Global Crush Tear Curl Ctc Tea Processing Machine Market

Market Size in USD Billion

CAGR :

%

USD

1.64 Billion

USD

2.44 Billion

2024

2032

USD

1.64 Billion

USD

2.44 Billion

2024

2032

| 2025 –2032 | |

| USD 1.64 Billion | |

| USD 2.44 Billion | |

|

|

|

|

Crush, Tear, Curl (CTC) Tea Processing Machine Market Size

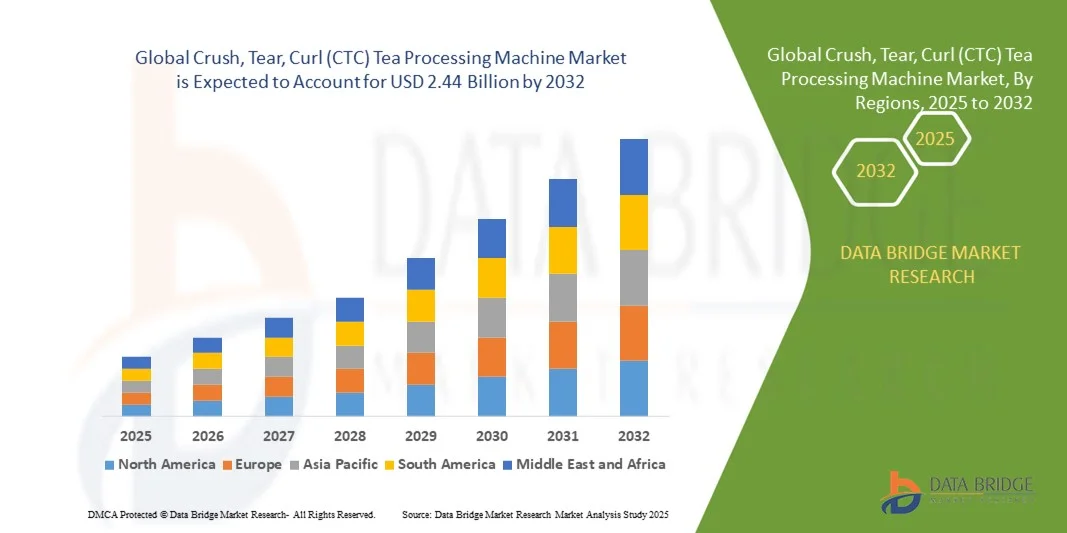

- The global Crush, Tear, Curl (CTC) tea processing machine market size was valued at USD 1.64 billion in 2024 and is expected to reach USD 2.44 billion by 2032, at a CAGR of 5.14% during the forecast period

- The market growth is largely fueled by increasing mechanization and modernization in tea processing, enabling manufacturers to improve efficiency, consistency, and output quality. The adoption of advanced CTC machinery is helping tea producers meet growing global demand for black and blended teas, thereby accelerating market expansion

- Furthermore, rising demand for high-quality, uniform tea granules in both domestic and international markets is encouraging tea manufacturers to invest in automated and high-capacity CTC machines. For instance, manufacturers such as T & I Global Ltd are introducing upgraded CTC models with higher throughput and energy-efficient designs, boosting adoption and driving overall market growth

Crush, Tear, Curl (CTC) Tea Processing Machine Market Analysis

- CTC tea processing machines, offering automated crushing, tearing, and curling of tea leaves, are becoming essential in modern tea factories due to their ability to enhance flavor extraction, reduce labor dependency, and maintain product consistency across large-scale production lines

- The escalating need for productivity improvements, quality control, and operational efficiency is primarily fueled by the growing global tea consumption, rising exports from major producing countries, and increasing adoption of automated processing technologies

- Asia-Pacific dominated the Crush, Tear, Curl (CTC) tea processing machine market with a share of 38.41% in 2024, due to extensive tea cultivation, high consumption rates, and the presence of major tea-producing nations

- North America is expected to be the fastest growing region in the Crush, Tear, Curl (CTC) tea processing machine market during the forecast period due to growing popularity of ready-to-drink and specialty teas

- Black tea segment dominated the market with a market share of 62.8% in 2024, due to the global preference for CTC-processed black tea in both traditional markets and ready-to-drink tea products. Black tea manufacturers often prioritize CTC machines for their ability to maintain robust flavor, color, and strength in bulk production. The demand for black tea processing equipment is further strengthened by widespread consumer consumption patterns and the growing popularity of packaged tea products worldwide

Report Scope and Crush, Tear, Curl (CTC) Tea Processing Machine Market Segmentation

|

Attributes |

Crush, Tear, Curl (CTC) Tea Processing Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Crush, Tear, Curl (CTC) Tea Processing Machine Market Trends

Automated CTC Machines Enhance Tea Quality and Efficiency

- A major trend in the Crush, Tear, Curl (CTC) tea processing machine market is the rising adoption of automation technologies aimed at improving tea quality, productivity, and consistency across large-scale tea manufacturing units. Automated CTC machines streamline the process of rolling, tearing, and curling tea leaves, ensuring uniform particle size and oxidation levels that enhance the flavor and aroma of finished black teas

- For instance, companies such as SARA Tea Machinery and Premier Tea Machinery have introduced advanced automated CTC machines equipped with programmable logic controllers (PLCs) and precision control systems. These machines help monitor rolling pressure and moisture levels, enabling producers to achieve optimal quality outcomes while reducing manual dependency in high-capacity tea factories

- Automation in CTC tea processing supports consistent leaf cutting and curling, which minimizes variation between production batches. This process uniformity is critical in maintaining brand identity for large tea exporters and helps improve blending compatibility with other tea varieties for global markets

- In addition, modern CTC machines with integrated safety systems and energy-efficient motors have gained prominence as manufacturers seek to reduce operational costs and minimize material waste. By optimizing throughput and achieving continuous production, producers can meet increasing demand without compromising product standards

- The integration of automation has also aided real-time monitoring and predictive maintenance capabilities. Sensors embedded within machines allow operators to detect mechanical wear or deviations instantly, supporting proactive upkeep and extending machine lifecycle

- This trend indicates a clear shift toward technology-driven tea processing, where automation enhances both quality consistency and cost efficiency. The transformation toward smarter manufacturing in the tea industry underscores long-term competitiveness, aligning with global modernization efforts in agricultural processing sectors

Crush, Tear, Curl (CTC) Tea Processing Machine Market Dynamics

Driver

Growing Global Demand for Black and Blended Teas

- The rising consumption of black and blended teas worldwide is a primary driver boosting demand for efficient CTC processing machines. Tea-producing nations are focusing on raising processing capacity to cater to growing exports and shifting consumption trends favoring strong, aromatic tea varieties processed using the CTC method

- For instance, Jay Shree Tea & Industries Ltd. expanded its CTC production lines in 2024 across Assam and West Bengal, supported by new automated machines to improve quality uniformity for global supply chains. Similarly, Indian and Kenyan tea exporters are increasingly investing in high-output machines to meet the steady growth in demand from Europe, the Middle East, and North America

- The CTC process produces finely cut particles ideal for quick infusion and strong flavor, which suits modern consumer preferences for convenience-based brewing such as tea bags and instant blends. This market alignment has significantly strengthened CTC tea’s position in both retail and foodservice channels

- In addition, rising disposable incomes and urbanization in developing countries have expanded packaged tea consumption, encouraging manufacturers to adopt high-capacity automated equipment to achieve scalability and maintain consistency at economical production levels

- The strong growth of the global tea trade, driven by premium black tea blends and flavored formulations, is expected to continue supporting the adoption of technologically advanced CTC machines. Their ability to deliver uniformity and flavor enhancement plays a central role in ensuring competitive advantage for tea processors seeking international market presence

Restraint/Challenge

High Costs Limit Adoption Among Small Manufacturers

- The high capital requirement for installing modern automated CTC tea processing machines remains a major challenge, particularly for small-scale and medium-sized tea producers. Advanced machinery integrated with PLC systems and precision automation features involves substantial upfront investment, which often exceeds the financial reach of local processors in tea-growing regions

- For instance, small-scale manufacturers in regions such as Sri Lanka and Kenya have reported limited access to automated CTC equipment due to high procurement and maintenance costs. Companies such as SARA Tea Machinery provide modular setups, yet adoption among smallholders remains slow due to financial barriers and limited technical know-how

- Operating and maintaining these machines also require specialized technical training and dedicated service personnel, which imposes additional expenses. The dependency on skilled labor and spare parts availability can further increase downtime in rural manufacturing zones where machine servicing infrastructure is less developed

- In addition, fluctuations in global metal and component prices affect the production costs of CTC machinery, leading to price volatility for buyers. Unfavorable financing conditions or lack of government incentives for small tea processors further compound adoption challenges in emerging markets

- Addressing this issue through equipment leasing models, government-backed technology funds, and local manufacturing collaborations can promote affordability and accessibility. Providing flexible financing and technical training support will be vital for encouraging small producers to transition toward automated tea processing systems that can modernize the sector sustainably

Crush, Tear, Curl (CTC) Tea Processing Machine Market Scope

The market is segmented on the basis of process component, tea type, end user, and distribution channel.

- By Process Component

On the basis of process component, the CTC tea processing machine market is segmented into sorting, sifting, rolling, fermenting, and drying. The rolling segment dominated the market with the largest revenue share of 41.8% in 2024, driven by its critical role in shaping tea leaves and ensuring optimal extraction of flavor compounds. Tea manufacturers often prioritize rolling machines for their ability to produce consistent granules suitable for bulk black tea production. The strong demand for rolling equipment is also fueled by its compatibility with various tea grades and the availability of automated systems enhancing both efficiency and quality control.

The drying segment is anticipated to witness the fastest growth rate of 19.5% from 2025 to 2032, fueled by rising demand for precision-controlled drying processes in large-scale and specialty tea production. Drying machines with advanced temperature and humidity controls improve the aroma and shelf-life of processed tea, making them increasingly popular among manufacturers seeking high-quality output. The adoption of energy-efficient drying technologies and integration with automated production lines further contributes to the accelerated growth of this segment.

- By Tea Type

On the basis of tea type, the market is segmented into black tea, green tea, oolong tea, and others. The black tea segment held the largest revenue share of 62.8% in 2024, driven by the global preference for CTC-processed black tea in both traditional markets and ready-to-drink tea products. Black tea manufacturers often prioritize CTC machines for their ability to maintain robust flavor, color, and strength in bulk production. The demand for black tea processing equipment is further strengthened by widespread consumer consumption patterns and the growing popularity of packaged tea products worldwide.

The green tea segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing health-conscious consumer trends and rising adoption of specialty teas. Green tea processing requires precise control over rolling and drying to preserve its delicate flavor and antioxidant properties, driving demand for advanced machines. Manufacturers producing premium green tea are investing in innovative technologies that enhance consistency and quality, accelerating the growth of this segment.

- By End User

On the basis of end user, the market is segmented into small and medium tea manufacturers and large tea manufacturers. Large tea manufacturers dominated the market with the largest revenue share of 55.7% in 2024, driven by their capability to invest in fully automated CTC processing lines for high-volume production. Large-scale manufacturers often prioritize efficiency, uniformity, and reduced labor costs, making them the primary buyers of advanced machines. The market demand is further boosted by the global distribution networks and brand recognition of these manufacturers, enabling large-scale adoption of innovative processing technologies.

The small and medium tea manufacturers segment is anticipated to witness the fastest growth rate of 22.1% from 2025 to 2032, fueled by increasing initiatives to upgrade traditional tea processing units and meet quality standards. SMEs are investing in cost-effective machines that optimize leaf handling, improve yield, and enhance product consistency. Growing support from government schemes and financial institutions for modernization of tea factories is expected to drive accelerated adoption among smaller manufacturers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The offline segment dominated the market with the largest revenue share in 2024, driven by manufacturers’ preference for direct equipment inspection, hands-on demonstrations, and post-purchase support. Offline channels provide tea processing companies with the advantage of personalized consultations and customized solutions for plant layouts and machine capacity requirements. The strong presence of authorized distributors and regional dealers further strengthens the dominance of offline sales in the market.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing trend of e-commerce platforms and digital marketplaces for industrial machinery. Online channels enable manufacturers to access a wider range of suppliers, compare specifications, and place orders with greater convenience. The adoption of virtual demonstrations, online technical support, and direct shipping options is contributing to the accelerated growth of online distribution for CTC tea processing machines.

Crush, Tear, Curl (CTC) Tea Processing Machine Market Regional Analysis

- Asia-Pacific dominated the Crush, Tear, Curl (CTC) tea processing machine market with the largest revenue share of 38.41% in 2024, driven by extensive tea cultivation, high consumption rates, and the presence of major tea-producing nations

- The region’s strong manufacturing base, availability of skilled labor, and continuous technological advancements in tea machinery are propelling market expansion

- Rising investments in modernizing tea processing facilities and government initiatives to enhance export quality are further strengthening regional growth

India Crush, Tear, Curl (CTC) Tea Processing Machine Market Insight

India held the largest share in the Asia-Pacific CTC tea processing machine market in 2024, owing to its dominant position as one of the world’s leading tea producers and exporters. The country’s vast tea plantations in Assam and West Bengal, coupled with strong domestic demand, are driving equipment adoption. Growing emphasis on automation, quality enhancement, and increased support from the Tea Board of India for factory modernization are fueling the demand for advanced CTC machinery.

China Crush, Tear, Curl (CTC) Tea Processing Machine Market Insight

China is witnessing the fastest growth in the Asia-Pacific region, fueled by the rapid expansion of its tea manufacturing capacity and the adoption of high-efficiency processing systems. Rising interest in black and blended teas for both domestic and international markets is boosting equipment demand. Continuous innovation in tea processing technologies, coupled with rising exports and premium tea production, contributes to China’s accelerated market growth.

Europe Crush, Tear, Curl (CTC) Tea Processing Machine Market Insight

The Europe CTC tea processing machine market is expanding steadily, supported by the region’s growing preference for processed and packaged tea imports and investments in tea production automation. Manufacturers in Europe are increasingly adopting modern equipment to ensure consistency, efficiency, and high-quality blends. Emphasis on sustainability, energy-efficient systems, and precision-controlled machinery is shaping the regional demand for advanced CTC tea processing solutions.

U.K. Crush, Tear, Curl (CTC) Tea Processing Machine Market Insight

The U.K. market is driven by a strong tea consumption culture and a rising trend of local packaging and processing units aimed at meeting quality and sustainability standards. Investments in energy-efficient machines and automation solutions are supporting operational modernization. The focus on premium tea products and partnerships with global machine manufacturers are strengthening the U.K.’s market presence in the European region.

North America Crush, Tear, Curl (CTC) Tea Processing Machine Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by the growing popularity of ready-to-drink and specialty teas. Rising consumer awareness of health benefits and demand for high-quality blends are encouraging manufacturers to invest in advanced tea processing technologies. Expanding retail tea brands, coupled with modernization of small-scale production facilities, is boosting equipment adoption across the region.

U.S. Crush, Tear, Curl (CTC) Tea Processing Machine Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by increasing consumption of black and herbal teas and the expansion of artisanal tea brands. The country’s focus on efficiency, automation, and consistency in flavor has driven the adoption of modern CTC processing equipment. Growing imports of premium teas and investments in localized processing are further enhancing market growth.

Crush, Tear, Curl (CTC) Tea Processing Machine Market Share

The Crush, Tear, Curl (CTC) tea processing machine industry is primarily led by well-established companies, including:

- Steelsworth (India)

- Marshall Fowler (U.K.)

- Kawasaki Kiko Co., Ltd. (Japan)

- M/s. Bharat Engineering Works (India)

- G. K. Tea Industries (India)

- MESCO EQUIPMENT (P) LTD. (India)

- QUANZHOU DELI AGROFORESTRIAL MACHINERY CO., LTD. (China)

- T&I GLOBAL LTD (U.K.)

- Anxi Yongxing Machinery Co., Ltd. (China)

- Workson Industries (India)

- Lakshmi Industrial Equipments (India)

- The Aarkay Group. (India)

- Terada seisakusho (Japan)

- JF McCloy Ltd (U.K.)

- Tea Spares Enterprises (India)

- Zenith Forgings (India)

- Bühler Group (Switzerland)

- Hamilton Engineering Company (U.K.)

- SHRINATH FABRICATORS (India)

Latest Developments in Global Crush, Tear, Curl (CTC) Tea Processing Machine Market

- In 2025, T & I Global Limited introduced the “KAIZEN Nova CTC” and “KAIZEN Super CTC” models, marking a significant step in product innovation and equipment modernization. These machines deliver higher throughput, energy-efficient performance, and enhanced reliability, enabling tea manufacturers to optimize production capacity while reducing operational costs. The launch strengthens the market by encouraging existing operators to upgrade outdated machines and supports large-scale adoption of technologically advanced solutions, boosting revenue potential for both manufacturers and suppliers

- In March 2024, the China Foundation for Rural Development (CFRD) initiated the shipment of advanced CTC tea machinery to support a tea production project in Nepal. This development demonstrates growing cross-border demand for modern equipment and highlights the expansion of market reach into emerging tea-producing regions. By enabling technology transfer and the adoption of automated processing lines, it is expected to enhance production efficiency, improve tea quality, and create new revenue streams for machinery suppliers, driving overall market growth

- In February 2024, a government-backed tender was issued for the supply, installation, and commissioning of tea-processing machinery in a prominent Indian tea cluster. This public-sector initiative underscores strategic investment in modernizing production units, aiming to improve operational efficiency and product consistency. By facilitating the adoption of advanced CTC lines, it is likely to increase market demand, support small and medium-sized manufacturers in scaling production, and enhance the competitiveness of local tea manufacturers both domestically and internationall

- In 2025, T & I Global Limited introduced the “KAIZEN Nova CTC” and “KAIZEN Super CTC” models, marking a significant step in product innovation and equipment modernization. These machines deliver higher throughput, energy-efficient performance, and enhanced reliability, enabling tea manufacturers to optimize production capacity while reducing operational costs. The launch strengthens the market by encouraging existing operators to upgrade outdated machines and supports large-scale adoption of technologically advanced solutions, boosting revenue potential for both manufacturers and suppliers

- In June 2022, PCD Industries in Kolkata focused on manufacturing modern CTC tea processing machinery, signaling a growing regional emphasis on automation and equipment modernization. The introduction of these machines supports small and mid-sized manufacturers in upgrading their facilities, increasing operational efficiency, and maintaining consistent product quality. By improving processing speed and reducing manual dependency, this development reinforces market readiness for automated solutions and contributes to overall growth in the Indian subcontinent

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Crush Tear Curl Ctc Tea Processing Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Crush Tear Curl Ctc Tea Processing Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Crush Tear Curl Ctc Tea Processing Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.