Global Dairy Testing Market

Market Size in USD Billion

CAGR :

%

USD

7.47 Billion

USD

14.68 Billion

2024

2032

USD

7.47 Billion

USD

14.68 Billion

2024

2032

| 2025 –2032 | |

| USD 7.47 Billion | |

| USD 14.68 Billion | |

|

|

|

|

Dairy Testing Market Size

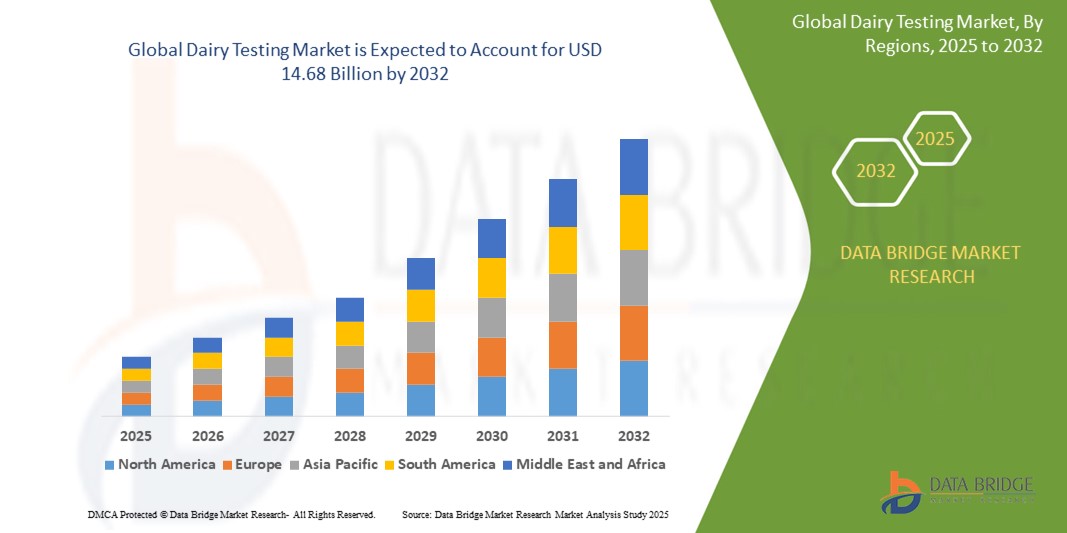

- The global dairy testing market size was valued at USD 7.47 billion in 2024 and is expected to reach USD 14.68 billion by 2032, at a CAGR of 8.80% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of food safety, stringent regulatory standards for dairy products, and advancements in testing technologies, leading to greater adoption in both developed and emerging markets

- Rising demand for high-quality dairy products, coupled with growing concerns over contamination and adulteration, is positioning dairy testing as a critical component of the global dairy supply chain, further accelerating market expansion

Dairy Testing Market Analysis

- Dairy testing, encompassing safety and quality assessments for dairy products, is a vital process ensuring compliance with regulatory standards and consumer safety in the food and beverage industry

- The surge in demand for dairy testing is fueled by increasing incidences of foodborne illnesses, heightened consumer focus on product quality, and the global expansion of dairy trade requiring rigorous testing protocols

- North America dominated the dairy testing market with the largest revenue share of 42.5% in 2024, driven by advanced testing infrastructure, strict regulatory frameworks, and high consumer demand for safe dairy products, with the U.S. leading due to innovations in rapid testing technologies and a strong presence of key market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rising dairy consumption, increasing urbanization, and growing investments in food safety infrastructure

- The safety testing segment dominated the largest market revenue share of 73% in 2024, driven by rising concerns about foodborne illnesses caused by pathogens such as Salmonella, E. coli, and Listeria, as well as chemical residues such as antibiotics and pesticides

Report Scope and Dairy Testing Market Segmentation

|

Attributes |

Dairy Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dairy Testing Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global dairy testing market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing and analysis, providing deeper insights into dairy product safety, quality, and compliance with regulatory standards

- AI-powered testing solutions enable proactive identification of contaminants, such as pathogens or chemical residues, before they impact consumer safety or product quality

- For instances, companies are developing AI-driven platforms that analyze microbial data to detect anomalies such as contamination or adulteration in dairy products, such as milk and cheese, and optimize testing processes for faster results

- This trend enhances the efficiency and accuracy of dairy testing, making it more appealing to dairy producers, processors, and regulatory bodies

- AI algorithms can analyze vast datasets, including production conditions, storage environments, and supply chain logistics, to ensure consistent quality and safety across products such as milk powder, yogurt, and infant food

Dairy Testing Market Dynamics

Driver

“Rising Demand for Safe and High-Quality Dairy Products”

- Increasing consumer demand for safe, high-quality dairy products, such as milk, yogurt, and cheese, is a major driver for the global dairy testing market

- Dairy testing systems enhance product safety by detecting pathogens, chemical residues , and adulterants, ensuring compliance with stringent regulatory standards

- Government mandates, particularly in regions such as Europe with rigorous food safety regulations, are driving the widespread adoption of dairy testing

- The proliferation of IoT and advancements in rapid testing technologies, such as real-time PCR and biosensors, are enabling faster and more accurate testing, supporting sophisticated quality control measures

- Dairy producers are increasingly adopting advanced testing systems as standard practice to meet consumer expectations and enhance product value in markets such as North America, which dominates the industry

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The significant initial investment required for advanced testing hardware, software, and integration of rapid testing technologies can be a barrier to adoption, particularly in emerging markets within Asia-Pacific, despite its rapid growth

- Implementing testing systems for products such as milk powder, cheese, and infant food can be complex and costly, especially for Ascertainwhen integrating with existing production lines

- Data security and privacy concerns are a major challenge, as dairy testing systems collect sensitive data on production processes and product composition, raising risks of breaches or misuse, particularly under strict regulations such as those in Europe

- The fragmented regulatory landscape across regions, such as differing standards in North America and Asia-Pacific, complicates compliance for global manufacturers and service providers

- These factors may deter adoption in cost-sensitive markets or regions with heightened awareness of data privacy, potentially limiting market expansion

Dairy Testing market Scope

The market is segmented on the basis of type, technology, and product.

- By Type

On the basis of type, the global dairy testing market is segmented into safety testing and quality analysis. The safety testing segment dominated the largest market revenue share of 73% in 2024, driven by rising concerns about foodborne illnesses caused by pathogens such as Salmonella, E. coli, and Listeria, as well as chemical residues such as antibiotics and pesticides. Strict global regulations, including those from the FDA, EFSA, and FSSAI, further emphasize the need for rigorous safety testing to ensure consumer health and compliance.

The quality analysis segment is expected to witness significant growth from 2025 to 2032, fueled by increasing consumer demand for consistent nutritional content, taste, and shelf-life stability in dairy products. Advancements in testing technologies, such as spectrometry and molecular diagnostics, are enhancing the ability to assess quality parameters such as fat content, protein levels, and viscosity, driving adoption in this segment.

- By Technology

On the basis of technology, the global dairy testing market is segmented into traditional and rapid. The rapid technology segment dominated the market with a revenue share of 58.89% in 2024, attributed to its faster, more accurate, and cost-effective testing solutions. Technologies such as real-time PCR, biosensors, and high-throughput systems are increasingly adopted for their efficiency in detecting contaminants and quality indicators, reducing turnaround time for dairy producers.

The traditional technology segment is anticipated to experience steady growth from 2025 to 2032. While less efficient than rapid methods, traditional testing remains relevant in regions with limited access to advanced infrastructure, particularly in developing economies. Its reliability for certain applications, such as microbiological analysis, supports its continued use.

- By Product

On the basis of product, the global dairy testing market is segmented into milk and milk powder, cheese, butter and spreads, infant food, ice cream and desserts, yogurt, and others. The milk and milk powder segment held the largest market revenue share of 43.5% in 2024, due to milk’s widespread consumption, susceptibility to contamination from poor handling or packaging, and its role as a base for other dairy derivatives.

The yogurt segment is anticipated to witness robust growth from 2025 to 2032, driven by increasing consumer demand for probiotic and health-focused dairy products. Rigorous testing for microbial safety and nutritional content is critical to meet regulatory standards and consumer expectations for high-quality yogurt products.

Dairy Testing Market Regional Analysis

- North America dominated the dairy testing market with the largest revenue share of 42.5% in 2024, driven by advanced testing infrastructure, strict regulatory frameworks, and high consumer demand for safe dairy products, with the U.S. leading due to innovations in rapid testing technologies and a strong presence of key market players

- Consumers prioritize dairy testing for ensuring product safety, preventing foodborne illnesses, and maintaining quality, particularly in regions with high dairy consumption

- Growth is supported by advancements in testing technologies, such as rapid testing methods and automation, alongside increasing adoption in dairy processing and regulatory compliance

U.S. Dairy Testing Market Insight

The U.S. dairy testing market captured the largest revenue share of 81.2% in 2024 within North America, fueled by strong demand for safety and quality testing and growing consumer awareness of health risks associated with contaminated dairy products. Strict regulations from the FDA and USDA, along with high dairy consumption, drive market expansion. The adoption of advanced testing technologies, such as real-time PCR and biosensors, complements both processing and regulatory needs, creating a robust testing ecosystem.

Europe Dairy Testing Market Insight

The Europe dairy testing market is expected to witness significant growth, supported by stringent food safety regulations and high consumer demand for quality dairy products. Testing for pathogens, adulterants, and nutritional content is critical in countries such as Germany and France, where dairy consumption is high. Growth is prominent in both dairy processing plants and regulatory compliance, driven by the European Food Safety Authority (EFSA) standards and urban demand for safe dairy products.

U.K. Dairy Testing Market Insight

The U.K. market for dairy testing is expected to witness rapid growth, driven by increasing consumer demand for safe and high-quality dairy products in urban and suburban settings. Growing awareness of foodborne illness risks and the need for quality assurance encourages adoption of advanced testing methods. Evolving regulations balancing safety and quality standards influence testing practices, with rapid technologies gaining traction for efficiency.

Germany Dairy Testing Market Insight

Germany is expected to witness rapid growth in the dairy testing market, attributed to its advanced dairy industry and strong consumer focus on food safety and quality. German consumers prefer technologically advanced testing methods, such as chromatography and spectrometry, to ensure pathogen-free and high-quality dairy products. The integration of these technologies in large-scale dairy processing and aftermarket testing supports sustained market growth.

Asia-Pacific Dairy Testing Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding dairy production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of food safety, health concerns, and the need for quality assurance boosts demand for dairy testing. Government initiatives promoting food safety and regulatory compliance further encourage the adoption of advanced testing technologies, such as rapid methods.

Japan Dairy Testing Market Insight

Japan’s dairy testing market is expected to witness rapid growth due to strong consumer preference for high-quality, safe dairy products that meet stringent regulatory standards. The presence of major dairy producers and the integration of advanced testing technologies in processing facilities accelerate market penetration. Rising interest in quality testing for nutritional content and safety testing for pathogens also contributes to growth.

China Dairy Testing Market Insight

China holds the largest share of the Asia-Pacific dairy testing market, propelled by rapid urbanization, rising dairy consumption, and increasing demand for safety and quality assurance. The country’s growing middle class and focus on food safety drive the adoption of advanced testing methods. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, with rapid technologies such as PCR and biosensors gaining prominence.

Dairy Testing Market Share

The dairy testing industry is primarily led by well-established companies, including:

- SGS Société Générale de Surveillance SA (Switzerland)

- Bureau Veritas (France)

- Eurofins Scientific (Luxembourg)

- Intertek Group plc (U.K.)

- Mérieux NutriSciences Corporation (U.S.)

- ALS (Australia)

- AsureQuality (New Zealand)

- Charm Sciences (U.S.)

- Premier Analytics Servies (U.K.)

- Dairyland Laboratories, Inc. (U.S.)

- AES Laboratories Pvt. Ltd. (India)

- EnviroLogix (U.S.)

- Krishgen Biosystems (U.S.)

What are the Recent Developments in Global Dairy Testing Market?

- In June 2025, Face Rock Creamery voluntarily recalled two specific lots of its Vampire Slayer Garlic Cheddar Cheese Curds due to potential contamination with Listeria monocytogenes. The affected 6 oz. cups—marked with lot numbers 20250519VS01 and 20250519VS02 and a use-by date of August 29, 2025—were sold at Trader Joe’s stores in Northern California and Northern Nevada, including locations in Monterey, Fresno, Carson City, Reno, and Sparks. The recall was initiated following routine testing that detected the bacteria, though no illnesses have been reported to date

- In June 2025, the Pennsylvania Department of Agriculture issued a public health warning regarding raw milk from Meadow View Jerseys Dairy, after samples tested positive for Campylobacter. The affected milk—sold in glass half-gallon, plastic half-gallon, and gallon containers—was distributed through the farm’s store in Leola and various retail outlets across Berks, Dauphin, Lancaster, and Lebanon counties. The warning applies to milk purchased since April 1, 2025, with sell-by dates between April 15 and July 8, 2025. Although no full customer list was available, the department urged consumers to discard the milk immediately due to the risk of campylobacteriosis, a bacterial illness that can cause diarrhea, fever, and abdominal cramps

- In March 2024, Everest Instruments unveiled three state-of-the-art dairy testing solutions to advance milk quality analysis and processing. The lineup includes the YAMA FTIR-based Milk Analyser, India’s first of its kind, which delivers rapid, 30-second assessments of fat, SNF, protein, and adulterants. The Everest GC4500 Gas Chromatography system enables detailed profiling of milk fat fatty acids and triglycerides, streamlining multiple analyses into one platform. Completing the trio is the Somatic Cell Analyser, which uses fluorescence optics to detect somatic cells—key indicators of milk quality and udder health

- In March 2024, the Food Safety and Standards Authority of India (FSSAI) initiated a Nationwide Milk Quality Survey to evaluate the safety and quality of milk and milk products across the country. This large-scale surveillance effort targets both the organized and unorganized sectors, collecting samples from all states and union territories. The survey focuses on detecting adulteration and ensuring compliance with FSSAI’s quality standards. By identifying hotspots and trends in milk safety, the initiative is expected to boost demand for advanced dairy testing technologies, supporting public health and consumer confidence

- In April 2023, Eurofins USA launched a validated method to detect recombinant Bovine Somatotropin (rBST) in liquid milk, marking a significant advancement in dairy quality control. Utilizing liquid chromatography tandem mass spectrometry (LC-MS/MS), the method identifies a specific peptide of the recombinant protein with high sensitivity—capable of detecting rBST at concentrations below 0.001%. This innovation allows dairy processors to scientifically verify “rBST-free” claims, replacing vague labeling with data-backed assurance. It also opens new opportunities for U.S. dairy exports to countries where rBST use is banned, reinforcing consumer trust and regulatory compliance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dairy Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dairy Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dairy Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.