Global Covid 19 Infection Market

Market Size in USD Billion

CAGR :

%

USD

26.82 Billion

USD

70.31 Billion

2024

2032

USD

26.82 Billion

USD

70.31 Billion

2024

2032

| 2025 –2032 | |

| USD 26.82 Billion | |

| USD 70.31 Billion | |

|

|

|

|

COVID-19 Infection Market Size

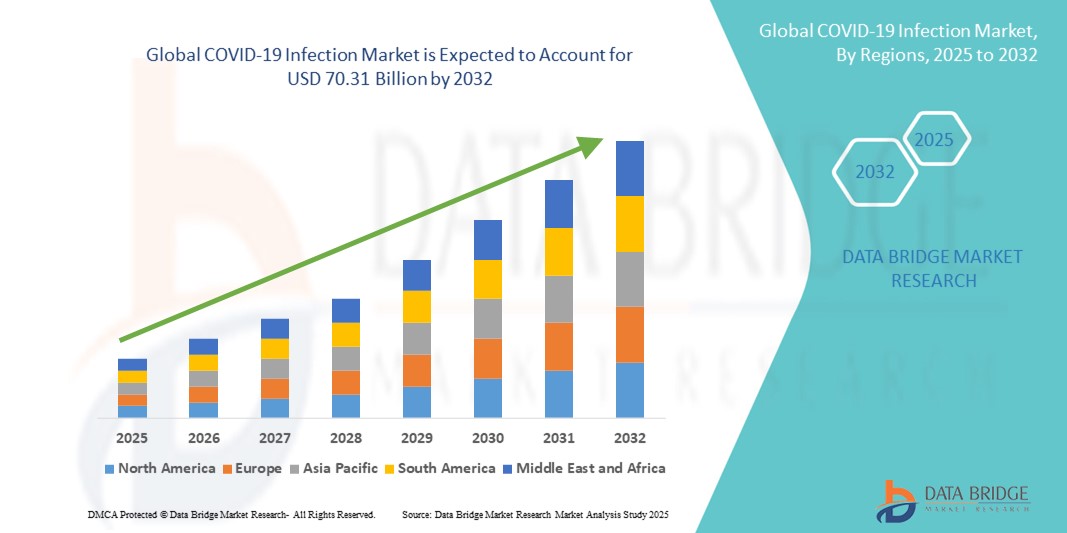

- The global COVID-19 Infection market size was valued at USD 26.82 billion in 2024 and is expected to reach USD 70.31 billion by 2032, at a CAGR of 12.80% during the forecast period

- The market growth is largely fueled by the increasing prevalence of COVID-19 infections worldwide and the urgent need for effective diagnostic, treatment, and prevention solutions. Continuous technological advancements in rapid testing, vaccine development, and antiviral therapies are driving enhanced capabilities in managing the pandemic across healthcare settings

- Furthermore, rising consumer and healthcare provider demand for accurate, fast, and accessible COVID-19 infection solutions is establishing new standards for infectious disease control. These converging factors are accelerating the uptake of COVID-19 diagnostics, therapeutics, and vaccines, thereby significantly boosting the industry's growth

COVID-19 Infection Market Analysis

- The global COVID-19 Infection market continues to evolve with ongoing efforts in diagnostics, treatment, and monitoring, driven by the persistent need to manage new variants and improve healthcare responses worldwide.

- Increasing investments in rapid testing technologies and vaccine development are key growth drivers

- North America dominated the COVID-19 infection market with the largest revenue share of 41.5% in 2024. This dominance is attributed to well-established healthcare infrastructure, early and widespread deployment of advanced diagnostic tools, and strong government support for vaccination and treatment programs. The U.S., in particular, accounts for the majority of this share due to its aggressive testing campaigns and high healthcare expenditure

- Asia-Pacific is projected to be the fastest-growing region in the COVID-19 infection market, with a robust CAGR of 23.8% from 2025 to 2032. Factors fueling this rapid growth include increasing urbanization, improving healthcare infrastructure, large-scale government screening initiatives, and rising awareness among populations in countries such as China, India, Japan, and South Korea

- The Swab Test segment dominated the COVID-19 infection market with a revenue share of 63.8% in 2024, driven by its position as the gold standard for acute infection detection

Report Scope and COVID-19 Infection Market Segmentation

|

Attributes |

COVID-19 Infection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

COVID-19 Infection Market Trends

Ongoing Innovations and Global Response Drive Growth in the COVID-19 Infection Market

- The global COVID-19 Infection market continues to be driven by ongoing demand for rapid and accurate diagnostic tools, effective treatment options, and comprehensive infection management strategies. Governments and healthcare providers worldwide are emphasizing early detection and efficient containment to mitigate further outbreaks

- The increasing adoption of advanced molecular diagnostic techniques, such as RT-PCR and next-generation sequencing, is a primary factor propelling market growth. These technologies provide highly sensitive and specific results, enabling timely intervention and improved patient outcomes

- There is also a growing focus on developing affordable and accessible testing solutions to reach underserved populations, particularly in emerging economies. This push is enhancing market penetration and enabling large-scale screening efforts in communities and workplaces

- The rise of new COVID-19 variants continues to challenge healthcare systems, stimulating innovation in both diagnostic assays and therapeutic treatments. This dynamic environment fosters continuous market expansion as manufacturers strive to keep pace with evolving viral strains

- Public and private sectors are investing heavily in vaccination programs and antiviral drug research, which is expected to contribute to long-term market stability and growth. Moreover, increased awareness and education regarding COVID-19 prevention measures are reinforcing the demand for testing and monitoring services

- The expansion of healthcare infrastructure in developing regions, along with improved regulatory frameworks, supports the broader availability of COVID-19 diagnostic and treatment products, further fueling market advancement through 2032

COVID-19 Infection Market Dynamics

Driver

Growing Need Due to Rising Infection Rates and Digital Healthcare Adoption

- The increasing prevalence of COVID-19 infections globally has significantly heightened awareness around public health safety, prompting strong demand for advanced diagnostic, monitoring, and treatment solutions. Both healthcare providers and government bodies are heavily investing in scalable tools that allow early detection and effective response to outbreaks

- For instance, in April 2024, several health tech companies introduced AI-powered surveillance systems and next-generation biosensors to track infections in real time. These innovations mirror the growing emphasis on proactive healthcare infrastructure and data-driven decision-making

- As new COVID-19 variants continue to emerge, there is an urgent need for real-time data sharing, remote diagnostics, and integrated care systems. These elements are becoming critical components of infection management strategies across hospitals, clinics, and even home-care setups

- Furthermore, the shift towards decentralized and digital healthcare—spanning telemedicine consultations, cloud-based diagnostics, and home-testing kits—has boosted consumer and institutional reliance on advanced COVID-19 monitoring solutions. This trend is especially prominent in regions with developed healthcare infrastructure and strong internet penetration

- Patient preferences are also evolving. The convenience of remote care and the ability to monitor symptoms at home through wearable devices or smart diagnostic tools have significantly enhanced patient compliance and safety, contributing to the overall market expansion

Restraint/Challenge

Cybersecurity Concerns and High Implementation Costs

- Despite its rapid growth, the COVID-19 Infection market faces key hurdles related to cybersecurity and cost. The increased reliance on digital platforms and connected devices—such as cloud-based diagnostics, remote monitoring systems, and mobile health applications—exposes these tools to potential data breaches and cyber threats

- Public concerns about personal health data privacy, especially in systems linked to national health databases, continue to raise barriers to widespread adoption. In fact, reported vulnerabilities in digital health platforms have made healthcare organizations more cautious about fully transitioning to digital systems

- Addressing these issues requires stringent cybersecurity frameworks, including data encryption, secure authentication, and continuous software updates. Companies that highlight robust data protection measures, like end-to-end encryption and HIPAA compliance, are more likely to gain user trust

- In addition, the high initial costs of advanced diagnostic kits, AI-integrated monitoring systems, and telehealth infrastructure can deter adoption—particularly in low- and middle-income countries. The financial burden on underfunded healthcare systems can slow down implementation, despite the clear need for such tools

- To mitigate this, market players must focus on affordability through scalable, modular solutions while educating stakeholders on best practices for digital health security. Affordable innovation and strong regulatory support will be crucial in overcoming these restraints and ensuring continued market momentum

COVID-19 Infection Market Scope

The market is segmented on the basis of type, treatment, diagnosis, dosage forms, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the COVID-19 infection market is segmented into Omicron, Delta, Gamma and Beta, and Alpha. The Omicron segment dominated the market with the largest revenue share of 46.3% in 2024, attributed to its high transmissibility and widespread global incidence since late 2021. The continuous mutation of the Omicron variant has kept it in public health focus due to recurring outbreaks. Its mild but persistent symptoms have resulted in high testing and treatment volumes.

The Delta variant segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by its strong association with severe cases and hospitalization, which sustains demand for intensive care and therapeutics in vulnerable populations.

- By Treatment

On the basis of treatment, the COVID-19 infection market is segmented into medication, vaccine, and others. The vaccine segment held the highest market share of 55.2% in 2024, due to mass immunization campaigns globally and inclusion of booster doses across age groups. Government-backed vaccine distribution, advancements in mRNA and vector-based vaccine platforms, and emergency approvals have fueled growth.

The medication segment is projected to witness the fastest CAGR of 19.4% from 2025 to 2032, supported by rising use of antivirals, monoclonal antibodies, and repurposed drugs for managing post-acute COVID and reinfections.

- By Diagnosis

On the basis of diagnosis, the COVID-19 infection market is segmented into swab test, antibody test, and others. The swab test segment dominated the market with a revenue share of 63.8% in 2024, driven by its position as the gold standard for acute infection detection. Widespread implementation of RT-PCR and antigen-based swab tests at clinics, airports, and home settings has ensured consistent demand.

The antibody test segment is projected to grow at the fastest CAGR of 17.1% from 2025 to 2032, fueled by rising interest in monitoring immunity status post-vaccination or post-infection, and large-scale seroprevalence studies by governments.

- By Dosage Forms

On the basis of dosage forms, the COVID-19 infection market is segmented into capsule, tablets, injections, and others. The injection segment accounted for the highest market share of 48.5% in 2024, driven by injectable vaccine administration and emergency use of intravenous antivirals and monoclonal antibodies in hospitals. Injections ensure fast action and reliable bioavailability, making them essential for critical care.

The tablet segment is anticipated to register the fastest CAGR of 20.3% during the forecast period, supported by the growing availability of oral antivirals like Paxlovid and Molnupiravir, enabling easy at-home treatment and better patient compliance.

- By Route of Administration

On the basis of route of administration, the COVID-19 infection market is segmented into oral, parenteral, and others. The Parenteral segment held the largest market share of 51.7% in 2024, owing to the extensive use of injectable vaccines and IV therapeutics in severe COVID-19 management. Rapid onset of action and reliable therapeutic effects make this route preferable in clinical settings.

The oral segment is projected to grow at the fastest CAGR of 22.4% from 2025 to 2032, as oral antivirals and supportive medications become the preferred choice for mild to moderate cases, allowing home isolation and treatment without hospitalization.

- By End-Users

On the basis of end-users, the COVID-19 infection market is segmented into hospitals, specialty clinics, homecare, and others. The hospital segment dominated with the highest market share of 57.6% in 2024, due to the influx of patients requiring inpatient treatment during waves of infection, especially among high-risk groups. Hospitals remain central to emergency care, oxygen therapy, and ICU services for COVID-19.

The homecare segment is expected to witness the fastest CAGR of 21.6% from 2025 to 2032, driven by the shift toward at-home management of mild to moderate cases, teleconsultations, and the rise in home-based diagnostic and therapeutic solutions.

- By Distribution Channel

On the basis of distribution channel, the COVID-19 infection market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment held the largest share of 45.9% in 2024, as these pharmacies are primary suppliers of vaccines, critical care medications, and injectables used in inpatient treatment. Their close integration with hospital operations supports efficient supply chain management.

The online pharmacy segment is projected to grow at the fastest CAGR of 23.8% from 2025 to 2032, supported by rising consumer preference for contactless medicine delivery, expansion of digital health platforms, and growing trust in e-pharmacies for COVID-related care and support products.

COVID-19 Infection Market Regional Analysis

- North America dominated the COVID-19 Infection market with the largest revenue share of 41.5% in 2024, driven by high infection surveillance, advanced healthcare infrastructure, and rapid access to novel diagnostic and treatment technologies

- The region’s strategic investments in public health preparedness, coupled with government-backed vaccination programs and antiviral drug distribution, have supported the expansion of the market

- In addition, the continued emergence of new variants and increased testing frequency in institutional and commercial settings have reinforced the demand for COVID-19 diagnostics and therapeutics across the U.S. and Canada

U.S. COVID-19 Infection Market Insight

The U.S. covid-19 infection market captured the largest revenue share of 77% in 2024 within North America, driven by strong federal and state-level health initiatives, early access to mRNA vaccines, and widespread adoption of PCR and rapid antigen tests. Ongoing investments in pandemic preparedness, therapeutic R&D, and digital contact tracing technologies are further accelerating market growth. Moreover, the presence of major pharmaceutical companies and regulatory agencies such as the FDA fosters rapid approval and commercialization of treatments and diagnostics.

Europe COVID-19 Infection Market Insight

The Europe COVID-19 Infection market is projected to expand at a substantial CAGR throughout the forecast period, supported by comprehensive healthcare systems, coordinated vaccination drives, and robust surveillance networks across EU nations. Increasing public awareness, the emergence of long COVID cases, and proactive government strategies—such as mass testing and border screening—continue to stimulate demand for diagnostics, therapeutics, and preventive measures across residential and healthcare facilities.

U.K. COVID-19 Infection Market Insight

The U.K. COVID-19 Infection market is anticipated to grow at a noteworthy CAGR during the forecast period, backed by initiatives such as NHS Test and Trace, booster vaccination rollouts, and investments in genome sequencing of SARS-CoV-2 variants. The country’s high testing capacity, access to antiviral treatments like Paxlovid, and real-time public health monitoring systems are further boosting market penetration across hospitals, clinics, and community settings.

Germany COVID-19 Infection Market Insight

The Germany COVID-19 Infection market is expected to expand at a considerable CAGR, attributed to the country's strong healthcare infrastructure, high testing volumes, and consistent vaccination programs. Government subsidies for diagnostics, increased funding for pharmaceutical innovation, and strong public-private collaborations have enhanced the country’s preparedness and response capabilities. Additionally, local biotech firms continue to contribute to the rapid production and distribution of tests and therapeutics.

Asia-Pacific COVID-19 Infection Market Insight

The Asia-Pacific COVID-19 Infection market is poised to grow at the fastest CAGR of 23.8% from 2025 to 2032, propelled by increasing urbanization, rising population density, and a high prevalence of infectious disease outbreaks. Countries such as China, India, and Japan are scaling up healthcare investments, expanding testing infrastructure, and advancing vaccine distribution. The growing emphasis on early detection, along with rising demand for affordable and accessible diagnostic tools, is fueling regional market growth.

Japan COVID-19 Infection Market Insight

The Japan COVID-19 Infection market is gaining momentum due to efficient governmental health strategies, high diagnostic test accuracy, and population-wide vaccination coverage. The country’s extensive use of PCR testing, coupled with strong adoption of telemedicine and remote health monitoring tools, supports continuous surveillance and containment. Moreover, the government’s preparedness for future variants and reinforcement of quarantine measures are boosting ongoing market demand.

China COVID-19 Infection Market Insight

The China COVID-19 Infection market accounted for the largest revenue share in the Asia-Pacific region in 2024, owing to its robust centralized public health management, massive production capacity for diagnostic kits, and expansive vaccination coverage. China's “zero COVID” legacy infrastructure, combined with large-scale testing capacity and domestic pharmaceutical innovation, continues to support strong market demand across urban and rural areas. The integration of digital health platforms and AI-driven disease surveillance further enhances detection and management capabilities.

COVID-19 Infection Market Share

The COVID-19 infection industry is primarily led by well-established companies, including:

- Serum Institute of India Pvt. Ltd. (India)

- Bharat Biotech (India)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Lilly (U.S.)

- Merck & Co., Inc. (U.S.)

- Allergan (Ireland)

- AstraZeneca (U.K.)

- Johnson & Johnson and its affiliates (U.S.)

- Cipla Inc. (U.S.)

- Abbott (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Genentech Inc. (U.S.)

- Zydus Cadila (India)

Latest Developments in Global COVID-19 Infection Market

- In March 2023, Honeywell International Inc. successfully deployed its COVID-19 surveillance technology under the Bengaluru Safe City Project. The initiative aims to reduce virus transmission in densely populated urban zones by integrating thermal screening, contactless health monitoring, and real-time data analytics. This project demonstrates the rising importance of IoT-based public health safety solutions and the integration of smart technology in infectious disease response

- In February 2023, Thermo Fisher Scientific announced the global expansion of its mobile COVID-19 testing labs in remote and underserved regions. These labs are equipped with advanced RT-PCR diagnostic tools and are designed for rapid deployment in areas facing test accessibility issues. This development supports faster containment efforts, especially during outbreak spikes or in rural geographies

- In January 2023, Siemens Healthineers launched its CLINITEST Rapid COVID-19 Antigen Self-Test, a user-friendly home test delivering results within 15 minutes. This test does not require specialized lab equipment and is designed to support large-scale public self-screening during surges. The launch underscores Siemens' commitment to improving rapid, reliable access to testing solutions globally

- In May 2025, Novavax announced ongoing discussions with the U.S. FDA for full approval of its protein-based COVID-19 vaccine, Nuvaxovid. The company also highlighted strategic supply collaborations with SK Bioscience and Takeda, leading to an optimistic annual revenue forecast

- In June 2025, scientists at UCSF and the Gladstone Institutes introduced two novel broad-spectrum antivirals, AVI-4516 and AVI-4773, shown to be more effective than Paxlovid in preclinical models. These compounds offer dual protection against SARS-CoV-2 and MERS, bolstering global pandemic preparedness

- In March 2025, Pfizer initiated Phase 3 clinical trials of ibuzatrelvir, a next-generation COVID-19 antiviral intended to address limitations of Paxlovid, such as bitter taste and drug-drug interactions. This development represents Pfizer’s continued investment in expanding oral antiviral portfolios

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.