Market Analysis and Size

Counterfeit drugs is one of the greatest challenges faced by the healthcare institutions and pharmaceuticals manufacturers. Counterfeit drugs and medical equipment are available at a large scale in the market, thereby hampering the goodwill of the market. As a result, there emerged a strong demand for efficient detection systems. This led to the introduction of counterfeit drug detection devices in the market.

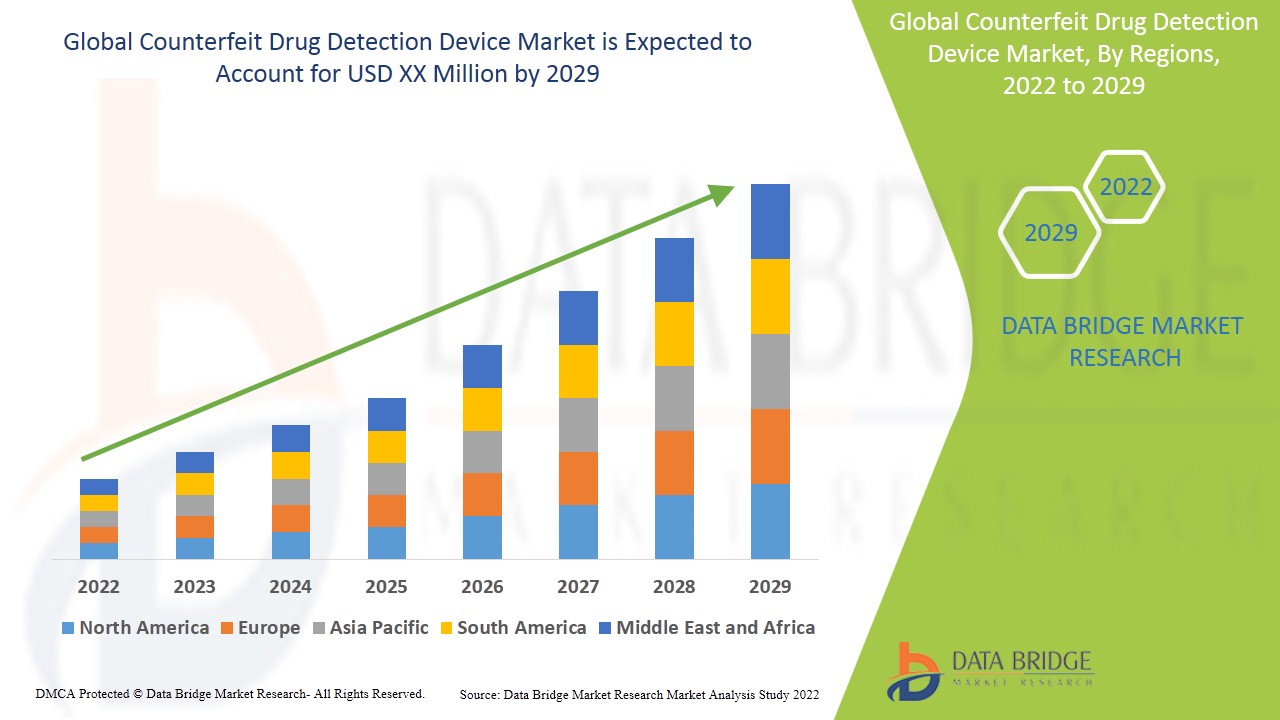

Data Bridge Market Research analyses that the counterfeit drug detection device market is expected to undergo a CAGR of 4.80% during the forecast period. “Handheld Devices” accounts for the largest modality segment in the counterfeit drug detection device market owing to the rising adoption of these devices due to an integrated flexible user interface, ergonomic design, and longer battery life.

Market Definition

Counterfeit drug detection devices are the products that are effective and efficient in detecting low grade, low quality and duplicate pharmaceutical drugs in the market. The counterfeit drug detection devices offer superior quality services and protect the customers against frauds and fake products in the market. Counterfeit drugs can have a range of ill effects and side effects on the consumers and this is where the counterfeit drug detection devices assume their role.

Counterfeit Drug Detection Device Market Dynamics

Drivers

-

The rise in the prevalence of diseases

Surging prevalence of chronic and acute diseases and infections in the population is one of the major factors responsible for fostering growth in the demand for counterfeit drug detection devices. In other words, growing incidence rate of skin disorder, chronic respiratory disease, asthma, musculoskeletal disorder, cancer and others is creative lucrative growth opportunities for the counterfeit drug detection devices market.

-

Rising geriatric population base

It is a fact of life that as the age grows, one becomes more vulnerable to developing diseases and infections. This indicates that increasing age is directly proportional to the increase in demand for drugs in the market. Since there is a wide scale availability of fake drugs and products in the market, this factor will propel growth in the demand for counterfeit drug detection devices.

-

Government investments on healthcare infrastructure

The increase in the funding by the federal government is set to drive the demand for counterfeit drug detection devices. Moreover, growth and expansion of healthcare industry being driven by both public and private players especially in the developing economies will create lucrative market growth opportunities.

Additionally, surge in the personal disposable income level, rising awareness about the several side effects of counterfeit drugs and increasing investment for the development of advanced and innovative technology, positively affect the market growth rate.

Opportunities

Furthermore, upsurge in the public-private funding for target research activities and rising awareness of working people will extend profitable opportunities for the market players in the forecast period of 2022 to 2029. Additionally, surging focus of the government on the introduction of stringent norms and innovation of new medical devices and instruments will further expand the market's growth rate in the future.

Restraints/Challenges

On the other hand, high cost associated with the research and development proficiencies, lack of awareness in the underdeveloped economies, limited infrastructural facilities and dearth of skilled medical professionals and researchers are expected to obstruct market growth. Also, production of fake medicines in Myanmar region and loop holes in the hierarchy of packaging industry and sublimation of product while transportation are projected to challenge the market in the forecast period of 2022-2029.

This counterfeit drug detection device market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the counterfeit drug detection device market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Counterfeit Drug Detection Device Market

COVID-19 has had a positive impact on the counterfeit drug detection device market. In this pandemic phase, there was a high scale introduction of new medical products, devices and drugs in the market. This indicates that there was a subsequent availability of fake drugs and medicines. This led t the rise in demand for counterfeit drug detection devices from the pharmacies, healthcare institutions and end customers.

Global Counterfeit Drug Detection Device Market Scope

The counterfeit drug detection device market is segmented on the basis of product, modality, end use, drug assessment and therapeutic assessment. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Counterfeit Chemical Composition Detection Devices

- Counterfeit Packaging

- Labelling Detection Devices

On the basis of product, the counterfeit drug detection device market is segmented into chemical composition detection devices, and packaging and labelling detection devices. Counterfeit chemical composition detection devices are further divided into ultraviolet/vis devices, infrared and near infrared spectroscopy devices, Raman spectrometers, and spectroscopy devices. Packaging and labelling detection devices is further sub-segmented into analyzers, scanning and imaging systems, and others.

Modality

- Portable Devices

- Handheld Devices

- Benchtop Devices

On the basis of modality, the counterfeit drug detection device market is bifurcated into portable devices, handheld devices, and benchtop devices.

End use

- Pharmaceutical Companies

- Drug Testing Laboratories

- Research Organizations

- Others

On the basis of end use, the counterfeit drug detection device market is segregated into pharmaceutical companies, drug testing laboratories, and research organizations.

Drug assessment

- Oral Pill

- Injectable

- Inhalable

- Topical

- Eye Drop

On the basis of drug assessment, the counterfeit drug detection device market is segmented into oral pill, injectable, inhalable, topical, and eye drop.

Therapeutic assessment

- Alimentary

- Anti-Infectives

- Blood Agents

- Cardiovascular

- Central Nervous System

- Cytostatics

- Dermatological

- Genitourinary

- Hormones

- Hospital Solutions

- Metabolism

- Musculoskeletal

- Respiratory

- Other Parasitology

- Sensory Organs

On the basis of therapeutic assessment, the counterfeit drug detection device market is fragmented into alimentary, anti-infectives, blood agents, cardiovascular, central nervous system, cytostatics, dermatological, genitourinary, hormones, hospital solutions, metabolism, musculoskeletal, respiratory, other parasitology, and sensory organs.

Counterfeit Drug Detection Device Market Regional Analysis/Insights

The counterfeit drug detection device market is analysed and market size insights and trends are provided by country, product, modality, end use, drug assessment and therapeutic assessment as referenced above.

The countries covered in the counterfeit drug detection device market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the counterfeit drug detection device market because of the strong base of healthcare facilities, increasing number of toxicological laboratories, and the growing adoption of drug testing at the workplace.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 due to the increase in government initiatives to promote awareness, rise in medical tourism, rising duplicity of medicines and drugs and the growing demand for quality healthcare in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The counterfeit drug detection device market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for counterfeit drug detection device market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the counterfeit drug detection device market. The data is available for historic period 2010-2020.

Competitive Landscape and Counterfeit Drug Detection Device Market Share Analysis

The counterfeit drug detection device market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to counterfeit drug detection device market.

Some of the major players operating in the counterfeit drug detection device market are Advanced Systems Development, Inc., B&W Tek., Centice Corporation, Consumer Physics, Global Pharma HealthCare Ltd., Olympus Corporation, PharmaSecure Inc., RIGAKU CORPORATION, Sproxil, Stratio, Inc., Thermo Fisher Scientific Inc., TSI Group Inc., Veripad, Bayer AG, Getinge AB, Midmark Corporation, STERIS, Abbott, GAO Group, Markem-Imaje and Spectral Engines GmbH among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COUNTERFEIT DRUG DETECTION DEVICES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL COUNTERFEIT DRUG DETECTION DEVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

5.3 STRATEGIC INITIATIVES

6 REGULATORY FRAMWORK

7 GLOBAL COUNTERFEIT DRUG DETECTION DEVICES, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COUNTERFEIT CHEMICAL COMPOSITION DETECTION DEVICES

7.2.1 ULTRAVIOLET/VISIBLE DEVICE

7.2.1.1. BY TYPE

7.2.1.1.1. SINGLE BEAM

7.2.1.1.1.1 MARKET VALUE (US MN)

7.2.1.1.1.2 MARKET VOLUME (UNITS)

7.2.1.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.1.1.2. SPLIT BEAM

7.2.1.1.2.1 MARKET VALUE (US MN)

7.2.1.1.2.2 MARKET VOLUME (UNITS)

7.2.1.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.1.1.3. DOUBLE BEAM

7.2.1.1.3.1 MARKET VALUE (US MN)

7.2.1.1.3.2 MARKET VOLUME (UNITS)

7.2.1.1.3.3 AVERAGE SELLING PRICE (USD)

7.2.1.2. BY MODALITY

7.2.1.2.1. PORTABLE

7.2.1.2.1.1 CONTINUOUS DOSE UV-C LIGHT

7.2.1.2.1.1.1. MARKET VALUE (US MN)

7.2.1.2.1.1.2. MARKET VOLUME (UNITS)

7.2.1.2.1.1.3. AVERAGE SELLING PRICE (USD)

7.2.1.2.1.2 PULSED XENON LIGHT

7.2.1.2.1.2.1. MARKET VALUE (US MN)

7.2.1.2.1.2.2. MARKET VOLUME (UNITS)

7.2.1.2.1.2.3. AVERAGE SELLING PRICE (USD)

7.2.1.2.2. HANDHELD

7.2.1.2.2.1 MARKET VALUE (US MN)

7.2.1.2.2.2 MARKET VOLUME (UNITS)

7.2.1.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.1.2.3. BENCHTOP

7.2.1.2.3.1 MARKET VALUE (US MN)

7.2.1.2.3.2 MARKET VOLUME (UNITS)

7.2.1.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.2 MASS SPECTROMETERS

7.2.2.1. BY TYPE

7.2.2.1.1. MALDI_TOF

7.2.2.1.1.1 MARKET VALUE (US MN)

7.2.2.1.1.2 MARKET VOLUME (UNITS)

7.2.2.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.2.1.2. ICP-MS

7.2.2.1.2.1 MARKET VALUE (US MN)

7.2.2.1.2.2 MARKET VOLUME (UNITS)

7.2.2.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.2.1.3. DART-MS

7.2.2.1.3.1 MARKET VALUE (US MN)

7.2.2.1.3.2 MARKET VOLUME (UNITS)

7.2.2.1.3.3 AVERAGE SELLING PRICE (USD)

7.2.2.1.4. SIMS

7.2.2.1.4.1 MARKET VALUE (US MN)

7.2.2.1.4.2 MARKET VOLUME (UNITS)

7.2.2.1.4.3 AVERAGE SELLING PRICE (USD)

7.2.2.2. BY MODALITY

7.2.2.2.1. PORTABLE

7.2.2.2.1.1 MARKET VALUE (US MN)

7.2.2.2.1.2 MARKET VOLUME (UNITS)

7.2.2.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.2.2.2. HANDHELD

7.2.2.2.2.1 MARKET VALUE (US MN)

7.2.2.2.2.2 MARKET VOLUME (UNITS)

7.2.2.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.2.2.3. BENCHTOP

7.2.2.2.3.1 MARKET VALUE (US MN)

7.2.2.2.3.2 MARKET VOLUME (UNITS)

7.2.2.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.3 NUCLEAR MAGNETIC RESONANCE

7.2.3.1. BY TYPE

7.2.3.1.1. CONTINUOUS WAVE NMR SPECTROMETER

7.2.3.1.1.1 MARKET VALUE (US MN)

7.2.3.1.1.2 MARKET VOLUME (UNITS)

7.2.3.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.3.1.2. FOURIER TRANSFORM (FT-NMR)

7.2.3.1.2.1 MARKET VALUE (US MN)

7.2.3.1.2.2 MARKET VOLUME (UNITS)

7.2.3.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.3.2. BY MODALITY

7.2.3.2.1. PORTABLE

7.2.3.2.1.1 MARKET VALUE (US MN)

7.2.3.2.1.2 MARKET VOLUME (UNITS)

7.2.3.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.3.2.2. HANDHELD

7.2.3.2.2.1 MARKET VALUE (US MN)

7.2.3.2.2.2 MARKET VOLUME (UNITS)

7.2.3.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.3.2.3. BENCHTOP

7.2.3.2.3.1 MARKET VALUE (US MN)

7.2.3.2.3.2 MARKET VOLUME (UNITS)

7.2.3.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.4 INFRARED AND NEAR INFRARED SPECTROSCOPY DEVICE

7.2.4.1. BY TYPE

7.2.4.1.1. DISPERSIVE INFRARED SPECTROMETER

7.2.4.1.1.1 MARKET VALUE (US MN)

7.2.4.1.1.2 MARKET VOLUME (UNITS)

7.2.4.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.4.1.2. FOURIER TRANSFORM INFRARED SPECTROMETER

7.2.4.1.2.1 MARKET VALUE (US MN)

7.2.4.1.2.2 MARKET VOLUME (UNITS)

7.2.4.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.4.2. BY MODALITY

7.2.4.2.1. PORTABLE

7.2.4.2.1.1 MARKET VALUE (US MN)

7.2.4.2.1.2 MARKET VOLUME (UNITS)

7.2.4.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.4.2.2. HANDHELD

7.2.4.2.2.1 MARKET VALUE (US MN)

7.2.4.2.2.2 MARKET VOLUME (UNITS)

7.2.4.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.4.2.3. BENCHTOP

7.2.4.2.3.1 MARKET VALUE (US MN)

7.2.4.2.3.2 MARKET VOLUME (UNITS)

7.2.4.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.5 RAMAN SPECTROMETERS

7.2.5.1. BY TYPE

7.2.5.1.1. CONFOCAL RAMAN SPECTROSCOPY

7.2.5.1.1.1 MARKET VALUE (US MN)

7.2.5.1.1.2 MARKET VOLUME (UNITS)

7.2.5.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.5.1.2. MODULATED RAMAN SPECTROSCOPY

7.2.5.1.2.1 MARKET VALUE (US MN)

7.2.5.1.2.2 MARKET VOLUME (UNITS)

7.2.5.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.5.1.3. SURFACE ENHANCED RAMAN SPECTROSCOPY

7.2.5.1.3.1 MARKET VALUE (US MN)

7.2.5.1.3.2 MARKET VOLUME (UNITS)

7.2.5.1.3.3 AVERAGE SELLING PRICE (USD)

7.2.5.1.4. TIP ENHANCED RAMAN SPECTROSCOPY

7.2.5.1.4.1 MARKET VALUE (US MN)

7.2.5.1.4.2 MARKET VOLUME (UNITS)

7.2.5.1.4.3 AVERAGE SELLING PRICE (USD)

7.2.5.2. BY MODALITY

7.2.5.2.1. PORTABLE

7.2.5.2.1.1 MARKET VALUE (US MN)

7.2.5.2.1.2 MARKET VOLUME (UNITS)

7.2.5.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.5.2.2. HANDHELD

7.2.5.2.2.1 MARKET VALUE (US MN)

7.2.5.2.2.2 MARKET VOLUME (UNITS)

7.2.5.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.5.2.3. BENCHTOP

7.2.5.2.3.1 MARKET VALUE (US MN)

7.2.5.2.3.2 MARKET VOLUME (UNITS)

7.2.5.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.6 HIGH PERFORMANCE LIQUID CHROMATOGRAPHY (HPLC)

7.2.6.1. BY TYPE

7.2.6.1.1. NORMAL PHASE HPLC COLUMNS

7.2.6.1.1.1 MARKET VALUE (US MN)

7.2.6.1.1.2 MARKET VOLUME (UNITS)

7.2.6.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.6.1.2. REVERSE PHASE HPLC COLUMNS

7.2.6.1.2.1 MARKET VALUE (US MN)

7.2.6.1.2.2 MARKET VOLUME (UNITS)

7.2.6.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.6.1.3. ION EXCHANGE HPLC COLUMNS

7.2.6.1.3.1 MARKET VALUE (US MN)

7.2.6.1.3.2 MARKET VOLUME (UNITS)

7.2.6.1.3.3 AVERAGE SELLING PRICE (USD)

7.2.6.1.4. SIZE EXCLUSION HPLC COLUMNS

7.2.6.1.4.1 MARKET VALUE (US MN)

7.2.6.1.4.2 MARKET VOLUME (UNITS)

7.2.6.1.4.3 AVERAGE SELLING PRICE (USD)

7.2.6.2. BY MODALITY

7.2.6.2.1. PORTABLE

7.2.6.2.1.1 MARKET VALUE (US MN)

7.2.6.2.1.2 MARKET VOLUME (UNITS)

7.2.6.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.6.2.2. HANDHELD

7.2.6.2.2.1 MARKET VALUE (US MN)

7.2.6.2.2.2 MARKET VOLUME (UNITS)

7.2.6.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.6.2.3. BENCHTOP

7.2.6.2.3.1 MARKET VALUE (US MN)

7.2.6.2.3.2 MARKET VOLUME (UNITS)

7.2.6.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.7 GAS CHROMATOGRAPHY

7.2.7.1. BY TYPE

7.2.7.1.1. PACKED COLUMN

7.2.7.1.1.1 MARKET VALUE (US MN)

7.2.7.1.1.2 MARKET VOLUME (UNITS)

7.2.7.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.7.1.2. CAPILLARY COLUMN

7.2.7.1.2.1 MARKET VALUE (US MN)

7.2.7.1.2.2 MARKET VOLUME (UNITS)

7.2.7.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.7.2. BY MODALITY

7.2.7.2.1. PORTABLE

7.2.7.2.1.1 MARKET VALUE (US MN)

7.2.7.2.1.2 MARKET VOLUME (UNITS)

7.2.7.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.7.2.2. HANDHELD

7.2.7.2.2.1 MARKET VALUE (US MN)

7.2.7.2.2.2 MARKET VOLUME (UNITS)

7.2.7.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.7.2.3. BENCHTOP

7.2.7.2.3.1 MARKET VALUE (US MN)

7.2.7.2.3.2 MARKET VOLUME (UNITS)

7.2.7.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.8 THIN LAYER CHROMATOGRAPH

7.2.8.1. BY TYPE

7.2.8.1.1. HPTLC

7.2.8.1.1.1 MARKET VALUE (US MN)

7.2.8.1.1.2 MARKET VOLUME (UNITS)

7.2.8.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.8.1.2. PLC

7.2.8.1.2.1 MARKET VALUE (US MN)

7.2.8.1.2.2 MARKET VOLUME (UNITS)

7.2.8.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.8.1.3. TLC-MS

7.2.8.1.3.1 MARKET VALUE (US MN)

7.2.8.1.3.2 MARKET VOLUME (UNITS)

7.2.8.1.3.3 AVERAGE SELLING PRICE (USD)

7.2.8.2. BY MODALITY

7.2.8.2.1. PORTABLE

7.2.8.2.1.1 MARKET VALUE (US MN)

7.2.8.2.1.2 MARKET VOLUME (UNITS)

7.2.8.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.8.2.2. HANDHELD

7.2.8.2.2.1 MARKET VALUE (US MN)

7.2.8.2.2.2 MARKET VOLUME (UNITS)

7.2.8.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.8.2.3. BENCHTOP

7.2.8.2.3.1 MARKET VALUE (US MN)

7.2.8.2.3.2 MARKET VOLUME (UNITS)

7.2.8.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.9 XRD & XRF SPECTROSCOPY DEVICE

7.2.9.1. BY TYPE

7.2.9.1.1. CCD X-RAY DETECTOR

7.2.9.1.1.1 MARKET VALUE (US MN)

7.2.9.1.1.2 MARKET VOLUME (UNITS)

7.2.9.1.1.3 AVERAGE SELLING PRICE (USD)

7.2.9.1.2. ENERGY DISPERSIVE XRF SECTROMETER

7.2.9.1.2.1 MARKET VALUE (US MN)

7.2.9.1.2.2 MARKET VOLUME (UNITS)

7.2.9.1.2.3 AVERAGE SELLING PRICE (USD)

7.2.9.1.3. HANDHELD XRF ANALYZER

7.2.9.1.3.1 MARKET VALUE (US MN)

7.2.9.1.3.2 MARKET VOLUME (UNITS)

7.2.9.1.3.3 AVERAGE SELLING PRICE (USD)

7.2.9.1.4. WDXRF SPECTROMETER

7.2.9.1.4.1 MARKET VALUE (US MN)

7.2.9.1.4.2 MARKET VOLUME (UNITS)

7.2.9.1.4.3 AVERAGE SELLING PRICE (USD)

7.2.9.1.5. X-RAY CRYSTALLOGRAPHY

7.2.9.1.5.1 MARKET VALUE (US MN)

7.2.9.1.5.2 MARKET VOLUME (UNITS)

7.2.9.1.5.3 AVERAGE SELLING PRICE (USD)

7.2.9.2. BY MODALITY

7.2.9.2.1. PORTABLE

7.2.9.2.1.1 MARKET VALUE (US MN)

7.2.9.2.1.2 MARKET VOLUME (UNITS)

7.2.9.2.1.3 AVERAGE SELLING PRICE (USD)

7.2.9.2.2. HANDHELD

7.2.9.2.2.1 MARKET VALUE (US MN)

7.2.9.2.2.2 MARKET VOLUME (UNITS)

7.2.9.2.2.3 AVERAGE SELLING PRICE (USD)

7.2.9.2.3. BENCHTOP

7.2.9.2.3.1 MARKET VALUE (US MN)

7.2.9.2.3.2 MARKET VOLUME (UNITS)

7.2.9.2.3.3 AVERAGE SELLING PRICE (USD)

7.2.10 OTHERS

7.3 COUNTERFEIT PACKAGING AND LABELLING DETECTION

7.3.1 RFID ANALYZERS

7.3.1.1. BY TYPE

7.3.1.1.1. ACTIVE RFID ANALYZER

7.3.1.1.1.1 MARKET VALUE (US MN)

7.3.1.1.1.2 MARKET VOLUME (UNITS)

7.3.1.1.1.3 AVERAGE SELLING PRICE (USD)

7.3.1.1.2. SEMI PASSIVE RFID ANALYZER

7.3.1.1.2.1 MARKET VALUE (US MN)

7.3.1.1.2.2 MARKET VOLUME (UNITS)

7.3.1.1.2.3 AVERAGE SELLING PRICE (USD)

7.3.1.1.3. PASSIVE RFID ANALYZER

7.3.1.1.3.1 MARKET VALUE (US MN)

7.3.1.1.3.2 MARKET VOLUME (UNITS)

7.3.1.1.3.3 AVERAGE SELLING PRICE (USD)

7.3.1.2. BY MODALITY

7.3.1.2.1. PORTABLE

7.3.1.2.1.1 MARKET VALUE (US MN)

7.3.1.2.1.2 MARKET VOLUME (UNITS)

7.3.1.2.1.3 AVERAGE SELLING PRICE (USD)

7.3.1.2.2. HANDHELD

7.3.1.2.2.1 MARKET VALUE (US MN)

7.3.1.2.2.2 MARKET VOLUME (UNITS)

7.3.1.2.2.3 AVERAGE SELLING PRICE (USD)

7.3.1.2.3. BENCHTOP

7.3.1.2.3.1 MARKET VALUE (US MN)

7.3.1.2.3.2 MARKET VOLUME (UNITS)

7.3.1.2.3.3 AVERAGE SELLING PRICE (USD)

7.3.2 SCANNING AND IMAGING SYSTEMS

7.3.2.1. BY TYPE

7.3.2.1.1. FT-IR IMAGING SYSTEM

7.3.2.1.1.1 MARKET VALUE (US MN)

7.3.2.1.1.2 MARKET VOLUME (UNITS)

7.3.2.1.1.3 AVERAGE SELLING PRICE (USD)

7.3.2.1.2. TRUSCAN

7.3.2.1.2.1 MARKET VALUE (US MN)

7.3.2.1.2.2 MARKET VOLUME (UNITS)

7.3.2.1.2.3 AVERAGE SELLING PRICE (USD)

7.3.2.1.3. TRUTAG

7.3.2.1.3.1 MARKET VALUE (US MN)

7.3.2.1.3.2 MARKET VOLUME (UNITS)

7.3.2.1.3.3 AVERAGE SELLING PRICE (USD)

7.3.2.2. BY MODALITY

7.3.2.2.1. PORTABLE

7.3.2.2.1.1 MARKET VALUE (US MN)

7.3.2.2.1.2 MARKET VOLUME (UNITS)

7.3.2.2.1.3 AVERAGE SELLING PRICE (USD)

7.3.2.2.2. HANDHELD

7.3.2.2.2.1 MARKET VALUE (US MN)

7.3.2.2.2.2 MARKET VOLUME (UNITS)

7.3.2.2.2.3 AVERAGE SELLING PRICE (USD)

7.3.2.2.3. BENCHTOP

7.3.2.2.3.1 MARKET VALUE (US MN)

7.3.2.2.3.2 MARKET VOLUME (UNITS)

7.3.2.2.3.3 AVERAGE SELLING PRICE (USD)

7.3.3 OTHERS

8 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 MISLABELED MEDICATION

8.2.1 RFID ANALYZERS

8.2.2 SCANNING AND IMAGING SYSTEMS

8.2.3 OTHERS

8.3 INCORRECT DOSE OF THE ACTIVE INGREDIENT

8.3.1 MASS SPECTROMETER

8.3.2 RAMAN SPECTROMETER

8.3.3 OTHERS

8.4 ACTIVE DRUG PRESENCE

8.4.1 THIN LAYER CHROMATOGRAPHY

8.4.2 HPLC

8.4.3 GAS CHROMATOGRAPHY

8.4.4 OT

8.5 HARMFUL SUBSTANCE PRESENCE

8.5.1 UV/VISIBLE SPECTROMETER

8.5.2 NMR SPECTROSCOPY

8.6 UNLISTED ACTIVE INGREDIENT

8.6.1 GAS CHROMATOGRAPHY

8.6.2 XRF & XRD SPECTROSCOPY DEVICE

8.6.3 INFRARED SPECTROSCOPY DEVICE

8.7 OTHERS

9 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, BY DRUG ASSESSMENT

9.1 ORAL PILLS

9.2 INJECTABLES

9.3 INHALABLE

9.4 TOPICAL SOLUTIONS

9.5 EYE DROPS

9.6 OTHERS

10 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL COMPANIES

10.3 DRUG TESTING LABORATORIES

10.4 RESEARCH ORGANIZATION

10.5 GOVERNMENT AUTHORITIES

10.6 OTHERS

11 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

12 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, BY REGION

12.1 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.1.1. U.S. COUNTERFEIT DRUG DETECTION DEVICE MARKET,BY PRODUCT

12.2.1.2. U.S.COUNTERFEIT DRUG DETECTION DEVICE MARKET,BY MODALITY

12.2.1.3. U.S.COUNTERFEIT DRUG DETECTION DEVICE MARKET,BY APPLICATION

12.2.1.4. U.S.COUNTERFEIT DRUG DETECTION DEVICE MARKET,BY DRUG ASSESSMENT

12.2.1.5. U.S. COUNTERFEIT DRUG DETECTION DEVICE MARKET,BY END USER

12.2.1.6. U.S.COUNTERFEIT DRUG DETECTION DEVICE MARKET,BY DISTRIBUTION CHANNEL

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 U.K.

12.3.4 HUNGARY

12.3.5 LITHUANIA

12.3.6 AUSTRIA

12.3.7 IRELAND

12.3.8 NORWAY

12.3.9 POLAND

12.3.10 ITALY

12.3.11 SPAIN

12.3.12 RUSSIA

12.3.13 TURKEY

12.3.14 NETHERLANDS

12.3.15 SWITZERLAND

12.3.16 REST OF EUROPE

12.4 ASIA-PACIFIC

12.4.1 JAPAN

12.4.2 CHINA

12.4.3 TAIWAN

12.4.4 SOUTH KOREA

12.4.5 INDIA

12.4.6 AUSTRALIA

12.4.7 SINGAPORE

12.4.8 THAILAND

12.4.9 MALAYSIA

12.4.10 INDONESIA

12.4.11 PHILIPPINES

12.4.12 VIETNAM

12.4.13 REST OF ASIA-PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ECUADOR

12.5.3 CHILE

12.5.4 COLOMBIA

12.5.5 VENEZUELA

12.5.6 ARGENTINA

12.5.7 PERU

12.5.8 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 SAUDI ARABIA

12.6.3 UAE

12.6.4 EGYPT

12.6.5 KUWAIT

12.6.6 ISRAEL

12.6.7 REST OF MIDDLE EAST AND AFRICA

12.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, SWOT AND DBMR ANALYSIS

14 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL COUNTERFEIT DRUG DETECTION DEVICE MARKET, COMPANY PROFILE

15.1 BRUKER

15.1.1 COMPANY OVERVIEW

15.1.2 REVELUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPEMENTS

15.2 AGILENT

15.2.1 COMPANY OVERVIEW

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPEMENTS

15.3 METTLER TOLEDO

15.3.1 COMPANY OVERVIEW

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPEMENTS

15.4 SHIMADZU CORPORATION

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPEMENTS

15.5 HITACHI HIGH-TECH CORPORATION

15.5.1 COMPANY OVERVIEW

15.5.2 REVNUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPEMENTS

15.6 PERKINELMER INC

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPEMENTS

15.7 THERMO FISHER SCIENTIFIC

15.7.1 COMPANY OVERVIEW

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPEMENTS

15.8 SCIEX

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPEMENTS

15.9 WATERS

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPEMENTS

15.1 ANALYTIK JENA GMBH

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPEMENTS

15.11 JEOL LTD

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPEMENTS

15.12 HORIBA

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPEMENTS

15.13 JASCO

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPEMENTS

15.14 RENISHAW

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPEMENTS

15.15 MCPHERSON

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPEMENTS

15.16 APPLIED RIGAKU TECHNOLOGIES, INC

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPEMENTS

15.17 EVIDENT

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPEMENTS

15.18 GENERAL ELECTRONIC

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPEMENTS

15.19 BIO-RAD LABORATORIES, INC

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPEMENTS

15.2 SHOWA DENKO K.K

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPEMENTS

15.21 ANASAZI INSTRUMENTS INC

15.21.1 COMPANY OVERVIEW

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPEMENTS

15.22 NIUMAG CORPORATION

15.22.1 COMPANY OVERVIEW

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPEMENTS

15.23 OXFORD INSTRUMENTS

15.23.1 COMPANY OVERVIEW

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPEMENTS

15.24 GBC SCIENTIFIC EQUIPMENTS

15.24.1 COMPANY OVERVIEW

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPEMENTS

15.25 BUCK SCIENTIFIC

15.25.1 COMPANY OVERVIEW

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPEMENTS

15.26 COLE-PARM

15.26.1 COMPANY OVERVIEW

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPEMENTS

15.27 SPECTRIS

15.27.1 COMPANY OVERVIEW

15.27.2 REVENUE ANALYSIS

15.27.3 GEOGRAPHIC PRESENCE

15.27.4 PRODUCT PORTFOLIO

15.27.5 RECENT DEVELOPEMENTS

15.28 DANAHER CORPORATION

15.28.1 COMPANY OVERVIEW

15.28.2 REVENUE ANALYSIS

15.28.3 GEOGRAPHIC PRESENCE

15.28.4 PRODUCT PORTFOLIO

15.28.5 RECENT DEVELOPEMENTS

15.29 NOVASEP HOLDING S.A.S

15.29.1 COMPANY OVERVIEW

15.29.2 REVENUE ANALYSIS

15.29.3 GEOGRAPHIC PRESENCE

15.29.4 PRODUCT PORTFOLIO

15.29.5 RECENT DEVELOPEMENTS

15.3 TOSOH CORPORATION

15.30.1 COMPANY OVERVIEW

15.30.2 REVENUE ANALYSIS

15.30.3 GEOGRAPHIC PRESENCE

15.30.4 PRODUCT PORTFOLIO

15.30.5 RECENT DEVELOPEMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 CONCLUSION

18 QUESTIONNAIRE

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.