Global Cricket Equipment Market

Market Size in USD Million

CAGR :

%

USD

705.82 Million

USD

1,042.81 Million

2025

2033

USD

705.82 Million

USD

1,042.81 Million

2025

2033

| 2026 –2033 | |

| USD 705.82 Million | |

| USD 1,042.81 Million | |

|

|

|

|

Cricket Equipment Market Size

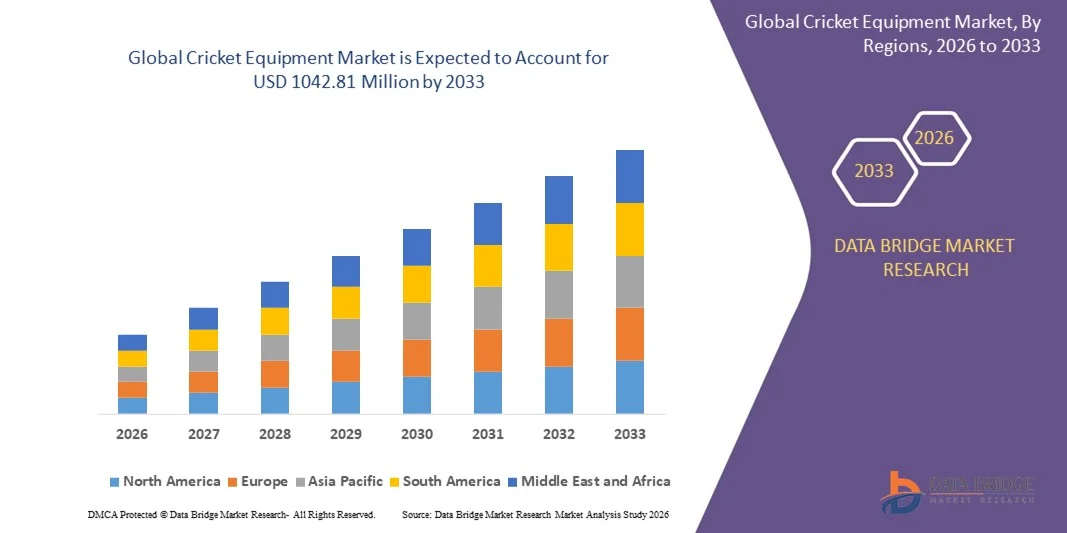

- The global cricket equipment market size was valued at USD 705.82 million in 2025 and is expected to reach USD 1042.81 million by 2033, at a CAGR of 5.0% during the forecast period

- The market growth is largely fueled by the increasing popularity of cricket worldwide, rising participation in professional and amateur leagues, and growing investments in grassroots and youth cricket programs, leading to higher demand for quality cricket equipment

- Furthermore, technological advancements in cricket gear, including the use of lightweight materials, ergonomic designs, and smart training accessories, are enhancing player performance and safety, thereby driving adoption of advanced cricket equipment and boosting market expansion

Cricket Equipment Market Analysis

- Cricket equipment, including bats, balls, protective gear, and training accessories, is becoming increasingly essential for players across professional, amateur, and recreational levels due to its impact on performance, safety, and skill development

- The escalating demand for cricket equipment is primarily fueled by the rising popularity of T20 leagues, growing female participation, expanding youth programs, and increased accessibility through specialty stores and online channels

- Asia-Pacific dominated cricket equipment market with a share of 35.3% in 2025, due to high participation in cricket, strong presence of professional leagues, and growing grassroots programs

- Europe is expected to be the fastest growing region in the cricket equipment market during the forecast period due to increasing popularity of cricket in emerging markets such as the U.K., Netherlands, and Ireland

- Bat segment dominated the market with a market share of 38.5% in 2025, due to its essential role in the game and demand for professional-grade and customized bats. Cricketers prioritize bats for performance, balance, and durability, while innovations in willow and composite materials enhance stroke power. Cricket academies and clubs contribute to consistent demand across age groups and skill levels. A wide variety of bat designs from major brands strengthens the segment’s market position

Report Scope and Cricket Equipment Market Segmentation

|

Attributes |

Cricket Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cricket Equipment Market Trends

Rising Adoption of Advanced and Smart Cricket Equipment

- A significant trend in the cricket equipment market is the increasing adoption of advanced and technologically enhanced gear, driven by the growing focus on player performance, safety, and training efficiency across professional, amateur, and youth levels. This adoption is elevating the role of innovative materials, ergonomic designs, and smart training tools as essential elements in modern cricket

- For instance, Str8bat’s Elev8 AI Smart Sticker provides real-time performance analytics for batsmen, helping players refine stroke technique and improve consistency during practice. Such smart accessories are rapidly gaining popularity among academies, clubs, and individual players, reinforcing the shift toward data-driven cricket training

- High-quality composite and laminated willow bats from companies such as Kookaburra and Gray‑Nicolls are increasingly preferred in competitive cricket, enhancing stroke power and durability while supporting ergonomic comfort. This trend is fostering stronger brand differentiation and encouraging investment in research and development of innovative cricket gear

- The integration of lightweight protective gear such as pads, gloves, and helmets with advanced shock absorption is also shaping player safety trends. Companies such as SG and MRF are innovating in protective equipment to reduce injury risk without compromising mobility, making safety-oriented products a key market driver

- Cricket training aids, including bowling machines and digital performance trackers, are becoming mainstream in coaching centers and academies. These tools enable precise skill assessment, technique improvement, and injury prevention, highlighting the increasing reliance on technology in cricket equipment

- In addition, growing awareness of sustainability and eco-friendly manufacturing processes is influencing the design and production of cricket gear. Companies such as Grays International are adopting sustainable materials and manufacturing methods to meet consumer expectations while reducing environmental impact

Cricket Equipment Market Dynamics

Driver

Increasing Participation in Professional, Amateur, and Youth Cricket Programs

- The rising involvement in cricket at professional, amateur, and youth levels is driving demand for high-quality equipment across bats, balls, protective gear, and training aids. Expanding domestic leagues, grassroots programs, and international tournaments are encouraging investments in standardized and technologically advanced cricket gear

- For instance, Sanspareils Greenlands (SG) has supplied cricket kits and equipment for domestic academies and international youth tournaments in India, increasing accessibility and raising standards of training. This adoption ensures that players at all levels have access to high-performance equipment, strengthening the overall market

- The popularity of T20 leagues worldwide, including the Indian Premier League (IPL) and Big Bash League (BBL), has created high demand for performance-optimized cricket bats and protective gear. Leading manufacturers such as Kookaburra and Gray‑Nicolls are meeting these demands with professional-grade products designed for intense match conditions

- Youth development programs and school cricket initiatives are fostering early adoption of standardized cricket equipment. Companies such as CA Sports and MRF actively supply equipment to school-level teams, promoting engagement and long-term loyalty among emerging players

- The expansion of cricket in non-traditional markets, supported by logistic initiatives from DP World and similar organizations, is further broadening the consumer base and stimulating global demand. This increasing participation across geographies reinforces the growth driver for the cricket equipment market

Restraint/Challenge

High Cost of Premium and Technologically Advanced Cricket Gear

- The cricket equipment market faces challenges due to the high cost of premium bats, protective gear, and smart training accessories, which can limit adoption among amateur players and cost-sensitive regions. These price points are influenced by the use of high-quality willow, advanced composites, shock-absorbing materials, and integrated technology in training aids

- For instance, Str8bat’s AI-enabled performance stickers and smart batting analytics tools are priced at a premium, restricting access to well-funded academies and professional teams. Similarly, customized bats from Kookaburra or Gray‑Nicolls often carry high costs due to specialized willow selection and craftsmanship

- Producing technologically advanced protective gear involves sophisticated materials and rigorous quality testing, increasing operational costs for manufacturers. SG and MRF incorporate multiple layers of padding and reinforced designs in helmets and pads, which elevates production expenses and retail prices

- The reliance on advanced manufacturing processes, such as precision bat pressing, laminating, and ergonomically tailored equipment, further adds to production complexity. Maintaining consistency while controlling costs remains a key challenge for cricket equipment producers

- Scaling distribution of premium products while balancing affordability for emerging cricket markets is a persistent constraint. Manufacturers must optimize production and logistics to ensure that high-quality, tech-enhanced cricket gear is accessible without compromising profitability

Cricket Equipment Market Scope

The market is segmented on the basis of product type, end user, and distribution channel.

- By Product Type

On the basis of product type, the cricket equipment market is segmented into bat, ball, pads, stumps, bails, kits, and others. The bat segment dominated the market with the largest share of 38.5% in 2025 due to its essential role in the game and demand for professional-grade and customized bats. Cricketers prioritize bats for performance, balance, and durability, while innovations in willow and composite materials enhance stroke power. Cricket academies and clubs contribute to consistent demand across age groups and skill levels. A wide variety of bat designs from major brands strengthens the segment’s market position.

The pads segment is expected to witness the fastest growth from 2026 to 2033, driven by rising safety awareness and growing cricket participation. For instance, SG and Kookaburra are launching lightweight, shock-absorbing pads appealing to both professionals and amateurs. Technological enhancements in padding materials offer protection without compromising comfort. Increased female participation and youth programs further boost demand for ergonomically designed pads.

- By End User

On the basis of end user, the cricket equipment market is segmented into men, women, and kids. The men’s segment dominated the market in 2025 due to high participation and demand for advanced, premium equipment. Endorsements by professional cricketers and focus on academies and clubs strengthen sales. Marketing campaigns and international events encourage investment in bats, balls, and protective gear. Diverse product lines for all skill levels maintain dominance in this segment.

The women’s segment is expected to grow fastest from 2026 to 2033, fueled by increasing female participation and organized leagues. For instance, Gray-Nicolls and Puma are introducing women-specific bats, pads, and kits. Awareness programs and ergonomic designs promote adoption, and stylish, functional gear attracts new players.

- By Distribution Channel

On the basis of distribution channel, the cricket equipment market is segmented into hypermarket or supermarket, specialty stores, and online sales channels. The specialty stores segment dominated in 2025 due to expert guidance, product variety, and premium offerings. In-store services, custom fittings, and equipment maintenance strengthen customer loyalty. Clubs and serious players prefer specialty stores for bulk and specialized purchases, ensuring steady revenue.

The online sales channels segment is expected to witness the fastest growth from 2026 to 2033, driven by e-commerce adoption and convenience. For instance, Amazon and Sportsadda offer wide assortments, competitive pricing, and delivery options. Access to international brands and detailed product information encourages informed purchases. Bulk orders for academies and digital marketing further accelerate growth.

Cricket Equipment Market Regional Analysis

- Asia-Pacific dominated the cricket equipment market with the largest revenue share of 35.3% in 2025, driven by high participation in cricket, strong presence of professional leagues, and growing grassroots programs

- The region’s expanding manufacturing base for sports equipment, cost-effective production, and rising disposable income are accelerating market growth

- Increasing popularity of cricket academies, youth programs, and organized tournaments is contributing to higher adoption of quality cricket gear across age groups

India Cricket Equipment Market Insight

India held the largest share in the Asia-Pacific cricket equipment market in 2025, owing to its status as the global hub for cricket and home to a vast player base across professional and amateur levels. The country’s strong cricket culture, growing domestic manufacturing of bats, balls, and protective gear, and rising popularity of T20 leagues are major growth drivers. Increasing sponsorships, academies, and government initiatives promoting sports participation are further boosting market demand.

Australia Cricket Equipment Market Insight

Australia is witnessing steady growth in the Asia-Pacific region, supported by established domestic leagues, high-quality equipment manufacturing, and a strong culture of sports engagement. Investments in sports infrastructure, cricket academies, and youth training programs are enhancing demand for advanced cricket equipment. Rising participation in both men’s and women’s cricket, along with increasing adoption of professional-grade gear, is fueling market expansion.

Europe Cricket Equipment Market Insight

Europe is expected to witness the fastest growth in the cricket equipment market from 2026 to 2033, driven by increasing popularity of cricket in emerging markets such as the U.K., Netherlands, and Ireland. For instance, initiatives by the England and Wales Cricket Board (ECB) to promote cricket at school and club levels are expanding the player base. Rising interest in T20 leagues, youth programs, and recreational cricket is creating demand for high-quality bats, protective gear, and training kits. In addition, growth in e-commerce and specialty sports stores is improving accessibility of cricket equipment across the region.

U.K. Cricket Equipment Market Insight

The U.K. market is growing steadily, supported by organized leagues, increasing youth participation, and the presence of prominent cricket clubs. Investments in training facilities, sponsorship of domestic tournaments, and initiatives promoting women’s cricket are strengthening market adoption. The availability of premium and imported equipment, along with a mature retail and online distribution network, further enhances market growth.

North America Cricket Equipment Market Insight

North America is expanding gradually, driven by the rising popularity of cricket among immigrants and the younger generation. Cricket clubs, local leagues, and increasing media coverage of international tournaments are contributing to equipment demand. Focus on training programs and amateur leagues in cities with high cricket participation is supporting steady growth.

U.S. Cricket Equipment Market Insight

The U.S. held the largest share in the North American cricket equipment market in 2025, underpinned by the growing number of cricket academies, tournaments, and community leagues. Increasing awareness of cricket as a recreational sport, along with rising demand for high-quality bats, balls, and protective gear, is driving market expansion. Online sales channels and specialty stores further support accessibility and distribution of cricket equipment.

Cricket Equipment Market Share

The cricket equipment industry is primarily led by well-established companies, including:

- Kookaburra Sport Pty Ltd (Australia)

- Unicorn Products Ltd (U.K.)

- Gray‑Nicolls (U.K.)

- Sareen Sports Industries (India)

- Adidas AG (Germany)

- Puma SE (Germany)

- Sunridges (India)

- Spartan Sports (India)

- British Cricket Balls Limited (U.K.)

- Grays of Cambridge (U.K.)

- CA Sports (Pakistan)

- Sommers Sports (U.K.)

- MRF (India)

- KIPPAX WILLOW LIMITED (U.K.)

- SportsDirect.com Retail Ltd. (U.K.)

- Duncan Fearnley Cricket Sales Ltd (U.K.)

- Woodworm.tv (U.K.)

- Callen Cricket (U.K.)

- Sanspareils Greenlands Pvt Ltd (India)

Latest Developments in Global Cricket Equipment Market

- In November 2025, Str8bat launched its Elev8 AI Smart Sticker, an advanced performance‑tracking tool integrating artificial‑intelligence analytics to improve training effectiveness and player engagement. This innovation enhances grassroots and elite player development by providing real‑time performance insights during practice sessions, accelerating adoption of data-driven training across academies and individual players, and reinforcing the trend toward smart, tech-enabled cricket equipment

- In September 2025, Sanspareils Greenlands (SG) entered into a strategic partnership with Salesforce to digitize its trade-channel sales and dealer-management system across over 850 outlets in India. This collaboration leverages AI-driven platforms to streamline operations, enhance customer engagement, and improve market reach, strengthening SG’s distribution network and supporting broader adoption of cricket equipment through more efficient sales processes

- In October 2023, Emirati supply chain logistics company DP World launched an initiative to drive the growth of cricket worldwide by using its global logistics network to supply 50 shipping containers full of essential cricket equipment to local teams globally. This initiative expanded accessibility of quality equipment to amateur players, promoting the sport in emerging markets and strengthening the international distribution and adoption of cricket gear

- In 2023, Kookaburra Sport Pvt Ltd. entered into a partnership with Burley-Sekem to create a larger, stronger group combining complementary skill sets. The merger consolidated 240 years of experience, enhancing product innovation, operational efficiency, and market presence, further strengthening the Australian sporting goods and apparel industry and positioning the combined entity as a key leader in cricket equipment

- In 2023, Grays International focused on product innovation to cater to the growing demand for flexible and sustainable cricket accessories. By manufacturing equipment tailored to evolving player preferences, the company addressed both performance and environmental considerations, supporting the shift toward eco-friendly and customer-focused cricket products and boosting its competitive position in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.