Global Corporate Banking Solutions Market

Market Size in USD Billion

CAGR :

%

USD

1.66 Billion

USD

2.42 Billion

2024

2032

USD

1.66 Billion

USD

2.42 Billion

2024

2032

| 2025 –2032 | |

| USD 1.66 Billion | |

| USD 2.42 Billion | |

|

|

|

|

Corporate Banking Solutions Market Size

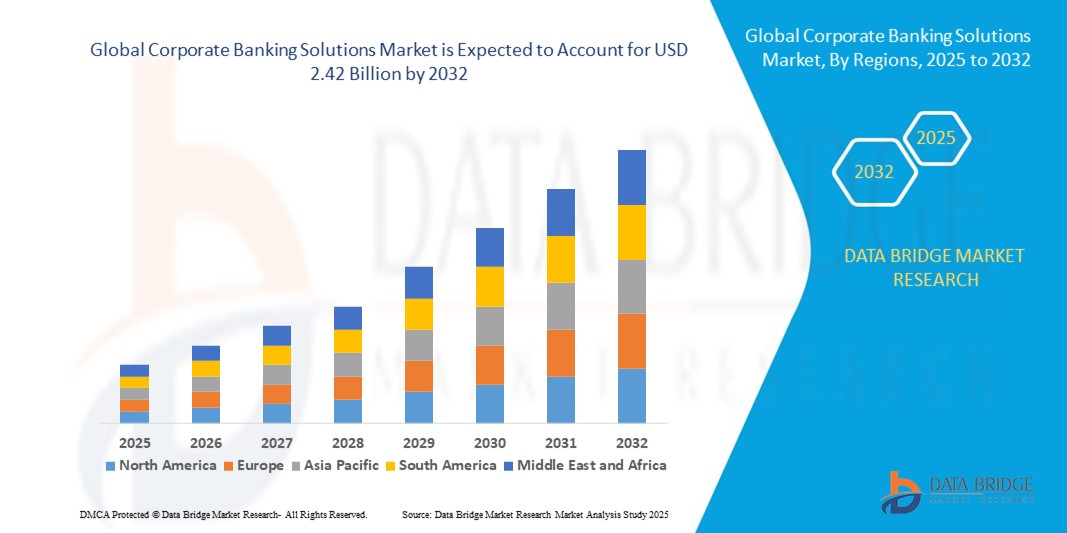

- The global corporate banking solutions market size was valued at USD 1.66 billion in 2024 and is projected to reach USD 2.42 billion by 2032, with a CAGR of 4.80% during the forecast period.

- The market growth is primarily driven by the increasing demand for digital transformation across banking institutions, emphasizing real-time transaction processing, automation, and efficient customer relationship management

- In addition, the rising adoption of cloud-based platforms, AI, and advanced analytics within corporate banking is enabling banks to offer more secure, scalable, and customized solutions, thereby fueling the market's expansion across diverse business segments and regions

Corporate Banking Solutions Market Analysis

- Corporate banking solutions, encompassing a wide array of digital tools and platforms, are increasingly essential for banks aiming to streamline complex financial services for large enterprises, including payments, liquidity management, trade finance, and risk mitigation, with a growing emphasis on automation and compliance

- The rising demand for seamless digital experiences, real-time processing, and customized financial products is driving the adoption of advanced corporate banking platforms, particularly among multinational corporations and large regional enterprises seeking greater efficiency and transparency

- North America dominated the corporate banking solutions market with the largest revenue share of 38.5% in 2024, driven by the presence of advanced financial institutions and high adoption of digital banking technologies

- The Asia-Pacific corporate banking solutions market is forecast to grow at the fastest CAGR of 7.5% from 2024 to 2031, driven by the region’s rapid digitization, increasing SME banking needs, and government-led fintech initiatives in countries such as China, India, and Singapore

- The cash management segment dominated the corporate banking solutions market with a market share of 36.7% in 2023, driven by increasing enterprise demand for centralized control over liquidity, enhanced treasury operations, and real-time visibility into global cash positions amid rising economic complexity and globalization

Report Scope and Market Segmentation

|

Attributes |

Global Corporate Banking Solutions Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Corporate Banking Solutions Market Trends

Accelerated Shift Toward AI-Driven and Cloud-Based Banking Platforms

- A major and accelerating trend in the global corporate banking solutions market is the widespread adoption of artificial intelligence (AI) and cloud computing technologies, which are transforming how banks manage corporate client relationships, risk, compliance, and operational efficiency across services

- For instance, JP Morgan Chase and HSBC have deployed AI-powered tools for transaction monitoring, fraud detection, and real-time decision-making in trade finance and cash management operations. Similarly, cloud-native platforms such as Oracle FLEXCUBE and Finastra’s Fusion Corporate Channels are enabling banks to deliver scalable and secure services with faster deployment cycles

- AI integration is enhancing predictive analytics in cash forecasting, automating routine processes such as reconciliation and credit assessment, and personalizing client interactions through data-driven insights. Banks are increasingly leveraging machine learning algorithms to detect anomalies, optimize working capital, and anticipate client needs more proactively

- Cloud-based infrastructure supports flexible, API-driven architecture, allowing banks to integrate with fintech ecosystems and deliver omnichannel corporate banking experiences. This integration facilitates real-time processing, mobile access, and seamless service delivery across global operations, which is especially critical for multinational corporate clients

- This trend toward intelligent, agile, and customer-centric banking platforms is significantly reshaping the competitive landscape. Banks that embrace AI and cloud innovation are gaining a strategic advantage through cost efficiency, operational scalability, and enhanced customer loyalty

- As regulatory bodies increasingly support digital transformation and data security measures, the demand for AI-driven, cloud-enabled corporate banking solutions continues to rise across all regions, particularly among large enterprises and financial institutions seeking future-ready infrastructures

Global Corporate Banking Solutions Market Dynamics

Driver

Rising Demand for Digital Transformation and Real-Time Financial Management

- The growing need for digital transformation across the banking industry, especially in serving large corporate clients, is a major driver fueling demand for corporate banking solutions. Banks are increasingly investing in advanced platforms that enable real-time processing, automation, and enhanced customer engagement

- For instance, in February 2024, Citi launched an AI-enhanced digital platform for its corporate banking division, enabling real-time cash visibility and predictive analytics for global treasury operations. Such initiatives reflect the industry's push toward smarter, data-driven banking experiences

- As enterprises demand faster, more secure, and more flexible financial services, corporate banks are turning to digital platforms to modernize their offerings, reduce operational costs, and meet client expectations for real-time access and seamless integration across channels

- Furthermore, growing globalization and cross-border business activities are increasing the complexity of corporate financial management. This is prompting banks to adopt scalable digital platforms capable of handling multi-currency transactions, compliance requirements, and real-time liquidity management across regions

- The shift toward open banking, API-based architectures, and AI-powered insights is also driving adoption, allowing banks to offer more personalized, efficient, and client-centric services. These innovations are positioning digital corporate banking solutions as critical tools for enhancing competitiveness and client retention

Restraint/Challenge

Cybersecurity Risks and Legacy System Integration

- Despite the growing benefits, cybersecurity risks and the complexity of integrating digital solutions with legacy banking systems remain significant challenges in the corporate banking solutions market. As these platforms handle sensitive financial data and high-value transactions, they are frequent targets for cyberattacks and fraud

- For instance, high-profile breaches and fraud attempts in recent years have increased scrutiny around digital banking systems, leading to stricter regulations and a heightened focus on data protection and cyber resilience in corporate banking

- Ensuring secure access, end-to-end encryption, and compliance with global data protection standards (such as GDPR and PSD2) is critical for maintaining client trust. Financial institutions must also invest in real-time fraud detection tools and continuous monitoring systems to mitigate risks

- Another major barrier is the challenge of integrating modern corporate banking platforms with outdated core banking systems. Many banks still rely on legacy infrastructure that lacks the flexibility, speed, and compatibility required for implementing cloud-based and API-driven solutions, resulting in costly and time-consuming digital transitions

- The high cost of technology upgrades, combined with the operational risks of transitioning to new platforms, can discourage smaller banks or those in developing markets from adopting advanced solutions. Overcoming these challenges will require strategic investments, robust cybersecurity frameworks, and partnerships with fintech firms that can provide modular, scalable innovations

Global Corporate Banking Solutions Market Scope

The market is segmented on the basis of solution type, deployment mode, enterprise size, and end-user industry.

- By Solution Type

On the basis of solution type, the corporate banking solutions market is segmented into cash management, trade finance, credit management, treasury services, risk management, and others. The cash management segment dominated the corporate banking solutions market with a market share of 36.7% in 2023, driven by increasing enterprise demand for centralized control over liquidity, enhanced treasury operations, and real-time visibility into global cash positions amid rising economic complexity and globalization. These solutions help optimize working capital and reduce operational risk, making them essential for large corporations operating in complex global environments.

The trade finance segment is anticipated to witness the fastest growth rate of 6.3% from 2024 to 2031, fueled by increasing globalization, rising cross-border trade, and the digitization of traditional trade finance operations. Advanced platforms are improving transaction transparency, reducing fraud, and speeding up document processing, making trade finance solutions attractive to businesses of all sizes.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into on-premises and cloud-based solutions. The on-premises segment dominated the market with the revenue share of 78.98% in 2024 due to legacy infrastructure and data security preferences among traditional financial institutions, particularly in highly regulated environments. Many banks continue to rely on in-house systems for core functions such as treasury and risk management.

However, the cloud-based segment is expected to witness the fastest CAGR from 2025 to 2032 driven by increased demand for agility, cost efficiency, and scalability. Cloud deployments enable quicker upgrades, improved integration with APIs and fintech ecosystems, and real-time data access, making them increasingly attractive to modern financial institutions undergoing digital transformation.

- By Enterprise Size

On the basis of enterprise size, the market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment accounted for the largest market revenue share of 67.12% in 2024 due to their complex banking needs, higher transaction volumes, and demand for tailored financial solutions such as treasury management and structured finance. These enterprises often maintain multiple banking relationships and require advanced platforms for consolidated reporting and compliance.

The SME segment is projected to grow at the fastest rate from 2024 to 2031, driven by the rising availability of scalable, modular banking solutions tailored to the needs of smaller organizations. As SMEs increasingly expand into new markets and adopt digital tools, banks are offering simplified platforms for managing payments, cash flow, and financing more efficiently.

- By End-User Industry

On the basis of end-user industry, the market is segmented into BFSI, manufacturing, IT and telecom, healthcare, energy and utilities, and others. The BFSI sector held the largest market revenue share of 34.15% in 2023, as corporate banking solutions are widely used by financial institutions to streamline services such as payments, risk mitigation, and regulatory compliance for their corporate clients.

The manufacturing sector is expected to witness the fastest CAGR from 2024 to 2031, as manufacturers seek integrated financial tools to manage global supply chains, trade finance, and vendor payments. With increasing pressure to digitize operations and optimize capital flows, manufacturers are turning to advanced banking platforms for better financial visibility and operational efficiency.

Global Corporate Banking Solutions Market Regional Analysis

- North America dominated the corporate banking solutions market with the largest revenue share of 38.5% in 2024, driven by the presence of advanced financial institutions and high adoption of digital banking technologies

- Corporate clients in the region prioritize real-time financial visibility, integrated treasury and cash management, and secure digital platforms that offer automation and regulatory compliance across services

- This widespread adoption is further supported by a high concentration of leading financial institutions, growing investment in AI and cloud-based solutions, and increasing demand for seamless, data-driven corporate banking experiences, positioning North America as a global leader in digital corporate banking transformation

U.S. Corporate Banking Solutions Market Insight

The U.S. corporate banking solutions market accounted for 78% of North America’s revenue share in 2023, fueled by large-scale digital transformation initiatives and a robust corporate client base across industries such as manufacturing, healthcare, and technology. The demand for integrated cash management, trade finance, and AI-powered risk management tools is accelerating, with major banks such as Bank of America and Citi leading innovation through cloud-native platforms and embedded fintech partnerships. The U.S. regulatory environment, while stringent, encourages innovation through clear digital compliance frameworks, further driving market growth.

Europe Corporate Banking Solutions Market Insight

The Europe corporate banking solutions market is projected to grow at a significant CAGR during the forecast period, driven by the region’s push toward open banking, real-time payment systems, and regulatory compliance under PSD2 and GDPR. Banks across the EU are adopting digital corporate banking platforms to meet evolving expectations from enterprise clients, especially in sectors such as logistics, automotive, and energy. Growing demand for cross-border financial solutions and sustainable finance options is also encouraging banks to upgrade to agile, API-driven platforms that support ESG and compliance reporting.

U.K. Corporate Banking Solutions Market Insight

The U.K. corporate banking solutions market is expected to grow steadily, supported by London’s role as a global financial hub and the country’s active fintech ecosystem. The shift to digital banking post-Brexit, alongside the increasing demand for secure, cloud-based platforms, is driving adoption across mid-sized and large enterprises. Banks are focusing on enhancing corporate client experience through automated loan origination, digital onboarding, and data-driven risk analysis tools. The U.K.'s strong regulatory oversight and emphasis on innovation provide a stable environment for market expansion.

Germany Corporate Banking Solutions Market Insight

Germany’s corporate banking solutions market is expanding rapidly, fueled by the country’s strong industrial base and demand for precision financial tools among global exporters and manufacturers. German banks are increasingly investing in digital treasury platforms, trade finance automation, and AI-based risk management solutions to meet the needs of complex multinational operations. In addition, regulatory requirements around data protection and secure transactions are prompting financial institutions to modernize legacy systems while ensuring compliance with EU standards.

Asia-Pacific Corporate Banking Solutions Market Insight

The Asia-Pacific corporate banking solutions market is forecast to grow at the fastest CAGR of 7.5% from 2024 to 2031, driven by the region’s rapid digitization, increasing SME banking needs, and government-led fintech initiatives in countries such as China, India, and Singapore. As APAC economies expand, banks are investing in mobile-first, cloud-based platforms to support digital onboarding, cross-border trade finance, and real-time liquidity management. The rise of regional fintech firms and regulatory support for open banking are further accelerating innovation and adoption across diverse enterprise segments.

Japan Corporate Banking Solutions Market Insight

Japan’s corporate banking solutions market is growing steadily, supported by the country’s advanced technological infrastructure and strong corporate client base. Japanese banks are prioritizing automation and cloud modernization to improve treasury, risk, and compliance functions. With many local firms expanding internationally, there is rising demand for integrated, multilingual platforms offering end-to-end cash and trade finance solutions. In addition, Japan’s aging population is driving demand for user-friendly digital banking platforms with minimal manual processes.

China Corporate Banking Solutions Market Insight

China held the largest revenue share in the Asia-Pacific region in 2023, driven by rapid economic growth, high fintech adoption, and a thriving digital payment ecosystem. Chinese banks are increasingly offering AI-enhanced platforms for large enterprises, integrating features such as smart lending, blockchain-enabled trade finance, and real-time risk management. Government initiatives promoting digital yuan (e-CNY), smart cities, and digital banking regulations are further propelling the demand for advanced corporate banking solutions in both public and private sectors.

Corporate Banking Solutions Market Share

Corporate Banking Solutions Market Leaders Operating in the Market Are:

- JPMorgan Chase & Co. (U.S.)

- HSBC Holdings plc (U.K.)

- Bank of America (U.S.)

- Citigroup Inc. (U.S.)

- Wells Fargo & Co. (U.S.)

- Deutsche Bank AG (Germany)

- Barclays plc (U.K.)

- Societe Generale (France)

- Standard Chartered plc (U.K.)

- BNP Paribas (France)

- UBS Group AG (Switzerland)

- Credit Suisse Group AG (Switzerland)

- Royal Bank of Canada (Canada)

- ING Group (Netherlands)

Recent Developments in Global Corporate Banking Solutions Market

- In May 2023, HSBC launched "HSBC Trade Solutions" (HTS), a next-generation digital trade platform designed to simplify and modernize global trade finance. Built in collaboration with CGI, HTS allows for end-to-end digitization, real-time tracking, and streamlined workflows, significantly improving efficiency for corporate clients. This development highlights HSBC’s commitment to digital innovation and enhancing client experience in global trade operations

- In April 2023, JPMorgan Chase announced the expansion of its AI-powered corporate banking platform to include advanced predictive cash flow analytics and real-time liquidity management. The platform supports large enterprises in optimizing working capital, enabling more informed financial decision-making. This initiative reflects the bank’s strategy to integrate AI and data-driven tools to improve service delivery for complex corporate clients

- In March 2023, BNP Paribas partnered with Tink, a leading open banking platform, to offer enhanced financial data aggregation and payment initiation services for corporate clients across Europe. The collaboration aims to leverage PSD2 frameworks to deliver improved cash visibility, real-time account connectivity, and seamless digital payment capabilities, marking a significant advancement in corporate banking digitization

- In February 2023, ICICI Bank launched its digital platform “InstaBIZ Global,” aimed at offering cross-border banking services to Indian corporates with international operations. The platform provides integrated solutions including trade services, foreign exchange, and treasury management through a single interface. This move is part of ICICI’s broader vision to simplify international banking for SMEs and large enterprises asuch as

- In January 2023, Standard Chartered Bank introduced a blockchain-based trade finance platform in partnership with TradeLens, designed to improve transparency and reduce processing times for cross-border trade transactions. By integrating blockchain, the bank aims to minimize documentation errors and fraud risks, reinforcing its leadership in secure, technology-driven corporate banking solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Corporate Banking Solutions Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corporate Banking Solutions Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corporate Banking Solutions Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.