Cystectomy Market Size

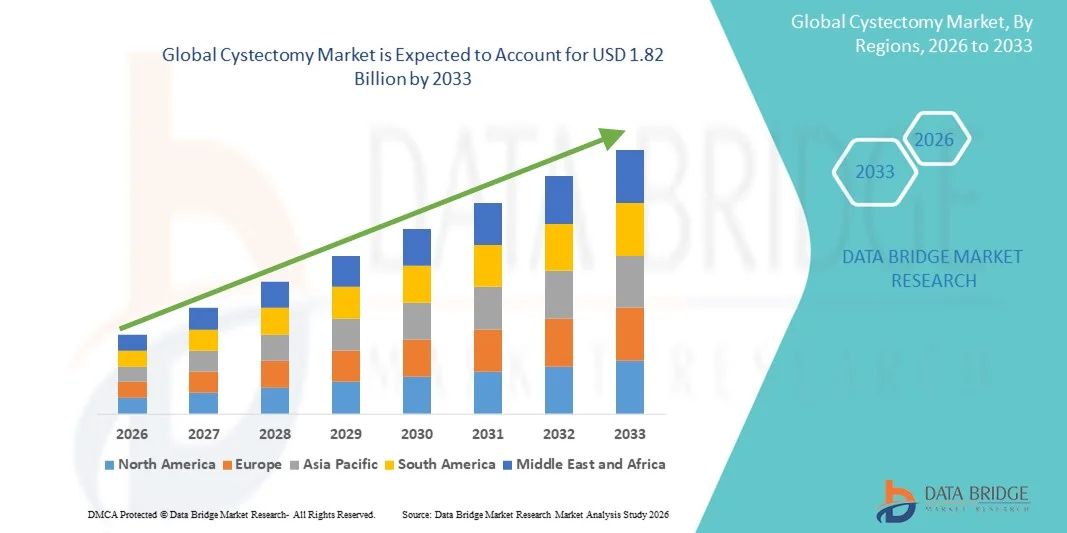

- The global cystectomy market size was valued at USD 1. 23 billion in 2025 and is expected to reach USD 1.82 billion by 2033, at a CAGR of 5.02% during the forecast period

- The market growth is largely driven by the rising prevalence of bladder cancer, increasing geriatric population, and growing adoption of advanced surgical techniques, including minimally invasive and robotic-assisted cystectomy procedures across healthcare settings

- Furthermore, improving diagnostic rates, expanding access to specialized urology care, and rising demand for effective surgical management of complex urological conditions are positioning cystectomy as a critical treatment approach, thereby significantly supporting the overall market growth trajectory

Cystectomy Market Analysis

- Cystectomy, involving partial or radical removal of the bladder, is increasingly recognized as a critical surgical intervention for treating bladder cancer and other severe urological conditions, with its adoption rising across hospitals and specialized urology centers due to advancements in minimally invasive and robotic-assisted techniques

- The escalating demand for cystectomy procedures is primarily driven by the growing prevalence of bladder cancer, increasing awareness of early detection and treatment, and the rising preference for less invasive surgical options that reduce recovery time and improve patient outcomes

- North America dominated the cystectomy market with the largest revenue share of 39.6% in 2025, supported by high incidence rates of bladder cancer, well-established healthcare infrastructure, advanced surgical facilities, and the presence of key medical device manufacturers, with the U.S. witnessing significant uptake of robotic-assisted cystectomy procedures in both academic and private healthcare settings

- Asia-Pacific is expected to be the fastest-growing region in the cystectomy market during the forecast period, driven by increasing healthcare expenditure, expanding access to tertiary care centers, and rising awareness of surgical treatment options among the aging population

- Radical cystectomy segment dominated the cystectomy market with a market share of 46.5% in 2025, fueled by its effectiveness in treating invasive bladder cancer and the growing adoption of enhanced recovery protocols post-surgery

Report Scope and Cystectomy Market Segmentation

|

Attributes |

Cystectomy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Cystectomy Market Trends

Adoption of Robotic-Assisted and Minimally Invasive Procedures

- A significant and accelerating trend in the global cystectomy market is the increasing adoption of robotic-assisted and minimally invasive surgical techniques, which are enhancing precision, reducing recovery times, and improving patient outcomes

- For instance, the da Vinci Surgical System is widely used for robotic-assisted radical cystectomy, allowing surgeons to perform complex procedures with enhanced dexterity and visualization

- These advanced surgical approaches enable features such as reduced blood loss, shorter hospital stays, and lower post-operative complications, thereby increasing patient preference for robotic-assisted cystectomy

- Integration of imaging technologies, such as intraoperative fluorescence and 3D visualization, with robotic systems is improving surgical planning and execution, creating a more efficient operating environment

- This trend towards technologically advanced, patient-friendly surgical procedures is fundamentally reshaping expectations for bladder cancer treatment. Consequently, hospitals and specialized urology centers are increasingly investing in robotic systems and training programs to support these procedures

- The demand for robotic-assisted and minimally invasive cystectomy procedures is growing rapidly across both developed and emerging markets, as patients and providers increasingly prioritize surgical efficiency and improved recovery outcomes

- Growing collaborations between medical device companies and hospitals are accelerating the adoption of next-generation surgical tools and supporting training programs for urologists globally

Cystectomy Market Dynamics

Driver

Rising Prevalence of Bladder Cancer and Geriatric Population

- The increasing incidence of bladder cancer, coupled with the growing geriatric population, is a significant driver for the heightened demand for cystectomy procedures

- For instance, in 2025, Memorial Sloan Kettering Cancer Center reported an increase in radical cystectomy procedures due to early cancer detection and advanced surgical facilities

- As awareness of bladder cancer symptoms improves and diagnostic technologies advance, more patients are identified as suitable candidates for cystectomy, driving procedural volume

- Furthermore, the rising preference for effective treatment options that improve long-term survival and reduce recurrence is making cystectomy a critical intervention in urological oncology

- The convenience of minimally invasive and robotic-assisted procedures, along with access to specialized urology centers, are key factors propelling cystectomy adoption in both hospital and outpatient surgical settings

- Expanding healthcare infrastructure and specialized training programs in major hospitals further contribute to the growing uptake of cystectomy procedures

- Increasing government initiatives and funding for cancer treatment programs in emerging markets are creating opportunities for greater procedural access and market growth

- Rising collaborations between academic institutions and medical technology companies are fostering innovation in cystectomy techniques and surgical devices, further driving market demand

Restraint/Challenge

High Procedure Costs and Limited Skilled Surgeons

- The high cost of cystectomy procedures, particularly robotic-assisted surgeries, poses a significant challenge to broader market penetration, limiting access in price-sensitive regions

- For instance, the overall treatment cost for a robotic-assisted radical cystectomy in the U.S. can be substantially higher than traditional open surgery, creating a barrier for some patients

- Limited availability of skilled urologic surgeons trained in advanced cystectomy techniques restricts procedural adoption in certain regions, slowing market growth

- In addition, the risk of post-operative complications and the need for extensive patient follow-up can deter some patients and healthcare providers from selecting cystectomy, particularly in developing countries

- While advancements in training and telemedicine support are gradually addressing these challenges, the perceived high cost and surgical complexity continue to hinder widespread adoption

- Overcoming these barriers through cost optimization, surgeon training programs, and improved access to advanced surgical facilities will be vital for sustained market growth

- Regulatory variations and stringent surgical approval processes in different regions can delay the introduction of innovative cystectomy devices and techniques

- Limited awareness and education about advanced cystectomy options among patients in rural or underdeveloped areas can reduce procedure uptake despite availability

Cystectomy Market Scope

The market is segmented on the basis of cystectomy type, methodology, equipment, and end user.

- By Cystectomy Type

On the basis of cystectomy type, the market is segmented into partial cystectomy, simple cystectomy, and radical cystectomy. The radical cystectomy segment dominated the market with the largest revenue share of 46.5% in 2025, driven by its effectiveness in treating invasive bladder cancer and reducing recurrence rates. Radical cystectomy is widely preferred in hospitals and specialized urology centers for its comprehensive removal of cancerous tissue, often combined with urinary diversion procedures to improve patient outcomes. The segment also benefits from technological advancements such as robotic assistance and minimally invasive techniques that reduce recovery time. High adoption rates in developed regions such as North America and Europe, coupled with increasing awareness of advanced surgical options, further support its market dominance. In addition, radical cystectomy is often covered under major health insurance policies, enhancing accessibility for patients requiring this treatment. The procedural standardization and extensive clinical data supporting its efficacy make radical cystectomy a key revenue contributor.

The partial cystectomy segment is anticipated to witness the fastest growth rate of 22.3% from 2026 to 2033, fueled by increasing demand for organ-preserving surgical options. Partial cystectomy is preferred for select early-stage bladder cancer patients, providing effective treatment while maintaining bladder function. The segment benefits from advancements in imaging technologies and precise tumor localization, allowing safer and more effective surgeries. Growing awareness among patients and clinicians about bladder-sparing procedures is contributing to adoption, especially in regions with rising cancer incidence. In addition, minimally invasive approaches, including robotic-assisted partial cystectomy, are driving patient preference due to faster recovery and fewer complications. The expanding healthcare infrastructure in emerging markets further supports the growth of partial cystectomy procedures.

- By Methodology

On the basis of methodology, the market is segmented into open surgery, minimally invasive surgery, and robotic surgery. The open surgery segment dominated the market in 2025 due to its long-standing use as the standard surgical approach for bladder removal and its applicability across a wide range of clinical scenarios. Open cystectomy remains highly preferred in hospitals with limited access to advanced robotic systems, offering reliable outcomes for patients with complex or advanced tumors. The segment benefits from extensive clinical experience, standardized protocols, and wide availability of surgical expertise. Hospitals in developing regions often favor open surgery due to cost-effectiveness and the need for less specialized equipment. Open surgery also allows for direct visualization and manipulation during complex cases, making it a dependable choice for urologic surgeons. The segment’s large installed base and familiarity among surgeons continue to support its market dominance.

The robotic surgery segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising adoption of robotic-assisted radical and partial cystectomy procedures in developed countries. Robotic surgery offers enhanced precision, reduced blood loss, shorter hospital stays, and faster recovery, making it increasingly preferred by patients and surgeons alike. Integration of advanced imaging, AI-assisted guidance, and minimally invasive techniques further supports procedural accuracy and improved outcomes. Growing awareness of the benefits of robotic systems among healthcare providers and patients, combined with increasing investments in robotic platforms, is accelerating adoption. Robotic-assisted cystectomy is gaining popularity in academic hospitals and specialty urology centers due to its potential to improve long-term survival and reduce post-operative complications.

- By Equipment

On the basis of equipment, the market is segmented into general surgical instruments, diagnostic instruments, surgical robots, and others. The general surgical instruments segment dominated the market with the largest revenue share in 2025 due to its essential role in performing standard cystectomy procedures across hospitals and clinics. These instruments, including scalpels, retractors, and suturing tools, are universally required for both open and minimally invasive procedures, ensuring consistent demand. The segment is supported by a broad installed base in hospitals and surgical centers globally, with continuous demand for replacements and upgrades. Surgeons rely on high-quality general surgical instruments for procedural safety and accuracy, maintaining their dominance in the market. In addition, regulatory approvals and established supply chains make these instruments highly accessible in most regions. The segment also benefits from training programs in surgical schools that emphasize proficiency with traditional instruments.

The surgical robots segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of robotic-assisted cystectomy procedures. Surgical robots provide enhanced dexterity, 3D visualization, and precise control, reducing operative complications and improving patient recovery times. The rising number of hospitals and urology centers investing in robotic platforms, particularly in North America and Europe, is supporting rapid market growth. Technological advancements, such as AI integration and augmented reality guidance, further enhance procedural accuracy. Training programs and partnerships between hospitals and medical device manufacturers are facilitating wider deployment of robotic systems. Increasing patient preference for minimally invasive and technologically advanced procedures also contributes to segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals and clinics, urology centers, and others. The hospitals and clinics segment dominated the market with the largest revenue share in 2025, owing to the availability of comprehensive surgical facilities, specialized urologists, and advanced post-operative care infrastructure. Hospitals handle the majority of cystectomy procedures, especially complex radical cystectomies, benefiting from well-established surgical protocols and multidisciplinary teams. High patient inflow, reimbursement coverage, and access to advanced surgical technologies contribute to the dominance of this segment. The presence of large academic and tertiary care hospitals in developed regions further drives the segment’s market share. In addition, hospitals often serve as training centers for surgeons, reinforcing procedural expertise and adoption rates.

The urology centers segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing specialization in urological care and rising patient preference for dedicated treatment facilities. These centers provide targeted expertise in bladder cancer management, often offering advanced robotic-assisted procedures and minimally invasive surgeries. Expansion of urology centers in urban regions and emerging markets is enhancing accessibility to cystectomy procedures. Focused patient care, specialized rehabilitation programs, and streamlined procedural workflows make these centers highly attractive to patients seeking efficient treatment. Partnerships with medical device companies to adopt latest surgical technologies are further accelerating growth in this segment.

Cystectomy Market Regional Analysis

- North America dominated the cystectomy market with the largest revenue share of 39.6% in 2025, supported by high incidence rates of bladder cancer, well-established healthcare infrastructure, advanced surgical facilities, and the presence of key medical device manufacturers

- Patients and healthcare providers in the region prioritize access to advanced surgical care, improved post-operative outcomes, and state-of-the-art treatment facilities, making cystectomy a preferred treatment option for invasive bladder cancer

- This widespread adoption is further supported by strong healthcare funding, well-established urology centers, a technologically advanced medical workforce, and growing awareness of bladder cancer management, establishing cystectomy as a critical surgical intervention across both hospitals and specialty clinics

U.S. Cystectomy Market Insight

The U.S. cystectomy market captured the largest revenue share of 82% in 2025 within North America, fueled by the rising prevalence of bladder cancer and the widespread adoption of minimally invasive and robotic-assisted surgical procedures. Patients and healthcare providers increasingly prioritize access to advanced surgical care, improved recovery outcomes, and reduced post-operative complications. The growing preference for specialized urology centers, combined with high awareness of early cancer detection and treatment options, further propels the cystectomy market. Moreover, the availability of insurance coverage and government healthcare support is significantly contributing to market expansion.

Europe Cystectomy Market Insight

The Europe cystectomy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing incidence of bladder cancer and stringent healthcare regulations promoting advanced surgical interventions. Rising urbanization, coupled with growing access to tertiary care hospitals, is fostering the adoption of cystectomy procedures. European patients also seek effective treatment options that offer improved long-term survival and reduced recurrence. The region is experiencing significant growth across hospitals and specialized urology centers, with cystectomy increasingly incorporated into both new treatment programs and upgraded surgical facilities.

U.K. Cystectomy Market Insight

The U.K. cystectomy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for minimally invasive and robotic-assisted procedures offering higher precision and faster recovery. In addition, increasing awareness of bladder cancer symptoms and early intervention is encouraging patients to undergo cystectomy. The U.K.’s well-established healthcare system, coupled with advanced diagnostic and surgical infrastructure, is expected to continue stimulating market growth. Public and private hospitals are focusing on specialized urology units, further supporting adoption of cystectomy procedures.

Germany Cystectomy Market Insight

The Germany cystectomy market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing bladder cancer awareness and demand for technologically advanced surgical solutions. Germany’s well-developed healthcare infrastructure and emphasis on medical innovation promote the adoption of robotic-assisted and minimally invasive cystectomy procedures. Hospitals and specialized urology centers are integrating advanced imaging and surgical robots to enhance procedural accuracy. A strong focus on patient safety, post-operative care, and clinical training also contributes to growing market adoption.

Asia-Pacific Cystectomy Market Insight

The Asia-Pacific cystectomy market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by rising bladder cancer incidence, expanding healthcare infrastructure, and technological advancements in countries such as China, Japan, and India. Increasing urbanization and growing awareness about early diagnosis and treatment options are driving adoption of cystectomy procedures. Moreover, government initiatives promoting cancer treatment programs and investments in robotic-assisted surgery facilities are supporting the market. The expanding geriatric population in APAC further increases demand for effective bladder cancer interventions.

Japan Cystectomy Market Insight

The Japan cystectomy market is gaining momentum due to the country’s high incidence of bladder cancer, advanced healthcare infrastructure, and increasing preference for minimally invasive and robotic-assisted procedures. Japanese patients prioritize surgical precision, reduced recovery times, and post-operative quality of life. Hospitals and specialized urology centers are investing in advanced surgical equipment and training programs to support these procedures. In addition, Japan’s aging population is likely to spur demand for safer and more effective cystectomy interventions in both residential and hospital settings.

India Cystectomy Market Insight

The India cystectomy market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the growing prevalence of bladder cancer, increasing healthcare expenditure, and expanding access to specialized surgical centers. India has a rapidly developing healthcare infrastructure, and cystectomy procedures are becoming increasingly accessible in both urban and semi-urban hospitals. The push towards advanced surgical techniques, including robotic-assisted cystectomy, alongside government initiatives for cancer treatment, are key factors propelling the market in India. Rising patient awareness and adoption of minimally invasive procedures further support growth.

Cystectomy Market Share

The Cystectomy industry is primarily led by well-established companies, including:

- Intuitive Surgical Operations, Inc. (U.S.)

- Medtronic (Ireland)

- Zimmer Biomet (U.S.)

- Boston Scientific Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Stryker (U.S.)

- Smith & Nephew (U.K.)

- TransEnterix, Inc. (U.S.)

- Titan Medical Inc. (Canada)

- Asensus Surgical, Inc. (U.S.)

- CMR Surgical Limited (U.K.)

- Medrobotics Corporation (U.S.)

- Renishaw plc (U.K.)

- Distalmotion SA (Switzerland)

- Levita Magnetics International Corp. (U.S.)

- Virtual Incision Corporation (U.S.)

- PROCEPT BioRobotics Corporation (U.S.)

- Nanjing Perlove Medical Equipment Co. Ltd. (China)

What are the Recent Developments in Global Cystectomy Market?

- In November 2025, the U.S. FDA approved the combination of pembrolizumab (Keytruda) and enfortumab vedotin‑ejfv (Padcev), administered perioperatively as a new therapeutic option for cisplatin‑ineligible adults with muscle‑invasive bladder cancer, marking a shift toward systemic immuno‑oncologic support around cystectomy

- In September 2025, Johnson & Johnson’s gemcitabine intravesical system (INLEXZO™, formerly TAR‑200) was approved by the U.S. FDA for BCG‑unresponsive non‑muscle‑invasive bladder cancer, offering an alternative to radical cystectomy for patients unwilling or ineligible for bladder removal through sustained local drug delivery

- In August 2025, interim clinical trial results showed that Pfizer’s Padcev and Keytruda combination significantly improved event‑free and overall survival in patients with muscle‑invasive bladder cancer compared with surgery alone, underscoring the potential of systemic therapies to change post‑surgical outcomes

- In July 2025, a team of urologists in India performed a successful robotic radical cystectomy with intracorporeal neobladder reconstruction using advanced robotic surgical technology, highlighting the global adoption of minimally invasive robotic techniques for complex bladder cancer surgeries and enhanced recovery prospects

- In March 2025, the U.S. FDA approved durvalumab (Imfinzi) in combination with gemcitabine and cisplatin as neoadjuvant treatment, followed by single‑agent durvalumab post‑radical cystectomy for adults with muscle‑invasive bladder cancer (MIBC), representing a significant advancement by integrating immunotherapy into perioperative settings and potentially improving long‑term outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.