Global Corrosion Protection Coatings Market

Market Size in USD Billion

CAGR :

%

USD

21.86 Billion

USD

33.30 Billion

2024

2032

USD

21.86 Billion

USD

33.30 Billion

2024

2032

| 2025 –2032 | |

| USD 21.86 Billion | |

| USD 33.30 Billion | |

|

|

|

|

What is the Global Corrosion Protection Coatings Market Size and Growth Rate?

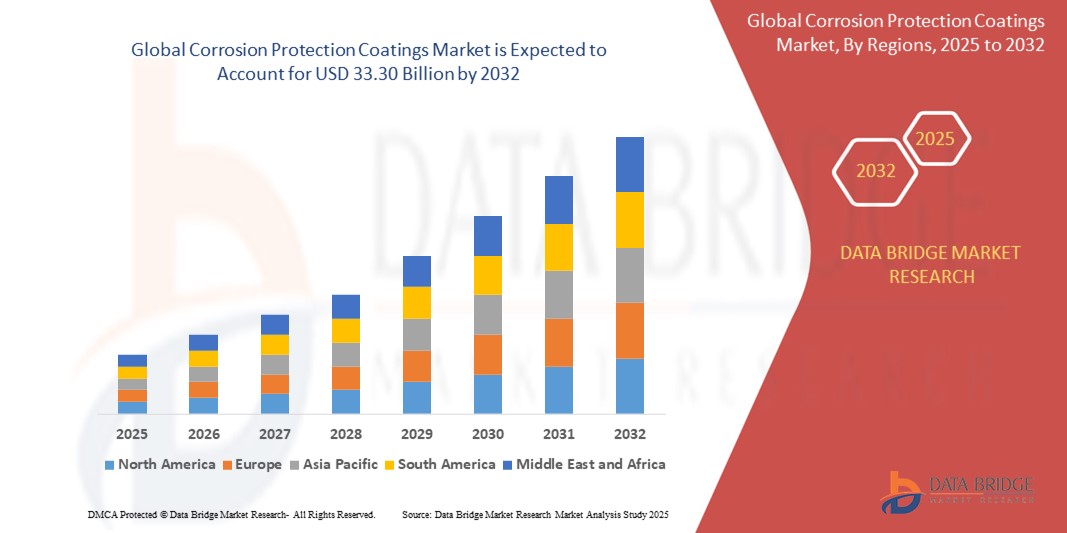

- The global corrosion protection coatings market size was valued at USD 21.86 billion in 2024 and is expected to reach USD 33.30 billion by 2032, at a CAGR of 6.20% during the forecast period

- In the automotive industry, corrosion protection coatings play a critical role in preserving the longevity and integrity of vehicle components. These coatings are applied to various parts, including the chassis, underbody, suspension components, and exhaust systems, to shield them from corrosion caused by exposure to moisture, road salts, and other environmental elements

- These coatings help prevent rusting, pitting, and deterioration by forming a protective barrier between the metal substrate and corrosive agents which extends the lifespan of the vehicle and reducing maintenance costs. Corrosion protection coatings contribute to improving the overall durability and resale value of automobiles, enhancing customer satisfaction and brand reputation

What are the Major Takeaways of Corrosion Protection Coatings Market?

- The growing demand for corrosion protection coatings let countries to invest in expanding and upgrading their infrastructure, such as bridges, highways, pipelines, and utilities. These coatings are essential for preserving the structural integrity and lifespan of infrastructure assets, mitigating the corrosive effects of environmental factors such as moisture, chemicals, and extreme weather conditions

- In addition, the need for long-term durability and maintenance cost reduction drives the adoption of corrosion protection coatings, ensuring the sustainability and resilience of critical infrastructure components

- Asia-Pacific dominated the corrosion protection coatings market with the largest revenue share of 46.6% in 2024, driven by robust industrialization, expanding infrastructure projects, and the presence of major manufacturing hubs

- North America is projected to grow at the fastest CAGR of 5.3% during the forecast period from 2025 to 2032, propelled by increasing refurbishment of aging infrastructure, technological innovations, and heightened environmental regulations

- The epoxy segment dominated the corrosion protection coatings market with the largest market revenue share of 39.5% in 2024, owing to its superior adhesion, chemical resistance, and mechanical properties

Report Scope and Corrosion Protection Coatings Market Segmentation

|

Attributes |

Corrosion Protection Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Corrosion Protection Coatings Market?

“Sustainable Formulations and Eco-Friendly Coating Technologies”

- A dominant trend shaping the global corrosion protection coatings market is the shift towards environmentally sustainable and low-VOC formulations, driven by stringent environmental regulations and growing consumer preference for green products

- Leading manufacturers are increasingly investing in water-based, solvent-free, and high-solids coatings to reduce environmental impact without compromising performance. For instance, Jotun has introduced solvent-free epoxy coatings that deliver high durability with a reduced carbon footprint

- Innovations in bio-based resins and nanotechnology are enabling the development of coatings that offer superior corrosion resistance while being less harmful to human health and the environment. These advanced coatings also improve lifecycle performance and minimize maintenance needs

- The adoption of sustainable manufacturing practices, such as energy-efficient production lines and recyclable packaging, is gaining traction among key players such as AkzoNobel and BASF. These efforts align with global sustainability goals and improve brand positioning

- This trend is influencing new product development and driving collaborative initiatives between coating manufacturers and regulatory agencies to establish eco-certifications and green labels, boosting credibility and customer trust

- As a result, eco-friendly corrosion protection coatings are increasingly being adopted in sectors such as marine, automotive, and infrastructure, where environmental impact and compliance are critical purchasing criteria

What are the Key Drivers of Corrosion Protection Coatings Market?

- Infrastructure modernization across both developing and developed economies is significantly boosting demand for high-performance corrosion protection coatings. As governments invest in roads, bridges, and oil & gas pipelines, the need for durable coatings to prolong asset life grows

- For instance, in March 2024, Hempel A/S partnered with the Norwegian government on a project to provide anti-corrosive coatings for coastal infrastructure, reflecting the rising demand in maritime applications

- In addition, growing demand from the automotive and aerospace industries for lightweight and corrosion-resistant components is pushing manufacturers to adopt advanced coatings that ensure both longevity and aesthetic appeal

- The rise in energy and utility sector projects, including offshore wind farms and power transmission systems, is creating new opportunities for corrosion-resistant coatings that can endure harsh environmental conditions

- Technological innovations, such as self-healing coatings and smart coatings that detect corrosion early, are further enhancing product value and encouraging wider adoption. These advancements help reduce maintenance costs and extend equipment lifespan, which is critical in industrial settings

- Collectively, these drivers are fostering robust growth in the corrosion protection coatings market across various end-user sectors including marine, oil & gas, infrastructure, and automotive

Which Factor is challenging the Growth of the Corrosion Protection Coatings Market?

- A major hurdle for the corrosion protection coatings market is regulatory pressure related to environmental safety and the use of hazardous chemicals in traditional coatings, particularly those with high VOC content

- For instance, the U.S. EPA and European REACH regulations are pushing for reduced use of heavy metals and toxic solvents, compelling manufacturers to reformulate products—often at a high R&D cost

- Compliance with diverse regional regulations can be complex and costly, especially for multinational companies operating in North America, Europe, and Asia-Pacific. Failing to meet standards can result in product bans or import restrictions, negatively impacting revenue

- Furthermore, the high cost of advanced raw materials used in sustainable coatings (e.g., nano-additives, bio-based polymers) can deter price-sensitive customers, particularly in developing markets

- Another challenge is the technical skill gap in applying specialized coatings. Improper application can lead to coating failure, undermining performance and increasing long-term maintenance costs

- To overcome these barriers, companies must invest in sustainable R&D, compliance-focused innovation, and installer training programs, while also working on cost-effective formulations that meet regulatory and performance demands. This balance is key to securing long-term market resilience

How is the Corrosion Protection Coatings Market Segmented?

The market is segmented on the basis of type, technology, and end-use industries.

- By Type

On the basis of type, the corrosion protection coatings market is segmented into Epoxy, Polyurethane, Zinc, Alkyd, Acrylic, Chlorinated Rubber, and Others. The epoxy segment dominated the corrosion protection coatings market with the largest market revenue share of 39.5% in 2024, owing to its superior adhesion, chemical resistance, and mechanical properties. Epoxy coatings are widely used across industrial and marine applications for long-term corrosion protection of steel structures, pipelines, and equipment.

The polyurethane segment is expected to witness the fastest growth rate of 20.8% from 2025 to 2032, driven by its excellent UV stability, flexibility, and aesthetic appeal, making it highly suitable for topcoats in outdoor applications. Polyurethane coatings are increasingly adopted in sectors such as automotive, infrastructure, and architectural coatings due to their enhanced weather resistance and gloss retention.

- By Technology

On the basis of technology, the corrosion protection coatings market is segmented into Water-Based, Solvent-Based, Powder-Based, and Others. The solvent-based segment held the largest market revenue share in 2024, attributed to its strong performance characteristics, widespread industrial use, and compatibility with a wide range of substrates. These coatings are preferred in environments demanding high durability and chemical resistance, such as petrochemical and offshore facilities.

The water-based segment is anticipated to witness the fastest CAGR from 2025 to 2032, due to increasing environmental regulations restricting VOC emissions and rising demand for eco-friendly coating solutions. Water-based coatings are gaining traction in infrastructure and residential projects, supported by advancements in performance and drying time.

- By End-Use Industries

On the basis of end-use industries, the corrosion protection coatings market is segmented into Marine, Oil and Gas, Petrochemical, Infrastructure, Power Generation, Water Treatment, and Others. The infrastructure segment accounted for the largest market revenue share in 2024, driven by massive investments in public infrastructure projects, bridges, roads, and buildings requiring long-term corrosion protection. Governments across developing regions are prioritizing infrastructure resilience, which further boosts demand for protective coatings.

The oil and gas segment is projected to register the fastest CAGR from 2025 to 2032, due to rising global energy demands and the need for corrosion-resistant coatings in extreme operational environments such as offshore rigs, pipelines, and refineries. These coatings are critical for minimizing maintenance costs and extending asset life in corrosive conditions.

Which Region Holds the Largest Share of the Corrosion Protection Coatings Market?

- Asia-Pacific dominated the corrosion protection coatings market with the largest revenue share of 46.6% in 2024, driven by robust industrialization, expanding infrastructure projects, and the presence of major manufacturing hubs. Countries such as China, India, and Japan are experiencing significant demand for corrosion protection solutions in sectors such as oil & gas, marine, and construction

- The region benefits from large-scale investments in power generation, petrochemicals, and transportation infrastructure, all of which require long-lasting and high-performance coatings

- In addition, favorable government policies supporting industrial growth, coupled with a growing emphasis on asset longevity and cost-effective maintenance, are boosting the adoption of advanced corrosion protection technologies across APAC

China Corrosion Protection Coatings Market Insight

The China corrosion protection coatings market captured the largest revenue share in Asia-Pacific in 2024, driven by rapid infrastructure development, increasing oil & gas exploration activities, and the presence of large domestic coating manufacturers. China’s expanding marine and shipbuilding industry, along with its focus on sustainable urban development, is further propelling demand for durable coatings across various sectors.

India Corrosion Protection Coatings Market Insight

The India corrosion protection coatings market is projected to grow at a significant CAGR throughout the forecast period, fueled by rising investments in industrial infrastructure, highways, bridges, and power generation. The government’s “Make in India” and Smart Cities Mission are encouraging the use of protective coatings to enhance the durability of public infrastructure. Growth is also supported by increasing awareness of corrosion-related losses and a shift towards eco-friendly coating solutions.

Japan Corrosion Protection Coatings Market Insight

The Japan corrosion protection coatings market is expanding steadily due to the country’s mature industrial base and focus on innovation. With a strong emphasis on quality and sustainability, Japanese industries are adopting high-performance coatings for long-term asset protection, particularly in marine, petrochemical, and urban infrastructure projects. Demand is also rising in the renewable energy sector, especially in offshore wind energy installations.

Which Region is the Fastest Growing in the Corrosion Protection Coatings Market?

North America is projected to grow at the fastest CAGR of 5.3% during the forecast period from 2025 to 2032, propelled by increasing refurbishment of aging infrastructure, technological innovations, and heightened environmental regulations. Rising demand for durable and low-VOC coatings in the oil & gas and marine industries, along with a focus on infrastructure longevity, is driving market expansion in the region. Government funding for public infrastructure projects, coupled with strong adoption of powder-based and eco-friendly coatings, is reinforcing North America's position as a key growth market.

U.S. Corrosion Protection Coatings Market Insight

The U.S. corrosion protection coatings market accounted for the largest revenue share in North America in 2024, driven by robust investments in energy, transportation, and industrial facilities. The country’s ongoing focus on repairing and modernizing infrastructure, including bridges and pipelines, is a major growth factor. Demand is also bolstered by the presence of major players such as Sherwin-Williams and PPG Industries, who continue to innovate in high-performance and sustainable coatings.

Canada Corrosion Protection Coatings Market Insight

The Canada corrosion protection coatings market is experiencing notable growth due to increasing investments in oil sands, offshore energy exploration, and infrastructure development. The country's cold and harsh environmental conditions necessitate high-endurance coatings for pipelines, marine vessels, and equipment. In addition, Canada’s commitment to environmental protection is encouraging the shift toward low-emission and water-based coating technologies.

Mexico Corrosion Protection Coatings Market Insight

The Mexico corrosion protection coatings market is growing steadily with the expansion of its oil & gas sector and improving industrial base. Investment in refinery upgrades and coastal infrastructure is boosting demand for coatings that offer superior chemical resistance and durability. Government initiatives to attract foreign investment in infrastructure and energy are expected to further support market growth over the coming years.

Which are the Top Companies in corrosion protection coatings Market?

The corrosion protection coatings industry is primarily led by well-established companies, including:

- Hempel A/S (Denmark)

- Kansai Paint Co., Ltd (Japan)

- Nycote Laboratories, Inc. (U.S.)

- Diamond Vogel (U.S.)

- Jotun (Norway)

- Ashland Inc. (U.S.)

- RPM International Inc. (U.S.)

- Nippon Paint Co., Ltd. (Japan)

- E.I. Du Pont De Nemours (U.S.)

- DOW (U.S.)

- Koninklijke DSM N.V (Netherlands)

- 3M Co (U.S.)

- Heubach Color (Germany)

- The Magni Group (U.S.)

- Wacker Chemie AG (Germany)

- SK Formulations India (India)

- Bluechem Group (Germany)

- AkzoNobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- Axalta Coating Systems Ltd. (U.S.)

- BASF SE (Germany)

What are the Recent Developments in Global Corrosion Protection Coatings Market?

- In June 2023, AkzoNobel’s Powder Coatings division introduced the Interpon Redox portfolio, specifically designed to enhance corrosion protection in challenging environments such as high-humidity and coastal regions. This launch strengthens AkzoNobel’s market position in offering specialized coatings for harsh climates

- In April 2023, PETRONAS unveiled ProShield+, an advanced corrosion protection technology aimed at safeguarding assets in both downstream and upstream operations. The solution reflects PETRONAS’ commitment to innovation and asset longevity in critical sectors

- In October 2022, Sherwin-Williams expanded its passive fire protection product lineup for structural steel with the launch of FIRETEX FX6010. This coating is easy to apply using single-spray equipment and is suitable for use in high-risk environments such as hospitals, schools, and transportation hubs. The product enhances safety and durability in C5 corrosive zones

- In March 2021, PPG Industries, Inc. launched the PPG PITTHANE ULTRA LS polyurethane topcoat, formulated for use in corrosion-prone environments where a low-sheen finish is preferred to minimize glare and hide imperfections. This innovation highlights PPG’s focus on performance and aesthetics in protective coatings

- In July 2020, Sherwin-Williams Protective & Marine expanded its FIRETEX passive fire protection coatings portfolio by introducing a solution optimized for onshore facilities, which improves application efficiency and reduces overall costs. This addition underscores the company's effort to streamline protection in industrial settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Corrosion Protection Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corrosion Protection Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corrosion Protection Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.