Global Cosmetics And Personal Care Packaging Equipment Market

Market Size in USD Billion

CAGR :

%

USD

5.30 Billion

USD

8.07 Billion

2025

2033

USD

5.30 Billion

USD

8.07 Billion

2025

2033

| 2026 –2033 | |

| USD 5.30 Billion | |

| USD 8.07 Billion | |

|

|

|

|

Cosmetics and Personal Care Packaging Equipment Market Size

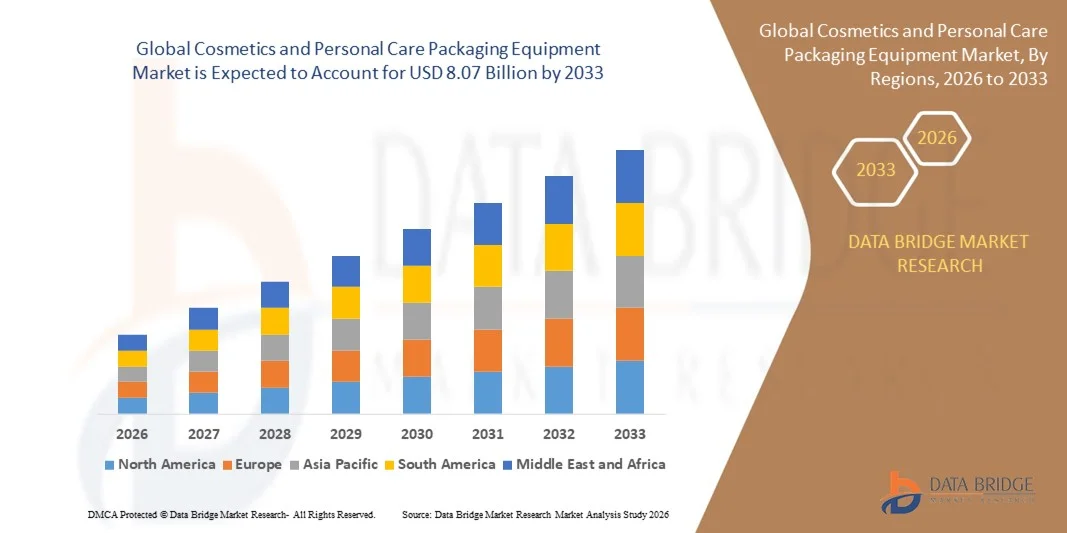

- The global cosmetics and personal care packaging equipment market size was valued at USD 5.30 billion in 2025 and is expected to reach USD 8.07 billion by 2033, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the increasing automation and technological advancements in the cosmetics and personal care manufacturing sector, leading to higher adoption of efficient and precision-based packaging equipment across production lines. Rising demand for premium, hygienic, and aesthetically appealing packaging solutions is also driving manufacturers to invest in advanced machinery that enhances productivity and quality control

- Furthermore, the growing emphasis on sustainable and eco-friendly packaging materials is prompting equipment manufacturers to develop solutions compatible with biodegradable and recyclable components. These converging factors are accelerating the adoption of innovative, flexible, and energy-efficient packaging technologies, thereby significantly boosting the cosmetics and personal care packaging equipment market growth

Cosmetics and Personal Care Packaging Equipment Market Analysis

- Cosmetics and personal care packaging equipment, encompassing filling, labeling, cartoning, and sealing systems, play a crucial role in maintaining product integrity, visual appeal, and compliance with industry standards. Their application ensures precision in handling diverse formulations such as creams, serums, perfumes, and makeup, enabling manufacturers to meet increasing consumer expectations for both quality and sustainability

- The escalating demand for automation, coupled with the expansion of the global beauty and personal care industry, is fueling market growth. Manufacturers are prioritizing technologically advanced packaging lines that offer faster production rates, reduced operational waste, and compatibility with smart control systems, reinforcing the market’s transition toward sustainable, high-efficiency production environments

- Asia-Pacific dominated the cosmetics and personal care packaging equipment market with a share of 38.6% in 2025, due to expanding cosmetics manufacturing, growing consumer demand for premium personal care products, and the region’s strong presence of packaging machinery producers

- North America is expected to be the fastest growing region in the cosmetics and personal care packaging equipment market during the forecast period due to the rising demand for customized and sustainable packaging across beauty and personal care products

- Filling segment dominated the market with a market share of 39.4% in 2025, due to its indispensable role in accurately dispensing a wide variety of cosmetic formulations, from lotions and creams to serums and perfumes. Manufacturers prioritize advanced filling equipment due to its precision, reduced material wastage, and compatibility with automated production lines. The rising demand for sustainable and airless packaging solutions has further increased the adoption of modern filling systems that maintain product integrity and extend shelf life. In addition, major players are integrating digital controls and real-time monitoring technologies into filling equipment to enhance operational efficiency and product consistency across batches

Report Scope and Cosmetics and Personal Care Packaging Equipment Market Segmentation

|

Attributes |

Cosmetics and Personal Care Packaging Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetics and Personal Care Packaging Equipment Market Trends

Integration of Smart and Automated Packaging Technologies

- The cosmetics and personal care packaging equipment market is experiencing strong growth with the integration of smart and automated packaging technologies designed to enhance efficiency, precision, and product differentiation. Automated systems are streamlining tasks such as filling, capping, labeling, and sealing, enabling faster production cycles and improved quality consistency essential for premium cosmetic brands

- For instance, ProMach, Inc. introduced its integrated automated packaging lines that feature robotics and real-time monitoring functionalities, allowing cosmetic manufacturers to reduce human intervention and enhance line productivity. Such advancements are enabling companies to maintain high-volume production while meeting aesthetic and hygiene standards demanded by global beauty brands

- Smart packaging equipment equipped with sensors and IoT connectivity enables real-time tracking, predictive maintenance, and automated quality control. These systems help minimize downtime, detect packaging defects early, and ensure compliance with stringent cosmetic industry safety regulations

- The rising need for personalized cosmetics and packaging diversity has further encouraged the adoption of flexible, modular automation systems. These allow quick format changes and adaptation to various package sizes, shapes, and materials, ensuring manufacturers meet consumer demand for variety and design innovation

- In addition, automation supports sustainability by improving material utilization and reducing waste through precise dosage control and optimized resource use. Many manufacturers are deploying smart monitoring software to track energy consumption and reduce the environmental impact of production lines

- The integration of smart technologies such as robotics, AI-based inspection, and digital monitoring is transforming cosmetics packaging efficiency and design capabilities worldwide. As the industry continues to move toward data-driven production and intelligent packaging lines, the role of automation is becoming central to competitiveness and quality assurance in beauty and personal care manufacturing

Cosmetics and Personal Care Packaging Equipment Market Dynamics

Driver

Rising Demand for Sustainable and Eco-Friendly Packaging Solutions

- Growing consumer preference for eco-friendly and sustainable cosmetics packaging is a major driver boosting equipment modernization across production facilities. Manufacturers are investing in advanced machinery capable of handling recyclable, biodegradable, and lightweight packaging materials while maintaining product aesthetics and structural integrity

- For instance, Marchesini Group introduced packaging systems specifically designed for sustainable materials such as paperboard and glass alternatives. The company’s innovation supports brands aiming to reduce plastic use in skincare and personal care packaging while complying with environmental labeling policies in Europe and North America

- Consumer awareness of environmental impact, coupled with global regulations restricting single-use plastics, is accelerating the shift toward compostable and recyclable packaging formats. Equipment manufacturers are responding with adaptable machinery capable of processing novel materials without compromising efficiency or design precision

- The trend toward refillable and reusable packaging formats is also reshaping the cosmetics manufacturing landscape. Companies are upgrading equipment lines to accommodate refill cartridges, modular dispensers, and other eco-conscious product formats that align with circular economy goals

- The ongoing transformation toward sustainable packaging innovations is fueling consistent upgrades in packaging equipment globally. As brands strive to meet consumer and regulatory expectations, eco-friendly capabilities will remain a fundamental factor driving demand for advanced cosmetics packaging machinery

Restraint/Challenge

High Initial Investment and Maintenance Costs of Advanced Equipment

- The high capital expenditure required for advanced and automated packaging equipment represents a significant restraint for small and mid-sized cosmetics manufacturers. These systems involve complex mechanical, electronic, and digital components, resulting in elevated procurement and installation costs compared to conventional machinery

- For instance, companies such as Bosch Packaging Technology and IMA S.p.A. have launched high-precision robotic lines that require substantial investment in infrastructure and technical expertise. Many emerging cosmetics brands find it challenging to adopt such systems due to limited financial resources and long payback periods

- Regular maintenance and the need for skilled technicians further increase operational costs. Automated equipment requires specialized servicing and software updates to ensure optimal functionality and data security, adding to the long-term cost burden for manufacturers

- The complexity of integrating smart technologies with existing production lines can also lead to operational downtime during installation and calibration. This poses a risk for companies operating under tight production schedules, particularly in fast-moving consumer goods segments such as cosmetics and skincare

- Addressing these challenges involves promoting modular system designs, leasing options, and government incentives for technological adoption. Collaborative financing programs and scalable automation solutions are expected to enhance accessibility and reduce financial barriers, enabling broader market participation in advanced packaging technologies over time

Cosmetics and Personal Care Packaging Equipment Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the cosmetics and personal care packaging equipment market is segmented into filling, labeling, cleaning, form-fill-seal, cartoning, wrapping, and palletizing. The filling segment dominated the market with the largest revenue share 39.4% in 2025, driven by its indispensable role in accurately dispensing a wide variety of cosmetic formulations, from lotions and creams to serums and perfumes. Manufacturers prioritize advanced filling equipment due to its precision, reduced material wastage, and compatibility with automated production lines. The rising demand for sustainable and airless packaging solutions has further increased the adoption of modern filling systems that maintain product integrity and extend shelf life. In addition, major players are integrating digital controls and real-time monitoring technologies into filling equipment to enhance operational efficiency and product consistency across batches.

The labeling segment is projected to witness the fastest growth rate from 2026 to 2033, propelled by the rising importance of brand differentiation and regulatory compliance in cosmetic packaging. Labeling equipment is increasingly utilized for applying high-quality, customizable labels that convey brand identity while meeting international packaging standards. The expansion of e-commerce and the trend toward personalized packaging are further encouraging investment in flexible, high-speed labeling machines. In addition, automation advancements and the incorporation of smart label technologies, such as QR codes and RFID, are enhancing traceability and consumer engagement, driving the segment’s accelerated growth.

- By Application

On the basis of application, the market is segmented into skin care, hair care, decorative cosmetics, bath and shower, perfumes, and other applications. The skin care segment dominated the market in 2025, owing to the rapidly expanding global skincare industry and the growing consumer focus on health-conscious and premium products. Skin care brands heavily invest in packaging automation to ensure precision filling, contamination-free sealing, and appealing presentation of creams, serums, and lotions. The demand for hygienic and aesthetically pleasing packaging equipment is further fueled by the premiumization trend and the rising adoption of glass and recyclable containers. Moreover, increased production of multifunctional skincare products has driven manufacturers to adopt versatile equipment capable of handling various packaging formats efficiently.

The decorative cosmetics segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the surge in color cosmetics demand and frequent product launches by major brands. Equipment designed for compact powders, lipsticks, and foundations requires advanced precision to maintain texture, color accuracy, and shelf stability, making automation a key investment focus. The growing influence of social media marketing and seasonal product variations has increased the need for agile, small-batch production lines with quick changeover capabilities. Furthermore, the adoption of eco-friendly packaging materials in decorative cosmetics has prompted manufacturers to innovate equipment compatible with recyclable and biodegradable packaging formats, fueling rapid segmental growth.

Cosmetics and Personal Care Packaging Equipment Market Regional Analysis

- Asia-Pacific dominated the cosmetics and personal care packaging equipment market with the largest revenue share of 38.6% in 2025, driven by expanding cosmetics manufacturing, growing consumer demand for premium personal care products, and the region’s strong presence of packaging machinery producers

- Rapid urbanization, increasing disposable incomes, and the popularity of e-commerce beauty sales are further stimulating equipment investments across skincare and haircare lines

- The region’s cost-efficient production landscape and continuous technological advancements in packaging automation are accelerating market expansion

China Cosmetics and Personal Care Packaging Equipment Market Insight

China held the largest share in the Asia-Pacific cosmetics and personal care packaging equipment market in 2025, attributed to its position as a global center for cosmetics manufacturing and packaging innovation. The presence of major domestic and international brands, along with government support for advanced manufacturing technologies, is driving equipment demand. Rising exports of skincare and makeup products, coupled with increased focus on sustainable packaging materials, are boosting the need for automated and efficient packaging systems across local facilities.

India Cosmetics and Personal Care Packaging Equipment Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by the rapidly expanding beauty and personal care sector and increasing investments by both multinational and regional brands. The growing middle-class population, rising influence of social media-driven beauty trends, and shift toward localized production are supporting equipment adoption. In addition, initiatives promoting manufacturing modernization and eco-friendly packaging solutions are further propelling market development in the country.

Europe Cosmetics and Personal Care Packaging Equipment Market Insight

The Europe market is expanding steadily, supported by the strong presence of global cosmetics brands, strict regulatory frameworks, and growing investments in sustainable and recyclable packaging technologies. European manufacturers emphasize precision, product safety, and sustainability, which is driving the adoption of advanced automated packaging equipment. Increasing focus on green materials, energy-efficient operations, and digital integration is further fostering equipment modernization across production lines.

Germany Cosmetics and Personal Care Packaging Equipment Market Insight

Germany’s cosmetics and personal care packaging equipment market is driven by its leadership in advanced machinery engineering and the strong presence of high-end cosmetics manufacturers. The country’s focus on innovation, coupled with automation excellence and export-oriented production, supports steady growth. Germany’s emphasis on sustainable machinery designs and smart packaging technologies is also strengthening its position as a key hub for packaging equipment development within Europe.

U.K. Cosmetics and Personal Care Packaging Equipment Market Insight

The U.K. market is supported by a robust cosmetics manufacturing base, growing emphasis on sustainability, and the localization of packaging supply chains. Investments in digitalized production lines, eco-conscious packaging formats, and flexible automation are enhancing operational efficiency across beauty brands. The country’s strong R&D ecosystem and continuous innovation in labeling, filling, and sealing technologies are further elevating its role in Europe’s personal care packaging landscape.

North America Cosmetics and Personal Care Packaging Equipment Market Insight

North America is projected to witness the fastest CAGR from 2026 to 2033, driven by the rising demand for customized and sustainable packaging across beauty and personal care products. The region’s established cosmetics industry, focus on automation, and adoption of smart manufacturing technologies are fueling market growth. Increasing consumer preference for high-quality, aesthetically designed packaging and the trend toward clean beauty are further stimulating equipment upgrades among manufacturers.

U.S. Cosmetics and Personal Care Packaging Equipment Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by the presence of leading cosmetics brands, advanced production facilities, and strong technological innovation in packaging automation. The shift toward eco-friendly packaging materials and integration of digital control systems is driving demand for next-generation equipment. Moreover, the country’s focus on enhancing production efficiency and reducing operational waste continues to position the U.S. as a major driver of regional market growth.

Cosmetics and Personal Care Packaging Equipment Market Share

The cosmetics and personal care packaging equipment industry is primarily led by well-established companies, including:

- Marchesini Group S.p.A. (Italy)

- Reagent Chemical (U.S.)

- I.M.A. Industria Macchine Automatiche S.p.A. (Italy)

- APACKS (U.S.)

- PackSys Global AG (Switzerland)

- TurboFil Packaging Machines, LLC (U.S.)

- VPack Technologies (India)

- Zhejiang Rigao Machinery Corp., Ltd. (China)

- Liquid Packaging Solutions, Inc. (U.S.)

- Turpack Packaging Machinery (Turkey)

- VK Engineering & Company (India)

- Filamatic (U.S.)

- MESPACK (Spain)

- Bosch Limited (Germany)

- Accutek Packaging Equipment Company, Inc. (U.S.)

- OPTIMA Packaging Group GmbH (Germany)

- E-PAK Machinery, Inc. (U.S.)

- Ronchi Mario S.p.A. (Italy)

- Sonoco Products Company (U.S.)

- Gerresheimer AG (Germany)

Latest Developments in Global Cosmetics and Personal Care Packaging Equipment Market

- In October 2024, IMA Group introduced a new generation of Smart Packaging Automation Systems tailored for cosmetics and personal care applications. This development enhances operational flexibility, enabling faster changeovers between product types and packaging formats. The introduction of this system is expected to strengthen automation adoption among manufacturers focusing on high-speed and precision packaging, driving market competitiveness and production efficiency

- In September 2024, Marchesini Group expanded its portfolio by unveiling a sustainable wrapping and cartoning line designed for eco-friendly packaging materials such as recyclable films and paper-based cartons. This innovation aligns with the global shift toward sustainability, encouraging cosmetic brands to adopt greener packaging solutions. The launch is anticipated to boost the market demand for environmentally responsible packaging equipment and reinforce Marchesini’s position in the premium cosmetics machinery segment

- In August 2024, Coesia Group announced the integration of AI-driven quality inspection systems across its cosmetic packaging machinery range. This advancement enhances accuracy in detecting packaging defects, ensuring consistent product presentation and minimizing material waste. The adoption of AI technologies is expected to accelerate smart manufacturing trends in the cosmetics and personal care packaging equipment market, promoting higher operational precision and efficiency

- In July 2024, ProSys Fill announced the launch of LB300 Lip Balm Filler, designed for high-volume and efficient manufacturing in cosmetics and personal care. This equipment provides enhanced speed, reduced product waste, and consistent filling accuracy, making it suitable for mass production of lip care products. The introduction strengthens ProSys Fill’s competitive positioning in the high-speed filling equipment segment of the market

- In June 2024, Syntegon acquired Azbil Telstar, a subsidiary of Azbil Corporation listed on the Tokyo Stock Exchange Prime Market. With production facilities in the U.K., China, and Spain, the acquisition broadens Syntegon’s global reach across life sciences, pharma, and personal care industries. This strategic move enhances Syntegon’s technological capabilities and market presence in Western Europe, India, and the U.S., thereby consolidating its position in the global packaging equipment landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cosmetics And Personal Care Packaging Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cosmetics And Personal Care Packaging Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cosmetics And Personal Care Packaging Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.