Global Cutting Tools Inserts Market

Market Size in USD Billion

CAGR :

%

USD

6.20 Billion

USD

8.20 Billion

2024

2032

USD

6.20 Billion

USD

8.20 Billion

2024

2032

| 2025 –2032 | |

| USD 6.20 Billion | |

| USD 8.20 Billion | |

|

|

|

|

Cutting Tools Inserts Market Analysis

The cutting tools inserts market has witnessed considerable technological progress, especially with the development of advanced materials and coatings that enhance the performance and lifespan of inserts. The introduction of carbide inserts, which provide higher wear resistance and hardness, has transformed machining processes in industries like automotive, aerospace, and metalworking. Alongside these material innovations, coating technologies, such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), have gained popularity. These coatings improve the cutting edge's durability and reduce friction, making the cutting process more efficient and cost-effective. The integration of smart technology, including sensors and data analytics, is also becoming increasingly relevant in cutting tools, allowing manufacturers to monitor real-time tool conditions and optimize cutting operations.

As manufacturing industries adopt automation and the need for precision increases, the demand for cutting tool inserts is on the rise. Key factors driving the market include advancements in manufacturing technologies, the growing need for high-precision and high-performance components, and the increasing trend of outsourcing to low-cost regions. Cutting tool inserts also play a crucial role in improving productivity by reducing downtime and enhancing tool life, which significantly benefits industries with high machining volume needs.

Cutting Tools Inserts Market Size

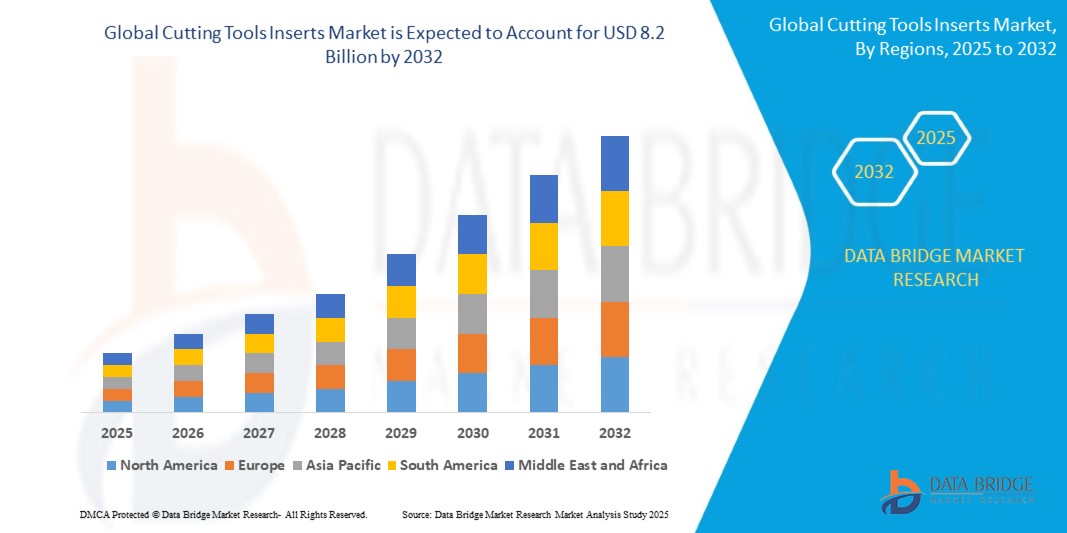

The global cutting tools inserts market size was valued at USD 6.2 billion in 2024 and is projected to reach USD 8.2 billion by 2032, with a CAGR of 3.60% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Cutting Tools Inserts Market Trends

“Emerging Demand for High-Performance Coated Inserts”

The growing trend towards high-performance cutting tools is one of the key drivers of the cutting tools inserts market. Coating technologies such as PVD and CVD are becoming increasingly popular as they improve tool life and operational efficiency, allowing for faster cutting speeds and deeper cuts. Coated inserts are used in high-precision applications, reducing the risk of wear and failure, which is particularly critical in sectors like aerospace, automotive, and electronics manufacturing. Companies such as Kennametal and Sandvik Coromant are leading the way in advancing cutting tool inserts with coatings designed to withstand extreme temperatures and cutting forces, making these tools ideal for high-performance machining operations.

Report Scope and Cutting Tools Inserts Market Segmentation

|

Attributes |

Clinical Microscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Sigma Toolings India Pvt. Ltd. (India), Kennametal (U.S.), Sandvik Coromant (Sweden), Mitsubishi Materials (Japan), Seco Tools (Sweden), Iscar (Israel), Kyocera Corporation (Japan), Tungaloy Corporation (Japan), Walter AG (Germany), Makino (Japan), Huareal (China), Winstar Cutting Technologies Corp. (China), ZhuZhou Otomo Tools & Metal Co.,Ltd (China), A-Tec Corp.(India), Focus Technology Co., Ltd. (China), WIDIA (Germany), WhizCut of Sweden AB (Sweden), UKO (China), ENS Cutting Tools Co., Ltd.(China), and Xiamen Betalent Carbide Co., Ltd (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Cutting Tools Inserts Market Definition

Cutting tools are tools used in manufacturing processes to remove material from a workpiece, shaping it into the desired form. These tools, made from materials like high-speed steel, carbide, or ceramics, are designed to withstand high temperatures and mechanical stresses during cutting operations. They are employed in various machining processes, such as turning, drilling, milling, and grinding, across industries like automotive, aerospace, and metalworking. Cutting tools include inserts, drills, taps, and end mills, each serving specific functions to achieve precision and efficiency in the production of components. These tools are essential for modern manufacturing, ensuring high-quality results.

Cutting Tools Inserts Market Dynamics

Drivers

- Increasing Demand for Precision in Manufacturing

The continuous rise in demand for precision machining in industries such as automotive, aerospace, and electronics is a key driver for the cutting tools inserts market. Industries requiring high-performance and durable parts are increasingly adopting cutting tools with advanced inserts that improve the quality of components and reduce material wastage. With the automotive sector experiencing rapid growth, particularly in electric vehicles (EVs) and autonomous vehicles, the need for cutting tools that can handle complex machining operations is greater than ever.

- Growth in Emerging Economies

The rise of manufacturing hubs in emerging economies such as India, China, and Southeast Asia is contributing to the global growth of the cutting tools inserts market. With more industries moving to these regions for cost advantages, the demand for efficient and cost-effective tooling solutions is rising. Moreover, the rapid development of infrastructure and industrial facilities in these regions further boosts the demand for cutting tools in sectors like construction, energy, and mining.

Opportunities

- Technological Advancements in Coatings and Materials

Advancements in coating technologies and new materials for cutting tool inserts present significant opportunities in the market. The development of coatings that enhance wear resistance and reduce friction is helping to extend the life of cutting tools, improving machining efficiency. In addition, the use of advanced materials, such as cermet and ceramic inserts, is enabling faster cutting speeds and superior performance under extreme conditions. These innovations will allow manufacturers to achieve higher throughput and cost reductions, thus contributing to market growth.

- Shift Towards Sustainable Manufacturing Practices

The growing emphasis on sustainability in manufacturing is presenting an opportunity for eco-friendly cutting tools. Manufacturers are increasingly seeking cutting tools that reduce environmental impact by minimizing material waste, reducing energy consumption, and offering longer tool life, which decreases the need for frequent replacements. This shift towards sustainable practices is motivating market players to invest in developing eco-friendly cutting tool solutions, thereby providing significant opportunities for growth in the market.

Restraints/Challenges

- High Initial Cost of Advanced Inserts

Despite the numerous benefits of advanced cutting tool inserts, the high initial cost of these tools remains a significant challenge for many small- and medium-sized enterprises (SMEs). The cost of high-performance inserts, particularly those with specialized coatings, can be prohibitive, limiting their adoption among budget-conscious manufacturers. This factor may hinder the widespread implementation of cutting-edge tools, especially in emerging markets with lower manufacturing budgets.

- Complexity in Tool Maintenance and Replacement

The maintenance and replacement of cutting tool inserts can be complex and costly. Improper handling or use of these inserts can result in wear and tear, leading to production downtime and increased operational costs. Additionally, the requirement for skilled labor to maintain and replace these inserts adds to the operational challenges. These factors can limit the adoption of cutting tools in industries with limited expertise or lower budgets for maintenance, thus slowing market expansion.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Cutting Tools Inserts Market Scope

The market is segmented on the basis of material type, application, coating, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material Type

- Carbide Inserts

- Steel

- Cast Iron

- Aluminum Alloy

- Plastics

- Ceramic inserts

- PCD inserts

- Cermet Inserts

- High-Speed Steel Inserts

- Others

Application

- Turning And Milling

- Drilling And Grinding

- Shearing And Cutting,

- Mining,

- Cutoff And Parting

Coating

- Uncoated

- PVD Coated

- CVD Coated

- TiN Coated

- TiCN Coated

- Al2O3 (aluminum oxide) Coated

- Others

End User

- Automotive

- Aerospace

- Construction

- Oil and Gas

- Die and Mould

- Medical

- Others

Cutting Tools Inserts Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, material type, application, coating, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

Asia-Pacific is expected to dominate the cutting tools inserts market due to rapid industrialization, growing manufacturing sectors, and technological advancements across countries like China, India, and Japan. The region benefits from an increasing demand for precision cutting tools in industries such as automotive, aerospace, and electronics. Additionally, significant government investments in infrastructure and manufacturing capabilities are driving demand for high-performance cutting tools, further establishing Asia-Pacific's leadership in the market.

North America and Europe are expected to exhibit the highest growth rate in the cutting tools inserts market due to increasing investments in advanced manufacturing technologies, strong industrial sectors, and demand for high-precision tools. Both regions are home to leading manufacturers and are seeing continuous developments in automation and digital manufacturing, which boost the demand for high-quality cutting tools. Additionally, ongoing industrial expansion in sectors like aerospace, automotive, and metalworking is expected to further accelerate market growth in these regions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Cutting Tools Inserts Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Cutting Tools Inserts Market Leaders Operating in the Market Are:

- Sigma Toolings India Pvt. Ltd. (India)

- Kennametal (U.S.)

- Sandvik Coromant (Sweden)

- Mitsubishi Materials (Japan)

- Seco Tools (Sweden)

- Iscar (Israel)

- Kyocera Corporation (Japan)

- Tungaloy Corporation (Japan)

- Walter AG (Germany)

- Makino (Japan)

- Huareal (China)

- Winstar Cutting Technologies Corp. (China)

- ZhuZhou Otomo Tools & Metal Co., Ltd (China)

- A-Tec Corp. (India)

- Focus Technology Co., Ltd. (China)

- WIDIA (Germany)

- WhizCut of Sweden AB (Sweden)

- UKO (China)

- ENS Cutting Tools Co., Ltd. (China)

- Xiamen Betalent Carbide Co., Ltd (China)

Latest Developments in Cutting Tools Inserts Market

- In July 2024, ARCH Cutting Tools has acquired O-D Tool & Cutter, a manufacturer of solid carbide and high-speed steel round tools based in Mansfield, Massachusetts. This acquisition strengthens ARCH's position in custom tooling and customer service. O-D Tool will merge with ARCH’s Smithfield, Rhode Island facility, and both will relocate to a new 30,000-square-foot campus in Lincoln, enhancing capabilities and supporting growth in the Northeast

- In September 2023, Seco Tools has introduced new products to enhance machining efficiency, including X-tra Long Solid Carbide Drills for deeper holes, CH1050 and CH2581 PCBN inserts for high-volume production, and MF2 chipbreakers for improved chip control in round carbide inserts

- In June, 2021, CERATIZIT has acquired 70% of Changzhou CW Toolmaker Inc., a Chinese company specializing in tungsten carbide cutting tools for industries like electronics, aviation, and mold making. This acquisition strengthens CERATIZIT's presence in Asia, enabling expansion into new markets, especially the 3C sector. The partnership enhances CERATIZIT's capabilities with high-quality production technologies and manufacturing capacities

- In May 2021, GWS Tool Group has acquired Indexable Cutting Tools of Canada, enhancing its ceramic insert capabilities with advanced microwave sintering technology. This acquisition strengthens GWS’s position in the cutting tools market, offering high-performance products for industries like aerospace, automotive, and power generation

- In June 2020, Seco Tools has acquired the cutting tool division of Quimmco Centro Tecnológico (QCT) in Mexico, strengthening its presence in North America. This acquisition enhances Seco’s capabilities in solid carbide tooling, particularly for the growing aerospace and automotive sectors, with operations continuing under the Seco Tools brand

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cutting Tools Inserts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cutting Tools Inserts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cutting Tools Inserts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.