Global Crop Micronutrients Market

Market Size in USD Billion

CAGR :

%

USD

10.20 Billion

USD

16.20 Billion

2024

2032

USD

10.20 Billion

USD

16.20 Billion

2024

2032

| 2025 –2032 | |

| USD 10.20 Billion | |

| USD 16.20 Billion | |

|

|

|

|

Crop Micronutrients Market Size

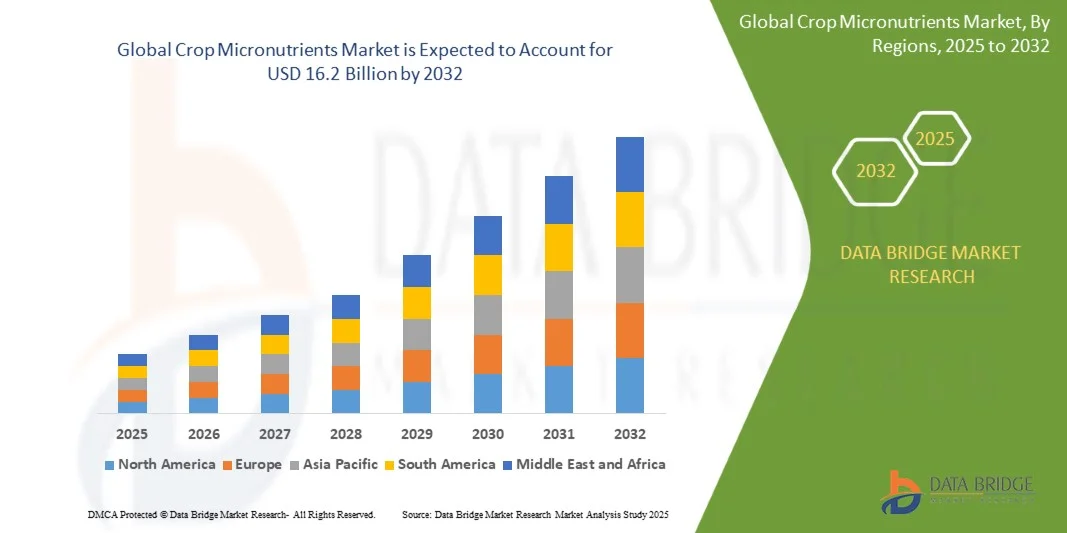

- The global crop micronutrients market size was valued at USD 10.2 billion in 2024 and is expected to reach USD 16.2 billion by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely fuelled by the increasing awareness among farmers regarding soil health management and the importance of micronutrients in improving crop yield and quality

- Rising global demand for high-value crops, coupled with the expansion of sustainable farming practices and precision agriculture technologies, is further contributing to the market’s expansion

Crop Micronutrients Market Analysis

- The market is witnessing steady growth due to the growing adoption of balanced nutrient management practices across developing and developed economies. Governments and agricultural organizations are promoting micronutrient-enriched fertilizers to combat soil deficiencies and ensure food security

- Increasing instances of micronutrient deficiency in soils, particularly zinc, boron, and iron, are prompting greater usage of customized micronutrient blends. Technological advancements in chelation and nano-formulation processes are enhancing nutrient bioavailability and efficiency

- North America dominated the crop micronutrients market with the largest revenue share of

- North America region is expected to witness the highest growth rate in the global crop micronutrients market, driven by growing investments in agricultural innovation, strong R&D presence, and increasing adoption of customized micronutrient solutions among farmers

- The zinc-based micronutrients segment held the largest market revenue share in 2024, driven by the widespread zinc deficiency in agricultural soils and its critical role in enzyme activation and protein synthesis in plants. The use of zinc-based fertilizers has become increasingly important to improve root development and enhance crop yield, especially in cereals and grains

Report Scope and Crop Micronutrients Market Segmentation

|

Attributes |

Crop Micronutrients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Crop Micronutrients Market Trends

“Rising Integration of Micronutrients In Precision Farming Practices”

- The increasing adoption of precision farming techniques is reshaping the crop micronutrients landscape by enabling site-specific nutrient management. Farmers are using GPS-based tools, remote sensing, and data analytics to determine soil micronutrient deficiencies accurately, ensuring targeted application and improved crop yields. This precision approach minimizes waste, enhances soil health, and supports sustainable agriculture practices, ultimately leading to higher farm efficiency and profitability across diverse agro-climatic zones

- The demand for micronutrient-enriched fertilizers is accelerating as farmers focus on improving nutrient efficiency and reducing input costs. These fertilizers are specifically formulated to address regional soil deficiencies, promoting balanced plant growth and higher productivity. Precision application systems ensure optimal micronutrient distribution, minimizing environmental impact while increasing the sustainability of large-scale farming operations and improving overall crop resilience

- The integration of IoT-enabled sensors and drones is further driving the adoption of micronutrient monitoring systems. These technologies help in real-time tracking of soil and crop nutrient status, providing actionable insights that guide nutrient application schedules. The use of artificial intelligence (AI) and cloud-based platforms further allows farmers to make data-driven decisions, resulting in optimal input usage and improved crop performance throughout the growing season

- For instance, in 2023, several agritech companies in India introduced micronutrient management solutions that combine soil testing kits with data-driven advisory services. These systems have significantly improved the micronutrient balance in major crops such as rice, wheat, and maize, leading to higher farm profitability. The integration of mobile-based advisory platforms is also helping farmers track soil nutrition dynamically and implement corrective measures instantly

- While precision farming is transforming the utilization of micronutrients, its success depends on the availability of affordable technology, farmer awareness, and training. Manufacturers and policymakers must collaborate to promote precision-based micronutrient adoption in both large-scale and smallholder farming systems. Creating regional demonstration projects and offering digital literacy programs can further accelerate precision micronutrient integration and long-term adoption

Crop Micronutrients Market Dynamics

Driver

“Increasing Soil Micronutrient Deficiency And Rising Demand For High-Yield Crops”

- The global decline in soil micronutrient levels due to continuous cropping, erosion, and chemical overuse has intensified the need for micronutrient supplementation. Deficiencies in key elements such as zinc, iron, boron, and manganese are leading to lower crop productivity and reduced food quality, prompting farmers to adopt specialized fertilizers and foliar sprays. These deficiencies are especially critical in developing nations, where poor soil management practices have further exacerbated nutrient depletion

- The rising global population and the growing need for high-yield, nutrient-rich crops are further driving market demand. Farmers are increasingly incorporating micronutrients into integrated nutrient management programs to improve overall soil fertility and sustain agricultural productivity. In addition, the rising consumer demand for biofortified and nutrient-dense food products is encouraging the use of micronutrients to enhance both yield and nutritional quality

- Public-private initiatives are also accelerating the distribution of micronutrient fertilizers in developing regions. Subsidy programs and awareness campaigns are supporting the adoption of these products among small and mid-scale farmers, ensuring equitable access and encouraging sustainable farming practices. Several international organizations are also collaborating with local governments to develop efficient distribution networks for micronutrient-based products

- For instance, in 2022, the Indian government launched a micronutrient enhancement initiative under the National Food Security Mission, aimed at improving soil zinc and boron content across major agricultural zones. Similar programs have been introduced in African and Southeast Asian countries, promoting balanced fertilizer use and raising awareness about micronutrient deficiencies. These initiatives are helping to close the productivity gap between traditional and advanced farming systems

- While awareness of micronutrient importance is growing, ensuring consistent supply, farmer education, and localized formulation development remains critical to maximizing adoption and maintaining crop productivity. Building regional production facilities and providing farmer training through extension services can further strengthen the market and support global food security goals

Restraint/Challenge

“High Cost of Micronutrient Fertilizers And Limited Farmer Awareness In Developing Regions”

- The relatively high cost of micronutrient-based fertilizers compared to conventional options continues to limit their adoption, particularly among smallholder farmers in low-income economies. Price sensitivity and limited access to credit or subsidies make it difficult for these farmers to invest in specialized micronutrient products. The high dependency on imported raw materials and production costs further increase end-user pricing, making affordability a major barrier

- Lack of awareness regarding micronutrient benefits and application methods further hampers market growth. Many farmers remain dependent on macronutrient fertilizers, unaware of the long-term yield losses caused by micronutrient deficiencies. This knowledge gap is more prominent in regions with limited agricultural extension services, leading to unbalanced nutrient management and declining soil health over time

- Inadequate distribution networks and inconsistent product availability in rural markets exacerbate adoption challenges. Without proper access to high-quality micronutrient formulations, farmers struggle to maintain soil balance and achieve optimal yields. The lack of reliable supply chains and storage facilities further restricts timely product delivery, especially during critical crop growth stages

- For instance, in 2023, agricultural agencies in Sub-Saharan Africa reported that less than 35% of small-scale farmers had access to micronutrient fertilizers, primarily due to high input costs and lack of local distribution channels. This has led to persistent soil degradation, reduced yields, and higher dependency on imported food grains in the region. Addressing these challenges is vital for agricultural self-sufficiency

- While innovation in formulation and distribution is ongoing, improving farmer education, strengthening supply chains, and introducing affordable micronutrient blends are essential to overcoming these challenges and ensuring broader market penetration. Encouraging local production and government-backed credit programs can significantly expand market reach and accelerate rural adoption globally

Crop Micronutrients Market Scope

The crop micronutrients market is segmented into five notable segments based on type, form, application method, crop type, and end-use.

• By Type

On the basis of type, the crop micronutrients market is segmented into zinc-based micronutrients, iron-based micronutrients, boron-based micronutrients, manganese-based micronutrients, and copper-based micronutrients. The zinc-based micronutrients segment held the largest market revenue share in 2024, driven by the widespread zinc deficiency in agricultural soils and its critical role in enzyme activation and protein synthesis in plants. The use of zinc-based fertilizers has become increasingly important to improve root development and enhance crop yield, especially in cereals and grains.

The iron-based micronutrients segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising prevalence of iron deficiency in alkaline soils and its importance in chlorophyll synthesis. Iron chelates are increasingly being adopted in both open-field and greenhouse farming to correct nutrient imbalances and prevent chlorosis in crops such as fruits, vegetables, and pulses.

• By Form

On the basis of form, the crop micronutrients market is segmented into solid, liquid, and chelated. The solid segment held the largest market revenue share in 2024, primarily due to its cost-effectiveness, ease of storage, and longer shelf life. Granular and powder formulations are widely used for soil application in large-scale farming operations, offering controlled nutrient release and compatibility with traditional fertilizer systems.

The chelated segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior nutrient availability and enhanced absorption efficiency. Chelated micronutrients are particularly beneficial in high-pH soils where non-chelated forms often become insoluble, providing better nutrient uptake and consistent results in precision and hydroponic farming systems.

• By Application Method

On the basis of application method, the crop micronutrients market is segmented into soil application and foliar application. The soil application segment accounted for the largest market revenue share in 2024, supported by its extensive use in conventional farming and compatibility with existing fertilization practices. Soil application ensures slow nutrient release, improved root absorption, and better long-term soil fertility management across various crop types.

The foliar application segment is projected to witness the fastest growth rate from 2025 to 2032, as it provides rapid nutrient absorption through leaves, leading to immediate correction of deficiencies. This method is increasingly favored for high-value horticultural and cash crops, offering enhanced flexibility, lower nutrient wastage, and improved crop response during critical growth stages.

• By Crop Type

On the basis of crop type, the crop micronutrients market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and turf and ornamentals. The cereals and grains segment held the largest market revenue share in 2024, driven by the growing global demand for staple crops such as rice, wheat, and maize. The rising need for yield improvement and balanced nutrition is promoting the extensive use of micronutrient fertilizers in this segment.

The fruits and vegetables segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing consumer preference for nutrient-rich food and the need to enhance crop quality, color, and shelf life. Farmers in both developed and developing regions are adopting targeted micronutrient solutions to improve productivity and ensure compliance with export quality standards.

• By End-Use

On the basis of end-use, the crop micronutrients market is segmented into conventional farming, organic farming, and hydroponics. The conventional farming segment held the largest market revenue share in 2024, attributed to its widespread adoption and extensive use of micronutrient fertilizers in field crops. Traditional farming systems continue to rely on soil-based nutrient management, with growing emphasis on balanced fertilizer usage to sustain soil health and crop output.

The hydroponics segment is anticipated to record the fastest growth rate from 2025 to 2032, propelled by the increasing adoption of soilless cultivation and controlled-environment agriculture. The precision-based nutrient delivery in hydroponic systems ensures optimal micronutrient utilization, higher yields, and reduced environmental footprint, making it a key growth area for the future of sustainable agriculture.

Crop Micronutrients Market Regional Analysis

- Asia-Pacific dominated the crop micronutrients market with the largest revenue share of 42.15% in 2024, driven by extensive agricultural production, growing soil micronutrient deficiencies, and the rapid adoption of precision farming technologies

- Farmers in the region are increasingly aware of the importance of balanced crop nutrition, promoting the usage of micronutrient-enriched fertilizers to enhance yield and quality

- The growth is further supported by government initiatives promoting sustainable agricultural practices and the expansion of high-value crop cultivation, positioning Asia-Pacific as a key hub for micronutrient utilization in global agriculture

China Crop Micronutrients Market Insight

The China crop micronutrients market captured the largest revenue share in 2024 within the Asia-Pacific region, driven by the nation’s strong agricultural base, widespread soil degradation, and growing focus on improving crop productivity. The rapid shift towards intensive farming, coupled with government-backed programs encouraging the use of micronutrient fertilizers, is driving market expansion. In addition, the country’s efforts to modernize agriculture through technology-driven solutions and advanced crop nutrition management are boosting the demand for zinc, iron, and boron-based micronutrients.

Japan Crop Micronutrients Market Insight

The Japan crop micronutrients market is expected to witness steady growth from 2025 to 2032, driven by the country’s advanced agricultural technologies and focus on high-value crop cultivation. Japanese farmers are increasingly adopting micronutrient-enriched fertilizers to improve crop quality and meet the growing demand for premium fruits and vegetables. In addition, government support for sustainable and smart farming practices, alongside innovations in hydroponics and vertical farming, is boosting the use of chelated micronutrients across the country.

North America Crop Micronutrients Market Insight

The North America crop micronutrients market is expected to grow steadily from 2025 to 2032, supported by the high adoption of precision agriculture technologies and an increasing focus on soil health management. The region’s well-established agricultural infrastructure, coupled with ongoing research and development in micronutrient formulations, enhances product effectiveness and farmer adoption. The rising emphasis on sustainability and environmentally friendly fertilizers is also shaping the market landscape.

U.S. Crop Micronutrients Market Insight

The U.S. crop micronutrients market is expected to grow steadily from 2025 to 2032, fuelled by the adoption of advanced agricultural technologies and an emphasis on high-yield crop production. The increasing trend of sustainable farming and the need to address soil micronutrient depletion are driving demand. In addition, the presence of leading agrochemical companies and innovation in chelated micronutrient formulations contribute to the country’s market leadership.

Europe Crop Micronutrients Market Insight

The Europe crop micronutrients market is expected to grow steadily from 2025 to 2032, driven by strict environmental regulations promoting eco-friendly fertilizers and increasing demand for high-quality agricultural produce. The region’s focus on organic and sustainable farming practices, combined with technological advancements in fertilizer applications, supports steady market expansion across major countries such as Germany, France, and the U.K.

Germany Crop Micronutrients Market Insight

The Germany crop micronutrients market is expected to grow steadily from 2025 to 2032, driven by the increasing adoption of sustainable farming practices and a strong focus on soil health. German farmers are investing in micronutrient-rich fertilizers to enhance crop efficiency and comply with stringent EU environmental standards. Moreover, the integration of digital farming tools and nutrient management systems is enhancing the precision and efficiency of micronutrient application.

U.K. Crop Micronutrients Market Insight

The U.K. crop micronutrients market is expected to grow steadily from 2025 to 2032, fuelled by the increasing adoption of sustainable farming and precision agriculture. Farmers are emphasizing soil nutrient management to enhance productivity and crop resilience, particularly under changing climatic conditions. Moreover, the rise in organic farming and technological integration in fertilizer application is driving demand for advanced micronutrient formulations in both traditional and controlled-environment agriculture.

Crop Micronutrients Market Share

The Crop Micronutrients industry is primarily led by well-established companies, including:

- Nutrien Ltd. (Canada)

- Yara International ASA (Norway)

- The Mosaic Company (U.S.)

- BASF SE (Germany)

- ICL Group Ltd. (Israel)

- Corteva Agriscience (U.S.)

- Bayer AG (Germany)

- Haifa Group (Israel)

- Syngenta AG (Switzerland)

- Valagro S.p.A (Italy)

Latest Developments in Global Crop Micronutrients Market

- In September 2025, Nutrien entered into a long-term supply agreement with a major Australian grain cooperative to deliver customized micronutrient blends for broadacre crops. This collaboration aims to enhance soil fertility and crop yield across key grain-producing regions. The initiative strengthens Nutrien’s footprint in the Asia-Pacific market while supporting sustainable crop nutrition practices among Australian farmers, contributing to the overall expansion of the micronutrient fertilizer sector

- In August 2025, Corteva Agriscience launched its next-generation micronutrient seed treatment for soybeans, designed to enhance early root development and improve stress tolerance. The innovation focuses on improving nutrient efficiency during the early growth stages, resulting in stronger plants and higher yields. This advancement is expected to reinforce Corteva’s leadership in seed technology and expand the adoption of micronutrient-based seed treatments globally

- In July 2025, Compass Minerals acquired a 20% minority stake in MicroNutrient Technologies, a U.S.-based startup specializing in advanced micronutrient delivery systems for crops. The investment strengthens Compass Minerals’ position in precision agriculture and accelerates innovation in targeted nutrient delivery. This strategic move enhances product efficiency and contributes to the wider use of smart fertilizers in sustainable farming

- In May 2025, Mosaic announced a USD 50 million expansion of its micronutrient production facility in Florida to meet rising demand for specialty crop nutrition products. The expansion is set to boost production capacity and improve supply chain efficiency, enabling the company to serve both domestic and international markets more effectively. This initiative reinforces Mosaic’s commitment to addressing the global need for high-quality crop nutrition solutions

- In March 2025, Valagro secured regulatory approval from Chinese authorities for its new micronutrient product, marking its official entry into one of the world’s largest agricultural markets. The product aims to improve nutrient uptake and yield in a variety of crops cultivated across China. This development enhances Valagro’s regional presence and supports the growing demand for advanced plant nutrition solutions in Asia

- In September 2024, ICL announced a strategic partnership with Indian AgroTech to expand the distribution of its micronutrient products across key agricultural regions in India. The partnership focuses on improving farmer access to high-quality micronutrient solutions and enhancing soil health. This move strengthens ICL’s distribution network and contributes to the modernization of nutrient management practices in Indian agriculture

- In July 2024, Syngenta appointed Dr. Maria Lopez as the new global head of its micronutrient business unit, signaling a renewed focus on innovation and global market expansion. Under her leadership, Syngenta aims to accelerate product development and strengthen its strategic presence in emerging agricultural markets. This leadership change is expected to enhance the company’s competitive position in the global crop nutrition industry

- In June 2024, Yara International inaugurated a new state-of-the-art micronutrient blending facility in Brazil to cater to the growing demand for customized crop nutrition solutions in South America. The facility is designed to optimize blending precision and product quality, supporting the region’s push for sustainable agricultural productivity. This expansion further solidifies Yara’s leadership in the Latin American crop nutrition market

- In May 2024, Bayer and UPL announced a joint venture focused on developing and commercializing innovative micronutrient solutions for rice cultivation in Asia. The partnership aims to enhance nutrient efficiency and yield in one of the world’s most widely grown crops. This collaboration combines Bayer’s R&D expertise with UPL’s strong distribution network, driving growth in the Asian crop micronutrient sector

- In April 2024, BASF launched a new foliar-applied micronutrient formulation for wheat designed to address zinc and manganese deficiencies while improving grain quality. The product supports balanced crop nutrition and strengthens BASF’s position in the specialty fertilizer market. Its introduction is expected to contribute to better yield outcomes and promote sustainable farming practices

- In March 2024, Nutrien announced the commercial launch of a new line of micronutrient fertilizers specifically designed for row crops such as corn and soybeans. The new range aims to enhance nutrient uptake efficiency and increase crop yields through balanced nutrient application. This product line expansion underscores Nutrien’s commitment to innovation and meeting the evolving needs of global farmers

- In February 2024, Haifa Group introduced a new controlled-release micronutrient fertilizer in Europe targeting high-value fruit and vegetable crops. The product offers gradual nutrient release, improving nutrient use efficiency and reducing environmental losses. This launch reinforces Haifa’s leadership in sustainable fertilizer solutions and aligns with Europe’s drive toward eco-friendly agricultural practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.