Global Cosmetic And Perfume Glass Packaging Market

Market Size in USD Billion

CAGR :

%

USD

10.32 Billion

USD

15.54 Billion

2025

2033

USD

10.32 Billion

USD

15.54 Billion

2025

2033

| 2026 –2033 | |

| USD 10.32 Billion | |

| USD 15.54 Billion | |

|

|

|

|

Cosmetic and Perfume Glass Packaging Market Size

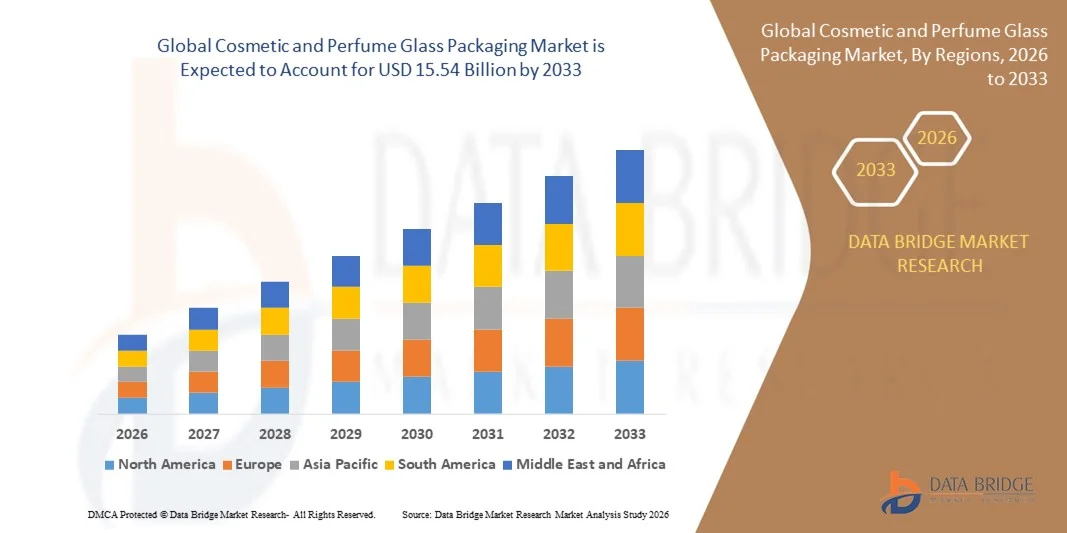

- The global cosmetic and perfume glass packaging market size was valued at USD 10.32 billion in 2025 and is expected to reach USD 15.54 billion by 2033, at a CAGR of 5.25% during the forecast period

- The market growth is largely fueled by the rising demand for premium and luxury cosmetic and perfume products, which drives the adoption of high-quality, visually appealing, and sustainable glass packaging solutions. Increasing consumer focus on aesthetics, brand differentiation, and product presentation is encouraging manufacturers to invest in innovative and decorative glass containers

- Furthermore, growing awareness of environmental sustainability and the shift toward eco-friendly packaging are establishing glass as a preferred material in the cosmetic and perfume industry. These converging factors are accelerating the uptake of advanced glass packaging solutions, thereby significantly boosting the market’s growth

Cosmetic and Perfume Glass Packaging Market Analysis

- Cosmetic and perfume glass packaging, offering durable, recyclable, and visually distinctive containers, is increasingly vital for enhancing product appeal, preserving formulation integrity, and supporting premium brand positioning in both the beauty and personal care sectors

- The escalating demand for cosmetic and perfume glass packaging is primarily fueled by the rising consumption of luxury fragrances, skincare, and nail care products, growing focus on sustainability, and increasing investments in innovative and customizable packaging designs that enhance brand visibility and consumer experience

- Europe dominated the cosmetic and perfume glass packaging market in 2025, due to high consumer demand for luxury fragrances, increasing preference for premium skincare products, and the growing adoption of innovative and aesthetically appealing glass packaging solutions across the cosmetics and perfume industry

- Asia Pacific is expected to be the fastest growing region in the cosmetic and perfume glass packaging market during the forecast period due to rising disposable incomes, growing middle-class population, and increasing consumption of luxury and premium beauty products in countries such as China, India, and Japan

- Perfumes segment dominated the market with a market share of 45.5% in 2025, due to the premium positioning of perfume products and the rising demand for luxury and designer fragrances. Perfume glass bottles are often designed for aesthetic appeal and brand differentiation, enhancing consumer perception and gifting potential. The segment also benefits from innovative bottle shapes, intricate designs, and high-quality glass materials, making them a preferred choice for brand owners seeking to strengthen market presence. In addition, increasing awareness of fragrance longevity and the need for airtight, high-quality containers reinforces the dominance of perfume glass packaging

Report Scope and Cosmetic and Perfume Glass Packaging Market Segmentation

|

Attributes |

Cosmetic and Perfume Glass Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetic and Perfume Glass Packaging Market Trends

Rising Adoption of Sustainable and Refillable Glass Packaging

- A significant trend in the cosmetic and perfume glass packaging market is the growing adoption of sustainable and refillable glass containers, driven by increasing consumer awareness of environmental sustainability and demand for eco-friendly packaging. Brands are integrating refillable solutions to reduce waste and carbon footprint, enhancing their appeal among environmentally conscious customers

- For instance, Armani launched a refillable fragrance bottle that reduces carbon footprint by 25 percent, setting a benchmark for luxury brands pursuing sustainability goals. Such initiatives are reinforcing the importance of eco-conscious packaging in shaping consumer preference and brand reputation

- The demand for refillable and reusable glass packaging is also rising in premium skincare and nail care products, where consumers value both aesthetic appeal and environmental responsibility. This trend encourages innovation in container design and materials that maintain product safety while promoting reuse

- Luxury perfume and skincare brands are increasingly investing in decorative and high-quality glass bottles that combine elegance with sustainability, positioning refillable packaging as a key differentiator in competitive markets

- Emerging markets are witnessing greater adoption of sustainable glass packaging due to growing disposable incomes and awareness of global environmental concerns. This is enabling international brands to expand their reach while promoting responsible consumption

- Overall, the trend toward refillable and sustainable glass packaging is driving innovation, brand differentiation, and consumer engagement, strengthening its role as a core growth driver for the cosmetic and perfume glass packaging industry

Cosmetic and Perfume Glass Packaging Market Dynamics

Driver

Growing Demand for Premium and Luxury Cosmetic Products

- The growing preference for high-end perfumes, skincare, and nail care products is driving the demand for premium glass packaging that enhances product appeal, preserves formulation integrity, and reinforces brand value. Consumers increasingly associate visually attractive, durable glass containers with quality and luxury

- For instance, SGD Pharma and Zignago Vetro supply high-quality decorative glass bottles widely used by luxury cosmetic brands. These solutions elevate product presentation and help brands stand out in crowded retail environments

- Rising disposable incomes and lifestyle upgrades are further boosting the consumption of premium beauty products, prompting manufacturers to invest in innovative and customizable glass packaging

- Brands are leveraging advanced designs, intricate bottle shapes, and finishes to attract discerning consumers while promoting product protection and long shelf life

- This convergence of consumer preference for luxury, aesthetics, and functional benefits is reinforcing the adoption of high-quality glass containers across the cosmetic and perfume industry

Restraint/Challenge

High Production Costs and Design Complexity

- The cosmetic and perfume glass packaging market faces challenges due to the high production costs and design complexities involved in manufacturing premium glass bottles. Achieving intricate designs, decorations, and sustainable features increases operational expenditure and production time

- For instance, companies such as Heinz-Glas employ advanced techniques for hygienic and aesthetically sophisticated bottles, which require specialized equipment and skilled labor, driving up costs

- Ensuring product durability, visual appeal, and environmental compliance simultaneously adds layers of complexity to the production process, limiting scalability and flexibility

- The reliance on high-quality raw materials and precise manufacturing standards exposes manufacturers to supply chain volatility and cost fluctuations

- Overall, these constraints necessitate careful process optimization and investment in innovation to balance premium design requirements with economic feasibility while meeting growing market demand

Cosmetic and Perfume Glass Packaging Market Scope

The market is segmented on the basis of type, form, and capacity.

- By Type

On the basis of type, the cosmetic and perfume glass packaging market is segmented into perfumes, nail care, and skincare. The perfumes segment dominated the market with the largest market revenue share of 45.5% in 2025, driven by the premium positioning of perfume products and the rising demand for luxury and designer fragrances. Perfume glass bottles are often designed for aesthetic appeal and brand differentiation, enhancing consumer perception and gifting potential. The segment also benefits from innovative bottle shapes, intricate designs, and high-quality glass materials, making them a preferred choice for brand owners seeking to strengthen market presence. In addition, increasing awareness of fragrance longevity and the need for airtight, high-quality containers reinforces the dominance of perfume glass packaging.

The skincare segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the rising adoption of premium and natural skincare products across emerging and developed markets. Skincare packaging requires robust and UV-protective glass to maintain product integrity, which is driving demand for advanced glass solutions. Brands are increasingly investing in visually appealing and sustainable glass packaging to enhance user experience and eco-conscious appeal. Rising e-commerce penetration and the need for safe, leak-proof packaging also contribute to the rapid growth of skincare glass containers.

- By Form

On the basis of form, the market is segmented into translucent, transparent, and opaque glass. The transparent segment dominated the market in 2025 due to its ability to showcase product colors and textures, which enhances visual appeal and brand visibility on retail shelves. Transparent glass is widely preferred by cosmetic and perfume manufacturers for its versatility, compatibility with decorative finishes, and the ease of integrating labels and branding elements. Consumer preference for product visibility and the growing trend of luxury packaging designs reinforce the dominance of transparent glass packaging. In addition, transparent packaging provides opportunities for interactive and aesthetically pleasing displays that attract end-users.

The opaque segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for products sensitive to light exposure, such as essential oils, serums, and high-value skincare formulations. Opaque glass offers protection from UV radiation and helps preserve product efficacy over longer durations. Brands focusing on premium and natural product positioning are adopting opaque packaging for enhanced product stability and sustainability appeal. The aesthetic flexibility of opaque glass with metallic coatings or embossing further fuels its adoption in the high-end cosmetic segment.

- By Capacity

On the basis of capacity, the market is segmented into 0–50 ml, 50–150 ml, and >150 ml. The 0–50 ml segment dominated the market in 2025, driven by the popularity of travel-sized and sample packaging for perfumes and skincare products. Smaller capacity packaging allows consumers to try premium products before committing to larger sizes and supports gifting trends in the cosmetics industry. This segment is also preferred for concentrated formulations such as perfumes and serums, where small, precise doses are sufficient for repeated use. Increasing demand from online retail channels and subscription-based beauty boxes reinforces the dominance of small-capacity packaging.

The 50–150 ml segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising adoption of mid-sized products for personal care and daily skincare routines. This capacity range balances convenience and product longevity, making it suitable for both personal use and professional applications. Consumers increasingly prefer mid-sized packaging for premium creams, lotions, and perfumes due to portability, practicality, and value-for-money considerations. Growing demand for eco-friendly, reusable, and aesthetically designed glass containers in this segment further accelerates market growth.

Cosmetic and Perfume Glass Packaging Market Regional Analysis

- Europe dominated the cosmetic and perfume glass packaging market with the largest revenue share in 2025, driven by high consumer demand for luxury fragrances, increasing preference for premium skincare products, and the growing adoption of innovative and aesthetically appealing glass packaging solutions across the cosmetics and perfume industry

- Consumers and manufacturers in the region highly value high-quality, sustainable, and visually distinctive glass packaging, which enhances product appeal and brand differentiation in competitive retail markets

- This widespread adoption is further supported by advanced manufacturing capabilities, strong design and R&D investments, and rising awareness of eco-friendly packaging alternatives, establishing cosmetic and perfume glass packaging as a preferred choice in both personal care and luxury product segments

Russia Cosmetic and Perfume Glass Packaging Market Insight

The Russia cosmetic and perfume glass packaging market captured the largest share in Europe in 2025, fueled by rising consumer preference for premium perfumes and high-end skincare products. Increasing adoption of luxury and designer fragrances, along with the demand for visually attractive and durable packaging, is driving growth. The presence of established domestic and international brands, coupled with robust retail and e-commerce channels, is further supporting market expansion.

North America Cosmetic and Perfume Glass Packaging Market Insight

The North America cosmetic and perfume glass packaging market is projected to expand steadily, primarily driven by strong demand for luxury perfumes, skincare, and nail care products across the U.S. and Canada. Consumers increasingly prefer visually appealing, eco-friendly, and high-quality glass packaging that enhances product shelf impact and brand value. The presence of leading cosmetic brands and well-established distribution networks supports widespread adoption in the region.

U.S. Cosmetic and Perfume Glass Packaging Market Insight

The U.S. cosmetic and perfume glass packaging market accounted for the largest revenue share in North America in 2025, fueled by high consumer demand for premium and designer fragrances and increasing investments in sustainable packaging. Rising e-commerce penetration and gifting trends, along with the focus on product presentation and aesthetics, drive adoption of glass containers. Strong presence of multinational cosmetic manufacturers and innovative packaging solutions further supports market growth.

Asia-Pacific Cosmetic and Perfume Glass Packaging Market Insight

The Asia-Pacific cosmetic and perfume glass packaging market is poised to grow at the fastest CAGR during the forecast period, driven by rising disposable incomes, growing middle-class population, and increasing consumption of luxury and premium beauty products in countries such as China, India, and Japan. Increasing awareness of personal care, beauty trends, and demand for high-quality packaging are propelling market adoption. Expanding domestic manufacturing and investments in innovative glass designs further boost regional market growth.

China Cosmetic and Perfume Glass Packaging Market Insight

The China cosmetic and perfume glass packaging market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid growth of the luxury fragrance and skincare markets. Rising consumer demand for aesthetically appealing, high-quality, and safe glass packaging supports market expansion. The availability of cost-effective and innovative packaging solutions from domestic manufacturers further strengthens market penetration.

Japan Cosmetic and Perfume Glass Packaging Market Insight

The Japan cosmetic and perfume glass packaging market is witnessing steady growth due to high consumer preference for premium and eco-friendly beauty products. Adoption of high-quality glass packaging enhances product appeal and brand perception, especially for luxury perfumes and skincare. Strong domestic manufacturing capabilities, innovative design approaches, and a focus on sustainability are expected to sustain market demand in both personal care and luxury segments.

Cosmetic and Perfume Glass Packaging Market Share

The cosmetic and perfume glass packaging industry is primarily led by well-established companies, including:

- HEINZ‑GLAS GmbH & Co. KGaA (Germany)

- SGD Pharma (France)

- ZIGNAGO VETRO S.p.A (Italy)

- Piramal Glass Private Limited (India)

- Roma International PLC (U.K.)

- Rockwood & Hines Glass Group (U.S.)

- Gerresheimer AG (Germany)

- Vitro (Mexico)

- Verescence Group (France)

- Stölzle Glass Group (Austria/France)

- Bormioli Luigi S.p.A. (Italy)

- Baralan International S.p.A. (Italy)

- Beatson Clark Ltd. (U.K.)

- Ardagh Group S.A. (Luxembourg)

Latest Developments in Global Cosmetic and Perfume Glass Packaging Market

- In November 2024, Stratasys Ltd. partnered with Baralan to enhance creative glass packaging options using advanced 3D printing technology. The collaboration allows the production of fully customized and intricately decorated glass containers, enabling cosmetic and perfume brands to offer personalized, low-volume premium packaging. This development boosts brand differentiation, supports innovative design strategies, and responds to the rising trend of bespoke packaging in the luxury and high-end cosmetics segment

- In October 2024, SGD Pharma introduced a new line of post‑consumer recycled (PCR) glass packaging, featuring bottles made with up to 20 % recycled glass. This innovation reduces reliance on virgin raw materials and lowers carbon emissions during production, catering to the growing demand for sustainable and eco-friendly cosmetic packaging. The development strengthens the market shift toward environmentally conscious solutions, enabling brands to meet consumer expectations for sustainability while maintaining premium quality and aesthetic appeal

- In September 2024, Stoelzle Glass Group launched the Elixir 30 ml lightweight dropper bottle, which is 32 % lighter than traditional bottles and reduces CO₂ emissions. This innovation addresses environmental sustainability while preserving premium aesthetics and functional quality for serums and foundations. By combining reduced material usage with modern design, the development reinforces the adoption of eco-conscious yet visually appealing glass packaging in the cosmetic industry

- In October 2022, Heinz Glas introduced a collection of glass bottles in collaboration with Weil Burger that targets health and bacterial contamination concerns. The new bottles offer enhanced hygiene, product safety, and durability, addressing contemporary consumer expectations for safe and high-quality cosmetic packaging. This development strengthens confidence in glass containers as a preferred medium for premium skincare and fragrance products

- In July 2020, Armani launched a refillable fragrance bottle for its latest perfume edition, aiming to reduce the carbon footprint by 25 %. The refillable design promotes sustainability and minimizes waste in luxury perfume packaging, encouraging consumers to adopt environmentally responsible practices without compromising on aesthetics or product experience. This initiative set a benchmark in the market for combining eco-friendly practices with high-end brand identity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cosmetic And Perfume Glass Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cosmetic And Perfume Glass Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cosmetic And Perfume Glass Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.