Global Cosmeceutical Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

4.12 Billion

USD

5.83 Billion

2025

2033

USD

4.12 Billion

USD

5.83 Billion

2025

2033

| 2026 –2033 | |

| USD 4.12 Billion | |

| USD 5.83 Billion | |

|

|

|

|

Cosmeceutical Ingredients Market Size

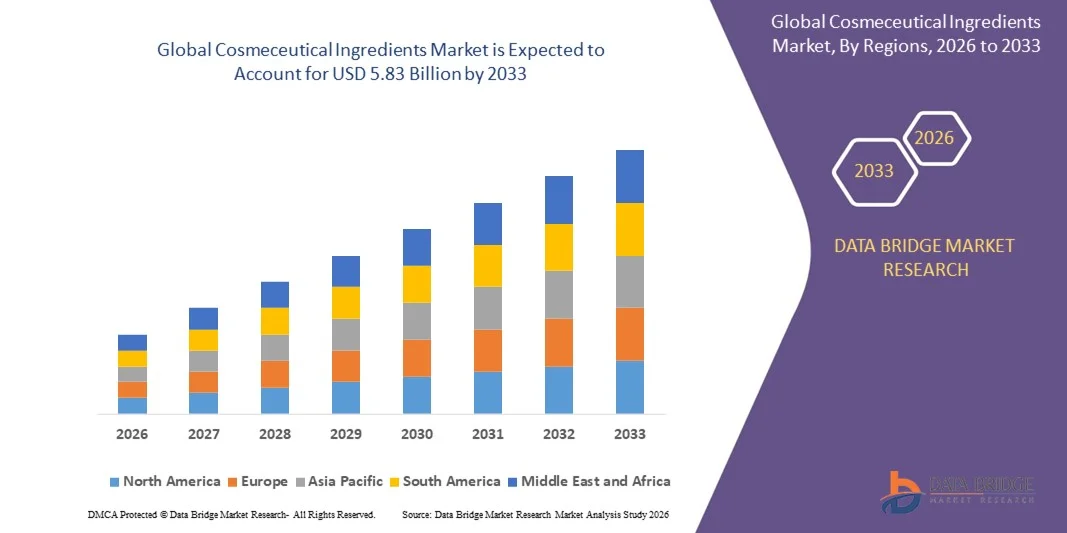

- The global cosmeceutical ingredients market size was valued at USD 4.12 billion in 2025 and is expected to reach USD 5.83 billion by 2033, at a CAGR of 4.43% during the forecast period

- The market growth is largely fuelled by the increasing demand for multifunctional skincare products that combine cosmetic appeal with therapeutic benefits, such as anti-aging, moisturizing, and sun protection

- Rising consumer awareness about natural and bioactive ingredients is accelerating the adoption of cosmeceutical products across all age groups, particularly among millennials and Gen Z

Cosmeceutical Ingredients Market Analysis

- Increasing preference for organic, plant-based, and sustainable ingredients is shaping product development trends in the cosmeceutical sector

- Technological advancements in dermatology and cosmetic formulations are enabling innovative, high-efficacy ingredients that meet growing consumer demands for targeted skincare solutions

- North America dominated the cosmeceutical ingredients market with the largest revenue share of 38.50% in 2025, driven by rising demand for advanced skincare products, increasing consumer awareness about skin health, and the strong presence of leading cosmetic manufacturers

- Asia-Pacific region is expected to witness the highest growth rate in the global cosmeceutical ingredients market, driven by rapid urbanization, increasing beauty consciousness, expanding middle-class population, and government initiatives promoting cosmetic and personal care manufacturing

- The Antioxidants segment held the largest market revenue share in 2025, driven by their widespread incorporation in skincare and personal care products for anti-aging, protective, and restorative benefits. Antioxidant-based ingredients are particularly favored for their multifunctional properties, enhancing product efficacy and consumer appeal

Report Scope and Cosmeceutical Ingredients Market Segmentation

|

Attributes |

Cosmeceutical Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmeceutical Ingredients Market Trends

Rise of Natural and Bioactive Cosmeceutical Ingredients

- The growing preference for natural and bioactive ingredients is transforming the cosmeceutical ingredients market by enabling the development of skincare and personal care products with enhanced efficacy. These ingredients, such as botanical extracts, peptides, and vitamins, support anti-aging, hydration, and skin repair, resulting in increased adoption across premium and mass-market formulations. In addition, rising consumer inclination toward cruelty-free and sustainable products further reinforces the demand for plant-based and ethically sourced actives. Continuous innovation in ingredient extraction and stabilization techniques is also expanding their application across diverse product lines

- The high demand for multifunctional ingredients in cosmetics is accelerating the introduction of novel compounds that provide combined benefits, including UV protection, antioxidant activity, and anti-inflammatory properties. This trend is particularly pronounced among consumers seeking clean-label and sustainable formulations. The development of hybrid ingredients that can target multiple skin concerns simultaneously is increasing product appeal. Moreover, partnerships between ingredient suppliers and cosmetic brands are driving R&D efforts to deliver next-generation bioactives with scientifically proven benefits

- The availability and versatility of modern cosmeceutical ingredients are making them attractive across multiple product categories, including creams, serums, lotions, and masks. Manufacturers are increasingly sourcing innovative actives to differentiate products and meet evolving consumer preferences. In addition, the integration of bioactives into mass-market and mid-tier brands is broadening market penetration. Retailers and e-commerce platforms are also facilitating wider distribution and faster adoption of new ingredient innovations

- For instance, in 2023, several European and U.S. skincare brands reported significant growth in sales after launching serums and creams formulated with peptides and plant-derived extracts, catering to health-conscious and beauty-focused consumers. Many of these products also highlighted clinical trial data to substantiate efficacy, enhancing consumer trust. Marketing campaigns emphasizing natural sourcing and multifunctionality contributed to higher visibility and premium positioning, further boosting market growth

- While natural and bioactive innovations are driving market growth, long-term impact depends on ingredient efficacy, safety validation, and continuous research to meet changing consumer expectations. Regulatory scrutiny and consumer education regarding ingredient benefits are also critical for sustained adoption. Ongoing technological advancements in formulation science, encapsulation, and bioavailability enhancement are expected to maintain momentum and broaden the application of cosmeceutical ingredients globally

Cosmeceutical Ingredients Market Dynamics

Driver

Rising Consumer Awareness of Skin Health and Preference for Bioactive Components

- Increasing awareness of skin health and the desire for effective, science-backed cosmetic solutions are driving demand for bioactive and functional ingredients. Products containing antioxidants, collagen-boosting peptides, and herbal extracts are gaining traction among consumers seeking visible results. The rise of influencer-led skincare education and social media campaigns has further amplified consumer knowledge and acceptance of bioactive ingredients

- Growth in the premium skincare segment and rising disposable incomes are accelerating the adoption of cosmeceutical ingredients. Consumers are increasingly willing to invest in products that offer long-term skin benefits, fueling market expansion in urban and semi-urban areas. In parallel, demand from emerging markets is growing as middle-class consumers seek aspirational skincare products. Strategic marketing highlighting efficacy, sustainability, and natural sourcing is supporting premium ingredient adoption

- Expansion of research and development, along with collaborations between ingredient suppliers and cosmetic manufacturers, is supporting market growth. Innovative formulations and clinical trials enhance product credibility and consumer trust. Investments in biotechnology and novel extraction processes are enabling the creation of highly potent, stable, and multifunctional actives. Academic-industry partnerships are also fostering knowledge transfer and accelerating product innovation cycles

- For instance, in 2022, several North American and European cosmetic brands launched serums with multifunctional bioactive compounds, leading to rapid acceptance and higher sales volumes. Brands emphasized efficacy, safety, and natural sourcing in marketing campaigns to enhance brand loyalty. The successful launch of these products demonstrated strong consumer preference for scientifically backed ingredients and reinforced confidence in cosmeceutical innovations

- While consumer awareness and demand for bioactives are driving the market, ensuring ingredient efficacy, regulatory compliance, and continuous innovation remain essential for sustained adoption. Collaboration with dermatologists and certification bodies is increasingly used to validate claims and build credibility. Advances in ingredient personalization and customization are also expected to drive further market expansion

Restraint/Challenge

High Cost of Premium Ingredients and Stringent Regulatory Requirements

- The relatively higher price of premium, bioactive, or organic cosmeceutical ingredients compared to conventional compounds limits adoption among price-sensitive manufacturers. Cost remains a major barrier, especially for small- and mid-sized cosmetic brands. In addition, high R&D, sourcing, and quality control expenses further contribute to elevated production costs, restricting wider application

- Stringent regulatory compliance related to safety, efficacy, and labeling increases the cost of ingredient development and slows product launches. Adhering to regional and international cosmetic regulations is critical but challenging. Delays in regulatory approvals, differing standards across countries, and ongoing updates in legislation can impact launch timelines and product availability

- Supply chain fluctuations, including scarcity of natural extracts, peptides, and specialty actives, can impact production costs and availability. Logistics disruptions may also affect ingredient quality and consistency. Moreover, geopolitical uncertainties and environmental concerns surrounding raw material sourcing can further exacerbate supply challenges

- For instance, in 2023, reports indicated that rising raw material and extraction costs constrained the expansion of premium cosmeceutical ingredient offerings in certain regions. Many small manufacturers delayed product launches due to financial constraints and supply chain unpredictability, impacting overall market growth

- While product innovation continues, addressing cost barriers, regulatory challenges, and supply chain reliability is crucial to unlock the full potential of the global cosmeceutical ingredients market. Adoption of sustainable sourcing practices, alternative ingredient development, and regional manufacturing strategies are expected to mitigate these challenges and support long-term growth

Cosmeceutical Ingredients Market Scope

The cosmeceutical ingredients market is segmented into four notable segments based on ingredient type, source, form, and application.

- By Ingredient Type

On the basis of ingredient type, the market is segmented into Sunscreens Ingredients, Antioxidants, Hydroxy Acids, Retinoids (Vitamin A), Skin Lightening Agents, Botanicals, Peptides and Proteins, and Others. The Antioxidants segment held the largest market revenue share in 2025, driven by their widespread incorporation in skincare and personal care products for anti-aging, protective, and restorative benefits. Antioxidant-based ingredients are particularly favored for their multifunctional properties, enhancing product efficacy and consumer appeal.

The Peptides and Proteins segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for bioactive ingredients that promote collagen synthesis, skin repair, and overall dermatological health. Peptide-based formulations are increasingly used in premium and mass-market products, offering scientifically backed results that appeal to health- and beauty-conscious consumers.

- By Source

On the basis of source, the market is segmented into Natural and Synthetic. The Natural segment held the largest market revenue share in 2025, driven by consumer preference for clean-label, eco-friendly, and plant-derived ingredients. Natural sources such as botanical extracts, algae, and fruit-derived compounds are increasingly incorporated into skincare, haircare, and oral care products to meet rising sustainability and safety expectations.

The Synthetic segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by innovations in bioengineered and lab-synthesized ingredients that offer enhanced stability, potency, and multifunctionality. Synthetic actives allow manufacturers to develop high-performance formulations while maintaining consistency and scalability in production.

- By Form

On the basis of form, the market is segmented into Powder and Liquid. The Liquid segment held the largest market revenue share in 2025, driven by its ease of incorporation into creams, serums, lotions, and other topical applications, along with better bioavailability of active compounds. Liquid formulations are particularly favored in high-end skincare and multifunctional cosmetic products.

The Powder segment is expected to witness the fastest growth rate from 2026 to 2033, attributed to its longer shelf life, convenience in handling, and precise dosing capabilities. Powder-based ingredients are increasingly used in DIY cosmetic kits, mask formulations, and dry-blend products, catering to evolving consumer preferences.

- By Application

On the basis of application, the market is segmented into Skin Care, Hair Care, Oral Care, and Others. The Skin Care segment held the largest market revenue share in 2025, driven by the growing demand for anti-aging, moisturizing, and protective products. Consumers are increasingly seeking functional skincare products enriched with bioactive ingredients for visible results and overall skin health.

The Hair Care segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer awareness regarding scalp health, hair strengthening, and multifunctional formulations. Hair serums, shampoos, and conditioners enriched with peptides, botanicals, and vitamins are gaining traction across both premium and mass-market categories.

Cosmeceutical Ingredients Market Regional Analysis

- North America dominated the cosmeceutical ingredients market with the largest revenue share of 38.50% in 2025, driven by rising demand for advanced skincare products, increasing consumer awareness about skin health, and the strong presence of leading cosmetic manufacturers

- Consumers in the region highly value scientifically backed, multifunctional, and bioactive ingredients that provide visible skin benefits, including anti-aging, hydration, and UV protection

- This widespread adoption is further supported by high disposable incomes, robust R&D infrastructure, and the growing preference for premium and innovative personal care products, establishing cosmeceutical ingredients as a key component in skincare and haircare formulations

U.S. Cosmeceutical Ingredients Market Insight

The U.S. cosmeceutical ingredients market captured the largest revenue share in 2025 within North America, fueled by the increasing focus on anti-aging solutions, wellness-driven beauty trends, and a strong skincare and personal care industry. Consumers are prioritizing products containing peptides, antioxidants, and plant-derived extracts. The rising integration of ingredients into multifunctional formulations, along with collaborations between ingredient suppliers and cosmetic brands, further drives market growth. Moreover, the growing demand for clean-label and bioactive products is significantly contributing to the market's expansion.

Europe Cosmeceutical Ingredients Market Insight

The Europe cosmeceutical ingredients market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent regulations promoting safe and effective cosmetic formulations, as well as increasing consumer awareness of bioactive skincare ingredients. Rising urbanization, disposable incomes, and a preference for premium and innovative products are boosting adoption. The region is seeing substantial growth across skincare, haircare, and anti-aging segments, with ingredient suppliers focusing on natural and multifunctional compounds.

U.K. Cosmeceutical Ingredients Market Insight

The U.K. cosmeceutical ingredients market is expected to witness rapid growth from 2026 to 2033, driven by rising demand for natural, multifunctional, and scientifically validated ingredients in skincare and personal care products. Consumers’ increasing concern for skin health, coupled with a robust e-commerce and retail infrastructure, is accelerating adoption. In addition, sustainability trends and demand for clean-label products are encouraging cosmetic brands to incorporate innovative bioactive compounds.

Germany Cosmeceutical Ingredients Market Insight

The Germany cosmeceutical ingredients market is expected to witness strong growth from 2026 to 2033, fueled by high consumer awareness of dermatologically tested products and the preference for eco-friendly and technologically advanced skincare solutions. Germany’s well-established cosmetic industry and emphasis on research and innovation promote adoption of peptides, antioxidants, and natural extracts. Integration of bioactive ingredients into multifunctional formulations for both premium and mass-market segments is also increasing, aligning with local consumer expectations.

Asia-Pacific Cosmeceutical Ingredients Market Insight

The Asia-Pacific cosmeceutical ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and rapid adoption of skincare and personal care products in countries such as China, Japan, and India. Government initiatives supporting health and beauty awareness, along with expanding e-commerce penetration, are fueling market expansion. Furthermore, APAC is emerging as a manufacturing hub for cosmeceutical actives, making premium ingredients more accessible and affordable to a wider consumer base.

Japan Cosmeceutical Ingredients Market Insight

The Japan cosmeceutical ingredients market is expected to witness rapid growth from 2026 to 2033 due to the country’s high-tech beauty culture, increasing skincare awareness, and demand for multifunctional ingredients. Japanese consumers prioritize anti-aging, hydrating, and protective formulations. The growing integration of bioactive ingredients such as peptides and botanical extracts in advanced skincare routines, coupled with the aging population seeking effective and easy-to-use products, is further driving adoption in both residential and professional cosmetic applications.

China Cosmeceutical Ingredients Market Insight

The China cosmeceutical ingredients market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rising skincare awareness, and rapid adoption of advanced personal care products. China is one of the largest markets for bioactive and multifunctional ingredients, with growing demand in skincare, haircare, and anti-aging formulations. The push toward premiumization, combined with domestic manufacturing capabilities and innovative product launches, is significantly propelling market growth.

Cosmeceutical Ingredients Market Share

The Cosmeceutical Ingredients industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Lonza (Switzerland)

- SEPPIC (France)

- Eastman Chemical Company (U.S.)

- Solvay (Belgium)

- Dow (U.S.)

- The Lubrizol Corporation (U.S.)

- Ashland (U.S.)

- Croda International plc (U.K.)

- ROBERTET (France)

- Allergan (U.S.)

- COBIOSA (France)

- Select Botanical (U.S.)

- Nexira (France)

- Symrise (Germany)

- Unilever (U.K./Netherlands)

- L'Oréal Paris (France)

- Johnson & Johnson Services, Inc. (U.S.)

- ELEMENTIS PLC (U.K.)

- Beiersdorf AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.