Global Dairy Disinfectants Market

Market Size in USD Billion

CAGR :

%

USD

4.18 Billion

USD

7.35 Billion

2025

2033

USD

4.18 Billion

USD

7.35 Billion

2025

2033

| 2026 –2033 | |

| USD 4.18 Billion | |

| USD 7.35 Billion | |

|

|

|

|

Global Dairy Disinfectants Market Size

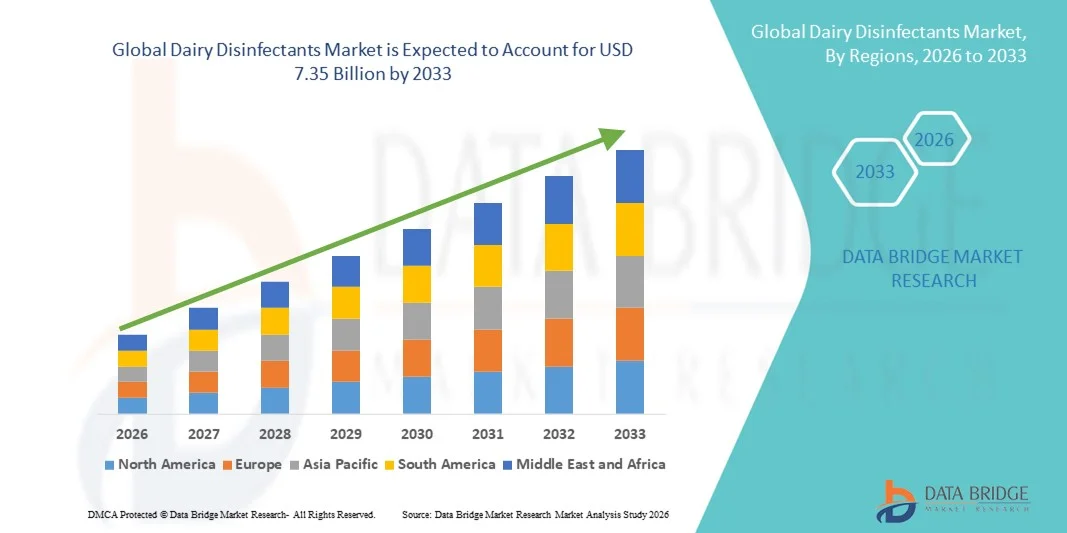

- The global Dairy Disinfectants Market size was valued at USD 4.18 billion in 2025 and is expected to reach USD 7.35 billion by 2033, at a CAGR of 7.30% during the forecast period.

- The market growth is largely driven by increasing awareness of hygiene and food safety standards across the dairy industry, along with stringent government regulations regarding microbial contamination and dairy product quality.

- Furthermore, rising demand for high-quality dairy products and the adoption of advanced sanitation technologies in dairy farms and processing plants are fueling the need for effective disinfectants. These factors are collectively accelerating the uptake of dairy disinfectant solutions, thereby significantly boosting the industry’s growth.

Global Dairy Disinfectants Market Analysis

- Dairy disinfectants, including chemical and bio-based solutions used for cleaning and sanitizing equipment, surfaces, and milking systems, are increasingly essential in modern dairy farming and processing operations due to their effectiveness in controlling microbial contamination and ensuring product safety.

- The growing demand for dairy disinfectants is primarily driven by stringent food safety regulations, rising consumer awareness of hygiene standards, and increasing adoption of automated and high-efficiency dairy processing systems.

- Asia-Pacific dominated the Global Dairy Disinfectants Market with the largest revenue share of 33.5% in 2025, supported by advanced dairy infrastructure, high regulatory compliance standards, and a strong presence of leading market players, with the U.S. witnessing significant uptake in disinfectant solutions for both large-scale dairy farms and processing plants.

- North America is expected to be the fastest-growing region in the Global Dairy Disinfectants Market during the forecast period due to rapid urbanization, expanding dairy production, and increasing focus on quality and safety standards in emerging economies.

- The fluid milk segment dominated the market with the largest revenue share of 36.8% in 2025, driven by the high consumption of liquid milk and the critical need for hygiene in raw milk handling and storage.

Report Scope and Global Dairy Disinfectants Market Segmentation

|

Attributes |

Dairy Disinfectants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Ecolab Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Dairy Disinfectants Market Trends

Enhanced Efficiency Through Automation and Smart Monitoring

- A significant and accelerating trend in the global Dairy Disinfectants Market is the increasing integration of automated monitoring systems and smart farm management technologies. This fusion of innovations is significantly enhancing operational efficiency, hygiene management, and traceability across dairy farms and processing units.

- For instance, automated disinfectant dosing systems can precisely measure and deliver cleaning solutions to milking equipment and processing lines, reducing human error and ensuring consistent sanitation standards. Similarly, IoT-enabled sensors can monitor surface cleanliness and alert farm managers when equipment requires disinfection, streamlining routine maintenance.

- Smart monitoring in dairy disinfectants enables features such as real-time tracking of hygiene compliance, predictive alerts for equipment sanitation schedules, and optimization of chemical usage to reduce waste and environmental impact. For instance, some advanced systems utilize AI algorithms to recommend disinfectant concentrations based on microbial load and equipment type.

- The seamless integration of disinfectant management systems with broader farm management platforms allows centralized control over sanitation, herd health, and milk quality. Through a single interface, farm operators can manage cleaning schedules alongside temperature monitoring, feed management, and overall operational analytics, creating a unified and automated dairy operation.

- This trend towards more intelligent, automated, and data-driven sanitation solutions is fundamentally reshaping expectations for dairy hygiene and operational efficiency. Consequently, companies such as Ecolab and Diversey are developing AI-enabled disinfectant solutions with features such as automated dosing, real-time monitoring, and integration with farm management software.

- The demand for dairy disinfectants that offer smart monitoring, automation, and data-driven efficiency is growing rapidly across both large-scale commercial farms and small-to-medium dairy operations, as producers increasingly prioritize hygiene, productivity, and sustainability.

Global Dairy Disinfectants Market Dynamics

Driver

Growing Need Due to Rising Food Safety Standards and Hygiene Awareness

- The increasing prevalence of foodborne illnesses, coupled with the tightening of regulatory hygiene standards in the dairy industry, is a significant driver for the heightened demand for dairy disinfectants.

- For instance, in 2025, Ecolab introduced advanced automated disinfectant systems for dairy farms and processing plants, integrating real-time monitoring and precision dosing to maintain optimal hygiene. Such innovations by key companies are expected to drive growth in the dairy disinfectants market during the forecast period.

- As consumers become more conscious of food safety and demand higher-quality dairy products, disinfectants provide effective sanitation for milking equipment, storage tanks, and processing surfaces, ensuring compliance with safety standards and preventing contamination.

- Furthermore, the rising adoption of modern dairy practices and automated farm management systems is making disinfectants an integral part of daily operations, enabling seamless integration with cleaning schedules, IoT-based monitoring, and farm management software.

- The efficiency of automated dosing, the ability to track hygiene compliance, and the ease of maintaining sanitation protocols are key factors propelling the adoption of dairy disinfectants across both commercial and small-to-medium-scale farms. The trend toward sustainable and eco-friendly formulations further supports market growth.

Restraint/Challenge

Concerns Regarding Chemical Safety and High Operational Costs

- Concerns surrounding the safe handling and environmental impact of chemical disinfectants pose a significant challenge to broader market penetration. Improper use can result in residue contamination, regulatory non-compliance, or worker safety issues, raising caution among farm operators.

- For instance, reports of chemical misuse in dairy operations have prompted some producers to delay adoption of more potent disinfectant solutions.

- Addressing these concerns through the development of eco-friendly, biodegradable, and low-toxicity formulations, along with proper training and safety protocols, is crucial for building confidence among users. Companies such as Diversey and Chr. Hansen emphasize sustainable formulations and clear usage guidelines in their product offerings to reassure customers. Additionally, the relatively high operational costs associated with advanced automated disinfectant systems can be a barrier for smaller farms or budget-conscious operators. While basic chemical disinfectants remain affordable, premium automated systems and eco-friendly formulations often come with higher upfront and maintenance costs.

- While costs are gradually decreasing, the perceived expense of adopting advanced disinfectant solutions can still hinder widespread adoption, particularly in developing regions or for smaller-scale farms.

- Overcoming these challenges through innovation in safe, cost-effective solutions, training programs for proper chemical handling, and sustainable practices will be vital for sustained growth in the dairy disinfectants market.

Global Dairy Disinfectants Market Scope

Dairy disinfectants market is segmented on the basis of usage, form, application and type.

- By Usage

On the basis of usage, the Global Dairy Disinfectants Market is segmented into fluid milk, UHT milk, flavored milk, cream, table butter, ghee, anhydrous milk fat, skimmed milk powder, whole milk powder, whey protein, casein powder, lactose powder, cheese, yogurt, ice cream, cottage cheese, and probiotic dairy products. The fluid milk segment dominated the market with the largest revenue share of 36.8% in 2025, driven by the high consumption of liquid milk and the critical need for hygiene in raw milk handling and storage. Dairy processors prioritize disinfectants for fluid milk due to its susceptibility to microbial contamination and strict safety standards.

The probiotic dairy products segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by the rising consumer preference for functional and fortified dairy products and the increasing focus on stringent hygiene practices to preserve live cultures and ensure product safety.

- By Form

On the basis of form, the Global Dairy Disinfectants Market is segmented into liquid and dry disinfectants. The liquid form segment dominated the market with a 61.5% revenue share in 2025, owing to its easy application on milking equipment, storage tanks, and processing surfaces, providing rapid microbial control. Liquid disinfectants are preferred by most dairy farms and processing plants due to their efficient coverage, faster action, and compatibility with automated dosing systems.

The dry form segment is anticipated to witness the fastest CAGR of 20.7% from 2026 to 2033, driven by its long shelf life, stability under varying storage conditions, and increasing use in powdered dairy processing and cleaning-in-place (CIP) applications where liquid formulations may not be ideal.

- By Application

On the basis of application, the Global Dairy Disinfectants Market is segmented into milk housing plants, dairy food plants, and dairy farms. The dairy farm segment dominated the market with the largest revenue share of 42.3% in 2025, driven by the critical role of disinfectants in maintaining hygiene during milking, feed handling, and livestock housing. Ensuring farm-level sanitation reduces microbial contamination risks and ensures compliance with food safety regulations.

The dairy food plant segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, fueled by the rising production of processed and value-added dairy products, stricter regulatory oversight, and the growing adoption of automated cleaning and sanitation systems in commercial processing environments.

- By Type

On the basis of type, the Global Dairy Disinfectants Market is segmented into iodine, lactic acid, hydrogen peroxide, and phenolic acid. The hydrogen peroxide segment dominated the market with a revenue share of 39.7% in 2025, owing to its strong antimicrobial properties, ease of application, and effectiveness across various dairy hygiene processes including equipment sterilization and surface cleaning. Hydrogen peroxide is widely preferred due to its rapid action and minimal residue, making it suitable for sensitive dairy products.

The lactic acid segment is expected to witness the fastest CAGR of 23.2% from 2026 to 2033, driven by the growing preference for environmentally friendly, food-grade disinfectants, and its ability to preserve the quality and flavor of dairy products while ensuring microbial control.

Global Dairy Disinfectants Market Regional Analysis

- Asia-Pacific dominated the Global Dairy Disinfectants Market with the largest revenue share of 33.5% in 2025, driven by stringent food safety regulations, high standards for dairy hygiene, and widespread adoption of modern dairy farming and processing practices.

- Dairy producers and processors in the region prioritize the use of disinfectants to maintain equipment sanitation, prevent microbial contamination, and comply with regulatory guidelines set by agencies such as the FDA and USDA.

- This strong market presence is further supported by advanced technological infrastructure, high investment capacity, and growing awareness of food safety and quality among both producers and consumers, establishing North America as a key market for dairy disinfectant solutions across farms, milk processing plants, and value-added dairy production facilities.

U.S. Dairy Disinfectants Market Insight

The U.S. dairy disinfectants market captured the largest revenue share of 82% in 2025 within North America, driven by stringent food safety regulations, high hygiene standards, and the modernization of dairy farms and processing plants. Dairy producers increasingly prioritize disinfectants to prevent microbial contamination and ensure compliance with FDA and USDA guidelines. The rising demand for high-quality dairy products, coupled with growing awareness of foodborne illness prevention, is further propelling market growth. Moreover, the adoption of automated cleaning-in-place (CIP) systems and precision hygiene technologies is expanding the use of advanced disinfectant solutions across farms, milk plants, and value-added dairy processing units.

Europe Dairy Disinfectants Market Insight

The Europe dairy disinfectants market is projected to expand at a substantial CAGR during the forecast period, driven by stringent hygiene regulations, increasing consumer awareness of dairy safety, and the adoption of modern dairy farming practices. Countries such as France, Germany, and the Netherlands are witnessing strong growth due to regulatory compliance mandates, automated cleaning systems, and rising demand for high-quality milk and dairy products. European processors are increasingly integrating eco-friendly disinfectants, enhancing both safety and sustainability in operations.

U.K. Dairy Disinfectants Market Insight

The U.K. dairy disinfectants market is anticipated to grow at a notable CAGR, fueled by rising hygiene standards, the demand for premium and safe dairy products, and government regulations on food safety. Increased awareness among dairy farmers and processors regarding microbial contamination risks is encouraging the adoption of advanced disinfectants. Additionally, the integration of automated cleaning systems in both dairy farms and processing plants supports market expansion, particularly for small and medium-scale operations.

Germany Dairy Disinfectants Market Insight

The Germany dairy disinfectants market is expected to expand at a considerable CAGR during the forecast period, driven by strong regulatory frameworks, high-quality dairy production standards, and the adoption of innovative cleaning and sanitation technologies. Germany’s focus on sustainable and eco-friendly disinfectant solutions is promoting the use of lactic acid- and hydrogen peroxide-based formulations. Furthermore, the emphasis on precision hygiene and process automation in dairy processing plants is supporting demand for high-performance disinfectants.

Asia-Pacific Dairy Disinfectants Market Insight

The Asia-Pacific dairy disinfectants market is poised to grow at the fastest CAGR of 23% during the forecast period, driven by rapid urbanization, increasing disposable incomes, and modernization of dairy farms in countries such as China, India, and Japan. Growing consumer awareness of dairy safety and government initiatives to improve food hygiene standards are accelerating the adoption of disinfectants. The rise of organized dairy processing units and expansion of value-added dairy product production are further propelling market growth across the region.

Japan Dairy Disinfectants Market Insight

The Japan dairy disinfectants market is witnessing steady growth due to the country’s high focus on food safety, stringent hygiene regulations, and technological adoption in dairy farms and processing plants. The demand for high-quality milk and functional dairy products is driving the use of advanced disinfectants. Moreover, automated cleaning systems and integrated farm management practices are boosting the adoption of disinfectants across both small-scale and large-scale dairy operations.

China Dairy Disinfectants Market Insight

The China dairy disinfectants market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid urbanization, a growing middle class, and government-led food safety initiatives. The expansion of large-scale dairy farms and processing units, combined with increasing awareness of microbial contamination risks, is driving the adoption of advanced disinfectant solutions. Additionally, domestic production of cost-effective disinfectants and the push for high-quality dairy products are further supporting market growth in China.

Global Dairy Disinfectants Market Share

The Dairy Disinfectants industry is primarily led by well-established companies, including:

• Ecolab Inc. (U.S.)

• Diversey Holdings, Ltd. (U.S.)

• Chr. Hansen A/S (Denmark)

• Kemin Industries, Inc. (U.S.)

• Zoetis Inc. (U.S.)

• BASF SE (Germany)

• Novozymes A/S (Denmark)

• Clariant AG (Switzerland)

• DuPont de Nemours, Inc. (U.S.)

• Lonza Group AG (Switzerland)

• AkzoNobel N.V. (Netherlands)

• Henkel AG & Co. KGaA (Germany)

• SNF Floerger (France)

• Solvay S.A. (Belgium)

• Procter & Gamble Co. (U.S.)

• Advanced Microbial Solutions (U.S.)

• F.H. Bertling GmbH & Co. KG (Germany)

• Novapex Biotech (France)

• Hydrite Chemical Co. (U.S.)

• Sanitarium Health & Wellbeing Company (Australia)

What are the Recent Developments in Global Dairy Disinfectants Market?

- In April 2024, Ecolab Inc., a global leader in hygiene and food safety solutions, launched a strategic initiative in South Africa to enhance dairy farm and processing plant sanitation through its advanced disinfectant solutions. This initiative highlights Ecolab’s commitment to delivering innovative, reliable hygiene technologies tailored to regional dairy safety requirements, reinforcing its presence in the rapidly growing global Dairy Disinfectants Market.

- In March 2024, Diversey Holdings, Ltd., a leading provider of cleaning and hygiene solutions, introduced its new high-performance dairy disinfectant line designed for UHT milk and cheese processing facilities. The solution offers rapid microbial control while being environmentally sustainable, showcasing Diversey’s focus on advancing food safety technologies for commercial dairy operations.

- In March 2024, Zoetis Inc., in partnership with major dairy cooperatives in India, implemented a large-scale farm hygiene program aimed at reducing microbial contamination in milk production. The initiative leverages cutting-edge disinfectants and automated cleaning systems, emphasizing the importance of sanitation in improving product quality and safety across dairy farms.

- In February 2024, Chr. Hansen, a global bioscience company, announced a collaboration with European dairy processors to develop next-generation lactic acid-based disinfectants for dairy food plants. This partnership aims to enhance sanitation efficiency, streamline cleaning processes, and support compliance with strict EU food safety regulations.

- In January 2024, Kemin Industries, a leader in food and animal health solutions, unveiled its innovative hydrogen peroxide-based disinfectant for milk housing plants at the International Dairy Expo 2024. The product offers rapid microbial control, safety for dairy workers, and compatibility with automated cleaning systems, reflecting Kemin’s dedication to integrating advanced hygiene solutions into modern dairy operations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.