Global Curry Powder Market

Market Size in USD Million

CAGR :

%

USD

825.52 Million

USD

1,376.53 Million

2025

2033

USD

825.52 Million

USD

1,376.53 Million

2025

2033

| 2026 –2033 | |

| USD 825.52 Million | |

| USD 1,376.53 Million | |

|

|

|

|

Global Curry Powder Market Size

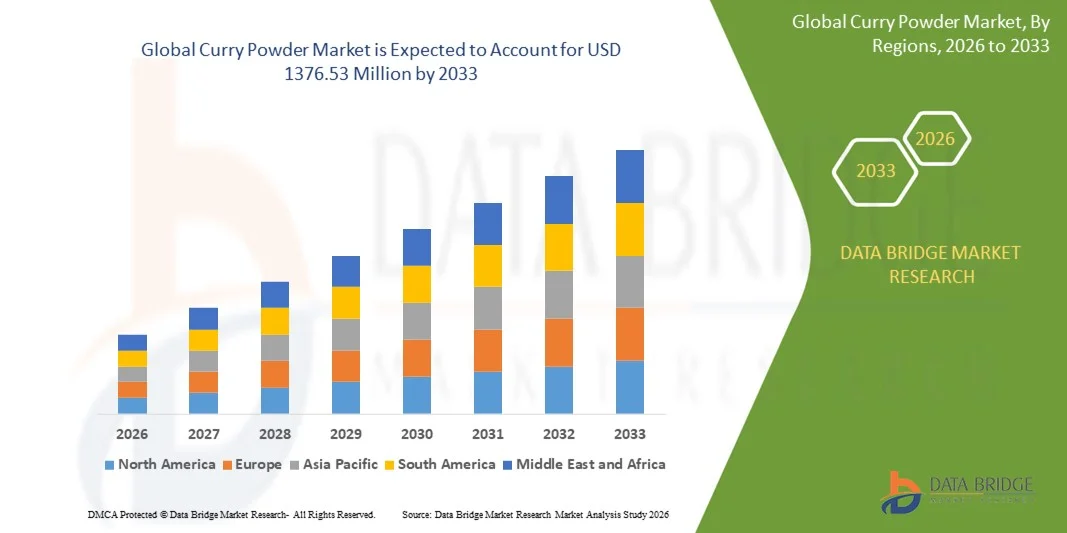

- The global Curry Powder Market size was valued at USD 825.52 million in 2025 and is expected to reach USD 1376.53 million by 2033, at a CAGR of 6.60% during the forecast period.

- The market growth is largely fueled by the rising demand for diverse and flavorful cuisines, increased consumer preference for ready-to-use spice blends, and the expansion of the foodservice industry across emerging and developed regions.

- Furthermore, growing awareness of the health benefits associated with natural spices, coupled with innovations in product formulations and convenient packaging, is driving consumer adoption of curry powders. These converging factors are accelerating the consumption of curry powder in households and restaurants, thereby significantly boosting the industry's growth.

Global Curry Powder Market Analysis

- Curry powder, a blend of spices used to enhance flavor and aroma in a variety of cuisines, is increasingly essential in both home cooking and the foodservice industry due to its convenience, versatility, and consistent taste profiles.

- The escalating demand for curry powder is primarily fueled by the growing popularity of ethnic and fusion cuisines, rising consumer preference for ready-to-use spice blends, and increasing adoption in restaurants and packaged food products.

- Asia-Pacific dominated the Global Curry Powder Market with the largest revenue share of 36% in 2025, characterized by high consumer awareness, preference for diverse culinary experiences, and a strong presence of key spice manufacturers, with the U.S. experiencing substantial growth in retail and foodservice segments, driven by product innovations and convenient packaging formats.

- North America is expected to be the fastest-growing region in the Global Curry Powder Market during the forecast period due to increasing urbanization, rising disposable incomes, and strong culinary traditions that favor spice consumption.

- The Without Additive Type segment dominated the market with the largest revenue share of 58.4% in 2025, driven by increasing consumer preference for natural, pure, and chemical-free spice blends.

Report Scope and Global Curry Powder Market Segmentation

|

Attributes |

Curry Powder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• McCormick & Company (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Curry Powder Market Trends

Enhanced Convenience Through Ready-to-Use and Health-Focused Blends

- A significant and accelerating trend in the global Curry Powder Market is the growing development of ready-to-use spice blends that combine convenience with health-conscious formulations, catering to busy consumers seeking flavorful, quick, and nutritious cooking solutions.

- For instance, brands such as McCormick’s “Easy Cook Curry” and MDH’s “Instant Curry Mix” allow users to prepare traditional dishes in minutes without compromising on authentic flavor, making them ideal for households and quick-service restaurants alike.

- Innovations in curry powder formulations include blends enriched with natural antioxidants, low-sodium options, and organic ingredients, addressing rising consumer awareness about health and wellness. Some products now also incorporate functional spices known for anti-inflammatory or digestive benefits, meeting the demand for both taste and nutrition.

- The convenience of pre-mixed curry powders allows consumers to streamline meal preparation while experimenting with global cuisines. By reducing the need to source multiple individual spices, these products simplify cooking and encourage consistent flavor profiles across recipes.

- This trend towards more convenient, health-focused, and versatile curry powders is reshaping consumer expectations for home cooking and foodservice operations. Consequently, companies such as Everest Spices and Aachi Masala are expanding their product portfolios with blends that emphasize ease of use, authenticity, and nutritional benefits.

- The demand for curry powders that combine convenience, authentic flavor, and health-conscious features is growing rapidly across both residential kitchens and commercial foodservice sectors, as consumers increasingly prioritize efficiency, taste, and wellness in their culinary choices.

Global Curry Powder Market Dynamics

Driver

Growing Demand Due to Increasing Culinary Exploration and Health Awareness

- The increasing interest in global cuisines, along with rising awareness of the health benefits of natural spices, is a significant driver for the heightened demand for curry powders.

- For instance, in 2025, McCormick & Company launched a range of health-oriented curry blends enriched with natural antioxidants and low-sodium formulations, aiming to cater to health-conscious consumers and convenience-seeking households. Such initiatives by key companies are expected to drive the curry powder industry growth during the forecast period.

- As consumers become more adventurous in their cooking and seek flavorful yet healthy meal options, curry powders provide a convenient way to prepare authentic dishes while incorporating spices known for their antioxidant, anti-inflammatory, and digestive properties.

- Furthermore, the growing popularity of ready-to-use spice blends and packaged foods is making curry powder an essential ingredient in kitchens worldwide, offering consistent taste, ease of preparation, and versatility across multiple cuisines.

- The convenience of pre-mixed blends, combined with the ability to experiment with various dishes without purchasing individual spices, is propelling the adoption of curry powders in both residential kitchens and commercial foodservice settings. The trend towards easy-to-use, health-focused products and innovative packaging further contributes to market growth.

Restraint/Challenge

Concerns Regarding Authenticity, Quality, and Pricing

- Concerns surrounding the authenticity and quality of curry powders, including adulteration or inconsistent spice content, pose a challenge to broader market adoption. As consumers become more discerning about ingredient sourcing and purity, low-quality or counterfeit products can negatively impact brand trust.

- For instance, reports of adulterated spice blends in certain regions have made some consumers cautious about trying new or unfamiliar curry powder brands.

- Addressing these concerns through strict quality control, sourcing transparency, and certifications such as ISO, organic, or FSSAI is crucial for building consumer confidence. Companies such as MDH and Everest emphasize their authentic sourcing and traditional processing methods in marketing to reassure buyers.

- Additionally, the relatively higher cost of premium curry powders compared to locally blended or generic alternatives can be a barrier for price-sensitive consumers, particularly in developing markets. While affordable blends from brands like Catch or Kitchen King have gained traction, specialty products with organic or health-enhancing features often come at a premium.

- Overcoming these challenges through quality assurance, consumer education on health benefits, and expanding affordable yet authentic product lines will be vital for sustained market growth.

Global Curry Powder Market Scope

The curry powder market is segmented on the basis of type and application.

- By Type

On the basis of type, the Global Curry Powder Market is segmented into With Additive Type and Without Additive Type. The Without Additive Type segment dominated the market with the largest revenue share of 58.4% in 2025, driven by increasing consumer preference for natural, pure, and chemical-free spice blends. Health-conscious consumers and culinary enthusiasts favor additive-free curry powders for their authentic flavor, nutritional benefits, and perceived safety, making them a staple in both household kitchens and premium foodservice operations. Additionally, additive-free options are preferred in packaged ready-to-eat meals and ethnic cuisine products due to regulatory compliance and growing demand for “clean label” ingredients.

The With Additive Type segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by the convenience offered by pre-mixed functional blends that include preservatives, flavor enhancers, or colorants to improve shelf life and visual appeal, particularly in mass-market retail and processed food sectors.

- By Application

On the basis of application, the Global Curry Powder Market is segmented into Retail, Food Service, and Food Processing. The Retail segment accounted for the largest market revenue share of 52.6% in 2025, driven by rising household consumption, the growing popularity of ready-to-cook meals, and increasing consumer interest in experimenting with global cuisines. Supermarkets, hypermarkets, and online retail platforms play a significant role in making diverse curry powder variants easily accessible to consumers, further boosting retail demand.

The Food Service segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, supported by the rapid expansion of restaurants, cafes, and quick-service outlets across urban and semi-urban regions. Food service operators prefer standardized, ready-to-use curry powders to maintain flavor consistency, reduce preparation time, and cater to evolving consumer taste preferences, which is driving strong adoption in this segment.

Global Curry Powder Market Regional Analysis

- Asia-Pacific dominated the Global Curry Powder Market with the largest revenue share of 36% in 2025, driven by increasing consumer interest in diverse cuisines, rising awareness of health benefits associated with natural spices, and strong retail penetration of branded spice products.

- Consumers in the region highly value convenience, consistent flavor, and high-quality ingredients offered by packaged and ready-to-use curry powders, making them a staple in both home kitchens and foodservice establishments.

- This widespread adoption is further supported by high disposable incomes, a culturally diverse population with exposure to international cuisines, and the growing trend of home cooking and gourmet meal preparation, establishing branded curry powders as a preferred choice for residential and commercial cooking applications.

U.S. Curry Powder Market Insight

The U.S. curry powder market captured the largest revenue share of 81% in 2025 within North America, fueled by the growing interest in ethnic cuisines and rising consumer awareness of the health benefits of natural spices. Consumers are increasingly prioritizing convenience and consistent flavor, driving demand for ready-to-use curry powders and packaged spice blends. The popularity of home cooking, coupled with robust growth in the foodservice sector and e-commerce retailing, further propels the market. Moreover, the integration of international culinary trends into everyday cooking, alongside demand for gourmet and health-focused products, is significantly contributing to market expansion.

Europe Curry Powder Market Insight

The Europe curry powder market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing adoption of international cuisines and growing health-consciousness among consumers. Rising urbanization, higher disposable incomes, and the popularity of ready-to-cook meals are fostering demand for curry powders. The market is witnessing strong growth across residential kitchens, restaurants, and packaged food products, with consumers showing preference for high-quality, additive-free spice blends and authentic flavors.

U.K. Curry Powder Market Insight

The U.K. curry powder market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s rich culinary diversity and a strong affinity for Indian and Asian cuisines. The demand for convenient, pre-mixed curry powders is increasing in both homes and the foodservice sector. Additionally, rising consumer awareness about natural ingredients and authentic flavors encourages the adoption of premium and organic curry powder brands, further supporting market growth.

Germany Curry Powder Market Insight

The Germany curry powder market is expected to expand at a considerable CAGR during the forecast period, fueled by growing interest in ethnic cuisines and health-oriented cooking. Consumers in Germany are increasingly seeking high-quality, additive-free, and organic spice blends, which are widely used in both home cooking and commercial foodservice. The preference for authentic flavor, combined with demand for convenient packaged products, promotes the adoption of curry powders in both residential and commercial kitchens.

Asia-Pacific Curry Powder Market Insight

The Asia-Pacific curry powder market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by increasing urbanization, rising disposable incomes, and the popularity of diverse culinary traditions in countries such as India, China, and Japan. The growing demand for convenience and ready-to-use spice blends, coupled with expanding retail and e-commerce channels, is fueling market growth. Additionally, the region’s strong production capabilities and availability of cost-effective products enhance affordability and accessibility, further accelerating adoption.

Japan Curry Powder Market Insight

The Japan curry powder market is gaining momentum due to the country’s strong interest in international cuisines, home cooking trends, and demand for convenience. Consumers are increasingly seeking authentic, high-quality, and pre-mixed curry powders that deliver consistent flavor. Moreover, the rising popularity of ready-to-cook meal kits and the integration of global culinary practices in everyday meals are driving adoption in both residential and commercial foodservice sectors.

China Curry Powder Market Insight

The China curry powder market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and growing culinary experimentation. Curry powders are increasingly popular in home kitchens, restaurants, and processed food products. The growth is further supported by strong domestic manufacturers, increasing availability of affordable packaged blends, and rising interest in global cuisines, making curry powder a staple ingredient in Chinese households and commercial kitchens.

Global Curry Powder Market Share

The Curry Powder industry is primarily led by well-established companies, including:

• McCormick & Company (U.S.)

• Everest Spices (India)

• MDH (India)

• Badshah Masala (India)

• Patak’s (U.K.)

• Aachi Masala (India)

• Catch Spices (India)

• Eastern Condiments (India)

• Kohinoor Spices (India)

• Sakthi Masala (India)

• Keya Spices (India)

• Radhuni (Bangladesh)

• Priya (India)

• TRS (U.K.)

• Lobo (India)

• National Brand (India)

• Rajah Spices (Australia)

• Kitchen King (India)

• B&G Foods (U.S.)

• Shan Foods (Pakistan)

What are the Recent Developments in Global Curry Powder Market?

- In April 2024, McCormick & Company, a global leader in spices and seasonings, launched a strategic initiative in South Africa aimed at expanding the availability of its premium curry powder blends. This initiative underscores the company’s dedication to delivering high-quality, authentic spice products tailored to local culinary preferences. By leveraging its global expertise and innovative product offerings, McCormick is addressing regional demand while reinforcing its position in the rapidly growing global Curry Powder Market.

- In March 2024, Everest Spices, a veteran-led Indian spice manufacturer, introduced a new range of health-oriented curry powders, enriched with natural antioxidants and low-sodium formulations, specifically designed for home cooking and foodservice use. This advancement highlights Everest Spices’ commitment to combining convenience, flavor, and nutrition, catering to the growing health-conscious consumer base.

- In March 2024, MDH (Mahashian Di Hatti) successfully launched a series of ready-to-use curry powder blends in Bengaluru and other urban centers, aimed at simplifying meal preparation and ensuring consistent authentic flavor. This initiative underscores MDH’s focus on innovation and its contribution to modernizing cooking practices while meeting increasing urban demand.

- In February 2024, Aachi Masala, a leading South Indian spice brand, announced a strategic partnership with national grocery chains to expand the availability of its packaged curry powders across urban and semi-urban markets. This collaboration is designed to enhance accessibility for consumers, streamline distribution, and strengthen brand presence, reflecting Aachi Masala’s commitment to innovation and operational efficiency in the spice industry.

- In January 2024, Patak’s, a renowned U.K.-based spice company, unveiled its “Ready-to-Use Curry Powder Collection” at the International Food & Drink Expo 2024. These blends, crafted for both retail and foodservice sectors, offer convenience, consistent flavor, and authentic taste. Patak’s initiative highlights the company’s commitment to integrating high-quality ingredients with innovative packaging, providing consumers with enhanced ease of use while maintaining traditional flavor profiles.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Curry Powder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Curry Powder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Curry Powder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.