Global Cosmetic Skin Care Market

Market Size in USD Million

CAGR :

%

USD

642.10 Million

USD

105,472.00 Million

2024

2032

USD

642.10 Million

USD

105,472.00 Million

2024

2032

| 2025 –2032 | |

| USD 642.10 Million | |

| USD 105,472.00 Million | |

|

|

|

|

Cosmetic Skin Care Market Size

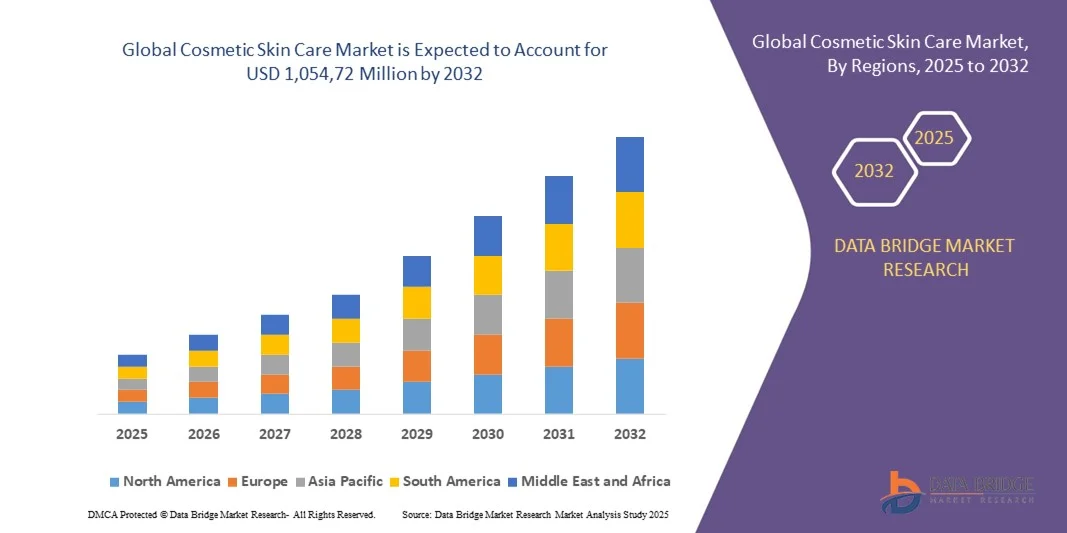

- The global cosmetic skin care market size was valued at USD 642.10 million in 2024 and is expected to reach USD 1,054,72 million by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fuelled by rising consumer awareness about skin health, increasing demand for anti-aging and multifunctional products, and the growing influence of social media and beauty influencers

- Continuous innovation in formulations, adoption of natural and organic ingredients, and expansion of e-commerce platforms are further driving market penetration

Cosmetic Skin Care Market Analysis

- The market is witnessing significant innovation in product offerings, including serums, creams, masks, and lotions with multifunctional benefit

- Rising preference for natural, organic, and cruelty-free products is shaping consumer purchasing behavior and influencing product development

- North America dominated the cosmetic skin care market with the largest revenue share of 35.4% in 2024, driven by high consumer awareness regarding skin health, increasing demand for premium and anti-aging products, and widespread adoption of e-commerce and online retail channels

- Asia-Pacific region is expected to witness the highest growth rate in the global cosmetic skin care market, driven by increasing urbanization, expanding middle-class population, and rapid adoption of modern beauty and wellness trends. Countries such as China, Japan, and South Korea are witnessing strong demand for anti-aging, skin brightening, and multifunctional products

- The Skin and Sun Care Products segment held the largest market revenue share in 2024, driven by increasing awareness of skin health, rising adoption of anti-aging and sun protection products, and the growing preference for natural and multifunctional formulations. Consumers are increasingly seeking products that offer dermatologically tested and chemical-free benefits

Report Scope and Cosmetic Skin Care Market Segmentation

|

Attributes |

Cosmetic Skin Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetic Skin Care Market Trends

Rising Demand for Natural and Anti-Aging Products

- The growing preference for natural, organic, and anti-aging skin care products is transforming the cosmetic skin care market by driving innovation in formulations and ingredients. Consumers are increasingly seeking chemical-free, dermatologically tested, and multifunctional products that improve skin health while addressing aging concerns. The rise of clean-label certifications and sustainable sourcing is further boosting confidence in these products

- The popularity of personalized and premium skin care routines is accelerating the adoption of serums, creams, masks, and toners tailored to individual skin types. E-commerce and direct-to-consumer channels further enable easy access to diverse product offerings, expanding market reach. Influencer-led campaigns and targeted social media marketing are also enhancing brand visibility and product trial

- The affordability and availability of natural and multifunctional products are encouraging frequent usage and experimentation, particularly among millennials and urban populations. Subscription-based beauty boxes and bundled offers are motivating consumers to try new products regularly. Rising awareness of skin health benefits is supporting adoption across different age groups and skin types

- For instance, in 2023, several online cosmetic retailers reported strong sales of organic face serums and anti-aging creams, reflecting growing consumer trust in natural and scientifically formulated products. Retailers also noted an increase in repeat purchases for cruelty-free and vegan-certified products. The trend indicates an expanding market for products combining efficacy with ethical and sustainable practices

- While the trend toward natural and anti-aging solutions is strong, sustained growth depends on product efficacy, innovative delivery mechanisms, and competitive pricing to attract a broad consumer base. Companies are also investing in research for multifunctional products that offer hydration, anti-aging, and sun protection in one formula. Consumer education and transparent labeling remain key for adoption in emerging markets

Cosmetic Skin Care Market Dynamics

Driver

Increasing Awareness About Skin Health and Wellness

- Rising consumer awareness about skin health, sun protection, and anti-aging benefits is encouraging higher spending on cosmetic skin care products across all age groups. Consumers are actively seeking products that combine safety, effectiveness, and added skin benefits. Urbanization and changing lifestyles are further accelerating the adoption of advanced skin care routines

- The influence of social media, beauty influencers, and dermatologists has amplified consumer education on ingredient safety, product efficacy, and brand trust. This awareness is boosting demand for premium and natural products globally. In addition, virtual consultations and digital skincare tools are helping consumers make informed product choices

- For instance, in 2022, a survey across the U.S., U.K., and Germany indicated that over 70% of consumers preferred skin care products with natural extracts and clinically tested benefits over conventional cosmetic products. Retailers also observed a surge in demand for multifunctional products and personalized skincare regimens. Education on anti-pollution and UV-protection products has become a critical factor in purchase decisions

- The rising focus on wellness and self-care routines is promoting repeat purchases and the adoption of multifunctional and anti-aging formulations. Growing disposable incomes and health-conscious lifestyles are contributing to higher per capita spending on skin care. Wellness-driven marketing campaigns highlighting holistic beauty benefits are accelerating product adoption

- The expansion of cosmetic clinics and wellness centers further complements the market by offering professional-grade products to consumers seeking advanced skin care solutions. Clinics are increasingly recommending home-use products alongside professional treatments, creating cross-selling opportunities. Consumer trust in clinically approved products is supporting growth across premium and niche segments

Restraint/Challenge

High Cost of Premium Products and Regulatory Compliance

- The premium cosmetic skin care segment faces high pricing, which limits accessibility among price-sensitive consumers, particularly in developing regions. Consumers may opt for low-cost alternatives, restricting market penetration despite strong demand for high-quality products. Seasonal promotions and discounts partially mitigate affordability concerns

- Stringent regulations related to ingredient safety, product testing, and labeling across global markets increase the cost and time required for product launches. Compliance with FDA, EU, and other international standards is resource-intensive and can delay new product introductions. Companies must also navigate country-specific restrictions on active ingredients and preservatives

- For instance, several U.S.- and Europe-based cosmetic manufacturers faced delays exceeding 12 months in obtaining approvals for innovative anti-aging formulations containing novel plant extracts. Product reformulations to meet regulatory standards also impact profitability and time-to-market. Global supply chains must adhere to stringent quality audits, increasing operational complexity

- Supply chain constraints for natural and high-quality ingredients, coupled with fluctuating raw material costs, further challenge product affordability and consistent availability. Disruptions due to seasonal scarcity or geopolitical factors can impact production timelines. Companies are exploring synthetic alternatives or blended formulations to stabilize supply without compromising product quality

- To overcome these barriers, companies are focusing on cost-efficient sourcing, scalable production, and tiered pricing strategies to expand reach while maintaining product quality and regulatory compliance. Partnerships with local suppliers and technology-driven manufacturing processes are being adopted to ensure consistent quality. Educating consumers about product value and efficacy is crucial for maintaining loyalty despite higher prices

Cosmetic Skin Care Market Scope

The market is segmented on the basis of category, gender, application, and distribution channel.

- By Category

On the basis of category, the cosmetic skin care market is segmented into Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, and Makeup and Color Cosmetics. The Skin and Sun Care Products segment held the largest market revenue share in 2024, driven by increasing awareness of skin health, rising adoption of anti-aging and sun protection products, and the growing preference for natural and multifunctional formulations. Consumers are increasingly seeking products that offer dermatologically tested and chemical-free benefits.

The Hair Care Products segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for natural, nourishing, and damage-repair formulations, coupled with the convenience of ready-to-use products. Hair care products are particularly popular among urban consumers seeking to address hair health, scalp issues, and styling needs, making this segment a high-growth area within the market.

- By Gender

On the basis of gender, the market is segmented into Men, Women, and Unisex. The Women’s segment held the largest revenue share in 2024, fueled by higher awareness of skin and hair care routines, the adoption of premium products, and active engagement with beauty trends via social media and influencers. Women are increasingly seeking multifunctional and natural products, contributing to consistent market growth.

The Men’s segment is expected to witness the fastest growth rate from 2025 to 2032, driven by a growing focus on male grooming, personal care awareness, and the introduction of specialized products catering to men’s skincare, hair care, and fragrance needs. Male consumers are increasingly experimenting with anti-aging and premium formulations.

- By Application

On the basis of application, the cosmetic skin care market is segmented into Flakiness Reduction, Stem Cells Protection Against UV, Rehydrate the Skin’s Surface, Minimize Wrinkles, Increase the Viscosity of Aqueous, and Others. The Rehydrate the Skin’s Surface segment held the largest market revenue share in 2024, driven by high demand for moisturizers, serums, and hydrating products that maintain skin elasticity and prevent dryness.

The Minimize Wrinkles segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer interest in anti-aging solutions, the popularity of serums and creams with clinically proven efficacy, and the growing adoption of multifunctional products that combine hydration, UV protection, and wrinkle reduction.

- By Distribution Channel

On the basis of distribution, the cosmetic skin care market is segmented into Hypermarkets/Supermarkets, Specialty Stores, Pharmacies, Online Sales Channels, and Others. Hypermarkets/Supermarkets held the largest market revenue share in 2024, driven by the wide availability of products, in-store promotions, and the convenience of one-stop shopping for multiple brands. Consumers prefer physical stores for product trial, immediate purchase, and expert guidance, contributing to steady sales.

The Online Sales Channels segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the convenience of home delivery, competitive pricing, easy product comparison, and access to a wider range of domestic and international brands. E-commerce platforms also offer personalized recommendations, subscription options, and targeted promotions, appealing to tech-savvy urban and semi-urban consumers and driving frequent purchases.

Cosmetic Skin Care Market Regional Analysis

- North America dominated the cosmetic skin care market with the largest revenue share of 35.4% in 2024, driven by high consumer awareness regarding skin health, increasing demand for premium and anti-aging products, and widespread adoption of e-commerce and online retail channels

- Consumers in the region prioritize quality, safety, and multifunctional benefits, seeking dermatologically tested products that cater to diverse skin types and concerns

- This widespread adoption is further supported by high disposable incomes, strong presence of global brands, and a growing inclination toward self-care and wellness routines, establishing cosmetic skin care as a high-growth segment in both urban and semi-urban areas

U.S. Cosmetic Skin Care Market Insight

The U.S. cosmetic skin care market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of premium, natural, and anti-aging products. Consumers increasingly prefer personalized skin care routines, including serums, creams, and multifunctional formulations. The robust e-commerce ecosystem, coupled with rising awareness through social media and influencer marketing, further drives product experimentation and frequent purchases. Moreover, increasing integration of dermatology-backed products and clinical testing enhances consumer trust, propelling market expansion.

Europe Cosmetic Skin Care Market Insight

The Europe cosmetic skin care market is expected to witness the fastest growth rate from 2025 to 2032 primarily driven by the demand for natural, organic, and sustainably sourced products. Rising urbanization and growing awareness of skin health and anti-aging benefits are encouraging adoption across residential and professional settings. The region is witnessing notable growth in premium skin care, with increasing purchases in specialty stores, pharmacies, and online channels. Consumers are also drawn to eco-friendly packaging and cruelty-free products, boosting the overall market growth.

U.K. Cosmetic Skin Care Market Insight

The U.K. cosmetic skin care market is expected to witness the fastest growth rate from 2025 to 2032, driven by heightened consumer focus on personal care, wellness, and natural ingredients. Concerns about skin sensitivity, aging, and UV protection are encouraging consumers to adopt dermatologically tested and chemical-free products. The country’s strong retail infrastructure, growing online sales, and the influence of beauty influencers and clinical endorsements are expected to continue fueling market growth.

Germany Cosmetic Skin Care Market Insight

The Germany cosmetic skin care market is expected to witness the fastest growth rate from 2025 to 2032, fueled by consumer preference for anti-aging, natural, and multifunctional products. Rising awareness about skin wellness and the benefits of premium formulations is driving demand across both retail and professional channels. Germany’s well-developed distribution network, along with the availability of dermatologically tested and sustainable products, supports consistent adoption. Integration of advanced skin care technologies, such as serums and stem cell-based formulations, is further propelling market growth.

Asia-Pacific Cosmetic Skin Care Market Insight

The Asia-Pacific cosmetic skin care market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and growing awareness of premium and multifunctional skin care products in countries such as China, Japan, and India. The region’s expanding e-commerce landscape, coupled with a rising middle-class population and government campaigns promoting personal care, is boosting product adoption. In addition, local manufacturing hubs and competitive pricing are making cosmetic skin care products increasingly accessible to a broader consumer base.

Japan Cosmetic Skin Care Market Insight

The Japan cosmetic skin care market is expected to witness the fastest growth rate from 2025 to 2032 due to high consumer interest in anti-aging, natural, and technologically advanced skin care products. Consumers are adopting multifunctional products that combine hydration, UV protection, and wrinkle reduction. The country’s tech-savvy population, coupled with rising e-commerce penetration and an emphasis on self-care, is fueling demand. Furthermore, Japan’s aging demographic is increasing the need for products that offer convenient, effective, and safe skin care solutions for both men and women.

China Cosmetic Skin Care Market Insight

The China cosmetic skin care market accounted for the largest revenue share in Asia Pacific in 2024, driven by growing urban populations, increasing disposable incomes, and high consumer awareness of skin care and anti-aging benefits. Rising demand for premium, natural, and multifunctional products is prominent in both e-commerce and offline retail channels. The development of local cosmetic brands, coupled with government initiatives promoting skin health awareness, is further contributing to the market expansion. Growing interest in personalized and dermatologist-backed formulations is also accelerating adoption across residential and professional segments.

Cosmetic Skin Care Market Share

The Cosmetic Skin Care industry is primarily led by well-established companies, including:

- L'Oréal (France)

- Unilever (U.K.)

- New Avon Company (U.S.)

- Estée Lauder Companies (U.S.)

- Espa (U.K.)

- THE BODY SHOP INTERNATIONAL LIMITED (U.K.)

- Shiseido Co., Ltd. (Japan)

- Coty Inc. (U.S.)

- Bo International (India)

- A One Cosmetics Products (India)

- Lancôme (France)

- Clinique Laboratories, LLC (U.S.)

- Galderma Laboratories, L.P. (Switzerland)

- AVON Beauty Products India Pvt Ltd (India)

- Nutriglow Cosmetics Pvt. Ltd. (India)

- Shree Cosmetics Ltd (India)

- Kao Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Procter & Gamble (U.S.)

- Beiersdorf (Germany)

Latest Developments in Global Cosmetic Skin Care Market

- In January 2022, L'Oréal and Verily forged a strategic partnership focused exclusively on beauty, aiming to enhance skin health. This innovative collaboration will launch two key initiatives that delve into the mechanisms of skin and hair aging. The partnership aims to guide L'Oréal’s precision beauty technology strategy and product development, marking a significant step in combining scientific research with beauty industry advancements

- In January 2022, Procter & Gamble made a strategic acquisition of Tula, a luxury skincare brand renowned for its clean beauty approach. Tula harnesses the power of probiotic extracts and superfoods to create products that enhance skin balance, soothe irritation, and boost hydration. As part of the deal, P&G Beauty will support Tula’s growth initiatives, driving innovation and expanding its product offerings in the skincare market

- In December 2021, L'Oréal S.A. announced the acquisition of 'Youth to the People,' a California-based skincare company known for its high-performance, vegan formulations. Youth to the People focuses on utilizing premium superfood extracts combined with scientific advancements to deliver effective skincare solutions. This acquisition enhances L'Oréal's portfolio, allowing it to expand into the clean beauty sector while leveraging Youth to the People's innovative approach to skincare

- In July 2021, Shiseido Co. Ltd. launched the ULTIMUNE Power Infusing Concentrate III in Japan, rejuvenating its iconic serum. This enhanced formulation, designed to strengthen skin's defenses against aging and environmental stressors, will be available in approximately 380 retail stores across the country and on the beauty website watashi+. This product renewal reflects Shiseido’s commitment to delivering advanced skincare solutions that cater to evolving consumer needs

- In June 2021, Beiersdorf AG’s NX NIVEA Accelerator program expanded into China, selecting five promising startups for collaboration in Shanghai. The initiative includes a partnership with Tmall, China’s leading e-commerce platform. By focusing on beauty technology, personalization, and innovative platform business models, Beiersdorf aims to leverage high digitalization levels in the beauty industry, fostering the growth of indie brands and enhancing consumer engagement

- In June 2021, Procter & Gamble introduced GoodSkin MD, its skincare line, to CVS Pharmacy’s physical and online stores. The product lineup includes six offerings, featuring sunscreen, vitamin C and B serums, a nourishing night cream, a restorative rescue cream, and a gentle cleanser. This launch reflects P&G’s strategy to meet diverse skincare needs, combining science-backed formulations with convenience for consumers seeking effective solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.