Global Coronavirus Diagnostic Market

Market Size in USD Billion

CAGR :

%

USD

35.13 Billion

USD

124.20 Billion

2025

2033

USD

35.13 Billion

USD

124.20 Billion

2025

2033

| 2026 –2033 | |

| USD 35.13 Billion | |

| USD 124.20 Billion | |

|

|

|

|

Coronavirus Diagnostic Market Size

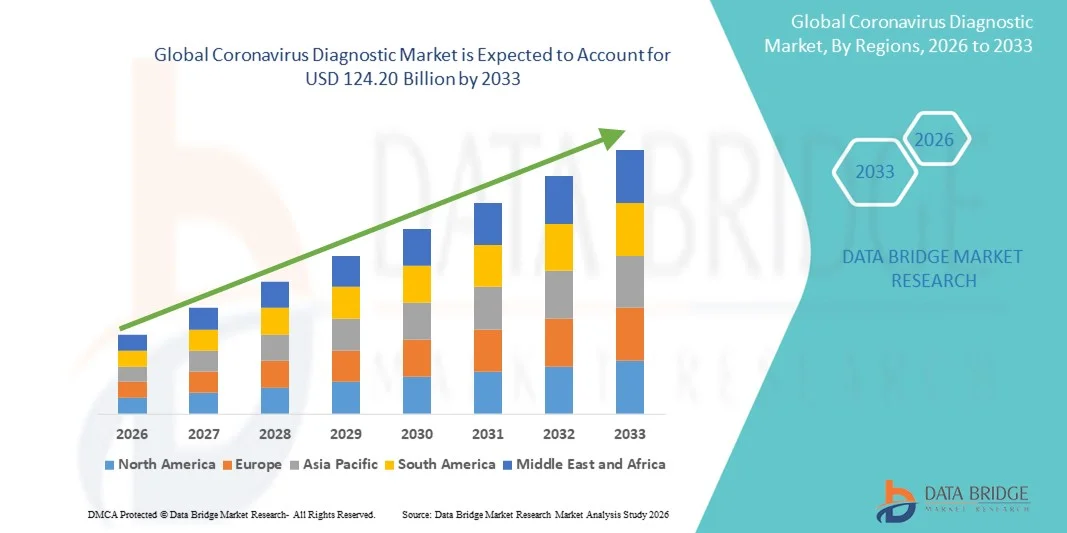

- The global coronavirus diagnostic market size was valued at USD 35.13 billion in 2025 and is expected to reach USD 124.20 billion by 2033, at a CAGR of 17.10%% during the forecast period

- The market growth is largely fueled by the continued demand for rapid, accurate, and scalable testing solutions as the SARS‑CoV‑2 virus evolves, which has sustained investment in diagnostic technologies and expanded public health testing infrastructure worldwide

- Furthermore, rising healthcare awareness, integration of digital diagnostics, and broader adoption of advanced molecular and point‑of‑care testing methods are establishing coronavirus diagnostics as a critical component of infectious disease management systems. These converging factors are accelerating the uptake of coronavirus diagnostic solutions, thereby significantly boosting the industry’s growth

Coronavirus Diagnostic Market Analysis

- Coronavirus diagnostic tests, including molecular, antigen, and antibody-based assays, are increasingly vital components of global healthcare infrastructure due to their role in rapid detection, disease surveillance, and effective pandemic management across both clinical and community settings

- The escalating demand for coronavirus diagnostics is primarily fueled by ongoing public health needs, the emergence of new SARS-CoV-2 variants, and a rising emphasis on early detection to prevent transmission and manage outbreaks efficiently

- North America dominated the coronavirus diagnostic market with the largest revenue share of 39.6% in 2025, characterized by robust healthcare infrastructure, widespread testing capabilities, and strong government support, with the U.S. experiencing substantial growth in testing volumes driven by innovations in rapid molecular and point-of-care diagnostic technologies

- Asia-Pacific is expected to be the fastest growing region in the coronavirus diagnostic market during the forecast period due to increasing healthcare investments, expanding testing infrastructure, and rising awareness of infectious disease control

- Molecular tests dominated the coronavirus diagnostic market with a market share of 46.7% in 2025, driven by their high sensitivity, reliability, and widespread adoption in hospitals, laboratories, and point-of-care settings

Report Scope and Coronavirus Diagnostic Market Segmentation

|

Attributes |

Coronavirus Diagnostic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Coronavirus Diagnostic Market Trends

Integration of Rapid Testing and Digital Health Platforms

- A significant and accelerating trend in the global coronavirus diagnostic market is the growing integration of rapid testing technologies with digital health platforms, enabling faster results and real-time reporting for patients, hospitals, and public health authorities

- For instance, Abbott’s BinaxNOW COVID-19 rapid antigen test pairs with mobile apps to instantly report results to healthcare providers, improving surveillance and patient management

- Integration of diagnostics with AI-driven data analytics allows predictive modeling for outbreak monitoring and identification of high-risk zones. For instance, some molecular diagnostic platforms utilize AI to analyze testing trends and provide alerts for potential surges

- Digital integration also enables remote result access, appointment scheduling, and population-level reporting, improving the efficiency of testing programs. For instance, cloud-based reporting platforms facilitate centralized monitoring of testing data across multiple sites

- This trend towards more connected, intelligent, and user-centric diagnostic systems is reshaping expectations for infectious disease testing. For instance, companies such as Roche and Cepheid are developing AI-enhanced diagnostics with automated result interpretation and cloud connectivity

- The demand for rapid, reliable, and digitally integrated coronavirus diagnostics is growing rapidly across hospitals, clinics, and community testing centers, as authorities increasingly prioritize fast detection and efficient case management

- Point-of-care and mobile testing units are increasingly being adopted to provide testing in remote or underserved areas. For instance, mobile PCR labs in India and Africa are helping improve accessibility for rural populations

- Wearable and continuous monitoring technologies are being explored to integrate with diagnostics for early symptom detection. For instance, some pilot programs combine wearable fever and oxygen sensors with test result tracking to enable preemptive action

Coronavirus Diagnostic Market Dynamics

Driver

Rising Need for Rapid Detection and Pandemic Preparedness

- The increasing prevalence of infectious diseases and the continuing risk of COVID-19 variants is a significant driver for the growing demand for coronavirus diagnostic tests

- For instance, in March 2025, Thermo Fisher Scientific launched an expanded portfolio of PCR-based COVID-19 kits to improve detection speed and coverage in clinical labs, supporting pandemic preparedness

- As healthcare authorities focus on early detection to prevent outbreaks, diagnostics offer high sensitivity, rapid turnaround, and scalable testing capacity, providing critical tools for containment

- Furthermore, the adoption of integrated health platforms and point-of-care testing solutions is making coronavirus diagnostics a central component of public health strategies, offering seamless coordination between labs and healthcare providers

- The convenience of rapid, accurate testing, coupled with the ability to monitor infections at scale and manage patient data digitally, is propelling adoption across hospitals, clinics, and testing centers. The trend towards mobile and drive-through testing sites further contributes to market growth

- Rising investment from governments and private entities to expand testing infrastructure is boosting market expansion. For instance, U.S. and EU funding programs in 2025 have accelerated deployment of advanced testing platforms

- Public awareness campaigns emphasizing early detection and routine testing are increasing diagnostic adoption. For instance, campaigns in Southeast Asia and Latin America have encouraged individuals to seek timely COVID-19 testing

Restraint/Challenge

Regulatory Hurdles and Test Accuracy Concerns

- Stringent regulatory requirements for diagnostic approvals and variations in test accuracy pose significant challenges to broader market adoption, particularly in emerging regions

- For instance, inconsistent performance of some rapid antigen tests has caused hesitancy among consumers and healthcare providers regarding their reliability

- Addressing these challenges through robust validation, adherence to regulatory guidelines, and continuous accuracy improvements is crucial for building trust. For instance, companies such as Quidel and Becton Dickinson emphasize high sensitivity and specificity in their marketing to reassure buyers

- In addition, the relatively high cost of advanced molecular diagnostics compared to conventional methods can limit adoption among budget-conscious healthcare providers. While rapid antigen tests are more affordable, PCR-based platforms often involve higher setup and operational costs

- Overcoming these challenges through regulatory alignment, test optimization, and cost-effective solutions will be vital for sustained market growth

- Supply chain disruptions for reagents and test kits can hinder timely availability, especially during pandemic surges. For instance, shortages of PCR reagents in early 2025 delayed testing in multiple countries

- Misinformation and distrust in testing technologies can reduce consumer compliance with testing protocols. For instance, public skepticism in certain regions has led to underutilization of rapid tests despite availability

Coronavirus Diagnostic Market Scope

The market is segmented on the basis of type, application, technology type, product, and end-user.

- By Type

On the basis of type, the coronavirus diagnostic market is segmented into molecular tests and serology tests. The molecular tests segment dominated the market with the largest revenue share of 46.7% in 2025, driven by its high sensitivity, accuracy, and widespread adoption in hospitals and public health laboratories. Molecular tests, including PCR-based diagnostics, are considered the gold standard for COVID-19 detection and are preferred for early detection of infections. The segment benefits from extensive research funding, government-backed testing initiatives, and integration of automated laboratory systems, which improve throughput and reliability. Laboratories and hospitals often rely on molecular testing for accurate case confirmation, surveillance, and variant detection, making it an essential component of public health strategies. Molecular testing also enables variant tracking and epidemiological studies, supporting broader pandemic management and containment efforts.

The serology tests segment is anticipated to witness the fastest growth rate of 22.3% from 2026 to 2033, fueled by increasing demand for antibody testing to determine population-level immunity and past exposure. Serology tests are critical for epidemiological studies, vaccine efficacy assessments, and monitoring community spread. The growth is supported by advancements in rapid immunoassay kits and point-of-care serology platforms, allowing decentralized testing in clinics, workplaces, and remote locations. Rising awareness among individuals and governments about immunity profiling further accelerates adoption. Serology testing also helps healthcare providers understand immune response trends and make informed vaccination decisions. Increasing partnerships between diagnostic companies and public health organizations amplify access to serology tests in emerging markets.

- By Application

On the basis of application, the market is segmented into hospitals, public health labs, private/commercial labs, and physician labs. The hospitals segment dominated the market in 2025 due to the high volume of COVID-19 testing conducted in inpatient and outpatient facilities. Hospitals prioritize reliable, fast, and scalable testing platforms to manage patient influx, reduce transmission risks, and support clinical decision-making. Investments in centralized molecular testing infrastructure and trained personnel further contribute to the dominance of this segment. Hospitals also serve as primary reporting centers for public health monitoring and outbreak management. The integration of testing results with electronic health records enables streamlined patient care and faster contact tracing. Hospital laboratories often receive government funding to expand testing capacity during surges, maintaining their market leadership.

The private/commercial labs segment is expected to witness the fastest growth from 2026 to 2033, driven by the growing outsourcing of COVID-19 testing by governments, businesses, and educational institutions. Commercial labs offer flexible, high-throughput solutions and can rapidly deploy testing kits for workplace and community surveillance. Innovations in automated workflows, digital reporting, and point-of-care partnerships enhance the appeal of private labs for rapid, large-scale diagnostics. Private labs also provide specialized services such as pooled testing and mobile testing units to reach underserved regions. Increasing collaboration with telemedicine platforms allows commercial labs to expand access and convenience. The segment’s growth is supported by technological upgrades, cost-effective testing models, and faster turnaround times compared to traditional hospital testing.

- By Technology Type

On the basis of technology type, the market is segmented into antibody testing and PCR testing. The PCR testing segment dominated the market in 2025 with the largest revenue share, due to its unmatched sensitivity and specificity for detecting SARS-CoV-2 infections. PCR tests remain the preferred diagnostic tool for early infection detection, clinical diagnosis, and variant identification. Government testing programs, hospital protocols, and research-driven adoption all reinforce the strong market presence of PCR-based technologies. PCR platforms are continuously upgraded with faster machines and multiplexing capabilities to detect multiple viral targets. Laboratories value PCR for regulatory compliance and epidemiological reporting. High accuracy and reliability make PCR tests indispensable for outbreak control and policy-making decisions.

The antibody testing segment is projected to witness the fastest growth during the forecast period, driven by increasing demand for immunity monitoring and post-vaccination surveillance. Antibody tests provide critical insights into prior infection and vaccine response, supporting large-scale epidemiological studies. Advances in lateral flow immunoassays, portable devices, and digital readout systems further facilitate adoption in community clinics, workplaces, and remote locations. Antibody testing also helps governments and health agencies plan booster vaccination campaigns effectively. Integration with digital health records and AI-based analytics enhances interpretation of immunity data. Growing public interest in understanding immune status after infection or vaccination fuels the rapid adoption of antibody diagnostics.

- By Product

On the basis of product, the market is segmented into PCR kits, POC kits, and immunoassay kits. The PCR kits segment dominated the market in 2025 due to its critical role in laboratory-based SARS-CoV-2 detection and high global deployment. PCR kits benefit from automated platforms, standardized protocols, and strong partnerships with hospitals and government testing centers, ensuring consistent demand and high revenue generation. Laboratories prefer PCR kits for their high sensitivity, reproducibility, and ability to process large sample volumes. Continuous innovations in reagent formulations and multiplex detection further reinforce dominance. PCR kits also provide reliable results for clinical trials and epidemiological surveillance. Government-supported procurement programs for PCR kits drive steady revenue streams across developed and emerging markets.

The POC kits segment is expected to witness the fastest growth rate during forecast period, fueled by rising demand for rapid, on-site diagnostics in clinics, airports, workplaces, and remote areas. POC tests offer quick results, minimal sample handling, and convenience for decentralized testing, enabling timely intervention and isolation measures. Technological advancements in portable PCR and antigen-based POC kits further accelerate market penetration. POC kits also enhance testing accessibility in underserved regions and rural areas. Increasing partnerships with mobile health units and telemedicine platforms expand reach. Rising consumer awareness and preference for immediate results contribute to fast adoption of POC diagnostic kits.

- By End-User

On the basis of end-user, the market is segmented into hospitals, physician offices & urgent care clinics, and diagnostic labs. The hospitals segment dominated in 2025 due to the continuous need for high-volume, reliable testing to manage patient care and support infection control measures. Hospitals invest heavily in laboratory infrastructure, trained staff, and automated PCR systems, reinforcing their dominant position. Hospitals also coordinate with public health agencies to report and track infection trends. They adopt a wide range of diagnostic technologies to cover both symptomatic and asymptomatic populations. High patient trust and regulatory approvals further support hospital dominance. Hospitals remain central to testing strategies in urban and rural regions asuch as.

The diagnostic labs segment is expected to witness the fastest growth during forecast period, driven by outsourcing of large-scale testing, partnerships with businesses and schools, and the ability to provide rapid reporting. Diagnostic labs increasingly leverage automated workflows, cloud-based reporting, and high-throughput PCR platforms to meet growing demand efficiently, making this segment the fastest-growing end-user category. Diagnostic labs also offer specialized services, such as pooled testing and genomic surveillance for variants. Strategic collaborations with telehealth providers expand testing accessibility. The convenience of sample collection and rapid results boosts lab adoption among corporate, educational, and government clients. Continuous technology upgrades and operational efficiency enable sustained growth of diagnostic labs global

Coronavirus Diagnostic Market Regional Analysis

- North America dominated the coronavirus diagnostic market with the largest revenue share of 39.6% in 2025, characterized by robust healthcare infrastructure, widespread testing capabilities, and strong government support, with the U.S. experiencing substantial growth in testing volumes driven by innovations in rapid molecular and point-of-care diagnostic technologies

- Healthcare providers and public health authorities in the region prioritize rapid, accurate, and scalable testing solutions, ensuring timely diagnosis, outbreak containment, and effective patient management across hospitals, clinics, and laboratories

- This widespread adoption is further supported by high public health expenditure, well-established laboratory networks, and strong collaboration between diagnostic companies and government agencies, establishing coronavirus diagnostics as a critical component of the region’s healthcare strategy

U.S. Coronavirus Diagnostic Market Insight

The U.S. coronavirus diagnostic market captured the largest revenue share of 82% in 2025 within North America, fueled by the extensive deployment of PCR and rapid testing infrastructure across hospitals, clinics, and public health labs. Healthcare providers and government agencies are prioritizing early detection and mass testing to manage COVID-19 cases effectively. The rising adoption of point-of-care testing and integration with digital reporting platforms further drives market growth. Consumers and healthcare institutions increasingly rely on reliable, high-throughput testing systems for accurate results. Furthermore, ongoing innovations in rapid antigen and molecular testing kits, combined with strong public health funding, contribute to the expansion of the U.S. market. The country’s robust regulatory framework and advanced laboratory network also support sustained growth and rapid deployment of diagnostic technologies.

Europe Coronavirus Diagnostic Market Insight

The Europe coronavirus diagnostic market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards and rising public health initiatives for disease surveillance. Increased awareness of testing importance among individuals, coupled with the growing demand for rapid and reliable diagnostics, is fostering adoption. European healthcare facilities are investing in both laboratory-based and point-of-care testing solutions to meet growing demand. Countries such as France, Italy, and Spain are witnessing significant growth in PCR and antibody testing across hospitals, private labs, and community centers. The adoption of integrated digital health reporting systems also enhances efficiency and accessibility. Government-supported campaigns and cross-border collaborations are further accelerating the expansion of diagnostics in Europe.

U.K. Coronavirus Diagnostic Market Insight

The U.K. coronavirus diagnostic market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong government initiatives to expand testing and surveillance programs. Concerns about new variants and the need for early detection are encouraging widespread adoption of PCR and rapid antigen testing in hospitals, clinics, and private labs. The U.K.’s robust healthcare infrastructure, combined with high public awareness, supports the use of advanced testing platforms and digital reporting systems. Increasing integration of point-of-care diagnostics for workplaces, schools, and travel hubs is enhancing accessibility. Rapid deployment of mobile testing units and community screening programs further stimulates growth. In addition, the U.K.’s established biotechnology sector contributes to innovation and availability of advanced testing kits.

Germany Coronavirus Diagnostic Market Insight

The Germany coronavirus diagnostic market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investments in laboratory infrastructure and advanced diagnostic technologies. Rising awareness of disease prevention and rapid testing requirements is driving demand across hospitals, public health labs, and private facilities. Germany’s strong regulatory framework ensures the accuracy and reliability of diagnostic kits, fostering trust among consumers and healthcare providers. The integration of molecular and point-of-care testing platforms with digital health systems is becoming increasingly prevalent. Large-scale testing initiatives in urban centers and industrial hubs are further supporting adoption. The country’s focus on innovation and precision healthcare is strengthening Germany’s position as a key market for coronavirus diagnostics in Europe.

Asia-Pacific Coronavirus Diagnostic Market Insight

The Asia-Pacific coronavirus diagnostic market is poised to grow at the fastest CAGR of 25% from 2026 to 2033, driven by increasing healthcare investments, rising urbanization, and government-supported testing initiatives in countries such as China, Japan, and India. The region is witnessing a growing preference for rapid, decentralized testing in hospitals, clinics, and community centers. Expansion of laboratory networks and digital reporting systems enhances accessibility and efficiency. Technological advancements in PCR, rapid antigen, and serology testing kits are further boosting adoption. Countries in APAC are also increasing domestic manufacturing of diagnostic kits, improving affordability and supply reliability. Public awareness campaigns and workplace testing mandates contribute to rapid uptake across both residential and commercial sectors.

Japan Coronavirus Diagnostic Market Insight

The Japan coronavirus diagnostic market is gaining momentum due to the country’s advanced healthcare infrastructure, high-tech culture, and growing demand for early detection and rapid testing solutions. Hospitals and clinics increasingly adopt PCR and rapid antigen testing kits integrated with digital reporting platforms for accurate results and real-time monitoring. The Japanese market emphasizes precise diagnostics and patient safety, driving investments in automated laboratory systems. Point-of-care testing is being deployed in workplaces, schools, and residential communities. The country’s aging population further increases demand for convenient and reliable diagnostic solutions. In addition, Japan’s strong R&D capabilities in biotechnology support continuous innovation in testing technologies.

India Coronavirus Diagnostic Market Insight

The India coronavirus diagnostic market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rapid urbanization, and increasing public awareness of testing. Hospitals, clinics, and private labs are rapidly adopting PCR, rapid antigen, and serology tests to manage population-level screening and outbreak containment. Government initiatives promoting testing in urban and rural regions enhance market growth. Domestic manufacturing of diagnostic kits ensures affordability and supply reliability. Rising digital reporting platforms and mobile testing units further improve accessibility. Strong demand for early detection, workplace testing, and public health surveillance is propelling the market in India, making it a key contributor to APAC’s growth in coronavirus diagnostics.

Coronavirus Diagnostic Market Share

The Coronavirus Diagnostic industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BIOMÉRIEUX (France)

- Cepheid (U.S.)

- QIAGEN (Netherlands)

- Hologic, Inc. (U.S.)

- BD (U.S.)

- DiaSorin S.p.A. (Italy)

- PerkinElmer (U.S.)

- Siemens Healthineers AG (Germany)

- Illumina, Inc. (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Danaher (U.S.)

- Grifols, S.A. (Spain)

- Sysmex Corporation (Japan)

- Ortho Clinical Diagnostics (U.S.)

- Seegene Inc. (South Korea)

- Mylab Discovery Solutions Pvt Ltd (India)

- QuidelOrtho Corporation (U.S.)

What are the Recent Developments in Global Coronavirus Diagnostic Market?

- In April 2024, the U.S. Food and Drug Administration (FDA) issued Emergency Use Authorization (EUA) for the CorDx TyFast Flu A/B & COVID‑19 At Home Multiplex Rapid Test, enabling individuals to self‑test for both influenza A/B and SARS‑CoV‑2 using a single nasal swab specimen at home, expanding multi‑pathogen rapid diagnostic options outside traditional clinical settings

- In April 2024, Creative Diagnostics introduced new SARS‑CoV‑2 immunoassay kits including IgG, IgM, antigen, and total antibody ELISA assays for direct detection and research, boosting tools available for serological and antigen research applications globally

- In January 2024, Nano‑Ditech Corporation’s Nano‑Check™ COVID‑19 Antigen Test received FDA 510(k) clearance, providing a new point‑of‑care antigen diagnostic option for SARS‑CoV‑2 detection and facilitating broader access to rapid antigen testing in clinical settings

- In May 2023, the FDA granted Emergency Use Authorization for the over‑the‑counter Nano‑Check COVID‑19 Antigen Test by Nano‑Ditech, significantly increasing availability of easy‑to‑use home antigen tests that allow users to screen for COVID‑19 without professional administration

- In March 2022, Kaneka Corporation launched the KANEKA RT‑PCR Kit “SARS‑CoV‑2 (Omicron/Delta) ver.2”, a real‑time PCR test capable of simultaneously detecting multiple SARS‑CoV‑2 variants (Omicron BA.1, BA.2, and Delta) in a single assay, reducing test complexity for variant surveillance and clinical diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.