Global Countertop Oven Market

Market Size in USD Billion

CAGR :

%

USD

9.82 Billion

USD

15.07 Billion

2024

2032

USD

9.82 Billion

USD

15.07 Billion

2024

2032

| 2025 –2032 | |

| USD 9.82 Billion | |

| USD 15.07 Billion | |

|

|

|

|

Countertop Oven Market Size

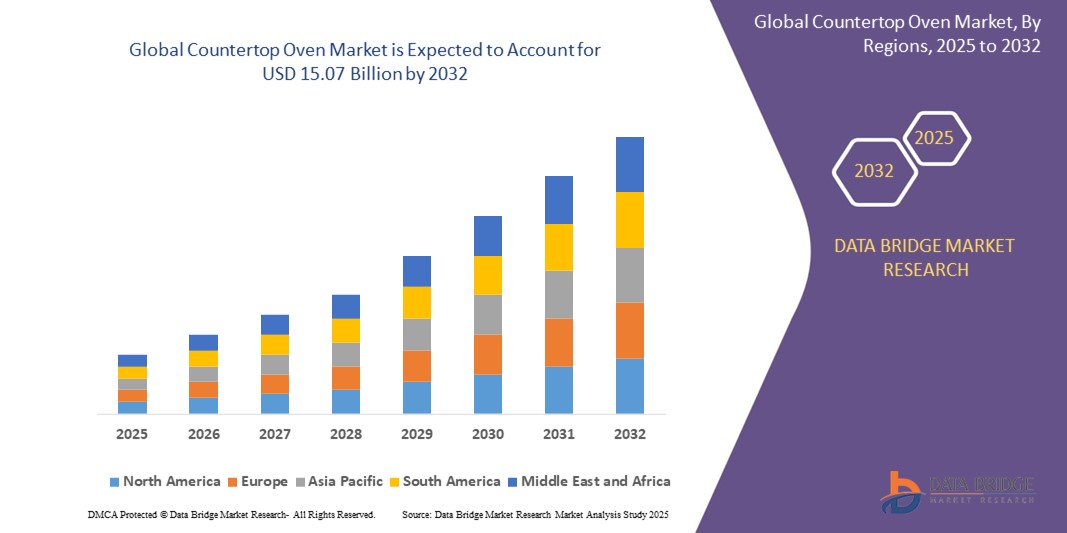

- The global countertop oven market was valued at USD 9.82 billion in 2024 and is expected to reach USD 15.07 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.5%, primarily driven by the increasing demand for space-saving kitchen appliances and technological innovations

- This growth is driven by factors such as the rise in consumer preference for energy-efficient and multi-functional kitchen appliances, the growing trend of smart kitchens, and an increase in the number of small households and urbanization

Countertop Oven Market Analysis

- Countertop ovens are versatile kitchen appliances used for baking, broiling, toasting, and roasting, offering convenience and energy efficiency for small-scale cooking. They are essential in both residential and commercial kitchens, providing a quick and space-saving alternative to traditional ovens

- The demand for countertop ovens is significantly driven by the increasing trend of home cooking, consumer preference for energy-efficient appliances, and the rising number of small households and apartments. Over half of the global demand is driven by the growing adoption of countertop ovens in residential settings, with significant growth seen in regions with high urbanization and busy lifestyles

- The North America region stands out as one of the dominant regions for countertop ovens, driven by its advanced kitchen appliance market, consumer demand for multi-functional and smart appliances, and high disposable incomes

- For instance, the adoption of smart countertop ovens in the U.S. has seen significant growth, with features such as Wi-Fi connectivity and app-controlled cooking. The North America region not only leads in the use of countertop ovens but also drives innovations in appliance technology

- Globally, countertop ovens rank as one of the most popular kitchen appliances, following traditional ovens, and play a crucial role in providing convenience, energy savings, and flexibility in everyday cooking

Report Scope and Countertop Oven Market Segmentation

|

Attributes |

Countertop Oven Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Countertop Oven Market Trends

"Increasing Adoption of Smart Features and Multifunctionality"

- One prominent trend in the global countertop oven market is the growing adoption of smart features and multifunctionality

- These advanced features improve the user experience by offering convenient options like remote control, preset cooking programs, and integration with voice assistants such as Alexa and Google Assistant

- For instance, smart countertop ovens with Wi-Fi connectivity allow users to control cooking settings remotely, monitor progress, and receive notifications, making meal preparation more convenient and efficient

- Multifunctionality is also a key trend, with modern countertop ovens now offering multiple cooking modes such as baking, broiling, toasting, air frying, and dehydrating, all in one appliance, appealing to consumers seeking space-saving yet versatile solutions

- This trend is reshaping the countertop oven market by improving convenience, energy efficiency, and cooking precision, driving greater consumer demand for advanced, multifunctional kitchen appliances

Countertop Oven Market Dynamics

Driver

"Growing Demand Due to Changing Lifestyles and Home Cooking Trends"

- The increasing shift toward home cooking and healthier eating habits is significantly contributing to the rising demand for countertop ovens globally

- As more consumers seek convenient, time-saving solutions for daily meal preparation, countertop ovens offer a compact, energy-efficient alternative to traditional ovens, suitable for modern, fast-paced lifestyles

- The rising popularity of multifunctional appliances that can bake, toast, broil, and air fry is further accelerating the demand, especially among urban dwellers and small households with limited kitchen space

- The availability of user-friendly features like preset cooking functions, digital controls, and smart connectivity enhances convenience and appeals to tech-savvy consumers who prioritize efficiency in their kitchen routines

For instance,

- In 2023 report by the U.S. Bureau of Labor Statistics, more than 60% of households reported cooking meals at home at least five times a week, a behavior sustained since the COVID-19 pandemic, boosting demand for compact and easy-to-use appliances like countertop ovens

- In 2022 report by Statista, the global air fryer oven segment, a subcategory of countertop ovens, saw a sharp increase in sales, particularly in North America and Europe, reflecting a broader consumer move toward healthier cooking methods

- As a result of these changing lifestyle habits and the preference for compact, multi-use, and smart appliances, the global countertop oven market continues to experience steady growth, establishing itself as a kitchen essential

Opportunity

"Expanding Potential with Smart Technology and AI Integration"

- The integration of smart technology and AI in countertop ovens presents a major opportunity for manufacturers to enhance user experience, efficiency, and cooking precision

- AI-powered countertop ovens can learn user preferences, suggest optimal cooking settings, and automatically adjust time and temperature based on the food type and weight, making cooking more intuitive and less error-prone

- These smart ovens can also incorporate sensors and cameras to monitor the cooking process in real time, ensuring consistent results and reducing the chances of overcooking or undercooking

For instance,

- In January 2024, according to a report by the Consumer Technology Association (CTA), the global smart kitchen appliance market saw a 30% rise in AI-integrated product launches, with smart countertop ovens being among the most adopted appliances due to their convenience and versatility

- In September 2023, a market insight report by TechCrunch highlighted that smart oven with built-in food recognition and adaptive cooking algorithms, such as those by June and Tovala, are rapidly gaining popularity among tech-savvy consumers and busy professionals looking for effortless cooking solutions

- The integration of AI and smart features in countertop ovens opens doors to new product categories, personalized cooking experiences, and improved energy efficiency, offering a strong growth opportunity in both developed and emerging markets

Restraint/Challenge

"High Product Costs and Limited Affordability in Emerging Markets"

- The relatively high cost of advanced countertop ovens, especially those with smart features and multifunctional capabilities, poses a significant challenge to market penetration, particularly in price-sensitive and developing regions

- Premium countertop ovens can range from a few hundred to over a thousand U.S. dollars, making them less accessible to budget-conscious consumers who may opt for more basic cooking appliances or traditional ovens

- This cost barrier often limits the adoption of high-end models in lower-income households and rural areas, where affordability plays a key role in consumer decision-making

For instance,

- In October 2024, a market study by Global Appliance Insights highlighted that the average price of smart countertop ovens in North America and Europe is nearly 3–4 times higher than in basic appliance categories, which hinders mass adoption in emerging economies like India, Brazil, and Southeast Asia

- As a result, the high cost of technologically advanced countertop ovens continues to be a major restraint, affecting overall market expansion and limiting access to innovation in cost-sensitive regions

Countertop Oven Market Scope

The market is segmented on the basis of category, capacity, application, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Category |

|

|

By Capacity |

|

|

By Application |

|

|

By Distribution Channel |

|

Countertop Oven Market Regional Analysis

“North America is the Dominant Region in the Countertop Oven Market”

- North America dominates the global countertop oven market, driven by a high level of kitchen appliance penetration, advanced consumer lifestyles, and the widespread adoption of smart home technologies

- The U.S. holds a major market share due to strong consumer demand for compact, energy-efficient, and multifunctional kitchen appliances, especially among urban households and health-conscious individuals

- The presence of leading appliance brands, frequent technological innovations, and growing preferences for smart, connected ovens continue to strengthen the regional market

- Additionally, high disposable incomes, changing dietary habits, and a strong focus on home cooking trends, especially post-pandemic, contribute to consistent demand for premium countertop ovens across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global countertop oven market, fueled by increasing urbanization, changing lifestyles, and rising consumer spending on kitchen appliances

- Countries such as China, India, and Japan are rapidly adopting modern kitchen technologies due to growing middle-class populations, rising awareness about energy-efficient cooking solutions, and smaller household sizes favoring compact appliances

- Japan remains a prominent market with its affinity for advanced home appliances and space-saving kitchen solutions, while China and India show accelerated demand driven by growing e-commerce channels and government initiatives promoting energy-efficient products

- The increasing presence of international brands, coupled with rising consumer preference for multifunctional, affordable, and smart kitchen appliances, positions Asia-Pacific as a key growth driver for the countertop oven industry

Countertop Oven Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Panasonic Corporation (Japan)

- Breville Group Ltd. (Australia)

- Cuisinart (U.S.)

- Hamilton Beach Brands Holding Company (U.S.)

- Black+Decker (U.S.)

- GE Appliances (U.S.)

- Samsung Electronics (South Korea)

- Sharp Corporation (Japan)

- KitchenAid (U.S.)

- DeLonghi S.p.A. (Italy)

- Miele & Cie. KG (Germany)

- Smeg S.p.A. (Italy)

- Whirlpool Corporation (U.S.)

- LG Electronics (South Korea)

- Tefal (Group SEB) (France)

- Haier Group (China)

- Viking Range, LLC (U.S.)

- Westinghouse (U.S.)

- Russell Hobbs (U.K.)

- Euro-Pro Operating LLC (Ninja Kitchen) (U.S.)

Latest Developments in Global Countertop Oven Market

- In July 2024, Smeg launched a new multifunctional countertop oven aimed at redefining modern culinary experiences. This state-of-the-art appliance integrates multiple cooking functionalities—including baking, grilling, and roasting into a single compact unit, catering to the evolving needs of contemporary kitchens. True to Smeg’s signature design philosophy, the oven features an elegant and space-efficient build, making it a sophisticated yet practical addition to any home. This product introduction aligns with current trends in the global countertop oven market, where consumer demand is increasingly shifting toward multifunctional, aesthetically pleasing, and space-saving kitchen appliances

- In January 2024, Panasonic, a global leader in consumer lifestyle technologies, announced an expanded strategic partnership with Fresco, the premier smart kitchen platform serving the world’s top appliance brands. The collaboration aims to deliver an advanced, AI-powered cooking assistant integrated into Panasonic’s kitchen appliance portfolio, beginning with the Panasonic HomeCHEF 4-in-1 multi-oven. This partnership marks a significant development in the global countertop oven market, reflecting the growing trend toward smart, multifunctional appliances that cater to increasingly tech-savvy and convenience-oriented consumers

- In April 2024, LG Electronics unveiled its latest additions to the Signature Kitchen Suite, including a new built-in oven, free zone induction hob, and downdraft hood. Showcasing cutting-edge AI technologies and a refined, modern design, the expanded lineup of built-in appliances is designed to deliver exceptional convenience, performance, and aesthetic appeal to contemporary kitchens. These innovations reflect LG’s continued commitment to advancing smart kitchen solutions, with features that enable intuitive cooking, personalized settings, and seamless integration into connected home ecosystems

- In August 2023, LG Electronics announced a strategic partnership with ITC Foods, a prominent diversified conglomerate, aimed at enhancing customer convenience, health-conscious cooking, and culinary versatility. The collaboration introduces the LG Charcoal Healthy Ovens, which come equipped with Wi-Fi connectivity and can be seamlessly controlled via the LG ThinQ app. This integration allows users to effortlessly scan the barcode on ITC Master Chef frozen food packaging, automatically transmitting the cooking instructions directly to the oven with a simple touch of a button. This partnership has significant implications for the global countertop oven market, as it highlights the increasing consumer demand for smart, multifunctional kitchen appliances

- In February 2023, Samsung Electronics introduced the Series 7 Bespoke AI Oven, a state-of-the-art appliance designed to enhance the culinary experience with cutting-edge technology. Equipped with the advanced AI Pro Cooking technology, the Series 7 Bespoke AI Oven is capable of preparing meals that are precisely tailored to users’ dietary preferences and needs. The oven's sleek, minimalist design is complemented by a user-friendly auto-open door feature, offering both functional convenience and a modern aesthetic appeal. This product introduction is highly relevant to the global countertop oven market, as it aligns with the growing demand for smart, multifunctional kitchen appliances

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.