Global Cryogenic Tanks Market

Market Size in USD Billion

CAGR :

%

USD

7.66 Billion

USD

11.74 Billion

2024

2032

USD

7.66 Billion

USD

11.74 Billion

2024

2032

| 2025 –2032 | |

| USD 7.66 Billion | |

| USD 11.74 Billion | |

|

|

|

|

Cryogenic Tanks Market Size

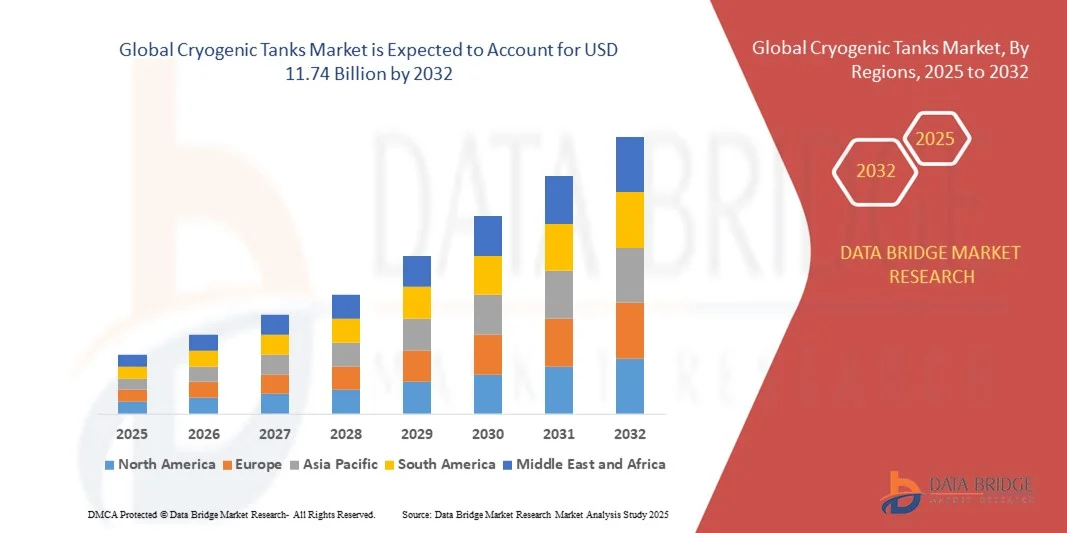

- The global cryogenic tanks market size was valued at USD 7.66 billion in 2024 and is expected to reach USD 11.74 billion by 2032, at a CAGR of 5.49% during the forecast period

- The market growth is largely fueled by the rising demand for industrial and medical gases, coupled with expanding energy infrastructure and LNG storage requirements, driving the adoption of advanced cryogenic tanks across multiple sectors

- Furthermore, increasing investments in clean energy projects, industrial modernization, and healthcare infrastructure are establishing cryogenic tanks as essential solutions for efficient storage and transportation of liquefied gases. These converging factors are accelerating the uptake of cryogenic storage solutions, thereby significantly boosting the market's expansion

Cryogenic Tanks Market Analysis

- Cryogenic tanks, designed for the storage and transport of liquefied gases at extremely low temperatures, are becoming vital components in industrial, energy, and healthcare sectors due to their safety, efficiency, and reliability

- The escalating demand for cryogenic tanks is primarily fueled by the growing LNG industry, rising adoption of industrial gases, and expanding healthcare applications requiring liquid oxygen and nitrogen, driving continuous market growth

- Asia-Pacific dominated the cryogenic tanks market with a share of 36.3% in 2024, due to rapid industrialization, expanding energy generation infrastructure, and increasing demand for medical and industrial gases

- North America is expected to be the fastest growing region in the cryogenic tanks market during the forecast period due to increasing LNG imports and exports, rising energy and industrial gas demand, and expanding medical infrastructure

- Steel segment dominated the market with a market share of 62.5% in 2024, due to its high strength, durability, and cost-effectiveness for large-scale storage applications. Steel tanks are widely used in energy, metal processing, and industrial gas industries where resistance to thermal stress and pressure containment is critical. The segment benefits from ease of fabrication, availability of corrosion-resistant coatings, and compatibility with existing infrastructure. Industries prefer steel tanks for long-term investment in large storage and transportation setups, ensuring safety and regulatory compliance

Report Scope and Cryogenic Tanks Market Segmentation

|

Attributes |

Cryogenic Tanks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cryogenic Tanks Market Trends

Rising Use of Cryogenic Tanks for LNG and Industrial Gases

- The increasing global demand for liquefied natural gas (LNG) and industrial gases such as oxygen, nitrogen, and argon has led to a significant rise in the adoption of cryogenic tanks. These tanks play a critical role in the storage and transportation of liquefied gases at extremely low temperatures, ensuring product stability and operational safety across industrial supply chains

- For instance, Air Products and Chemicals, Inc. and Linde plc have expanded their cryogenic storage capabilities by investing in advanced tank systems to cater to the growing requirement for LNG distribution and industrial gas supply. These developments reflect how leading manufacturers are responding to rising demand from industries such as energy, healthcare, and metallurgy

- Technological advancements in material science and insulation design are enabling the development of cryogenic tanks that offer enhanced thermal efficiency and reduced boil-off losses. Manufacturers are adopting vacuum-insulated and multi-layered designs to ensure long-term durability and minimize evaporative losses during gas storage and transport

- The increasing focus on transitioning toward cleaner fuels has strengthened the role of LNG as an alternative to conventional fossil fuels. Consequently, cryogenic tanks are being widely deployed at refueling stations, maritime transport systems, and industrial gas facilities to support the infrastructure expansion for LNG and hydrogen supply networks

- Growing industrialization and healthcare sector demand, especially for oxygen in medical applications, are further amplifying the need for efficient cryogenic storage solutions. Hospitals and pharmaceutical manufacturers are increasingly relying on compact and mobile cryogenic systems to maintain uninterrupted supply chains

- The market is heading toward greater innovation in tank design, capacity optimization, and temperature control integration. As end-user industries continue to embrace low-emission fuels and advanced gas applications, the adoption of cryogenic tanks is expected to accelerate across global markets, marking them as a key enabler of energy transition and industrial gas reliability

Cryogenic Tanks Market Dynamics

Driver

Growing Need for Safe and Efficient Gas Storage

- The rising consumption of industrial gases and LNG across various sectors has created a strong necessity for safe, reliable, and efficient storage systems. Cryogenic tanks meet this need by allowing gases to be stored in liquid form at ultra-low temperatures, thereby reducing volume and enhancing transport efficiency for large-scale industrial applications

- For instance, Chart Industries, Inc. launched advanced cryogenic storage solutions for LNG and hydrogen sectors in 2024, focusing on improved insulation stability and real-time monitoring systems. Such innovations reflect how key market players are leveraging design advancements to increase safety, operational control, and cost-effectiveness for end users

- The capability of cryogenic tanks to withstand extreme conditions while maintaining the purity of gases such as liquid oxygen and nitrogen makes them indispensable across domains such as aerospace, healthcare, and material processing. This advantage reinforces their commercial relevance and establishes them as a backbone for continuous supply in sensitive operations

- Industrial decarbonization efforts and the adoption of cleaner fuels are prompting both private and public entities to invest in advanced cryogenic infrastructure. Energy companies and refueling stations are deploying these tanks to ensure compact storage capable of supporting long-distance LNG and hydrogen distribution

- The ongoing emphasis on sustainability and the evolution of safety compliance standards are further propelling demand for modern cryogenic storage systems. The convergence of energy transition goals and the pursuit of storage reliability continues to drive steady market growth for cryogenic tanks across diverse industrial sectors

Restraint/Challenge

High Costs and Technical Complexity

- The high initial investment required for manufacturing and installing cryogenic tanks poses a major hurdle for small and medium-scale industries. These tanks involve advanced materials and engineering precision to maintain low temperatures, which substantially increases setup and maintenance expenses compared with conventional gas storage systems

- For instance, companies such as INOX India and Cryolor have reported significant capital intensity associated with large-capacity cryogenic tank projects for LNG infrastructure. The substantial cost of design customization, vacuum insulation, and transport logistics adds to the overall complexity of operations in this segment

- The need for specialized handling, regular inspection, and adherence to stringent safety standards contributes to higher operational costs. Personnel must be trained to manage cryogenic systems safely, as mishandling can lead to severe product loss or safety risks, which limits adoption in cost-sensitive industries

- Supply chain disruptions and fluctuations in raw material prices for stainless steel and aluminum alloys used in tank construction also impact production economics. These pressures reduce the profitability of small manufacturers and slow expansion in developing regions

- The long-term resolution lies in scaling production technologies, improving insulation materials, and implementing efficient maintenance protocols to minimize lifecycle costs. Overcoming technical complexities and cost barriers will be essential for enhancing the global penetration of cryogenic tank solutions across both energy and industrial sectors

Cryogenic Tanks Market Scope

The market is segmented on the basis of type, design, storage type, raw material, cryogenic liquid, application, and end-use industry.

- By Type

On the basis of type, the cryogenic tanks market is segmented into horizontal and vertical tanks. The horizontal segment dominated the market with the largest revenue share in 2024, driven by its stable structure, ease of installation, and suitability for bulk storage in industrial settings. Industries prefer horizontal tanks for on-site storage of cryogenic liquids due to their enhanced safety features, reduced risk of tipping, and ability to handle large volumes efficiently. The segment also benefits from compatibility with automated filling and dispensing systems, ensuring operational convenience and minimal downtime. Horizontal tanks are widely adopted across energy, medical, and metal processing industries due to their reliability and cost-effectiveness.

The vertical segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in urban industrial facilities and areas with limited floor space. Vertical tanks optimize land usage, making them suitable for compact installations in chemical, food, and beverage industries. Their design allows easier integration with advanced monitoring systems for temperature and pressure control, enhancing operational safety. The aesthetic and space-efficient design also supports modern industrial layouts, driving demand in emerging markets.

- By Design

On the basis of design, the market is segmented into elliptical bottom and flat bottom tanks. The elliptical bottom segment held the largest market revenue share in 2024 due to its superior structural integrity, ability to withstand high pressure, and lower thermal stress during cryogenic liquid storage. Industries favor elliptical bottom tanks for large-scale storage of LNG, liquid nitrogen, and oxygen as they provide better stress distribution and reduce maintenance costs. Their durability and long operational life make them suitable for energy generation plants and large-scale medical gas storage facilities. Elliptical designs also allow safer handling during transportation and refilling processes, contributing to market dominance.

The flat bottom segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing adoption in smaller industrial units and transportable storage solutions. Flat bottom tanks are easier to manufacture and maintain, providing cost-effective options for mid-sized facilities. They integrate seamlessly with trailer-type storage systems and modular setups, offering flexibility for expanding operations. The demand is particularly high in emerging economies where smaller-scale storage and localized distribution are essential for industrial and medical applications.

- By Storage Type

On the basis of storage type, the market is segmented into stationary and trailer-type tanks. The stationary segment dominated the market with the largest revenue share in 2024 due to its suitability for permanent installations in industrial plants, medical facilities, and energy generation units. Stationary tanks are preferred for their ability to safely store large volumes of cryogenic liquids for long durations with minimal thermal loss. They support integration with advanced monitoring and safety systems, reducing operational risks and downtime. Industries also value stationary tanks for their durability, low maintenance requirements, and compliance with stringent safety regulations.

The trailer-type segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for on-the-go transportation of cryogenic liquids. Trailer-type tanks offer mobility and flexibility for industries requiring temporary storage or transport to remote locations. They are extensively used in medical supply chains, LNG distribution, and specialty gas delivery, providing controlled storage while in transit. Advances in lightweight materials and insulation technology further drive adoption of trailer-type cryogenic tanks globally.

- By Raw Material

On the basis of raw material, the cryogenic tanks market is segmented into steel, nickel alloy, aluminium alloy, and others. The steel segment dominated the market with the largest revenue share of 62.5% in 2024 due to its high strength, durability, and cost-effectiveness for large-scale storage applications. Steel tanks are widely used in energy, metal processing, and industrial gas industries where resistance to thermal stress and pressure containment is critical. The segment benefits from ease of fabrication, availability of corrosion-resistant coatings, and compatibility with existing infrastructure. Industries prefer steel tanks for long-term investment in large storage and transportation setups, ensuring safety and regulatory compliance.

The aluminium alloy segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand for lightweight, corrosion-resistant, and portable tanks. Aluminium tanks offer easier handling and transport, making them suitable for trailer-type storage and mobile distribution of cryogenic liquids. Industries such as medical technology, food and beverage, and electronics increasingly adopt aluminium tanks for specialized applications requiring high purity and low contamination risk. The superior thermal conductivity and reduced maintenance requirements further accelerate growth of this segment.

- By Cryogenic Liquid

On the basis of cryogenic liquid, the market is segmented into liquid nitrogen, liquefied natural gas (LNG), liquid oxygen, liquid hydrogen, argon, and others. The LNG segment dominated the market with the largest revenue share in 2024 due to rapid global adoption of LNG for energy generation and industrial fuel requirements. LNG storage requires high-capacity, low-temperature tanks with advanced insulation, which drives the demand for high-performance cryogenic tanks. Energy companies and industrial players prefer specialized tanks for safe handling, minimal evaporation losses, and regulatory compliance. The segment benefits from expanding infrastructure for LNG import, export, and domestic distribution networks.

The liquid hydrogen segment is expected to witness the fastest growth from 2025 to 2032, fueled by the rising focus on hydrogen as a clean energy source. Liquid hydrogen storage demands extremely low temperatures and highly insulated tanks, leading to adoption of advanced cryogenic technologies. The segment sees strong growth in energy generation, transportation, and aerospace applications, where safety, efficiency, and portability are critical. Increasing investment in hydrogen fuel cell projects globally supports the rapid adoption of liquid hydrogen storage tanks.

- By Application

On the basis of application, the market is segmented into storage and transportation. The storage segment dominated the market with the largest revenue share in 2024 due to extensive industrial usage for bulk cryogenic liquids in energy, medical, and metal processing sectors. Storage tanks are preferred for their ability to maintain extremely low temperatures over extended periods, ensuring liquid quality and safety. Companies invest in stationary tanks for on-site storage to streamline operations, reduce supply chain risks, and meet regulatory standards. The segment benefits from the integration of monitoring and automation systems that enhance operational efficiency and reduce labor dependency.

The transportation segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand for mobile and flexible distribution of cryogenic liquids. Transport tanks provide safe, temperature-controlled delivery solutions for medical gases, LNG, and industrial gases. Rising urbanization, expansion of healthcare facilities, and growth in remote industrial operations fuel the demand for efficient transportation tanks. Advanced insulation, lightweight materials, and improved safety features contribute to the growing adoption of transport cryogenic tanks globally.

- By End Use Industry

On the basis of end-use industry, the market is segmented into metal processing, energy generation, electronics, medical technology, food and beverage, water treatment, and others. The energy generation segment dominated the market with the largest revenue share in 2024 due to high consumption of LNG, liquid oxygen, and hydrogen in power plants and industrial energy setups. Energy companies invest in cryogenic tanks for safe, long-term storage and efficient supply chain management. The segment benefits from government initiatives promoting clean energy adoption and expanding infrastructure for energy storage. Safety, durability, and integration with automated systems drive preference for high-performance cryogenic tanks.

The medical technology segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for cryogenic storage of biological samples, vaccines, and oxygen for hospitals. Medical facilities require highly reliable, contamination-free storage tanks with advanced monitoring systems. The growth is supported by rising healthcare infrastructure, expansion of medical research centers, and global vaccination initiatives. Cryogenic tanks in this segment ensure safe preservation of sensitive materials, enhancing operational efficiency and patient care outcomes.

Cryogenic Tanks Market Regional Analysis

- Asia-Pacific dominated the cryogenic tanks market with the largest revenue share of 36.3% in 2024, driven by rapid industrialization, expanding energy generation infrastructure, and increasing demand for medical and industrial gases

- The region’s cost-effective manufacturing base, growing investments in cryogenic storage facilities, and expanding exports of LNG and industrial gases are accelerating market growth

- Availability of skilled labor, favorable government policies, and rising adoption of advanced storage solutions across emerging economies are contributing to increased consumption of cryogenic tanks in both industrial and medical sectors

China Cryogenic Tanks Market Insight

China held the largest share in the Asia-Pacific cryogenic tanks market in 2024, owing to its robust industrial base, significant energy generation capacity, and growing manufacturing sector. The country’s strong infrastructure, government incentives for industrial gas production, and strategic initiatives supporting clean energy and LNG storage are key growth drivers. Demand is further supported by ongoing investments in cryogenic transportation and storage for industrial, medical, and chemical applications.

India Cryogenic Tanks Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising energy demand, expansion of the healthcare sector, and growing industrial gas consumption. Government initiatives such as “Make in India” and increasing investment in LNG terminals, industrial gas plants, and medical cryogenic storage facilities are strengthening market expansion. In addition, rising adoption of advanced cryogenic storage solutions for metal processing and food and beverage industries is contributing to robust growth.

Europe Cryogenic Tanks Market Insight

The Europe cryogenic tanks market is expanding steadily, supported by stringent safety and environmental regulations, high demand for LNG and industrial gas storage, and investments in sustainable storage solutions. The region emphasizes compliance, quality, and advanced engineering for cryogenic systems, particularly in energy, medical, and chemical sectors. Increasing adoption of cryogenic technology in aerospace, pharmaceuticals, and specialty gas applications is further driving market growth.

Germany Cryogenic Tanks Market Insight

Germany’s cryogenic tanks market is driven by its leadership in industrial gas production, advanced manufacturing capabilities, and strong focus on energy efficiency. The country benefits from well-established R&D infrastructure, partnerships between industrial and academic institutions, and export-oriented production of high-performance cryogenic tanks. Demand is particularly strong in metal processing, energy generation, and medical technology applications.

U.K. Cryogenic Tanks Market Insight

The U.K. market is supported by a mature energy and healthcare industry, growing investments in LNG and industrial gas infrastructure, and increasing adoption of mobile cryogenic storage solutions. Rising focus on research and innovation, partnerships between academia and industrial players, and initiatives to strengthen localized production are contributing to robust demand for cryogenic tanks.

North America Cryogenic Tanks Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing LNG imports and exports, rising energy and industrial gas demand, and expanding medical infrastructure. Strong investment in cryogenic storage technology, advancements in transportation systems, and growing industrial applications are boosting market growth. Rising reshoring of industrial gas production and collaboration between energy, healthcare, and chemical companies further support market expansion.

U.S. Cryogenic Tanks Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its extensive energy infrastructure, growing industrial gas demand, and advanced R&D in cryogenic storage solutions. The country’s focus on technological innovation, regulatory compliance, and sustainability is driving adoption of high-performance cryogenic tanks for LNG, medical, and industrial applications. Presence of key manufacturers and a mature distribution network further solidify the U.S.'s leading position in the region.

Cryogenic Tanks Market Share

The cryogenic tanks industry is primarily led by well-established companies, including:

- LAPESA GRUPO EMPRESARIAL (Spain)

- Linde plc (U.K.)

- Chart Industries (U.S.)

- Cryofab (U.S.)

- Henan Jianshen Metal Material Co. Ltd (China)

- INOX India Pvt Ltd (India)

- Air Products Inc. (U.S.)

- Cryolor (France)

- AIR WATER INC (Japan)

- Wessington Cryogenics (U.K.)

- FIBA Technologies, Inc. (U.S.)

- ISISAN A.S (Turkey)

- Nikkiso (Japan)

- Gardner Cryogenics (U.S.)

- Beijing Tianhai Industry Co., Ltd. (China)

- Hoover CS (U.S.)

- UIG (U.S.)

- Auguste Cryogenics (France)

- Macomber Cryogenics (U.S.)

- M1 Engineering (U.S.)

- GTS Maintenance Limited (U.K.)

- DABAR INDUSTRIES, LLC dba Eden Cryogenics (U.S.)

- Taylor-Wharton (U.S.)

Latest Developments in Global Cryogenic Tanks Market

- In November 2024, INOX India Ltd announced a significant contract with Highview Power, UK, to supply five vertical 690kl high-pressure, vacuum-insulated cryogenic tanks for the Liquid Air Energy Storage (LAES) facility in Carrington, Manchester. This project marks the first instance of cryogenic tanks being used at an industrial scale for clean energy storage, highlighting INOXCVA's entry into the energy storage sector. The contract strengthens INOXCVA's position in the global cryogenic equipment market and opens new avenues in the rapidly growing energy storage segment

- In September 2024, TransTech Group, a portfolio company of Bridge Industries, acquired Cryogenic Technology Resources (CTR), a provider of engineered solutions for the industrial gas sector. This acquisition strengthens TransTech's position in the cryogenic and high-pressure gas storage and transfer market, including advanced automation and control technologies. The buy-out aligns with TransTech's strategic vision to enhance service offerings and support the evolving needs of the cryogenic gas market

- In 2024, Chart Industries inaugurated a new manufacturing facility in India dedicated to producing cryogenic tanks for industrial gas and LNG applications. This expansion enhances Chart Industries’ global production capacity, strengthens its presence in the rapidly growing Asia-Pacific market, and enables faster supply to meet rising industrial and energy demands

- In 2024, Air Liquide entered a long-term, multi-year supply agreement with Hyundai Heavy Industries to provide cryogenic tanks for shipbuilding and LNG transport applications. The contract reinforces Air Liquide’s strategic position in the Asian maritime sector, supports the growth of LNG-powered shipping solutions, and expands the company’s footprint in industrial and energy infrastructure projects

- In 2024, Linde launched a next-generation cryogenic tank designed specifically for hydrogen storage, targeting clean energy and mobility markets. This innovation positions Linde at the forefront of hydrogen storage technology, addresses growing demand for sustainable energy solutions, and enables adoption of hydrogen-based mobility and industrial applications globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cryogenic Tanks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cryogenic Tanks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cryogenic Tanks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.