Global Dairy And Ruminants Disinfectants Market

Market Size in USD Billion

CAGR :

%

USD

2.22 Billion

USD

3.77 Billion

2024

2032

USD

2.22 Billion

USD

3.77 Billion

2024

2032

| 2025 –2032 | |

| USD 2.22 Billion | |

| USD 3.77 Billion | |

|

|

|

|

Dairy and Ruminants Disinfectants Market Size

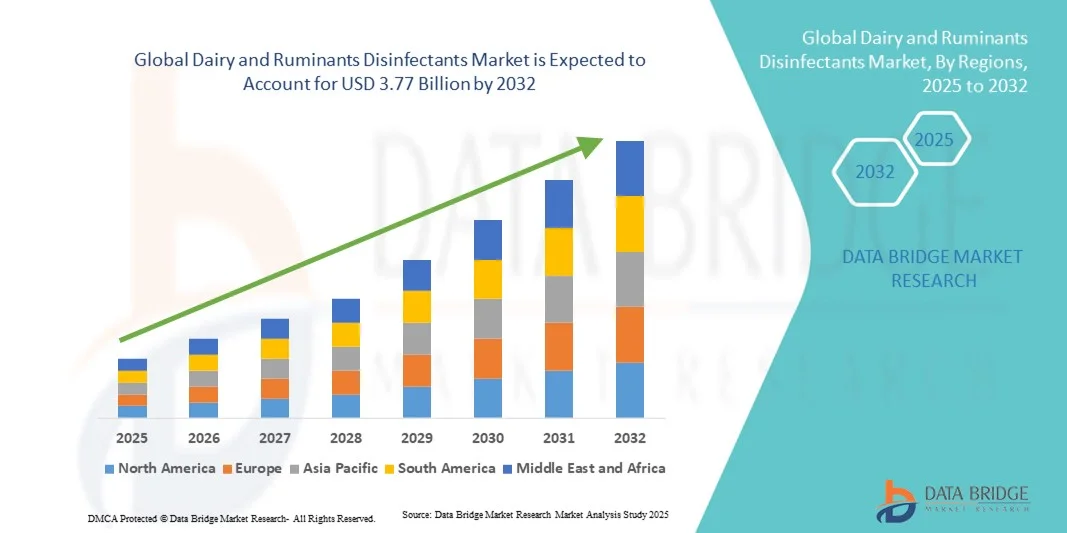

- The global dairy and ruminants disinfectants market size was valued at USD 2.22 billion in 2024 and is expected to reach USD 3.77 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fuelled by the increasing focus on animal hygiene to prevent infectious diseases and improve milk yield

- The growing awareness among dairy farmers regarding biosecurity measures and the importance of maintaining clean housing environments is also contributing to market expansion

Dairy and Ruminants Disinfectants Market Analysis

- The global dairy and ruminants disinfectants market is witnessing significant growth owing to the rising prevalence of contagious livestock diseases such as mastitis, foot-and-mouth disease, and brucellosis

- The adoption of effective sanitation practices is becoming increasingly essential to ensure animal welfare and maintain product quality across the dairy value chain

- North America dominated the dairy and ruminants disinfectants market with the largest revenue share in 2024, driven by the strong presence of large-scale dairy farms and stringent hygiene regulations

- Asia-Pacific region is expected to witness the highest growth rate in the global dairy and ruminants disinfectants market, driven by growing dairy production, rising investment in animal healthcare, and adoption of modern farm sanitation solutions across emerging economies

- The iodine segment held the largest market revenue share in 2024, driven by its broad-spectrum antimicrobial properties and high efficacy in preventing mastitis and other bacterial infections in dairy cattle. Iodine-based disinfectants are widely used due to their effectiveness, availability, and compatibility with diverse farm sanitation processes, making them a preferred choice among dairy producers globally

Report Scope and Dairy and Ruminants Disinfectants Market Segmentation

|

Attributes |

Dairy and Ruminants Disinfectants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dairy and Ruminants Disinfectants Market Trends

Growing Shift Toward Natural and Bio-Based Disinfectant Solutions

- The increasing demand for sustainable and non-toxic disinfectant formulations is reshaping the dairy and ruminants disinfectants market. Farmers and producers are increasingly turning to bio-based and plant-derived disinfectants due to their lower environmental impact and compatibility with animal welfare regulations. This transition is supported by stricter residue control norms in milk and meat production, as well as growing scrutiny from regulatory bodies concerning chemical residues and environmental safety in animal farming

- The growing consumer preference for organic and chemical-free dairy products is further fuelling the adoption of eco-friendly disinfectants. These products ensure hygiene without compromising milk safety or affecting beneficial microflora in livestock environments. The trend is especially prominent in regions emphasizing sustainable agriculture and green farming practices, with organic dairy farms increasingly adopting certified disinfectant products that align with global sustainability standards

- Technological innovations in enzyme-based and probiotic disinfectants are gaining traction, offering effective microbial control while reducing antimicrobial resistance concerns. Such formulations are increasingly used for cleaning milking equipment, animal housing, and water systems in dairy farms. The integration of advanced biotechnological processes is also enabling the development of highly targeted solutions that maintain microbial balance, ensuring better udder health and improved milk yield

- For instance, in 2024, several European dairy cooperatives began adopting natural lactic acid-based disinfectants developed by biotechnology firms to replace chlorine-based products. This move resulted in improved hygiene standards, reduced chemical residues, and higher consumer confidence in organic dairy products. The success of these initiatives is prompting other regions to implement similar eco-friendly disinfection models, particularly within EU-regulated and export-oriented dairy operations

- While bio-based disinfectants offer promising results, ensuring efficacy, cost-effectiveness, and consistent performance remains key. Manufacturers must continue investing in product optimization and farmer awareness programs to accelerate the shift toward sustainable livestock hygiene solutions. Strategic collaborations between biotech firms and dairy associations are also expected to foster innovation and large-scale deployment of safer, performance-driven disinfectant alternatives

Dairy and Ruminants Disinfectants Market Dynamics

Driver

Rising Incidence of Livestock Diseases and Increased Hygiene Awareness

- The growing prevalence of infectious diseases among dairy cattle and ruminants has made disinfection a critical part of herd management practices. Pathogens such as foot-and-mouth disease, mastitis, and bovine respiratory infections are major causes of productivity loss, driving the adoption of effective disinfectant solutions to prevent outbreaks. As global dairy consumption rises, preventive disinfection has become essential to maintaining milk safety and international trade compliance

- Farmers and producers are becoming more aware of the role of sanitation in ensuring milk quality and animal health. Regular cleaning and disinfection of equipment, animal housing, and feeding systems are being increasingly integrated into standard operating procedures, improving operational efficiency and biosecurity. This shift also aligns with the growing emphasis on traceability and food safety certifications within the dairy supply chain

- Government regulations and animal health organizations are emphasizing the implementation of preventive hygiene measures. Subsidized veterinary programs and awareness campaigns are further promoting disinfectant use across both commercial and smallholder farms. Such initiatives are supported by public-private partnerships that aim to reduce disease outbreaks, minimize antibiotic usage, and enhance livestock productivity in emerging economies

- For instance, in 2023, the U.S. Department of Agriculture (USDA) expanded its Clean Herd Initiative, which includes the use of approved disinfectants for farm biosecurity, boosting adoption rates across dairy operations nationwide. The initiative also supports training programs that educate farmers on proper application techniques and safety practices, fostering widespread and effective implementation of disinfection measures

- While disease control measures continue to drive demand, expanding access to cost-effective disinfectant products and training programs for small-scale farmers will be crucial to sustaining long-term market growth. Partnerships between manufacturers, cooperatives, and government agencies can help ensure affordability and availability, thereby strengthening resilience across the dairy value chain

Restraint/Challenge

High Product Cost and Limited Awareness Among Small-Scale Farmers

- Despite growing recognition of the importance of disinfection, the high cost of premium disinfectant formulations remains a barrier, particularly in developing regions. Many smallholder farmers continue to rely on traditional cleaning methods such as lime or detergent washing due to affordability concerns. This limits the widespread adoption of scientifically validated disinfectant solutions that are more effective in controlling microbial contamination

- Limited awareness regarding proper disinfection protocols and dosage accuracy also hampers product effectiveness. A lack of training and technical knowledge often results in inconsistent application, reducing the overall efficacy of hygiene programs in dairy farms. Furthermore, misinformation about chemical safety and product handling contributes to underutilization, affecting both herd health and milk quality

- Supply chain constraints and inconsistent product availability in rural areas further restrict market reach. Farmers in remote zones face challenges in accessing high-quality disinfectant formulations and support services, leading to uneven adoption across regions. Weak distribution networks, limited cold chain facilities, and inadequate after-sales support compound these challenges in emerging economies

- For instance, in 2024, a study by the Food and Agriculture Organization (FAO) revealed that over 60% of dairy farmers in sub-Saharan Africa had limited access to commercial disinfectants due to cost and distribution issues, relying instead on low-grade cleaning substitutes. This lack of access has contributed to recurring disease outbreaks, lower productivity, and increased economic vulnerability among smallholder dairy producers

- Addressing these barriers through affordable product innovations, awareness campaigns, and supply chain strengthening will be vital for improving market penetration and enhancing farm-level hygiene standards globally. Expanding digital training platforms and localized production units could further ensure that rural farmers have access to reliable, cost-effective disinfectant solutions tailored to regional needs

Dairy and Ruminants Disinfectants Market Scope

The dairy and ruminants disinfectants market is segmented on the basis of type, form, and application.

- By Type

On the basis of type, the dairy and ruminants disinfectants market is segmented into iodine, lactic acid, hydrogen peroxide, phenolic acids, peracetic acid, quaternary compounds, chlorine, chlorine dioxide, chlorohexidine, glut-quat mixes, glycolic acid, and others. The iodine segment held the largest market revenue share in 2024, driven by its broad-spectrum antimicrobial properties and high efficacy in preventing mastitis and other bacterial infections in dairy cattle. Iodine-based disinfectants are widely used due to their effectiveness, availability, and compatibility with diverse farm sanitation processes, making them a preferred choice among dairy producers globally.

The lactic acid segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to increasing demand for bio-based and eco-friendly disinfectants. Lactic acid formulations are recognized for their biodegradability, safety, and effectiveness against pathogens, making them ideal for sustainable dairy operations. Their rising use in organic and residue-free milk production systems is further supporting the rapid growth of this segment across both developed and emerging markets.

- By Form

On the basis of form, the market is segmented into powder and liquid. The liquid segment dominated the market in 2024, accounting for the largest share due to its ease of application, quick action, and superior coverage in cleaning and disinfection processes. Liquid disinfectants are widely preferred for teat dips, equipment sanitation, and housing hygiene, as they ensure uniform application and faster microbial control.

The powder segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its longer shelf life, reduced transportation cost, and suitability for dry surface applications. Powder disinfectants are particularly beneficial in regions with limited water access and are increasingly being adopted for hoof care and dry sanitation routines in livestock facilities.

- By Application

On the basis of application, the market is segmented into teat dip and hoof care. The teat dip segment held the largest market share in 2024, owing to the increasing focus on preventing mastitis and maintaining udder hygiene in dairy herds. Regular use of disinfectant-based teat dips is an integral part of herd health management programs, improving milk quality and reducing antibiotic dependence.

The hoof care segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising prevalence of hoof-related infections such as digital dermatitis and foot rot. Disinfectants formulated for hoof baths and surface treatments are gaining popularity among dairy farmers as part of integrated biosecurity programs to enhance animal welfare and productivity.

Dairy and Ruminants Disinfectants Market Regional Analysis

- North America dominated the dairy and ruminants disinfectants market with the largest revenue share in 2024, driven by the strong presence of large-scale dairy farms and stringent hygiene regulations

- The region’s focus on animal health management, along with advanced farming infrastructure, supports the widespread use of disinfectants for disease prevention and milk quality improvement

- In addition, the adoption of biosecurity programs and the increasing emphasis on sustainable livestock practices are boosting market growth across the U.S. and Canada

U.S. Dairy and Ruminants Disinfectants Market Insight

The U.S. dairy and ruminants disinfectants market captured the largest revenue share in 2024 within North America, fuelled by strict regulatory standards for milk safety and animal health. The increasing prevalence of mastitis and other bacterial infections has prompted dairy producers to adopt effective disinfectants for milking equipment and livestock housing. Furthermore, rising awareness among farmers regarding hygiene protocols and the availability of advanced, eco-friendly formulations are propelling market demand across the country.

Europe Dairy and Ruminants Disinfectants Market Insight

The Europe dairy and ruminants disinfectants market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict EU biosecurity norms and the growing shift toward sustainable livestock hygiene. The region’s dairy industry emphasizes residue-free disinfectant solutions to ensure compliance with food safety standards. Increasing adoption of organic and plant-based disinfectants across leading dairy-producing countries such as Germany, France, and the Netherlands is further accelerating regional growth.

U.K. Dairy and Ruminants Disinfectants Market Insight

The U.K. dairy and ruminants disinfectants market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s well-established dairy sector and focus on animal welfare. British dairy producers are increasingly investing in hygiene management systems to control disease transmission and improve productivity. Moreover, the rising consumer demand for high-quality, chemical-free dairy products is encouraging the adoption of safer, non-toxic disinfectant formulations.

Germany Dairy and Ruminants Disinfectants Market Insight

The Germany dairy and ruminants disinfectants market is expected to witness the fastest growth rate from 2025 to 2032, driven by technological innovation and sustainability initiatives in the livestock industry. German farmers are rapidly adopting bio-based and enzyme-based disinfectants to minimize environmental impact and comply with stringent hygiene standards. In addition, the country’s strong dairy production capacity and ongoing government support for clean farming practices are key factors propelling market growth.

Asia-Pacific Dairy and Ruminants Disinfectants Market Insight

The Asia-Pacific dairy and ruminants disinfectants market is expected to witness the fastest growth rate from 2025 to 2032, attributed to increasing dairy production, government-led animal health programs, and growing awareness about farm hygiene. Countries such as China, India, and Japan are experiencing a surge in demand for disinfectants due to expanding dairy herds and modernization of farming practices. The availability of affordable disinfectant formulations and the emergence of domestic manufacturers are further strengthening regional market expansion.

Japan Dairy and Ruminants Disinfectants Market Insight

The Japan dairy and ruminants disinfectants market is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in dairy automation and a focus on maintaining high hygiene standards. The country’s dairy sector emphasizes biosecure and residue-free production systems, resulting in increased adoption of premium disinfectant solutions. Furthermore, Japan’s focus on technology integration and the development of environmentally sustainable farming methods are expected to propel steady market growth.

China Dairy and Ruminants Disinfectants Market Insight

The China dairy and ruminants disinfectants market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the rapid expansion of dairy farms and rising consumer demand for safe, high-quality milk products. Government efforts to improve livestock health through national hygiene programs are driving the adoption of effective disinfectant solutions. Moreover, China’s strong domestic manufacturing base and growing focus on bio-based formulations are contributing significantly to the country’s market leadership.

Dairy and Ruminants Disinfectants Market Share

The Dairy and Ruminants Disinfectants industry is primarily led by well-established companies, including:

• IROX Technologies Inc. (U.S.)

• Theseo Group (France)

• Evans Vanodine International PLC (U.K.)

• Krka (Slovenia)

• Diversey, Inc. (U.S.)

• Evonik Industries (Germany)

• Thymox (Canada)

• NEOGEN Corporation (U.S.)

• GEA Group (Germany)

• Zoetis (U.S.)

• LANXESS (Germany)

• Kersia Group (France)

• DeLaval (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.