Global Cyclin Dependent Kinase Inhibitor Market

Market Size in USD Billion

CAGR :

%

USD

2.89 Billion

USD

10.14 Billion

2024

2032

USD

2.89 Billion

USD

10.14 Billion

2024

2032

| 2025 –2032 | |

| USD 2.89 Billion | |

| USD 10.14 Billion | |

|

|

|

|

Cyclin-dependent Kinase Inhibitor Market Size

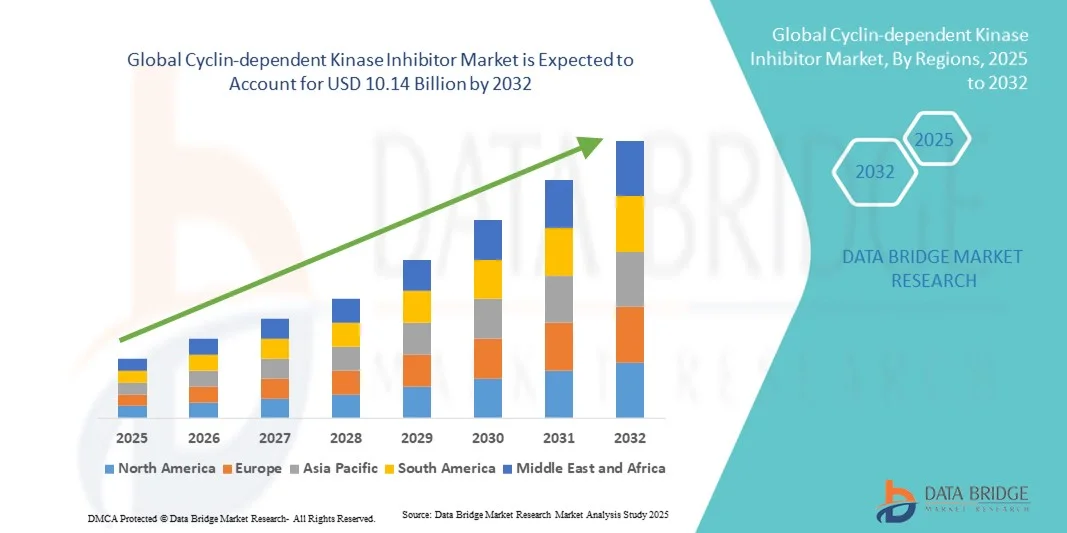

- The global cyclin-dependent kinase inhibitor market size was valued at USD 2.89 billion in 2024 and is expected to reach USD 10.14 billion by 2032, at a CAGR of 17.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of various cancers and neurodegenerative diseases, leading to a higher demand for targeted and effective therapeutic options. Continuous advancements in oncology research and drug development are further propelling market expansion

- Furthermore, growing adoption of precision medicine and combination therapies, along with rising investments by pharmaceutical companies in developing next-generation Cyclin-dependent Kinase (CDK) inhibitors, is accelerating the uptake of these solutions, thereby significantly boosting the industry’s growth

Cyclin-dependent Kinase Inhibitor Market Analysis

- Cyclin-dependent kinase inhibitors (CDKIs) have emerged as crucial agents in targeted cancer therapy, offering potent regulation of the cell cycle by inhibiting cyclin-CDK complexes involved in uncontrolled tumor proliferation. These inhibitors are primarily used in the treatment of breast cancer, lung cancer, and other solid tumors, demonstrating strong therapeutic efficacy and tolerability when used in combination with hormonal or chemotherapeutic regimens

- The increasing prevalence of cancer worldwide, coupled with rising demand for precision oncology treatments, is significantly propelling the adoption of CDK inhibitors. Growing R&D investments, clinical advancements, and approvals of next-generation inhibitors with enhanced selectivity and reduced toxicity are driving robust market expansion

- North America dominated the cyclin-dependent kinase inhibitor market with the largest revenue share of 41.6% in 2024, driven by strong research infrastructure, early adoption of targeted therapies, and substantial oncology drug expenditure. The U.S. remains the core growth engine due to the wide availability of FDA-approved drugs such as palbociclib, abemaciclib, and ribociclib, as well as ongoing clinical trials exploring expanded indications for these agents

- Asia-Pacific is expected to be the fastest growing region in the cyclin-dependent kinase inhibitor market during the forecast period, registering a CAGR from 2025 to 2032, owing to increasing cancer incidence, improving healthcare access, and the entry of affordable generics. Rapid clinical development activities in China, Japan, and India, along with government initiatives supporting oncology drug innovation, further enhance the regional growth potential

- The oral segment dominated the cyclin-dependent kinase inhibitor market with the largest market revenue share of 52.3% in 2024, driven by patient convenience, ease of home administration, and compatibility with long-term therapy regimens

Report Scope and Cyclin-dependent Kinase Inhibitor Market Segmentation

|

Attributes |

Cyclin-dependent Kinase Inhibitor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cyclin-dependent Kinase Inhibitor Market Trends

Advancements in Targeted Therapy and Combination Treatment Approaches

- A key and rapidly advancing trend in the global cyclin-dependent kinase (CDK) inhibitor market is the growing focus on targeted therapy and combination treatment approaches in oncology. The continuous development of novel CDK inhibitors, along with their integration into multi-drug regimens, is transforming cancer care by improving therapeutic efficacy and patient outcomes

- For instance, CDK4/6 inhibitors such as palbociclib, ribociclib, and abemaciclib have demonstrated significant success in treating hormone receptor-positive breast cancer, prompting further research into their applications across lung, colorectal, and pancreatic cancers

- Pharmaceutical companies are increasingly exploring combination therapies involving CDK inhibitors with immunotherapies, PARP inhibitors, and PI3K inhibitors to overcome drug resistance and enhance tumor response rates

- In addition, ongoing clinical trials aim to expand the use of CDK inhibitors beyond oncology to other disease areas such as neurodegenerative disorders and inflammatory conditions, broadening their therapeutic potential

- Technological advancements in biomarker identification and molecular profiling are also playing a crucial role in optimizing patient selection, allowing for more personalized and precision-based treatment strategies

- This trend toward combination therapies and precision oncology is expected to continue reshaping the CDK inhibitor landscape, driving innovation, improving patient survival rates, and supporting the long-term growth of the market

Cyclin-dependent Kinase Inhibitor Market Dynamics

Driver

Rising Prevalence of Cancer and Expansion of Targeted Drug Therapies

- The increasing global prevalence of cancer, particularly breast, lung, and colorectal cancers, is a major factor driving the demand for CDK inhibitors. These agents have become essential components in targeted cancer therapy due to their ability to regulate cell cycle progression and inhibit tumor proliferation

- For instance, in 2023, Novartis announced the initiation of a Phase III trial combining Kisqali with a PD-1 inhibitor for advanced triple-negative breast cancer, demonstrating the trend toward combination therapies and expanded indications

- According to the World Health Organization, cancer remains one of the leading causes of mortality worldwide, with millions of new cases reported annually. This has led to intensified research efforts and growing clinical adoption of CDK inhibitors

- The success of first-generation drugs such as Ibrance (palbociclib, Pfizer), Kisqali (ribociclib, Novartis), and Verzenio (abemaciclib, Eli Lilly) has fueled increased R&D investment in next-generation inhibitors with improved selectivity and safety profiles

- Furthermore, the growing emphasis on precision medicine and companion diagnostics supports the development of CDK inhibitors tailored to specific genetic and molecular profiles, enhancing their clinical effectiveness

- Pharmaceutical companies and academic research institutions are actively collaborating to expand indications and explore new combinations, fostering a robust pipeline and contributing to sustained market growth

Restraint/Challenge

Adverse Effects and High Treatment Costs

- Despite their proven efficacy, CDK inhibitors are associated with several limitations that challenge their widespread clinical adoption. One major concern is the occurrence of adverse effects such as neutropenia, fatigue, liver toxicity, and gastrointestinal complications, which can impact patient compliance and treatment continuity

- The high cost of CDK inhibitor therapy also poses a significant barrier, particularly in low- and middle-income countries where access to advanced oncology treatments remains limited.

- For instance, the average annual cost of treatment with approved CDK4/6 inhibitors can exceed USD 100,000, placing substantial pressure on healthcare systems and insurance providers

- In addition, the emergence of resistance mechanisms in long-term therapy presents another clinical challenge, necessitating the continuous development of next-generation inhibitors with broader activity and improved tolerability

- Addressing these issues through improved safety profiles, affordable pricing models, and combination therapy strategies will be crucial to enhancing patient access and maintaining steady market growth

Cyclin-dependent Kinase Inhibitor Market Scope

The market is segmented on the basis of inhibitor type, route of administration, target disease, and distribution channels.

- By Inhibitor Type

On the basis of inhibitor type, the cyclin-dependent kinase inhibitor market is segmented into specific inhibitors, non-specific or broad range inhibitors, and multiple target inhibitors. The specific inhibitors segment dominated the largest market revenue share of 44.5% in 2024, due to their precise action against CDK4/6 and CDK2, minimizing off-target toxicity while providing effective cell cycle arrest. These inhibitors are widely used in hormone receptor-positive breast cancer therapy and are being investigated in other solid tumors. Their dominance is supported by multiple FDA approvals, inclusion in clinical guidelines, and strong real-world evidence demonstrating improved progression-free survival and tolerability. The segment benefits from high physician confidence, strong clinical pipelines, and ongoing R&D to enhance potency and reduce side effects. Extensive post-marketing surveillance and patient outcome data further strengthen market share. North America and Europe account for a significant portion of the revenue, with Asia-Pacific showing growing adoption. Regulatory incentives and reimbursement support also reinforce the segment’s dominance globally.

The multiple target inhibitors segment is anticipated to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by the development of drugs that inhibit multiple CDK isoforms simultaneously, providing efficacy against resistant or refractory cancers. These inhibitors are increasingly explored in hematologic malignancies and aggressive solid tumors. Ongoing clinical trials and expanding indications accelerate adoption. Pharmaceutical companies are investing heavily in next-generation multi-target inhibitors, with combination therapy potential further boosting demand. Patient awareness and physician interest in broad-spectrum treatment options support growth. Adoption is accelerating particularly in emerging markets where multi-target efficacy is highly valued. Strategic partnerships, research collaborations, and government initiatives in oncology drug development also contribute to the segment’s rapid expansion.

- By Route of Administration

On the basis of route of administration, the cyclin-dependent kinase inhibitor market is segmented into nasal, oral, intravenous, and intramuscular. The oral segment dominated the largest market revenue share of 52.3% in 2024, driven by patient convenience, ease of home administration, and compatibility with long-term therapy regimens. Oral CDKIs such as palbociclib, ribociclib, and abemaciclib are widely prescribed for breast cancer and increasingly in other solid tumors. High patient compliance, flexible dosing, and reduced need for hospital visits support market dominance. Oral administration facilitates combination with oral hormonal therapies and is preferred in outpatient settings. Strong clinical evidence, guideline recommendations, and regulatory approvals enhance adoption. Growing awareness among patients and clinicians reinforces the segment. Real-world studies validate improved quality of life and clinical outcomes.

The intravenous segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, due to development of IV formulations providing rapid bioavailability, precise dosing, and applicability in hospitalized patients. IV CDKIs are preferred for aggressive cancers requiring controlled plasma concentrations and close monitoring. Clinical trials exploring IV formulations for broader CDK targets support growth. Adoption is higher in regions with advanced hospital infrastructure. Increasing combination therapy protocols and expanding indications drive segment expansion. Patient and physician preference for rapid-onset formulations further contributes. Emerging markets are witnessing increased uptake due to hospital-based oncology programs.

- By Target Disease

On the basis of target disease, the cyclin-dependent kinase inhibitor market is segmented into breast cancer, lymphoma, multiple myeloma, ovarian cancer, and others. The breast cancer segment dominated the market with a revenue share of 47.8% in 2024, due to high prevalence of hormone receptor-positive, HER2-negative breast cancer and wide approval of CDK4/6 inhibitors. Clinical guidelines recommend these drugs as first-line therapy in combination with hormonal treatments. Strong physician confidence, extensive clinical evidence, and demonstrated improvement in progression-free survival reinforce dominance. Real-world adoption in North America and Europe contributes significantly to revenue. Ongoing post-marketing studies and expanded label indications further strengthen the segment. Patient awareness campaigns and insurance coverage support access.

The multiple myeloma segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, driven by emerging research showing CDKI efficacy in hematologic malignancies. Increasing incidence of multiple myeloma, unmet treatment needs, and clinical trials exploring combination therapies support growth. Regulatory approvals and expanded indications in specialized centers accelerate adoption. Emerging markets are showing increasing uptake due to improved diagnostic capabilities. Pharmaceutical R&D investments and physician awareness programs further boost the segment. Patient advocacy and education initiatives support market expansion globally.

- By Distribution Channels

On the basis of distribution channels, the cyclin-dependent kinase inhibitor market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacy segment held the largest market revenue share of 45.6% in 2024, due to direct access to oncology drugs, integration with hospital treatment protocols, and proper patient monitoring. Hospital pharmacies ensure dosing accuracy, adherence to clinical guidelines, and supervision of therapy. High patient volume in specialized oncology centers supports dominance. Collaborative agreements with healthcare providers and insurance reimbursement enhance adoption. Strategic location of hospital pharmacies in urban centers further reinforces market share. Access to advanced therapies, clinical trial support, and patient education programs also contribute.

The online pharmacy segment is expected to witness the fastest CAGR of 23.0% from 2025 to 2032, driven by increasing e-pharmacy adoption, telemedicine integration, and convenience of home delivery. Growing patient preference for online prescriptions, digital health platforms, and remote monitoring boosts growth. Awareness of drug availability and ease of payment enhance adoption. Regulatory support for online pharmacy services in certain regions contributes. Expansion of logistics and distribution networks accelerates access. Increasing internet penetration and smartphone adoption reinforce rapid uptake. Patients in semi-urban and remote areas benefit from improved access, supporting global growth.

Cyclin-dependent Kinase Inhibitor Market Regional Analysis

- North America dominated the cyclin-dependent kinase inhibitor market with the largest revenue share of 41.6% in 2024, driven by strong research infrastructure, early adoption of targeted therapies, and substantial oncology drug expenditure

- The market remains the core growth engine due to the wide availability of FDA-approved drugs such as palbociclib, abemaciclib, and ribociclib, as well as ongoing clinical trials exploring expanded indications for these agents

- High healthcare spending, advanced diagnostic capabilities, and well-established oncology treatment centers further support market dominance in the region

U.S. Cyclin-dependent Kinase Inhibitor Market Insight

The U.S. cyclin-dependent kinase inhibitor market captured the largest revenue share within North America in 2024, fueled by extensive clinical adoption of CDK4/6 inhibitors, active government support for cancer treatment programs, and continuous R&D investments by leading pharmaceutical companies. Increasing cancer prevalence, combined with expanding precision medicine initiatives and patient access to targeted therapies, is significantly contributing to market expansion in the country.

Europe Cyclin-dependent Kinase Inhibitor Market Insight

The Europe cyclin-dependent kinase inhibitor market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising cancer incidence, well-established healthcare infrastructure, and increasing adoption of targeted therapies. Countries such as Germany, France, and the U.K. are witnessing robust growth due to supportive oncology guidelines, government-backed treatment programs, and widespread reimbursement coverage for CDK inhibitors.

U.K. Cyclin-dependent Kinase Inhibitor Market Insight

The U.K. cyclin-dependent kinase inhibitor market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of personalized cancer treatments, clinical adoption of CDK inhibitors, and the presence of structured oncology care pathways. Supportive regulatory frameworks and active government healthcare programs further enhance market expansion.

Germany Cyclin-dependent Kinase Inhibitor Market Insight

The Germany cyclin-dependent kinase inhibitor market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing cancer prevalence, robust healthcare infrastructure, and high adoption rates of innovative oncology drugs. Strong research initiatives, government support, and growing participation in clinical trials contribute to Germany’s significant market growth.

Asia-Pacific Cyclin-dependent Kinase Inhibitor Market Insight

The Asia-Pacific cyclin-dependent kinase inhibitor market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, owing to increasing cancer incidence, improving healthcare access, and the entry of affordable generics. Rapid clinical development activities in China, Japan, and India, along with government initiatives supporting oncology drug innovation, further enhance the regional growth potential. Expansion of hospital oncology facilities and increased patient awareness are key drivers in the region.

Japan Cyclin-dependent Kinase Inhibitor Market Insight

The Japan cyclin-dependent kinase inhibitor market is gaining momentum due to the country’s advanced healthcare infrastructure, high cancer prevalence, and rising adoption of targeted therapies. Strong government support for cancer research, along with clinical trial initiatives for new CDK inhibitors, is expected to further drive market growth in the forecast period.

China Cyclin-dependent Kinase Inhibitor Market Insight

The China cyclin-dependent kinase inhibitor market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, increasing cancer prevalence, and growing availability of affordable generic CDK inhibitors. Government-backed oncology programs, rapid clinical development, and rising patient access to targeted therapies are key factors supporting the market’s growth in China.

Cyclin-dependent Kinase Inhibitor Market Share

The Cyclin-dependent Kinase Inhibitor industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Lilly USA, LLC. (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- AstraZeneca (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Sanofi (France)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- G1 Therapeutics, Inc. (U.S.)

- Jiangsu Hengrui Pharmaceuticals Co., Ltd. (China)

- Regor Therapeutics Group. (U.S.)

- Lite Strategy (U.S.)

- Prelude Therapeutics (U.S.)

- Relay Therapeutics (U.S.)

Latest Developments in Global Cyclin-dependent Kinase Inhibitor Market

- In June 2025, Gilead Sciences announced a strategic partnership with Kymera Therapeutics, entering into an option and license agreement valued up to USD 750 million. This collaboration focuses on developing Kymera's novel cancer drug candidates known as molecular glue degraders, which aim to selectively eliminate CDK2 proteins. These drugs differ from traditional treatments by targeting and degrading the protein rather than merely inhibiting its activity. The partnership underscores a commitment to advancing targeted cancer therapies

- In September 2025, Roche announced positive Phase III results for Giredestrant, a selective estrogen receptor degrader (SERD), in combination with a CDK4/6 inhibitor for the treatment of ER-positive, HER2-negative advanced breast cancer. The study, known as PionERA, demonstrated that Giredestrant plus a CDK4/6 inhibitor showed promising efficacy compared to fulvestrant plus a CDK4/6 inhibitor, offering a potential new treatment option for patients resistant to adjuvant endocrine therapy

- In August 2025, Incyclix Bio announced the successful completion of an $11.25 million Series B extension funding round. The company is advancing its lead compound, INX-315, a potent and selective CDK2 inhibitor currently in clinical development. The funding aims to support the continued development of INX-315 for the treatment of various cancers, highlighting the growing interest in CDK2-targeted therapies

- In September 2025, a review article published in Translational Cancer Research highlighted recent advancements in the development of CDK7 inhibitors. The review discussed the progress of selective CDK7 inhibitors currently in clinical research, including their targets, indications, and the latest clinical trial developments. These advancements suggest that CDK7 inhibitors are emerging as promising candidates in cancer treatment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.