Global Crashworthy Aircraft Seats Market

Market Size in USD Billion

CAGR :

%

USD

1.02 Billion

USD

1.51 Billion

2024

2032

USD

1.02 Billion

USD

1.51 Billion

2024

2032

| 2025 –2032 | |

| USD 1.02 Billion | |

| USD 1.51 Billion | |

|

|

|

|

Crashworthy Aircraft Seats Market Size

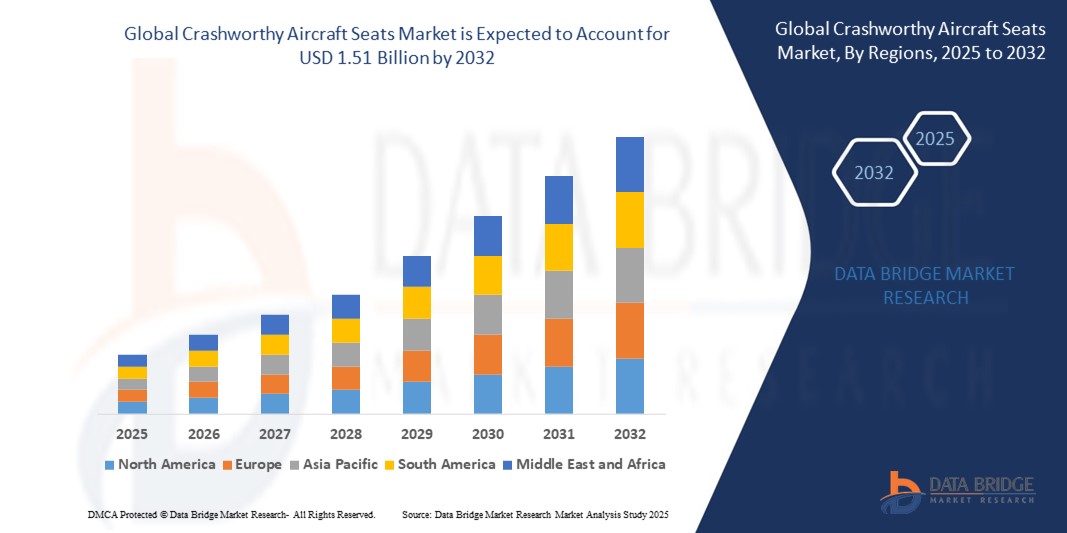

- The global crashworthy aircraft market size was valued at USD 1.02 billion in 2024 and is expected to reach USD 1.51 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is primarily driven by increasing demand for enhanced safety standards in aviation, advancements in lightweight and durable materials, and stringent regulatory requirements for aircraft safety across commercial and military applications

- In addition, rising air passenger traffic, fleet modernization programs, and growing investments in military aviation are accelerating the adoption of crashworthy aircraft seats, positioning them as critical components for occupant safety

Crashworthy Aircraft Seats Market Analysis

- Crashworthy aircraft seats, designed to protect occupants during crash scenarios through energy absorption, restraint systems, and fire-resistant materials, are integral to enhancing safety in both commercial and military aviation

- The demand for these seats is fueled by growing safety concerns, advancements in seat technology, and the need for compliance with stringent aviation safety regulations set by global authorities

- North America dominated the crashworthy aircraft seats market with the largest revenue share of 36.5% in 2024, driven by early adoption of advanced aviation technologies, significant investments in aerospace and defense, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid growth in air travel, increasing defense budgets, and rising aircraft production in countries such as China and India

- The passenger crashworthy aircraft seats dominated held the largest market revenue share of 55% in 2024, driven by the high demand for enhanced safety features in commercial aviation due to increasing passenger traffic and stringent regulatory requirements

Report Scope and Crashworthy Aircraft Seats Market Segmentation

|

Attributes |

Crashworthy Aircraft Seats Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Crashworthy Aircraft Seats Market Trends

Increasing Integration of Advanced Materials and Smart Technologies

- The global crashworthy aircraft seats market is experiencing a significant trend toward the integration of advanced materials, such as composite materials and lightweight alloys, alongside smart technologies

- These materials, including carbon fiber-reinforced polymers and high-strength alloys, enhance seat durability while reducing weight, improving fuel efficiency and occupant safety

- Smart technologies, such as embedded sensors and digital interfaces, enable real-time monitoring of seat performance and occupant posture, optimizing safety during crashes

- For instance, companies such as Collins Aerospace are developing seats with automatic energy absorbers and restraint technologies that adapt to impact conditions, enhancing crashworthiness

- This trend is increasing the appeal of crashworthy seats for both commercial and military aviation, as operators prioritize safety and compliance with stringent regulations

- Advanced features, such as airbags and fire-resistant materials, are being incorporated to further mitigate injury risks and improve occupant protection

Crashworthy Aircraft Seats Market Dynamics

Driver

Rising Demand for Enhanced Aviation Safety and Regulatory Compliance

- Growing consumer and regulatory demand for enhanced aviation safety is a key driver for the global crashworthy aircraft seats market

- Crashworthy seats, equipped with energy-absorbing mechanisms, restraint systems, and fire-resistant materials, significantly reduce injury risks during accidents, aligning with safety standards set by bodies such as the FAA and EASA

- Government mandates, such as those requiring 16G and 21G seats in commercial and military aircraft, are accelerating adoption across fixed-wing and rotary-wing platforms

- The rise in global air travel, with approximately 8.6 billion passengers in 2019, underscores the need for advanced safety features in commercial airplanes, business jets, and helicopters

- Aircraft manufacturers are increasingly integrating factory-fitted crashworthy seats to meet regulatory requirements and enhance passenger and crew safety, boosting market growth

Restraint/Challenge

High Implementation Costs and Regulatory Complexities

- The high initial costs associated with designing, manufacturing, and integrating crashworthy aircraft seats, particularly those using advanced composite materials and technologies, pose a significant barrier, especially for smaller operators and emerging markets

- Retrofitting existing aircraft with crashworthy seats can be complex and expensive, limiting adoption in older fleets

- Data privacy and cybersecurity concerns arise with smart seats that collect occupant data via sensors, raising issues about data protection and compliance with varying global regulations

- The fragmented regulatory landscape across regions, with differing certification standards for crashworthiness, complicates manufacturing and increases compliance costs for international suppliers

- These factors may deter adoption in cost-sensitive markets or regions with stringent data privacy laws, potentially hindering market expansion

Crashworthy Aircraft Seats market Scope

The market is segmented on the basis of product, end user, platform, aircraft type, material, and technology.

- By Product

On the basis of product, the global crashworthy aircraft seats market is segmented into crew crashworthy aircraft seats, passenger crashworthy aircraft seats, and others. The passenger crashworthy aircraft seats dominated held the largest market revenue share of 55% in 2024, driven by the high demand for enhanced safety features in commercial aviation due to increasing passenger traffic and stringent regulatory requirements.

The crew crashworthy aircraft seats segment is expected to witness the fastest growth rate of 7.9% from 2025 to 2032, fueled by increased investments in military aircraft and the need for advanced safety features to protect pilots and crew during high-risk missions.

- By End User

On the basis of end user, the global crashworthy aircraft seats market is segmented into commercial and military. The commercial segment dominated the market with a revenue share of 70% in 2024, driven by the surge in global air travel and the adoption of advanced seating solutions to meet safety standards and enhance passenger experience.

The military segment is anticipated to experience rapid growth of 8.5% from 2025 to 2032, propelled by modernization programs and the increasing demand for crashworthy seats in defense aircraft to ensure crew safety during critical operations.

- By Platform

On the basis of platform, the global crashworthy aircraft seats market is segmented into fixed-wing and rotary-wing. The fixed-wing segment held the largest market revenue share of 65% in 2024, attributed to the high volume of commercial airliners and military transport planes requiring crashworthy seats to comply with safety regulations.

The rotary-wing segment is expected to witness significant growth from 2025 to 2032, driven by the rising need for crashworthy seats in helicopters, particularly in military and emergency operations, where survivability in crash scenarios is critical.

- By Aircraft Type

On the basis of aircraft type, the global crashworthy aircraft seats market is segmented into commercial airplanes, business jets, military aircraft, helicopters, and regional jets. The commercial airplanes segment dominated the market with a revenue share of 50% in 2024, fueled by the increasing number of air passengers and fleet expansion by airlines prioritizing safety.

The helicopters segment is anticipated to grow rapidly from 2025 to 2032, driven by the demand for lightweight, crashworthy seating solutions in rotary-wing aircraft used for military and civilian applications, such as search and rescue.

- By Material

On the basis of material, the global crashworthy aircraft seats market is segmented into composite materials and metal alloys. The composite materials segment held the largest market revenue share of 60% in 2024, driven by their lightweight, durable properties and increasing use in advanced seat designs to enhance fuel efficiency and safety.

The metal alloys segment is expected to witness robust growth from 2025 to 2032, as alloys such as aluminum and titanium continue to be utilized for their strength in crashworthy seat structures, particularly in military applications.

- By Technology

On the basis of technology, the global crashworthy aircraft seats market is segmented into energy absorbing seats, systems of restraint, fire-resistant materials, emergency ejection systems, and advanced features. The energy absorbing seats segment held the largest market revenue share of 45% in 2024, owing to their critical role in minimizing impact forces and enhancing occupant protection during crashes.

The advanced features segment, including smart sensors and digital interfaces, is expected to experience the fastest growth from 2025 to 2032, driven by innovations in seat customization and integration of safety-enhancing technologies such as airbags and posture-improving sensors.

Crashworthy Aircraft Seats Market Regional Analysis

- North America dominated the crashworthy aircraft seats market with the largest revenue share of 36.5% in 2024, driven by early adoption of advanced aviation technologies, significant investments in aerospace and defense, and the presence of major industry players

- Consumers prioritize crashworthy seats for enhanced safety, impact protection, and compliance with aviation standards, particularly in regions with high air traffic and diverse operational conditions

- Growth is supported by advancements in seat technology, including energy-absorbing materials, lightweight composites, and smart sensors, alongside rising adoption in both OEM and aftermarket segments

U.S. Crashworthy Aircraft Seats Market Insight

The U.S. smart lock market captured the largest revenue share of 74.9% in 2024 within North America, fueled by strong demand for safety-focused seating solutions and growing awareness of occupant protection benefits. The trend towards aircraft modernization and strict regulatory standards from the FAA further boost market expansion. Aircraft manufacturers’ increasing integration of crashworthy seats in new aircraft complements aftermarket upgrades, creating a diverse product ecosystem.

Europe Crashworthy Aircraft Seats Market Insight

The European crashworthy aircraft seats market is expected to witness significant growth, supported by regulatory emphasis on aviation safety and occupant comfort. Consumers seek seats that enhance crash survivability while offering lightweight designs. The growth is prominent in both new aircraft installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising safety concerns and advanced aerospace industries.

U.K. Crashworthy Aircraft Seats Market Insight

The U.K. market for crashworthy aircraft seats is expected to witness notable growth, driven by demand for enhanced occupant safety and comfort in commercial and military aviation. Increased interest in advanced materials and regulatory compliance with EASA standards encourages adoption. The focus on upgrading existing fleets and integrating innovative seating solutions further supports market growth.

Germany Crashworthy Aircraft Seats Market Insight

Germany is expected to witness significant growth in the crashworthy aircraft seats market, attributed to its advanced aerospace manufacturing sector and high consumer focus on safety and efficiency. German consumers prefer technologically advanced seats that enhance crashworthiness and contribute to fuel efficiency through lightweight materials. The integration of these seats in premium aircraft and aftermarket options supports sustained market growth.

Asia-Pacific Crashworthy Aircraft Seats Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding aviation industries, rising air travel demand, and increasing investments in aircraft safety technologies in countries such as China, India, and Japan. Growing awareness of crashworthiness, occupant protection, and regulatory compliance boosts demand. Government initiatives promoting aviation safety and modernization further encourage the adoption of advanced crashworthy seats.

Japan Crashworthy Aircraft Seats Market Insight

Japan’s crashworthy aircraft seats market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced seats that enhance safety and comfort. The presence of major aircraft manufacturers and the integration of crashworthy seats in OEM aircraft accelerate market penetration. Rising interest in aftermarket customization and safety upgrades also contributes to growth.

China Crashworthy Aircraft Seats Market Insight

China holds the largest share of the Asia-Pacific crashworthy aircraft seats market, propelled by rapid urbanization, rising aircraft ownership, and increasing demand for occupant safety solutions. The country’s growing middle class and focus on aviation modernization support the adoption of advanced crashworthy seats. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Crashworthy Aircraft Seats Market Share

The crashworthy aircraft seats industry is primarily led by well-established companies, including:

- IAI (Israel)

- BAE Systems (U.K.)

- Martin-Baker Aircraft Co. Ltd (U.K.)

- T-KALIP (Turkey)

- Safe, Inc. (U.S.)

- Collins Aerospace (U.S.)

- Heinen & Hopman Engineering (Netherlands)

- East/West Industries Inc (U.S.)

- Astronics Corporation (U.S.)

- Crane Company (U.S.)

- Safran (France)

- Kyntec Corporation (U.S.)

- mesag-system AG (Switzerland)

- Quest Global (Singapore)

What are the Recent Developments in Global Crashworthy Aircraft Seats Market?

- In January 2024, Bushliner Aircraft announced a strategic partnership with Jungle Aviation and Relay Service (JAARS Inc.), securing design rights for upgraded S-frame seats tailored for the Bushliner 1850. These seats are engineered with inertia-absorbing technology capable of withstanding forces up to 30 Gs, significantly enhancing crashworthiness and occupant safety. Originally developed in response to a mission accident, the seats feature a modular design that allows for flexible cabin configurations, easy removal, and stowage. Their lightweight construction also improves fuel efficiency and overall aircraft performance, making them ideal for both special missions and general aviation use

- In October 2024, Air India became the first Indian airline to receive Design Organisation Approval (DOA) from the Directorate General of Civil Aviation (DGCA) under CAR 21 regulations. This landmark certification empowers Air India to independently design, modify, and upgrade its aircraft interiors—streamlining operations and reducing dependence on external vendors. The approval supports initiatives such as enhancing crashworthy seating solutions, improving passenger safety, and accelerating fleet modernization. It also aligns with Air India’s collaboration with Tata Technologies, aimed at boosting in-house engineering and maintenance capabilities through smart MRO services and digital innovation

- In May 2024, Collins Aerospace introduced its Helix™ main cabin seat for narrow-body aircraft at the Aircraft Interiors Expo in Hamburg. Designed with comfort, reliability, and sustainability in mind, Helix features a reimagined frame and high strength-to-weight composite materials that reduce overall seat weight—cutting fuel burn and emissions. The seat enhances passenger living space, increases under-seat stowage, and supports seat pitches as low as 28 inches without sacrificing cabin density. It also accommodates larger inflight entertainment systems and full-sized meal trays, making it a smart solution for modern airline fleets

- In November 2023, Safran unveiled its latest crashworthy aircraft seat design, showcasing a modular configuration and advanced energy-absorbing materials. This innovation aims to reduce passenger injuries during emergency situations while improving comfort and ease of maintenance. The modularity allows for flexible installation across various aircraft platforms, and the enhanced materials are engineered to absorb impact forces more effectively—reinforcing Safran’s commitment to elevating aviation safety and design standards

- In August 2021, Collins Aerospace spotlighted its advanced ergonomic seating solutions for military helicopters, designed to improve pilot and troop performance, safety, and comfort during demanding missions. These seats feature pressure-mapped ergonomic designs, energy-absorbing technologies, and customizable configurations that reduce spinal loads and mitigate vibration stress—critical for long-duration flights in platforms such as the Black Hawk and Future Vertical Lift aircraft. The crashworthy seats also incorporate ballistic protection, seatbelt pretensioners, and airbag systems, underscoring Collins’ commitment to mission-focused innovation and next-generation rotary-wing seating

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.