Global Dairy Based Beverage Flavoring Systems Market

Market Size in USD Billion

CAGR :

%

USD

4.27 Billion

USD

6.07 Billion

2025

2033

USD

4.27 Billion

USD

6.07 Billion

2025

2033

| 2026 –2033 | |

| USD 4.27 Billion | |

| USD 6.07 Billion | |

|

|

|

|

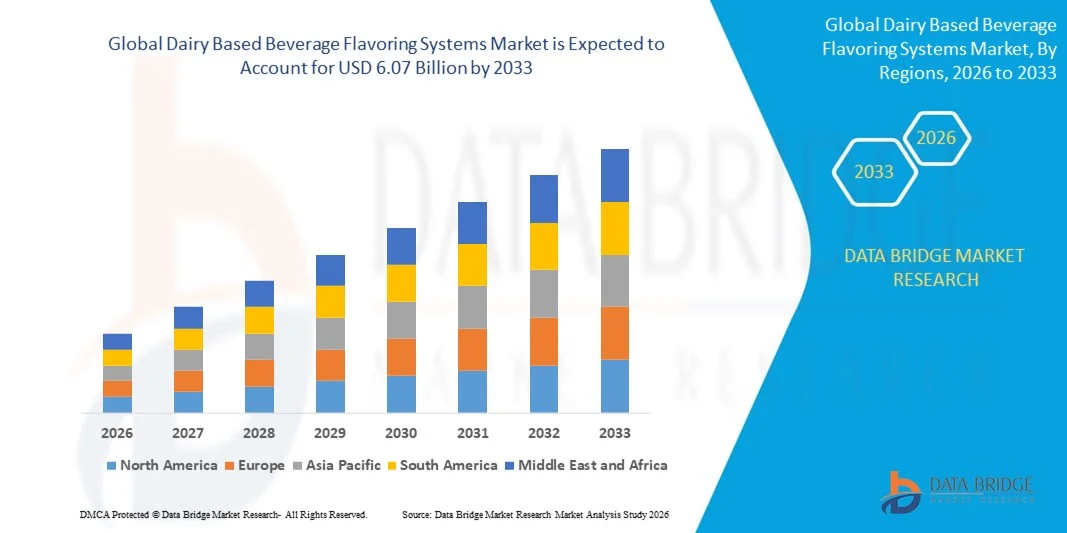

What is the Global Dairy Based Beverage Flavoring Systems Market Size and Growth Rate?

- The global dairy based beverage flavoring systems market size was valued at USD 4.27 billion in 2025 and is expected to reach USD 6.07 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the rising demand for innovative and clean-label flavored dairy beverages across health-conscious consumers and expanding applications in functional and fortified drink segments

- Growing consumer preference for ready-to-drink dairy beverages with natural and exotic flavors is encouraging manufacturers to develop advanced flavoring systems tailored to evolving taste trends and dietary needs

What are the Major Takeaways of Dairy Based Beverage Flavoring Systems Market?

- The dairy based beverage flavoring systems market is seeing steady growth due to increasing consumer demand for innovative and indulgent flavor experiences in both traditional and functional drinks

- Brands are enhancing their product portfolios with customized flavor blends to improve taste, shelf appeal, and customer satisfaction in various dairy beverages

- North America dominated the dairy based beverage flavoring systems market with the largest revenue share of 41.12% in 2025, supported by a strong demand for value-added dairy products and consumer preference for enhanced taste experiences

- The Europe market is expected to witness at the fastest growth rate of 10.36% from 2026 to 2033, supported by the region’s emphasis on natural ingredients and premium product offerings

- The flavoring agents segment held the largest market share in 2025 due to their essential role in determining the sensory appeal of dairy beverages. These agents are widely used in milk-based drinks, yogurts, and smoothies to provide distinct and desirable taste experiences, such as fruity, chocolate, or vanilla profiles

Report Scope and Dairy Based Beverage Flavoring Systems Market Segmentation

|

Attributes |

Dairy Based Beverage Flavoring Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dairy Based Beverage Flavoring Systems Market?

Rising Demand for Natural and Clean-Label Flavoring Solutions in Dairy Beverages

- Growing focus on health and transparency is driving demand for natural flavoring in dairy beverages, prompting brands to eliminate artificial additives and preservatives

- Manufacturers are reformulating dairy drinks using plant-based extracts and organic ingredients to align with clean-label expectations from health-conscious consumers

- Several brands have launched flavored milk with natural vanilla or real fruit ingredients such as mango and strawberry to cater to wellness-driven preferences

- Functional drinks such as kefir and probiotic yogurts are using herbs and spices such as mint and turmeric to enhance flavor while adding perceived health benefits

- Clean-label flavored dairy beverages are gaining more retail visibility as shoppers actively choose products with simpler ingredient lists and minimal processing

What are the Key Drivers of Dairy Based Beverage Flavoring Systems Market?

- Consumers are increasingly opting for functional and fortified dairy drinks that offer added nutritional benefits along with taste and hydration

- Flavoring systems are essential for improving the palatability of products that contain protein isolates, vitamins, and other functional ingredients

- Health-conscious millennials are driving the demand for probiotic yogurts, vitamin-enriched smoothies, and high-protein flavored milk drinks

- For instance, brands are using chocolate, vanilla, and tropical fruit flavors to mask the taste of nutrients in high-protein dairy beverages

- The market is further expanding with lactose-free and plant-based dairy alternatives that require customized flavor systems to suit varied dietary needs

Which Factor is Challenging the Growth of the Dairy Based Beverage Flavoring Systems Market?

- Manufacturers face regulatory hurdles in getting flavoring ingredients approved, especially when using synthetic or novel compounds in dairy-based beverages

- The shift toward clean-label products restricts the use of artificial colors, preservatives, and flavors, challenging formulators to maintain taste and shelf life

- Creating natural alternatives with the same flavor intensity as synthetic versions requires costly extraction methods and precise blending techniques

- For instance, achieving a natural strawberry flavor without artificial components demands advanced R&D and can slow down product timelines

- Small and medium enterprises often struggle with the high cost of innovation and adapting to varying international regulatory and labeling standards

How is the Dairy Based Beverage Flavoring Systems Market Segmented?

The market is segmented on the basis of ingredients, origin, and form.

- By Ingredients

On the basis of ingredients, the market is segmented into flavoring agents, flavor carriers, flavor enhancers, and others. The flavoring agents segment held the largest market share in 2025 due to their essential role in determining the sensory appeal of dairy beverages. These agents are widely used in milk-based drinks, yogurts, and smoothies to provide distinct and desirable taste experiences, such as fruity, chocolate, or vanilla profiles.

The flavor enhancers segment is expected to witness at the fastest growth rate from 2026 to 2033, driven by their ability to amplify the existing taste without overpowering the product. As clean-label and low-sugar formulations gain traction, flavor enhancers are increasingly being adopted to maintain taste quality in fortified or functional dairy beverages that may have off-notes from added nutrients.

- By Origin

On the basis of origin, the market is categorized into natural, artificial, and nature-identical. The natural segment accounted for the largest share in 2025, supported by a rising demand for clean-label and health-focused products. Consumers are showing a preference for dairy drinks flavored with plant-derived ingredients such as vanilla bean, cocoa, and fruit extracts, especially in wellness and probiotic beverages.

The artificial segment is expected to witness at the fastest growth rate from 2026 to 2033, particularly in price-sensitive markets, due to its cost-effectiveness and intense flavor delivery. These flavors continue to be used in flavored milks and desserts targeted at children and mass-market consumers seeking consistent taste and longer shelf stability.

- By Form

On the basis of form, the market is divided into liquid and dry. The liquid segment dominated the market in 2025, as it offers ease of blending with dairy bases and uniform dispersion of flavor. Liquid flavors are particularly preferred in ready-to-drink milk beverages, yogurts, and smoothies where high solubility and quick integration are essential.

The dry segment is expected to witness at the fastest growth rate from 2026 to 2033, due to its convenience in transportation and longer shelf life. Dry flavors are commonly used in powdered milk drinks and instant dairy beverage mixes, particularly for sports nutrition and on-the-go consumption.

Which Region Holds the Largest Share of the Dairy Based Beverage Flavoring Systems Market?

- North America dominated the dairy based beverage flavoring systems market with the largest revenue share of 41.12% in 2025, supported by a strong demand for value-added dairy products and consumer preference for enhanced taste experiences

- The region’s market growth is bolstered by the high consumption of flavored milk, yogurts, and dairy-based smoothies, especially among health-conscious individuals and younger demographics

- Major manufacturers in North America are focusing on natural flavor innovations, catering to the clean-label trend and leveraging functional ingredients to align with evolving dietary needs

U.S. Dairy Based Beverage Flavoring Systems Market Insight

The U.S. dairy based beverage flavoring systems market held the largest revenue share within North America in 2025, driven by a well-established dairy sector and increasing consumer interest in functional and indulgent beverage options. Brands are offering a wide range of flavored milk and yogurts featuring ingredients such as vanilla, cocoa, and tropical fruits to meet varied taste preferences. The focus on health has also led to the rise of fortified flavored dairy drinks enriched with proteins, vitamins, and probiotics.

Europe Dairy Based Beverage Flavoring Systems Market Insight

The Europe market is expected to witness at the fastest growth rate of 10.36% from 2026 to 2033, supported by the region’s emphasis on natural ingredients and premium product offerings. Flavored dairy drinks are popular across various age groups, with increasing adoption of organic and sustainable flavoring sources. Rising lactose intolerance awareness is also driving demand for flavored lactose-free alternatives, creating new opportunities for flavor innovation in plant-based dairy beverages.

U.K. Dairy Based Beverage Flavoring Systems Market Insight

The U.K. market is expected to witness at the fastest growth rate from 2026 to 2033, due to rising consumer demand for convenient, tasty, and nutritious dairy beverages. Clean-label products with reduced sugar and natural fruit flavors are gaining traction among health-aware consumers. Innovative launches such as flavored kefir and protein-rich yogurts with botanicals are further expanding market presence across retail and food service sectors.

Germany Dairy Based Beverage Flavoring Systems Market Insight

The Germany is experiencing increased demand for premium and health-driven dairy beverages, particularly among urban and younger consumers. Functional flavors such as turmeric, ginger, and elderberry are being used to boost the nutritional appeal of dairy drinks. Local manufacturers are also emphasizing transparency in sourcing and production, aligning with growing consumer interest in sustainability and traceability.

Asia-Pacific Dairy Based Beverage Flavoring Systems Market Insight

The Asia-Pacific market is expected to witness at the fastest growth rate from 2026 to 2033, driven by expanding dairy consumption, urbanization, and changing dietary patterns in countries such as China, India, and Japan. Rising awareness of health and wellness is fueling demand for functional and naturally flavored dairy beverages. The market also benefits from rapid innovation in flavor development and growing investments in dairy processing infrastructure across emerging economies.

Japan Dairy Based Beverage Flavoring Systems Market Insight

The Japan’s market is expected to witness at the fastest growth rate from 2026 to 2033, owing to its established culture of functional beverages and the popularity of drinkable yogurts and probiotic drinks. Traditional flavors such as matcha and yuzu are being integrated into dairy products to cater to local tastes. In addition, aging demographics are encouraging the development of dairy-based beverages with added nutritional benefits, including calcium and vitamins for bone health.

China Dairy Based Beverage Flavoring Systems Market Insight

The China held the largest revenue share in the Asia-Pacific region in 2025, supported by rapid urbanization, growing middle-class income, and rising interest in flavored nutritional drinks. Consumers are increasingly opting for dairy-based beverages infused with fruit and herbal flavors to balance health and taste. Domestic brands are expanding their product lines with functional flavoring systems and leveraging e-commerce platforms to reach a wider audience.

Which are the Top Companies in Dairy Based Beverage Flavoring Systems Market?

The dairy based beverage flavoring systems industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- Givaudan (Switzerland)

- Sensient Technologies Corporation (U.S.)

- Kerry Group plc (Ireland)

- Tate & Lyle (U.K.)

- MANE (France)

- Döhler GmbH (Germany)

- Flavorchem & Orchidia Fragrances (U.S.)

- Symrise (Germany)

- Firmenich SA (Switzerland)

- Takasago International Corporation (Japan)

- International Flavors & Fragrances Inc. (U.S.)

- T.Hasegawa U.S. Inc. (U.S.)

What are the Recent Developments in Global Dairy Based Beverage Flavoring Systems Market?

- In March 2024, Keysight and Q-CTRL formed a collaboration to accelerate next-generation quantum infrastructure software, strengthening innovation in quantum computing development and ecosystem advancement

- In March 2024, Rohde and Schwarz launched advanced phase noise analysis and VCO measurement capabilities up to 50 GHz with its R&S FSPN 50 solution, enhancing high-precision RF testing and supporting more efficient signal validation for advanced applications

- In January 2024, Fortive announced the completion of its acquisition of EA Elektro-Automatik, expanding its electronic test and measurement portfolio and reinforcing its global market position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dairy Based Beverage Flavoring Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dairy Based Beverage Flavoring Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dairy Based Beverage Flavoring Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.