Global Cultured Beef Market

Market Size in USD Million

CAGR :

%

USD

661.92 Million

USD

1,015.84 Million

2024

2032

USD

661.92 Million

USD

1,015.84 Million

2024

2032

| 2025 –2032 | |

| USD 661.92 Million | |

| USD 1,015.84 Million | |

|

|

|

|

Cultured Beef Market Size

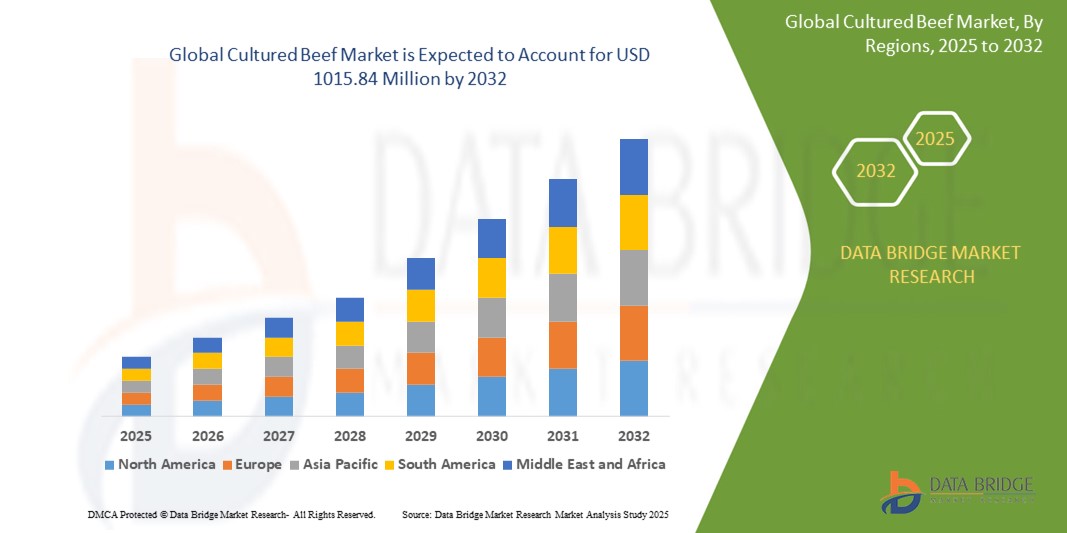

- The global cultured beef market size was valued at USD 661.92 million in 2024 and is expected to reach USD 1015.84 million by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is primarily driven by increasing consumer demand for sustainable and ethical food alternatives, advancements in cellular agriculture technologies, and growing awareness of environmental concerns related to traditional livestock farming

- In addition, rising investments in alternative protein solutions and shifting consumer preferences toward plant-based and lab-grown meat products are accelerating the adoption of cultured beef, significantly boosting industry growth

Cultured Beef Market Analysis

- Cultured beef, produced through cellular agriculture by cultivating animal cells in a controlled environment, is emerging as a sustainable alternative to traditional meat, offering reduced environmental impact and ethical benefits in both consumer and commercial markets

- The demand for cultured beef is fueled by growing environmental consciousness, increasing concerns over animal welfare, and the need for scalable, resource-efficient food production systems

- North America dominated the cultured beef market with the largest revenue share of 42.5% in 2024, driven by early adoption of alternative protein technologies, strong investment in food tech startups, and a robust regulatory framework supporting innovation, with the U.S. leading in cultured beef production and consumer acceptance

- Europe is expected to be the fastest-growing region in the cultured beef market during the forecast period due to supportive government policies, increasing consumer demand for sustainable foods, and rapid advancements in biotechnology

- The burgers segment dominated the largest market revenue share of 38% in 2024, driven by high consumer familiarity with burgers and strong demand for sustainable alternatives to traditional beef burgers in quick-service restaurants and retail

Report Scope and Cultured Beef Market Segmentation

|

Attributes |

Cultured Beef Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cultured Beef Market Trends

“Increasing Adoption of Biotechnology and Cellular Agriculture”

- The global cultured beef market is experiencing a notable trend toward the integration of advanced biotechnology and cellular agriculture techniques

- These technologies enable the production of cultured beef by cultivating animal cells in controlled environments, offering a sustainable alternative to traditional meat production

- Biotechnology advancements allow for enhanced scalability, improving the efficiency of cell growth and reducing production costs for cultured beef products

- For instance, companies are developing bioreactor systems that optimize cell proliferation and tissue development, enabling large-scale production of cultured beef for applications such as nuggets, burgers, and sausages

- This trend is increasing the appeal of cultured beef by addressing consumer demands for environmentally friendly and ethically produced meat alternatives

- Data analytics and automation are being utilized to monitor cell growth patterns, ensuring consistent quality and texture across products such as meatballs and hotdogs

Cultured Beef Market Dynamics

Driver

“Growing Demand for Sustainable and Ethical Protein Sources”

- Rising consumer awareness of the environmental impact of conventional livestock farming, such as high greenhouse gas emissions and land use, is a key driver for the cultured beef market

- Cultured beef offers a sustainable solution by significantly reducing resource consumption, including water and land, while addressing animal welfare concerns

- Government initiatives and regulatory approvals, particularly in North America, are supporting the commercialization of cultured beef, with the U.S. leading in approvals for products such as nuggets and burgers

- The expansion of plant-based and alternative protein markets is also fueling interest in cultured beef, as consumers seek diverse, high-protein food options

- Foodservice industries and retailers are increasingly incorporating cultured beef products, such as sausages and meatballs, to meet consumer demand for sustainable and innovative meat alternatives

Restraint/Challenge

“High Production Costs and Regulatory Hurdles”

- The significant initial investment required for bioreactors, cell culture media, and production facilities poses a major barrier to scaling cultured beef production, particularly for small-scale manufacturers

- Developing cost-effective processes for large-scale production of cultured beef products such as hotdogs and burgers remains complex and resource-intensive

- Regulatory challenges, including varying standards for safety, labeling, and commercialization across regions, create obstacles for market expansion, especially in Europe, despite its rapid growth

- Consumer acceptance and skepticism regarding the taste, texture, and safety of cultured beef products can hinder adoption, particularly in regions with strong traditional meat consumption cultures

- Data privacy concerns related to supply chain transparency and traceability, especially in business-to-consumer distribution channels, may also limit market growth in cost-sensitive or privacy-conscious markets

Cultured Beef market Scope

The market is segmented on the basis of end use and distribution channel.

- By End Use

On the basis of end use, the global cultured beef market is segmented into nuggets, burgers, meatballs, sausages, and hotdogs. The burgers segment dominated the largest market revenue share of 38% in 2024, driven by high consumer familiarity with burgers and strong demand for sustainable alternatives to traditional beef burgers in quick-service restaurants and retail. The scalability of cultured beef burgers, combined with their appeal to environmentally conscious consumers, supports their market dominance.

The nuggets segment is expected to witness the fastest growth rate from 2025 to 2032, with a projected CAGR of 18.5%. This growth is fueled by the rising popularity of convenient, on-the-go snacking options and increasing adoption of cultured meat in fast-food chains. Advancements in production techniques that improve texture and taste, along with growing consumer acceptance of plant-based and cultured meat alternatives, further drive this segment's growth.

- By Distribution Channel

On the basis of distribution channel, the global cultured beef market is segmented into business-to-business (B2B) and business-to-consumers (B2C). The B2B segment dominated the market with a revenue share of 60% in 2024, driven by strong demand from foodservice industries, including restaurants and fast-food chains, for cultured beef products. Regulatory approvals in key markets and partnerships with foodservice providers have facilitated the integration of cultured beef into menus, enhancing market penetration.

The B2C segment is anticipated to experience the fastest growth rate of 20.1% from 2025 to 2032. This growth is propelled by increasing consumer awareness of sustainable food options and the expansion of cultured beef products in retail channels, such as supermarkets and e-commerce platforms. The convenience of purchasing cultured beef through online and offline retail, coupled with improved product availability and marketing, supports rapid adoption among consumers.

Cultured Beef Market Regional Analysis

- North America dominated the cultured beef market with the largest revenue share of 42.5% in 2024, driven by early adoption of alternative protein technologies, strong investment in food tech startups, and a robust regulatory framework supporting innovation, with the U.S. leading in cultured beef production and consumer acceptance

- Consumers prioritize cultured beef products for their environmental benefits, animal welfare considerations, and health-focused attributes, particularly in regions with high awareness of sustainability issues

- Growth is supported by advancements in cell-based meat production technologies, such as scalable bioreactors and cost-effective culture media, alongside rising adoption in both B2B and B2C distribution channels

U.S. Cultured Beef Market Insight

The U.S. cultured beef market captured the largest revenue share of 88.5% in 2024 within North America, fueled by strong consumer demand for innovative food products and growing awareness of environmental and ethical benefits. The trend towards plant-based and lab-grown meat alternatives, coupled with increasing investments in food tech startups, boosts market expansion. Major food corporations and restaurants incorporating cultured beef products, such as nuggets and burgers, complement B2C sales, creating a diverse product ecosystem.

Europe Cultured Beef Market Insight

The Europe cultured beef market is expected to witness the fastest growth rate, supported by stringent environmental regulations and a strong emphasis on sustainable food systems. Consumers seek cultured beef products that offer health benefits and reduce environmental impact. Growth is prominent in both B2B (restaurants and foodservice) and B2C (retail) channels, with countries such as the Netherlands and Germany showing significant uptake due to advanced biotech infrastructure and consumer awareness.

U.K. Cultured Beef Market Insight

The U.K. market for cultured beef is expected to witness rapid growth, driven by demand for sustainable meat alternatives and increasing consumer focus on reducing carbon footprints. Interest in product aesthetics, such as cultured burgers and sausages, and health benefits encourages adoption. Evolving food safety and labeling regulations influence consumer choices, balancing innovation with compliance.

Germany Cultured Beef Market Insight

Germany is expected to witness the fastest growth rate in the cultured beef market, attributed to its advanced biotech sector and high consumer focus on sustainability and health. German consumers prefer technologically advanced cultured beef products, such as meatballs and hotdogs, that align with environmental goals and contribute to reduced resource consumption. Integration of these products in premium foodservice and retail channels supports sustained market growth.

Asia-Pacific Cultured Beef Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding food production capabilities and rising disposable incomes in countries such as China, Japan, and Singapore. Increasing awareness of sustainability, animal welfare, and health benefits boosts demand for cultured beef products. Government initiatives promoting food security and sustainable agriculture further encourage the adoption of advanced cultured beef technologies.

Japan Cultured Beef Market Insight

Japan’s cultured beef market is expected to witness rapid growth due to strong consumer preference for high-quality, innovative food products that enhance health and sustainability. The presence of major food tech companies and integration of cultured beef in B2B channels, such as high-end restaurants, accelerates market penetration. Rising interest in B2C retail channels, particularly for nuggets and burgers, also contributes to growth.

China Cultured Beef Market Insight

China holds the largest share of the Asia-Pacific cultured beef market, propelled by rapid urbanization, rising food demand, and increasing consumer interest in sustainable protein solutions. The country’s growing middle class and focus on food innovation support the adoption of cultured beef products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility across both B2B and B2C distribution channels.

Cultured Beef Market Share

The cultured beef industry is primarily led by well-established companies, including:

- Memphis Meats (U.S.)

- Supermeat (Israel)

- Integriculture Inc. (Japan)

- Finless Foods (U.S.)

- Higher Steaks (U.K.)

- Appleton Meats (U.S.)

- Biofood Systems Ltd. (Spain)

- Fork & Goode (U.S.)

- Finless Foods Inc. (U.S.)

- Avant Meats Co. Ltd. (Hong Kong)

- Future Meat Technologies Ltd. (Israel)

- Meatable (Netherlands)

- Mission Barns (U.S.)

- Bluenalu (U.S.)

- New Age Meats (U.S.)

- Aleph Farms Ltd. (Israel)

What are the Recent Developments in Global Cultured Beef Market?

- In May 2025, Dutch food tech company Meatable revealed plans for a retail launch of its cultivated pork and beef products across Europe, aiming to make lab-grown meat widely accessible. Using its proprietary opti-ox™ technology, Meatable accelerates the growth of muscle and fat cells from a single animal cell, producing high-quality meat in just eight days. This breakthrough enables cost-effective scaling, helping the company meet rising demand for sustainable protein while reducing the environmental impact of traditional meat production. The initiative marks a major step toward mainstream adoption of cultivated meat

- In April 2025, a Japanese consortium led by Osaka University debuted a 3D-printed cultured beef prototype and a conceptual “home meat maker” at Expo 2025 Osaka. Displayed in the Osaka Healthcare Pavilion, the exhibit envisions a future where consumers can produce customized marbled meat at home using 3D bioprinting technology. The consortium—comprising six organizations including Shimadzu, Itoham Yonekyu, and TOPPAN—aims to commercialize cultured meat by 2031, addressing global protein shortages and environmental concerns. The “future kitchen” concept allows users to tailor meat to their health and taste preferences, marking a bold step toward sustainable food innovation

- In February 2025, Aleph Farms announced that Israel had become the third country globally—after Singapore and the United States—to approve the sale of its cultivated beef products, marking a major regulatory breakthrough. The approval, granted by Israel’s Ministry of Health, allows Aleph Farms to market its Aleph Cuts brand, including its cultivated Petit Steak, to consumers. This milestone represents a pivotal moment in the commercialization of lab-grown meat, expanding access to sustainable protein alternatives and reinforcing Israel’s leadership in food innovation, climate action, and food security

- In January 2025, Mission Barns teamed up with Silva Sausage and other food companies to pilot hybrid meat products that incorporate cultivated animal fat. These products blend plant-based proteins with lab-grown fat, aiming to enhance the taste, texture, and cooking performance of meat alternatives. The flagship item, Mission Chorizo Sausage, combines Mission Fat™ with plant protein to deliver the succulence and sizzle of traditional sausage—without the environmental downsides of conventional meat. This partnership marks a key milestone in scaling cultivated fat technology and advancing sustainable food innovation

- In September 2024, Eat Just Inc., a U.S.-based food tech company known for its plant-based and cultivated meat innovations, entered a strategic partnership with Halal Products Development Company (HPDC)—a subsidiary of Saudi Arabia’s Public Investment Fund. The collaboration is designed to help Eat Just secure Halal certification and navigate regulatory approvals, enabling the company to export its products to local and regional markets. HPDC will provide advisory and auditing services, ensuring Eat Just’s production processes align with Halal principles, while also supporting the development of a sustainable market entry strategy for the Halal food sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cultured Beef Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cultured Beef Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cultured Beef Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.