Global Cranial Implants Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

2.55 Billion

2025

2033

USD

1.52 Billion

USD

2.55 Billion

2025

2033

| 2026 –2033 | |

| USD 1.52 Billion | |

| USD 2.55 Billion | |

|

|

|

|

Cranial Implants Treatment Market Size

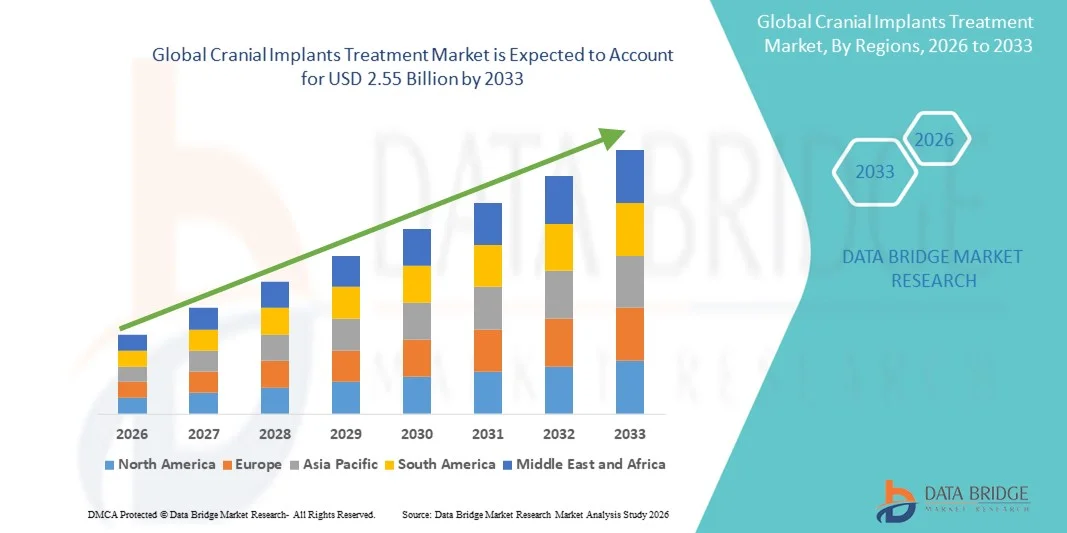

- The global cranial implants treatment market size was valued at USD 1.52 billion in 2025 and is expected to reach USD 2.55 billion by 2033, at a CAGR of6.70% during the forecast period

- The market growth is largely fueled by rising incidence of traumatic brain injuries, congenital skull deformities, and increasing neurosurgical procedures, along with continuous technological advancements in biocompatible materials and 3D-printed implants, leading to wider adoption of cranial implant treatment solutions in hospitals and specialty centers

- Furthermore, growing demand for safe, customized, and anatomically precise reconstruction solutions, combined with improving surgical outcomes and faster recovery times, is establishing cranial implants as a preferred option for cranial defect repair and reconstruction. These converging factors are accelerating the uptake of cranial implant treatment solutions, thereby significantly boosting the industry’s growth

Cranial Implants Treatment Market Analysis

- Cranial implants treatment, used for repairing skull defects resulting from trauma, tumors, or congenital conditions, has become an essential part of modern neurosurgical care due to advancements in biocompatible materials, patient-specific implant design, and improved surgical techniques across hospitals and specialty neurosurgical centers

- The escalating demand for cranial implants treatment is primarily driven by the rising incidence of traumatic brain injuries, increasing number of neurosurgical procedures, growing adoption of 3D-printed and customized implants, and a strong focus on improving functional and aesthetic outcomes for patients

- North America dominated the cranial implants treatment market with the largest revenue share of approximately 38% in 2025, supported by advanced healthcare infrastructure, high neurosurgical procedure volumes, strong reimbursement systems, and the presence of leading medical device manufacturers. The U.S. continues to witness substantial growth due to rapid adoption of personalized cranial implant solutions

- Asia-Pacific is expected to be the fastest-growing region in the cranial implants treatment market during the forecast period, registering a high CAGR due to increasing healthcare expenditure, rising road accident and trauma cases, improving access to neurosurgical care, and rapid adoption of advanced implant technologies in countries such as China and India

- The non-customized cranial implants segment dominated the largest market revenue share of approximately 58.4% in 2025, primarily due to their lower cost, immediate availability, and widespread use in emergency and trauma-related cranioplasty procedures

Report Scope and Cranial Implants Treatment Market Segmentation

|

Attributes |

Cranial Implants Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cranial Implants Treatment Market Trends

Enhanced Precision Through Digital Planning and Advanced Surgical Technologies

- A significant and accelerating trend in the global cranial implants treatment market is the increasing integration of advanced digital planning tools, computer-aided design/manufacturing (CAD/CAM), and image-guided surgical technologies. These innovations are substantially enhancing surgical precision, patient-specific customization, and overall treatment outcome

- For instance, the growing adoption of patient-specific cranial implants designed using preoperative CT and MRI imaging enables surgeons to achieve superior anatomical fit and symmetry during cranioplasty procedures. Companies such as Zimmer Biomet and Stryker offer customized cranial implants that are digitally modeled to match individual skull defects, improving both functional and aesthetic results

- The incorporation of 3D printing and CAD-based modeling allows for faster production of implants using materials such as titanium, PEEK, and porous polyethylene. These technologies reduce operating time, enhance implant accuracy, and minimize the risk of postoperative complications

- Advanced surgical navigation systems further improve outcome predictability by enabling real-time visualization during implantation procedures, enhancing surgeon control and accuracy. This technological convergence is reducing revision surgeries and improving long-term clinical outcomes

- Moreover, the use of digital workflows and virtual surgical planning supports better collaboration between surgeons and implant manufacturers, ensuring precision-driven implant fabrication and optimized surgical execution

- This trend toward digitally optimized, patient-specific, and technology-enabled cranial implant solutions is reshaping clinical expectations and accelerating adoption across trauma, tumor, and congenital defect treatment applications. As a result, manufacturers are increasingly focusing on innovation-driven product development to meet evolving surgical demands

Cranial Implants Treatment Market Dynamics

Driver

Rising Incidence of Traumatic Brain Injuries and Neurosurgical Procedures

- The increasing prevalence of traumatic brain injuries (TBIs), brain tumors, and cranial deformities, along with rising volumes of neurosurgical interventions, is a major driver for growth in the Cranial Implants Treatment market

- For instance, in March 2024, growing global road traffic accidents and sports-related head injuries continued to elevate demand for cranioplasty procedures requiring durable and anatomically precise cranial implants, as reported by public health and trauma registries

- Cranial implants play a critical role in restoring skull integrity, protecting brain tissue, and improving neurological outcomes following decompressive craniectomy procedures

- In addition, increasing awareness of advanced reconstructive options among neurosurgeons and patients is driving the shift from traditional bone grafts to synthetic cranial implant materials, which offer improved strength, biocompatibility, and infection resistance

- The expansion of advanced healthcare infrastructure, particularly in emerging economies, and improved access to neurosurgical care are further supporting market demand

- Technological advancements enabling faster recovery, reduced operative risks, and improved cosmetic outcomes are encouraging wider adoption of cranial implants across hospitals and specialty neurosurgical centers globally

Restraint/Challenge

High Treatment Costs and Post-Surgical Complication Risks

- The high cost of cranial implant treatments, especially patient-specific and technologically advanced implant solutions, remains a significant restraint restricting widespread adoption, particularly in low- and middle-income regions

- The use of premium materials such as titanium and PEEK, combined with advanced imaging, digital design, and surgical navigation technologies, contributes substantially to overall treatment expenses

- For instance, customized cranial implants may require specialized manufacturing facilities and longer production timelines, increasing procedural costs for healthcare providers and patients

- Postoperative complications, including infection, implant exposure, and implant rejection, also pose clinical challenges that may limit adoption in high-risk patient populations

- Addressing these concerns through improved material innovation, better surgical protocols, and enhanced infection-control measures is critical to improving treatment outcomes and physician confidence

- Overcoming cost barriers via expanded reimbursement coverage, local manufacturing initiatives, and development of cost-effective implant alternatives will be essential for sustained growth of the Cranial Implants Treatment market worldwide

Cranial Implants Treatment Market Scope

The market is segmented on the basis of product, material, and end user.

- By Product

On the basis of product, the Cranial Implants Treatment market is segmented into non-customized cranial implants and customized cranial implants. The non-customized cranial implants segment dominated the largest market revenue share of approximately 58.4% in 2025, primarily due to their lower cost, immediate availability, and widespread use in emergency and trauma-related cranioplasty procedures. Non-customized implants are often preferred in cases requiring rapid intervention, such as traumatic brain injuries, where time-critical surgical decisions are necessary. These implants are standardized in shape and size, making them easily accessible across hospitals and trauma centers. In addition, non-customized cranial implants are commonly used in healthcare settings with limited access to advanced digital design or 3D printing infrastructure. Their established clinical usage, affordability, and compatibility with conventional surgical techniques continue to support strong adoption globally, particularly in developing and cost-sensitive markets.

The customized cranial implants segment is expected to witness the fastest CAGR of around 9.8% from 2026 to 2033, driven by increasing adoption of patient-specific treatment approaches and advancements in digital imaging and 3D printing technologies. Customized implants are designed using CT and MRI data to precisely match individual skull defects, resulting in superior anatomical fit and improved cosmetic outcomes. Surgeons increasingly favor customized solutions for complex cranial reconstructions due to reduced surgical time and lower risk of postoperative complications. The rising focus on precision medicine, growing availability of advanced neurosurgical facilities, and higher patient demand for personalized solutions are accelerating the growth of this segment across developed healthcare markets.

- By Material

On the basis of material, the Cranial Implants Treatment market is segmented into ceramic, polymer, and metal. The metal segment accounted for the largest market revenue share of nearly 46.7% in 2025, supported by the extensive use of titanium-based cranial implants in neurosurgical procedures. Metal implants are widely preferred due to their high mechanical strength, durability, corrosion resistance, and excellent biocompatibility. Titanium implants, in particular, provide long-term structural stability and are suitable for large cranial defects resulting from trauma or tumor resections. Their proven clinical track record, ease of fixation, and compatibility with advanced imaging technologies further contribute to their dominance. In addition, metal implants are commonly used in both customized and non-customized forms, reinforcing their strong demand across hospitals and specialty neurosurgical centers worldwide.

The polymer segment is projected to grow at the fastest CAGR of approximately 11.2% from 2026 to 2033, driven by increasing preference for lightweight, radiolucent materials such as PEEK (polyether ether ketone). Polymer-based cranial implants offer excellent aesthetic outcomes, reduced thermal conductivity, and compatibility with postoperative imaging, making them increasingly attractive for elective and reconstructive procedures. These materials are particularly favored in customized implant applications due to their ease of processing via CAD/CAM and 3D printing technologies. Growing awareness of polymer implant advantages, coupled with continuous material innovation, is expected to significantly boost this segment’s growth during the forecast period.

- By End User

On the basis of end user, the Cranial Implants Treatment market is segmented into hospitals, specialty neurosurgery centres, and others. The hospitals segment dominated the largest market revenue share of about 52.9% in 2025, driven by the high volume of cranial surgeries performed in hospital settings, including trauma care, tumor resections, and emergency cranioplasty procedures. Hospitals are typically equipped with advanced surgical infrastructure, multidisciplinary neurosurgical teams, and access to intensive postoperative care, making them the primary point of treatment for complex cranial conditions. In addition, hospitals are more likely to adopt both standardized and customized cranial implant solutions due to broader procurement capabilities and reimbursement support. The presence of skilled neurosurgeons and rising hospitalization rates for traumatic brain injuries continue to sustain this segment’s dominance.

The specialty neurosurgery centres segment is anticipated to register the fastest CAGR of around 10.4% from 2026 to 2033, fueled by the growing preference for specialized, high-precision surgical care. These centers focus exclusively on advanced neurosurgical procedures and are increasingly adopting customized cranial implants and digitally guided surgical solutions. Patients seeking improved cosmetic outcomes, shorter recovery times, and specialized expertise are driving demand for treatment at these facilities. Moreover, rising investments in specialty care infrastructure and the expansion of standalone neurosurgical centers, particularly in developed regions, are expected to further accelerate growth in this segment.

Cranial Implants Treatment Market Regional Analysis

- North America dominated the cranial implants treatment market with the largest revenue share of approximately 38% in 2025, supported by advanced healthcare infrastructure, high neurosurgical procedure volumes, strong reimbursement systems, and the presence of leading medical device manufacturers. The U.S. continues to witness substantial growth due to rapid adoption of personalized cranial implant solutions

- The region benefits from early adoption of advanced surgical technologies, widespread availability of skilled neurosurgeons, and high awareness of reconstructive procedures following traumatic brain injuries and tumor resections

- This strong market position is further reinforced by high healthcare spending, favorable insurance coverage for cranial reconstruction procedures, and continuous investments in research and development of innovative implant materials and customized solutions

U.S. Cranial Implants Treatment Market Insight

The U.S. cranial implants treatment market captured the largest revenue share within North America in 2025, driven by a high incidence of traumatic brain injuries, neurosurgical disorders, and cranial defects requiring reconstructive intervention. The strong presence of key market players, coupled with the rapid adoption of patient-specific cranial implants and 3D-printing technologies, is significantly supporting market growth. In addition, advanced hospital infrastructure, favorable reimbursement policies, and growing demand for improved functional and aesthetic outcomes are accelerating the uptake of customized cranial implant solutions across both academic and private healthcare settings.

Europe Cranial Implants Treatment Market Insight

The Europe cranial implants treatment market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing prevalence of neurological disorders, growing aging population, and rising demand for reconstructive neurosurgical procedures. Strong public healthcare systems, supportive reimbursement frameworks, and growing awareness regarding post-surgical cranial reconstruction are fostering market growth across the region. Europe is witnessing steady demand from hospitals and specialty neurosurgical centers, particularly in trauma and oncology-related cranial reconstruction cases.

U.K. Cranial Implants Treatment Market Insight

The U.K. cranial implants treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising numbers of cranioplasty procedures and improvements in neurosurgical techniques. The National Health Service (NHS) plays a significant role in driving demand through increased access to advanced surgical care. Growing adoption of customized cranial implants and increased focus on improving cosmetic and functional patient outcomes are further contributing to market expansion in the country.

Germany Cranial Implants Treatment Market Insight

The Germany cranial implants treatment market is expected to expand at a considerable CAGR, fueled by strong healthcare infrastructure, high adoption of advanced medical technologies, and a growing focus on precision medicine. Germany’s emphasis on innovation, combined with rising investments in digital surgical planning and 3D-printed implants, is supporting increasing use of customized cranial implants. The presence of leading medical device manufacturers and specialized neurosurgical centers further strengthens the country’s market position.

Asia-Pacific Cranial Implants Treatment Market Insight

Asia-Pacific is expected to be the fastest-growing region in the cranial implants treatment market during the forecast period, registering a high CAGR due to increasing healthcare expenditure, rising road accident and trauma cases, improving access to neurosurgical care, and rapid adoption of advanced implant technologies in countries such as China and India. Rapid urbanization, expanding healthcare infrastructure, and growing awareness of reconstructive neurosurgery are accelerating market growth across the region

Japan Cranial Implants Treatment Market Insight

The Japan cranial implants treatment market is gaining steady momentum due to the country’s advanced healthcare system, aging population, and growing incidence of neurological disorders. Japan places strong emphasis on high-quality surgical outcomes, which is driving demand for precision-engineered and customized cranial implants. The adoption of advanced imaging, robotic-assisted surgery, and biocompatible implant materials is further supporting market growth in both hospital and specialty neurosurgical settings.

China Cranial Implants Treatment Market Insight

The China cranial implants treatment market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by rising trauma cases, expanding healthcare access, and increasing investments in advanced neurosurgical technologies. Rapid development of tertiary hospitals, growing availability of skilled neurosurgeons, and increasing adoption of customized and polymer-based cranial implants are strengthening market penetration. In addition, government initiatives to improve surgical care and the presence of domestic medical device manufacturers are supporting robust market growth across major urban centers.

Cranial Implants Treatment Market Share

The Cranial Implants Treatment industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Johnson & Johnson (U.S.)

• Stryker Corporation (U.S.)

• Zimmer Biomet Holdings, Inc. (U.S.)

• B. Braun SE (Germany)

• KLS Martin Group (Germany)

• Anatomics Pty Ltd. (Australia)

• Xilloc Medical B.V. (Netherlands)

• Materialise NV (Belgium)

• OsteoMed (U.S.)

• Synthes GmbH (Germany)

• OssDsign AB (Sweden)

• evonos GmbH & Co. KG (Germany)

• Integra LifeSciences (U.S.)

• Renishaw plc (UK)

Latest Developments in Global Cranial Implants Treatment Market

- In October 2023, 3D Systems announced that a patient‑specific 3D‑printed cranial implant produced using its point‑of‑care additive manufacturing technology was successfully used in cranioplasty at University Hospital Basel (Switzerland) — representing among the first regulated, hospital‑based uses of 3D‑printed cranial implants under the new medical‑device regulations in Europe

- In April 2024, 3D Systems received U.S. Food and Drug Administration (FDA) 510(k) clearance for its 3D‑printed, patient‑specific cranial implant — the VSP PEEK Cranial Implant — making it the first FDA‑cleared, additively manufactured PEEK implant intended for cranioplasty procedures

- In August 2024, a neurotechnology company Longeviti Neuro Solutions secured a patent for a novel prosthetic cranial implant, ClearFit Cranial Implant, which is described as integrating neuro‑imaging/neuro‑mapping capabilities (brain mapping + neurosonography) — signaling a potential next‑generation implant paradigm combining structural reconstruction with diagnostic or monitoring functionality

- In April 2025, researchers published a peer‑reviewed study detailing the use of a high-performance polymer, PEKK (polyether–ketone–ketone), to produce patient‑specific cranial implants using additive manufacturing via a process called Arburg Plastic Freeforming (APF). The study demonstrates that PEKK implants can meet mechanical property requirements and may offer advantages over existing materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.