Global Covid 19 Traditional Chinese Medicine Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

6.20 Billion

2024

2032

USD

2.20 Billion

USD

6.20 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 6.20 Billion | |

|

|

|

|

COVID-19 Traditional Chinese Medicine Treatment Market Size

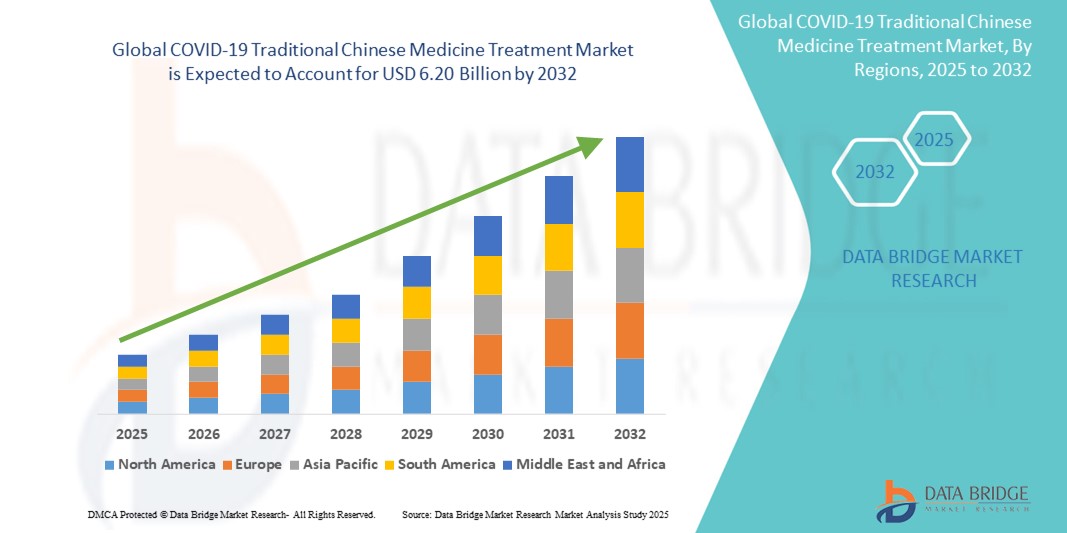

- The global COVID-19 Traditional Chinese Medicine Treatment market size was valued at USD 2.20 Billion in 2024 and is expected to reach USD 6.20 Billion by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is largely fueled by the growing adoption and clinical validation of Traditional Chinese Medicine (TCM) formulations in the management of COVID-19 symptoms across various stages of the disease, leading to increased integration of TCM into global healthcare protocols.

- Furthermore, rising patient demand for holistic, safe, and multi-targeted therapeutic solutions for infection prevention and recovery is establishing Traditional Chinese Medicine as a complementary treatment approach of choice. These converging factors are accelerating the uptake of TCM-based COVID-19 therapies, thereby significantly boosting the industry's growth.

COVID-19 Traditional Chinese Medicine Treatment Market Analysis

- Traditional Chinese Medicine (TCM), offering herbal and compound-based formulations for managing viral infections, is increasingly recognized as a vital component of integrated healthcare strategies in both hospital and home settings due to its holistic approach, stage-specific treatment capabilities, and compatibility with conventional therapies.

- The escalating demand for TCM in COVID-19 treatment is primarily fueled by its growing inclusion in national treatment guidelines, increased patient awareness of natural therapies, and a rising preference for multi-targeted, immune-boosting solutions.

- Asia-Pacific dominates the Traditional Chinese Medicine treatment market with the largest revenue share in 2025, characterized by strong cultural acceptance, government-supported research initiatives, and a well-established TCM infrastructure, with China experiencing substantial growth in the production and global export of key formulations such as Jinhua Qinggan and Lianhua Qingwen, driven by innovations in formulation technology and pandemic preparedness programs.

- North America is expected to be the fastest growing region in the Traditional Chinese Medicine treatment market during the forecast period due to increasing interest in alternative medicine, clinical trial collaborations, and growing integration of TCM with conventional care models.

- Parenteral dosage segment is expected to dominate the TCM treatment market with a market share in 2025, driven by its rapid therapeutic onset, suitability for critical stage interventions, and increasing hospital-based administration of injectable compounds like Xiyanping and Xuebijing.

Report Scope and COVID-19 Traditional Chinese Medicine Treatment Market Segmentation

|

Attributes |

COVID-19 Traditional Chinese Medicine Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

COVID-19 Traditional Chinese Medicine Treatment Market Trends

“Enhanced Efficacy Through Digital Integration and Clinical Validation”

- A significant and accelerating trend in the global COVID-19 Traditional Chinese Medicine treatment market is the deepening integration of digital health platforms and expanding clinical validation through global studies and real-world data. This fusion of evidence-based research and digital tracking tools is significantly enhancing treatment credibility and patient adherence.

- For instance, Jinhua Qinggan and Lianhua Qingwen have undergone randomized clinical trials demonstrating efficacy in symptom relief, while digital health platforms in China are enabling remote prescription and monitoring of TCM regimens during recovery and quarantine periods. Similarly, mobile health apps now allow physicians to recommend personalized herbal formulations based on patient-reported symptoms and disease progression.

- Integration of digital platforms in TCM delivery enables features such as patient-specific treatment optimization, symptom tracking, and early detection of complications through AI-supported alerts. For example, some platforms utilize AI to analyze patient response data and suggest formula adjustments over time, while also providing intelligent alerts for physicians when adverse effects or lack of response is detected. Furthermore, digital prescriptions offer patients the convenience of home-based treatment management and dosage reminders.

- The seamless integration of Traditional Chinese Medicine with national telemedicine portals and public health apps facilitates centralized monitoring and coordination of COVID-19 treatment, especially during outbreaks. Through a single interface, healthcare professionals can manage herbal prescriptions alongside allopathic medications, laboratory reports, and contact tracing, creating a unified and responsive care model.

- This trend toward more intelligent, validated, and technology-supported Traditional Chinese Medicine is fundamentally reshaping global perceptions of herbal therapy. Consequently, companies such as China Traditional Chinese Medicine Holdings and Yiling Pharmaceutical are advancing research-driven, digital-ready TCM products with features such as QR-coded traceability, AI-based prescription matching, and integration with electronic health records.

- The demand for TCM solutions that offer validated efficacy and digital integration is growing rapidly across both hospital and homecare settings, as patients and providers increasingly prioritize holistic, accessible, and personalized healthcare delivery.

COVID-19 Traditional Chinese Medicine Treatment Market Dynamics

Driver

“Growing Need Due to Rising COVID-19 Cases and Demand for Holistic Therapies”

- The increasing prevalence of COVID-19 cases globally, coupled with the rising demand for holistic and multi-targeted treatment approaches, is a significant driver for the heightened adoption of Traditional Chinese Medicine (TCM) in managing the disease.

- For instance, in March 2024, Shijiazhuang Yiling Pharmaceutical Co., Ltd. announced expanded distribution of Lianhua Qingwen capsules in overseas markets following regulatory recognition and clinical validation. Such strategies by key companies are expected to drive the TCM treatment industry growth in the forecast period.

- As patients and healthcare systems become more aware of the limitations of conventional antivirals and seek supportive treatment options that address immune function, inflammation, and respiratory symptoms, TCM offers herbal formulations with broad-spectrum therapeutic benefits and fewer side effects, providing a compelling complement to standard care.

- Furthermore, the growing popularity of traditional and integrative medicine and the push for self-care and home-based recovery are making TCM an integral component of COVID-19 management strategies, offering stage-specific formulations that can be administered in hospital or home settings.

- The convenience of oral and parenteral dosage forms, the adaptability of treatment based on symptom progression, and the ability to prescribe and monitor TCM remotely through digital platforms are key factors propelling the adoption of TCM in both acute and recovery phases of COVID-19. The trend toward evidence-based herbal therapies and increasing availability of standardized, government-approved TCM products further contribute to market growth.

Restraint/Challenge

“Concerns Regarding Standardization and Limited Global Acceptance”

- Concerns surrounding the lack of international standardization and scientific consensus regarding the efficacy and safety of certain Traditional Chinese Medicine (TCM) formulations pose a significant challenge to broader market penetration. As TCM relies on herbal compounds and traditional diagnostic approaches, it faces scrutiny from regulatory bodies and skepticism from segments of the global medical community.

- For instance, limited inclusion of TCM in formal treatment guidelines outside Asia and varying regulations across countries have made some healthcare providers hesitant to adopt TCM-based COVID-19 solutions.

- Addressing these concerns through rigorous clinical trials, transparent ingredient sourcing, and standardization of manufacturing practices is crucial for building global credibility. Companies such as Yiling Pharmaceutical and Tong Ren Tang emphasize their GMP-certified processes and published clinical results in their marketing to reassure international markets. Additionally, the relatively limited access to high-quality, standardized TCM products in non-Asian regions can be a barrier to adoption for patients and providers unfamiliar with the therapies. While several formulations have received emergency use approval in certain countries, broader registration remains complex and time-consuming.

- While global interest in natural and integrative therapies is increasing, the perceived lack of alignment with modern pharmacology and the absence of unified global regulations can still hinder widespread adoption, especially in Western healthcare systems.

- Overcoming these challenges through greater international collaboration, enhanced regulatory pathways, consumer education on TCM’s therapeutic potential, and investment in research and development will be vital for sustained market growth.

COVID-19 Traditional Chinese Medicine Treatment Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

By Severity

On the basis of severity, the COVID-19 Traditional Chinese Medicine treatment market is segmented into early stage, advance stage, critical stage, and recovery stage. The early stage segment dominates the largest market revenue share of 38.5% in 2025, driven by the high demand for herbal interventions at the onset of symptoms to prevent disease progression. Patients and healthcare providers often prioritize early-stage TCM treatment due to its perceived role in symptom mitigation, immune modulation, and viral suppression when initiated promptly. The market also sees strong demand for early-stage formulations due to their inclusion in several national COVID-19 guidelines and the availability of oral dosage forms facilitating home-based care.

The recovery stage segment is anticipated to witness the fastest growth rate of 20.9% from 2025 to 2032, fueled by increasing emphasis on post-infection rehabilitation and long COVID management. Recovery-stage TCM products offer support for respiratory function, fatigue reduction, and immune restoration, making them ideal for patients transitioning out of acute care. The growing clinical validation of recovery formulas and their integration into wellness programs and telemedicine platforms also contribute to their expanding market appeal globally.

By Treatment

On the basis of treatment, the COVID-19 Traditional Chinese Medicine treatment market is segmented into primary, secondary, and others. The primary treatment segment dominates the largest market revenue share of 46.1% in 2025, driven by the widespread use of TCM as a front-line therapy in mild to moderate COVID-19 cases, especially across China and other parts of Asia. Formulations such as Jinhua Qinggan and Lianhua Qingwen are frequently prescribed during the primary phase to alleviate symptoms like fever, cough, and fatigue. The market also sees strong demand for primary TCM treatment due to government endorsements, clinical integration into COVID-19 protocols, and increasing global awareness of herbal-based interventions.

The secondary treatment segment is anticipated to witness the fastest growth rate of 22.3% from 2025 to 2032, fueled by growing acceptance of TCM as a supportive therapy alongside conventional antivirals and hospital care. Secondary treatments are often deployed in more severe or hospitalized cases, offering benefits such as inflammation reduction and organ protection. The ability of these formulations to complement Western medicine and enhance overall patient outcomes is accelerating their adoption across integrated healthcare models and global research collaborations.

By Compounds

On the basis of compounds, the COVID-19 Traditional Chinese Medicine treatment market is segmented into Angong Niuhuang, Zixue, Huoxiang Zhengqi, Jinhua Qinggan, Xiyanping, Xuebijing, Reduning, Xingnaojing, and others. The Jinhua Qinggan segment dominates the largest market revenue share of 29.4% in 2025, driven by its proven efficacy in treating early and mild COVID-19 symptoms such as fever, cough, and sore throat. Widely used in China and exported globally during the pandemic, Jinhua Qinggan gained significant attention for its inclusion in national treatment guidelines and clinical endorsements. The market also sees strong demand for this compound due to its oral administration, accessibility through pharmacies, and consistent production by major TCM manufacturers.

The Xuebijing segment is anticipated to witness the fastest growth rate of 24.6% from 2025 to 2032, fueled by its growing application in managing severe and critical cases. Xuebijing, an injectable herbal compound, is known for its role in controlling systemic inflammation, reducing cytokine storms, and improving outcomes in ICU patients. Its recognition by healthcare professionals and increasing publication of supportive clinical data have driven its integration into hospital-based protocols, particularly in Asia and select international pilot studies, enhancing its global market potential.

By Dosage

On the basis of dosage, the COVID-19 Traditional Chinese Medicine treatment market is segmented into oral, parenteral, and others. The oral segment dominates the largest market revenue share of 57.8% in 2025, driven by the widespread availability of TCM capsules, powders, and decoctions designed for at-home treatment during various stages of COVID-19. Oral formulations such as Lianhua Qingwen, Huoxiang Zhengqi, and Jinhua Qinggan are highly favored for their ease of administration, rapid symptom relief, and mass distribution potential. The market also sees strong demand for oral TCM products due to their accessibility through retail and online pharmacies, making them a preferred option in both urban and rural areas.

The parenteral segment is anticipated to witness the fastest growth rate of 26.1% from 2025 to 2032, fueled by the increasing use of injectable formulations like Xuebijing and Xiyanping in hospitalized patients. These parenteral solutions are utilized for their anti-inflammatory, antiviral, and immune-regulating properties, especially in moderate to severe cases requiring intensive care. The growing clinical acceptance of these formulations within hospital settings and their role in managing complications associated with advanced COVID-19 stages are contributing to their rising market share across public and private healthcare institutions.

By End User

On the basis of end-users, the COVID-19 Traditional Chinese Medicine treatment market is segmented into hospitals, departmental store, home healthcare, and others. The hospital segment dominates the largest market revenue share of 48.6% in 2025, driven by the integration of TCM into institutional treatment protocols for both moderate and severe COVID-19 cases. Hospitals across China and select countries in Asia-Pacific and Africa are increasingly adopting herbal injectables such as Xuebijing and Xiyanping for their clinical benefits in inflammation control and organ protection. The market also sees strong demand from hospitals due to national health insurance reimbursements, clinical trial backing, and their ability to administer complex TCM treatments in monitored environments.

The home healthcare segment is anticipated to witness the fastest growth rate of 23.8% from 2025 to 2032, fueled by the increasing consumer shift towards self-care, especially in managing early-stage and recovery-phase COVID-19. Easy-to-use oral products such as Lianhua Qingwen and Huoxiang Zhengqi are highly preferred for home use due to their over-the-counter availability, minimal side effects, and cultural familiarity. The expansion of telemedicine services and digital pharmacies is further accelerating access to these remedies, making home healthcare a rapidly expanding channel in both developed and emerging markets.

COVID-19 Traditional Chinese Medicine Treatment Market Regional Analysis

- Asia-Pacific dominates the COVID-19 Traditional Chinese Medicine (TCM) treatment market with the largest revenue share of 61.4% in 2025, driven by strong historical reliance on traditional remedies and government-backed integration of TCM into national COVID-19 treatment protocols.

- Consumers in the region highly value the natural composition, holistic benefits, and cultural familiarity offered by traditional Chinese medicinal compounds such as Lianhua Qingwen, Jinhua Qinggan, and Xuebijing.

- This widespread adoption is further supported by centralized healthcare systems, robust domestic production capabilities, and the increasing preference for complementary therapies, establishing TCM as a favored solution for both early-stage and hospital-managed COVID-19 care.

China COVID-19 Traditional Chinese Medicine Treatment market Insight

The China COVID-19 Traditional Chinese Medicine (TCM) treatment market captured the largest revenue share of 79% within the Asia-Pacific region in 2025, fueled by the swift integration of TCM into national COVID-19 treatment guidelines and widespread public trust in herbal-based remedies. Consumers are increasingly prioritizing natural, immune-boosting solutions for both prevention and symptom management during early and recovery stages. The growing preference for over-the-counter herbal formulations, combined with robust demand for government-approved prescriptions and hospital-administered injectables, further propels the TCM market. Moreover, the institutional endorsement of compounds such as Lianhua Qingwen, Jinhua Qinggan, and Xuebijing is significantly contributing to the market’s expansion.

Europe COVID-19 Traditional Chinese Medicine Treatment market Insight

The European COVID-19 Traditional Chinese Medicine (TCM) treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing interest in alternative and complementary medicine and the escalating need for supportive care during respiratory infections. The increase in awareness of holistic wellness, coupled with the demand for natural, plant-based therapeutics, is fostering the adoption of TCM products. European consumers are also drawn to the immune-boosting and recovery-enhancing benefits these treatments offer. The region is experiencing significant growth across outpatient, retail, and homecare applications, with TCM formulations being incorporated into both integrative care protocols and over-the-counter wellness regimens.

U.K. COVID-19 Traditional Chinese Medicine Treatment market Insight

The U.K. COVID-19 Traditional Chinese Medicine (TCM) treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of integrative healthcare and a desire for natural, immune-supportive remedies. Additionally, concerns regarding post-viral recovery and respiratory resilience are encouraging both individuals and healthcare providers to explore traditional herbal formulations. The U.K.’s embrace of holistic wellness practices, alongside its robust e-commerce and pharmacy infrastructure, is expected to continue to stimulate market growth.

Germany COVID-19 Traditional Chinese Medicine Treatment market Insight

The German COVID-19 Traditional Chinese Medicine (TCM) treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of holistic healthcare and the demand for scientifically backed, plant-based therapeutic solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and evidence-based natural medicine, promotes the adoption of TCM treatments, particularly in outpatient and wellness-focused settings. The integration of TCM remedies within functional medicine and recovery protocols is also becoming increasingly prevalent, with a strong preference for safe, standardized, and regulation-compliant solutions aligning with local consumer expectations.

Asia-Pacific COVID-19 Traditional Chinese Medicine Treatment market Insight

The The Asia-Pacific COVID-19 Traditional Chinese Medicine (TCM) treatment market is poised to grow at the fastest CAGR of over 24% in 2025, driven by increasing healthcare awareness, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards integrative medicine, supported by government initiatives promoting traditional and complementary therapies, is driving the adoption of TCM treatments. Furthermore, as APAC emerges as a manufacturing hub for TCM formulations and ingredients, the affordability and accessibility of these treatments are expanding to a wider patient base.Top of FormBottom of Form

Japan COVID-19 Traditional Chinese Medicine Treatment market Insight

The Japan COVID-19 Traditional Chinese Medicine (TCM) treatment market is gaining momentum due to the country’s strong culture of integrative and traditional healthcare, rapid urbanization, and increasing demand for holistic treatment options. The Japanese market places a significant emphasis on health and wellness, and the adoption of TCM treatments is driven by the growing acceptance of complementary therapies alongside conventional medicine. The integration of TCM with modern healthcare approaches is fueling growth. Moreover, Japan’s aging population is likely to spur demand for safer, easier-to-use, and effective treatment solutions in both residential and clinical settings.

USA COVID-19 Traditional Chinese Medicine Treatment market Insight

The USA COVID-19 Traditional Chinese Medicine (TCM) treatment market is gaining traction due to increasing awareness of alternative and complementary therapies, rising interest in holistic health approaches, and the growing prevalence of COVID-19 cases. The American market places a significant emphasis on integrative healthcare, and the adoption of TCM treatments is driven by expanding research supporting their efficacy and safety. The integration of TCM with conventional COVID-19 treatments is fueling market growth. Moreover, the rising focus on preventive healthcare and wellness among consumers is expected to further propel demand in both outpatient and hospital settings.

COVID-19 Traditional Chinese Medicine Treatment market Share

The COVID-19 Traditional Chinese Medicine Treatment industry is primarily led by well-established companies, including:

- Shijiazhuang Yiling Pharmaceutical Co., Ltd. (China)

- Tianjin Chase Sun Pharmaceutical Co., Ltd. (China)

- China Traditional Chinese Medicine Holdings Co. Limited (China)

- Guangzhou Pharmaceutical Holdings Limited (China)

- Yunnan Baiyao (China)

- Xiamen Traditional Chinese Medicine Co., Ltd. (China)

- KPC Pharmaceuticals, Inc. (China)

- Aroma (Guangzhou Aroma Technology Co., Ltd.) (China)

- Beijing Tong Ren Tang Chinese Medicine Co., Ltd. (China)

- China SXT Pharmaceuticals, Inc. (China)

- Jumpcan Pharmaceutical Group (China)

- Kangmei Pharmaceutical Co., Ltd. (China)

- Merro Pharmaceutical Co., Ltd. (China)

- Henan Lingrui Pharmaceutical Co., Ltd. (China)

- Hunan Anbang Pharmaceutical Co., Ltd (China)

- Huadong Medicine Co., Ltd. (China)

- Sinopharm Group Co., Ltd. (China)

- Guangxi Yulin Pharmaceutical Group Co., Ltd. (China)

- Lanzhou Foci Pharmaceutical Co., Ltd. (China)

- Shanghai Hutchison Pharmaceuticals Limited (China)

Latest Developments in Global COVID-19 Traditional Chinese Medicine Treatment market

- In March 2025, Chinese herbal medicines manufactured by Jiangyin Tianjiang Pharmaceutical Company Ltd. became available in Kenya after obtaining certification from the national drug regulator. This development signifies the expanding global reach of TCM in combating COVID-19

- In April 2023, researchers identified key antiviral and anti-inflammatory compounds in the TCM decoction Huashi Paidu. The study, published in the Proceedings of the National Academy of Sciences, provides scientific insight into the mechanisms by which TCM formulations combat COVID-19.

- In January 2023, China's National Health Commission issued the 10th version of its COVID-19 diagnosis and treatment protocol, emphasizing the role of TCM in treating severe and critical cases. The updated guidelines reflect the integration of TCM into the national strategy against COVID-19.

- In April 2023, the traditional Chinese medicine Qingfei Paidu received market approval in Canada, marking it as the first anti-COVID TCM product approved in a developed country. This approval signifies a significant step in the global acceptance of TCM for COVID-19 treatment.

- In March 2023, Taiwan's Ministry of Health and Welfare extended the emergency use authorization (EUA) for the herbal formula Chingguan Yihau (NRICM101) until June 2024. This extension allows pharmaceutical companies additional time to complete clinical trials and obtain formal drug permits.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.