Global Cultured Seafood Market

Market Size in USD Million

CAGR :

%

USD

244.66 Million

USD

350.60 Million

2025

2033

USD

244.66 Million

USD

350.60 Million

2025

2033

| 2026 –2033 | |

| USD 244.66 Million | |

| USD 350.60 Million | |

|

|

|

|

Cultured Seafood Market Size

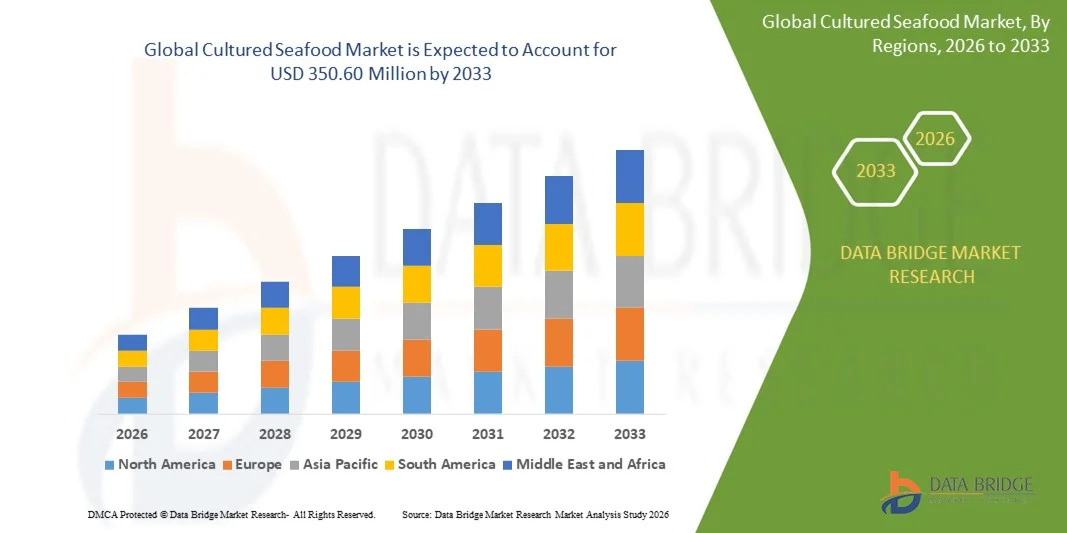

- The global cultured seafood market size was valued at USD 244.66 million in 2025 and is expected to reach USD 350.60 million by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fuelled by rising concerns over overfishing, depletion of marine resources, and the need for sustainable protein alternatives

- Increasing investments in cellular agriculture, biotechnology advancements, and growing interest from food tech startups are supporting market expansion

Cultured Seafood Market Analysis

- The market is witnessing steady growth due to advancements in cell cultivation techniques, scalable production processes, and improving cost efficiency

- Regulatory progress, pilot-scale commercialization, and partnerships between biotechnology firms and food manufacturers are shaping the competitive landscape

- North America dominated the cultured seafood market with the largest revenue share in 2025, driven by rising consumer demand for sustainable and safe seafood alternatives, as well as increased awareness of environmental and ethical issues associated with conventional seafood

- Asia-Pacific region is expected to witness the highest growth rate in the global cultured seafood market, driven by rapid population growth, rising disposable incomes, increasing demand for protein-rich foods, and expanding investment in cultured seafood technologies

- The Fishes segment held the largest market revenue share in 2025, driven by high consumer demand for salmon, tuna, and other premium fish varieties produced through sustainable, lab-grown methods. Cultured fish products are increasingly preferred for their traceability, reduced environmental impact, and consistent quality, making them a popular choice among health-conscious and environmentally aware consumers

Report Scope and Cultured Seafood Market Segmentation

|

Attributes |

Cultured Seafood Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cultured Seafood Market Trends

Rise of Sustainable and Lab-Grown Seafood Solutions

- The growing focus on cultured seafood is transforming the aquaculture landscape by providing sustainable, ethical alternatives to conventional seafood. Lab-grown fish and shellfish enable controlled production without overfishing or habitat destruction, improving environmental outcomes and supporting long-term industry sustainability. These solutions also help mitigate supply chain disruptions caused by climate change, disease outbreaks, or geopolitical factors, ensuring a stable seafood supply

- Increasing consumer demand for safe, traceable, and high-quality seafood is accelerating the adoption of cultured products. These products reduce risks of contamination and antibiotic residues associated with traditional aquaculture while catering to health-conscious and environmentally aware consumers. The trend is further reinforced by rising awareness of foodborne illnesses and growing preference for ethically sourced protein

- Advances in cellular agriculture and bioprocessing technologies are improving product taste, texture, and nutritional value, making cultured seafood more acceptable to mainstream markets. Enhanced scalability and cost reduction are also supporting wider commercial adoption across global markets. In addition, ongoing research in sustainable feed alternatives and energy-efficient bioreactors is enhancing production efficiency and market competitiveness

- In June 2025, Wildtype received FDA approval for its lab‑grown Coho salmon, making it the first cultured seafood product cleared for sale in the U.S. The salmon began appearing on restaurant menus in Portland, Oregon, marking a major commercial milestone for sustainable seafood. This approval demonstrated regulatory acceptance of cultured seafood and is expected to encourage broader product launches and investor confidence in the space

- While cultured seafood adoption is growing, sustained market impact depends on regulatory approval, cost efficiency, and consumer awareness. Producers must focus on production optimization, market education, and distribution strategies to fully capitalize on this emerging sector. The integration of blockchain and digital traceability tools further enhances consumer trust and facilitates global supply chain transparency

Cultured Seafood Market Dynamics

Driver

Rising Global Seafood Demand and Sustainability Concerns

- Increasing global seafood consumption and overfishing concerns are driving investment in cultured seafood as a reliable, eco-friendly alternative. This trend addresses the growing protein demand while conserving marine ecosystems. Moreover, it supports the global shift toward sustainable diets and helps companies meet ESG and sustainability commitments

- Consumers and retailers are prioritizing traceability, quality, and food safety, boosting adoption of cultured seafood products. Transparency in production methods supports premium pricing and consumer confidence. In addition, collaborations between food tech startups and established seafood distributors are expanding market reach and accessibility

- Technological advancements, including cell culture optimization and bioreactor innovations, are enhancing yield, reducing costs, and improving product quality, which encourages commercial-scale production and market penetration. Integration of AI, robotics, and IoT in production processes is further improving operational efficiency and reducing production risks

- In 2024, BLUU Seafood opened its first pilot plant in Hamburg, Germany to advance cell‑cultivated salmon and trout products. The facility supports research, product development, and scaling efforts to reduce production costs and move toward market readiness in Europe. This operational expansion is a key step in bridging production and commercialization for cultured fish products

- While sustainability and demand are driving growth, regulatory approval, cost management, and consumer education remain essential for long-term adoption and market expansion. Partnerships with research institutions, governments, and NGOs are critical to advance public awareness and policy frameworks for cultured seafood

Restraint/Challenge

High Production Costs and Regulatory Barriers

- The high capital investment and operational costs associated with cultured seafood production limit accessibility for small-scale producers. These costs make products more expensive than conventional seafood, affecting adoption in price-sensitive markets. Scaling production while maintaining consistent quality remains a significant operational challenge for new entrants

- Regulatory approval processes for lab-grown seafood remain complex and vary by region. Delays or uncertainty in approvals hinder product launch timelines and restrict global market expansion. Regulatory divergence between countries can increase compliance costs and slow international market penetration

- Supply chain limitations, including sourcing of growth media and specialized bioreactors, can affect production consistency and scalability, limiting market availability. Dependence on proprietary technologies and specialized raw materials further creates vulnerabilities in supply continuity and operational reliability

- In July 2024, Aqua Cultured Foods received self‑affirmed GRAS status in the U.S. for its fish‑free, fermentation‑derived seafood analogues such as tuna and scallops. This regulatory milestone allows the company to begin selling products to restaurants, helping broaden the definition of cultured and novel seafood alternatives while supporting market entry of sustainable seafood products

- While technological innovation continues, addressing cost, regulatory, and supply chain challenges is critical. Industry stakeholders must focus on scalable production, compliance, and consumer engagement to unlock the full potential of the global cultured seafood market. Initiatives such as joint ventures, shared manufacturing facilities, and government subsidies can further mitigate barriers and accelerate market growth

Cultured Seafood Market Scope

The market is segmented on the basis of product type, product format, and distribution channel.

- By Product Type

On the basis of product type, the cultured seafood market is segmented into Fishes, Crustaceans, Molluscs, and Others. The Fishes segment held the largest market revenue share in 2025, driven by high consumer demand for salmon, tuna, and other premium fish varieties produced through sustainable, lab-grown methods. Cultured fish products are increasingly preferred for their traceability, reduced environmental impact, and consistent quality, making them a popular choice among health-conscious and environmentally aware consumers.

The Crustaceans segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising interest in lab-grown shrimp, lobster, and crab products. Advances in cellular aquaculture techniques and bioprocessing technologies have improved texture, taste, and nutritional content, encouraging adoption in restaurants and retail markets. Crustaceans are particularly popular for their high market value and growing acceptance as sustainable seafood alternatives.

- By Product Format

On the basis of product format, the market is segmented into Fresh and Live, Frozen, Canned, and Chilled. The Fresh and Live segment held the largest share in 2025, driven by consumer preference for high-quality, minimally processed seafood with superior flavor and texture. Fresh cultured seafood provides enhanced traceability, reduced contamination risks, and appeals to premium market segments.

The Frozen segment is expected to witness the fastest growth rate from 2026 to 2033, due to improvements in freezing technologies that preserve product quality and extend shelf life. Frozen cultured seafood enables wider distribution, export opportunities, and year-round availability, making it attractive for both retail and foodservice sectors.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Supermarkets and Hypermarkets, Convenience Stores, Speciality Stores, Online Retail, and Others. Supermarkets and Hypermarkets held the largest revenue share in 2025, supported by increased consumer access to sustainable seafood products and growing awareness of lab-grown alternatives. Retailers are actively promoting cultured seafood to meet demand for eco-friendly and health-conscious choices.

The Online Retail segment is expected to witness the fastest growth rate from 2026 to 2033, driven by e-commerce expansion and rising digital adoption among consumers. Online platforms enable direct-to-consumer delivery, subscription models, and wider geographic reach, allowing cultured seafood producers to target new customer segments efficiently.

Cultured Seafood Market Regional Analysis

- North America dominated the cultured seafood market with the largest revenue share in 2025, driven by rising consumer demand for sustainable and safe seafood alternatives, as well as increased awareness of environmental and ethical issues associated with conventional seafood

- Consumers in the region highly value traceability, product quality, and eco-friendly sourcing, which are key factors in the adoption of cultured seafood products

- This growing adoption is further supported by supportive government initiatives, availability of investment for cellular agriculture startups, and a strong trend toward plant-based and lab-grown food products, establishing cultured seafood as a preferred solution for environmentally conscious consumers

U.S. Cultured Seafood Market Insight

The U.S. cultured seafood market captured the largest revenue share in 2025 within North America, fueled by the expansion of cellular agriculture and biotechnology firms producing lab-grown fish, shrimp, and other seafood. Consumers are increasingly prioritizing sustainable and safe seafood options, avoiding overfishing and antibiotic residues found in conventional products. Growing partnerships between producers, retailers, and restaurants, along with pilot product launches, are further propelling market growth. Moreover, increasing investments in scalable production systems and regulatory approvals are significantly contributing to the market’s expansion.

Europe Cultured Seafood Market Insight

The Europe cultured seafood market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strong sustainability regulations and consumer demand for traceable, eco-friendly seafood. Technological advancements in cellular aquaculture and government support for food innovation are fostering adoption across restaurants, retail, and foodservice channels. European consumers are also drawn to high-quality products with enhanced safety and taste profiles. The region is experiencing significant growth across cultured fish and crustacean segments, with pilot and commercial projects expanding rapidly.

U.K. Cultured Seafood Market Insight

The U.K. cultured seafood market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of overfishing, ethical sourcing, and environmental sustainability. In addition, consumer preference for traceable and high-quality seafood is encouraging adoption in retail and foodservice sectors. The country’s investment in foodtech startups, research partnerships, and supportive regulatory frameworks is expected to continue driving market expansion.

Germany Cultured Seafood Market Insight

The Germany cultured seafood market is expected to witness the fastest growth rate from 2026 to 2033, fueled by a combination of strong consumer demand for sustainable seafood and growing investments in cellular agriculture technology. Germany’s focus on environmental sustainability, coupled with its developed infrastructure for food innovation and biotechnology, promotes the adoption of cultured seafood. Pilot programs, collaborations with restaurants and retailers, and regulatory advancements are increasing market penetration, particularly for cultured fish and shrimp.

Asia-Pacific Cultured Seafood Market Insight

The Asia-Pacific cultured seafood market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as Japan, Singapore, and China. The region's growing inclination toward sustainable and safe seafood, supported by government incentives for food innovation and private investment, is driving the adoption of cultured seafood. Furthermore, APAC is emerging as a hub for cellular aquaculture startups and production facilities, making cultured seafood more accessible to a broader consumer base.

Japan Cultured Seafood Market Insight

The Japan cultured seafood market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high seafood consumption, technological innovation, and focus on food safety. Japanese consumers are increasingly seeking sustainable and high-quality seafood options, while pilot projects for cultured fish and shellfish are gaining traction. The integration of cultured seafood into retail, foodservice, and restaurant channels is fueling market growth. In addition, Japan’s aging population is likely to drive demand for convenient, safe, and easy-to-consume cultured seafood products.

China Cultured Seafood Market Insight

The China cultured seafood market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s increasing middle class, high seafood consumption, and rapid urbanization. China is one of the largest markets for seafood globally, and cultured products are gaining popularity in retail, restaurants, and high-end foodservice sectors. Strong domestic production capabilities, government support for food innovation, and pilot commercialization projects are key factors driving the market. The push toward sustainable aquaculture and the adoption of lab-grown seafood is expected to expand further in the coming years.

Cultured Seafood Market Share

The Cultured Seafood industry is primarily led by well-established companies, including:

- Pacific American Fish Company, Inc. (U.S.)

- NISSUI (Japan)

- NEW PESCANOVA GROUP (Spain)

- Mowi (Norway)

- Cermaq Group AS (Norway)

- Pacific Seafood (U.S.)

- KANGAMIUT SEAFOOD A/S (Denmark)

- American Seafoods Company LLC. (U.S.)

- Phillips Foods, Inc. (U.S.)

- Trident Seafoods Corporation (U.S.)

- Thai Union Group PCL (Thailand)

- LEE FISHING (U.S.)

- Amalgam Enterprises, Cochin (India)

- FOODSTUFFS NEW ZEALAND (New Zealand)

- Austevoll Seafood ASA (Norway)

- Cooke Aquaculture (Canada)

- Dongwon Group (South Korea)

- GuoLian.Cn (China)

- Princes Foods (U.K.)

- Tri Marine (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cultured Seafood Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cultured Seafood Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cultured Seafood Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.