key growth opportunities. In addition, collaborations with hospitals and device manufacturers enhance technology access for clinics, further boosting growth.

Corneal Surgery Devices Market Regional Analysis

- North America dominated the global corneal surgery devices market with the largest revenue share of 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative diagnostic and surgical technologies, and a strong presence of established ophthalmic device manufacturers

- Patients and healthcare providers in the region place significant emphasis on accuracy, surgical outcomes, and access to minimally invasive procedures, increasing demand for cutting-edge diagnostic and surgical corneal devices

- The dominance is further supported by high healthcare expenditure, strong reimbursement policies, and a large pool of trained ophthalmic surgeons, making North America a key market for both hospitals and specialized ophthalmic clinics

U.S. Corneal Surgery Devices Market Insight

The U.S. corneal surgery devices market captured the largest revenue share of 82% in North America in 2025, driven by the high prevalence of corneal disorders, advanced healthcare infrastructure, and widespread adoption of technologically advanced diagnostic and surgical devices. Patients and ophthalmologists increasingly prioritize precision, safety, and minimally invasive procedures. The growing number of specialized ophthalmic clinics, combined with strong reimbursement policies and supportive regulatory frameworks, further propels market adoption. Moreover, innovations in femtosecond laser-assisted systems, imaging platforms, and integrated surgical devices are significantly contributing to market expansion. The increasing awareness of early diagnosis and corrective interventions among patients strengthens the overall demand for corneal surgery devices.

Europe Corneal Surgery Devices Market Insight

The Europe corneal surgery devices market is projected to expand at a substantial CAGR during the forecast period, primarily driven by a growing prevalence of corneal disorders and the rising adoption of advanced ophthalmic technologies. Increasing urbanization, combined with rising healthcare expenditure, is fostering the uptake of diagnostic and surgical devices. European healthcare providers prioritize precision, patient safety, and minimally invasive techniques, encouraging the adoption of advanced corneal surgery solutions. The market is witnessing notable growth across hospitals, specialty eye clinics, and ambulatory surgical centers. In addition, the presence of stringent regulatory standards ensures the availability of high-quality devices, further strengthening market adoption.

U.K. Corneal Surgery Devices Market Insight

The U.K. corneal surgery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of eye health, rising prevalence of corneal diseases, and demand for advanced surgical procedures. Concerns regarding visual impairment and access to minimally invasive surgery are encouraging both hospitals and ophthalmic clinics to adopt state-of-the-art devices. The U.K.’s well-developed healthcare infrastructure, combined with the presence of leading ophthalmic device manufacturers, supports strong market growth. Moreover, innovations in diagnostic and surgical platforms that enhance precision and recovery times are further stimulating demand. The growing patient preference for integrated, technologically advanced surgical solutions also contributes to market expansion.

Germany Corneal Surgery Devices Market Insight

The Germany corneal surgery devices market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of corneal disorders, demand for advanced surgical solutions, and a strong focus on patient outcomes. Germany’s robust healthcare infrastructure, high adoption of technologically advanced medical devices, and emphasis on minimally invasive procedures promote the market’s growth. Hospitals and ophthalmic clinics are increasingly integrating diagnostics and surgical devices for precision-driven procedures. Furthermore, the country’s focus on quality standards and clinical efficacy supports widespread adoption of corneal surgery technologies. The preference for innovative, reliable, and outcome-oriented devices aligns with local physician and patient expectations.

Asia-Pacific Corneal Surgery Devices Market Insight

The Asia-Pacific corneal surgery devices market is poised to grow at the fastest CAGR of 25% from 2026 to 2033, driven by increasing prevalence of corneal disorders, rising healthcare expenditure, and rapid expansion of ophthalmic infrastructure in countries such as China, India, and Japan. The growing awareness regarding eye health, coupled with technological advancements and training for surgeons, is driving adoption. Government initiatives promoting eye care services, along with the increasing number of specialty eye clinics, are further accelerating market growth. Emerging markets in the region are witnessing higher demand for cost-effective, minimally invasive corneal surgery solutions. The expanding patient base and rising disposable incomes also contribute to the rapid uptake of advanced corneal surgery devices.

Japan Corneal Surgery Devices Market Insight

The Japan corneal surgery devices market is gaining momentum due to the country’s advanced healthcare system, high adoption of medical technology, and rising prevalence of corneal disorders. Japanese patients and surgeons prioritize precision, safety, and minimally invasive procedures, driving the demand for femtosecond laser-assisted and advanced diagnostic devices. Integration of corneal surgery devices with imaging and planning systems is fueling adoption in hospitals and specialty clinics. Moreover, Japan’s aging population increases the demand for corrective and therapeutic corneal procedures. Government programs supporting vision care and technological innovation further support market growth. Increasing awareness about early diagnosis and post-operative care reinforces device adoption across residential and clinical settings.

India Corneal Surgery Devices Market Insight

The India corneal surgery devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising prevalence of corneal diseases, rapid urbanization, and expanding ophthalmic infrastructure. India is witnessing increased adoption of minimally invasive corneal procedures in hospitals and specialty clinics. Government initiatives for eye care, coupled with growing awareness of preventive and corrective interventions, are driving demand. The presence of domestic and international ophthalmic device manufacturers ensures availability of cost-effective solutions. Moreover, the expansion of specialty eye hospitals and training programs for ophthalmologists supports the market. Increasing disposable incomes and rising patient preference for advanced surgical outcomes are key factors propelling market growth in India.

Corneal Surgery Devices Market Share

The Corneal Surgery Devices industry is primarily led by well-established companies, including:

- Alcon Inc., (Switzerland)

- Ziemer Ophthalmic Systems AG (Switzerland)

- Carl Zeiss Meditec AG (Germany)

- SCHWIND eye tech solutions GmbH (Germany)

- CorNeat Vision (Israel)

- Optovue, Inc. (U.S.)

- Topcon Corporation (Japan)

- NIDEK Co., Ltd. (Japan)

- Lumenis Ltd. (Israel)

- Cassini Technologies (Netherlands)

- BTI Biotechnology Institute (Spain)

- AUROLAB (India)

- Devine Meditech (India)

- Khosla Surgical Industries (India)

- Optikon 2000 International SpA (Italy)

- Paradigm Medical Industries Inc (U.S.)

- Paramount Surgimed Ltd (India)

- Rhein Medical (U.S.)

- Roboz Surgical Instrument Co., Inc. (U.S.)

What are the Recent Developments in Global Corneal Surgery Devices Market?

- In October 2025, Aurion Biotech reported positive 12‑month Phase 1/2 CLARA trial results for AURN001, showing significant visual acuity gains and safety in patients with corneal endothelial dysfunction, supporting further clinical development and confidence in regenerative cell therapy approaches

- In July 2025, CorneaGen expanded CTAK surgeon access by making the procedure compatible with the Ziemer GALILEI imaging platform, enabling integrated diagnostic imaging with personalized surgical planning for keratoconus treatment

- In March 2025, Alcon acquired a majority interest in Aurion Biotech, Inc. to advance AURN001, an innovative allogeneic corneal endothelial cell therapy for treating corneal edema due to endothelial dysfunction, and to accelerate its global development into Phase 3 clinical trials

- In June 2024, CorneaGen announced the commercial launch of Corneal Tissue Addition for Keratoplasty (CTAK) a novel, patient‑ready corneal tissue solution offering customized, gamma‑irradiated sterile graft segments for personalized contouring in keratoconic eyes, improving procedural efficiency and visual outcomes for patients with keratoconus

- In June 2021, EyeYon Medical’s EndoArt synthetic corneal implant received CE Mark and FDA approval, marking a key milestone for synthetic corneal implants that act as a minimally invasive alternative to traditional donor tissue by replacing non‑functioning endothelium

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.