Global Cow Milk Based Infant Formula Market

Market Size in USD Billion

CAGR :

%

USD

16.60 Billion

USD

34.57 Billion

2025

2033

USD

16.60 Billion

USD

34.57 Billion

2025

2033

| 2026 –2033 | |

| USD 16.60 Billion | |

| USD 34.57 Billion | |

|

|

|

|

Cow Milk Based Infant Formula Market Size

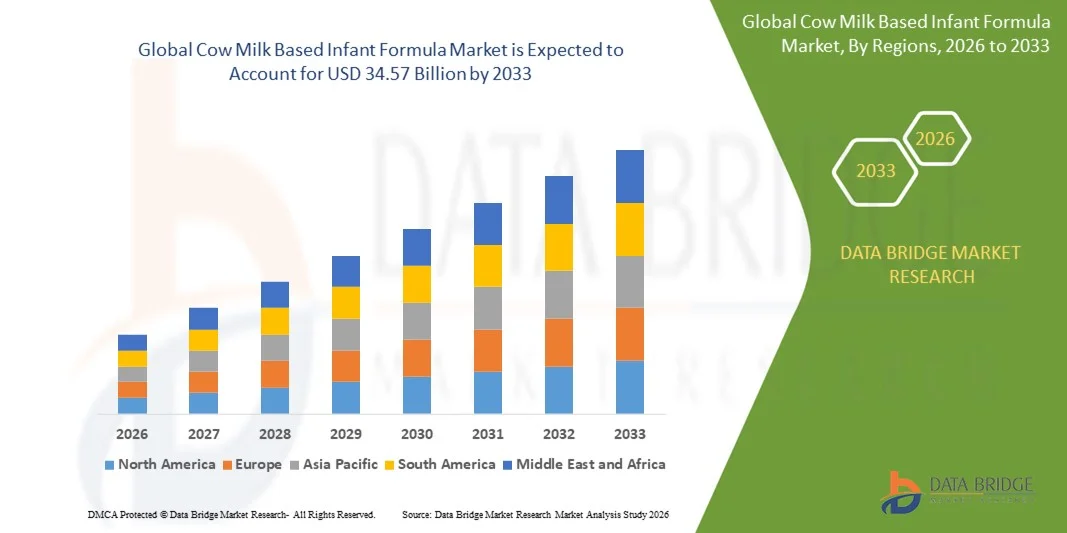

- The global cow milk based infant formula market size was valued at USD 16.60 billion in 2025 and is expected to reach USD 34.57 billion by 2033, at a CAGR of 9.60% during the forecast period

- The market growth is largely fuelled by the rising prevalence of infant malnutrition, increasing awareness of the nutritional benefits of formula milk, and growing working population seeking convenient feeding solutions

- The expansion of organized retail and e-commerce platforms is enhancing product accessibility, further supporting market growth

Cow Milk Based Infant Formula Market Analysis

- Increasing demand for premium and fortified infant formulas is driving product diversification and technological advancements in the market

- Rising disposable incomes, urbanization, and changing lifestyles, along with awareness campaigns by healthcare providers, are contributing to the widespread adoption of cow milk based infant formula

- North America dominated the cow milk based infant formula market with the largest revenue share in 2025, driven by high awareness of infant nutrition, strong purchasing power, and widespread acceptance of formula feeding alongside breastfeeding

- Asia-Pacific region is expected to witness the highest growth rate in the global cow milk based infant formula market, driven by rapid population growth, expanding middle-class population, increasing female workforce participation, and improving access to organised retail and e-commerce channels

- The Proteins segment held the largest market revenue share in 2025, driven by the critical role of milk proteins in supporting infant growth, muscle development, and overall nutrition. High-quality whey and casein protein blends are widely used in standard and premium formulas, making this segment a core component of infant nutrition products

Report Scope and Cow Milk Based Infant Formula Market Segmentation

|

Attributes |

Cow Milk Based Infant Formula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Arla Foods Ingredients (Denmark) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cow Milk Based Infant Formula Market Trends

Rise of Nutritionally Enhanced Cow Milk Based Infant Formula

- The growing preference for cow milk based infant formula with added nutrients and bioactive components is transforming the infant nutrition landscape by supporting healthy growth, immunity, and cognitive development. Fortified formulas enriched with DHA, ARA, probiotics, and essential micronutrients help bridge nutritional gaps during early life stages. This results in improved infant health outcomes, better developmental milestones, and reduced risk of nutrient deficiencies over time

- The high demand for specialty and premium formulas in urban and semi-urban regions is accelerating the adoption of stage-specific, hypoallergenic, and organic products. These formulas are particularly effective for infants with dietary sensitivities, lactose intolerance, or allergies, offering tailored nutrition solutions. Growing parental awareness and higher spending capacity further support the uptake of premium offerings

- The affordability, convenience, and wide availability of cow milk based infant formulas are making them attractive for households across income segments. Ready-to-use packaging, long shelf life, and easy preparation provide practical benefits for working parents and caregivers. This convenience supports consistent feeding practices without compromising nutritional quality or safety

- For instance, in 2024, several pediatric clinics in the U.S. reported improved infant health metrics after parents switched to fortified cow milk based formulas recommended by healthcare providers. These products supported better weight gain, digestion, and immunity outcomes in infants. The positive clinical feedback enhanced parental confidence and encouraged repeat purchases, strengthening market demand

- While cow milk based infant formulas are driving growth through enhanced nutrition and convenience, their long-term impact depends on ongoing innovation, regulatory compliance, and consumer education. Clear communication around nutritional benefits and safety standards is essential to build trust. Manufacturers must focus on differentiated formulations, certifications, and science-backed claims to fully capitalize on growing market demand

Cow Milk Based Infant Formula Market Dynamics

Driver

Rising Awareness About Infant Nutrition and Health Benefits

- Increasing awareness among parents and healthcare providers about the importance of early-life nutrition is encouraging the adoption of cow milk based infant formulas. Medical guidance and pediatric recommendations emphasize balanced nutrition during infancy. This awareness supports higher acceptance of fortified formulas as reliable nutritional alternatives or supplements

- Parents are increasingly seeking scientifically formulated products backed by clinical studies and quality certifications. Trust in regulated brands and evidence-based formulations drives demand for fortified, organic, and specialty formulas. This trend spans across different age groups, from newborns to toddlers, and across diverse income levels

- Expansion of retail networks, e-commerce platforms, and pharmacy chains is supporting wider accessibility of cow milk based infant formulas. Improved distribution ensures product availability even in smaller cities and semi-urban areas. Online platforms also provide product information, reviews, and subscription models, enhancing purchase convenience

- For instance, in 2023, European pediatric associations recommended fortified cow milk based formulas for infants with nutrient deficiencies. This guidance boosted consumer confidence and accelerated sales of premium and specialty products across multiple European markets. The recommendation reinforced the role of clinical endorsement in driving adoption

- While awareness and distribution expansion are fueling market growth, sustained adoption requires continued innovation, product quality assurance, and transparent labeling. Clear communication regarding ingredients, sourcing, and health benefits is essential. These factors help ensure parental trust and long-term brand loyalty

Restraint/Challenge

High Cost Of Premium Formulas And Stringent Regulatory Compliance

- The premium pricing of fortified, organic, and stage-specific cow milk based infant formulas limits adoption among price-sensitive households, particularly in emerging markets. Higher production and certification costs translate into elevated retail prices. This restricts penetration among low- and middle-income consumers despite rising nutritional awareness

- In many regions, stringent regulations related to nutritional labeling, health claims, and safety certifications increase product development timelines and compliance costs. Manufacturers must invest significantly in testing, approvals, and documentation. These regulatory complexities can delay product launches and limit market expansion

- Supply chain and production challenges, particularly for specialty and imported formulas, can impact product availability and timely distribution. Dependence on specific raw materials and international sourcing increases vulnerability to disruptions. This can constrain growth in remote or underserved markets

- For instance, in 2023, several small-scale retailers in Southeast Asia reported limited sales of premium formulas due to high prices, regulatory hurdles, and logistics issues. These challenges reduced product variety and shelf availability. As a result, consumers often opted for lower-priced or locally available alternatives

- While product innovation and nutritional enhancement continue to support the market, addressing cost, compliance, and distribution barriers remains critical. Stakeholders must focus on localized production, cost optimization, and regulatory alignment. These strategies are essential for broader adoption and sustained growth in the global cow milk based infant formula market

Cow Milk Based Infant Formula Market Scope

The market is segmented on the basis of type, form, and application

- By Type

On the basis of type, the global cow milk based infant formula market is segmented into Carbohydrates, Oils & Fats, Proteins, Vitamins, Minerals, Prebiotics, and Others. The Proteins segment held the largest market revenue share in 2025, driven by the critical role of milk proteins in supporting infant growth, muscle development, and overall nutrition. High-quality whey and casein protein blends are widely used in standard and premium formulas, making this segment a core component of infant nutrition products.

The Prebiotics segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of gut health and immunity in early childhood. Prebiotics help support healthy digestion and improve nutrient absorption, making them increasingly popular in fortified and specialty infant formulas recommended by pediatricians.

- By Form

On the basis of form, the global cow milk based infant formula market is segmented into Powder, and Liquid & Semi-Liquid. The Powder segment held the largest market revenue share in 2025, supported by its longer shelf life, cost effectiveness, and ease of storage and transportation. Powdered formulas are widely preferred by parents due to flexible preparation options and broad availability across retail and e-commerce channels.

The Liquid & Semi-Liquid segment is expected to register the fastest growth rate from 2026 to 2033, driven by rising demand for ready-to-feed and convenient nutrition solutions. These formats reduce preparation time and minimize contamination risks, making them increasingly attractive for working parents and on-the-go feeding requirements.

- By Application

On the basis of application, the global cow milk based infant formula market is segmented into Growing-Up Milk, Standard Infant Formula, Follow-On Formula, and Specialty Formula. The Standard Infant Formula segment accounted for the largest market revenue share in 2025, driven by its widespread use as a primary nutrition source for infants who are partially or fully formula-fed. Strong clinical backing and broad acceptance among healthcare providers support the dominance of this segment.

The Specialty Formula segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing diagnosis of lactose intolerance, milk protein allergies, and digestive sensitivities in infants. Specialty products such as hypoallergenic and fortified formulas are gaining traction due to targeted nutritional benefits and growing pediatric recommendations.

Cow Milk Based Infant Formula Market Regional Analysis

- North America dominated the cow milk based infant formula market with the largest revenue share in 2025, driven by high awareness of infant nutrition, strong purchasing power, and widespread acceptance of formula feeding alongside breastfeeding

- Parents in the region highly value scientifically formulated, fortified, and premium infant formulas that support immunity, digestion, and cognitive development

- This strong adoption is further supported by advanced healthcare infrastructure, pediatric recommendations, and the presence of leading infant nutrition brands, establishing cow milk based infant formula as a preferred choice across urban and suburban households

U.S. Cow Milk Based Infant Formula Market Insight

The U.S. cow milk based infant formula market captured the largest revenue share in 2025 within North America, supported by high awareness of early-life nutrition and strong trust in regulated, clinically tested products. Parents increasingly prefer fortified and stage-specific formulas to address nutritional gaps and lifestyle needs. The widespread availability of products through pharmacies, supermarkets, and online platforms further strengthens market growth. In addition, strong pediatric endorsement and innovation in specialty formulas continue to drive demand.

Europe Cow Milk Based Infant Formula Market Insight

The Europe cow milk based infant formula market is expected to witness the fastest growth rate from 2026 to 2033, driven by strict nutritional standards, rising focus on organic and clean-label products, and increasing working parent population. European consumers place strong emphasis on quality, traceability, and safety certifications. Growth is supported by demand for premium, organic, and specialty formulas across both Western and Eastern Europe.

U.K. Cow Milk Based Infant Formula Market Insight

The U.K. cow milk based infant formula market is expected to witness strong growth from 2026 to 2033, driven by rising awareness of infant dietary requirements and increasing reliance on formula feeding among working parents. Demand for fortified and specialty formulas addressing digestion and allergy concerns is rising. Strong retail penetration and regulatory assurance further support market expansion.

Germany Cow Milk Based Infant Formula Market Insight

The Germany cow milk based infant formula market is expected to grow steadily from 2026 to 2033, fueled by high consumer awareness, preference for organic products, and strong trust in regulated nutrition standards. German parents show strong inclination toward premium, bio-certified, and sustainably sourced infant formulas. The presence of established manufacturers and advanced R&D capabilities further strengthens market growth.

Asia-Pacific Cow Milk Based Infant Formula Market Insight

The Asia-Pacific cow milk based infant formula market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising birth rates in select countries, increasing urbanization, and growing middle-class population. Rapid lifestyle changes, higher female workforce participation, and improving healthcare access are accelerating formula adoption. Expanding retail and e-commerce channels are further enhancing product accessibility across the region.

Japan Cow Milk Based Infant Formula Market Insight

The Japan cow milk based infant formula market is expected to grow steadily from 2026 to 2033 due to high health awareness, aging parent demographics, and strong preference for premium and specialized nutrition products. Japanese consumers emphasize safety, quality, and functional benefits, driving demand for fortified and easily digestible formulas. Integration of advanced food technology supports consistent market growth.

China Cow Milk Based Infant Formula Market Insight

The China cow milk based infant formula market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rising disposable incomes, increasing birth rates in urban areas, and heightened focus on infant health and nutrition. Strong demand for premium, imported, and fortified formulas continues to shape the market. Government quality regulations and expanding domestic production capabilities are further strengthening consumer confidence and market expansion.

Cow Milk Based Infant Formula Market Share

The Cow Milk Based Infant Formula industry is primarily led by well-established companies, including:

• Arla Foods Ingredients (Denmark)

• Plum Organics (U.S.)

• Nestlé (Switzerland)

• Chr. Hansen Holding A/S (Denmark)

• Yili Group (China)

• Fonterra Co-operative Group (New Zealand)

• FrieslandCampina (Netherlands)

• Danone (France)

• The Kraft Heinz Company (U.S.)

• Perrigo Company plc (Ireland)

• Reckitt Benckiser Group PLC (U.K.)

• The Honest Company, Inc. (U.S.)

• AAK AB (Sweden)

• Abbott (U.S.)

• Carbery Food Ingredients Limited (Ireland)

• BASF SE (Germany)

• Koninklijke DSM N.V. (Netherlands)

• Glanbia plc (Ireland)

• Vitablend Nederland B.V. (Netherlands)

• Kerry Group PLC (Ireland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cow Milk Based Infant Formula Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cow Milk Based Infant Formula Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cow Milk Based Infant Formula Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.