Global Cosmetic Packaging Market

Market Size in USD Billion

CAGR :

%

USD

34.17 Billion

USD

47.85 Billion

2024

2032

USD

34.17 Billion

USD

47.85 Billion

2024

2032

| 2025 –2032 | |

| USD 34.17 Billion | |

| USD 47.85 Billion | |

|

|

|

|

Cosmetic Packaging Market Size

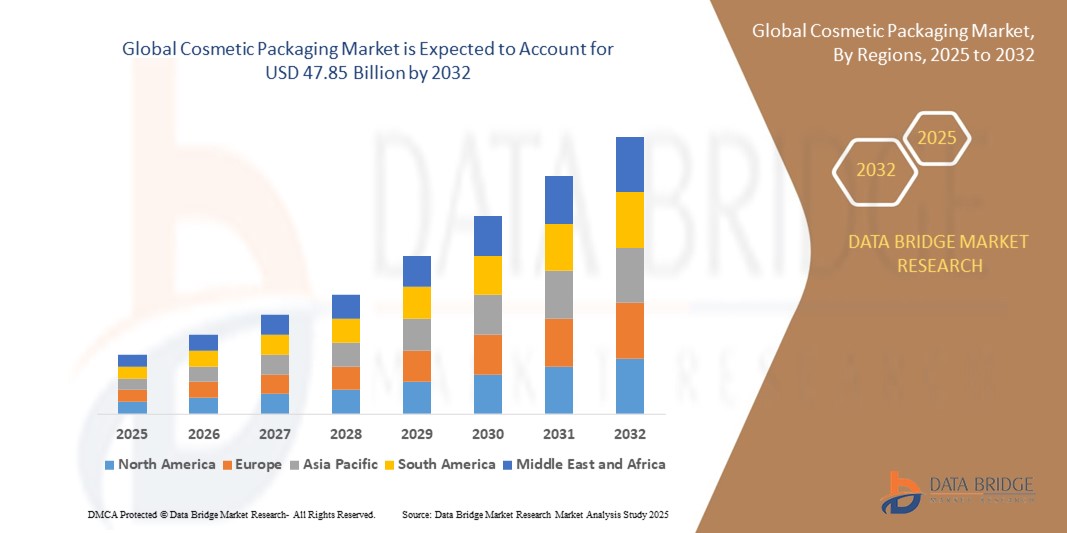

- The global cosmetic packaging market was valued at USD 34.17 billion in 2024 and is expected to reach USD 47.85 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.3%, primarily driven by the rising demand for sustainable and innovative packaging solutions

- This growth is driven by factors such as increasing consumer preference for eco-friendly packaging, the rising popularity of premium beauty products, and advancements in packaging technology

Cosmetic Packaging Market Analysis

- Cosmetic packaging plays a crucial role in the beauty and personal care industry, serving both functional and aesthetic purposes. It helps protect products from contamination and degradation while enhancing their visual appeal and brand identity

- The demand for innovative and sustainable packaging is significantly driven by the increasing consumer preference for eco-friendly materials, growing awareness of plastic waste reduction, and rising demand for premium and luxury beauty products. Over half of the global demand is driven by the skincare and makeup segments, where packaging plays a vital role in brand differentiation

- The North America region stands out as one of the dominant markets for cosmetic packaging, driven by its strong beauty and personal care industry, high disposable income, and growing consumer demand for sustainable and innovative packaging solutions

- For instance, GEKA's innovative launch! GEKA has introduced the first-ever formulation-compliant recycled polypropylene (PCR PP) material suitable for cosmetic packaging. This breakthrough material offers exceptional color brilliance, maintains visual effects, and reduces CO2 emissions by 75% compared to virgin materials. It is optimized for use in cosmetic packaging, meeting stringent international standards for safety and sustainability

- Globally, cosmetic packaging ranks among the most critical components in the beauty and personal care industry, with innovations in smart packaging, airless pumps, and lightweight materials playing a pivotal role in enhancing product longevity, ease of use, and environmental sustainability

Report Scope and Cosmetic Packaging Market Segmentation

|

Attributes |

Cosmetic Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetic Packaging Market Trends

“Increased Adoption of Smart Packaging and Digital Integration”

- One prominent trend in the global cosmetic packaging market is the growing adoption of smart packaging and digital integration

- These advanced features enhance consumer engagement and brand differentiation by incorporating interactive elements, such as QR codes, NFC technology, and augmented reality, into packaging solutions

- For instance, Meiyume's NFC-enabled smart packaging! This innovative technology is designed to enhance personalization for brands by integrating NFC (Near Field Communication) into their packaging. It allows consumers to interact with products in unique ways, such as accessing additional information, verifying authenticity, or even customizing their experience. This approach not only combats counterfeiting but also strengthens brand-consumer connections

- Digital integration also allows for better supply chain tracking, real-time inventory management, and increased transparency regarding product sourcing and sustainability efforts

- This trend is transforming the cosmetic packaging industry, boosting brand loyalty and increasing the demand for technologically advanced and eco-friendly packaging solutions in the market

Cosmetic Packaging Market Dynamics

Driver

“Growing Demand Driven by Sustainability and Consumer Preferences”

- The increasing demand for sustainable packaging solutions in the cosmetics industry is significantly contributing to the growth of the cosmetic packaging market

- As consumers become more environmentally conscious, there is a rising preference for eco-friendly packaging materials, such as biodegradable plastics, refillable containers, and recyclable materials, prompting brands to innovate their packaging designs

- Governments and regulatory bodies worldwide are implementing stricter environmental regulations, further encouraging cosmetic brands to adopt sustainable packaging alternatives.

- The ongoing advancements in packaging technology emphasize the need for lightweight, durable, and aesthetically appealing solutions that align with both sustainability goals and evolving consumer expectations

- As more brands shift toward green and minimal-waste packaging, the demand for innovative, sustainable cosmetic packaging continues to rise, ensuring reduced environmental impact and enhanced brand value

For instance,

- In March 2024, GEKA, Medmix's beauty brand, introduced a new sustainable material made from at least 95% recycled PP plastic, demonstrating the industry's move toward eco-friendly packaging solutions

- In August 2023, Alder Packaging established a strategic partnership with WWP Beauty, creating a direct factory pipeline for sustainable innovation, further supporting the company's expansion in the cosmetic packaging market

- As a result of the rising consumer preference for sustainable and eco-conscious packaging, there is a significant increase in demand for biodegradable, refillable, and recyclable cosmetic packaging solutions

Opportunity

“Transforming Cosmetic Packaging with Smart and AI-Driven Innovations”

- AI-powered cosmetic packaging solutions are revolutionizing the industry by enhancing consumer engagement, personalization, and sustainability, enabling brands to offer more interactive and efficient packaging options

- AI algorithms can analyze consumer preferences and trends, allowing brands to create customized packaging designs that resonate with their target audience while optimizing material usage for eco-friendly solutions

- Additionally, smart packaging integrated with AI can provide real-time product authentication, prevent counterfeiting, and track product freshness, enhancing brand trust and transparency

For instance,

- In February 2024, according to an article published in the Journal of Sustainable Packaging, AI-driven material selection tools help cosmetic brands choose sustainable packaging alternatives by analyzing factors such as recyclability, biodegradability, and carbon footprint, ensuring compliance with global environmental regulations

- In October 2023, according to an article published in the International Journal of Beauty Tech, AI-based customization platforms enable brands to offer personalized beauty packaging, allowing consumers to tailor designs, colors, and labeling through augmented reality (AR) applications, creating an immersive shopping experience

- The integration of AI in cosmetic packaging can also lead to increased efficiency, reduced waste, and enhanced consumer satisfaction. By leveraging AI-powered design and analytics, brands can streamline packaging development, minimize production costs, and cater to evolving sustainability demands

Restraint/Challenge

“High Production Costs Hindering Market Expansion”

- The high cost of production and raw materials in cosmetic packaging poses a significant challenge for the market, particularly impacting small and mid-sized beauty brands that aim to adopt sustainable and innovative packaging solutions

- Advanced eco-friendly packaging materials, such as biodegradable plastics, refillable containers, and smart packaging technologies, often come with higher manufacturing costs, making them less accessible to brands with limited budgets

- This substantial financial barrier can deter brands from transitioning to sustainable alternatives, leading some companies to continue using traditional plastic packaging due to its lower cost and wider availability

For instance,

- In December 2024, according to an article published by the Global Packaging Industry Report, one of the primary concerns surrounding the high cost of sustainable packaging is its impact on profit margins. The premium pricing of biodegradable materials and advanced printing technologies makes it difficult for brands to balance cost-efficiency with environmental responsibility, thereby slowing the adoption of green packaging solutions

- As a result, such limitations can lead to disparities in access to innovative and eco-friendly packaging, hindering the market’s overall growth and slowing the transition toward sustainable packaging practices

Cosmetic Packaging Market Scope

The market is segmented on the basis type, capacity, material, application, material source, product type, and cosmetic type.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Capacity |

|

|

By Material |

|

|

By Application |

|

|

By Material Type |

|

|

By Product Type |

|

|

By Cosmetic Type |

|

Cosmetic Packaging Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Global Cosmetic Packaging Market”

- Asia-Pacific dominates the global cosmetic packaging market, driven by a rapidly growing beauty and personal care industry, increasing consumer demand for sustainable packaging solutions, and the rising influence of e-commerce in emerging economies

- China and India hold significant shares due to expanding middle-class populations, rising disposable incomes, and a shift toward premium and eco-friendly cosmetic products

- The presence of key market players, continuous innovation in packaging materials, and advancements in smart and biodegradable packaging solutions further strengthen market growth

- The increasing demand for customized and aesthetically appealing packaging, coupled with the growing preference for lightweight and recyclable materials, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global cosmetic packaging market, driven by the increasing demand for beauty and personal care products, rising disposable incomes, and a growing preference for sustainable packaging solutions

- Countries such as China, India, and South Korea are emerging as key markets due to the rapid expansion of the cosmetics industry, fueled by urbanization, changing consumer lifestyles, and the rising influence of global beauty trends

- South Korea, known for its innovation in skincare and beauty packaging, remains a crucial market, leading in the adoption of premium, eco-friendly, and technologically advanced packaging solutions

- China and India, with their large consumer bases and booming e-commerce sectors, are witnessing increased investments from international and domestic cosmetic brands. The expanding presence of packaging manufacturers, along with advancements in biodegradable, refillable, and smart packaging technologies, is further contributing to market growth

Cosmetic Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Albea S.A. (France)

- Amcor PLC (Switzerland)

- DS Smith PLC (U.K.)

- RPC Group Plc (Berry Global Group) (U.S.)

- HCP Packaging (China)

- Silgan Holdings, Inc. (U.S.)

- Graham Packaging (U.S.)

- Libo Cosmetics Company (Taiwan)

- AptarGroup, Inc. (U.S.)

- Cosmopak Ltd. (U.K.)

- Quadpack Industries SA (Spain)

- Rieke Corporation (U.S.)

- Gerresheimer AG (Germany)

- Raepak Ltd (U.K.)

- Ball Corporation (U.S.)

- Verescence France (France)

- SKS Bottles & Packaging, Inc. (U.S.)

- Altium Packaging (Loews Corporation) (U.S.)

Latest Developments in Global Cosmetic Packaging Market

- In March 2024, GEKA, the beauty brand of Medmix, launched a new sustainable material for cosmetics. Developed in collaboration with its long-term partner WIS-Kunststoffe, the material consists of at least 95% recycled PP plastic and is odorless. It has undergone rigorous testing to meet multiple international standards for the cosmetic and food production industries

- In August 2023, Alder Packaging, a provider of sustainable beauty packaging solutions, formed a collaborative partnership with the new WWP Beauty. This strategic alliance established a direct factory pipeline for sustainable innovation, enhancing Alder's expanding customer base and supporting its future growth in the cosmetic packaging market

- In February 2021, Silgan Holdings announced the acquisition of Cobra Plastics Inc. By integrating Cobra's overcap product line with its aerosol actuators and dispensing systems, Silgan aims to provide a broader range of integrated solutions to meet the unique needs of its clients

- In January 2021, Albéa announced the opening of a new manufacturing facility in Huai'an, China. The inauguration ceremony was attended by local government authorities and Albéa leaders. This facility will serve as the company's new production site for metal parts used in cosmetic and skincare packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cosmetic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cosmetic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cosmetic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.