Global Cyber Security In Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

8.20 Billion

USD

13.42 Billion

2024

2032

USD

8.20 Billion

USD

13.42 Billion

2024

2032

| 2025 –2032 | |

| USD 8.20 Billion | |

| USD 13.42 Billion | |

|

|

|

|

Cyber Security in Healthcare Market Size

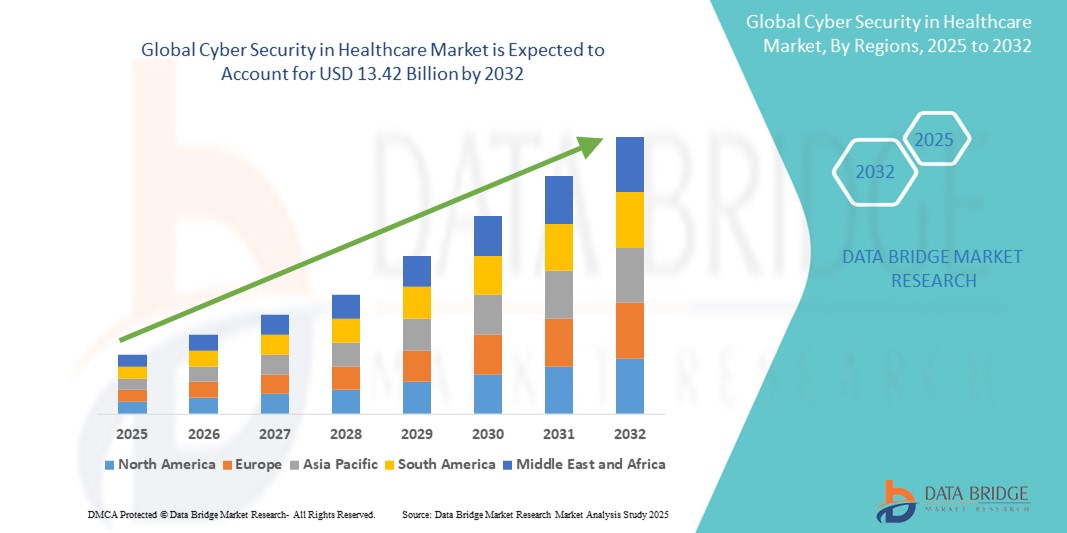

- The global cyber security in healthcare market size was valued at USD 8.20 billion in 2024 and is expected to reach USD 13.42 billion by 2032, at a CAGR of 6.34% during the forecast period

- The market growth is largely fueled by the increasing volume of sensitive patient data being digitized and the escalating frequency of cyber threats, prompting healthcare providers to prioritize robust digital protection frameworks

- Furthermore, regulatory pressures, adoption of telehealth, and growing reliance on cloud-based healthcare systems are driving demand for advanced cybersecurity solutions. These converging factors are accelerating the implementation of security protocols across the healthcare sector, thereby significantly boosting the industry's growth

Cyber Security in Healthcare Market Analysis

- Cyber security in healthcare, involving the protection of electronic health records, medical devices, and hospital infrastructure from unauthorized access and cyber threats, is becoming increasingly critical due to rising digitalization and the expansion of connected healthcare technologies in both clinical and non-clinical environments

- The escalating demand for healthcare cyber security is primarily fueled by the surge in cyberattacks targeting sensitive patient data, increasing adoption of telemedicine, and growing regulatory requirements for data protection and compliance

- North America dominated the cyber security in healthcare market with the largest revenue share of 42.1% in 2024, driven by a highly digitized healthcare infrastructure, stringent data privacy regulations such as HIPAA, and a strong presence of leading cyber security providers, with the U.S. experiencing rapid advancements in AI-based threat detection and cloud security platforms tailored for healthcare institutions

- Asia-Pacific is expected to be the fastest growing region in the cyber security in healthcare market during the forecast period due to expanding healthcare IT investments, rising cyber threat awareness, and government initiatives promoting healthcare digitization

- Network security segment dominated the cyber security in healthcare market with a market share of 39.4% in 2024, driven by its foundational role in safeguarding hospital networks, devices, and communication channels against data breaches and ransomware attacks

Report Scope and Cyber Security in Healthcare Market Segmentation

|

Attributes |

Cyber Security in Healthcare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cyber Security in Healthcare Market Trends

“AI-Driven Threat Detection and Cloud Integration Transforming Healthcare Cybersecurity”

- A significant and accelerating trend in the global cyber security in healthcare market is the increasing implementation of artificial intelligence (AI) and cloud-based solutions to detect, respond to, and prevent evolving cyber threats across healthcare systems. These innovations are greatly improving the ability of providers to safeguard sensitive data and ensure compliance with regulatory standards

- For instance, IBM Security offers AI-powered threat detection tailored for healthcare institutions, helping identify abnormal behavior and mitigate risks before breaches occur. Similarly, companies such as Palo Alto Networks and CrowdStrike are deploying healthcare-specific security tools that integrate with cloud platforms to deliver scalable, real-time protection

- AI-based tools enable predictive threat analysis, identifying patterns that indicate potential cyberattacks before they happen. These systems also facilitate automatic response mechanisms, minimizing response times and reducing the burden on IT teams. In addition, cloud-based platforms provide greater data flexibility, centralized monitoring, and faster threat containment, which are crucial in critical healthcare settings

- Seamless integration with hospital information systems and electronic health record (EHR) platforms allows for a more cohesive cybersecurity infrastructure, enabling real-time alerts, patient data protection, and compliance with data privacy regulations such as HIPAA and GDPR

- This trend toward advanced, intelligent, and integrated cyber defenses is transforming the way healthcare institutions manage data security. As a result, major providers such as Fortinet and Cisco are prioritizing healthcare-ready solutions that blend AI, machine learning, and cloud security to deliver end-to-end protection

- The growing demand for predictive, automated, and adaptive cybersecurity tools is expected to continue rising, driven by increased cyberattacks, the expansion of remote care models, and the need for uninterrupted access to health systems globally

Cyber Security in Healthcare Market Dynamics

Driver

“Rising Cyber Threat Landscape and Healthcare Digitalization Fuel Demand”

- The increasing frequency and sophistication of cyberattacks targeting healthcare providers and the rapid digitization of healthcare infrastructure are major drivers propelling the growth of the cyber security in healthcare market

- For instance, in February 2024, the U.S. Department of Health and Human Services announced a federal initiative to enhance hospital cybersecurity infrastructure, allocating funds to support small and mid-sized providers in deploying advanced threat detection systems. Such regulatory and institutional initiatives are expected to significantly boost market demand

- The surge in remote consultations, cloud-based EHRs, and connected medical devices has made healthcare institutions more vulnerable, prompting greater investment in cybersecurity measures such as endpoint security, encryption, and identity access management.

- Furthermore, compliance requirements such as HIPAA in the U.S. and the GDPR in Europe are compelling healthcare organizations to upgrade their cybersecurity protocols to avoid costly penalties and protect patient trust

- The growing reliance on third-party vendors, telehealth platforms, and mobile health applications also expands the threat surface, necessitating comprehensive and proactive security strategies. These factors, combined with the critical nature of healthcare data, are driving adoption across hospitals, clinics, and digital health startups

Restraint/Challenge

“Budget Constraints and Shortage of Cybersecurity Talent in Healthcare”

- Despite the urgency, limited IT budgets and a shortage of specialized cybersecurity professionals present key challenges to widespread adoption, particularly in small and rural healthcare facilities that may lack resources to deploy advanced security systems

- For instance, a 2024 survey by HIMSS revealed that over 45% of healthcare providers cited budget limitations and staffing shortages as primary barriers to implementing modern cybersecurity frameworks

- In addition, managing cybersecurity in highly regulated environments requires continuous compliance monitoring, regular audits, and specialized expertise, which many healthcare organizations find difficult to maintain

- The fragmented nature of healthcare IT systems and legacy infrastructure further complicates the deployment of uniform and effective cybersecurity measures. Without standardization, inconsistencies in protection levels across departments can expose vulnerabilities

- Moreover, the perception of cybersecurity as a cost center rather than a strategic investment can delay critical upgrades

- Overcoming this mindset, along with improving access to funding, skilled personnel, and training, is essential for ensuring resilient and secure digital healthcare environments worldwide

Cyber Security in Healthcare Market Scope

The market is segmented on the basis of type, type of threat, security measures, and deployment.

- By Type

On the basis of type, the cyber security in healthcare market is segmented into solutions and services. The solutions segment dominated the market with the largest revenue share in 2024, driven by the growing need for integrated cybersecurity tools that safeguard healthcare infrastructure from increasing cyberattacks. These include firewalls, intrusion detection systems, endpoint protection, encryption solutions, and identity and access management platforms. Hospitals and health systems are prioritizing these technologies to prevent data breaches and ensure compliance with regulatory mandates such as HIPAA and GDPR.

The services segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for managed security services, consulting, risk assessments, and incident response support. As many healthcare institutions lack in-house cybersecurity expertise, they are turning to external service providers for ongoing threat monitoring, system upgrades, and regulatory advisory.

- By Type Of Threat

On the basis of threat type, the cyber security in healthcare market is segmented into ransomware, malware and spyware, distributed denial of services (DDoS), phishing, and spear-phishing. The ransomware segment dominated the market in 2024 due to the alarming rise in targeted attacks on hospitals and clinics that often result in operational disruptions and significant financial losses. Healthcare organizations, considered soft targets due to their critical nature and legacy systems, are increasingly adopting ransomware protection tools.

The phishing and spear-phishing segment is projected to grow at the fastest pace over the forecast period. The sophistication of phishing techniques targeting healthcare professionals through emails and fake portals has triggered a surge in demand for email security and user awareness training solutions.

- By Security Measures

On the basis of security measures, the cyber security in healthcare market is segmented into application security, network security, and device security. The network security segment held the largest market share of 39.4% in 2024, driven by the need to protect internal hospital networks, EHR systems, and cloud databases from breaches. Key solutions include intrusion prevention systems (IPS), secure VPNs, and firewalls.

The device security segment is expected to grow the fastest from 2025 to 2032, propelled by the increasing use of connected medical devices and IoT-based diagnostic tools. The complexity of securing multiple endpoints within a healthcare environment is accelerating demand for robust endpoint detection and response (EDR) platforms and device authentication protocols.

- By Deployment

On the basis of deployment, the cyber security in healthcare market is segmented into on-premises and cloud-based solutions. The cloud-based segment dominated the market in 2024, attributed to the scalability, cost-efficiency, and centralized management offered by cloud security solutions. With the rapid digitization of healthcare and increased reliance on telemedicine and cloud-hosted EHRs, cloud cybersecurity tools are gaining prominence among both large hospital networks and smaller providers.

The on-premises segment continues to serve institutions that prioritize full control over data and have the infrastructure to support in-house cybersecurity frameworks. It remains relevant in regions with strict data sovereignty laws or limited cloud adoption.

Cyber Security in Healthcare Market Regional Analysis

- North America dominated the cyber security in healthcare market with the largest revenue share of 42.1% in 2024, driven by a highly digitized healthcare infrastructure, stringent data privacy regulations such as HIPAA, and a strong presence of leading cyber security providers, with the U.S. experiencing rapid advancements in AI-based threat detection and cloud security

- Healthcare providers in the region prioritize robust cybersecurity solutions to safeguard sensitive patient data and ensure uninterrupted medical services, especially with the increasing use of telehealth platforms, electronic health records (EHRs), and connected medical devices

- This strong market presence is further supported by high healthcare IT spending, advanced cloud infrastructure, and a well-established network of cybersecurity vendors offering AI-driven and compliance-focused solutions tailored to the healthcare sector

U.S. Cyber Security in Healthcare Market Insight

The U.S. cyber security in healthcare market captured the largest revenue share of 82.3% in 2024 within North America, driven by the rapid adoption of electronic health records (EHRs), growing threats of ransomware attacks, and strict enforcement of HIPAA compliance. Healthcare providers are heavily investing in advanced cybersecurity tools such as AI-based threat detection, multi-factor authentication, and cloud security platforms. The increasing use of telehealth services and connected medical devices is further amplifying the demand for comprehensive security solutions to protect patient data and maintain operational continuity.

Europe Cyber Security in Healthcare Market Insight

The Europe cyber security in healthcare market is projected to expand at a substantial CAGR throughout the forecast period, largely driven by stringent data privacy regulations such as the General Data Protection Regulation (GDPR) and increasing cases of cyberattacks targeting healthcare institutions. The rise in digitized healthcare services, coupled with growing demand for cloud-based EHR systems, is propelling cybersecurity investments. European nations are prioritizing infrastructure upgrades and cross-border digital health initiatives, enhancing the uptake of healthcare-specific cyber security solutions across public and private sectors.

U.K. Cyber Security in Healthcare Market Insight

The U.K. cyber security in healthcare market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the National Health Service’s (NHS) digital transformation initiatives and increasing incidences of healthcare-related cyberattacks. The market is also being driven by enhanced data security policies, strong cloud adoption, and growing telemedicine platforms. Healthcare institutions are actively deploying network monitoring, endpoint protection, and training solutions to fortify systems against phishing and ransomware threats.

Germany Cyber Security in Healthcare Market Insight

The Germany cyber security in healthcare market is expected to expand at a considerable CAGR during the forecast period, fueled by the government’s commitment to strengthening digital infrastructure in the healthcare sector. The integration of EHR systems and telemedicine solutions has amplified the need for advanced cyber protection. Germany’s focus on data privacy, combined with a rising number of cyber incidents, is encouraging hospitals and clinics to adopt next-generation firewalls, encryption tools, and threat intelligence systems aligned with European cybersecurity standards.

Asia-Pacific Cyber Security in Healthcare Market Insight

The Asia-Pacific cyber security in healthcare market is poised to grow at the fastest CAGR of 25.4% during the forecast period of 2025 to 2032, driven by the digital transformation of healthcare services across countries such as China, India, and Japan. Increasing cyberattacks, government regulations mandating data security, and a surge in telehealth platforms are major growth catalysts. In addition, the region’s expanding healthcare infrastructure and growing IT investments are enabling broader implementation of cyber protection tools, especially in urban healthcare centers and smart hospital projects.

Japan Cyber Security in Healthcare Market Insight

The Japan cyber security in healthcare market is gaining momentum due to the country’s strong emphasis on technological innovation, data privacy, and operational resilience. The healthcare sector is rapidly adopting AI-driven cyber solutions and zero-trust security frameworks to combat rising threats. With a high density of connected medical devices and an aging population, the need for secure, interoperable systems is growing. Japan’s government initiatives supporting medical IT modernization are further bolstering market expansion.

India Cyber Security in Healthcare Market Insight

The India cyber security in healthcare market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rapid healthcare digitalization, increasing cyber threat awareness, and supportive government initiatives such as the National Digital Health Mission (NDHM). India’s expanding hospital networks and digital health startups are fueling demand for cloud security, identity management, and endpoint protection solutions. The rising volume of patient data, coupled with the growth of telemedicine and wearable health technologies, underscores the critical need for robust cyber defenses across both urban and rural healthcare systems.

Cyber Security in Healthcare Market Share

The cyber security in healthcare industry is primarily led by well-established companies, including:

- Lockheed Martin Corporation (U.S.)

- IBM (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- CyberArk Software Ltd. (Israel)

- F5, Inc. (U.S.)

- FireEye, Inc. (U.S.)

- Forcepoint (U.S.)

- Fortinet, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Oracle (U.S.)

- Palo Alto Networks (U.S.)

- Imperva (U.S.)

- Qualys, Inc. (U.S.)

- Accenture (Ireland)

- HCL Technologies Limited (India)

- Northrop Grumman (U.S.)

- Capgemini (France)

- Cognizant (U.S.)

- Tata Consultancy Services Limited (India)

- Wipro (India)

What are the Recent Developments in Global Cyber Security in Healthcare Market?

- In April 2023, IBM launched new AI-driven threat detection capabilities within its IBM Security QRadar Suite, specifically tailored for the healthcare sector. This innovation enables early identification of anomalies in hospital networks and electronic health record systems, helping healthcare providers prevent breaches before they escalate. The development highlights IBM's strategic focus on delivering industry-specific cybersecurity solutions that combine real-time analytics with regulatory compliance tools

- In March 2023, Palo Alto Networks partnered with National Health Service (NHS) Digital in the U.K. to strengthen cybersecurity infrastructure across multiple NHS trusts. The collaboration focuses on implementing next-generation firewalls and endpoint protection to guard against rising ransomware attacks in the healthcare system. This initiative underscores the growing necessity for collaborative, large-scale defenses in the face of increasing cyber threats to public healthcare institutions

- In February 2023, Fortinet introduced a Zero Trust Network Access (ZTNA) framework for healthcare organizations, emphasizing secure remote access for telemedicine and distributed care settings. Designed to minimize internal and external threats, the solution integrates identity verification, device posture checks, and application control. Fortinet’s development reflects the industry's shift toward trust-based, adaptive security models amid evolving healthcare delivery methods

- In February 2023, Cisco announced the deployment of its SecureX platform across several hospitals in Southeast Asia, supporting unified security visibility and automation. This move supports the region’s growing healthcare digitalization efforts and offers scalable cybersecurity infrastructure to address rising threats. Cisco’s initiative highlights its role in enabling healthcare providers to streamline threat response and improve operational resilience

- In January 2023, Trend Micro collaborated with Philippine General Hospital (PGH) to implement comprehensive endpoint protection and data loss prevention systems. The project aims to secure patient data and enhance PGH’s cybersecurity posture as the hospital increases its use of cloud-based health systems. This development showcases the importance of private-public partnerships in advancing cybersecurity in developing healthcare markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.