Global Cubitainers Market

Market Size in USD Million

CAGR :

%

USD

120.79 Million

USD

195.59 Million

2025

2033

USD

120.79 Million

USD

195.59 Million

2025

2033

| 2026 –2033 | |

| USD 120.79 Million | |

| USD 195.59 Million | |

|

|

|

|

What is the Global Cubitainers Market Size and Growth Rate?

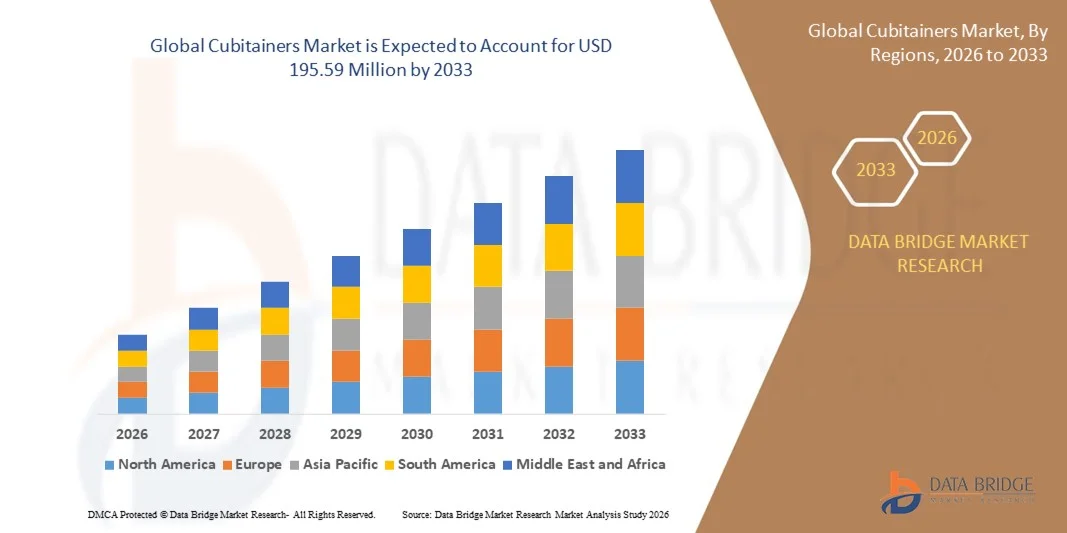

- The global cubitainers market size was valued at USD 120.79 million in 2025 and is expected to reach USD 195.59 million by 2033, at a CAGR of6.21% during the forecast period

- The rise in the economic growth and increasing middle class with growing disposable income acts as one of the major factors driving the growth of cubitainers market. The change in food habits with giving emphasis on the use of packed liquid food and increase in per capital income people started investing money on alcoholic and energy drinks accelerate the cubitainers market growth

- The increases in demand for the packaging solution owning to its recyclable and reusable nature and rise in demand for flexible packaging solution for liquid further influences the cubitainers market

What are the Major Takeaways of Cubitainers Market?

- Rapid industrialization, increase in retail outlets, rise in demand of packaged food and beverage products, and growth in population positively affect the cubitainers market. Furthermore, research and development activities and product innovations extends profitable opportunities to the cubitainers market

- The issues with the rigidity and environmental concerns are the factors expected to obstruct the cubitainers market growth. The negative impact of COVID-19 on the packaging sector is projected to challenge the cubitainers market

- Asia-Pacific dominated the Cubitainers market with a 43.2% revenue share in 2025, driven by strong growth in food & beverage production, chemical manufacturing, pharmaceuticals, and industrial goods packaging across China, India, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 10.3% from 2026 to 2033, supported by rapid growth in pharmaceutical, chemical, and specialty food packaging industries across the U.S. and Canada

- The 20 Liters segment dominated the market with a 41.2% share in 2025, as it is widely preferred for bulk liquid handling across chemicals, food ingredients, edible oils, laboratory reagents, and pharmaceutical solutions

Report Scope and Cubitainers Market Segmentation

|

Attributes |

Cubitainers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cubitainers Market?

Increasing Shift Toward High-Efficiency, Lightweight, and Sustainable Cubitainer

- The cubitainers market is experiencing strong adoption of lightweight, collapsible, and space-saving liquid packaging solutions designed to support food ingredients, edible oils, industrial chemicals, pharmaceuticals, and specialty liquids

- Manufacturers are introducing high-barrier, eco-friendly, and multi-layer LDPE cubitainers that offer improved durability, puncture resistance, and contamination-free dispensing for sensitive and high-value liquids

- Growing demand for cost-efficient, recyclable, and transport-optimized packaging is increasing the usage of cubitainers across beverage manufacturers, chemical processors, laboratory facilities, and healthcare sectors

- For instance, companies such as Thermo Fisher Scientific, Zacros, Changshun Plastic, and Berlin Packaging have upgraded their cubitainer portfolios with enhanced barrier properties, BPA-free designs, precision spouts, and UN-certified variants for hazardous liquids

- Increasing need for efficient liquid handling, safe storage, and reduced packaging waste is accelerating the shift toward collapsible, eco-focused cubitainer solutions

- As industries move toward sustainable, compact, and user-friendly liquid packaging, cubitainers will remain essential for ensuring safe transport, easy dispensing, and optimized logistics

What are the Key Drivers of Cubitainers Market?

- Rising demand for affordable, hygienic, and lightweight liquid packaging to support food processing, pharmaceuticals, laboratory reagents, industrial chemicals, and household product applications

- For instance, in 2024–2025, key companies such as Fujimori Kogyo, Thermo Fisher, and Berlin Packaging expanded production of high-purity LDPE cubitainers with improved barrier strength, stackability, and ergonomic dispensing features

- Growing adoption of bulk liquid packaging systems across food & beverage, chemical manufacturing, cosmetics, agrochemicals, and healthcare sectors is boosting the market across the U.S., Europe, and Asia-Pacific

- Advancements in multi-layer extrusion, container sterilization, tamper-evident caps, and recyclable materials have strengthened performance, compliance, and sustainability standards

- Rising use of pharmaceutical-grade liquids, high-purity chemicals, and specialized formulations is creating demand for UN-approved, contamination-free, and transport-secure cubitainers

- Supported by expanding industrial processing, logistics optimization, and sustainability mandates, the cubitainers market is positioned for strong long-term growth

Which Factor is Challenging the Growth of the Cubitainers Market?

- High costs associated with premium, multi-layer, and pharmaceutical-grade cubitainers limit adoption among small manufacturers and local packaging users

- For instance, during 2024–2025, fluctuations in polyethylene prices, resin shortages, and higher logistics costs increased production expenses for several global packaging companies

- Complexity in ensuring sterility, chemical compatibility, and regulatory compliance for food, pharma, and hazardous chemical applications increases the need for strict quality control

- Limited awareness in emerging markets regarding cubitainer features, safe liquid handling, and storage advantages slows adoption compared to conventional rigid containers

- Competition from plastic drums, HDPE bottles, bag-in-box systems, and rigid intermediate bulk containers (IBCs) creates pricing pressure and reduces product differentiation

- To address these challenges, companies are focusing on cost-optimized designs, sustainable materials, global distribution networks, and enhanced product certifications to support wider market adoption of cubitainers

How is the Cubitainers Market Segmented?

The market is segmented on the basis of capacity, material, and end user.

- By Capacity

On the basis of capacity, the cubitainers market is segmented into 1 Liter, 3 Liter, 10 Liters, 16 Liters, and 20 Liters. The 20 Liters segment dominated the market with a 41.2% share in 2025, as it is widely preferred for bulk liquid handling across chemicals, food ingredients, edible oils, laboratory reagents, and pharmaceutical solutions. Its high-volume storage, reduced transportation cost per unit, collapsible structure, and efficient cube-shaped design make it the most economical option for industrial-scale operations. Growing use of 20-liter cubitainers in export packaging, high-purity chemicals, and sterile liquid storage further strengthens segment leadership.

The 10 Liters segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for compact, easy-to-carry containers in laboratories, sampling operations, food processing units, and small-batch chemical handling. Its convenience, reduced spillage risk, and suitability for high-value liquids support rapid adoption across manufacturing and healthcare environments.

- By Material

On the basis of material, the cubitainers market is segmented into Low Density Polyethylene (LDPE), Linear Low Density Polyethylene (LLDPE), and High Density Polyethylene (HDPE). The LDPE segment dominated the market with a 57.6% share in 2025, owing to its superior flexibility, impact resistance, lightweight structure, and compatibility with food-grade, pharmaceutical-grade, and chemical applications. LDPE cubitainers provide excellent collapsibility, making them ideal for efficient storage, reduced logistic space, and contamination-free dispensing. Their adaptability for sterilization, ease of molding, and high chemical resistance further reinforce segment leadership across global markets.

The LLDPE segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for enhanced tensile strength, puncture resistance, and improved durability. LLDPE-based cubitainers are gaining traction in industrial chemicals, solvents, agricultural inputs, and specialty liquids due to better performance in harsh handling conditions and higher structural stability during long-distance transportation.

- By End User

On the basis of end user, the cubitainers market is segmented into Food & Beverages, Pharmaceuticals, Chemicals, and Other Industrial Goods. The Chemicals segment dominated the market with a 44.8% share in 2025, driven by extensive usage of cubitainers for acids, solvents, laboratory reagents, detergents, agrochemicals, and high-purity chemical formulations. Their collapsible design, reduced contamination risk, UN-certified variants, and cost-efficient bulk packaging make them ideal for chemical storage and transportation. The segment benefits from rising industrial production, increased export activities, and tightening safety regulations for handling hazardous liquids.

The Pharmaceuticals segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising use of cubitainers for sterile liquids, APIs, culture media, buffer solutions, and diagnostic reagents. Growing emphasis on aseptic packaging, hygienic dispensing, and leak-proof transport solutions is driving adoption across biopharma facilities, hospitals, laboratories, and clinical manufacturing environments.

Which Region Holds the Largest Share of the Cubitainers Market?

- Asia-Pacific dominated the Cubitainers market with a 43.2% revenue share in 2025, driven by strong growth in food & beverage production, chemical manufacturing, pharmaceuticals, and industrial goods packaging across China, India, Japan, South Korea, and Southeast Asia

- Rapid expansion of manufacturing infrastructure, rising demand for bulk liquid handling solutions, and increasing adoption of lightweight, collapsible, and sustainable cubitainers support market leadership. High-volume production of edible oils, syrups, cleaning chemicals, and lab reagents further accelerates demand for space- and cost-efficient liquid packaging solutions

- Leading companies in Asia-Pacific are introducing multi-layer, high-barrier, and recyclable cubitainers with tamper-evident caps, enhanced chemical compatibility, and stackable designs, strengthening the region’s technological advantage. Continuous investments in sustainable packaging, industrial automation, and cold-chain logistics drive long-term market expansion

- Strong manufacturing capabilities, favorable government initiatives, and expanding industrial clusters reinforce regional market dominance

China Cubitainers Market Insight

China is the largest contributor to Asia-Pacific, driven by world-leading chemical, pharmaceutical, and food manufacturing capacities, combined with strong government support for sustainable packaging and industrial standardization. Rising adoption of high-volume cubitainers for liquid chemicals, edible oils, syrups, and lab reagents is boosting demand for multi-layer LDPE, LLDPE, and HDPE containers. Local production efficiency and competitive pricing expand domestic and export adoption, ensuring China’s leadership in the regional market.

Japan Cubitainers Market Insight

Japan shows steady growth supported by advanced food processing, pharmaceutical manufacturing, and chemical industries. Strong emphasis on high-quality packaging, chemical compatibility, and contamination-free solutions drives adoption of premium cubitainers. Increasing need for hygienic liquid handling, space-efficient storage, and sustainable packaging reinforces long-term market expansion.

India Cubitainers Market Insight

India is emerging as a major growth hub, driven by expanding food & beverage production, pharmaceutical units, and chemical processing industries. Rising startup activity and government-backed manufacturing initiatives increase demand for lightweight, collapsible cubitainers. Growing requirement for bulk liquid packaging, chemical storage, and safe transportation accelerates market penetration.

South Korea Cubitainers Market Insight

South Korea contributes significantly due to high demand for chemical, pharmaceutical, and specialty food packaging. Adoption of space-saving, recyclable, and chemical-resistant cubitainers is rising across laboratories, industrial plants, and food & beverage facilities. Technological innovation, strong production capacity, and emphasis on sustainable packaging support consistent market growth.

North America Cubitainers Market

North America is projected to register the fastest CAGR of 10.3% from 2026 to 2033, supported by rapid growth in pharmaceutical, chemical, and specialty food packaging industries across the U.S. and Canada. Increasing adoption of eco-friendly, collapsible cubitainers in laboratories, hospitals, industrial chemical plants, and food & beverage manufacturing drives demand. Investment in sustainable packaging solutions, regulatory compliance, and high-volume liquid handling systems accelerates market expansion across the region.

Which are the Top Companies in Cubitainers Market?

The cubitainers industry is primarily led by well-established companies, including:

- Changshun Plastic Co. Ltd. (China)

- Fujimori KOGYO CO., LTD. (Japan)

- Zacros America (U.S.)

- ChangZhou HengQi Plastics Co., Ltd (China)

- The Cary Company (U.S.)

- Changzhou Sanjie Plastic Products Co., Ltd (China)

- RPC Promens (Netherlands)

- The Koizumi Jute Mills Ltd. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Quality Environmental Containers, Inc. (U.S.)

- Berlin Packaging (U.S.)

- Avantor, Inc. (U.S.)

- Cole-Parmer Instrument Company, LLC (U.S.)

What are the Recent Developments in Global Cubitainers Market?

- In March 2024, The Cary Company divested its raw materials and specialty chemicals distribution business as part of a strategic restructuring to focus more on containers and packaging, selling the business unit to Maroon Group LLC, owned by Barentz International. This move strengthens The Cary Company’s focus on high-growth packaging solutions

- In March 2024, Repsol introduced lubricant containers made with 60% mechanically recycled post-consumer plastic, part of the Repsol Reciclex range of sustainable polyolefins, suitable for all 1L, 4L, and 5L lubricant containers and available in five colors for multiple product lines. This launch reinforces Repsol’s commitment to sustainable packaging innovations

- In February 2024, Zacros America, Inc. announced the availability of its iconic non-interactive films (NIf) in the Americas, designed for pharmaceutical, medical, and cosmetic packaging applications. This expands Zacros’ presence in high-demand packaging markets

- In February 2024, Faerch Group developed a new tumbler range of recyclable on-the-go beverage containers, containing a minimum of 30% post-consumer recycled material. This initiative highlights Faerch’s dedication to eco-friendly and sustainable packaging solutions

- In January 2024, Cole-Parmer acquired ZeptoMetrix Corporation, enhancing its portfolio of quality controls and reference standards, further establishing Cole-Parmer as a leading provider of specialty chemistries and reagents for life sciences research and diagnostic testing. This acquisition strengthens Cole-Parmer’s competitive position in the life sciences sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cubitainers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cubitainers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cubitainers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.