Global Cut Flower Packaging Market

Market Size in USD Billion

CAGR :

%

USD

13.20 Billion

USD

19.99 Billion

2024

2032

USD

13.20 Billion

USD

19.99 Billion

2024

2032

| 2025 –2032 | |

| USD 13.20 Billion | |

| USD 19.99 Billion | |

|

|

|

|

Cut Flower Packaging Market Size

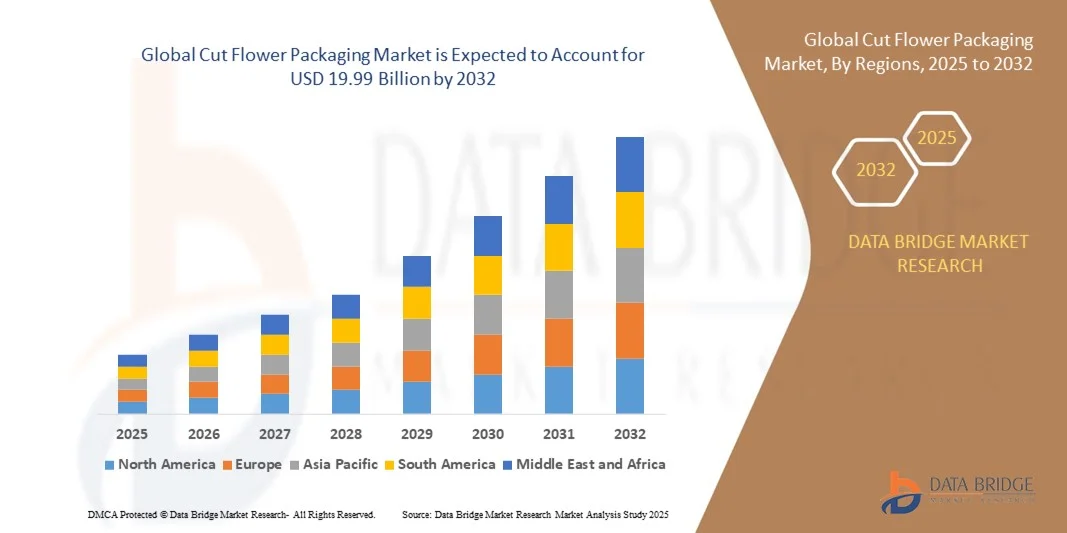

- The global cut flower packaging market size was valued at USD 13.2 billion in 2024 and is expected to reach USD 19.99 billion by 2032, at a CAGR of 5.33% during the forecast period

- The market growth is largely fuelled by the increasing demand for fresh cut flowers across retail, gifting, and floral decoration segments worldwide

- Rising adoption of eco-friendly and biodegradable packaging materials is driving innovation and encouraging sustainable practices within the floral supply chain

Cut Flower Packaging Market Analysis

- The market is experiencing steady growth due to technological advancements in packaging materials such as corrugated boxes, biodegradable films, and protective wraps that enhance flower shelf life and reduce damage during transit

- Increasing consumer preference for aesthetically appealing and sustainable packaging is encouraging manufacturers to adopt innovative designs and environmentally friendly materials

- Asia-Pacific dominated the cut flower packaging market with the largest revenue share of 42% in 2024, driven by rapid growth in floriculture, rising urbanization, and increasing exports of fresh flowers from countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global cut flower packaging market, driven by strong floriculture consumption, advanced logistics infrastructure, and growing awareness of eco-friendly and protective packaging options

- The Paper and Paperboard segment held the largest market revenue share in 2024, driven by its biodegradability, cost-effectiveness, and widespread use in retail and export packaging. Paper-based packaging solutions often provide structural strength, moisture retention, and easy customization, making them a preferred choice for florists and exporters

Report Scope and Cut Flower Packaging Market Segmentation

|

Attributes |

Cut Flower Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cut Flower Packaging Market Trends

Rise of Sustainable and Innovative Packaging Solutions

- The growing shift toward sustainable and biodegradable packaging is transforming the cut flower supply chain by reducing environmental impact while maintaining flower freshness during transport. Innovative packaging materials, including eco-friendly wraps, corrugated boxes, and protective films, are enabling longer shelf life and reducing waste

- The increasing demand for aesthetically appealing and functional packaging is accelerating the adoption of specialized designs such as perforated wraps, cushioning inserts, and humidity-controlled sleeves. These solutions help maintain flower quality during long-distance shipping and retail display

- The expansion of e-commerce and home delivery services for fresh flowers is driving the adoption of robust, lightweight, and protective packaging solutions. Consumers benefit from flowers arriving in pristine condition, supporting higher satisfaction and repeat orders

- For instance, in 2023, several European flower exporters reported reduced transit damage after implementing biodegradable, moisture-retaining wraps, which enhanced product presentation and reduced returns

- While sustainable and innovative packaging solutions are gaining traction, their widespread adoption depends on cost-efficiency, supply chain readiness, and compatibility with automated handling systems. Manufacturers must focus on scalable, customizable solutions to fully capitalize on this growing trend

Cut Flower Packaging Market Dynamics

Driver

Increasing Global Demand for Fresh Cut Flowers and Eco-Friendly Packaging

- The rising popularity of fresh flowers for gifting, décor, and commercial purposes is pushing floriculture and packaging companies to invest in advanced packaging solutions that preserve quality and aesthetics. Demand from retail chains, florists, and e-commerce platforms is further fueling growth. This trend is also supported by growing urbanization and rising disposable incomes, which increase flower consumption globally

- Growing awareness of environmental sustainability among consumers and businesses is encouraging the adoption of biodegradable, recyclable, and reusable packaging solutions. This trend is accelerating innovation in materials and designs. Regulatory support in several countries promoting eco-friendly packaging is also pushing companies to adopt greener alternatives

- Expansion of cold chain logistics and organized flower retail networks is improving the efficiency of flower distribution and enabling large-scale adoption of protective packaging solutions. Advanced logistics systems reduce spoilage, extend shelf life, and allow flowers to be shipped to distant markets without quality compromise

- For instance, in 2022, several Dutch exporters adopted moisture-controlled corrugated packaging for roses and tulips, reducing spoilage rates and enhancing shelf life during international shipments. Such innovations are enabling exporters to meet international quality standards and expand into new markets

- While global demand and sustainability concerns are driving growth, the need for affordable, lightweight, and scalable packaging solutions remains critical to ensure widespread adoption across small and medium-sized flower businesses. Manufacturers are increasingly focusing on customizable and modular packaging designs to cater to diverse market needs

Restraint/Challenge

High Cost of Advanced Packaging Solutions and Limited Awareness in Emerging Markets

- Advanced cut flower packaging solutions, such as biodegradable films, moisture-retaining wraps, and specialized corrugated boxes, often carry higher costs, limiting accessibility for small-scale floriculture operations. Cost remains a key barrier to adoption in price-sensitive markets. Smaller players often continue using conventional packaging that is less effective, leading to higher post-harvest losses

- In many emerging regions, there is limited awareness of proper flower handling and protective packaging techniques, which affects market penetration. Lack of training and technical knowledge often leads to higher post-harvest losses. Educational initiatives and workshops are needed to train farmers and distributors on modern packaging and handling practices

- Supply chain constraints, including inadequate cold storage and inefficient logistics, further restrict the use of sophisticated packaging solutions, resulting in inconsistent quality during transit. This affects international trade opportunities and reduces competitiveness of exporters in global markets

- For instance, in 2023, several flower exporters in South Asia reported that over 60% of shipments suffered quality degradation due to the absence of temperature-controlled and protective packaging solutions. Such challenges highlight the urgent need for infrastructure improvements and investment in supply chain modernization

- While innovation in packaging materials continues, addressing cost, awareness, and logistics challenges is crucial. Market stakeholders must focus on affordable, scalable, and easy-to-use packaging solutions to unlock the full potential of the cut flower packaging market. Collaboration between packaging manufacturers, floriculture associations, and governments can accelerate adoption and enhance market growth

Cut Flower Packaging Market Scope

The market is segmented on the basis of material type, packaging type, and distribution channel.

- By Material Type

On the basis of material type, the cut flower packaging market is segmented into Paper and Paperboard, Plastic, and Others. The Paper and Paperboard segment held the largest market revenue share in 2024, driven by its biodegradability, cost-effectiveness, and widespread use in retail and export packaging. Paper-based packaging solutions often provide structural strength, moisture retention, and easy customization, making them a preferred choice for florists and exporters.

The Plastic segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its durability, flexibility, and ability to preserve flower freshness during long-distance transport. Plastic-based wraps and protective films are particularly popular for online flower delivery and high-volume exports, offering enhanced protection against mechanical damage and environmental factors.

- By Packaging Type

On the basis of packaging type, the market is segmented into Sleeves, Boxes and Cartons, and Wrapping Sheets. The Boxes and Cartons segment held the largest share in 2024, supported by the need for robust packaging that prevents damage during storage and transit. Corrugated and specialty cartons are widely adopted by exporters and retail chains due to their stackability and moisture-control capabilities.

The Sleeves segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their ability to provide attractive presentation, protection, and easy handling. Sleeves are increasingly used for retail display and gifting purposes, especially in e-commerce deliveries where aesthetics and convenience are critical.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Florists, Supermarkets and Retail Stores, Online Sales, and Others. The Florists segment held the largest market share in 2024, supported by direct-to-consumer sales and personalized packaging solutions. Florists often prefer customizable packaging to enhance product appeal and cater to seasonal or special occasion demand.

The Online Sales segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing trend of e-commerce flower delivery and home gifting. Online platforms demand packaging that ensures flowers reach consumers in pristine condition, encouraging the adoption of innovative and protective materials.

Cut Flower Packaging Market Regional Analysis

- Asia-Pacific dominated the cut flower packaging market with the largest revenue share of 42% in 2024, driven by rapid growth in floriculture, rising urbanization, and increasing exports of fresh flowers from countries such as China, Japan, and India

- Consumers and businesses in the region highly value durable, sustainable, and aesthetically appealing packaging solutions that preserve flower quality during transit and retail display

- This widespread adoption is further supported by increasing disposable incomes, government initiatives promoting floriculture exports, and the growing trend of e-commerce flower sales, establishing Asia-Pacific as a key market for innovative cut flower packaging solutions

China Cut Flower Packaging Market Insight

The China cut flower packaging market captured the largest revenue share in 2024 within Asia-Pacific, fueled by the country’s expanding floriculture industry, rising middle-class consumer base, and growing demand for both domestic sales and exports. Protective and eco-friendly packaging solutions, such as corrugated boxes, moisture-retaining wraps, and biodegradable films, are increasingly adopted to maintain flower quality during shipment.

Japan Cut Flower Packaging Market Insight

The Japan cut flower packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by high demand for premium flowers, technological advancements in packaging, and the increasing trend of online flower delivery. Japanese consumers prefer aesthetically appealing, convenient, and eco-friendly packaging solutions, which is encouraging florists and exporters to adopt innovative materials and designs.

Europe Cut Flower Packaging Market Insight

The Europe cut flower packaging market is expected to witness the fastest growth rate from 2025 to 2032, supported by well-established floriculture industries, high export volumes, and strict sustainability regulations. Countries such as the Netherlands and Germany are key markets, where innovative packaging solutions such as biodegradable wraps, sleeves, and cartons are widely adopted.

Germany Cut Flower Packaging Market Insight

The Germany cut flower packaging market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by rising domestic demand for high-quality flowers and increasing adoption of biodegradable and recyclable packaging materials. The market is also supported by floriculture innovations and a growing trend of gifting flowers for corporate and personal occasions, boosting packaging requirements.

U.K. Cut Flower Packaging Market Insight

The U.K. cut flower packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing trend of online flower purchases and home delivery services. Rising consumer awareness of eco-friendly packaging and convenience in floral presentation is encouraging retailers to adopt innovative wraps, sleeves, and cartons.

North America Cut Flower Packaging Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by high consumer demand for fresh flowers, increasing floral gifting trends, and growing e-commerce flower delivery. Consumers and businesses in the region highly value visually appealing, protective, and sustainable packaging solutions that maintain flower quality during transit and retail display. The region’s well-developed logistics infrastructure, rising disposable incomes, and increasing adoption of eco-friendly materials are supporting market growth across retail and export channels.

U.S. Cut Flower Packaging Market Insight

The U.S. cut flower packaging market capture is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s high floriculture consumption, growing trend of online flower sales, and demand for premium, gift-ready flowers. Retailers and florists are increasingly adopting durable cartons, biodegradable wraps, and moisture-retaining sleeves to ensure flowers reach consumers in pristine condition. Moreover, sustainability concerns and government initiatives promoting eco-friendly packaging are further driving the adoption of advanced cut flower packaging solutions across residential, commercial, and e-commerce channels.

Cut Flower Packaging Market Share

The Cut Flower Packaging industry is primarily led by well-established companies, including:

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- UFlex Limited (India)

- Atlas Packaging (U.S.)

- Clondalkin Group (Netherlands)

- Sirane Ltd. (U.K.)

- A-ROO Company LLC (U.S.)

- Flamingo Holland Inc. (U.S.)

- Ernest Packaging Solutions (U.S.)

- KOEN PACK B.V. (Netherlands)

- Flopak, Inc. (U.S.)

- PerfoTec B.V. (Netherlands)

- Dilpack Kenya Limited (Kenya)

- Swedbrandgroup (Sweden)

Latest Developments in Global Cut Flower Packaging Market

- In February 2025, Carccu introduced its Boho-Inspired Flower Bouquet Wrapping Paper Trends for 2025, aiming to provide florists with sustainable and aesthetically appealing packaging options. The company plans to release around ten new patterns annually across its general and Christmas collections, catering to both classic and modern floral styles. This development enhances the variety and creativity available to florists, helping them meet diverse customer preferences while promoting ethically sourced materials. The initiative strengthens Carccu’s position in the floral packaging market and supports the growing demand for eco-friendly and visually appealing flower presentation solutions

- In December 2024, Ball Seed launched its 2025–2026 Cut Flower Catalog, an 82-page guide featuring national cut flower groups, expert recommendations, and a mix of traditional and modern floral varieties. This resource assists farmers in selecting high-quality flowers and planning their crops effectively. The catalog’s comprehensive information supports market growth by promoting informed cultivation practices and enhancing the availability of diverse flower varieties to meet consumer demand

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cut Flower Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cut Flower Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cut Flower Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.