Global Cutting Fluid Lubricants Market

Market Size in USD Billion

CAGR :

%

USD

126.46 Billion

USD

179.83 Billion

2025

2033

USD

126.46 Billion

USD

179.83 Billion

2025

2033

| 2026 –2033 | |

| USD 126.46 Billion | |

| USD 179.83 Billion | |

|

|

|

|

Global Cutting Fluid Lubricants Market Size

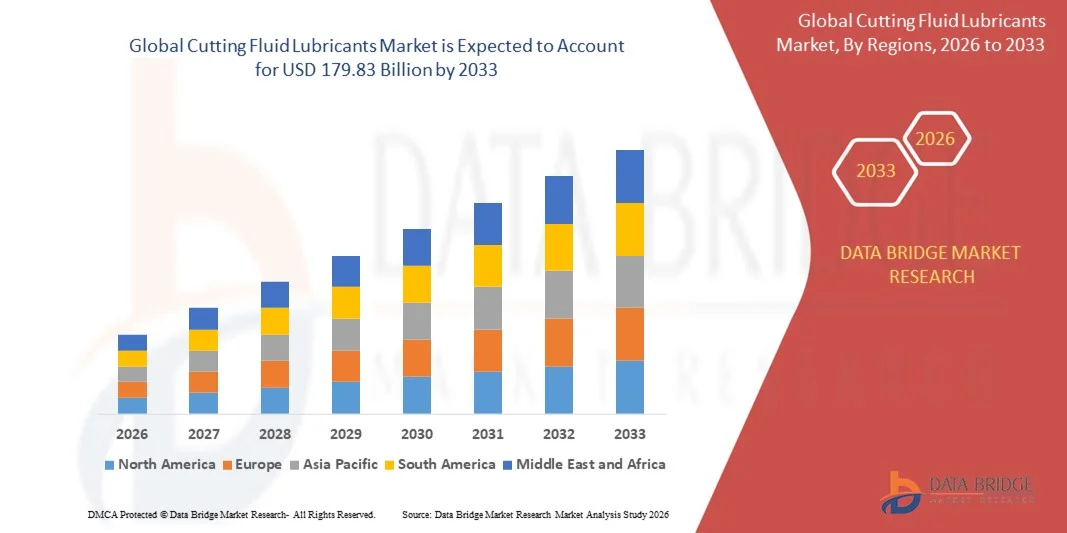

- The Global Cutting Fluid Lubricants Market was valued at USD 126.46 billion in 2025 and is projected to reach USD 179.83 billion by 2033, registering a CAGR of 4.50% throughout the forecast period.

- The market expansion is primarily driven by the increasing adoption of advanced machining technologies, coupled with rising industrial automation, which is boosting the demand for high-performance cutting fluids and lubricants across manufacturing sectors.

- Additionally, growing emphasis on operational efficiency, equipment longevity, and sustainable lubrication solutions is accelerating the shift toward innovative, eco-friendly cutting fluid formulations, thereby significantly contributing to the industry's overall growth.

Global Cutting Fluid Lubricants Market Analysis

- Cutting fluid lubricants, essential for cooling, lubrication, and friction reduction in metalworking operations, are becoming increasingly critical in modern manufacturing environments across automotive, aerospace, and heavy machinery industries due to their ability to enhance machining precision, tool life, and overall production efficiency.

- The rising demand for cutting fluid lubricants is primarily driven by the rapid adoption of advanced CNC machining, expanding industrial automation, and a growing preference for high-performance fluids that support faster production cycles and improved equipment protection.

- Asia-Pacific dominated the Global Cutting Fluid Lubricants Market with the largest revenue share of 34.3% in 2025, supported by a strong manufacturing base, early adoption of advanced machining technologies, and the presence of major market players, with the U.S. experiencing heightened demand from automotive, aerospace, and industrial machinery sectors increasingly focusing on precision engineering and productivity optimization.

- North America is expected to be the fastest-growing region in the Global Cutting Fluid Lubricants Market during the forecast period, driven by rapid industrialization, expanding production facilities, and rising investments in automotive and heavy engineering industries.

- The water-based cutting fluids segment dominated the market with the largest revenue share of 58.4% in 2024, driven by its superior cooling efficiency, lower viscosity, and ability to dissipate heat during high-speed machining processes.

Report Scope and Global Cutting Fluid Lubricants Market Segmentation

|

Attributes |

Cutting Fluid Lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Cutting Fluid Lubricants Market Trends

Technological Advancements Driving Performance and Automation

- A significant and rapidly growing trend in the Global Cutting Fluid Lubricants Market is the increasing integration of advanced technologies—such as smart monitoring systems, sensor-enabled equipment, and data-driven automation—into modern machining environments. These innovations are greatly enhancing operational efficiency, fluid performance, and process reliability across manufacturing sectors.

- For Instance, next-generation CNC machines are now being paired with intelligent lubrication systems that automatically adjust cutting fluid flow rates based on real-time machining conditions, improving tool life and optimizing coolant usage. Similarly, several leading lubricant manufacturers are developing formulations tailored for high-speed machining and automated production lines.

- Digital monitoring solutions enable features such as continuous assessment of fluid concentration, temperature, and contamination levels, allowing predictive maintenance and minimizing unplanned downtime. Some advanced fluid management systems can alert operators when fluid quality deteriorates or when replacement is needed, contributing to improved productivity and reduced operational costs.

- The seamless integration of cutting fluid management with broader Industry 4.0 platforms supports centralized control of manufacturing operations. Through a unified interface, users can track lubricant performance alongside machine status, energy usage, and overall equipment efficiency, creating a more synchronized and automated production ecosystem.

- This trend toward intelligent, high-performance, and automation-compatible cutting fluid solutions is reshaping expectations in industrial machining. As a result, companies are developing innovative formulations with enhanced thermal stability, lower environmental impact, and compatibility with smart monitoring systems.

- The demand for cutting fluids that offer advanced performance, improved sustainability, and compatibility with automated manufacturing technologies is accelerating across automotive, aerospace, metal fabrication, and emerging industrial sectors worldwide.

Global Cutting Fluid Lubricants Market Dynamics

Driver

Growing Demand Driven by Industrial Expansion and Precision Manufacturing Needs

- The rising need for enhanced machining efficiency, improved surface finish, and extended tool life across industries such as automotive, aerospace, metal fabrication, and heavy engineering is significantly accelerating the demand for cutting fluid lubricants.

- For Instance, ongoing investments in advanced manufacturing facilities and high-speed CNC machining systems are driving the adoption of specialized cutting fluids designed to handle higher temperatures, faster cutting speeds, and greater machining complexity. This shift toward precision engineering is expected to propel market growth in the forecast period.

- As manufacturers aim to reduce production downtime, increase productivity, and ensure consistent machining quality, cutting fluids provide critical benefits such as thermal control, reduced friction, and improved chip evacuation—offering a substantial upgrade over dry machining methods.

- Furthermore, the growing emphasis on automation and Industry 4.0–enabled workshops is making technologically advanced cutting fluids essential components of modern production environments, supporting cleaner operations, longer equipment lifespan, and stable machining performance.

- The increasing popularity of high-performance synthetic and semi-synthetic formulations, along with the demand for fluids compatible with automated fluid management systems, is driving adoption across both large-scale industries and small-to-medium machining enterprises. Expanding industrial infrastructure in emerging markets is also contributing to the rising global consumption of cutting fluids.

Restraint/Challenge

Environmental Regulations and High Disposal Costs

- Strict environmental regulations associated with the handling, usage, and disposal of cutting fluids pose a significant challenge to broader market adoption. Concerns related to hazardous waste, chemical exposure, and workplace safety have prompted stricter compliance requirements, creating operational and cost-related burdens for manufacturers.

- For instance, reports highlighting the environmental impact of mineral-based cutting fluids—particularly their disposal challenges and potential health risks—have led to increased scrutiny and hesitation among smaller workshops with limited waste management capabilities.

- Addressing these regulatory and environmental concerns through the development of eco-friendly, biodegradable formulations and improved waste treatment technologies is essential for strengthening market confidence. Leading companies are investing in low-toxicity, water-based, and long-life cutting fluids to reduce disposal frequency and minimize environmental impact. Additionally, the relatively high cost of advanced synthetic fluids compared to conventional options can deter adoption among cost-sensitive users, particularly in developing regions or small fabrication units.

- Although long-term savings from reduced fluid consumption and longer tool life can offset the initial investment, the perceived upfront cost remains a barrier for many end-users who prioritize short-term budgeting.

- Overcoming these challenges through sustainable product innovation, improved recycling and filtration systems, and greater awareness of long-term cost benefits will be crucial for enabling continued and widespread market growth.

Global Cutting Fluid Lubricants Market Scope

Cutting fluid lubricants market is segmented on the basis of product type, source and end use industry.

- By Product Type

On the basis of product type, the Global Cutting Fluid Lubricants Market is segmented into water-based cutting fluids and neat oils. The water-based cutting fluids segment dominated the market with the largest revenue share of 58.4% in 2024, driven by its superior cooling efficiency, lower viscosity, and ability to dissipate heat during high-speed machining processes. Manufacturers prefer water-based fluids for their reduced environmental impact, cost-effectiveness, and compatibility with a wide range of metalworking operations, particularly milling, turning, and drilling. Their ease of maintenance, lower consumption rates, and suitability for automated machining lines further contribute to their widespread adoption.

The neat oils segment is expected to witness the fastest growth rate of 7.9% from 2025 to 2032, fueled by increasing usage in heavy-duty applications such as gear cutting, deep drilling, and grinding, where superior lubrication, reduced friction, and extended tool life are essential. Their oxidation stability and strong film strength make them ideal for precision machining of hard metals.

- By Source

On the basis of source, the Global Cutting Fluid Lubricants Market is segmented into bio-based and synthetic-based fluids. The synthetic-based segment dominated the market with the largest revenue share of 64.7% in 2024, attributed to its enhanced chemical stability, long-life performance, and ability to withstand high temperatures and pressures in advanced machining environments. Synthetic fluids offer excellent corrosion resistance, improved microbial control, and reduced foaming, making them a preferred choice in industries using high-speed CNC machines and automated systems. Their ability to deliver consistent lubrication and cooling under demanding operations strengthens their dominance.

The bio-based segment is anticipated to witness the fastest CAGR of 9.4% from 2025 to 2032, driven by growing regulatory pressure on industrial waste, increasing sustainability initiatives, and rising demand for biodegradable, environmentally safe cutting fluids. Bio-based formulations are increasingly adopted across Europe and Asia for their reduced toxicity, low disposal impact, and improved operator safety.

- By End Use Industry

On the basis of end use, the Global Cutting Fluid Lubricants Market is segmented into the metalworking industry, oil & gas industry, automotive industry, general manufacturing industry, and others. The metalworking industry accounted for the largest revenue share of 41.3% in 2024, driven by its extensive use of cutting fluids in operations such as milling, drilling, grinding, shaping, and turning. Rapid industrial expansion, rising production of machinery components, and the increasing adoption of CNC equipment continue to elevate fluid consumption in this segment. Cutting fluids play a key role in extending tool longevity, improving surface finish, and reducing thermal deformation, making them indispensable in precision machining applications.

The automotive industry is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, fueled by increasing vehicle production, rising demand for lightweight components, and the rapid growth of electric vehicle manufacturing. Complex auto parts requiring high-precision machining further accelerate the demand for advanced cutting fluid formulations.

Global Cutting Fluid Lubricants Market Regional Analysis

- Asia-Pacific dominated the Global Cutting Fluid Lubricants Market with the largest revenue share of 34.3% in 2025, driven by the region’s strong manufacturing base, technological advancements in machining processes, and widespread adoption of high-precision CNC equipment across industries.

- Manufacturers in the region prioritize cutting fluids that offer superior performance, extended tool life, and compatibility with automated production environments. The presence of well-established automotive, aerospace, and metal fabrication industries further amplifies the demand for advanced cutting fluid formulations.

- This growing adoption is also supported by high investment capacity, a technologically advanced industrial sector, and increasing emphasis on operational efficiency and sustainability. As companies focus on improving machining productivity, reducing downtime, and enhancing environmental compliance, cutting fluids have become an essential component of modern manufacturing practices in both large-scale and small-to-medium industrial facilities.

U.S. Cutting Fluid Lubricants Market Insight

The U.S. cutting fluid lubricants market captured the largest revenue share of 81% in 2025 within North America, driven by the country’s strong industrial base, increasing adoption of advanced CNC machining, and continuous expansion in sectors such as automotive, aerospace, metal fabrication, and heavy machinery. Manufacturers are prioritizing high-performance cutting fluids that enhance tool life, reduce friction, and support high-speed precision operations. The rise of automated manufacturing systems and Industry 4.0 practices further fuels demand for synthetic and semi-synthetic formulations compatible with smart monitoring technologies. Additionally, increasing emphasis on sustainability and compliance with safety regulations encourages industries to shift toward low-toxicity, longer-life cutting fluids. The growing need for improved efficiency, reduced downtime, and automated fluid management systems continues to position the U.S. as a key growth engine in the global market.

Europe Cutting Fluid Lubricants Market Insight

The Europe cutting fluid lubricants market is projected to grow at a substantial CAGR throughout the forecast period, supported by the region's well-established automotive and heavy engineering sectors, along with stringent environmental and workplace safety regulations. Increasing demand for high-performance, energy-efficient machining solutions is encouraging the adoption of advanced synthetic and bio-based cutting fluids. Rising urbanization, industrial automation, and the widespread adoption of precision machining technologies are further driving growth. European manufacturers also emphasize sustainability, leading to stronger demand for biodegradable and low-emission formulations. The region is witnessing rising usage across metalworking, die-casting, and general fabrication, with cutting fluids increasingly integrated into upgraded production lines, both in new installations and renovation projects.

U.K. Cutting Fluid Lubricants Market Insight

The U.K. cutting fluid lubricants market is anticipated to grow at a notable CAGR during the forecast period, propelled by increasing investments in advanced manufacturing capabilities and growing adoption of CNC machining across automotive, aerospace, and industrial machinery sectors. Rising concerns regarding operational efficiency, tool wear reduction, and improved manufacturing precision are accelerating the adoption of high-performance cutting fluids. Additionally, the U.K.’s strong focus on automation and digital manufacturing technologies continues to drive fluid usage within modernized workshops. The country’s expanding engineering services industry, paired with a preference for sustainable and compliant industrial solutions, is also expected to stimulate further market growth.

Germany Cutting Fluid Lubricants Market Insight

The Germany cutting fluid lubricants market is expected to expand at a considerable CAGR over the forecast period, supported by the country’s advanced industrial infrastructure and strong emphasis on high-precision engineering. Germany’s leadership in automotive, aerospace, and machinery manufacturing drives consistent demand for reliable, thermally stable, and environmentally compliant cutting fluids. The growing shift toward eco-conscious solutions and stringent regulations on hazardous chemicals are encouraging broader adoption of synthetic and bio-based formulations. Additionally, German manufacturers’ focus on innovation, automation, and energy-efficient production systems enhances the need for cutting fluids that deliver long-lasting performance and reduced maintenance requirements.

Asia-Pacific Cutting Fluid Lubricants Market Insight

The Asia-Pacific cutting fluid lubricants market is poised to grow at the fastest CAGR of 24% during 2026–2032, driven by rapid industrialization, increasing manufacturing activity, and rising investments in automotive, electronics, and metal fabrication sectors across China, Japan, India, and Southeast Asia. The region’s strong economic expansion, coupled with government initiatives supporting industrial modernization and digitalization, is accelerating the adoption of advanced cutting fluids. APAC’s position as a global manufacturing hub also contributes to high consumption, with many cutting fluid producers expanding local production facilities to meet rising demand. Growing emphasis on efficiency, improved tool life, and cost-effective manufacturing further strengthens market growth.

Japan Cutting Fluid Lubricants Market Insight

The Japan cutting fluid lubricants market is gaining momentum due to the country’s technologically advanced manufacturing landscape and strong focus on precision engineering. With rising automation, robotics adoption, and increasing production complexity, Japanese industries require cutting fluids that deliver superior thermal management and lubrication. The country also prioritizes environmentally friendly and low-emission fluids, contributing to higher demand for synthetic and bio-based options. Japan’s aging workforce is driving further automation, increasing the need for high-performance fluids that support continuous, uninterrupted production in both industrial and commercial workshops.

China Cutting Fluid Lubricants Market Insight

The China cutting fluid lubricants market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrial expansion, a booming manufacturing sector, and widespread adoption of CNC machining across automotive, electronics, heavy machinery, and metalworking industries. China's strong domestic production capabilities and presence of numerous cutting fluid manufacturers contribute to its dominant position. The push toward smart factories, smart cities, and high-volume industrial output continues to boost demand for efficient cutting fluids. Additionally, the growing middle class and increasing infrastructure projects drive machining activity across construction, transportation, and energy sectors, further propelling market growth.

Global Cutting Fluid Lubricants Market Share

The Cutting Fluid Lubricants industry is primarily led by well-established companies, including:

• Fuchs Petrolub SE (Germany)

• Quaker Houghton / Houghton International (U.S.)

• Blaser Swisslube AG (Switzerland)

• ExxonMobil Corporation (U.S.)

• Castrol Limited (U.K.)

• Master Fluid Solutions (U.S.)

• TotalEnergies (France)

• Henkel AG & Co. KGaA (Germany)

• Cimcool / ITW (U.S.)

• Klüber Lubrication (Germany)

• Shenzhen Hengli Lubricants (China)

• Petro-Canada Lubricants (Canada)

• Shell Lubricants (Global)

• Milacron Holdings Corp. (U.S.)

• Lubrizol Corporation (U.S.)

• MotulTech (France)

• Hangzhou Qianjiang Lubricants (China)

• Oemeta GmbH (Germany)

• Panolin AG (Switzerland)

• Sinopec Lubricant Company Limited (China)

What are the Recent Developments in Global Cutting Fluid Lubricants Market?

- In April 2024, Fuchs Petrolub SE, a global leader in lubricants and metalworking fluids, launched a new line of high-performance synthetic cutting fluids in Southeast Asia. The initiative aims to support advanced manufacturing operations in the region by improving machining efficiency, extending tool life, and reducing environmental impact. By leveraging its global expertise and innovative formulations, Fuchs Petrolub is reinforcing its leadership position in the rapidly expanding Global Cutting Fluid Lubricants Market.

- In March 2024, Quaker Houghton / Houghton International introduced an advanced, biodegradable water-miscible cutting fluid, specifically designed for aerospace and automotive machining applications. The product enhances surface finish, minimizes friction, and supports sustainable manufacturing practices. This development highlights Houghton's commitment to providing technologically advanced and environmentally responsible solutions to industrial clients.

- In March 2024, ExxonMobil Corporation implemented a collaborative project with major CNC machine manufacturers in India to deploy smart cutting fluid monitoring systems. These solutions optimize fluid usage, reduce maintenance costs, and enhance precision machining performance. The initiative underscores ExxonMobil’s focus on integrating technology-driven efficiency into industrial operations, driving growth in the Global Cutting Fluid Lubricants Market.

- In February 2024, Blaser Swisslube AG, a leading provider of metalworking fluids, entered a strategic partnership with European automotive manufacturers to supply high-performance cutting fluids for electric vehicle component production. The collaboration aims to improve tool longevity, maintain consistent machining quality, and support sustainable production practices, demonstrating Blaser’s commitment to innovation and operational efficiency.

- In January 2024, Master Fluid Solutions, a prominent manufacturer of industrial cutting fluids, launched its next-generation semi-synthetic metalworking fluid at the IMTS 2024 in Chicago. The new formulation is designed for high-speed machining and automated production lines, offering improved cooling, reduced friction, and longer service life. The launch highlights Master Fluid Solutions’ dedication to enhancing manufacturing productivity and advancing the capabilities of the Global Cutting Fluid Lubricants Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cutting Fluid Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cutting Fluid Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cutting Fluid Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.