Global Countertop Paper Napkin Dispenser Market

Market Size in USD Million

CAGR :

%

USD

361.20 Million

USD

709.21 Million

2024

2032

USD

361.20 Million

USD

709.21 Million

2024

2032

| 2025 –2032 | |

| USD 361.20 Million | |

| USD 709.21 Million | |

|

|

|

|

Countertop Paper Napkin Dispenser Market Size

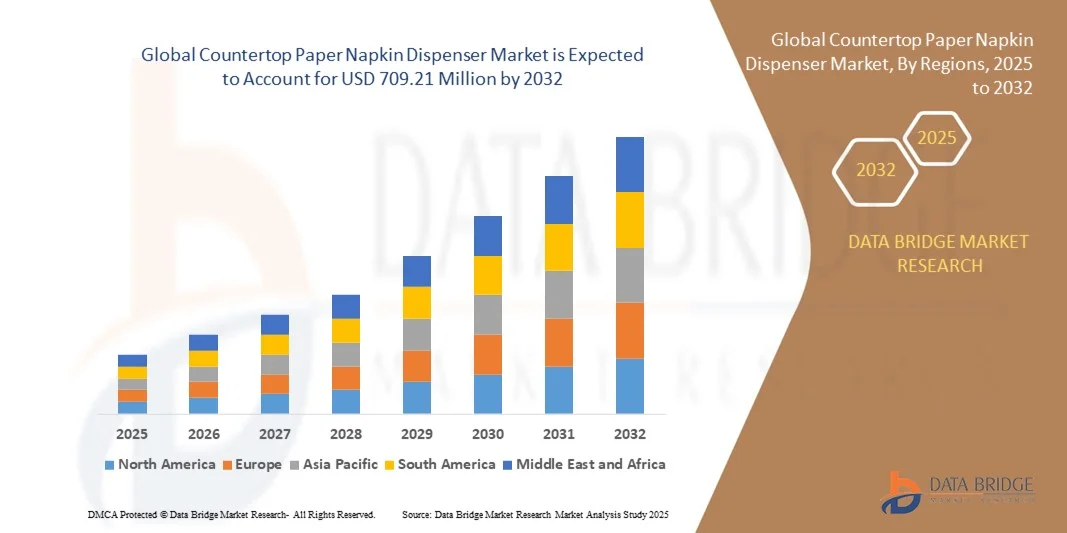

- The global countertop paper napkin dispenser market size was valued at USD 361.20 million in 2024 and is expected to reach USD 709.21 million by 2032, at a CAGR of 8.80% during the forecast period

- The market growth is largely fueled by the rising demand for hygiene-focused solutions in restaurants, offices, hospitals, and public facilities, leading to increased adoption of countertop paper napkin dispensers across commercial and institutional settings

- Furthermore, growing awareness of sanitation standards and the need to minimize paper wastage is driving businesses to invest in efficient, durable, and easy-to-use dispensers. These converging factors are accelerating the adoption of modern napkin dispensing solutions, thereby significantly boosting the industry's growth

Countertop Paper Napkin Dispenser Market Analysis

- Countertop paper napkin dispensers, providing organized, controlled, and accessible napkin distribution, are increasingly recognized as essential hygiene and convenience tools in foodservice, healthcare, and educational establishments

- The escalating demand for these dispensers is primarily fueled by the expansion of the quick-service and casual dining sectors, increasing footfall in public spaces, and rising consumer preference for touchless or one-at-a-time dispensing systems. Manufacturers are innovating with high-capacity, automatic, and aesthetically designed dispensers to meet evolving hygiene and operational efficiency needs, further strengthening market growth

- North America dominated the countertop paper napkin dispenser market in 2024, due to high product demand across foodservice establishments, corporate offices, and public facilities

- Asia-Pacific is expected to be the fastest growing region in the countertop paper napkin dispenser market during the forecast period due to rapid urbanization, increasing disposable incomes, and the expansion of the foodservice industry

- Manual segment dominated the market with a market share of 58.3% in 2024, due to its affordability and mechanical simplicity. Manual dispensers require no power source, making them ideal for cost-sensitive users and low-traffic environments. Their reliability, low maintenance, and compatibility with various napkin types continue to sustain their market position across diverse applications.

Report Scope and Countertop Paper Napkin Dispenser Market Segmentation

|

Attributes |

Countertop Paper Napkin Dispenser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Countertop Paper Napkin Dispenser Market Trends

Growth of Touchless and Automatic Napkin Dispensers

- The countertop paper napkin dispenser market is increasingly driven by the demand for touchless and automatic dispensing solutions that enhance hygiene and reduce cross-contamination risks. Consumer preference for hands-free operation has accelerated in public and commercial spaces, particularly following heightened awareness around health and sanitation due to the COVID-19 pandemic

- For instance, companies such as Bobrick Washroom Equipment and Cascades Inc. have developed sensor-activated napkin dispensers that dispense a controlled number of napkins per use, minimizing waste and ensuring sanitary conditions in foodservice, healthcare, and institutional environments

- Automated dispensing systems incorporate smart technologies such as adjustable dispensing lengths and real-time monitoring capabilities allowing facility managers to optimize napkin usage and reduce operational costs. These innovations also support sustainability goals by curbing excess consumption while maintaining convenience for users

- Growing adoption of these advanced dispensers is supported by expanding commercial food and beverage sectors, namely quick-service restaurants (QSRs), cafes, and cafeterias where hygiene standards and customer experience are prioritized

- In addition, evolving design aesthetics and material choices in napkin dispensers cater to diverse consumer preferences and venue styles, from minimalist hospitality settings to high-traffic institutional areas, further stimulating market growth

- This trend toward automation and touchless operation is shaping the countertop paper napkin dispenser market into a technology-driven segment focused on hygiene, waste efficiency, and user-friendly designs

Countertop Paper Napkin Dispenser Market Dynamics

Driver

Rising Demand for Hygienic and Waste-Efficient Solutions

- Rising consumer and organizational emphasis on hygiene and waste reduction is a significant driver of demand for countertop paper napkin dispensers. Facilities seek dispensers that reduce surface contact to mitigate contamination while curbing napkin waste to control costs and environmental footprint

- For instance, healthcare facilities and foodservice chains increasingly standardize sensor-based automatic dispensers to promote high hygiene standards and ensure consistent napkin usage. Such dispensers limit excess napkin consumption, reduce litter, and simplify maintenance, meeting strict regulatory and consumer expectations

- The growing penetration of sustainable operations in commercial outlets and institutional cafeterias further fuels interest in dispensers that align with eco-friendly initiatives. These devices help businesses demonstrate corporate responsibility while optimizing consumables management

- High footfall venues such as malls and airports adopt countertop napkin dispensers that support uninterrupted supply and efficient stationery use. This improves customer satisfaction and reduces staff workload by minimizing manual dispenser refills and paper waste

- Integration of dispenser usage data with building management systems enables real-time monitoring and inventory forecasting. This adoption of smart hygiene management helps organizations reduce operational inefficiencies, saving costs over the product lifecycle

Restraint/Challenge

High Cost and Maintenance of Advanced Dispensers

- Higher initial investment and ongoing maintenance costs of touchless and automatic napkin dispensers pose constraints on wider market adoption. These advanced dispensers require sensors, batteries or power supply, and periodic calibration which add expense and operational complexity compared to traditional manual dispensers

- For instance, small food outlets and low-margin businesses may hesitate to invest in automated models due to budget constraints, opting instead for simpler mechanical dispensers despite emerging benefits in hygiene and waste reduction

- The cost of maintenance—including battery replacement, sensor calibration, and cleaning to prevent shred accumulation—can increase total cost of ownership, impacting decisions in high-volume, cost-sensitive deployments

- Furthermore, lack of technical expertise among end-users can result in improper maintenance causing downtime and inconsistent dispenser performance. This risk slows adoption in locations with limited facilities management capability or digital infrastructure

- To address these challenges, manufacturers are developing modular, user-friendly dispenser designs and offering maintenance packages aimed at reducing total ownership costs. Advances in energy-efficient sensors and durable components are also expected to lower barriers and enable broader acceptance of automated countertop napkin dispensers globally

Countertop Paper Napkin Dispenser Market Scope

The market is segmented on the basis of product type, mounting type, fold type, material type, dispensing technology, capacity, and end use.

- By Product Type

On the basis of product type, the countertop paper napkin dispenser market is segmented into counter paper napkin dispensers, wall mounted folded paper napkin dispensers, recessed paper napkin dispensers, center-pull paper napkin dispensers, and lever/crank paper napkin dispensers. The counter paper napkin dispenser segment dominated the market with the largest revenue share in 2024, driven by its widespread use in restaurants, cafes, and self-service dining areas. These dispensers offer high convenience and easy accessibility for customers, reducing waste and ensuring better hygiene. Their durable build, compact design, and availability in various styles suitable for different decors have made them a preferred choice in both commercial and household environments. The growing trend of fast-casual dining and quick-service restaurants has further strengthened the demand for countertop napkin dispensers.

The center-pull paper napkin dispenser segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by its hygienic one-at-a-time dispensing feature that minimizes cross-contamination. These dispensers are gaining traction in healthcare facilities, offices, and educational institutions where hygiene and efficiency are top priorities. Their compatibility with high-capacity rolls and reduced maintenance needs make them cost-effective for high-traffic areas. In addition, the user-friendly design and smooth dispensing mechanism enhance convenience, supporting their increasing adoption across various end-use sectors.

- By Mounting Type

On the basis of mounting type, the market is segmented into surface mounted and countertop mounted. The countertop mounted segment held the largest market revenue share in 2024, primarily due to its versatility and suitability for various commercial and household settings. Countertop dispensers are easy to install, portable, and require no permanent fixtures, making them ideal for dynamic service environments such as restaurants and cafes. Their aesthetic appeal, combined with efficient space utilization, supports growing adoption in modern dining and hospitality facilities.

The surface mounted segment is projected to record the fastest growth during the forecast period, driven by its increased use in washrooms, office spaces, and institutional facilities. Surface-mounted dispensers offer secure installation, durability, and minimal risk of theft or damage. They are particularly favored in public restrooms and high-traffic areas where fixed installations ensure stability and controlled dispensing. The rise in infrastructural developments and hygiene-focused facility management practices has further boosted their adoption.

- By Fold Type

On the basis of fold type, the market is segmented into C-fold/M-fold and rolls. The C-fold/M-fold segment dominated the market with the largest revenue share in 2024, owing to its widespread use in commercial and institutional settings. These dispensers are cost-effective, easy to refill, and designed for single-sheet dispensing, minimizing paper wastage. Their compatibility with a variety of dispenser models and brands contributes to their steady market preference among end users. The rise in demand from restaurants, offices, and schools is further strengthening the dominance of this segment.

The rolls segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by increasing demand for continuous and high-capacity dispensing systems. Roll dispensers are highly suitable for high-traffic environments that require frequent napkin access with minimal refilling effort. Their compact design, combined with efficient dispensing, reduces operational downtime and enhances hygiene management. The ongoing preference for automatic and touchless roll dispensers in public facilities is further driving segment growth.

- By Material Type

On the basis of material type, the market is categorized into plastic and metal. The plastic segment accounted for the largest market revenue share in 2024, attributed to its cost-effectiveness, lightweight structure, and design flexibility. Plastic dispensers are commonly used across quick-service restaurants, cafes, and households due to their durability and ease of maintenance. Their resistance to corrosion and availability in varied colors and finishes also contribute to widespread use in both indoor and outdoor environments.

The metal segment is expected to witness the fastest growth during the forecast period, supported by rising demand in premium commercial spaces and institutional facilities. Metal dispensers offer superior strength, longer lifespan, and a modern appearance suitable for upscale establishments. In addition, their resistance to vandalism and ability to maintain cleanliness standards in high-traffic areas make them preferred in hospitals and airports. Growing sustainability initiatives promoting recyclable and long-lasting materials further favor metal dispenser adoption.

- By Dispensing Technology

On the basis of dispensing technology, the market is bifurcated into manual and automatic. The manual segment dominated the market in 2024, accounting for the largest revenue share of 68.3% due to its affordability and mechanical simplicity. Manual dispensers require no power source, making them ideal for cost-sensitive users and low-traffic environments. Their reliability, low maintenance, and compatibility with various napkin types continue to sustain their market position across diverse applications.

The automatic segment is projected to record the fastest growth rate through 2032, driven by the increasing preference for touchless dispensing solutions that enhance hygiene. Automatic napkin dispensers are gaining traction in hospitals, offices, and restaurants as part of broader automation and sanitation trends. Their sensor-based operation reduces contact and paper wastage, improving user convenience and operational efficiency. The integration of battery-efficient and motion-sensing technologies is further accelerating their adoption in modern infrastructure settings.

- By Capacity

On the basis of capacity, the market is segmented into less than 200 napkins, 200–500 napkins, and more than 500 napkins. The 200–500 napkins segment dominated the market in 2024, owing to its balance between compactness and sufficient capacity for mid-traffic environments. These dispensers are widely adopted in cafes, offices, and educational institutions where moderate refill frequency and space optimization are crucial. Their adaptability across manual and automatic dispensing systems has ensured consistent market preference.

The more than 500 napkins segment is anticipated to witness the fastest growth during the forecast period, driven by increasing installations in high-footfall areas such as airports, shopping malls, and large restaurants. These dispensers reduce the need for frequent refills and offer efficient napkin management for continuous use. Their compatibility with roll-based dispensing technologies and durable construction enhances operational efficiency, making them suitable for large-scale commercial applications.

- By End Use

On the basis of end use, the market is segmented into hospitals, restaurants, schools, colleges, offices, and households. The restaurant segment held the largest market revenue share in 2024, driven by the high consumption of disposable napkins in food service environments. Countertop napkin dispensers in restaurants improve hygiene, reduce paper wastage, and provide convenient access for customers. The growth of quick-service and self-service dining models has further accelerated product adoption.

The hospitals segment is expected to register the fastest growth through 2032, owing to the increasing emphasis on hygiene and infection control. Hospitals demand high-quality dispensers designed for minimal contact and controlled dispensing to ensure patient and staff safety. The expansion of healthcare infrastructure and growing awareness about touchless hygiene solutions are major factors fueling this segment’s growth trajectory.

Countertop Paper Napkin Dispenser Market Regional Analysis

- North America dominated the countertop paper napkin dispenser market with the largest revenue share in 2024, driven by high product demand across foodservice establishments, corporate offices, and public facilities

- The region’s strong focus on hygiene standards, supported by stringent sanitation regulations, has significantly accelerated dispenser adoption

- Consumers in North America prefer products that offer convenience, aesthetic appeal, and sustainable material use, particularly in quick-service and casual dining sectors. The growing prevalence of environmentally friendly paper products and advanced dispensing designs is further stimulating regional market growth

U.S. Countertop Paper Napkin Dispenser Market Insight

The U.S. held the largest revenue share within North America in 2024, attributed to its well-established foodservice industry and increasing emphasis on hygiene and waste reduction. Restaurants, cafes, and offices across the country are actively adopting efficient countertop napkin dispensers to enhance cleanliness and customer satisfaction. The presence of leading manufacturers and innovations in durable, eco-conscious dispenser materials support continued market expansion. Furthermore, the rising adoption of automatic and high-capacity dispensers across large dining chains is strengthening the U.S. market position.

Europe Countertop Paper Napkin Dispenser Market Insight

The Europe countertop paper napkin dispenser market is projected to grow at a steady CAGR during the forecast period, primarily fueled by sustainability initiatives and the adoption of eco-friendly hygiene solutions. Increasing emphasis on reducing paper wastage and enhancing facility hygiene in restaurants, educational institutions, and healthcare centers drives regional demand. European consumers favor compact and aesthetically designed dispensers that align with modern interiors. The region’s focus on environmental compliance and the growing number of green-certified commercial establishments are further boosting market growth.

U.K. Countertop Paper Napkin Dispenser Market Insight

The U.K. market is anticipated to grow at a notable CAGR, supported by the expansion of the hospitality and foodservice sectors. The rising number of quick-service restaurants, cafes, and catering units has increased the demand for compact and easy-to-maintain napkin dispensers. Heightened consumer awareness of hygiene and sustainability is encouraging the shift toward recyclable and durable dispenser materials. The market also benefits from the rising trend of digitalized foodservice operations emphasizing hygiene and operational efficiency.

Germany Countertop Paper Napkin Dispenser Market Insight

Germany’s countertop paper napkin dispenser market is expected to register healthy growth through 2032, supported by the country’s strong commitment to quality, hygiene, and sustainability. Commercial facilities and food establishments increasingly prefer durable and energy-efficient dispensing solutions. The integration of touch-free technology and recyclable materials in dispenser designs aligns with Germany’s eco-friendly infrastructure goals. The country’s well-developed restaurant and institutional sectors continue to drive consistent product demand.

Asia-Pacific Countertop Paper Napkin Dispenser Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, increasing disposable incomes, and the expansion of the foodservice industry. Rising awareness of hygiene and the modernization of restaurants and public spaces in China, Japan, and India are fueling market growth. Affordable pricing and widespread availability of compact dispenser models are enhancing product accessibility. Moreover, the emergence of sustainable and automatic dispensing solutions tailored to local consumer preferences is accelerating regional adoption.

China Countertop Paper Napkin Dispenser Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by rapid restaurant chain expansion and growing emphasis on public hygiene. The country’s robust manufacturing base allows easy availability of cost-effective dispenser models in multiple designs and materials. Increased government focus on clean and sustainable urban infrastructure is encouraging widespread product integration in foodservice and hospitality venues.

Japan Countertop Paper Napkin Dispenser Market Insight

Japan’s market is gaining momentum due to the nation’s high hygiene standards and innovation-driven culture. Restaurants, offices, and healthcare facilities are increasingly adopting compact, automated, and design-oriented napkin dispensers that align with Japan’s preference for efficiency and cleanliness. The growing use of eco-friendly materials and smart dispensing technologies is expected to further support market expansion in the coming years.

Countertop Paper Napkin Dispenser Market Share

The countertop paper napkin dispenser industry is primarily led by well-established companies, including:

- Diversified Metal Products, Inc. (U.S.)

- Alwin Manufacturing (U.S.)

- The Steril-Sil Company, LLC (U.S.)

- The Vollrath Company, LLC (U.S.)

- ASI American Specialties, Inc. (U.S.)

- Franke Holding AG (Switzerland)

- Georgia-Pacific (U.S.)

- Bobrick Washroom Equipment, Inc. (U.S.)

- Cintas Corporation (U.S.)

- Dolphin Solutions (U.K.)

- KCWW (Kimberly-Clark Worldwide, Inc.) (U.S.)

- San Jamar (U.S.)

- Cascades Tissue Group (Canada)

- Ableman International Co., Ltd (China)

- Bradleycare – Clean Hands Brochure (U.S.)

- BRADLEY AUSTRALIA (Australia)

- Brightwell Dispensers (U.K.)

- Ecolab (U.S.)

- Euronics Industries Pvt. Ltd (India)

Latest Developments in Global Countertop Paper Napkin Dispenser Market

- In September 2024, Morcon Tissue, Inc. launched its Valay Airlaid Napkin Product Line, featuring premium-quality napkins paired with sustainable dispenser systems tailored for upscale dining and hospitality environments. The launch aligns with growing consumer demand for eco-friendly, high-end hygiene solutions while offering operators reduced consumption through controlled dispensing. This product line is reshaping the premium segment by merging elegance with functionality, helping foodservice businesses maintain a polished brand image while supporting environmental goals

- In February 2024, Kimberly-Clark Professional announced a strategic partnership integrating its ICON Dispenser Collection with the Onvation Smart Restroom Solution, marking a significant advancement toward connected hygiene systems. This partnership enables real-time monitoring of dispenser usage and maintenance needs, driving operational efficiency and improved hygiene management. The move represents the growing convergence of traditional dispensing hardware with digital technologies, signaling a transformative shift in the hygiene and facilities management sector toward smart, data-driven operations

- In March 2023, Tork (by Essity AB) introduced its upgraded Drive-Thru Napkin Dispenser, designed specifically for quick-service restaurants to enhance speed and hygiene in high-volume drive-thru operations. The dispenser’s enclosed, dual-button design improves sanitary conditions while controlling napkin waste and optimizing service time. This innovation reinforces Tork’s leadership in the professional hygiene market by addressing operational bottlenecks in fast-paced environments and setting a new benchmark for sustainable and efficient dispensing solutions

- In March 2020, Tork launched the Xpressnap Fit napkin dispenser system, which significantly reduced refill frequency and minimized napkin wastage compared to conventional models. This innovation targeted small and mid-sized foodservice businesses, helping operators cut costs, save counter space, and improve guest satisfaction. The system’s design marked an important milestone in the evolution of efficient dispensing technologies and established a strong foundation for the brand’s subsequent product innovations aimed at performance and sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Countertop Paper Napkin Dispenser Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Countertop Paper Napkin Dispenser Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Countertop Paper Napkin Dispenser Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.