Global Cylindrical Lock Market

Market Size in USD Billion

CAGR :

%

USD

4.57 Billion

USD

7.01 Billion

2024

2032

USD

4.57 Billion

USD

7.01 Billion

2024

2032

| 2025 –2032 | |

| USD 4.57 Billion | |

| USD 7.01 Billion | |

|

|

|

|

Cylindrical Lock Market Size

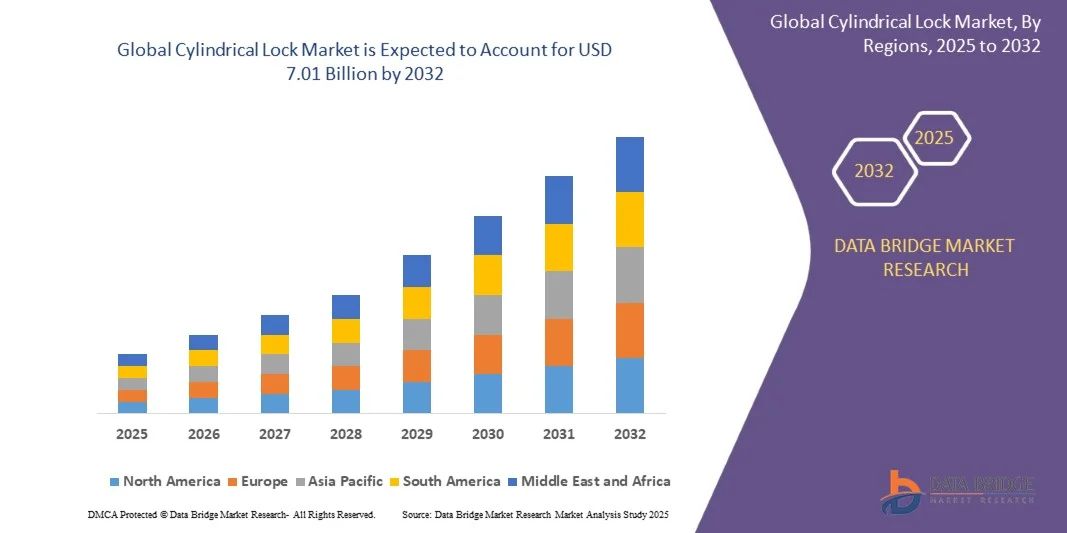

- The global cylindrical lock market size was valued at USD 4.57 billion in 2024 and is expected to reach USD 7.01 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely driven by increasing adoption of connected home devices and advancements in smart home technology, which are accelerating digitalization across residential and commercial spaces

- Rising consumer demand for secure, convenient, and integrated access control solutions is positioning cylindrical locks—particularly smart variants—as the preferred modern security system. The combination of technological progress and changing security expectations is rapidly boosting market adoption

Cylindrical Lock Market Analysis

- Cylindrical locks are mechanical or electromechanical devices that enable users to secure and access doors via traditional keys or smart technologies such as smartphones, keypads, biometric sensors, or voice commands. Integration with smart home platforms enhances security, convenience, and remote monitoring for both residential and commercial applications

- The growing market demand is fueled by rising consumer awareness of security risks, increasing adoption of keyless entry systems, and the popularity of smart home solutions. Technological innovations in user-friendly, durable, and interconnected lock systems are further strengthening the market’s growth trajectory

- Asia-Pacific dominated cylindrical lock market with a share of 36.5% in 2024, due to rapid urbanization, rising residential construction, and increasing adoption of both smart and non-smart door lock systems

- North America is expected to be the fastest growing region in the cylindrical lock market during the forecast period due to rising demand for smart cylindrical locks, strong adoption of connected home solutions, and increased investment in commercial and residential construction

- Non smart cylindrical door lock segment dominated the market with a market share of 60.5% in 2024, due to its cost-effectiveness, wide availability, and long-standing consumer familiarity. These locks remain highly preferred in developing regions and budget-conscious households where traditional mechanical security solutions continue to meet basic safety needs. Their ease of installation, low maintenance, and compatibility with a variety of door types further reinforce their strong demand across residential and small commercial spaces

Report Scope and Cylindrical Lock Market Segmentation

|

Attributes |

Cylindrical Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cylindrical Lock Market Trends

“Increasing Adoption of Smart Cylindrical Locks”

- The cylindrical lock market is increasingly driven by the adoption of smart cylindrical locks, as consumers and businesses seek advanced access control solutions that combine security with convenience. These locks integrate features such as keyless entry, biometric authentication, and remote monitoring, aligning with the broader trend of smart home and smart building technologies

- For instance, companies such as ASSA ABLOY and Allegion are expanding their portfolios of electronic cylindrical locks equipped with Bluetooth, Wi-Fi, and mobile app integration. These solutions are widely used in residential, hospitality, and institutional facilities where secure and efficient access management is critical

- Smart cylindrical locks are gaining popularity due to their ability to provide real-time access tracking, integration with IoT platforms, and compatibility with building automation systems. This makes them highly attractive for multi-tenant buildings, offices, hotels, and educational institutions

- Growing concerns over security breaches and unauthorized access are pushing end-users to shift from traditional mechanical locks to digital, data-driven locking solutions. Smart cylindrical locks offer audit trails, temporary access permissions, and remote control features, enhancing both safety and convenience

- The use of cylindrical smart locks is also rising in e-commerce and logistics, where parcel security and controlled delivery access are becoming priority applications. These deployments demonstrate the lock’s evolution from a mechanical component to an integrated security system within digital ecosystems

- The increasing adoption of smart cylindrical locks is positioning the product as a key enabler in the transition toward intelligent access control, blending robust physical security with connected, user-centric design

Cylindrical Lock Market Dynamics

Driver

“Rising Demand for Secure and Convenient Access Solutions”

- The rising need for secure and convenient access management is a major driver for the cylindrical lock market. Users are increasingly prioritizing both security and ease of use across residential, commercial, and industrial environments, creating strong demand for innovative locking systems

- For instance, dormakaba has developed cylindrical locks with advanced electronic features aimed at workplaces and institutional facilities, reflecting a broader customer preference for efficient, flexible, and adaptable locking solutions. Such offerings address the balance between safety requirements and operational convenience

- Cylindrical locks remain widely adopted due to their versatility, durability, and straightforward installation. With smart upgrades, they provide a seamless combination of physical robustness and digital control, making them useful in modern security infrastructures across diverse sectors

- The growing digital transformation of security systems is accelerating adoption, as cylindrical locks are increasingly integrated within keycard systems, mobile app access, or biometrics. This satisfies customer expectations for user-friendly, secure, and technology-driven solutions

- The persistent global need for reliable security alongside convenience ensures that cylindrical locks—both mechanical and smart—will remain an integral solution in multi-industry access control systems

Restraint/Challenge

“High Cost of Advanced Smart Locks”

- A significant restraint in the cylindrical lock market is the high cost of advanced smart cylindrical locks compared to traditional mechanical alternatives. Premium features such as biometric sensors, wireless connectivity, and cloud-based access control increase upfront product and installation expenses

- For instance, smart cylindrical locks from ASSA ABLOY or Allegion cost substantially more than conventional locks, limiting their adoption particularly in cost-sensitive residential markets or small businesses. Consumers frequently weigh these higher prices against the perceived value of advanced functionalities

- High initial costs are further amplified by ongoing requirements such as software updates, battery replacements, and system integration maintenance, which add to the life-cycle expenses of smart cylindrical locks. These factors discourage adoption in budget-constrained environments

- Affordability challenges are particularly evident in emerging economies, where traditional locks dominate due to cost efficiency and availability. This cost barrier slows the global penetration of connected cylindrical lock solutions, despite growing awareness of their security benefits

- To overcome these challenges, manufacturers are developing cost-optimized smart lock models, exploring bulk-scale pricing, and bundling solutions with wider smart home or building automation systems. Such strategies will be essential to balance affordability with innovation and expand adoption in both developed and developing regions

Cylindrical Lock Market Scope

The market is segmented on the basis of product, design, application, distribution channel, and end-user.

• By Product

On the basis of product, the cylindrical lock market is segmented into non smart cylindrical door lock and smart cylindrical door lock. The non smart cylindrical door lock segment dominated the largest market revenue share of 60.5% in 2024, supported by its cost-effectiveness, wide availability, and long-standing consumer familiarity. These locks remain highly preferred in developing regions and budget-conscious households where traditional mechanical security solutions continue to meet basic safety needs. Their ease of installation, low maintenance, and compatibility with a variety of door types further reinforce their strong demand across residential and small commercial spaces.

The smart cylindrical door lock segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the increasing adoption of connected security systems and smart home ecosystems. Rising urbanization, coupled with consumer demand for remote access, keyless entry, and enhanced convenience, is driving rapid integration of smart cylindrical locks in both residential and commercial settings. Features such as smartphone-controlled access, biometric authentication, and compatibility with voice assistants are attracting tech-savvy consumers and boosting the market’s premium segment growth.

• By Design

On the basis of design, the cylindrical lock market is segmented into mortise door lock, electronic or digital lock, deadbolt lock, heavy duty lock, and others. The mortise door lock segment held the largest market share in 2024, attributed to its superior durability, enhanced security features, and suitability for high-traffic doors. Mortise locks are widely used in commercial properties, luxury residences, and institutional buildings where strength and long-term reliability are key considerations. Their customizable design options and compatibility with various finishes also contribute to their sustained market leadership.

The electronic or digital lock segment is projected to register the fastest CAGR from 2025 to 2032, driven by the rising preference for keyless solutions and integration with advanced security systems. Increasing demand from smart building projects and modern residential complexes is accelerating the adoption of digital cylindrical locks that offer PIN codes, RFID cards, and mobile app-based control. Growing awareness of convenience and heightened security standards is further encouraging consumers and businesses to upgrade from conventional designs to electronic options.

• By Application

On the basis of application, the cylindrical lock market is segmented into private homes, small residential complex, cloakroom facilities, garage doors, and offices. The private homes segment dominated the market in 2024 due to widespread demand for door security solutions across single-family houses and apartments. Increasing concerns over household security, coupled with rising renovation activities and door hardware replacement, continue to drive strong installations in residential settings. The affordability and broad product variety available for homeowners further enhance its market share.

The offices segment is expected to witness the fastest growth rate during the forecast period, fueled by the growing need for advanced access control in corporate spaces and commercial complexes. Offices increasingly favor cylindrical locks for their combination of durability, aesthetic adaptability, and capability to integrate with digital access systems. Expansion of co-working spaces and small enterprises requiring secure yet flexible entry solutions is adding further momentum to this segment.

• By Distribution Channel

On the basis of distribution channel, the cylindrical lock market is divided into offline distribution channel and online distribution channel. The offline distribution channel segment led the market in 2024, supported by the dominance of retail hardware stores, specialty outlets, and dealer networks that allow customers to physically inspect and compare products before purchase. Strong relationships with contractors, locksmiths, and property developers further reinforce the offline segment’s leadership, especially in regions where trust and product validation are critical buying factors.

The online distribution channel is forecast to grow at the highest CAGR from 2025 to 2032, driven by the rapid expansion of e-commerce platforms and increasing consumer preference for convenient, contactless shopping. Wider product assortments, competitive pricing, and home delivery options are encouraging buyers to shift toward online purchases, particularly for smart cylindrical locks where specifications and reviews play a key role in decision-making.

• By End-User

On the basis of end-user, the cylindrical lock market is segmented into residential sector and commercial sector. The residential sector accounted for the largest market revenue share in 2024, owing to consistent demand for security upgrades in homes and apartments. Population growth, urban housing development, and ongoing home renovation trends continue to support strong sales across both traditional and smart cylindrical locks. Rising awareness of safety and the availability of budget-friendly options further sustain the segment’s dominance.

The commercial sector is projected to register the fastest growth rate through 2032, fueled by increasing construction of offices, retail spaces, and hospitality establishments requiring robust and technologically advanced locking solutions. The shift toward electronic access systems and compliance with stricter security regulations in commercial properties are key factors accelerating the adoption of high-performance cylindrical locks in this segment.

Cylindrical Lock Market Regional Analysis

- Asia-Pacific dominated the cylindrical lock market with the largest revenue share of 36.5% in 2024, driven by rapid urbanization, rising residential construction, and increasing adoption of both smart and non-smart door lock systems

- Strong growth in infrastructure development, expanding commercial real estate, and government initiatives promoting affordable housing projects are accelerating market expansion across the region

- The presence of large-scale manufacturing facilities, cost-effective labor, and rising consumer spending on home security solutions are further boosting cylindrical lock demand in key markets

China Cylindrical Lock Market Insight

China held the largest share in the Asia-Pacific cylindrical lock market in 2024, supported by its robust construction industry, strong domestic manufacturing capabilities, and increasing demand for both traditional and smart locking systems. Government initiatives in smart city development, large-scale residential and commercial projects, and growing exports of locking solutions are key drivers. Rising consumer awareness and preference for technologically advanced security solutions are further boosting adoption.

India Cylindrical Lock Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing urban housing projects, rapid adoption of smart home technologies, and government programs such as Pradhan Mantri Awas Yojana promoting affordable housing. Rising middle-class income, growing e-commerce channels for security products, and heightened awareness of property and office security are contributing to robust market expansion.

Europe Cylindrical Lock Market Insight

The Europe cylindrical lock market is expanding steadily due to increasing renovations in residential properties, growing adoption of electronic and digital locking systems, and stringent safety regulations. Demand for high-quality and durable locking mechanisms, along with the trend toward energy-efficient and smart building designs, is supporting market growth across the region.

Germany Cylindrical Lock Market Insight

Germany’s market is driven by advanced construction standards, strong consumer preference for precision-engineered and high-security locks, and the presence of major European lock manufacturers. Continuous technological innovation in smart and electronic locks, along with investments in commercial and residential infrastructure, are strengthening market demand.

U.K. Cylindrical Lock Market Insight

The U.K. market benefits from a mature real estate sector, increasing retrofitting and renovation projects, and growing adoption of smart security solutions in residential and commercial spaces. Focus on enhanced property security, technological upgrades in locking systems, and strong e-commerce penetration for home security products are enhancing market growth.

North America Cylindrical Lock Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for smart cylindrical locks, strong adoption of connected home solutions, and increased investment in commercial and residential construction. Emphasis on advanced security technologies, regulatory compliance, and replacement of traditional locks with technologically advanced systems are supporting market expansion.

U.S. Cylindrical Lock Market Insight

The U.S. accounted for the largest share in the North America market in 2024, fueled by a robust housing market, high adoption of smart homes, and growing replacement demand for advanced locking mechanisms. Strong presence of global lock manufacturers, extensive R&D in smart security systems, and increasing consumer preference for integrated security solutions reinforce its leadership position in the region.

Cylindrical Lock Market Share

The cylindrical lock industry is primarily led by well-established companies, including:

- Assa Abloy (Sweden)

- Allegion plc (Ireland)

- Kaba (India)

- Baldwin Hardware (U.S.)

- STANLEY CONVERGENT SECURITY SOLUTIONS, INC (U.S.)

- Liberty Safe (U.S.)

- Focus Technology Co., Ltd (China)

- Guard Security Equipment Co. Ltd (Hong Kong)

- Techlicious LLC (India)

- DOM Security (France)

- Serrature Meroni S.p.A. (Italy)

- Draper Tools Ltd (U.K.)

- EVVA Sicherheitstechnologie GmbH (Austria)

- C.Ed. Schulte Zylinderschlossfabrik (Germany)

- August Bremicker Söhne KG (Germany)

- dormakaba holding (Switzerland)

- The Eastern Company (U.S.)

Latest Developments in Cylindrical Lock Market

- In August 2025, Desloc launched the D110 Plus Smart Lock, a competitively priced smart lock targeting budget-conscious consumers. It features Wi-Fi connectivity, a fingerprint sensor, PIN pad, keyhole access, USB-C emergency power, and a small display for easier setup. Operating on four AA batteries with an estimated six-month lifespan, this launch makes advanced security technology more accessible, encouraging adoption among mid-tier residential and small commercial users. The lock’s affordability coupled with versatile features helps expand the market by bringing sophisticated smart lock solutions to a wider audience

- In March 2024, TCL introduced the K9G Plus Smart Door Lock in China, featuring a diamond-shaped design and a Grade C lock cylinder. It supports multiple unlocking options, including facial recognition, fingerprint, password, card, traditional key, and NFC, catering to diverse consumer preferences. This comprehensive feature set strengthens TCL’s position in the premium segment, attracting urban homeowners and smart home enthusiasts seeking secure and technologically advanced solutions. The launch also stimulates competitive innovation in the high-end smart lock market

- In July 2024, Aqara launched the Smart Lock U200, a retrofit model compatible with Apple Home Key. Supporting fingerprint recognition, PIN codes, and NFC unlocking, it enables hands-free access via iPhones and Apple Watches. The lock’s compatibility with both European and North American door types broadens its market reach, making it a versatile option for tech-savvy homeowners and integrators. This development drives smart lock adoption in regions where retrofitting existing doors is common, enhancing market penetration

- In June 2024, U-tec unveiled the Ulticam Smart Lock with Matter-over-Thread compatibility, incorporating fingerprint and facial recognition along with remote access. This high-end smart lock strengthens U-tec’s presence in the premium segment, supporting integration with broader smart home ecosystems. The launch reflects the market’s shift toward fully connected, interoperable security solutions, appealing to consumers prioritizing advanced technology, convenience, and comprehensive home automation

- In October 2023, Netatmo launched its first smart lock worldwide, featuring Bluetooth connectivity for smartphone-based unlocking. This introduction marked a significant advancement in smart home security by emphasizing ease of use, seamless integration, and enhanced convenience. The product set a benchmark for connected home security solutions, stimulating awareness and adoption of smart locks in residential markets globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.