Global Curcumin Market

Market Size in USD Million

CAGR :

%

USD

99.72 Million

USD

226.51 Million

2024

2032

USD

99.72 Million

USD

226.51 Million

2024

2032

| 2025 –2032 | |

| USD 99.72 Million | |

| USD 226.51 Million | |

|

|

|

|

What is the Global Curcumin Market Size and Growth Rate?

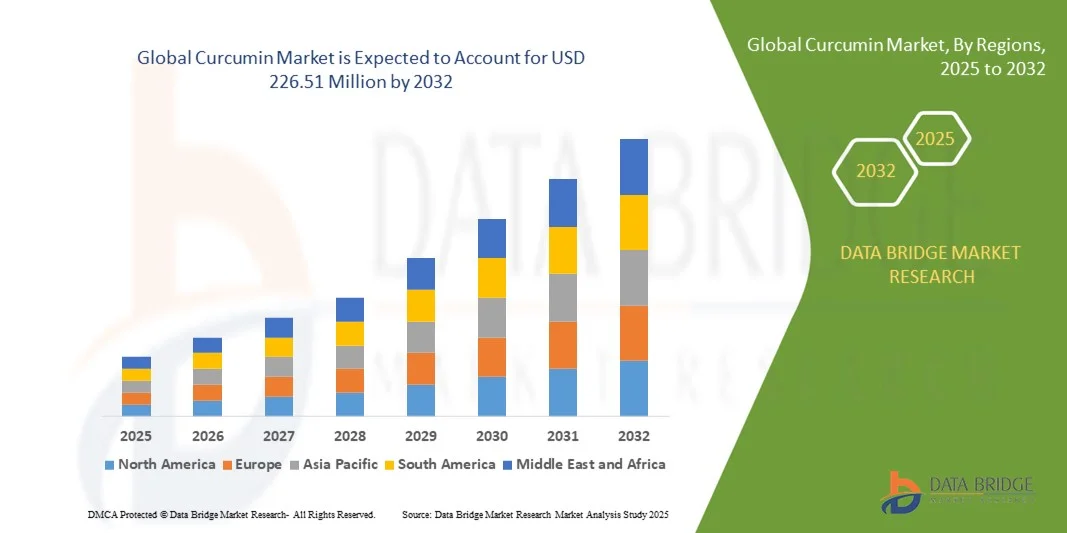

- The global curcumin market size was valued at USD 99.72 million in 2024 and is expected to reach USD 226.51 million by 2032, at a CAGR of 10.8% during the forecast period

- Major factors that are expected to boost the growth of the curcumin market in the forecast period are the rise in the growth because of increase in the customer alertness related to its therapeutic characteristics. Furthermore, the increase in the health alertness amongst the customers is further anticipated to propel the growth of the curcumin market

- Also, the strict government guidelines forbidding the utilization of specific chemicals in the food and beverage, medicine, and personal care products is further estimated to cushion the growth of the curcumin market

What are the Major Takeaways of Curcumin Market?

- The accessibility of cheaper synthetic food products is further projected to impede the growth of the curcumin market in the timeline period

- In addition, the rise in the alertness regarding the ill-effects of excess consumption of artificial additives will further provide potential opportunities for the growth of the curcumin market in the coming years. However, the creation difficulties in the products based on curcumin might further challenge the growth of the curcumin market in the near future

- The Asia-Pacific region dominated the curcumin market with the largest revenue share of 40.69% in 2024, driven by rapid urbanization, increasing disposable incomes, and rising health-consciousness among consumers

- The North America Curcumin market is expected to grow at the fastest CAGR of 8.54% during 2025–2032, fueled by rising consumer awareness regarding natural health supplements, dietary trends, and functional ingredients

- The Organic Curcumin segment dominated the market with the largest revenue share of 58% in 2024, driven by growing consumer preference for natural, chemical-free, and sustainably sourced ingredients

Report Scope and Curcumin Market Segmentation

|

Attributes |

Curcumin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Curcumin Market?

Growing Adoption of AI and Smart Technology in Curcumin Solution

- A prominent trend in the global Curcumin market is the increasing integration with artificial intelligence (AI) and voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit. This convergence is significantly improving user convenience, personalization, and control over their health and wellness routines

- For instance, some smart supplement dispensers for Curcumin can interact with voice assistants, enabling users to track intake, set reminders, and adjust dosage schedules via simple voice commands

- AI-enabled Curcumin devices and platforms can analyze consumption patterns and provide personalized suggestions, alerts, and health insights, enhancing the overall user experience

- The integration with digital wellness ecosystems allows users to manage supplement intake alongside fitness trackers, diet apps, and other connected devices, promoting holistic health management

- This trend toward intelligent, automated, and user-friendly solutions is reshaping consumer expectations in the nutraceutical sector, with companies developing smart Curcumin solutions that combine AI insights and seamless device connectivity

- Demand for such intelligent, integrated Curcumin offerings is rapidly rising across households, wellness centers, and healthcare facilities, as consumers prioritize convenience, personalization, and comprehensive health management

What are the Key Drivers of Curcumin Market?

- Increasing awareness of preventive healthcare, chronic inflammation management, and natural supplements is a significant driver for the growth of the Curcumin market

- For instance, in 2024, several nutraceutical companies launched AI-enabled Curcumin dispensers and mobile apps to facilitate personalized supplement schedules, expected to boost market adoption

- Consumers are increasingly seeking natural solutions for joint health, anti-inflammatory support, and overall wellness, making Curcumin products highly attractive

- The growing popularity of connected wellness devices, coupled with the demand for holistic health management solutions, is further encouraging Curcumin integration into digital health ecosystems

- Convenience features such as app-based reminders, dosage tracking, and automated supplement dispensers are enabling easy management, appealing to busy lifestyles and tech-savvy consumers

- The trend toward preventive healthcare, home-based wellness management, and user-friendly Curcumin products is anticipated to drive sustained market growth across global regions

Which Factor is Challenging the Growth of the Curcumin Market?

- Cybersecurity and data privacy concerns related to AI-enabled Curcumin devices pose challenges to market expansion. Users may hesitate to adopt connected health platforms due to potential vulnerabilities in data sharing and network connectivity

- High costs of advanced smart Curcumin dispensers and AI-enabled platforms can be a barrier for price-sensitive consumers, particularly in emerging markets

- Addressing these concerns through robust encryption, secure authentication protocols, and regular software updates is essential for building trust. Companies emphasize secure data handling and reliability to reassure users

- While conventional Curcumin supplements remain affordable, advanced features such as automated dispensing, AI-based insights, and integration with other wellness platforms often carry a premium price

- Consumer education, affordable smart solutions, and strong cybersecurity measures are key to overcoming adoption barriers, ensuring long-term growth and wider penetration of intelligent Curcumin products

How is the Curcumin Market Segmented?

The curcumin market is segmented on the basis of nature, form, application and end use.

- By Type

On the basis of type, the Curcumin market is segmented into Organic Curcumin and Conventional Curcumin. The Organic Curcumin segment dominated the market with the largest revenue share of 58% in 2024, driven by growing consumer preference for natural, chemical-free, and sustainably sourced ingredients. Health-conscious consumers are increasingly willing to pay a premium for organic formulations, particularly in dietary supplements, functional foods, and cosmetics. Organic Curcumin is also favored for its higher bioavailability and perceived safety compared to conventional alternatives.

Meanwhile, Conventional Curcumin is expected to witness the fastest CAGR of 19% from 2025 to 2032, driven by cost-effectiveness, widespread availability, and adoption in processed food and beverage industries. Manufacturers are innovating with conventional Curcumin to improve solubility, stability, and color retention, making it increasingly attractive for industrial applications. Overall, both segments benefit from rising awareness of Curcumin’s health benefits and expanding applications across nutraceutical and functional product portfolios.

- By Form

On the basis of form, the Curcumin market is segmented into Powder and Liquid. The Powder segment accounted for the largest market revenue share of 65% in 2024, owing to its versatility, long shelf life, and ease of incorporation into dietary supplements, food products, and nutraceutical formulations. Powdered Curcumin is widely preferred by manufacturers and consumers for its precise dosing, stability during processing, and compatibility with encapsulation and fortification techniques.

The Liquid form is anticipated to witness the fastest CAGR of 20% from 2025 to 2032, driven by rising demand for ready-to-consume beverages, functional drinks, and liquid dietary supplements. Liquid Curcumin also offers enhanced bioavailability and faster absorption, which aligns with growing consumer preferences for convenient and efficient health solutions. Innovations in emulsification and formulation technologies are further supporting the growth of liquid Curcumin in global markets.

- By Application

On the basis of application, the Curcumin market is segmented into Heart Health, Brain Health, Stress or Anxiety Relief, Anti-inflammation, Antioxidant, and Flavorant & Colorant. The Anti-inflammation segment dominated the market with the largest revenue share of 45% in 2024, driven by extensive scientific evidence supporting Curcumin’s role in managing chronic inflammation, joint disorders, and metabolic health. Increasing consumer awareness about lifestyle-related diseases is fueling demand in dietary supplements and functional foods.

Meanwhile, the Brain Health application is expected to witness the fastest CAGR of 18% from 2025 to 2032, supported by studies highlighting Curcumin’s neuroprotective and cognitive-enhancing properties. Applications in heart health, stress relief, and antioxidants are also expanding rapidly, with consumers seeking natural alternatives for preventive health. In addition, Curcumin’s use as a flavorant and natural colorant in processed foods and beverages further strengthens its market penetration across multiple sectors.

- By End Use

On the basis of end use, the Curcumin market is segmented into Dietary Supplements, Food Products, Herbal and Medicinal Products, and Cosmetics. The Dietary Supplements segment dominated the market with the largest revenue share of 50% in 2024, due to the rising demand for convenient, functional, and preventive health solutions among health-conscious consumers. Curcumin-based capsules, tablets, and soft gels are widely preferred for their ease of consumption and measurable dosing.

The Cosmetics segment is expected to witness the fastest CAGR of 17% from 2025 to 2032, driven by growing incorporation of Curcumin in anti-aging creams, skin brightening formulations, and natural personal care products. Increasing awareness about natural ingredients, herbal formulations, and bioactive compounds is further boosting demand across all end-use segments. Food products and herbal medicinal applications continue to expand as manufacturers innovate with fortification, functional beverages, and therapeutic formulations.

Which Region Holds the Largest Share of the Curcumin Market?

- The Asia-Pacific region dominated the curcumin market with the largest revenue share of 40.69% in 2024, driven by rapid urbanization, increasing disposable incomes, and rising health-consciousness among consumers. The region also benefits from a strong manufacturing base for Curcumin, enabling wide availability and competitive pricing

- Consumers in APAC highly value natural, organic, and functional products, which supports the adoption of Curcumin across dietary supplements, functional foods, and personal care products

- The widespread adoption is further supported by government initiatives promoting health awareness and traditional herbal consumption, establishing Curcumin as a preferred ingredient across residential and commercial applications

China Curcumin Market Insight

The China curcumin market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the expanding middle class, increasing disposable incomes, and growing demand for nutraceutical and functional food products. Rising health awareness and traditional usage of turmeric-based ingredients support strong consumer acceptance. In addition, domestic manufacturers offering cost-effective, high-quality Curcumin products are facilitating widespread adoption. Urban centers and the push for preventive healthcare further accelerate demand, making China a key driver of the APAC curcumin market.

Japan Curcumin Market Insight

The Japan curcumin market is witnessing steady growth due to the country’s emphasis on wellness, longevity, and preventive healthcare. The increasing adoption of functional foods, supplements, and natural health products is supporting market expansion. Japanese consumers are particularly drawn to scientifically validated Curcumin formulations, such as bioavailable extracts for joint health and anti-inflammatory benefits. Moreover, the aging population is driving demand for daily dietary supplements that promote overall health, providing significant growth potential for curcumin manufacturers.

Which Region is the Fastest Growing Region in the Curcumin Market?

The North America curcumin market is expected to grow at the fastest CAGR of 8.54% during 2025–2032, fueled by rising consumer awareness regarding natural health supplements, dietary trends, and functional ingredients. Increased focus on preventive healthcare, coupled with the popularity of organic and plant-based formulations, is driving demand. Growing e-commerce penetration, along with robust distribution networks and health-conscious urban populations in the U.S. and Canada, further support rapid market adoption.

U.S. Curcumin Market Insight

The U.S. curcumin market captured the largest share within North America in 2024, propelled by rising consumer preference for herbal dietary supplements and functional foods. Consumers are increasingly seeking natural anti-inflammatory, antioxidant, and joint health solutions. The availability of standardized, high-bioavailability Curcumin formulations through retail and online channels, along with extensive marketing and education efforts, is accelerating adoption. Increasing integration of Curcumin into multivitamins, beverages, and nutraceuticals ensures continued expansion in both retail and healthcare sectors.

Canada Curcumin Market Insight

The Canada curcumin market is growing steadily due to rising awareness about preventive healthcare and natural health products. Consumers are adopting Curcumin for joint support, anti-inflammatory benefits, and overall wellness. Increased availability of organic and standardized extracts in dietary supplements, functional foods, and beverages, alongside strong regulatory support for herbal ingredients, is further boosting market growth. E-commerce platforms and health retailers are expanding access, helping to reach health-conscious urban and suburban populations across the country.

Which are the Top Companies in Curcumin Market?

The Curcumin industry is primarily led by well-established companies, including:

- NOW Foods (U.S.)

- Wacker Chemie AG (Germany)

- Arjuna Natural Pvt Ltd (India)

- Synthite Industries Ltd (India)

- BioThrive Sciences (U.S.)

- Biomaxls.com (India)

- Konark Herbals & Health Care (India)

- SVagrofood (India)

- Star Hi Herbs Pvt Ltd. (India)

- Phyto Life Sciences P. Ltd (India)

- Herboveda India Pvt. Ltd. (India)

- Sabinsa (U.S.)

- Shaanxi Jiahe Phytochem Co., Ltd. (China)

- The Green Labs LLC (U.S.)

- HINDUSTAN MINT & AGRO PRODUCTS PVT. LTD (India)

- Rosun Natural Products Pvt. Ltd. (India)

- Hebei Food Additive Co. Ltd. (China)

- PT. Helmigs Prima Sejahtera (Indonesia)

- Tri Rahardja PT (Javaplant) (Indonesia)

What are the Recent Developments in Global Curcumin Market?

- In September 2023, NutriOriginal, in collaboration with Star-Hi Herbs Pvt. Ltd, introduced TurmiMax Bio, a turmeric-based supplement designed with enhanced absorption and water solubility using the patented OptiBio Assurance process, reinforcing its commitment to improving curcumin bioavailability and consumer health

- In February 2023, Herbalife Nutrition implemented nanotechnology to develop a turmeric-based supplement aimed at increasing the solubility and concentration of curcumin in the body, initially launching in Indonesia and planning expansion across Asia Pacific, highlighting the growing use of advanced technologies in nutraceuticals

- In September 2022, NextEvo Naturals launched Revive CBD Complex Curcumin and Hemp Extract, a premium supplement featuring a vegan, non-GMO, and gluten-free formulation, ensuring a high-quality, user-friendly experience and positioning itself strongly in the health supplement market

- In July 2022, OmniActive Health Technologies released Curcumin Ultra +, a nutritional solution targeting knee joint comfort, mobility, and cartilage health, expanding its product portfolio and reinforcing its focus on functional curcumin-based solutions for musculoskeletal wellness

- In February 2022, Sabinsa Corporation introduced CurCousina, a turmeric-derived ingredient featuring Calebin A, demonstrated to support healthy weight management, cholesterol, and blood sugar levels, strengthening its reputation in functional ingredient innovation

- In February 2020, Arjuna Natural Pvt. Ltd., a Kerala-based manufacturer, launched a new range of certified organic turmeric extracts, including clinically studied, bioavailable BCM-95 (Curcugreen), as well as water- and oil-dispersible formulations, broadening its portfolio and accessibility for health-conscious consumers globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Curcumin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Curcumin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Curcumin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.