Global Countering Illicit Tobacco Trade Market

Market Size in USD Billion

CAGR :

%

USD

2.78 Billion

USD

3.52 Billion

2025

2033

USD

2.78 Billion

USD

3.52 Billion

2025

2033

| 2026 –2033 | |

| USD 2.78 Billion | |

| USD 3.52 Billion | |

|

|

|

|

Countering Illicit Tobacco Trade Market Size

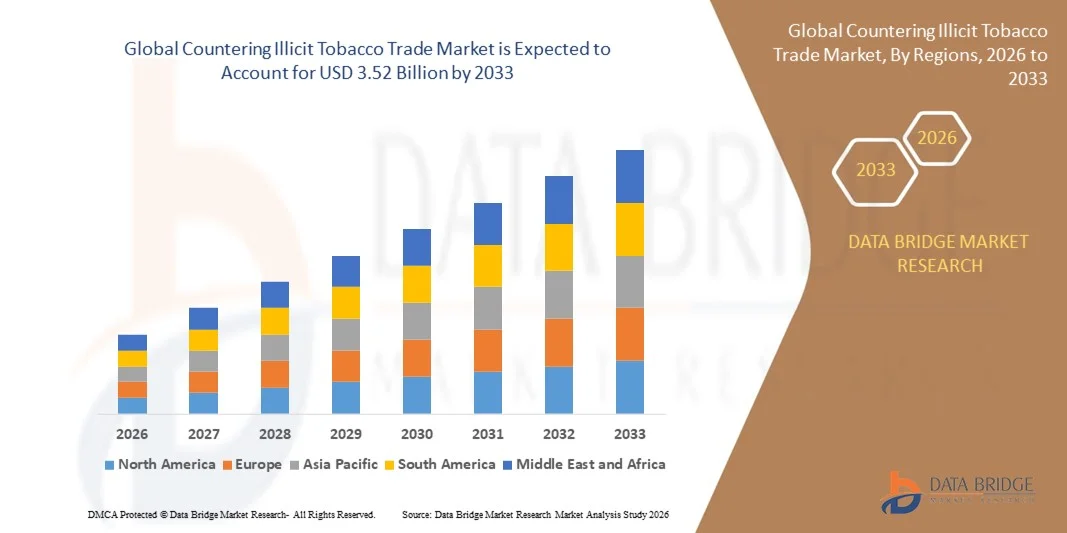

- The global countering illicit tobacco trade market size was valued at USD 2.78 billion in 2025 and is expected to reach USD 3.52 billion by 2033, at a CAGR of 3.00% during the forecast period

- The market growth is largely fuelled by the strengthening of regulatory frameworks and increased global efforts to curb tax evasion in the tobacco sector

- Growing adoption of advanced track-and-trace technologies across emerging and developed economies

Countering Illicit Tobacco Trade Market Analysis

- Market expansion is driven by rising demand for authentication solutions, serialization systems, and digital tax stamp technologies aimed at enhancing supply-chain transparency

- Stricter compliance requirements under frameworks such as the WHO FCTC Protocol are encouraging manufacturers and governments to invest in more robust anti-counterfeiting and surveillance systems

- North America dominated the countering illicit tobacco trade market with the largest revenue share in 2025, driven by the strong presence of advanced authentication technologies and strict regulatory frameworks aimed at reducing illicit cigarette circulation. The region’s proactive enforcement measures and increasing adoption of digital tax stamp systems further support market expansion

- Asia-Pacific region is expected to witness the highest growth rate in the global countering illicit tobacco trade market, driven by rapid digitalization of tax systems, strengthening border security frameworks, and growing awareness regarding illicit trade prevention among manufacturers and authorities

- The tax stamps segment held the largest market revenue share in 2025, driven by increasing regulatory mandates requiring secure tax verification across tobacco products. Tax stamps provide a standardized, government-approved method for authentication, enabling effective monitoring of legal product movement and supporting enforcement activities across domestic and cross-border markets

Report Scope and Countering Illicit Tobacco Trade Market Segmentation

|

Attributes |

Countering Illicit Tobacco Trade Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Countering Illicit Tobacco Trade Market Trends

Rise of Digital Track-and-Trace Systems

- The rapid shift toward digital track-and-trace technologies is reshaping the countering illicit tobacco trade landscape by enabling real-time product authentication and enhanced visibility across distribution networks. These systems allow authorities to monitor regulated products more accurately, preventing tax evasion and identifying smuggling routes. As governments tighten compliance norms, adoption is becoming essential for both manufacturers and distributors

- The increasing deployment of serialization, unique identification codes, and digital tax stamps is accelerating the adoption of integrated monitoring platforms. These digital identifiers allow automated verification, reduce human errors, and streamline regulatory audits. Such tools are especially valuable in regions with limited enforcement infrastructure, supporting more efficient oversight

- The affordability and scalability of digital compliance tools are encouraging wider adoption among tobacco manufacturers. Cloud-based platforms and modular software solutions help reduce operational complexity and improve data management throughout supply chains. Enhanced visibility from production to retail reduces leakage, improves accountability, and strengthens tax collection outcomes

- For instance, in 2023, several Southeast Asian countries recorded a significant decline in illicit cigarette circulation after implementing national track-and-trace systems integrated with digital tax verification. These initiatives improved enforcement efficiency, strengthened border controls, and helped governments recover lost tax revenue. The positive results encouraged further regional adoption of digital systems

- While digital systems are improving traceability and reducing illegal trade, their long-term success depends on robust infrastructure, user training, and regulatory alignment across jurisdictions. Developing unified compliance standards and enabling broader technology access remain essential for sustained impact. Stakeholders must prioritize modernization and interoperability to fully leverage these solutions

Countering Illicit Tobacco Trade Market Dynamics

Driver

Increasing Government Enforcement and Regulatory Frameworks

- Strengthening anti-illicit trade regulations is driving sustained investment in monitoring systems, tax verification tools, and border enforcement technologies. Governments aim to curb revenue losses caused by counterfeit and smuggled tobacco products, leading to tighter controls and stricter penalties. These measures are compelling manufacturers to upgrade supply chain visibility and compliance capabilities

- Rising awareness among retailers, distributors, and consumers regarding the risks of illegal tobacco—such as health hazards, financing of criminal networks, and economic losses—is further supporting adoption of compliant systems. With increasing scrutiny from authorities, legitimate businesses are prioritizing transparency to protect reputational and operational stability. Improved awareness is contributing to a structured compliance culture

- Collaborative efforts between tax authorities, customs agencies, and international organizations are improving surveillance and enforcement capacity. Shared intelligence networks, real-time data exchange, and harmonized regulations help identify illicit trade patterns more efficiently. These coordinated actions have enhanced cross-border visibility and resulted in stronger enforcement outcomes

- For instance, in 2022, European regulatory bodies enhanced their cross-border digital monitoring systems to combat illicit cigarette trade, resulting in higher seizure rates and improved compliance across the region. The upgrades enabled better collaboration among member states, reducing loopholes previously exploited by illegal networks. This demonstrated the effectiveness of digital harmonization policies

- While strict enforcement is accelerating market growth, continued investment in advanced technologies, regulatory transparency, and stakeholder education is essential to sustain progress. Governments must focus on modernizing infrastructure and fostering industry-wide coordination to minimize compliance gaps. Long-term improvements rely on consistent policy support and technology-driven oversight

Restraint/Challenge

High Implementation Costs and Limited Infrastructure in Developing Regions

- The deployment of advanced track-and-trace systems and authentication technologies requires significant investment in software, hardware, and digital infrastructure. Many small and medium manufacturers struggle with installation and maintenance costs, limiting adoption across developing countries. High upfront expenses remain a major barrier to strengthening regulatory compliance

- Limited digital readiness, lack of trained personnel, and insufficient enforcement capabilities hinder effective implementation in rural and underdeveloped regions. In many areas, outdated systems and weak connectivity restrict real-time monitoring, causing delays in identifying illicit product movement. These constraints result in fragmented compliance frameworks

- Supply chain fragmentation and widespread informal markets further complicate enforcement. In regions with weak governance structures, illegal networks operate more freely and often circumvent regulatory controls. This reduces the effectiveness of digital systems, especially when legitimate and illegitimate supply chains overlap

- For instance, in 2023, several African nations reported challenges in implementing national track-and-trace programs due to infrastructure gaps and limited funding. These barriers restricted rollout speed and hindered enforcement efforts, enabling illicit products to continue circulating. The issues underscored the need for scalable and cost-effective solutions

- While technology adoption is growing, addressing cost barriers, infrastructure limitations, and capability gaps is critical for expanding enforcement coverage. Stakeholders must prioritize decentralized solutions, mobile-enabled platforms, and phased implementation strategies to improve accessibility. Strengthening local capacity will be essential for long-term success

Countering Illicit Tobacco Trade Market Scope

The countering illicit tobacco trade market is segmented on the basis of packaging and technology.

- By Packaging

On the basis of packaging, the countering illicit tobacco trade market is segmented into holograms, printing and marking, stamping foil, and tax stamps.The tax stamps segment held the largest market revenue share in 2025, driven by increasing regulatory mandates requiring secure tax verification across tobacco products. Tax stamps provide a standardized, government-approved method for authentication, enabling effective monitoring of legal product movement and supporting enforcement activities across domestic and cross-border markets.

The holograms segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising adoption of high-security optical features that help prevent counterfeiting and improve product traceability. Hologram-based packaging solutions are gaining popularity due to their tamper-evident design, easy visual verification, and strong applicability across varied tobacco product categories.

- By Technology

On the basis of technology, the countering illicit tobacco trade market is segmented into overt and covert.The overt segment accounted for the largest market revenue share in 2025, supported by the widespread deployment of visible authentication elements such as holograms, colour-shifting inks, and printed tax markings that enable quick on-site inspection by authorities, retailers, and consumers. These features enhance trust and compliance while reducing the circulation of counterfeit tobacco products.

The covert segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing reliance on hidden security elements such as microtext, UV inks, and forensic markers that provide an additional layer of protection. Covert technologies are increasingly adopted by enforcement agencies and manufacturers for advanced verification, enabling more accurate identification of illicit products throughout distribution channels.

Countering Illicit Tobacco Trade Market Regional Analysis

- North America dominated the countering illicit tobacco trade market with the largest revenue share in 2025, driven by the strong presence of advanced authentication technologies and strict regulatory frameworks aimed at reducing illicit cigarette circulation. The region’s proactive enforcement measures and increasing adoption of digital tax stamp systems further support market expansion

- Consumers and regulatory bodies in the region highly value secure packaging solutions, traceability systems, and effective supply chain monitoring technologies such as holograms, digital tax stamps, and serialization

- This rising emphasis on product integrity, combined with strong governmental initiatives and cross-border anti-smuggling programs, continues to establish North America as a leading hub for technologies designed to mitigate illicit tobacco activities

North America Countering Illicit Tobacco Trade Market Insight

The U.S. countering illicit tobacco trade market captured the largest revenue share in 2025 within North America, driven by intensified federal and state-level taxation measures, enforcement programs, and investments in digital authentication systems. The growing need to curb illegal cigarette imports and counterfeit tobacco products has accelerated the adoption of tax stamps, track-and-trace solutions, and secure packaging. In addition, the rising collaboration between government agencies and technology providers is further contributing to the market’s growth in the U.S.

Europe Countering Illicit Tobacco Trade Market Insight

The Europe countering illicit tobacco trade market is expected to witness the fastest growth rate from 2026 to 2033, primarily fuelled by stringent EU regulations, such as the Tobacco Products Directive (TPD) and mandatory track-and-trace systems. Increasing concerns over tax revenue losses and the growing prevalence of illicit cigarette trade are prompting governments to adopt secure packaging, overt and covert technologies, and advanced monitoring solutions. Europe’s strong regulatory environment continues to support demand across both manufacturing and distribution channels.

U.K. Countering Illicit Tobacco Trade Market Insight

The U.K. countering illicit tobacco trade market is expected to witness strong growth from 2026 to 2033, driven by rising efforts to combat smuggling, counterfeit tobacco products, and tax evasion. The government’s consistent enforcement actions, together with growing adoption of digital tracking solutions and secure tax stamps, are strengthening the market. The shift toward enhanced monitoring technologies across retail and wholesale distribution is likely to support future growth in the U.K.

Germany Countering Illicit Tobacco Trade Market Insight

The Germany countering illicit tobacco trade market is anticipated to grow significantly from 2026 to 2033, supported by the country’s strict fiscal policies, well-defined regulatory framework, and increasing focus on product authentication. Strong emphasis on compliance, combined with the adoption of high-security printing technologies, holographic labels, and tamper-evident packaging, is driving market development. Germany’s robust enforcement strategies continue to promote widespread use of secure traceability solutions across the supply chain.

Asia-Pacific Countering Illicit Tobacco Trade Market Insight

The Asia-Pacific countering illicit tobacco trade market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising regulatory scrutiny, and increasing government concerns over large-scale illicit cigarette production. Countries such as China, India, Indonesia, and the Philippines are investing heavily in authentication technologies, digital tax stamp programs, and enforcement modernization. The region’s expanding tobacco consumption base and growing adoption of secure packaging solutions are further driving market growth.

Japan Countering Illicit Tobacco Trade Market Insight

The Japan countering illicit tobacco trade market is projected to grow rapidly from 2026 to 2033 due to the country’s strong focus on regulatory compliance, product safety, and advanced security technologies. Japan’s technologically mature ecosystem supports the deployment of sophisticated overt and covert authentication solutions. Increasing government initiatives to prevent illicit distribution and ensure traceability across retail channels are expected to boost the adoption of secure packaging throughout the market.

China Countering Illicit Tobacco Trade Market Insight

The China countering illicit tobacco trade market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by high tobacco consumption, strong domestic production, and expanding implementation of digital tax stamp technologies. China’s large-scale tobacco distribution network, combined with its efforts to curb counterfeit cigarette production and illegal cross-border trade, is accelerating the adoption of secure packaging solutions, stamping foils, and advanced monitoring technologies across the market.

Countering Illicit Tobacco Trade Market Share

The Countering Illicit Tobacco Trade industry is primarily led by well-established companies, including:

• Advanced Track & Trace (France)

• AlpVision (Switzerland)

• Alien Technology, LLC. (U.S.)

• Authentix (U.S.)

• Holostik (India)

• Impinj, Inc. (U.S.)

• Linx Printing Technologies (U.K.)

• Suzhou Image Laser Technology Co., Ltd (China)

• VeriTrace, Inc. (U.S.)

• Zebra Technologies Corp. (U.S.)

• Japan Tobacco Inc. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Countering Illicit Tobacco Trade Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Countering Illicit Tobacco Trade Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Countering Illicit Tobacco Trade Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.