Global Corrugated Automotive Packaging Market

Market Size in USD Billion

CAGR :

%

USD

18.42 Billion

USD

24.25 Billion

2024

2032

USD

18.42 Billion

USD

24.25 Billion

2024

2032

| 2025 –2032 | |

| USD 18.42 Billion | |

| USD 24.25 Billion | |

|

|

|

|

Corrugated Automotive Packaging Market Size

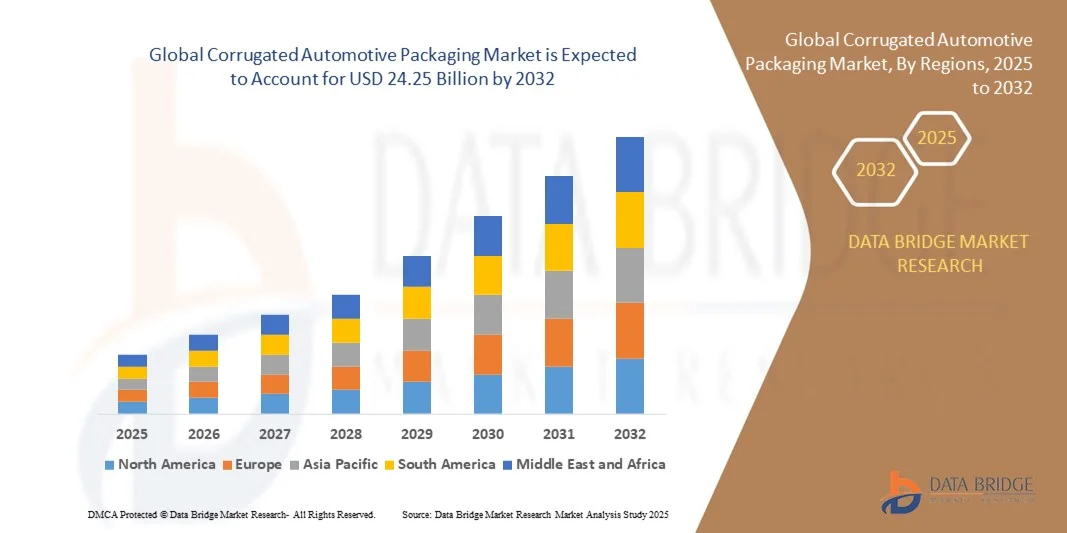

- The global corrugated automotive packaging market size was valued at USD 18.42 billion in 2024 and is expected to reach USD 24.25 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable, lightweight, and cost-effective packaging solutions across the automotive supply chain

- The growing emphasis on reducing transportation costs and carbon emissions is prompting automotive manufacturers to adopt recyclable corrugated packaging materials for component and parts shipment

Corrugated Automotive Packaging Market Analysis

- The corrugated automotive packaging market is witnessing steady growth due to the surge in automotive component trade and the rising need for secure, eco-friendly packaging alternatives. Manufacturers are increasingly using multi-layer corrugated packaging to ensure enhanced durability and protection during long-distance transportation

- In addition, the integration of smart packaging technologies and returnable corrugated packaging systems is transforming logistics operations in the automotive industry. The trend toward circular packaging solutions is expected to continue as automakers prioritize sustainability and cost optimization across their global supply chains

- Asia-Pacific dominated the corrugated automotive packaging market with the largest revenue share in 2024, driven by the rapid expansion of the automotive manufacturing sector, growing exports, and the increasing adoption of sustainable packaging materials. The region’s strong industrial base, coupled with rising demand for efficient logistics and component protection, continues to bolster market growth across major automotive hubs

- North America region is expected to witness the highest growth rate in the global corrugated automotive packaging market, driven by advancements in packaging design, rising exports of automotive components, and increasing collaboration between packaging manufacturers and OEMs

- The single wall segment held the largest market revenue share in 2024, driven by its cost-effectiveness, lightweight structure, and sufficient strength for packaging small to medium-sized automotive components. Its versatility in protecting parts such as electrical and lighting components during transportation has made it a preferred choice among automotive OEMs and Tier 1 suppliers

Report Scope and Corrugated Automotive Packaging Market Segmentation

|

Attributes |

Corrugated Automotive Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Corrugated Automotive Packaging Market Trends

Adoption of Lightweight and Sustainable Packaging Solution

- The growing emphasis on sustainability is reshaping the corrugated automotive packaging market, with manufacturers increasingly adopting lightweight, recyclable, and biodegradable materials. These eco-friendly alternatives are reducing the overall carbon footprint of the automotive supply chain while maintaining durability and strength for part protection. Companies are also focusing on renewable raw materials and waste minimization strategies to align with global carbon neutrality targets

- The automotive industry’s shift toward electric and hybrid vehicles is further driving the need for specialized, lightweight packaging to support complex components such as batteries and electronic systems. This ensures safe transportation while aligning with global sustainability mandates and emission reduction goals. The adoption of advanced corrugated structures designed to handle high-value EV components is expanding rapidly among OEMs seeking both efficiency and environmental compliance

- The demand for sustainable corrugated packaging is also being accelerated by regulatory initiatives and OEM preferences for environmentally responsible suppliers. Companies are investing in advanced corrugation technologies to improve performance while minimizing material waste and energy consumption. Partnerships between packaging manufacturers and automakers are becoming common to co-develop green packaging solutions that align with ESG and CSR goals

- For instance, in 2024, several European packaging companies introduced corrugated solutions made from recycled fibers designed for electric vehicle component transport, resulting in a measurable reduction in packaging waste and logistics costs. These solutions demonstrated improved stack strength and moisture resistance, optimizing space utilization during transport. Such innovations are helping companies meet circular economy standards and appeal to sustainability-conscious customers

- While sustainability remains a key trend, continued innovation in material science, recycling processes, and supply chain collaboration will be crucial to meeting the industry’s long-term environmental and operational goals. The integration of digital tools for material traceability and eco-impact monitoring is expected to enhance transparency in production. Manufacturers must focus on balancing environmental responsibility with cost-effectiveness to ensure scalable adoption

Corrugated Automotive Packaging Market Dynamics

Driver

Increasing Demand for Protective and Cost-Efficient Packaging Solutions in the Automotive Supply Chain

- The global automotive industry’s expansion, coupled with the complexity of vehicle components, is fueling the demand for durable and protective corrugated packaging. These solutions safeguard delicate parts such as headlights, bumpers, and electronic modules during long-distance transportation and storage. Their ability to absorb shocks, resist moisture, and maintain integrity under heavy loads is making them indispensable in modern automotive logistics

- Corrugated packaging provides cost-efficient protection through its lightweight yet strong structure, reducing transportation costs and minimizing damage-related losses. The material’s flexibility enables customized packaging designs tailored to diverse automotive components, improving supply chain efficiency. Moreover, modular and returnable designs are increasingly being used to enhance reusability and reduce waste across distribution networks

- Growing vehicle exports and the globalization of component manufacturing have strengthened the need for standardized and reliable packaging formats. Manufacturers are increasingly turning to corrugated materials to balance protection, cost, and sustainability in cross-border logistics. The expansion of just-in-time (JIT) and just-in-sequence (JIS) production models has also increased the reliance on efficient packaging solutions that support seamless component flow

- For instance, in 2023, several automotive OEMs in Asia-Pacific partnered with corrugated packaging providers to develop foldable, reusable packaging systems for spare parts, reducing shipping costs and warehouse space requirements. These solutions not only enhanced space utilization but also lowered reverse logistics expenses. The approach has been widely adopted in automotive hubs such as Japan and South Korea, setting a new benchmark for supply chain sustainability

- While cost-efficiency and durability drive market growth, collaboration between packaging producers and automotive manufacturers is essential to enhance design optimization, logistics integration, and waste reduction across the value chain. Integrating digital twins and simulation-based packaging design can further improve part protection and operational agility. Such collaboration will also enable adaptive packaging innovations aligned with evolving automotive technologies

Restraint/Challenge

Fluctuating Raw Material Costs and Limited Adoption of Automation in Packaging Production

- The volatility in raw material prices, especially paper and pulp, poses a major challenge to corrugated packaging manufacturers. These cost fluctuations directly affect profit margins and make long-term pricing contracts difficult to maintain, particularly for large-scale automotive suppliers. In addition, external pressures from energy and fuel cost variations further influence overall manufacturing expenditure, impacting profitability and competitiveness

- Limited adoption of automation in packaging production processes increases operational inefficiencies and labor dependency. Smaller manufacturers often lack the capital investment needed to implement robotic or digital printing systems, slowing down production and customization capabilities. This technological gap also limits the consistency and precision needed to meet OEM standards for complex component packaging

- Supply chain disruptions, especially in paper sourcing, further impact the availability of corrugated materials and delivery timelines. These issues can delay automotive part shipments, leading to potential supply chain bottlenecks for OEMs and Tier 1 suppliers. Unpredictable geopolitical conditions and environmental regulations have also added strain to global paper production, intensifying raw material procurement challenges

- For instance, in 2022, several packaging producers in North America reported profit declines due to increased kraft paper costs and energy price surges, compelling them to raise packaging prices for automotive clients. This price increase led to renegotiations in supply contracts and forced OEMs to explore alternative suppliers. Such cost fluctuations have amplified the need for sustainable sourcing and local production strategies

- Addressing these challenges requires greater investment in process automation, sustainable raw material sourcing, and the adoption of circular economy principles to stabilize supply chains and enhance long-term market competitiveness. Automation and digital transformation can significantly improve operational resilience, while the shift to recycled paper inputs can reduce cost sensitivity. Manufacturers that embrace such measures will be better positioned to maintain steady growth despite market volatility

Corrugated Automotive Packaging Market Scope

The market is segmented on the basis of layer type, product type, and automotive parts.

- By Layer Type

On the basis of layer type, the corrugated automotive packaging market is segmented into single face, single wall, double wall, and triple wall. The single wall segment held the largest market revenue share in 2024, driven by its cost-effectiveness, lightweight structure, and sufficient strength for packaging small to medium-sized automotive components. Its versatility in protecting parts such as electrical and lighting components during transportation has made it a preferred choice among automotive OEMs and Tier 1 suppliers.

The double wall segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its enhanced strength and durability required for heavy or fragile automotive parts such as engines, batteries, and underbody components. The dual-layer design offers superior cushioning and compression resistance, ensuring reliable protection during long-distance shipping and export operations.

- By Product Type

On the basis of product type, the corrugated automotive packaging market is segmented into boxes, crates, trays, corrugated partitions, corrugated pallets, octabins, and PoP displays. The boxes segment held the largest market revenue share in 2024, primarily due to its widespread application across the automotive supply chain for storing and transporting various components. Their lightweight and stackable nature make them ideal for space optimization and cost-efficient logistics.

The corrugated pallets segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing adoption by automotive manufacturers seeking eco-friendly and reusable alternatives to wooden or plastic pallets. These pallets are gaining traction for their strength-to-weight ratio, recyclability, and ability to meet international shipping standards without fumigation or heat treatment requirements.

- By Automotive Parts

On the basis of automotive parts, the corrugated automotive packaging market is segmented into automotive filter, battery, engine components, lighting components, underbody components, electrical components, and cooling system. The engine components segment held the largest market revenue share in 2024, driven by the need for high-strength, shock-resistant packaging solutions that ensure the safe transport of complex mechanical assemblies. Manufacturers prefer corrugated packaging for its cushioning capability and adaptability to custom inserts.

The battery segment is expected to witness the fastest growth rate from 2025 to 2032, primarily due to the surge in electric vehicle (EV) production and the increasing need for specialized corrugated solutions that ensure safe handling and storage of lithium-ion batteries. Corrugated packaging designed for thermal protection and electrostatic discharge (ESD) resistance is becoming essential in EV supply chains, supporting safe and sustainable logistics operations.

Corrugated Automotive Packaging Market Regional Analysis

- Asia-Pacific dominated the corrugated automotive packaging market with the largest revenue share in 2024, driven by the rapid expansion of the automotive manufacturing sector, growing exports, and the increasing adoption of sustainable packaging materials. The region’s strong industrial base, coupled with rising demand for efficient logistics and component protection, continues to bolster market growth across major automotive hubs

- Manufacturers in Asia-Pacific are focusing on lightweight, recyclable corrugated solutions to optimize cost-efficiency and meet sustainability targets. The region’s increasing investment in electric vehicle (EV) production and complex component logistics is also supporting the demand for customized corrugated packaging solutions tailored to battery systems, engine parts, and other delicate assemblies

China Corrugated Automotive Packaging Market Insight

The China corrugated automotive packaging market accounted for the largest market revenue share in 2024 within Asia-Pacific, fueled by its expansive automotive manufacturing industry and strong export infrastructure. The country’s focus on electric vehicle production and the need for durable, eco-friendly packaging solutions to transport sensitive components are key growth drivers. The rising adoption of corrugated materials made from recycled paper aligns with China’s green manufacturing initiatives. Moreover, domestic packaging suppliers are increasingly investing in automation and precision design technologies to enhance product quality and logistics efficiency.

Japan Corrugated Automotive Packaging Market Insight

The Japan corrugated automotive packaging market is expected to witness significant growth from 2025 to 2032, driven by advancements in sustainable packaging technologies and the country’s commitment to high-quality manufacturing standards. Japan’s automotive sector demands precision and durability in packaging solutions for both domestic and export use. The integration of lightweight corrugated materials that reduce transportation emissions is gaining momentum. Furthermore, collaboration between packaging producers and automotive OEMs is leading to innovations that improve reusability and recyclability, aligning with Japan’s circular economy objectives.

Europe Corrugated Automotive Packaging Market Insight

The Europe corrugated automotive packaging market is expected to witness a strong growth rate from 2025 to 2032, supported by the region’s stringent environmental regulations and shift toward sustainable packaging practices. European automakers are increasingly adopting corrugated packaging for safe transport of EV components, engine parts, and lighting systems. The growing emphasis on carbon reduction and recyclability is pushing packaging manufacturers to innovate with lightweight, biodegradable materials. In addition, the increasing presence of global automotive brands and the expansion of export activities are further fueling market demand.

Germany Corrugated Automotive Packaging Market Insight

The Germany corrugated automotive packaging market is expected to witness a strong growth rate from 2025 to 2032, driven by the country’s advanced automotive manufacturing ecosystem and focus on sustainable industrial practices. German automotive suppliers are prioritizing packaging that ensures high structural integrity and minimizes waste. The adoption of corrugated packaging solutions for high-value automotive parts such as batteries, sensors, and electronic modules is expanding rapidly. Moreover, local companies are integrating digital tracking and smart packaging systems to improve supply chain visibility and reduce material handling costs.

U.K. Corrugated Automotive Packaging Market Insight

The U.K. corrugated automotive packaging market is expected to witness notable growth from 2025 to 2032, driven by the country’s strong automotive manufacturing and export activities. The growing focus on sustainability and the circular economy is encouraging manufacturers to adopt recyclable and lightweight corrugated packaging solutions. The U.K.’s shift toward electric vehicle production and the need for secure, durable packaging for components such as batteries, lighting systems, and engine parts are further propelling market demand. In addition, continuous investments in logistics optimization and the adoption of innovative, eco-friendly materials are enhancing the efficiency and resilience of the automotive packaging supply chain across the country.

North America Corrugated Automotive Packaging Market Insight

The North America corrugated automotive packaging market is projected to witness steady growth from 2025 to 2032, supported by rising vehicle production and increasing export of automotive components. The U.S. and Canada are emphasizing the use of recyclable corrugated packaging to enhance logistics efficiency and align with corporate sustainability goals. The region’s well-established automotive supply chain, combined with technological advancements in automated packaging systems, is driving product innovation. Furthermore, the shift toward electric and hybrid vehicles is prompting manufacturers to design corrugated packaging tailored to battery modules and lightweight assemblies.

U.S. Corrugated Automotive Packaging Market Insight

The U.S. corrugated automotive packaging market is expected to witness a strong growth rate from 2025 to 2032, driven by high automotive output and an expanding aftermarket parts sector. The increasing focus on eco-friendly materials and cost-effective packaging solutions is supporting market expansion. Manufacturers are investing in smart and modular corrugated packaging designs that enhance protection and reduce logistics expenses. Moreover, collaborations between packaging suppliers and automotive OEMs are promoting the development of reusable, space-saving packaging systems that improve supply chain sustainability and performance.

Corrugated Automotive Packaging Market Share

The Corrugated Automotive Packaging industry is primarily led by well-established companies, including:

• International Paper (U.S.)

• Sonoco Products Company (U.S.)

• Mondi (U.K.)

• Sealed Air (U.S.)

• WestRock Company (U.S.)

• Greif (U.S.)

• DS Smith (U.K.)

• Smurfit Kappa (U.K.)

• NEFAB Group (U.K.)

• Elsons International (U.K.)

• Orcon Industries (U.S.)

• Victory Packaging (U.S.)

• Encase (U.K.)

• Pacific Packaging Products, Inc. (U.S.)

• Sunbelt Paper & Packaging (U.S.)

• The Corrugated Case Company (U.K.)

• Kunert Wellpappe (U.K.)

• Georgia-Pacific (U.S.)

• Orora Packaging Solutions (U.S.)

• Packaging Corporation of America (U.S.)

Latest Developments in Global Corrugated Automotive Packaging Market

- In June 2025, DS Smith opened a new innovation center in Lyon, France, dedicated to advancing corrugated packaging technologies for the automotive sector. The facility focuses on accelerating innovation in material performance, design efficiency, and sustainability. This move positions DS Smith at the forefront of research and development in circular packaging solutions for the European automotive industry

- In May 2025, DS Smith secured a contract to supply custom corrugated packaging for Toyota’s European spare parts operations. The partnership aims to improve packaging protection, sustainability, and efficiency across Toyota’s logistics network. This collaboration further strengthens DS Smith’s reputation as a leading supplier to global automotive manufacturers

- In January 2025, Mondi announced a €50 million investment to build a new corrugated packaging plant in Poland dedicated to automotive components. The facility will focus on producing lightweight, high-strength, and recyclable packaging solutions to support the growing demand from European automakers. This expansion underscores Mondi’s long-term commitment to sustainable manufacturing in Central Europe

- In September 2024, Mondi partnered with Faurecia to co-develop sustainable corrugated packaging for car interior components. The collaboration centers on optimizing packaging design to reduce waste, enhance protection, and minimize environmental impact. The initiative highlights Mondi’s continued leadership in eco-innovative automotive packaging

- In August 2024, Smurfit Kappa completed the acquisition of Cartonajes del Automóvil, a Spanish automotive packaging specialist. The acquisition expands Smurfit Kappa’s European network and strengthens its expertise in tailored corrugated solutions for automotive components. This move solidifies the company’s position in the competitive European automotive packaging market

- In April 2024, WestRock launched a modular corrugated packaging system designed for automotive aftermarket parts. The new system provides flexible, cost-effective, and protective packaging options, optimizing efficiency and reducing damage during transport. This innovation enhances WestRock’s offerings in the aftermarket segment and aligns with evolving customer needs

- In April 2024, Mondi partnered with Renault Group to develop lightweight and recyclable corrugated packaging for electric vehicle components. The partnership aims to reduce material usage, improve supply chain sustainability, and ensure safe transportation of delicate EV parts. This collaboration reinforces Mondi’s role as a sustainable solutions provider in the automotive industry

- In April 2024, DS Smith unveiled a fully recyclable corrugated packaging solution tailored for electric vehicle (EV) batteries. The design enhances transport safety and supports OEM sustainability initiatives while minimizing carbon impact. This launch positions DS Smith as a pioneer in green packaging for next-generation mobility

- In March 2024, Smurfit Kappa inaugurated a new corrugated packaging facility in Casablanca, Morocco, aimed at supporting automotive component manufacturers and exporters across North Africa. The new plant enhances the company’s operational capacity, promotes regional economic development, and strengthens its supply chain efficiency in emerging automotive markets

- In February 2024, International Paper appointed Maria Gonzalez as Vice President of its automotive packaging division, marking a strategic step toward innovation and global market expansion. Her leadership is expected to drive the company’s focus on customized, high-performance packaging solutions for the automotive sector

- In February 2024, WestRock expanded its automotive packaging operations by opening a logistics hub in Stuttgart, Germany. The facility is designed to streamline supply chain operations and strengthen service delivery for European automotive suppliers. This expansion enhances WestRock’s regional presence and responsiveness to OEM demands

- In May 2024, International Paper signed a multi-year supply contract with Stellantis to provide custom corrugated packaging for its global automotive parts distribution network. The agreement enhances supply consistency, packaging quality, and operational efficiency for Stellantis, reinforcing International Paper’s position as a preferred packaging partner for the global automotive industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Corrugated Automotive Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corrugated Automotive Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corrugated Automotive Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.