Global Cosmetics Market

Market Size in USD Billion

CAGR :

%

USD

301.20 Billion

USD

472.50 Billion

2025

2033

USD

301.20 Billion

USD

472.50 Billion

2025

2033

| 2026 –2033 | |

| USD 301.20 Billion | |

| USD 472.50 Billion | |

|

|

|

|

What is the Cosmetics Market Size and Growth Rate?

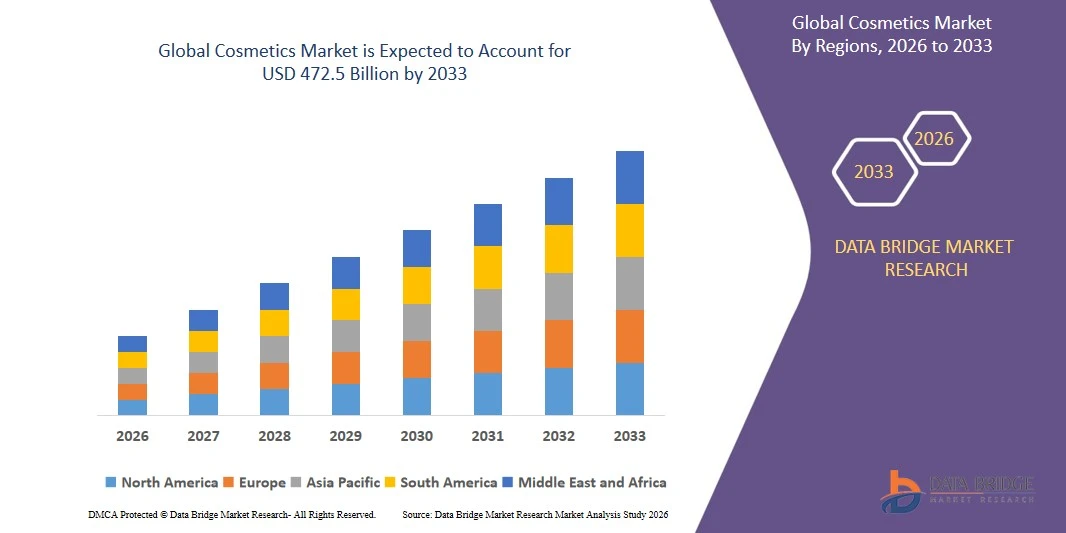

The global Cosmetics market size was valued at USD 301.2 billion in 2025 and is expected to reach USD 472.5 billion by 2033, at a CAGR of 5.80% during the forecast period. The market expansion is significantly driven by rising disposable incomes, growing beauty consciousness, and an increasing emphasis on personal grooming across both developed and emerging economies. In addition, the surge in digital engagement, influencer-driven marketing, and e-commerce platforms has fueled product accessibility and consumer awareness, thereby enhancing market penetration worldwide

Market Size and Forecast:

- Market Size (2025): USD 301.2 Billion

- Projected Market Size (2033): USD 472.5 Billion

- CAGR (2026-2033): 5.80%

What are the Major Takeaways of Cosmetics Market?

- Cosmetics have evolved from luxury items to everyday essentials, with consumers seeking multifunctional products that offer skincare benefits, UV protection, and long-lasting wear. This shift toward hybrid beauty solutions is reshaping product innovation

- The market is also witnessing strong growth in natural and organic formulations, aligned with rising concerns over ingredient safety, sustainability, and eco-friendly packaging

- The growing adoption of AI-based virtual try-ons, personalized beauty solutions, and gender-neutral cosmetics is further accelerating market momentum, especially among tech-savvy and Gen Z consumers

- Asia Pacific dominates the Cosmetics market with the largest revenue share of approximately 49.57% in 2024. This is driven by a large and diverse consumer base, increasing purchasing power, and a growing emphasis on personal grooming, particularly in countries such as China, India, and Japan

- North America Cosmetics market is projected to be the fastest-growing region with the highest CAGR throughout the forecast period. This growth is primarily driven by a strong emphasis on personal grooming, the introduction of advanced product variants, and the escalating demand for vegan and clean cosmetics

- The skin care segment dominated the market with the largest revenue share of 44.48% in 2024, attributed to rising consumer focus on skin health, anti-aging solutions, and daily skincare routin

Report Scope and Cosmetics Market Segmentation

|

Attributes |

Cosmetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cosmetics Markett?

Growing Preference for Natural, Sustainable, and Personalized Beauty

- A significant and accelerating trend in the global Cosmetics market is the increasing consumer demand for natural and organic products, aligning with a growing awareness of health and environmental concerns. This includes a rising preference for clean beauty formulations and sustainably sourced ingredients in both mass-market and premium segments

- For instance, In January 2025, L’Oréal launched its Botanica Naturals line under Garnier, focusing on biodegradable formulas and recyclable packaging. Estée Lauder also expanded its Origins line to include 100% organic-certified ingredients

- Another key trend is the growing adoption of personalized beauty solutions. This includes customized skincare regimens, personalized makeup formulations, and the use of technology to analyze individual skin types and preferences. The increasing availability of at-home beauty tech devices also contributes to this trend

- Furthermore, the influence of social media and beauty influencers continues to be a prominent trend in the Cosmetics market. Platforms such as Instagram, TikTok, and YouTube play a crucial role in shaping consumer preferences, driving trends, and facilitating direct-to-consumer sales

- The expansion of e-commerce channels is also significantly impacting the Cosmetics market, providing consumers with a wider range of options and easier access to various brands and product types. The online availability has further fueled the trend towards exploring niche brands and international beauty products

- This trend towards natural, sustainable, and personalized beauty is fundamentally reshaping product development and marketing strategies in the market. Consequently, manufacturers are focusing on innovation in formulations, packaging, and digital engagement to cater to these evolving consumer preferences

- The demand for cosmetics that offer a blend of efficacy, natural ingredients, sustainability, and personalization is growing rapidly across all age groups and demographics, reflecting the increasing importance of beauty and self-care in consumers' lives

What are the Key Drivers of Cosmetics Market?

Driver

Rising Consumer Awareness and Increasing Disposable Incomes

- The increasing level of consumer awareness regarding beauty and personal care, coupled with growing disposable incomes in many regions, is a significant driver for the heightened demand for cosmetics. Greater access to information and a growing interest in self-care routines contribute to higher consumption of cosmetic products

- For instance, According to Euromonitor (2024), India’s beauty and personal care market is projected to reach USD 30 billion by 2027, driven largely by Gen Z and millennials investing in skincare

- In addition, the increasing influence of social media and the constant exposure to beauty trends and products drive greater consumer interest and spending in the cosmetics market. Online platforms have democratized beauty knowledge and made a wider range of products accessible to consumers globally

- Furthermore, the increasing consumer focus on personal appearance and the desire to enhance their self-confidence through the use of cosmetic products further propel market growth. This is observed across various demographics and genders, contributing to the overall expansion of the market

- The continuous innovation in product formulations, textures, and packaging by cosmetics manufacturers ensures a constant stream of new and appealing products, further stimulating consumer demand and driving market growth

Restraint/Challenge

Intense Competition and Evolving Consumer Preferences

- Intense competition among a large number of global and local cosmetics brands can act as a restraint, putting pressure on pricing and profitability. The ease of entry for new brands, particularly through online channels, further intensifies the competitive landscape

- For instance, the market is characterized by the constant emergence of new indie beauty brands leveraging social media to gain traction, creating a highly fragme`nted and competitive environment

- Another significant challenge comes from the rapidly evolving consumer preferences and beauty trends. Consumers are increasingly informed and demanding, with their preferences shifting quickly in response to new ingredients, scientific research, and social media trends

- In late 2024, Beiersdorf (Nivea) discontinued several product lines after declining sales, citing misalignment with Gen Z sustainability concerns

- Furthermore, growing concerns about product safety and ethical considerations, such as animal testing and ingredient sourcing, can also pose a challenge for manufacturers. Meeting these evolving expectations requires continuous adaptation and investment in research and development

- Economic downturns and fluctuations in consumer spending can also indirectly affect the cosmetics market, particularly the demand for premium and luxury products. Manufacturers need to navigate these economic uncertainties by offering a diverse range of products catering to different price points and consumer needs

How is the Cosmetics Marke Segmented?

The market is segmented on the basis of product type, nature, category, packaging type, distribution channel, form, and application.

By Product Type

On the basis of product type, the personal care products market is segmented into skin care, hair care, make-up, deodorants and fragrances, and others. The skin care segment dominated the market with the largest revenue share of 44.48% in 2024, attributed to rising consumer focus on skin health, anti-aging solutions, and daily skincare routines. The growing popularity of multifunctional products such as moisturizers with SPF and serums with active ingredients continues to fuel this segment’s dominance.

The hair care segment is expected to register the fastest CAGR of 8.01% from 2025 to 2032, driven by increased demand for personalized hair treatments, clean-label formulations, and scalp health awareness.

By Nature

On the basis of nature, the market is segmented into inorganic and organic. The inorganic segment dominated the market in 2024 with a revenue share of 61.5%, owing to its cost-effectiveness, longer shelf life, and established use in mass-market personal care formulations.

The organic segment is witnessing rapid growth due to increasing consumer preference for natural ingredients and clean beauty trends. Brands offering organic certifications and sustainable sourcing are gaining significant traction, particularly in North America and Europe.

By Form

On the basis of form, the market includes creams and gels, lotions, sprays, solid, and others. The creams and gels segment held the highest market share in 2024, accounting for 36.8% of the total market, favored for their ease of application and high efficacy in targeted skincare and hair care routines.

Sprays are projected to grow at the fastest rate from 2025 to 2032, owing to their convenience, especially in deodorants, sunscreens, and fragrances.

By Category

On the basis of category, the market is segmented into mass products, premium products, and professional products. The mass products segment dominated the market in 2024 with a revenue share of 58.4%, due to affordability, wide availability, and strong penetration in emerging economies.

The premium segment is expected to witness the fastest CAGR through 2032, supported by rising disposable incomes and increasing inclination towards high-end, dermatologically tested, and branded solutions.

By Packaging Type

On the basis of packaging type, the market is segmented into bottles and jars, tubes, containers, pumps and dispensers, sticks, aerosol cans, pouches, blisters and strip packs, and others. Bottles and jars dominated in 2024, holding a revenue share of 29.3%, due to their reusability and suitability for a wide range of product viscosities.

The pumps and dispensers segment is expected to grow rapidly due to hygienic dispensing and growing demand for user-friendly packaging in premium products.

By Distribution Channel

On the basis of distribution channel, the market is segmented into offline and online. The offline segment led the market with the revenue share of 73.36% in 2024, owing to strong presence of retail chains, beauty salons, and exclusive brand outlets.

The online segment is projected to grow at the highest CAGR through 2032, driven by the increasing adoption of e-commerce, influencer marketing, and personalized digital shopping experiences.

By End-User

On the basis of end-user the market is segmented into women, men, unisex, and kids. The women segment accounted for the largest revenue share of 72.11% in 2024, supported by a broader product range and higher usage frequency.

The men's grooming segment is expected to see fastest growth in the forecast years, reflecting changing lifestyle trends, awareness about self-care, and rising demand for male-centric personal care products.

Which Region Holds the Largest Share of the Cosmetics Market?

- North America dominates the Cosmetics market with the largest revenue share of 35.67% in 2024. This is driven by a strong construction industry, high adoption rates in both residential and commercial sectors, and a preference for modern and aesthetically appealing kitchen and bathroom fixtures

- Consumers in the region highly value durability, design, and the availability of various sink materials and styles

- This widespread adoption is supported by established plumbing infrastructure and a mature retail market

- Asia Pacific dominates the Cosmetics market with the largest revenue share of approximately 49.57% in 2024. This is driven by a large and diverse consumer base, increasing purchasing power, and a growing emphasis on personal grooming, particularly in countries such as China, India, and Japan

- The region's expanding middle class and rising disposable incomes are leading to an increased demand for a wide range of cosmetic products

China Cosmetics Market Insight

The China Cosmetics market accounts for a significant share in the Asia-Pacific region, attributed to the country's massive population and rapid urbanization. The demand for cosmetics in both urban and rural areas is substantial, with a growing preference for both domestic and international brands. The increasing number of social media users promoting cosmetic products also contributes significantly to market growth.

Japan Cosmetics Market Insight

The Japan Cosmetics market is a key player in the Asia Pacific region, driven by a strong focus on high-quality and innovative products. The demand for skincare and beauty products remains strong, with a particular emphasis on anti-aging and natural ingredients. The market also sees a preference for well-established and trusted brands.

North America Cosmetics Market Insight

North America Cosmetics market is projected to be the fastest-growing region with the highest CAGR throughout the forecast period. This growth is primarily driven by a strong emphasis on personal grooming, the introduction of advanced product variants, and the escalating demand for vegan and clean cosmetics. The rising product availability on e-commerce platforms is also significantly contributing to market expansion.

U.S. Cosmetics Market Insight

The U.S. Cosmetics market captured the largest revenue share within North America. This is fueled by a large and diverse consumer base with a strong inclination towards beauty and personal care products. The demand for a wide variety of cosmetic categories, including skincare, makeup, and haircare, remains high. The trend towards online shopping and the influence of beauty influencers are key factors driving market growth in the U.S.

Canada Cosmetics Market Insight

The Canada Cosmetics market is also experiencing steady growth, influenced by similar factors as the U.S. market, including a rising emphasis on personal grooming and increasing disposable incomes. The market benefits from a stable economy and a growing demand for diverse cosmetic products through various distribution channels.

Europe Cosmetics Market Insight

The Europe Cosmetics market is experiencing steady growth, driven by increasing consumer awareness of beauty and personal care products and a preference for high-quality and sustainable options. European consumers are increasingly focusing on natural and organic cosmetics, leading to a higher adoption of brands offering such products. The region is experiencing growth in both the retail and online sectors.

U.K. Cosmetics Market Insight

The U.K. Cosmetics market is expected to grow at a significant rate within the European market, driven by a strong beauty culture and a high level of consumer engagement with cosmetic products. Consumers in the U.K. show a preference for a wide range of beauty brands and are increasingly influenced by social media and beauty trends.

Germany Cosmetics Market Insight

The Germany Cosmetics market is expected to expand at a considerable rate, fueled by a robust economy and a strong consumer focus on quality and efficacy. German consumers prioritize skincare and natural cosmetics, and the market sees a growing demand for innovative and scientifically-backed products.

Which are the Top Companies in Cosmetics Market?

The Cosmetics industry is primarily led by well-established companies, including:

- Procter & Gamble (U.S.)

- L'Oréal Paris (France)

- Estée Lauder (U.S.)

- Coty Inc. (U.S.)

- Shiseido Company, Limited (Japan)

- Colgate-Palmolive Company (U.S.)

- Kao Corporation (Japan)

- Unilever (U.K.)

- AMOREPACIFIC US, INC. (South Korea)

- Johnson & Johnson Services, Inc. (U.S.)

- Revlon (U.S.)

- LMVH (France)

- Oriflame Cosmetics Global SA (Switzerland)

- Henkel AG & Co. KGaA (Germany)

- Mary Kay (U.S.)

- Natura&Co (Brazil)

- CHANEL (France)

- KOSÉ Corporation (Japan)

What are the Recent Developments in Cosmetics Market?

- In June 2023, Vellvette Lifestyle Private Limited, operating under the brand Sugar Cosmetics, inaugurated its first offline retail store in Bengaluru at Orion Mall. Covering 400 square feet, this expansion marks the brand’s strategic entry into brick-and-mortar retail to enhance customer engagement and expand its market presence

- In January 2023, Maybelline New York introduced the Fit Me Fresh Tint foundation, a multifunctional 2-in-1 product that combines skincare and makeup. Infused with pigments, vitamin C, and SPF 50, the launch caters to growing consumer demand for daily-use beauty products that offer both protection and nourishment

- In June 2022, L’Oréal relaunched its luxury brand Lancôme in the Indian market to tap into the rising appetite for premium beauty products. The move aims to attract consumers seeking indulgent and high-quality personal care experiences amid India's expanding luxury beauty segment

- In November 2021, The Estée Lauder Companies Inc. collaborated with Florida A&M University to launch a talent development program focused on supporting the next generation of Black professionals in travel retail. This initiative, featuring exclusive internships and scholarships, highlights the company’s commitment to fostering diversity and inclusion in the beauty industry

- In September 2021, Coty Inc. announced a partnership with Perfect Corp. to integrate artificial intelligence (AI) and augmented reality (AR) into its digital marketing strategies. This collaboration is designed to enhance customer experiences through virtual try-ons and innovative digital engagement across Coty’s cosmetic brands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COSMETICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COSMETICS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL COSMETICS MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICE INDEX

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL COSMETICS MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 SKIN CARE

11.2.1 SKIN CARE, BY PRODUCT TYPE

11.2.1.1. MASKS

11.2.1.2. CLEANSING CREAM

11.2.1.3. MOISTURIZERS

11.2.1.4. SUNSCREENS

11.2.1.5. TONER

11.2.1.6. FACIAL REMOVER

11.2.1.7. DAY CREAM

11.2.1.8. NIGHT SERUM

11.2.1.9. BODY LOTIONS

11.2.1.10. BODY WASH

11.2.1.11. HAND & FOOT CREAMS

11.2.1.12. OTHERS

11.3 HAIR CARE

11.3.1 HAIR CARE, BY PRODUCT TYPE

11.3.1.1. SHAMPOO

11.3.1.2. HAIR COLOR

11.3.1.2.1. HAIR COLOR, BY TYPE

11.3.1.2.1.1 HAIR DYES AND COLORS

11.3.1.2.1.2 HAIR TINTS

11.3.1.2.1.3 HAIR BLEACHES

11.3.1.2.1.4 OTHERS

11.3.1.2.2. HAIR COLOR, BY HAIR TYPE

11.3.1.2.2.1 NORMAL

11.3.1.2.2.2 DRY

11.3.1.2.2.3 OILY

11.3.1.3. CONDITIONERS

11.3.1.4. SERUMS

11.3.1.5. SPRAYS

11.3.1.6. OIL

11.3.1.7. OTHERS

11.4 FRAGRANCES

11.5 MAKE UP

11.5.1 MAKE UP, BY PRODUCT TYPE

11.5.1.1. EYE SHADOWS

11.5.1.2. FOUNDATION

11.5.1.3. MASCARA

11.5.1.4. BRONZER

11.5.1.5. BLUSH

11.5.1.6. OTHERS

11.6 OTHERS

12 GLOBAL COSMETICS MARKET, BY NATURE, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 ORGANIC

12.3 CONVENTIONAL

13 GLOBAL COSMETICS MARKET, BY FORM, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 CREAMS & GELS

13.3 LOTIONS

13.4 SPRAYS

13.5 SOLID

13.6 ROLL-ON

13.7 OTHERS

14 GLOBAL COSMETICS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 MASS PRODUCT

14.3 PREMIUM PRODUCT

14.4 PROFESSIONAL PRODUCT

15 GLOBAL COSMETICS MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 BOTTLES AND JARS

15.3 TUBES

15.4 CONTAINERS

15.5 POUCHES

15.6 STICKS

15.7 PUMPS & DISPENSERS

15.8 BLISTERS AND STRIP PACKS

15.9 AEROSOL CANS

15.1 OTHERS

16 GLOBAL COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 OFFLINE

16.2.1 OFFLINE, BY CATEGORY

16.2.1.1. SUPERMARKETS & HYPERMARKETS

16.2.1.2. SPECIALTY STORES

16.2.1.3. CONVENIENCE STORES

16.2.1.4. PHARMACIES/MEDICAL STORES

16.2.1.5. OTHERS

16.3 ONLINE

16.3.1 ONLINE, BY CATEGORY

16.3.1.1. COMPANY-OWNED

16.3.1.2. E-COMMERCE

17 GLOBAL COSMETICS MARKET, BY END USER, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 WOMEN

17.2.1 WOMEN, BY PROUCT TYPE

17.2.1.1. SKIN CARE

17.2.1.2. HAIR CARE

17.2.1.3. FRAGRANCES

17.2.1.4. MAKE UP

17.2.1.5. OTHERS

17.3 MEN

17.3.1 MEN, BY PROUCT TYPE

17.3.1.1. SKIN CARE

17.3.1.2. HAIR CARE

17.3.1.3. FRAGRANCES

17.3.1.4. MAKE UP

17.3.1.5. OTHERS

18 GLOBAL COSMETICS MARKET, BY GEOGRAPHY, 2020-2029 (USD MILLION)

18.1 GLOBAL ANTIFOULING COATING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.2 NORTH AMERICA

18.2.1 U.S.

18.2.2 CANADA

18.2.3 MEXICO

18.3 EUROPE

18.3.1 GERMANY

18.3.2 U.K.

18.3.3 ITALY

18.3.4 FRANCE

18.3.5 SPAIN

18.3.6 RUSSIA

18.3.7 SWITZERLAND

18.3.8 TURKEY

18.3.9 BELGIUM

18.3.10 NETHERLANDS

18.3.11 REST OF EUROPE

18.4 ASIA-PACIFIC

18.4.1 JAPAN

18.4.2 CHINA

18.4.3 SOUTH KOREA

18.4.4 INDIA

18.4.5 SINGAPORE

18.4.6 THAILAND

18.4.7 INDONESIA

18.4.8 MALAYSIA

18.4.9 PHILIPPINES

18.4.10 AUSTRALIA & NEW ZEALAND

18.4.11 REST OF ASIA-PACIFIC

18.5 SOUTH AMERICA

18.5.1 BRAZIL

18.5.2 ARGENTINA

18.5.3 REST OF SOUTH AMERICA

18.6 MIDDLE EAST AND AFRICA

18.6.1 SOUTH AFRICA

18.6.2 EGYPT

18.6.3 SAUDI ARABIA

18.6.4 UNITED ARAB EMIRATES

18.6.5 ISRAEL

18.6.6 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL COSMETICS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS AND ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

19.7 EXPANSIONS

19.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

21 GLOBAL COSMETICS MARKET - COMPANY PROFILES

21.1 SHISEIDO COMPANY

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT UPDATES

21.2 JOHNSON & JOHNSON PRIVATE LIMITED

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT UPDATES

21.3 UNILEVER

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT UPDATES

21.4 AMWAY

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT UPDATES

21.5 PROCTER & GAMBLE

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT UPDATES

21.6 L'ORÉAL S.A.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT UPDATES

21.7 REVLON GROUP

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT UPDATES

21.8 BEIERSDORF AG

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT UPDATES

21.9 NATURA

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT UPDATES

21.1 YVES ROCHER

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT UPDATES

21.11 KAO CORPORATION

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT UPDATES

21.12 ESTÉE LAUDER COMPANIES INC.

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT UPDATES

21.13 AVON SKINCARE

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT UPDATES

21.14 OLAPLEX

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT UPDATES

21.15 NEOSTRATA COMPANY, INC.

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT UPDATES

21.16 ORIFLAME COSMETICS

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 BIODERMA

21.17.1 COMPANY SNAPSHOT

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 RECENT UPDATES

21.18 CLARINS

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT UPDATES

21.19 MITCHELL USA

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT UPDATES

21.2 HELIOS LIFESTYLE PRIVATE LIMITED

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 PRODUCT PORTFOLIO

21.20.4 RECENT UPDATES

21.21 AMISHI CONSUMER TECHNOLOGIES PRIVATE LIMITED

21.21.1 COMPANY SNAPSHOT

21.21.2 REVENUE ANALYSIS

21.21.3 PRODUCT PORTFOLIO

21.21.4 RECENT UPDATES

21.22 L'OCCITANE

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 PRODUCT PORTFOLIO

21.22.4 RECENT UPDATES

21.23 KIEHL’S SINCE 1851

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 PRODUCT PORTFOLIO

21.23.4 RECENT UPDATES

21.24 CLINIQUE LABORATORIES, LLC

21.24.1 COMPANY SNAPSHOT

21.24.2 REVENUE ANALYSIS

21.24.3 PRODUCT PORTFOLIO

21.24.4 RECENT UPDATES

21.25 DRDOPPELT.COM

21.25.1 COMPANY SNAPSHOT

21.25.2 REVENUE ANALYSIS

21.25.3 PRODUCT PORTFOLIO

21.25.4 RECENT UPDATES

21.26 GALDERMA

21.26.1 COMPANY SNAPSHOT

21.26.2 REVENUE ANALYSIS

21.26.3 PRODUCT PORTFOLIO

21.26.4 RECENT UPDATES

21.27 LANCER SKINCARE LLC

21.27.1 COMPANY SNAPSHOT

21.27.2 REVENUE ANALYSIS

21.27.3 PRODUCT PORTFOLIO

21.27.4 RECENT UPDATES

22 RELATED REPORTS

23 QUESTIONNAIRE

24 CONCLUSION

25 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.