Global Crude Oil Market

Market Size in USD Billion

CAGR :

%

USD

2,988.00 Billion

USD

4,381.11 Billion

2025

2033

USD

2,988.00 Billion

USD

4,381.11 Billion

2025

2033

| 2026 –2033 | |

| USD 2,988.00 Billion | |

| USD 4,381.11 Billion | |

|

|

|

|

Crude Oil Market Size

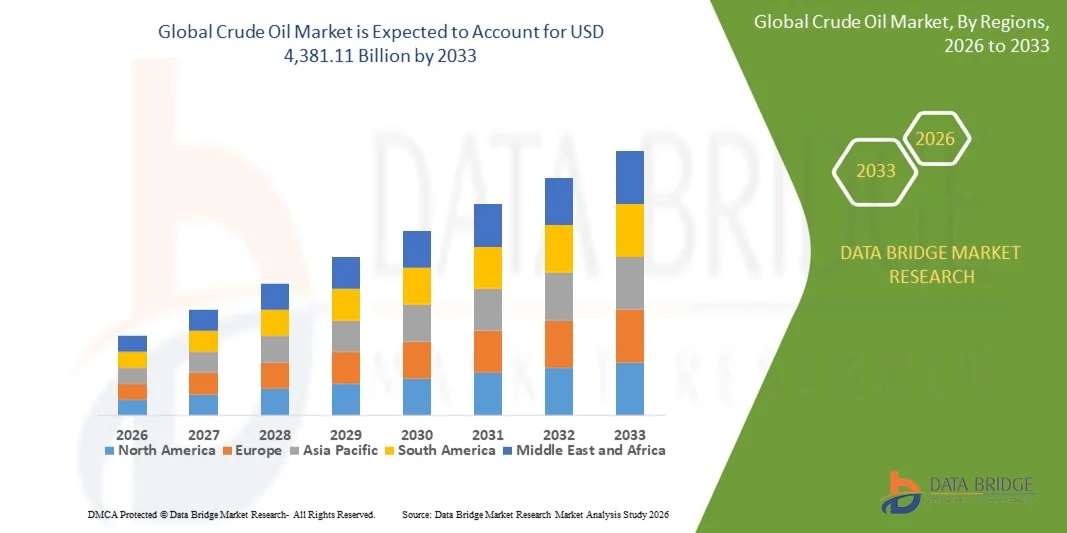

- The global crude oil market size was valued at USD 2,988.00 billion in 2025 and is expected to reach USD 4,381.11 billion by 2033, at a CAGR of 4.90% during the forecast period

- The market growth is largely fuelled by increasing global energy demand, rising industrialization, and growing consumption of transportation fuels

- Expansion of oil exploration and production activities, coupled with technological advancements in drilling and extraction processes, is further supporting market growth

Crude Oil Market Analysis

- The market is witnessing steady growth due to rising global energy requirements and heavy dependence on crude oil for transportation, power generation, and petrochemical production

- Increasing investments in exploration and production, particularly in unconventional reserves, are enhancing supply capabilities and market stability

- North America dominated the crude oil market with the largest revenue share in 2025, driven by high industrial demand, extensive refining infrastructure, and robust energy consumption across transportation, manufacturing, and petrochemical sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global crude oil market, driven by increasing energy consumption, expanding transportation networks, and government initiatives supporting domestic production and energy security

- The Paraffin segment held the largest market revenue share in 2025, driven by its extensive use in fuels, lubricants, and petrochemical products. Paraffin-rich crude is highly valued for refining into gasoline, diesel, and jet fuel, making it a preferred choice for both industrial and commercial applications

Report Scope and Crude Oil Market Segmentation

|

Attributes |

Crude Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Crude Oil Market Trends

Rising Global Energy Demand and Industrial Growth

- The growing global reliance on crude oil as a primary energy source is significantly shaping the crude oil market, as industries and transportation sectors continue to demand stable and affordable fuel supplies. Crude oil remains essential for electricity generation, transportation, and petrochemical production, driving sustained market growth

- Increasing industrialization, urbanization, and expansion of manufacturing activities across emerging economies are accelerating the demand for crude oil. Growing consumption in transportation fuels, plastics, and chemical feedstocks is encouraging investments in upstream exploration and production activities

- Environmental regulations and sustainability considerations are influencing production methods and the adoption of cleaner refining technologies. Companies are also prioritizing operational efficiency, carbon management, and innovation in extraction techniques to maintain competitiveness

- For instance, in 2024, ExxonMobil in the U.S. and Saudi Aramco in Saudi Arabia expanded crude oil exploration and production operations, responding to rising global demand. These projects focused on both conventional and unconventional reserves, enhancing supply stability and supporting the market’s long-term growth

- While global demand for crude oil remains strong, market expansion depends on geopolitical stability, technological advancements in exploration and refining, and efficient supply chain management. Companies are also focusing on cost optimization, diversification of supply sources, and investment in strategic reserves to meet fluctuating demand

Crude Oil Market Dynamics

Driver

Rising Global Energy Consumption and Industrialization

- Increasing global energy requirements, particularly in transportation, power generation, and industrial sectors, are major drivers for the crude oil market. The growing demand for gasoline, diesel, jet fuel, and petrochemicals supports continued exploration, production, and refining activities

- Expansion of industrial and manufacturing activities in emerging economies is accelerating the consumption of crude oil. Rapid urbanization, infrastructure development, and increasing vehicle ownership further reinforce market growth

- Oil and gas companies are increasingly investing in technological innovations such as advanced drilling, hydraulic fracturing, and enhanced oil recovery to improve production efficiency and reduce operational costs

- For instance, in 2023, Chevron in the U.S. and BP in the U.K. reported significant expansion of upstream and downstream operations, including new drilling projects and refinery upgrades, in response to rising energy demand. These initiatives strengthened market supply, enhanced efficiency, and ensured compliance with regulatory standards

- Although rising energy demand and industrial growth support market expansion, wider adoption depends on volatile crude oil prices, geopolitical tensions, and environmental regulations. Investment in supply chain optimization, sustainable production, and renewable integration will be critical for maintaining competitive advantage

Restraint/Challenge

Price Volatility And Geopolitical Risks

- Crude oil price fluctuations due to geopolitical tensions, OPEC production policies, and global demand-supply imbalances remain a key challenge, impacting revenue stability and investment planning. These fluctuations often lead to sudden changes in operating margins for oil producers and refiners, affecting capital expenditure and expansion plans. Companies must adopt flexible pricing strategies and financial hedging mechanisms to mitigate risks associated with volatile oil prices

- Environmental concerns and stricter regulations on carbon emissions and fuel standards are pressuring companies to adopt cleaner technologies, increasing operational costs. Compliance with international and regional environmental laws requires investment in carbon capture, low-sulfur fuel production, and energy-efficient operations. Failure to adhere to these regulations can result in fines, reputational damage, and restrictions on production capacity

- Dependence on politically unstable regions for crude oil supply can disrupt global availability and affect pricing, creating uncertainty in long-term planning and investments. Political unrest, civil conflicts, or trade embargoes can halt production and transportation, leading to global supply shortages. Companies are increasingly seeking to diversify sourcing through alternative suppliers, strategic reserves, and domestic production to minimize exposure to geopolitical risks

- For instance, in 2024, conflicts in the Middle East and trade restrictions imposed on major oil-producing countries led to temporary supply disruptions, price volatility, and increased market uncertainty. These events caused sudden spikes in crude oil prices, affecting fuel costs, refinery margins, and the affordability of petroleum products worldwide. Energy companies had to rapidly adjust supply contracts, logistics, and hedging strategies to maintain operational continuity and meet demand

- Overcoming these challenges requires diversification of supply sources, investment in strategic reserves, technological innovations, and risk management strategies. Companies must balance production, sustainability, and regulatory compliance to ensure stable growth in the global crude oil market. In addition, leveraging predictive analytics, robust supply chain planning, and long-term contracts with multiple suppliers helps mitigate risks and stabilize pricing in a volatile market environment

Crude Oil Market Scope

The crude oil market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the crude oil market is segmented into Paraffin, Naphthene, Aromatics, and Asphaltic. The Paraffin segment held the largest market revenue share in 2025, driven by its extensive use in fuels, lubricants, and petrochemical products. Paraffin-rich crude is highly valued for refining into gasoline, diesel, and jet fuel, making it a preferred choice for both industrial and commercial applications.

The Aromatics segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its increasing use in high-value chemical and petrochemical products. Aromatics are crucial for producing plastics, synthetic fibers, and solvents, fueling demand in downstream industries. The segment’s growth is further supported by technological advancements in refining processes and rising industrialization across emerging economies.

- By Application Transportation

On the basis of application in transportation, the crude oil market is segmented into Mining, Agriculture, and Refining. The Refining segment held the largest market revenue share in 2025, fueled by the need for processed fuels such as gasoline, diesel, and jet fuel. Refineries serve as a critical link between crude oil production and end-use, supporting industrial, commercial, and consumer energy demands.

The Agriculture segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing mechanization and fuel requirements in farming operations. The demand for diesel and lubricants in agricultural machinery, combined with rising global food production needs, is accelerating the adoption of crude oil-based products. This trend is reinforced by the expansion of modern farming techniques and precision agriculture technologies.

Crude Oil Market Regional Analysis

- North America dominated the crude oil market with the largest revenue share in 2025, driven by high industrial demand, extensive refining infrastructure, and robust energy consumption across transportation, manufacturing, and petrochemical sectors

- The region’s focus on technological advancements in extraction, coupled with strong regulatory frameworks, supports stable production and supply

- In addition, strategic reserves and investments in upstream and downstream operations further strengthen North America’s position in the global crude oil market

U.S. Crude Oil Market Insight

The U.S. crude oil market captured the largest revenue share in North America in 2025, fueled by substantial shale oil production, advanced drilling technologies, and increasing domestic consumption. Investments in pipeline infrastructure, refining capacity, and export capabilities are further propelling market growth. Moreover, government initiatives supporting energy independence and the integration of cleaner fuel alternatives are shaping market dynamics while ensuring supply reliability.

Europe Crude Oil Market Insight

The Europe crude oil market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by investments in refining technologies, increasing industrial demand, and the transition toward low-sulfur and cleaner fuel standards. The adoption of energy-efficient processes and regulatory incentives for sustainable crude utilization are fostering market expansion. European countries are also modernizing storage and transportation facilities to meet rising demand and ensure consistent supply.

U.K. Crude Oil Market Insight

The U.K. crude oil market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising energy consumption in transportation and industrial applications. In addition, offshore production advancements, government policies promoting energy security, and investment in refining and storage infrastructure are encouraging market growth. The integration of cleaner fuels and efficiency-focused technologies is also expected to play a pivotal role in market development.

Germany Crude Oil Market Insight

The Germany crude oil market is expected to witness significant growth from 2026 to 2033, fueled by the country’s strong industrial base, refining capacity, and energy-intensive manufacturing sector. Germany’s focus on transitioning toward lower-emission fuels, combined with advanced storage and transportation networks, promotes steady market expansion. Strategic partnerships between refineries and energy companies further support supply stability and technological innovation.

Asia-Pacific Crude Oil Market Insight

The Asia-Pacific crude oil market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising energy demand, rapid industrialization, and urbanization in countries such as China, India, and Japan. The region’s expanding refining capacity, growing transportation sector, and investments in import infrastructure are accelerating market adoption. Furthermore, government initiatives promoting energy security and the development of strategic reserves are contributing to market growth.

China Crude Oil Market Insight

The China crude oil market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to increasing industrial consumption, expanding transportation networks, and rising urban energy needs. China’s focus on energy security, diversification of import sources, and development of domestic refining capacity are key factors driving market expansion. The push toward cleaner fuels, strategic stockpiling, and technological modernization further enhances the country’s dominance in the regional crude oil market.

Japan Crude Oil Market Insight

The Japan crude oil market is expected to witness strong growth from 2026 to 2033 due to the country’s heavy reliance on imports for industrial and transportation fuel needs. The adoption of efficient refining technologies, modernization of storage facilities, and integration of low-sulfur and cleaner fuels are driving market growth. In addition, government policies supporting energy security and industrial demand management are bolstering Japan’s crude oil market expansion.

Crude Oil Market Share

The Crude Oil industry is primarily led by well-established companies, including:

- ExxonMobil (U.S.)

- Royal Dutch Shell (U.K./Netherlands)

- BP (U.K.)

- Chevron Corporation (U.S.)

- TotalEnergies (France)

- Saudi Aramco (Saudi Arabia)

- Gazprom (Russia)

- Rosneft (Russia)

- PetroChina (China)

- Sinopec Group (China)

- Kuwait Petroleum Corporation (Kuwait)

- ConocoPhillips (U.S.)

- Equinor ASA (Norway)

- Lukoil (Russia)

- ADNOC (Abu Dhabi National Oil Company) (U.A.E)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.