Global Cyclophilin Inhibitors Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

4.27 Billion

USD

8.76 Billion

2024

2032

USD

4.27 Billion

USD

8.76 Billion

2024

2032

| 2025 –2032 | |

| USD 4.27 Billion | |

| USD 8.76 Billion | |

|

|

|

|

Cyclophilin Inhibitors Therapeutics Market Size

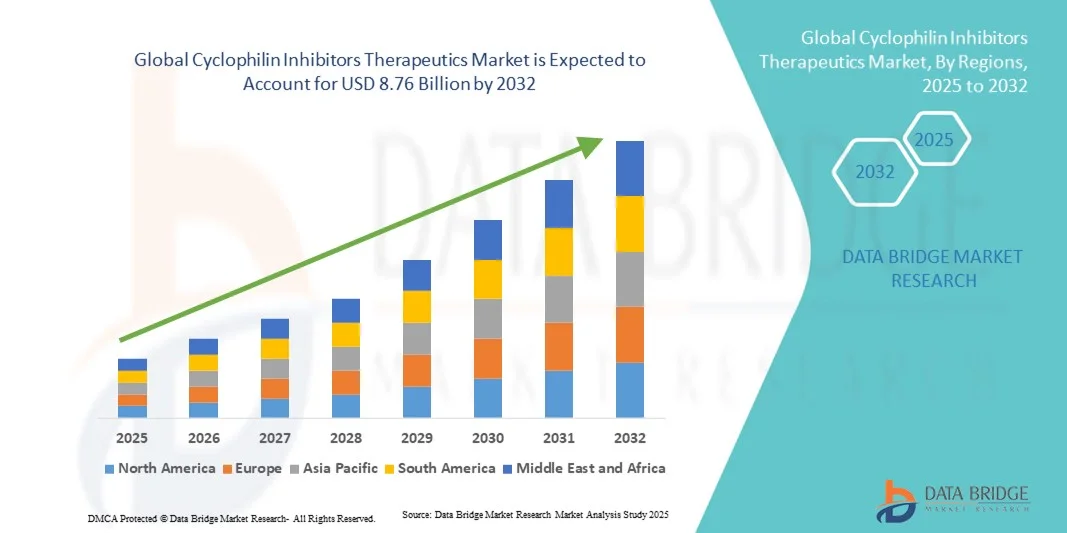

- The global cyclophilin inhibitors therapeutics market size was valued at USD 4.27 billion in 2024 and is expected to reach USD 8.76 billion by 2032, at a CAGR of 9.4% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hepatitis C virus (HCV) infections, rising demand for targeted therapies, and advancements in drug development, driving adoption of personalized medicine

- Furthermore, emerging therapies targeting cyclophilins are gaining attention for their potential to offer effective and tailored treatment options. These converging factors are accelerating the uptake of cyclophilin inhibitors, thereby significantly boosting the industry's growth

Cyclophilin Inhibitors Therapeutics Market Analysis

- Cyclophilin inhibitors, offering targeted therapeutic action against cyclophilins involved in viral replication and immune regulation, are increasingly recognized as critical components in treating hepatitis C virus (HCV) infections due to their specificity, potential efficacy, and integration into combination therapies

- The escalating demand for cyclophilin inhibitors is primarily fueled by the growing prevalence of HCV infections, rising adoption of personalized medicine, and increasing focus on novel antiviral therapies that minimize resistance and side effects

- North America dominated the cyclophilin inhibitors therapeutics market with the largest revenue share of 43% in 2024, characterized by advanced healthcare infrastructure, high R&D investment, and strong presence of key pharmaceutical companies, with the U.S. witnessing substantial growth in clinical trials and drug approvals, particularly for adult populations, driven by innovations from both established pharma firms and biotech startups

- Asia-Pacific is expected to be the fastest-growing region in the cyclophilin inhibitors therapeutics market during the forecast period, due to increasing healthcare expenditure, rising awareness of HCV treatments, and expanding access to advanced therapeutics

- HCV1 dominated the market with a share of 39.7% in 2024 due to its high prevalence globally and the strong clinical focus on developing targeted therapies for this genotype

Report Scope and Cyclophilin Inhibitors Therapeutics Market Segmentation

|

Attributes |

Cyclophilin Inhibitors Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cyclophilin Inhibitors Therapeutics Market Trends

Targeted Therapy Expansion and Personalized Medicine Integration

- A significant and accelerating trend in the global cyclophilin inhibitors therapeutics market is the growing adoption of targeted antiviral therapies and integration with personalized medicine approaches, enhancing treatment specificity and patient outcomes

- For instance, emerging cyclophilin inhibitors are being combined with direct-acting antivirals to improve sustained virologic response rates in HCV patients, reducing the risk of drug resistance

- Personalized dosing regimens and genotype-specific therapies are being developed, enabling clinicians to tailor treatment plans according to patient HCV genotype and disease progression, optimizing efficacy and minimizing side effects

- Integration of cyclophilin inhibitors into combination therapy protocols allows for improved tolerability, reduced treatment duration, and better compliance among patients, particularly in adult populations with chronic HCV

- This trend towards precise, patient-centric therapy is reshaping expectations for antiviral treatment, encouraging pharmaceutical companies to innovate with next-generation cyclophilin inhibitors that can be customized for diverse patient populations

- The demand for therapies offering high efficacy, reduced adverse effects, and compatibility with existing treatment regimens is growing rapidly across global healthcare markets, driven by increasing focus on patient outcomes and therapeutic precision

Cyclophilin Inhibitors Therapeutics Market Dynamics

Driver

Rising Prevalence of HCV and Demand for Effective Antivirals

- The increasing global prevalence of HCV infections, coupled with the need for highly effective and targeted antiviral therapies, is a major driver for the adoption of cyclophilin inhibitors

- For instance, the growing incidence of chronic HCV in North America and Europe has prompted pharmaceutical companies to invest in R&D for more potent and well-tolerated cyclophilin inhibitor formulations

- Patients and healthcare providers are increasingly seeking treatments that can achieve high sustained virologic response rates while minimizing side effects, making cyclophilin inhibitors an attractive therapeutic option

- Furthermore, the trend of integrating cyclophilin inhibitors with direct-acting antivirals in combination therapies is enhancing treatment outcomes and expanding the market potential

- Increasing awareness about HCV and the benefits of early, targeted intervention is also contributing to higher adoption rates among adults and specialty clinics

- Government initiatives and supportive healthcare policies encouraging access to novel antiviral treatments further bolster market growth, particularly in developed regions with high HCV burden

Restraint/Challenge

Safety Concerns and Regulatory Hurdles

- Concerns surrounding drug safety, potential adverse effects, and stringent regulatory approvals pose significant challenges to widespread market adoption of cyclophilin inhibitors

- For instance, regulatory agencies in the U.S. and Europe require extensive clinical trials to validate the efficacy and safety of new cyclophilin inhibitors, which can delay product launches and increase development costs

- Reports of adverse reactions or drug interactions in certain patient populations have made some clinicians cautious about prescribing cyclophilin inhibitors without careful monitoring

- Addressing these safety concerns through robust clinical validation, post-market surveillance, and clear prescribing guidelines is critical to building trust among healthcare providers and patients

- The high cost of innovative cyclophilin inhibitors, especially branded formulations, can be a barrier to access in price-sensitive markets, limiting uptake in developing regions

- Overcoming these challenges through regulatory support, pharmacovigilance, and development of more affordable generic options will be essential for sustained market growth

Cyclophilin Inhibitors Therapeutics Market Scope

The market is segmented on the basis of indication, population type, drug type, route of administration, end user, and distribution channel.

- By Indication

On the basis of indication, the cyclophilin inhibitors therapeutics market is segmented into HCV1, HCV2, HCV3, HCV4, HCV5, and HCV6. The HCV1 segment dominated the market with the largest revenue share of 39.7% in 2024, driven by its high global prevalence and strong clinical focus. Patients with HCV1 often receive combination therapies involving cyclophilin inhibitors and direct-acting antivirals to improve sustained virologic response rates. The segment benefits from established treatment guidelines and extensive ongoing clinical trials supporting cyclophilin inhibitor use. Oral formulations enhance patient compliance and convenience, contributing to its dominance. Healthcare providers prioritize HCV1 therapies due to predictable outcomes and extensive evidence of efficacy. Overall, HCV1 remains the most commercially attractive subsegment globally.

The HCV3 segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing diagnosis rates in emerging markets. HCV3 is associated with higher liver complication risks, prompting demand for effective therapies. Development of cyclophilin inhibitors specifically targeting HCV3 is gaining momentum through ongoing clinical research. Awareness campaigns and government initiatives for HCV3 screening further drive adoption. Combination therapy strategies improve tolerability and treatment duration for HCV3 patients. Consequently, HCV3 presents substantial growth potential due to unmet medical needs.

- By Population Type

On the basis of population type, the market is segmented into children and adults. The adult population dominated the market with the largest share of 85% in 2024, driven by higher prevalence of HCV infections and widespread use of cyclophilin inhibitors in chronic hepatitis C. Adults benefit from targeted oral formulations and combination therapy protocols designed for improved adherence and minimal side effects. Pharmaceutical companies focus on adult populations due to the larger patient base and predictable outcomes. Hospitals and specialty clinics remain the primary treatment settings for adults. Clinical trials and regulatory approvals predominantly involve adults, consolidating this segment’s dominance. Overall, adults remain the key revenue driver for the market.

The children segment is expected to witness the fastest growth from 2025 to 2032, fueled by increased pediatric HCV diagnosis and adaptation of cyclophilin inhibitors for safe pediatric use. Pediatric treatment protocols ensure proper dosing and safety. Awareness among healthcare providers and parents about early HCV intervention supports adoption. Government and NGO initiatives promote access to pediatric therapies in high-prevalence regions. Oral formulations suitable for children improve compliance and acceptance. Consequently, the pediatric segment is poised for rapid growth during the forecast period.

- By Drug Type

On the basis of drug type, the market is segmented into branded and generics. The branded segment dominated the market with a revenue share of 62% in 2024, driven by extensive R&D investment, clinical validation, and regulatory approvals. Branded cyclophilin inhibitors are preferred by healthcare providers for consistent quality and predictable outcomes. Marketing support, patient assistance programs, and physician awareness campaigns further reinforce dominance. Patent protection enables pricing power and sustained market share. Hospitals and specialty clinics primarily dispense branded drugs, ensuring revenue stability. Branded drugs also lead in combination therapy adoption due to proven efficacy.

The generics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for cost-effective HCV therapies and expanded access in emerging markets. Patent expirations of key branded drugs enable entry of generics. Healthcare providers increasingly favor generics to manage treatment costs. High HCV prevalence in price-sensitive regions accelerates adoption. Generics benefit from simplified distribution through hospital and retail pharmacies. Overall, generics represent a major growth opportunity for the global market.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral and parenteral. The oral segment dominated the market with a share of 61.2% in 2024, driven by patient preference for non-invasive, convenient dosing and compatibility with combination therapies. Oral cyclophilin inhibitors enhance compliance and reduce hospital visits. Pharmaceutical companies focus on oral bioavailable formulations for adults and children. Hospitals and specialty clinics favor oral drugs for easier outpatient management. Oral therapy enables wider adoption across geographies. The convenience and safety of oral administration reinforce this segment’s dominance.

The parenteral segment is expected to witness the fastest growth from 2025 to 2032, fueled by injectable formulations for patients who cannot tolerate oral drugs or require rapid drug action. Parenteral administration ensures higher bioavailability and therapeutic efficacy. Specialty clinics and hospital settings prioritize parenteral formulations for controlled dosing. Clinical research supports development of long-acting injectables. Healthcare providers benefit from predictable pharmacokinetics. Improved monitoring and training enhance adoption in targeted patient populations.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, and others. Hospitals dominated the market with a combined share of 52% in 2024, due to high patient volumes and established treatment infrastructure. Hospitals implement standardized protocols for consistent use of cyclophilin inhibitors. Adult patient populations contribute significantly to hospital demand. Hospitals support clinical trials and post-marketing surveillance. Pharmaceutical companies prioritize hospital distribution for scale and reliability. Hospitals remain the primary point of care for chronic HCV management.

Specialty clinics are expected to witness the fastest growth from 2025 to 2032, fueled by outpatient HCV management and personalized care. Clinics provide tailored treatment plans, adherence monitoring, and follow-up care. Growing awareness among patients and providers supports increased adoption. Clinics favor oral and branded formulations for efficiency. Expansion of specialty clinics in emerging markets further drives demand. Clinics offer specialized HCV management that complements hospital-based care.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. Hospital pharmacies dominated the market with a share of 45.8% in 2024, due to dispensing combination therapies and coordination with prescribing physicians. Hospital pharmacies also handle clinical trial logistics and post-marketing programs. Secure storage and management of high-value drugs reinforce their dominance. Hospitals remain the primary distribution hub for cyclophilin inhibitors. Hospital pharmacy access ensures timely therapy for inpatient and outpatient populations.

Online pharmacies are expected to witness the fastest growth from 2025 to 2032, driven by increasing e-pharmacy adoption and convenience of home delivery. Online channels improve access in remote or underserved regions. Patients prefer digital solutions for refills and tracking. Online pharmacies facilitate access to both branded and generic drugs. Integration with telemedicine platforms enhances engagement. Overall, online distribution represents a significant growth opportunity for the market.

Cyclophilin Inhibitors Therapeutics Market Regional Analysis

- North America dominated the cyclophilin inhibitors therapeutics market with the largest revenue share of 43% in 2024, characterized by advanced healthcare infrastructure, high R&D investment, and strong presence of key pharmaceutical companies

- Patients and healthcare providers in the region highly value the efficacy, safety, and availability of cyclophilin inhibitors in combination therapies for HCV management

- The widespread adoption is further supported by government initiatives, reimbursement policies, and well-established hospital and specialty clinic networks, establishing cyclophilin inhibitors as a preferred therapeutic option for both adult and pediatric populations

U.S. Cyclophilin Inhibitors Therapeutics Market Insight

The U.S. cyclophilin inhibitors therapeutics market captured the largest revenue share of 38% in 2024 within North America, fueled by a high prevalence of hepatitis C virus (HCV) infections and strong healthcare infrastructure. Patients and healthcare providers increasingly prioritize effective, targeted antiviral therapies, particularly combination treatments involving cyclophilin inhibitors. The growing adoption of personalized medicine, robust clinical trial activity, and availability of advanced treatment protocols further propels the market. Moreover, reimbursement support and well-established hospital and specialty clinic networks significantly contribute to market expansion.

Europe Cyclophilin Inhibitors Therapeutics Market Insight

The Europe cyclophilin inhibitors therapeutics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and rising demand for effective HCV treatments. Increased awareness of viral hepatitis and widespread access to advanced therapies are fostering market growth. European healthcare providers value the convenience and efficacy of cyclophilin inhibitors in combination therapies. The region is experiencing significant adoption across hospitals, specialty clinics, and treatment centers, with therapies incorporated into both newly diagnosed and chronic HCV patient management protocols.

U.K. Cyclophilin Inhibitors Therapeutics Market Insight

The U.K. cyclophilin inhibitors therapeutics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing emphasis on targeted HCV therapies and improved patient outcomes. Rising awareness among patients and healthcare providers about the benefits of cyclophilin inhibitors supports adoption. In addition, government initiatives for viral hepatitis screening and treatment, alongside robust pharmaceutical distribution networks, are expected to stimulate market growth. Hospitals and specialty clinics continue to be primary end users for combination therapy regimens, ensuring consistent demand.

Germany Cyclophilin Inhibitors Therapeutics Market Insight

The Germany cyclophilin inhibitors therapeutics market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of HCV treatment options and increasing adoption of advanced antiviral therapies. Germany’s well-developed healthcare infrastructure, emphasis on innovation, and strong clinical research ecosystem promote the adoption of cyclophilin inhibitors. Hospitals and specialty clinics prioritize these therapies for their proven efficacy and safety profiles. Integration into standardized HCV management protocols and patient-centric care programs further strengthens market demand.

Asia-Pacific Cyclophilin Inhibitors Therapeutics Market Insight

The Asia-Pacific cyclophilin inhibitors therapeutics market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by increasing prevalence of HCV infections, rising healthcare expenditure, and expanding access to advanced therapies in countries such as China, Japan, and India. The region’s growing focus on early diagnosis and treatment, supported by government health initiatives, is driving adoption. Furthermore, Asia-Pacific’s expanding pharmaceutical manufacturing capabilities and cost-effective therapy options are improving accessibility for a wider patient population.

Japan Cyclophilin Inhibitors Therapeutics Market Insight

The Japan cyclophilin inhibitors therapeutics market is gaining momentum due to the country’s advanced healthcare infrastructure, rising HCV prevalence in certain cohorts, and strong focus on precision medicine. Adoption is driven by increasing patient awareness and the integration of cyclophilin inhibitors into combination therapy protocols. Hospitals and specialty clinics emphasize effective antiviral regimens, while research collaborations support clinical innovation. The aging population also contributes to demand for safe and effective therapies suitable for older adults.

India Cyclophilin Inhibitors Therapeutics Market Insight

The India cyclophilin inhibitors therapeutics market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s growing HCV patient population, expanding healthcare infrastructure, and rising access to advanced antiviral therapies. Awareness campaigns and government programs promoting early diagnosis and treatment are boosting adoption. Hospitals and specialty clinics are the primary end users for combination therapies. In addition, availability of cost-effective generic cyclophilin inhibitors and strong domestic pharmaceutical manufacturing capabilities are key factors propelling market growth in India.

Cyclophilin Inhibitors Therapeutics Market Share

The Cyclophilin Inhibitors Therapeutics industry is primarily led by well-established companies, including:

- SCYNEXIS, Inc. (U.S.)

- Cypralis (U.K.)

- Debiopharm (Switzerland)

- Hepion Pharmaceuticals (U.S.)

- Mitotech Ltd (U.K.)

- Abliva AB. (Sweden)

- Hepion Pharmaceuticals (U.S.)

- Guilford Pharmaceuticals, Inc. (U.S.)

- Vernalis (U.K.)

- Ensemble Discovery (U.S.)

- Thanapaisal Company (Thailand)

- BioCanCell Ltd. (Israel)

- ZymoGenetics, Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- AbbVie Inc. (Ireland)

What are the Recent Developments in Global Cyclophilin Inhibitors Therapeutics Market?

- In July 2025, Revolution Medicines announced the publication of a peer-reviewed article detailing the discovery and development of zoldonrasib (RMC-9805), a RAS(ON) G12D-selective covalent inhibitor. The publication highlights the compound's novel mechanism involving cyclophilin A and its potential in targeting KRAS G12D-mutant cancers

- In April 2024, GenFleet Therapeutics unveiled GFH547, an oral pan-RAS(ON) inhibitor that employs a novel mechanism by reshaping and repurposing intracellular cyclophilin A (CypA) protein to target active RAS proteins across various subtypes. Preclinical data demonstrated profound pan-RAS inhibitory activity of GFH547, holding potential to overcome adaptive and acquired resistance against SIIP-based KRAS inhibitors

- In April 2024, Revolution Medicines advanced RMC-9805, a first-in-class covalent KRAS(G12D) molecular glue inhibitor that recruits cyclophilin A through a tricomplex mechanism. This innovative approach targets the previously "undruggable" KRAS(G12D) mutation, representing a significant advancement in cancer therapeutics

- In August 2023, Revolution Medicines advanced RMC-9805, a first-in-class covalent KRAS(G12D) molecular glue inhibitor that recruits cyclophilin A through a tricomplex mechanism. This innovative approach targets the previously "undruggable" KRAS(G12D) mutation, representing a significant advancement in cancer therapeutics

- In January 2023, Hepion Pharmaceuticals announced plans to present Phase 2a multiomics data for Rencofilstat (CRV431) at the NASH-TAG 2023 conference. Rencofilstat is a potent inhibitor of cyclophilins, currently in clinical-phase development for the treatment of nonalcoholic steatohepatitis (NASH), with the potential to play an important role in the overall treatment of liver disease

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.