Global Cyclodextrins Market

Market Size in USD Million

CAGR :

%

USD

355.02 Million

USD

453.23 Million

2024

2032

USD

355.02 Million

USD

453.23 Million

2024

2032

| 2025 –2032 | |

| USD 355.02 Million | |

| USD 453.23 Million | |

|

|

|

|

Cyclodextrins Market Size

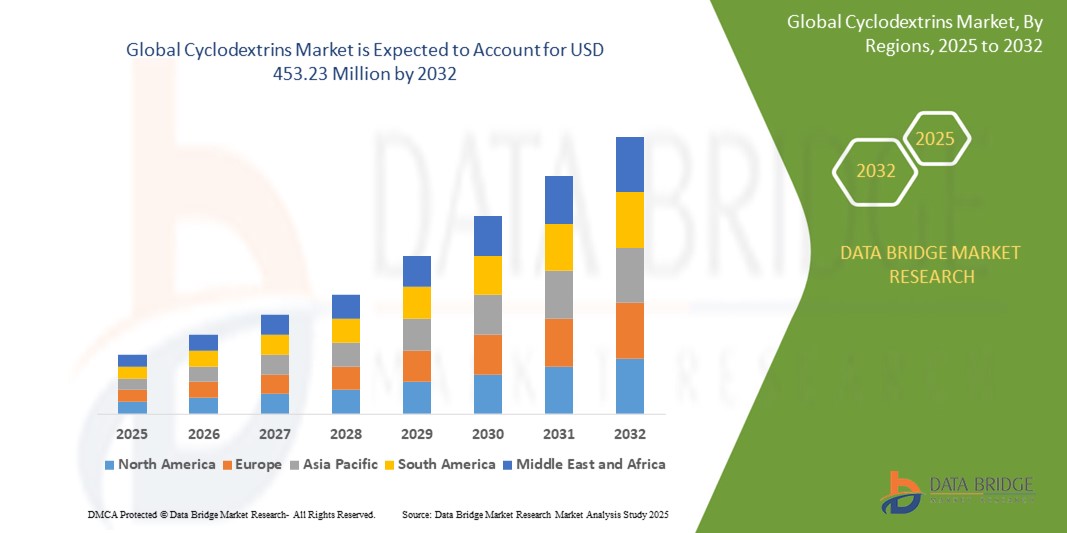

- The global cyclodextrins market size was valued at USD 355.02 million in 2024 and is expected to reach USD 453.23 million by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is largely fueled by the increasing demand for solubility and bioavailability enhancement in pharmaceutical formulations, with cyclodextrins widely adopted as functional excipients that stabilize and deliver active pharmaceutical ingredients more effectively across various dosage forms

- Furthermore, the rising consumer preference for clean-label, odor-masking, and preservative-reducing ingredients in food, beverages, and cosmetics is establishing cyclodextrins as a versatile and health-conscious additive of choice. These converging factors are accelerating their adoption across industries, thereby significantly boosting the market's expansion

Cyclodextrins Market Analysis

- Cyclodextrins, cyclic oligosaccharides capable of forming inclusion complexes with a variety of molecules, are increasingly essential in pharmaceutical, food, and cosmetic industries due to their ability to improve solubility, stability, and controlled release of active ingredients

- The escalating demand for cyclodextrins is primarily driven by their versatile functional benefits, growing use in advanced drug delivery systems, and rising consumer preference for clean-label and functional ingredients in health-conscious and performance-oriented formulation

- North America dominated the cyclodextrins market with a share of 32.5% in 2024, due to extensive use in pharmaceuticals, food, and cosmetics industries, alongside advanced R&D capabilities and strong regulatory support for drug formulation improvements

- Asia-Pacific is expected to be the fastest growing region in the cyclodextrins market during the forecast period due to expanding pharmaceutical production, increased demand for processed foods, and rising investments in R&D

- Beta-cyclodextrin segment dominated the market with a market share of 67.2% in 2024 due to its widespread availability, cost-effectiveness, and versatile inclusion capabilities. Beta-cyclodextrin is extensively used due to its optimal cavity size, which effectively encapsulates a wide range of guest molecules, enhancing solubility and stability in various applications. Its well-established use in pharmaceuticals and food industries further supports strong demand

Report Scope and Cyclodextrins Market Segmentation

|

Attributes |

Cyclodextrins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cyclodextrins Market Trends

“Emerging Trends in the Pharmaceutical Sector”

- A significant and accelerating trend in the global cyclodextrins market is the growing integration of cyclodextrins in advanced pharmaceutical formulations to address solubility, stability, and targeted delivery challenges of active pharmaceutical ingredients (APIs). With an increasing number of poorly water-soluble drugs in development pipelines, cyclodextrins are being actively explored and adopted by pharmaceutical companies to improve drug efficacy and patient outcomes

- For instance, beta-cyclodextrin is widely utilized in oral, nasal, and injectable drug delivery systems to enhance bioavailability, reduce irritation, and stabilize sensitive compounds. Similarly, hydroxypropyl-beta-cyclodextrin (HPβCD) is a key excipient in several FDA-approved drugs including those targeting rare diseases and oncology

- The trend is further supported by the increasing approval of cyclodextrin-based formulations by regulatory authorities such as the FDA and EMA, reflecting their established safety profile and functional versatility

- Moreover, growing investments in nanotechnology and targeted therapies are encouraging R&D in cyclodextrin derivatives for specialized delivery mechanisms

- Pharmaceutical manufacturers are increasingly incorporating cyclodextrins into drug delivery strategies for sustained and controlled release, enabling dose reduction and minimizing side effects. This positions cyclodextrins as critical enablers in the development of next-generation drug formulations

- As a result, the expanding pharmaceutical applications of cyclodextrins are driving innovation and reshaping expectations around excipient performance, solidifying their role in the future of drug delivery systems

Cyclodextrins Market Dynamics

Driver

“Growing Demand for Enhanced Stability”

- The growing demand for enhanced stability across pharmaceutical, food, and cosmetic applications is a significant driver for the cyclodextrins market, as these compounds are increasingly used to protect sensitive ingredients from degradation caused by light, heat, and oxidation

- For instance, hydroxypropyl-beta-cyclodextrin is widely employed in injectable drug formulations to improve the chemical and physical stability of APIs, extending shelf life and maintaining therapeutic efficacy

- As manufacturers seek to ensure consistent product quality and performance throughout distribution and storage, cyclodextrins provide a reliable solution by forming inclusion complexes that encapsulate and stabilize active molecules

- Furthermore, in the food and beverage industry, cyclodextrins are used to stabilize flavors, vitamins, and essential oils that would otherwise degrade quickly, allowing for the development of more durable and appealing functional products. The cosmetics industry also leverages cyclodextrins to preserve the integrity of volatile or sensitive active ingredients, enhancing the performance and longevity of skincare and personal care formulations

- This rising focus on product stability, combined with increasing consumer expectations for safe and effective products with extended shelf life, is driving the adoption of cyclodextrins as essential stabilizing agents across diverse end-use sectors

Restraint/Challenge

“Presence of Competitive Alternatives”

- The presence of competitive alternatives such as polymer-based carriers, nanoemulsions, liposomes, and other encapsulation technologies poses a significant challenge to the broader adoption of cyclodextrins across end-use industries

- For instance, liposomes and solid lipid nanoparticles are gaining traction in pharmaceutical and cosmetic applications due to their ability to enhance solubility and bioavailability while offering biocompatibility and controlled release properties

- These alternatives often offer distinct functional advantages, such as higher loading capacity or targeted delivery capabilities, making them appealing substitutes in specific formulations or advanced drug delivery systems. In addition, in the food industry, alternative stabilizers and encapsulation materials such as maltodextrin, gums, and modified starches are widely available and often more cost-effective, especially for manufacturers operating in price-sensitive markets

- While cyclodextrins are highly effective and generally recognized as safe (GRAS), their comparatively higher production cost and complex extraction or derivatization processes can limit their competitiveness against simpler or more economical alternatives

- Overcoming this challenge requires continued innovation in cyclodextrin manufacturing to reduce production costs, as well as increased awareness among formulators of their multifunctional benefits in enhancing product stability, solubility, and safety across sectors

Cyclodextrins Market Scope

The market is segmented on the basis of product type, alcoholic content, flavor, category, packaging, and distribution channel.

- By Product Type

By Product Type On the basis of product type, the cyclodextrins market is segmented into alpha-cyclodextrin, beta-cyclodextrin, gamma-cyclodextrin, and cyclodextrin derivatives. The beta-cyclodextrin segment dominates the largest market revenue share of 67.2% in 2024, driven by its widespread availability, cost-effectiveness, and versatile inclusion capabilities. Beta-cyclodextrin is extensively used due to its optimal cavity size, which effectively encapsulates a wide range of guest molecules, enhancing solubility and stability in various applications. Its well-established use in pharmaceuticals and food industries further supports strong demand.

The cyclodextrin derivatives segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing research and development focused on improving solubility, bioavailability, and functional properties. Derivatives such as hydroxypropyl-beta-cyclodextrin and methyl-beta-cyclodextrin are gaining traction for specialized applications in drug delivery and cosmetics, where enhanced performance and safety profiles are critical.

- By Application

On the basis of application, the cyclodextrins market is segmented into food, beverages, pharmaceuticals, cosmetics, chemicals, and others. The pharmaceuticals segment accounted for the largest market revenue share in 2024, driven by the growing demand for drug delivery solutions that improve solubility, stability, and controlled release of active ingredients. Cyclodextrins are extensively used to formulate more effective and safer pharmaceutical products, contributing to their dominant position.

The food segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising consumer preference for functional foods and natural additives. Cyclodextrins enhance flavor retention, reduce off-notes, and stabilize volatile compounds in food products, encouraging their increased use in processed foods and beverages. Growing awareness of health benefits and clean-label trends further stimulate growth in this segment.

Cyclodextrins Market Regional Analysis

- North America dominated the cyclodextrins market with the largest revenue share of 32.5% in 2024, driven by extensive use in pharmaceuticals, food, and cosmetics industries, alongside advanced R&D capabilities and strong regulatory support for drug formulation improvements

- The region’s established pharmaceutical sector utilizes cyclodextrins to enhance drug solubility and stability, while demand for clean-label and functional ingredients in food and cosmetic applications also contributes to market expansion

- Robust infrastructure, the presence of key industry players, and a favorable innovation ecosystem continue to reinforce North America’s leadership in the cyclodextrins market

U.S. Cyclodextrins Market Insight

U.S. cyclodextrins market captured most of the North American revenue share in 2024, supported by the nation’s mature pharmaceutical industry and growing applications in food and beverage formulations. The increasing emphasis on bioavailability enhancement in drug delivery, combined with a rising preference for functional food ingredients, drives cyclodextrin demand. Ongoing FDA approvals and research into cyclodextrin derivatives for targeted therapies further strengthen market prospects.

Europe Cyclodextrins Market Insight

The Europe cyclodextrins market is projected to grow at a robust CAGR through 2032, fueled by increasing demand in pharmaceutical, cosmetic, and personal care formulations. EU regulations promoting excipients with improved safety and performance profiles support the incorporation of cyclodextrins in novel drug delivery systems. In addition, growing health awareness and consumer preference for odor-masking and stabilization in food and cosmetic products are driving adoption.

Germany Cyclodextrins Market Insight

Germany holds a significant share of the European cyclodextrins market, benefiting from a strong pharmaceutical manufacturing base and high standards for product stability and efficacy. German companies are actively investing in research on cyclodextrin derivatives for specialty drugs, while the country’s proactive approach to food safety and sustainability is encouraging wider use in functional foods and eco-friendly formulations.

Asia-Pacific Cyclodextrins Market Insight

Asia-Pacific is expected to register the fastest CAGR from 2025 to 2032, driven by expanding pharmaceutical production, increased demand for processed foods, and rising investments in R&D across countries such as China, Japan, and India. Government support for pharmaceutical innovation and a shift towards premium cosmetic ingredients are further accelerating market growth.

China Cyclodextrins Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, driven by its position as a leading producer and exporter of cyclodextrins. The country’s rapidly growing pharmaceutical and food processing sectors are major contributors, supported by domestic production capabilities and competitive pricing. The increasing use of cyclodextrins in traditional Chinese medicine and functional foods also underscores its dominant position.

Japan Cyclodextrins Market Insight

Japan is witnessing growing demand for cyclodextrins in advanced pharmaceutical and cosmetic formulations, backed by a strong culture of innovation and high consumer expectations for product quality. Cyclodextrins are widely used to enhance shelf life, stability, and delivery efficiency in both health and personal care applications. The country’s focus on aging population health solutions further strengthens demand in drug formulation.

Cyclodextrins Market Share

The cyclodextrins industry is primarily led by well-established companies, including:

- CTD Holdings, Inc. (U.S.)

- Wacker Chemie AG (Germany)

- Cyclolab (Hungary)

- Merck KGaA (Germany)

- NIHON SHOKUHIN KAKO CO., LTD. (Japan)

- Roquette Frères (France)

- Ashland (U.S.)

- Shandong Xinda Biological Technology Co., Ltd. (China)

- Yunan County Yongguang Group (China)

- Mengzhou Hongji Biological Co., Ltd. (China)

- Gangwal Chemicals Pvt. Ltd. (India)

- Geno (Norway)

- Fengchen Group Co., Ltd. (China)

- Cayman Chemical (U.S.)

- Zhonglan Industry Co., Ltd. (China)

- Shandong Binzhou Zhiyuan Biotechnology Co., Ltd. (China)

- Captisol (U.S.)

Latest Developments in Global Cyclodextrins Market

- In May 2023, WACKER launched CAVAMAX Foam Topping Powder at the 2023 HOTELEX Shanghai, introducing an innovative solid beverage formulation that utilizes cyclodextrin to create creamy, stable foam toppings across various drink types such as tea, milk, and plant-based alternatives. This product launch, although currently limited to the Chinese market, highlights the expanding use of cyclodextrins in functional food and beverage applications, supporting market growth through value-added formulations that enhance texture and consumer appeal

- In July 2020, Wacker Chemie AG introduced CAVAMAX W6, a branded alpha-cyclodextrin derived from renewable raw materials. With six glucose units, alpha-cyclodextrin offers significant potential for improving solubility, stability, and bioavailability in pharmaceutical and food formulations. The commercialization of CAVAMAX W6 underscores the growing focus on sustainable and high-performance excipients, contributing to the broader adoption of cyclodextrins in both health-related and consumer product sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cyclodextrins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cyclodextrins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cyclodextrins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.