Global Corrosion Monitoring Market

Market Size in USD Million

CAGR :

%

USD

338.08 Million

USD

887.93 Million

2024

2032

USD

338.08 Million

USD

887.93 Million

2024

2032

| 2025 –2032 | |

| USD 338.08 Million | |

| USD 887.93 Million | |

|

|

|

|

Corrosion Monitoring Market Size

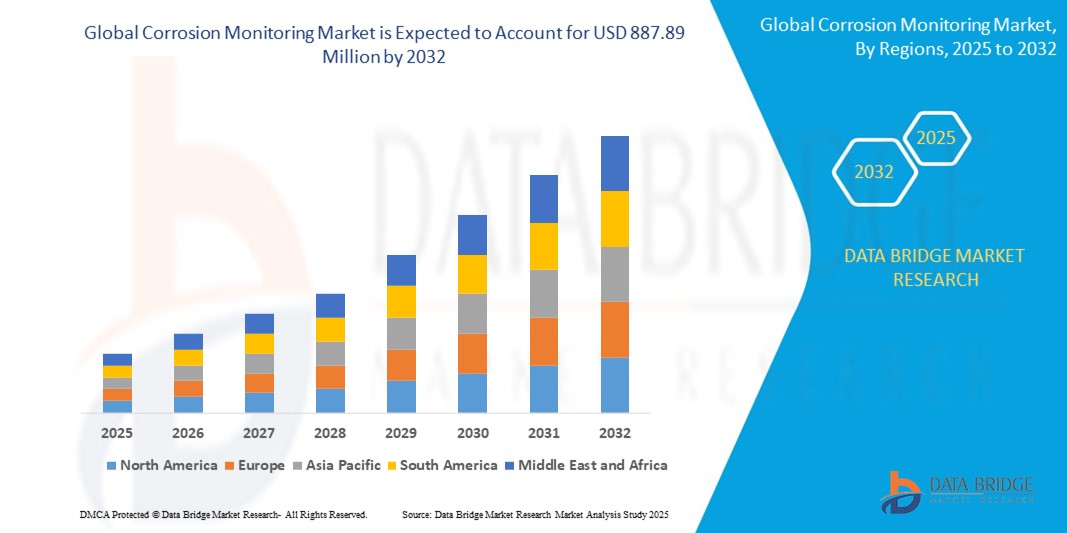

- The global corrosion monitoring market size was valued at USD 388.08 million in 2024 and is expected to reach USD 887.93 million by 2032, at a CAGR of 10.9% during the forecast period

- The market growth is primarily driven by increasing demand for asset protection, operational safety, and regulatory compliance across industries such as oil and gas, chemicals, and power generation

- Rising awareness of the economic and safety implications of corrosion, coupled with advancements in IoT and AI-based monitoring technologies, is further propelling market demand

Corrosion Monitoring Market Analysis

- The corrosion monitoring market is experiencing robust growth due to the increasing need for predictive maintenance and asset integrity in industrial applications

- Growing adoption in critical industries such as oil and gas, where corrosion can lead to significant safety risks and financial losses, is encouraging manufacturers to innovate with advanced, non-intrusive, and real-time monitoring solutions

- North America dominated the corrosion monitoring market with a revenue share of over 33% in 2024, driven by a mature industrial base, stringent safety regulations, and significant investments in infrastructure

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing infrastructure investments, and rising awareness of corrosion-related challenges in countries such as China, India, and Japan

- The uniform segment dominates the largest market revenue share of 62.5% in 2024, driven by its widespread occurrence across industrial applications and the ease of monitoring through established techniques

Report Scope and Corrosion Monitoring Market Segmentation

|

Attributes |

Corrosion Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Corrosion Monitoring Market Trends

“Rising Preference for Non-Intrusive Corrosion Monitoring Techniques”

- Non-intrusive techniques, such as ultrasonic thickness measurement and remote monitoring, are gaining popularity due to their ability to provide real-time data without disrupting operations

- These methods, including electrical resistance probes and electromagnetic monitoring, ensure minimal downtime, making them ideal for critical industries such as oil and gas, chemicals, and power generation

- In harsh environments, such as offshore oil platforms in the North Sea, non-intrusive techniques are favored for their ability to monitor corrosion without invasive procedures

- Major industrial players seek non-intrusive solutions for enhanced safety and operational efficiency

- For instance, Emerson Electric Co. offers advanced ultrasonic corrosion sensors as part of its erosion and corrosion monitoring portfolio for real-time asset integrity management

- Service providers are increasingly integrating non-intrusive monitoring systems with IoT and AI technologies to offer predictive maintenance packages

Corrosion Monitoring Market Dynamics

Driver

“Rising Demand for Predictive Maintenance and Asset Integrity”

- Growing awareness of the costly impacts of corrosion, such as equipment failure and safety risks, is driving demand for advanced corrosion monitoring systems with real-time data capabilities

- These systems help extend asset lifespan by detecting corrosion early, reducing maintenance costs and downtime in industries such as oil and gas, petrochemicals, and power generation

- Corrosion monitoring enhances operational safety and regulatory compliance, particularly in regions with stringent environmental standards, such as the U.S. and Europe

- Major companies are integrating corrosion monitoring into their asset management strategies, with firms such as Siemens AG and Honeywell International Inc. offering smart sensor solutions

- For instance, Baker Hughes provides corrosion monitoring systems tailored for upstream, midstream, and downstream oil and gas operations to optimize

- The rise of digital technologies, such as IoT and AI, is fueling the adoption of smart corrosion monitoring systems for predictive maintenance, improving efficiency and reducing operational risks

Restraint/Challenge

“High Initial Investment and Regulatory Compliance”

- High costs associated with advanced corrosion monitoring systems, including sensors, software, and installation, limit adoption, particularly among small and medium enterprises (SMEs)

- Different regions have varying regulatory standards for corrosion monitoring, complicating global standardization efforts for manufacturers and service providers

- Excessive reliance on intrusive techniques can pose safety risks in hazardous environments, such as chemical plants, due to the need for direct contact with equipment

- For inst`ance, in the U.S., strict OSHA regulations require specific safety protocols for intrusive monitoring, increasing operational complexity and costs

- These regulatory and cost barriers discourage widespread adoption of advanced systems and may result in limited deployment, particularly in developing regions, hindering market growth

Corrosion Monitoring Market Scope

The market is segmented on the basis of type, technique type, method type, probe type, and end user.

- By Type

On the basis of type, the global corrosion monitoring market is segmented into uniform and localized. The uniform segment dominates the largest market revenue share of 62.5% in 2024, driven by its widespread occurrence across industrial applications and the ease of monitoring through established techniques. Uniform corrosion is often prioritized due to its predictable nature, allowing for straightforward implementation of preventive measures in industries such as oil and gas and manufacturing. The market sees strong demand for uniform corrosion monitoring due to its compatibility with various monitoring systems and the availability of reliable, cost-effective solutions.

The localized segment is anticipated to witness the fastest growth rate of 12.3% from 2025 to 2032, fueled by increasing concerns over unpredictable and severe damage caused by pitting, crevice, and galvanic corrosion. Localized corrosion poses significant risks in critical infrastructure, such as pipelines and chemical plants, driving the adoption of advanced monitoring technologies such as electrochemical noise (EN) and ultrasonic thickness measurement to detect and mitigate these issues effectively.

- By Technique Type

On the basis of technique type, the global corrosion monitoring market is segmented into intrusive techniques, non-intrusive techniques, corrosion coupons, electrical resistance, linear polarization resistance, galvanic monitoring, ultrasonic thickness measurement, biological monitoring, hydrogen penetration monitoring, power generation, manufacturing, and others. The non-intrusive techniques segment held the largest market revenue share of 64.2% in 2024, driven by its ability to provide real-time data without disrupting operations. Non-intrusive methods, such as ultrasonic thickness measurement and remote monitoring, are highly valued in industries such as oil and gas and power generation for their safety and efficiency.

The ultrasonic thickness measurement segment is expected to witness the fastest CAGR of 13.8% from 2025 to 2032, driven by its precision, non-destructive nature, and ability to monitor large surface areas. This technique is rapidly replacing older methods such as corrosion coupons due to its ease of operation and integration with digital systems, making it ideal for pipelines, tanks, and other critical assets.

- By Method Type

On the basis of method type, the global corrosion monitoring market is segmented into direct methods and indirect methods. The direct methods segment held the largest market revenue share in 2024, driven by its ability to provide accurate, real-time measurements of corrosion rates through techniques such as corrosion coupons and electrical resistance probes. These methods are widely adopted in industries requiring precise data to ensure asset integrity, such as oil and gas and chemicals/petrochemical plants.

The indirect methods segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advancements in technologies such as corrosion potential and acoustic emission, which offer insights into corrosion processes without direct contact with the asset. Indirect methods are gaining traction in applications where non-invasive monitoring is critical, such as in hazardous or hard-to-access environments.

- By Probe Type

On the basis of probe type, the global corrosion monitoring market is segmented into electrical, mechanical, and electro-chemical. The electro-chemical segment held the largest market revenue share in 2024, driven by its effectiveness in conductive environments and its ability to provide real-time corrosion rate data through techniques such as linear polarization resistance and galvanic monitoring. Electro-chemical probes are particularly popular in water-based systems and oil and gas pipelines.

The electrical segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing adoption of electrical resistance (ER) probes for continuous monitoring in pipelines, tanks, and other assets. ER probes offer reliable, real-time data on metal loss, making them a preferred choice in industries such as chemicals and water/wastewater treatment.

- By End User

On the basis of end user, the global corrosion monitoring market is segmented into oil and gas, chemicals/petrochemical plants, pulp and paper, water/wastewater and LNG, utility, mining, construction, pharmaceutical, food and beverages, and others. The oil and gas segment accounted for the largest market revenue share of 32.4% in 2024, driven by the critical need to prevent pipeline failures, equipment degradation, and safety hazards in harsh environments. The increasing adoption of real-time monitoring technologies, such as ultrasonic sensors and smart corrosion coupons, further supports market growth in this sector.

The chemicals/petrochemical plants segment is expected to witness the fastest CAGR of 12.7% from 2025 to 2032, driven by the growing demand for corrosion monitoring to ensure operational safety and compliance with stringent environmental regulations. The need for continuous monitoring in corrosive chemical environments and the integration of IoT-based systems are key factors boosting this segment’s growth.

Corrosion Monitoring Market Regional Analysis

- North America dominated the corrosion monitoring market with a revenue share of over 33% in 2024, driven by a mature industrial base, stringent safety regulations, and significant investments in infrastructure

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing infrastructure investments, and rising awareness of corrosion-related challenges in countries such as China, India, and Japan

U.S. Corrosion Monitoring Market Insight

The U.S. is expected to witness the fastest growth rate in the North America corrosion monitoring market, fueled by increasing investments in infrastructure, a strong emphasis on asset protection in industries such as oil & gas and manufacturing, and continuous advancements in monitoring technologies. The region's mature industrial landscape, coupled with stringent safety and compliance regulations, drives the adoption of sophisticated corrosion monitoring solutions. There is a growing demand for real-time corrosion sensors and predictive analytics to manage operational risks and reduce maintenance costs, highlighting the importance of asset integrity management in the U.S.

Europe Corrosion Monitoring Market Insight

The European corrosion monitoring market is a mature market, expected to expand at a substantial CAGR, primarily driven by stringent security regulations and a heightened focus on asset integrity and safety in various industries. The region's well-developed industrial infrastructure and proactive approach towards maintenance and regulatory compliance are fostering the adoption of advanced corrosion monitoring solutions. Europe is witnessing significant growth across sectors such as oil & gas, chemical, and power generation, with a strong demand for solutions that minimize downtime and optimize operational efficiency.

U.K. Corrosion Monitoring Market Insight

The U.K. corrosion monitoring market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing concerns regarding asset degradation and safety across key industries. The U.K.'s robust industrial and energy sectors, coupled with its focus on maintaining critical infrastructure, are encouraging the adoption of proactive corrosion management strategies. The market is also benefiting from advancements in monitoring technologies and a growing recognition of the cost-saving benefits associated with early corrosion detection.

Germany Corrosion Monitoring Market Insight

The German corrosion monitoring market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of the economic and safety implications of corrosion and a strong preference for technologically advanced and sustainable solutions. Germany's well-developed industrial infrastructure and its emphasis on innovation and environmental compliance promote the adoption of cutting-edge corrosion monitoring systems, particularly in manufacturing, chemical, and energy sectors. The integration of corrosion monitoring with Industry 4.0 initiatives is also becoming increasingly prevalent, aligning with local industry expectations for efficiency and predictive maintenance.

Asia-Pacific Corrosion Monitoring Market Insight

The Asia-Pacific corrosion monitoring market is poised to grow at the fastest CAGR, driven by rapid industrialization, increasing urbanization, and significant investments in infrastructure projects in countries such as China, Japan, and India. The region's burgeoning oil & gas, chemical, power generation, and marine sectors are experiencing a surge in demand for corrosion monitoring solutions to protect assets and ensure operational safety. As APAC emerges as a manufacturing hub, the affordability and accessibility of advanced corrosion monitoring technologies are expanding to a wider industrial base.

Japan Corrosion Monitoring Market Insight

The Japan corrosion monitoring market is gaining momentum due to the country’s high-tech culture, strong emphasis on industrial safety, and the need for maintaining aging infrastructure. The Japanese market places a significant emphasis on precision and reliability, and the adoption of corrosion monitoring solutions is driven by the increasing number of smart factories and connected industrial assets. The integration of corrosion monitoring with other IoT devices and data analytics platforms is fueling growth, as industries seek to optimize maintenance strategies and extend asset life.

China Corrosion Monitoring Market Insight

The China corrosion monitoring market accounted for the largest market revenue share in Asia Pacific, attributed to the country's rapid industrialization, massive infrastructure development, and high rates of technological adoption. China stands as one of the largest markets for industrial equipment, and corrosion monitoring solutions are becoming increasingly popular in oil & gas, manufacturing, and construction sectors. The push towards smart cities and industries, coupled with the availability of affordable and locally manufactured corrosion monitoring options, are key factors propelling the market in China.

Corrosion Monitoring Market Share

The corrosion monitoring industry is primarily led by well-established companies, including:

- Corr Instruments, LLC (U.S.)

- Pepperl+Fuchs (Germany)

- ACM Instruments (U.K.)

- ICORR Technologies (U.K.)

- Sentry Equipment Corp. (U.S.)

- Matergenics Inc. (U.S.)

- CLAMPON AS (Norway)

- Applus+ (Spain)

- Aegion (U.S.)

- Intertek Group plc (U.K.)

- Cosasco (U.S.)

- Emerson Electric Co. (U.S.)

- Yokogawa Electric Corporation (Japan)

- Honeywell International Inc. (U.S.)

- Baker Hughes Company (U.S.)

Latest Developments in Global Corrosion Monitoring Market

- In June 2024, Emerson Electric Co. launched an upgraded Plantweb™ Corrosion Monitoring System, integrating IoT and cloud-based predictive maintenance. This enhanced system features advanced sensors that deliver real-time corrosion risk insights, optimizing asset integrity management in oil and gas and chemical industries. The Plantweb Insight™ platform enables continuous wall thickness monitoring and inline corrosion analysis, transforming traditional offline probes into online monitoring tools. With no reported recalls, the system ensures high reliability in harsh industrial environments

- In April 2024, Corr Instruments, LLC launched an advanced portable ultrasonic corrosion monitoring device, designed for real-time, non-intrusive corrosion assessment. Featuring high-precision sensors, it provides accurate corrosion rate measurements in harsh industrial environments, including oil and gas pipelines and chemical processing plants. Its compact design and user-friendly interface enhance on-site monitoring efficiency, catering to diverse sectors. This launch strengthens Corr Instruments’ position in non-intrusive monitoring, a segment that held a 39.23% market share in 2023.

- In March 2021, Olympus introduced its DC series (DC1–DC5) dual-element transducers, offering a comprehensive corrosion monitoring toolbox for pipeline and tank integrity. These versatile transducers optimize corrosion detection and thin-material inspections, supporting oil & gas, energy, and mining sectors. The DC3 model extends beyond corrosion monitoring to include pipe weld testing, while the DC1 and DC2 models feature heat-resistant delay lines for elevated-temperature inspections. The series enhances defect sizing, signal clarity, and inspection efficiency, reinforcing Olympus’ commitment to advanced NDT solutions

- In March 2021, Emerson introduced a comprehensive erosion and corrosion monitoring portfolio with digital capabilities, fully integrated into its Plantweb™ digital ecosystem. This suite includes the Rosemount series of corrosion and erosion wireless transmitters and Plantweb Insight Non-Intrusive Corrosion application, enabling real-time monitoring and predictive maintenance for oil and gas processing. The portfolio transforms offline corrosion probes into online tools, allowing operators to detect corrosion risks within minutes and take corrective actions before damage occurs

- In 2021, Saudi Aramco Energy Ventures (SAEV) invested in CorrosionRADAR, a UK-based predictive corrosion monitoring company. This funding, part of a $5 million investment round, enables CorrosionRADAR to expand operations and address Corrosion Under Insulation (CUI) through digitalization. The technology integrates electromagnetic guided radar (EMGR) wireless sensing and Industrial Internet of Things (IIoT) applications, providing real-time corrosion monitoring to prevent structural failures. The investment follows successful installations at an Aramco production facility, reinforcing SAEV’s commitment to advancing predictive maintenance in oil and gas, petrochemical, and chemical industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Corrosion Monitoring Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corrosion Monitoring Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corrosion Monitoring Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.