Global Custom Flash Module Market

Market Size in USD Billion

CAGR :

%

USD

17.52 Billion

USD

75.84 Billion

2024

2032

USD

17.52 Billion

USD

75.84 Billion

2024

2032

| 2025 –2032 | |

| USD 17.52 Billion | |

| USD 75.84 Billion | |

|

|

|

|

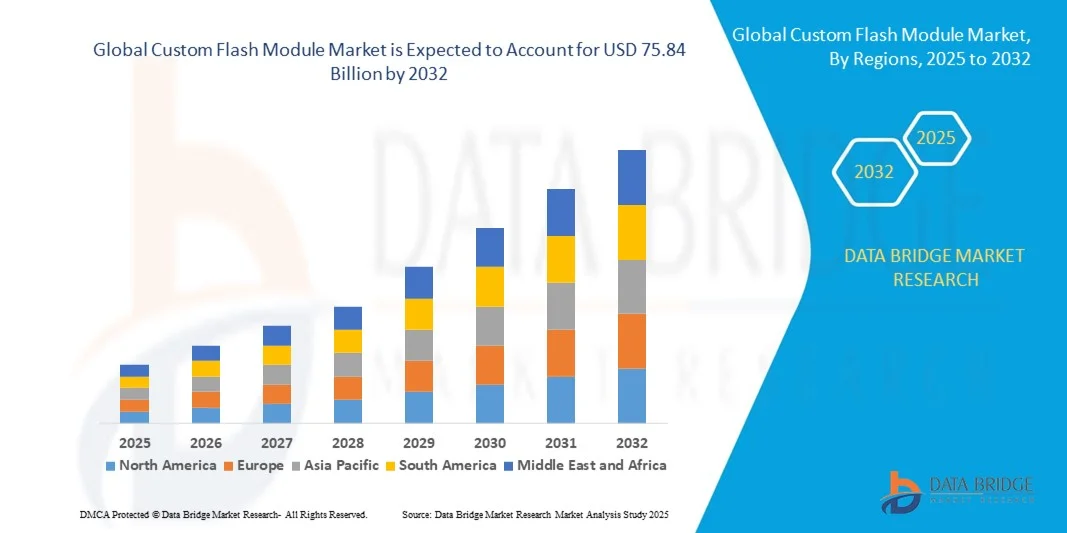

Global Custom Flash Module Market Size

- The global Custom Flash Module Market size was valued at USD 17.52 billion in 2024 and is projected to reach USD 75.84 billion by 2032, growing at a CAGR of 20.1o% during the forecast period.

- Market expansion is primarily driven by increasing integration of Custom Flash Modules in consumer electronics, automotive applications, and industrial automation, fueling demand for enhanced storage solutions.

- Additionally, advancements in memory technology and rising need for high-performance, reliable, and customizable flash storage are encouraging widespread adoption across diverse sectors, thereby accelerating market growth.

Global Custom Flash Module Market Analysis

- Custom Flash Modules, providing tailored non-volatile memory solutions for a wide range of applications including consumer electronics, automotive, and industrial sectors, are becoming essential components due to their enhanced performance, reliability, and adaptability to specific user needs.

- The rising demand for Custom Flash Modules is largely driven by advancements in digital storage technology, increasing data generation, and the need for high-speed, durable memory solutions in connected devices and IoT applications.

- North America led the global custom flash module market with the largest revenue share of 32.4% in 2024, supported by early adoption of advanced electronics, strong R&D infrastructure, and the presence of major semiconductor manufacturers driving innovation in customized memory solutions.

- Asia-Pacific is anticipated to be the fastest-growing region in the Global Custom Flash Module Market during the forecast period, propelled by rapid industrialization, growing electronics manufacturing hubs, and rising demand for smart devices and automotive electronics.

- The Block storage segment dominated the market with the largest revenue share of 45.6% in 2024, driven by its high-performance capabilities and suitability for structured data applications such as databases, virtual machines, and enterprise workloads.

Report Scope and Global Custom Flash Module Market Segmentation

|

Attributes |

Custom Flash Module Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Global Custom Flash Module Market Trends

Enhanced Performance Through AI Optimization and Edge Integration

- A significant and accelerating trend in the global Custom Flash Module Market is the integration of artificial intelligence (AI) with flash memory solutions, particularly for edge computing, autonomous systems, and AI-powered applications. This convergence is driving demand for faster, more reliable, and adaptive custom memory modules tailored to specific workloads.

- For Instance, Micron Technology has developed AI-optimized flash solutions that enhance data throughput and power efficiency, enabling real-time processing for AI-driven applications in automotive ADAS, industrial robotics, and smart surveillance systems. Similarly, Western Digital offers custom flash modules embedded with intelligence to support edge inference and data preprocessing.

- AI integration enables these flash modules to perform tasks such as predictive error correction, workload-aware memory allocation, and data prioritization, significantly improving performance and device longevity. In high-demand environments such as data centers and IoT networks, such capabilities are critical for managing large volumes of unstructured data efficiently and securely.

- The fusion of AI with flash storage also supports intelligent caching and adaptive wear leveling, enhancing storage reliability and speed for mission-critical applications. For instance, solutions from companies like IBM and Dell leverage AI-enhanced memory subsystems to accelerate workloads across hybrid cloud and enterprise AI platforms.

- This intelligent functionality is reshaping expectations around data storage and management, prompting OEMs and enterprises to prioritize custom flash modules with embedded AI capabilities for use in edge servers, smart devices, and autonomous systems.

- As demand grows for smarter, faster, and more energy-efficient data processing, especially in automotive, industrial, and AIoT sectors, the market is seeing a sharp rise in the adoption of AI-enhanced custom flash modules, led by innovations from major players like Micron, Western Digital, and Huawei.

Global Custom Flash Module Market Dynamics

Driver

Growing Demand Driven by Data-Intensive Applications and Digital Transformation

-

The rapid acceleration of digital transformation across industries, coupled with the surge in data-intensive applications such as AI, IoT, autonomous systems, and real-time analytics, is significantly driving demand for custom flash modules.

- For instance, in May 2024, Micron Technology announced the expansion of its custom flash product portfolio to cater specifically to AI workloads at the edge, enabling faster and more efficient data handling in connected and autonomous environments. This strategic move highlights how key players are adapting to meet growing market needs.

- Enterprises and device manufacturers are increasingly turning to tailored memory solutions that provide optimal performance, durability, and energy efficiency to support specific use cases in sectors like automotive, industrial automation, and telecommunications. Custom flash modules allow for this precision, offering features such as configurable capacity, rugged design, and enhanced read/write speeds.

- Additionally, the proliferation of edge devices and the need for real-time decision-making have further propelled the adoption of compact, high-speed flash memory solutions that can operate reliably in harsh or latency-sensitive environments.

- The ability to customize modules for unique requirements—whether it’s for small-form-factor devices, data logging in industrial systems, or persistent memory in AI-powered applications—is making custom flash modules an essential component in next-generation digital infrastructure across both developed and emerging markets.

Restraint/Challenge

Supply Chain Constraints and High Customization Costs

- Despite strong demand, the global Custom Flash Module Market faces challenges related to supply chain disruptions and the high costs associated with designing and producing specialized flash memory solutions. These factors can limit scalability and accessibility, particularly for smaller businesses or cost-sensitive sectors.

- For instance, ongoing geopolitical tensions and raw material shortages in 2024 have affected the semiconductor supply chain, resulting in longer lead times and increased production costs for flash memory components.

- The high cost of R&D and the complexity of designing modules tailored to niche applications—such as automotive-grade or rugged industrial environments—pose financial and technical barriers for some market entrants. Additionally, frequent changes in device specifications and evolving industry standards require continuous innovation, further driving up development costs.

- Customization also reduces the economies of scale typically available to standard memory products, making it harder for smaller OEMs to adopt these solutions at a competitive price.

- Addressing these challenges will require investment in localized manufacturing, partnerships for supply chain resilience, and the development of modular platforms that allow for cost-effective customization. Companies that can offer scalable, reliable, and affordable custom flash solutions—while ensuring supply chain stability—will be best positioned for long-term success in this fast-evolving market.

Global Custom Flash Module Market Scope

Custom flash module market is segmented on the basis of storage architecture/access pattern and end user

- By Storage Architecture/Access Pattern

On the basis of storage architecture/access pattern, the Global Custom Flash Module Market is segmented into File, Object, and Block storage. The Block storage segment dominated the market with the largest revenue share of 45.6% in 2024, driven by its high-performance capabilities and suitability for structured data applications such as databases, virtual machines, and enterprise workloads. Block storage enables low-latency, high-speed access, making it the preferred choice for mission-critical and high-I/O environments.

The Object storage segment is projected to witness the fastest CAGR of 21.3% from 2025 to 2032. This growth is fueled by the surge in unstructured data from cloud-native applications, media content, IoT devices, and backup systems. Object storage offers scalability, metadata capabilities, and cost-effective long-term retention, which makes it ideal for modern data lakes and archival storage. Its integration with AI-driven analytics and cloud platforms further supports its rapid adoption across industries.

- By End User

On the basis of end user, the Global Custom Flash Module Market is segmented into Enterprise, Banking, Financial Services, and Insurance (BFSI), Healthcare, Media and Entertainment, Retail, Government, Cloud, and Others. The Enterprise segment held the largest market share of 38.7% in 2024, driven by the increasing need for high-performance data storage solutions to support business-critical operations, virtualization, and big data analytics. Custom flash modules help enterprises optimize performance and reliability while reducing latency and energy consumption.

The Cloud segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, owing to the rising demand for scalable, high-throughput storage in cloud data centers and hyperscale environments. Cloud service providers are adopting custom flash modules to enhance workload flexibility, reduce downtime, and meet growing demand for SaaS, IaaS, and AI workloads. Furthermore, the shift toward hybrid and multi-cloud infrastructure is reinforcing the need for customized, high-speed storage solutions across distributed networks.

Global Custom Flash Module Market Regional Analysis

- North America dominated the Global Custom Flash Module Market with the largest revenue share of 32.4% in 2024, driven by strong demand for high-performance storage in data-intensive industries such as IT, telecom, automotive, and cloud computing. The region benefits from a mature semiconductor ecosystem and rapid adoption of AI, IoT, and edge computing technologies.

- Enterprises and tech companies in the U.S. and Canada are increasingly adopting custom flash modules to meet growing storage needs, enhance processing speed, and ensure data reliability in mission-critical applications.

- This widespread adoption is further supported by robust R&D investments, presence of key market players like Micron, Western Digital, and Dell, and a high level of technological readiness. Additionally, increasing digital transformation initiatives and demand for energy-efficient storage solutions across commercial and industrial sectors are contributing to North America's leadership in the custom flash module landscape.

U.S. Custom Flash Module Market Insight

The U.S. custom flash module market captured the largest revenue share of 79% in 2024 within North America, driven by robust demand for high-performance storage solutions in cloud computing, AI, automotive, and enterprise applications. The country’s strong presence of leading technology firms, including Micron, Western Digital, and Intel, continues to fuel innovation in custom memory solutions. With the growing adoption of edge computing and data-intensive applications, U.S. enterprises are increasingly relying on customizable flash storage to optimize performance, scalability, and energy efficiency. The shift toward AI-driven infrastructure and 5G deployment further reinforces the need for reliable, low-latency storage.

Europe Custom Flash Module Market Insight

The Europe custom flash module market is projected to grow at a substantial CAGR during the forecast period, supported by expanding industrial automation, digitization across sectors, and growing demand for localized data processing. Stringent data privacy regulations and initiatives like the EU’s Digital Strategy are encouraging investments in secure, high-performance storage solutions. Custom flash modules are increasingly being adopted in automotive, healthcare, and smart manufacturing applications. Additionally, sustainability concerns and energy efficiency standards are pushing European enterprises to adopt tailored memory solutions that balance performance and environmental responsibility.

U.K. Custom Flash Module Market Insight

The U.K. custom flash module market is expected to grow at a notable CAGR through the forecast period, fueled by the increasing reliance on digital services and the modernization of IT infrastructure across public and private sectors. The U.K.’s vibrant fintech and e-commerce ecosystems require fast, reliable, and secure storage—making custom flash modules a critical component in meeting operational demands. Growth is also driven by investments in cloud data centers and the integration of AI and analytics tools in business operations, where customized memory configurations improve processing efficiency and reduce latency.

Germany Custom Flash Module Market Insight

Germany’s custom flash module market is forecast to expand significantly, driven by the country’s advanced manufacturing base, industrial automation, and focus on innovation. As a leader in Industry 4.0, Germany is experiencing rising demand for customized memory in robotics, automotive systems, and smart factories. The push for energy-efficient and sustainable technology is also influencing purchasing decisions, with enterprises opting for flash modules that offer long lifespans, low power consumption, and high durability. Strong collaboration between industry and research institutions is supporting technological advancement in this space.

Asia-Pacific Custom Flash Module Market Insight

The Asia-Pacific custom flash module market is projected to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by rapid urbanization, industrial expansion, and the rise of connected devices. Countries like China, Japan, South Korea, and India are experiencing booming demand for flash-based storage in consumer electronics, telecommunications, and automotive sectors. Government support for semiconductor development and the growing number of domestic manufacturers are improving access to customized storage solutions. The region's large-scale adoption of 5G, AI, and IoT is further boosting demand for scalable, high-speed flash modules tailored to specific industry needs.

Japan Custom Flash Module Market Insight

Japan’s custom flash module market is gaining strong momentum, driven by its leading-edge electronics industry and emphasis on high-quality, precision-engineered solutions. Applications in automotive, robotics, and consumer electronics are particularly driving demand for durable and high-performance custom flash storage. With an aging population and labor shortage concerns, automation is expanding in both industrial and residential environments, increasing reliance on reliable flash memory. The integration of flash storage with edge AI and IoT devices is growing, supported by the country’s tech-savvy consumer base and established infrastructure.

China Custom Flash Module Market Insight

China accounted for the largest market revenue share in the Asia-Pacific custom flash module market in 2024, underpinned by its strong manufacturing ecosystem, large-scale adoption of smart devices, and ongoing investments in semiconductor development. The push toward self-sufficiency in core technologies, including memory, is driving domestic production and innovation. Custom flash modules are in high demand across various sectors—from smartphones and data centers to electric vehicles and surveillance systems. With initiatives such as “Made in China 2025,” the country is accelerating its focus on high-tech infrastructure and tailored storage solutions, contributing to sustained market expansion.

Global Custom Flash Module Market Share

The Custom Flash Module industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Cisco (U.S.)

- FUJITSU (Japan)

- Fortasa Memory Systems (U.S.)

- VIOLIN (United States)

- Huawei Technologies Co., Ltd. (China)

- Hewlett Packard Enterprise Development LP (U.S.)

- Nutanix (U.S.)

- Actifio Inc. (U.S.)

- NetApp (U.S.)

- Lenovo (China)

- Commvault Systems Inc. (U.S.)

- Dell Inc. (U.S.)

- IBM (U.S.)

- Western Digital Corporation (U.S.)

- Pure Storage, Inc. (U.S.)

- Kaminario (U.S.)

- Vexata (U.S.)

- Micron Technology, Inc. (U.S.)

- EchoStreams (U.S.)

What are the Recent Developments in Global Custom Flash Module Market?

- In May 2023, Micron Technology, Inc. announced the launch of its next-generation custom flash module solution optimized for AI and edge computing workloads. Designed to support real-time data processing in harsh environments, this new module features enhanced endurance, thermal management, and customizable capacity options. The product is particularly suited for autonomous vehicles, industrial automation, and IoT deployments, reinforcing Micron’s leadership in delivering application-specific memory innovations in the growing Global Custom Flash Module Market.

- In April 2023, Western Digital Corporation introduced a series of ultra-low latency custom flash modules targeted at data centers and high-frequency trading environments. Leveraging its proprietary architecture and controller design, the new solution offers faster read/write performance and improved reliability. This move reflects the company's strategic focus on providing scalable, high-performance storage tailored to specialized workloads, positioning Western Digital as a key player in the customized enterprise storage segment.

- In March 2023, Samsung Electronics partnered with leading automotive manufacturers to co-develop custom flash modules for next-generation infotainment and ADAS systems. The modules are engineered to support high-speed data logging and multimedia processing, ensuring faster boot times and improved user experiences in connected vehicles. This collaboration showcases Samsung’s commitment to expanding its custom memory solutions in automotive electronics, a rapidly growing segment of the flash module market.

- In February 2023, Intel Corporation unveiled a flexible custom flash solution integrated into its edge computing platforms. This offering is aimed at smart city infrastructure, industrial IoT, and healthcare systems requiring real-time analytics and localized storage. By offering modular customization, Intel allows system integrators to fine-tune performance, durability, and capacity based on project needs. The initiative underscores Intel’s focus on converging storage and compute capabilities in next-gen digital infrastructure.

- In January 2023, Kioxia Holdings Corporation (formerly Toshiba Memory) introduced a customizable NVMe-based flash module designed for hyperscale cloud providers and enterprise workloads. With enhanced scalability, power efficiency, and form factor flexibility, the module addresses the rising demand for tailored solutions in AI-driven data centers. This launch reflects Kioxia’s strategy to compete aggressively in the high-performance custom storage market and meet evolving enterprise data demands.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Custom Flash Module Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Custom Flash Module Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Custom Flash Module Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.